444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada smart home market represents a rapidly evolving sector that encompasses connected devices, automation systems, and intelligent technologies designed to enhance residential living experiences. Smart home technology adoption across Canadian households has accelerated significantly, driven by increasing consumer awareness of energy efficiency, security benefits, and convenience factors. The market demonstrates robust growth potential with 12.8% CAGR projected through the forecast period, reflecting strong consumer demand for integrated home automation solutions.

Canadian consumers are increasingly embracing smart home ecosystems that include security systems, lighting controls, climate management, entertainment devices, and energy monitoring solutions. The market spans diverse product categories from basic smart speakers to comprehensive home automation platforms. Regional adoption patterns show particularly strong growth in urban centers including Toronto, Vancouver, and Montreal, where tech-savvy consumers drive demand for innovative residential technologies.

Market dynamics indicate that the integration of artificial intelligence, Internet of Things (IoT) connectivity, and voice control technologies continues to shape product development and consumer preferences. The sector benefits from supportive government initiatives promoting energy efficiency and smart city development across Canadian provinces.

The Canada smart home market refers to the comprehensive ecosystem of connected devices, systems, and services that enable homeowners to remotely monitor, control, and automate various aspects of their residential properties through digital interfaces and intelligent technologies.

Smart home solutions encompass a wide range of interconnected devices including thermostats, security cameras, door locks, lighting systems, appliances, and entertainment equipment that communicate through wireless networks. These technologies leverage IoT connectivity, artificial intelligence, and cloud computing to provide enhanced functionality, energy efficiency, and user convenience. Home automation systems allow residents to create customized environments, optimize energy consumption, improve security measures, and streamline daily routines through centralized control platforms accessible via smartphones, tablets, or voice commands.

Market participants include device manufacturers, software developers, service providers, and system integrators who collaborate to deliver comprehensive smart home experiences tailored to Canadian consumer preferences and regulatory requirements.

Canada’s smart home market demonstrates exceptional growth momentum driven by technological advancement, changing consumer lifestyles, and increasing emphasis on energy efficiency. The sector encompasses diverse product categories with security systems, climate control, and entertainment devices leading adoption rates. Consumer behavior patterns indicate growing preference for integrated ecosystems rather than standalone devices, creating opportunities for comprehensive platform providers.

Key market drivers include rising energy costs prompting 35% of consumers to seek energy-efficient solutions, increasing security concerns, and the proliferation of high-speed internet infrastructure across Canadian regions. The market benefits from strong smartphone penetration rates and growing familiarity with voice-activated technologies. Competitive landscape features both international technology giants and specialized Canadian companies developing region-specific solutions.

Market challenges include privacy concerns, interoperability issues between different device ecosystems, and initial investment costs. However, declining device prices and improved user interfaces continue to lower adoption barriers. The sector shows particular strength in urban markets while rural adoption accelerates with improved connectivity infrastructure.

Strategic market insights reveal several critical trends shaping the Canadian smart home landscape:

Market maturation indicators include standardization efforts, improved device interoperability, and the emergence of comprehensive smart home service providers offering end-to-end solutions.

Primary market drivers propelling smart home adoption across Canada include multiple interconnected factors that address evolving consumer needs and technological capabilities.

Energy efficiency concerns represent a fundamental driver as Canadian households face rising utility costs and increasing environmental awareness. Smart thermostats, lighting controls, and energy monitoring systems enable significant cost savings while supporting sustainability goals. Government incentives and rebate programs further encourage adoption of energy-efficient smart home technologies.

Security enhancement needs drive substantial demand for smart security systems, cameras, and access control solutions. Growing urbanization and changing work patterns, including remote work arrangements, increase homeowner focus on property protection and monitoring capabilities. Insurance benefits offered for smart security installations provide additional adoption incentives.

Convenience and lifestyle factors motivate consumers to embrace automation solutions that simplify daily routines and enhance living experiences. Voice control integration, automated scheduling, and remote monitoring capabilities align with busy lifestyles and tech-savvy consumer preferences. Aging population demographics create demand for assistive technologies and health monitoring solutions integrated into smart home platforms.

Infrastructure improvements including widespread high-speed internet availability and 5G network deployment enable more sophisticated smart home applications and real-time connectivity requirements.

Market restraints present challenges that may limit the pace of smart home adoption across Canadian households, requiring strategic solutions from industry participants.

Privacy and security concerns represent significant barriers as consumers express apprehension about data collection, storage, and potential cybersecurity vulnerabilities. High-profile data breaches and privacy incidents in the technology sector have heightened consumer awareness and skepticism regarding connected devices in personal spaces. Regulatory uncertainty around data protection and device security standards creates additional consumer hesitation.

