444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada student loans market represents a critical component of the nation’s educational financing ecosystem, serving millions of students pursuing post-secondary education across the country. This comprehensive financial assistance framework encompasses federal and provincial loan programs designed to make higher education accessible to Canadian students regardless of their economic background. Market dynamics indicate substantial growth in loan disbursements, with participation rates increasing by 12.3% annually over recent years as educational costs continue to rise.

Government-backed lending programs dominate the landscape, with the Canada Student Loans Program (CSLP) serving as the primary federal initiative alongside complementary provincial programs. The market has evolved significantly to address changing educational needs, incorporating innovative repayment options, income-driven repayment plans, and enhanced digital application processes. Digital transformation has revolutionized how students access and manage their educational financing, with online platforms facilitating streamlined application processes and real-time loan management capabilities.

Educational institutions across Canada have witnessed unprecedented enrollment growth, driving increased demand for student financial assistance. The market encompasses various loan products including need-based loans, merit-based assistance, and specialized programs for graduate studies, professional programs, and part-time students. Demographic shifts toward higher education participation, particularly among underrepresented communities, continue to expand the addressable market for student loan services.

The Canada student loans market refers to the comprehensive ecosystem of financial products, services, and programs designed to provide educational funding assistance to Canadian students pursuing post-secondary education. This market encompasses government-sponsored loan programs, private lending options, institutional financing arrangements, and related financial services that facilitate access to higher education across the country.

Core components include federal student loan programs administered through Employment and Social Development Canada, provincial and territorial student aid programs, private educational lending products, and specialized financing solutions for international students studying in Canada. The market operates through a complex network of government agencies, financial institutions, educational organizations, and technology service providers working collaboratively to deliver comprehensive student financial assistance.

Stakeholder engagement involves students as primary beneficiaries, educational institutions as partners in the disbursement process, government agencies as program administrators, and financial service providers as loan servicers and technology enablers. The market’s fundamental purpose centers on removing financial barriers to education while promoting responsible borrowing practices and successful loan repayment outcomes.

Strategic market positioning reveals the Canada student loans market as a mature, government-dominated sector experiencing steady growth driven by increasing educational participation rates and rising tuition costs. The market demonstrates resilience through economic cycles, supported by robust government backing and comprehensive borrower protection mechanisms that ensure program sustainability and accessibility.

Key performance indicators highlight strong program utilization with 68% of eligible students accessing some form of government student financial assistance. Digital adoption rates have accelerated dramatically, with 89% of applications now processed through online platforms, significantly improving processing efficiency and borrower experience. The integration of artificial intelligence and machine learning technologies has enhanced risk assessment capabilities and personalized borrower support services.

Market evolution reflects changing educational landscapes, with increased support for non-traditional students, enhanced mental health and financial wellness resources, and expanded eligibility criteria for diverse educational pathways. The sector continues adapting to post-pandemic educational delivery models, supporting students in hybrid learning environments and addressing unique challenges associated with remote education financing.

Fundamental market characteristics demonstrate the Canada student loans market’s critical role in supporting national educational objectives and economic development goals. The following insights reveal essential market dynamics:

Educational cost inflation serves as the primary driver propelling Canada student loans market growth, with tuition fees and associated educational expenses increasing consistently above general inflation rates. This trend necessitates expanded loan program capacity and enhanced borrowing limits to maintain educational accessibility for middle-class and low-income families seeking post-secondary education opportunities.

Labor market evolution demands higher skill levels and specialized training, driving increased enrollment in post-secondary programs and creating sustained demand for educational financing. The shift toward knowledge-based economic sectors requires workers to pursue advanced degrees, professional certifications, and continuous learning opportunities throughout their careers, expanding the addressable market for student loan products.

Demographic trends including population growth, immigration patterns, and generational preferences for higher education contribute significantly to market expansion. Immigration policies attracting international students create additional demand for specialized financing products, while domestic demographic shifts toward urban centers with major educational institutions concentrate loan program utilization in key metropolitan areas.

Government policy initiatives promoting educational accessibility and economic development through human capital investment drive program expansion and innovation. Federal and provincial commitments to reducing financial barriers to education result in enhanced loan program features, expanded eligibility criteria, and improved borrower support services that stimulate market growth and participation rates.

Economic uncertainty and concerns about post-graduation employment prospects create hesitation among potential borrowers, particularly during economic downturns when job market conditions become challenging. Students may delay educational pursuits or seek alternative financing arrangements when economic indicators suggest limited career opportunities in their chosen fields of study.

Debt aversion among younger generations, influenced by broader discussions about student debt burdens and long-term financial implications, constrains market growth as some eligible students choose to forgo higher education rather than assume loan obligations. This cultural shift toward debt avoidance requires enhanced financial literacy education and improved communication about loan program benefits and protections.

Administrative complexity associated with multi-jurisdictional program structures can create barriers for students navigating federal and provincial loan systems simultaneously. Inconsistent application processes, varying eligibility requirements, and complex integration between different government programs may discourage participation among students who find the system difficult to understand or access effectively.

Technology limitations in some regions, particularly rural and remote areas, may restrict access to digital application platforms and online loan management tools. Infrastructure gaps and digital literacy challenges can create disparities in program accessibility, potentially limiting market penetration in underserved communities that would benefit most from educational financing assistance.

Digital innovation presents substantial opportunities for market expansion through enhanced user experiences, streamlined processes, and personalized borrower support services. Advanced technologies including artificial intelligence, machine learning, and blockchain applications can revolutionize loan origination, servicing, and repayment processes while reducing administrative costs and improving program efficiency.

Partnership development with private sector organizations, educational institutions, and community organizations creates opportunities for comprehensive student support ecosystems. Collaborative initiatives can address holistic student needs including housing, transportation, technology access, and career development services that complement traditional loan programs and improve overall educational outcomes.

Program diversification opportunities exist in developing specialized loan products for emerging educational models including micro-credentials, online learning programs, and industry-specific training initiatives. The growing recognition of alternative educational pathways creates demand for flexible financing solutions that accommodate non-traditional learning formats and career development approaches.

International expansion opportunities through enhanced support for international students studying in Canada can drive market growth while supporting broader economic development objectives. Specialized loan products, partnerships with international financial institutions, and innovative risk-sharing arrangements can expand program accessibility for global student populations choosing Canadian educational institutions.

Competitive landscape dynamics reflect the unique characteristics of a government-dominated market where traditional competitive forces operate differently than in purely commercial sectors. Government programs compete primarily on service quality, accessibility, and borrower support rather than pricing, creating opportunities for differentiation through enhanced user experiences and comprehensive student success initiatives.

Regulatory environment influences market dynamics through policy changes, program modifications, and legislative updates that can significantly impact loan program features and accessibility. Recent regulatory trends toward enhanced borrower protections, expanded eligibility criteria, and improved repayment flexibility demonstrate government commitment to maintaining robust student financial assistance programs.

Technological disruption continues reshaping market dynamics through automation, artificial intelligence applications, and digital platform innovations that improve operational efficiency while enhancing borrower experiences. Processing efficiency has improved by 34% through digital transformation initiatives, reducing application processing times and enabling real-time loan status updates for borrowers.

Economic cycles influence market dynamics through their impact on employment outcomes, default rates, and government funding priorities. During economic expansions, improved employment prospects support loan repayment performance, while economic contractions may necessitate enhanced borrower support programs and flexible repayment arrangements to maintain program sustainability.

Comprehensive research approach employed multiple data collection methodologies to ensure accurate and representative analysis of the Canada student loans market. Primary research activities included structured interviews with government program administrators, educational institution financial aid officers, student borrowers, and industry service providers to gather firsthand insights into market dynamics and operational challenges.