High initial investment costs deter price-sensitive consumers, particularly for comprehensive smart home systems requiring multiple devices and professional installation. While individual device prices continue declining, complete home automation systems still represent substantial upfront expenses. Ongoing subscription costs for cloud services and premium features add to total ownership expenses.

Technical complexity and interoperability challenges frustrate consumers attempting to integrate devices from different manufacturers. Compatibility issues between competing ecosystems create fragmented user experiences and limit system expandability. Installation and setup difficulties require technical expertise that many consumers lack, necessitating professional services that increase overall costs.

Rural connectivity limitations restrict smart home adoption in remote Canadian regions where internet infrastructure remains inadequate for reliable device operation and cloud-based services.

Emerging opportunities within the Canadian smart home market present significant potential for growth and innovation across multiple segments and applications.

Healthcare integration represents a substantial opportunity as Canada’s aging population creates demand for health monitoring, emergency response, and assisted living technologies. Smart home platforms can incorporate medical alert systems, medication reminders, and wellness tracking capabilities. Telehealth integration enables remote patient monitoring and consultation services through connected home devices.

Energy grid integration offers opportunities for smart home systems to participate in demand response programs, energy storage management, and renewable energy optimization. Utility partnerships can provide smart home devices and services while supporting grid stability and efficiency objectives. Solar panel integration and battery storage systems create comprehensive energy management ecosystems.

Artificial intelligence advancement enables more sophisticated automation, predictive analytics, and personalized user experiences. Machine learning algorithms can optimize energy consumption, predict maintenance needs, and adapt to user behavior patterns. Edge computing capabilities address privacy concerns while improving response times and reducing cloud dependency.

Commercial and multi-family applications extend smart home technologies to apartment buildings, condominiums, and rental properties. Property management companies increasingly recognize smart home features as competitive advantages for tenant attraction and retention.

Market dynamics within the Canadian smart home sector reflect complex interactions between technological innovation, consumer behavior, regulatory environment, and competitive forces shaping industry evolution.

Technology convergence drives integration between previously separate device categories, creating comprehensive ecosystem solutions. The boundaries between security, entertainment, climate control, and energy management systems continue blurring as platforms offer unified control interfaces. Artificial intelligence integration enables predictive capabilities and automated decision-making that enhance user experiences while reducing manual intervention requirements.

Consumer education initiatives by manufacturers, retailers, and industry associations help address knowledge gaps and reduce adoption barriers. Demonstration centers, online resources, and professional consultation services support informed purchase decisions. Retail channel evolution includes specialized smart home showrooms and enhanced online purchasing experiences with virtual consultations.

Competitive intensity increases as traditional technology companies, telecommunications providers, security firms, and new entrants compete for market share. Partnership strategies between device manufacturers, service providers, and installation companies create comprehensive value propositions. Strategic alliances enable companies to offer complete solutions while focusing on core competencies.

Regulatory developments around privacy protection, cybersecurity standards, and energy efficiency requirements influence product development and market positioning strategies.

Research methodology for analyzing the Canadian smart home market employs comprehensive data collection and analysis techniques to ensure accurate market insights and reliable projections.

Primary research includes structured surveys of Canadian consumers across diverse demographic segments, geographic regions, and income levels to understand adoption patterns, preferences, and barriers. In-depth interviews with industry executives, retailers, installers, and service providers provide qualitative insights into market dynamics and competitive strategies. Focus group discussions explore consumer attitudes toward smart home technologies, privacy concerns, and feature preferences.

Secondary research encompasses analysis of industry reports, government statistics, regulatory documents, and company financial disclosures. Patent filings, product launches, and technology announcements provide insights into innovation trends and competitive positioning. Market data triangulation validates findings across multiple sources to ensure accuracy and reliability.

Quantitative analysis employs statistical modeling techniques to project market growth, segment performance, and regional variations. Time series analysis identifies trends and cyclical patterns while regression analysis determines relationships between market drivers and adoption rates. Scenario modeling evaluates potential market outcomes under different economic and technological conditions.

Expert validation through industry advisory panels ensures research findings align with market realities and professional observations from experienced practitioners.

Regional analysis reveals distinct patterns of smart home adoption across Canadian provinces and territories, reflecting varying demographics, economic conditions, and infrastructure capabilities.