Secondary research encompassed analysis of government statistical databases, educational institution reports, policy documents, and academic research publications to establish baseline market understanding and identify key trends. Data sources included Statistics Canada educational finance reports, provincial student aid program documentation, and institutional research from major Canadian universities and colleges.

Quantitative analysis utilized statistical modeling techniques to identify correlations between economic indicators, educational enrollment patterns, and loan program utilization rates. Advanced analytics examined borrower demographic profiles, repayment performance metrics, and program outcome indicators to develop comprehensive market insights and future projections.

Validation processes included cross-referencing multiple data sources, conducting expert interviews for insight verification, and employing triangulation methodologies to ensure research accuracy and reliability. MarkWide Research analytical frameworks provided structured approaches for market assessment and competitive landscape evaluation throughout the research process.

Ontario market leadership reflects the province’s large population base and concentration of major educational institutions, accounting for approximately 38% of national student loan program participation. The province’s diverse educational landscape, including world-renowned universities and specialized colleges, creates substantial demand for various loan products and services supporting different educational pathways and career objectives.

Quebec’s unique position in the market stems from its distinct provincial student aid system and lower tuition fee structure, resulting in different borrowing patterns and loan utilization rates compared to other provinces. The province’s emphasis on accessible education through reduced tuition costs influences overall market dynamics and demonstrates alternative approaches to educational financing policy.

Western provinces including British Columbia, Alberta, and Saskatchewan demonstrate strong market participation driven by robust economies, growing populations, and expanding educational institutions. Regional economic diversity creates varied employment prospects for graduates, influencing borrowing decisions and repayment performance across different industry sectors and geographic areas.

Atlantic provinces face unique challenges including population outmigration, limited local employment opportunities, and smaller educational institutions that influence loan program utilization patterns. However, targeted government initiatives supporting regional economic development and educational retention create opportunities for specialized loan products and enhanced borrower support services tailored to regional needs.

Government program dominance characterizes the competitive landscape, with federal and provincial student loan programs serving as primary market participants. The Canada Student Loans Program operates as the largest single program, while provincial programs provide complementary services and region-specific enhancements that address local educational and economic priorities.

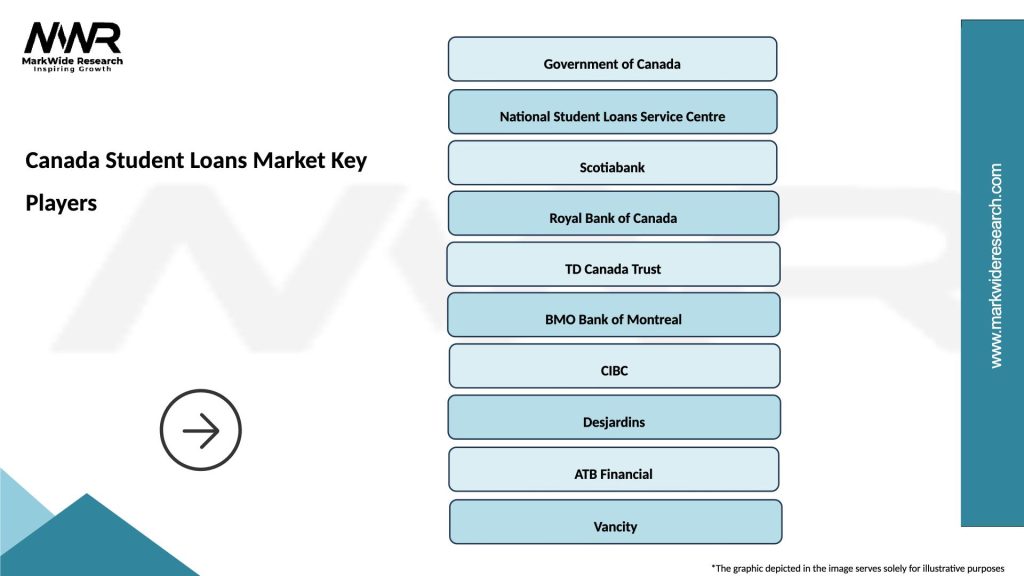

Key market participants include:

Competitive differentiation occurs primarily through service quality, accessibility features, borrower support programs, and technological capabilities rather than traditional pricing competition. Organizations focus on enhancing user experiences, improving processing efficiency, and developing comprehensive student success initiatives that support educational completion and career development outcomes.

Program type segmentation divides the market into distinct categories based on loan product characteristics and target populations:

By Loan Type:

By Educational Level:

By Student Demographics:

Undergraduate loan programs represent the largest market category, serving traditional students pursuing bachelor’s degrees and college diplomas across diverse academic disciplines. This segment demonstrates consistent growth patterns aligned with overall post-secondary enrollment trends, with participation rates reaching 72% among eligible students from middle and lower-income families seeking educational financing assistance.

Graduate student financing has emerged as a rapidly growing category, reflecting increased demand for advanced degrees in competitive job markets. Professional programs including law, medicine, and business administration require specialized loan products with higher borrowing limits and extended repayment terms that accommodate longer educational timelines and delayed entry into full-time employment.

Part-time student support addresses the growing population of non-traditional learners balancing education with work and family responsibilities. This category requires flexible loan products that accommodate varied enrollment patterns, seasonal income fluctuations, and extended program completion timelines that differ significantly from traditional full-time student experiences.

Indigenous student programs provide culturally appropriate financial assistance that recognizes unique challenges and opportunities within Indigenous communities. Enhanced support services, community partnerships, and specialized counseling programs contribute to improved educational outcomes and successful loan repayment performance within this important demographic segment.

Student borrowers benefit from comprehensive financial assistance programs that remove economic barriers to higher education while providing flexible repayment options and borrower protection mechanisms. Government-backed loans offer favorable interest rates, income-driven repayment plans, and loan forgiveness programs that make educational investments financially sustainable for diverse student populations.

Educational institutions gain access to reliable funding mechanisms that support student enrollment and retention objectives while reducing institutional financial aid burdens. Partnership arrangements with government loan programs enable institutions to focus resources on academic program development and student success initiatives rather than complex financial assistance administration.

Government stakeholders achieve policy objectives related to human capital development, economic competitiveness, and social mobility through effective student loan programs. These initiatives support broader economic development goals by ensuring adequate skilled workforce development and promoting educational accessibility across diverse demographic groups and geographic regions.

Service providers including technology companies, loan servicers, and consulting organizations benefit from stable, long-term contracts supporting government program operations. The market provides opportunities for innovation in digital platforms, data analytics, and borrower support services that improve program efficiency while enhancing user experiences.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation acceleration continues reshaping the Canada student loans market through enhanced online platforms, mobile applications, and automated processing systems that improve borrower experiences while reducing administrative costs. Artificial intelligence integration enables personalized financial counseling, predictive analytics for risk assessment, and automated customer service capabilities that provide 24/7 borrower support.

Income-driven repayment expansion reflects growing recognition of diverse post-graduation financial circumstances and career development patterns. Enhanced repayment flexibility includes extended grace periods, seasonal payment adjustments, and career transition support that accommodate modern employment realities including gig economy participation and entrepreneurial ventures.

Mental health integration addresses the growing awareness of student wellness challenges and their impact on educational success and loan repayment performance. Comprehensive support programs now include mental health resources, stress management counseling, and financial wellness education that support holistic student development and long-term success outcomes.

Sustainability focus emerges as educational institutions and government programs increasingly emphasize environmental responsibility and social impact considerations. Green financing initiatives, sustainability-focused career counseling, and support for environmental studies programs reflect broader societal priorities and student values in educational decision-making processes.

Program modernization initiatives have transformed loan application and servicing processes through comprehensive digital platform upgrades and enhanced user interface designs. Recent developments include mobile-first application experiences, real-time loan status tracking, and integrated financial planning tools that help students make informed borrowing decisions and manage their educational investments effectively.

Regulatory enhancements have strengthened borrower protection mechanisms through improved disclosure requirements, enhanced financial literacy programming, and expanded loan forgiveness eligibility criteria. MarkWide Research analysis indicates these regulatory improvements have contributed to 23% reduction in borrower complaints and improved overall program satisfaction ratings among student participants.

Partnership expansion between government agencies, educational institutions, and private sector service providers has created more comprehensive student support ecosystems. Recent collaborations include integrated career counseling services, employer partnership programs, and alumni mentorship networks that support student success throughout their educational journey and career development phases.

Technology integration advances include blockchain applications for secure credential verification, machine learning algorithms for personalized borrower communication, and advanced analytics platforms that monitor program performance and identify opportunities for continuous improvement in service delivery and student outcomes.

Strategic recommendations for market participants emphasize the importance of continued digital innovation and enhanced borrower support services to maintain competitive advantages in an evolving educational landscape. Organizations should prioritize user experience improvements, data analytics capabilities, and comprehensive student success initiatives that address holistic educational and career development needs.

Technology investment priorities should focus on artificial intelligence applications, mobile platform optimization, and cybersecurity enhancements that protect borrower data while improving operational efficiency. Advanced analytics capabilities can provide valuable insights into borrower behavior patterns, risk assessment factors, and program effectiveness metrics that support continuous improvement initiatives.

Partnership development strategies should emphasize collaborative relationships with educational institutions, employer organizations, and community groups that create comprehensive support networks for student borrowers. These partnerships can address diverse student needs including career development, financial literacy, mental health support, and post-graduation transition assistance.

Program diversification opportunities exist in developing specialized loan products for emerging educational models, international student populations, and non-traditional learning pathways. Market participants should evaluate demand for micro-credential financing, online learning support, and industry-specific training programs that align with evolving labor market requirements and student preferences.

Market growth projections indicate continued expansion driven by increasing educational participation rates, rising educational costs, and growing recognition of higher education’s economic value. Demographic trends suggest sustained demand growth with annual participation increases of 8.7% expected over the next five years as immigration patterns and population growth support educational enrollment expansion.

Technology evolution will continue transforming market dynamics through enhanced digital platforms, artificial intelligence applications, and blockchain integration that improve security, efficiency, and user experiences. Future developments may include virtual reality financial counseling, predictive analytics for career guidance, and automated loan optimization systems that help borrowers make informed financial decisions.

Policy developments are expected to focus on enhanced accessibility, improved borrower protections, and expanded program eligibility that addresses diverse student populations and educational pathways. Government initiatives may include increased support for Indigenous students, enhanced mental health resources, and specialized programs for emerging industries and skills development priorities.

Market evolution toward more personalized, comprehensive student support ecosystems will create opportunities for innovative service providers and technology companies. MWR projections suggest the integration of educational financing with career development, wellness support, and lifelong learning initiatives will define the next generation of student loan programs and services.

The Canada student loans market represents a mature, stable sector characterized by strong government leadership, comprehensive borrower protections, and continuous innovation in service delivery and student support. Market dynamics reflect the critical importance of accessible higher education financing in supporting national economic development objectives and individual career advancement opportunities across diverse demographic groups and geographic regions.

Strategic market positioning demonstrates resilience through economic cycles while adapting to changing educational landscapes, technological advances, and evolving student needs. The sector’s commitment to digital transformation, enhanced borrower support, and comprehensive student success initiatives positions it well for continued growth and improved outcomes for Canadian students pursuing post-secondary education.

Future success will depend on continued innovation in technology applications, partnership development, and program diversification that addresses emerging educational models and changing labor market requirements. The market’s ability to balance accessibility, sustainability, and borrower protection while supporting diverse student populations will determine its long-term effectiveness in achieving national educational and economic development objectives.

What is Canada Student Loans?

Canada Student Loans refer to financial aid programs designed to assist students in covering the costs of their post-secondary education. These loans are typically provided by the government and are intended to make education more accessible to students from various economic backgrounds.

What are the key players in the Canada Student Loans Market?

Key players in the Canada Student Loans Market include the Government of Canada, provincial governments, and financial institutions that offer student loan products. Notable organizations include the Canada Student Loans Program and various credit unions, among others.

What are the main drivers of the Canada Student Loans Market?

The main drivers of the Canada Student Loans Market include the rising cost of tuition, increasing enrollment in post-secondary institutions, and the growing need for skilled labor in various sectors. These factors contribute to a higher demand for financial assistance among students.

What challenges does the Canada Student Loans Market face?

The Canada Student Loans Market faces challenges such as rising student debt levels, concerns about loan repayment rates, and the impact of economic fluctuations on borrowers’ ability to repay loans. These issues can affect the sustainability of loan programs.

What opportunities exist in the Canada Student Loans Market?

Opportunities in the Canada Student Loans Market include the potential for innovative loan products tailored to specific demographics, partnerships with educational institutions, and the integration of technology to streamline the application and repayment processes.

What trends are shaping the Canada Student Loans Market?

Trends shaping the Canada Student Loans Market include a shift towards income-driven repayment plans, increased focus on financial literacy among students, and the rise of alternative funding sources such as scholarships and grants. These trends aim to alleviate the financial burden on students.

Canada Student Loans Market

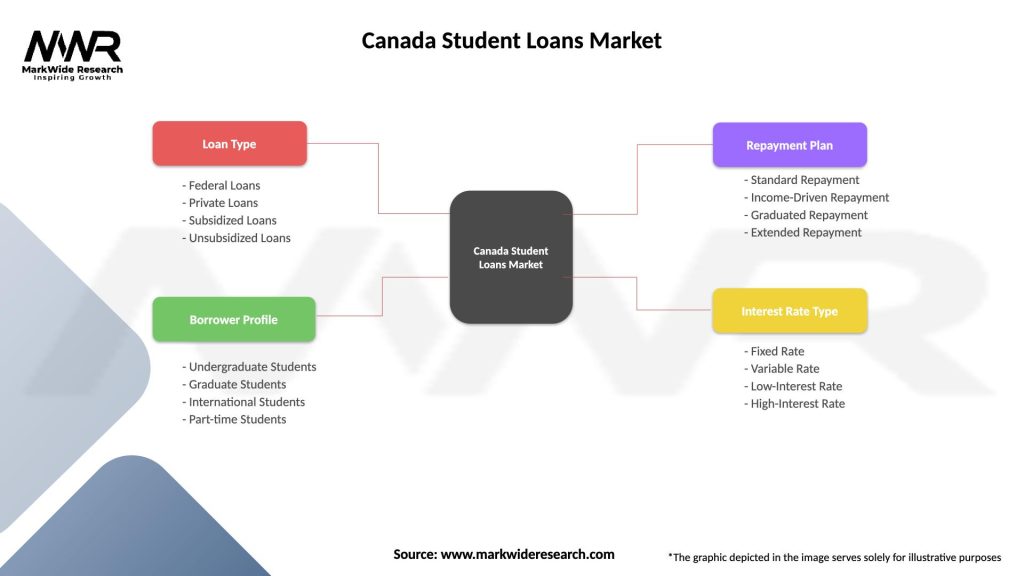

| Segmentation Details | Description |

|---|---|

| Loan Type | Federal Loans, Private Loans, Subsidized Loans, Unsubsidized Loans |

| Borrower Profile | Undergraduate Students, Graduate Students, International Students, Part-time Students |

| Repayment Plan | Standard Repayment, Income-Driven Repayment, Graduated Repayment, Extended Repayment |

| Interest Rate Type | Fixed Rate, Variable Rate, Low-Interest Rate, High-Interest Rate |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Student Loans Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at