Ontario market leads national adoption with 38% market share, driven by high population density, strong economic conditions, and technology-forward consumer base. The Greater Toronto Area demonstrates particularly high penetration rates for comprehensive smart home systems. Urban centers including Ottawa and Hamilton show strong growth in security and energy management applications.

British Columbia represents the second-largest market with 22% share, characterized by environmentally conscious consumers driving demand for energy-efficient smart home solutions. Vancouver’s tech industry presence influences early adoption of innovative products and services. Sustainability focus in the province aligns with smart home energy management capabilities.

Quebec market accounts for 19% share with unique characteristics including language preferences for French-language interfaces and customer support. Montreal’s diverse population creates demand for multicultural smart home solutions. Provincial energy policies supporting efficiency improvements encourage smart thermostat and energy monitoring adoption.

Prairie provinces including Alberta, Saskatchewan, and Manitoba show growing adoption rates, particularly in urban centers like Calgary and Edmonton. Rural connectivity improvements expand market opportunities in previously underserved areas. Atlantic provinces demonstrate increasing interest in smart home security and climate control solutions as infrastructure capabilities improve.

Competitive landscape analysis reveals a dynamic market structure featuring established technology leaders, telecommunications providers, specialized smart home companies, and emerging innovative players.

Market competition intensifies as companies expand beyond core competencies to offer comprehensive smart home ecosystems. Strategic partnerships between device manufacturers and service providers create integrated solutions addressing installation, support, and ongoing management requirements.

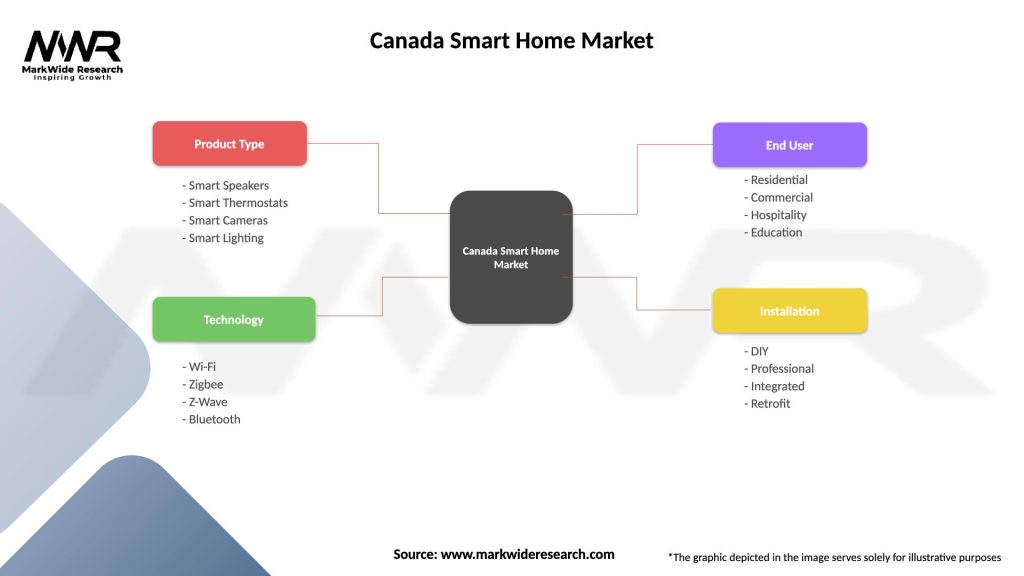

Market segmentation analysis provides detailed insights into various categories, applications, and consumer segments driving smart home adoption across Canada.

By Product Category:

By Technology:

By Application:

Category-wise insights reveal distinct growth patterns, consumer preferences, and market opportunities across different smart home product segments.

Security Systems Category maintains market leadership with consistent growth driven by safety concerns and insurance incentives. Video doorbells show particularly strong adoption as entry-level smart home devices. Professional monitoring services create recurring revenue opportunities while DIY security systems appeal to cost-conscious consumers. Integration capabilities with existing home security infrastructure support upgrade and expansion strategies.

Climate Control Segment demonstrates strong growth potential as energy costs rise and environmental awareness increases. Smart thermostats offer immediate value through energy savings and utility rebate programs. Advanced features including learning algorithms, occupancy detection, and weather integration enhance user experiences. HVAC system integration creates opportunities for comprehensive climate management solutions.

Entertainment Systems benefit from streaming service popularity and content consumption trends. Smart TV integration with voice control and home automation platforms creates seamless user experiences. Audio systems with multi-room capabilities and voice assistant integration show growing demand. Gaming integration appeals to younger demographics while family-friendly features attract broader audiences.

Kitchen Appliances represent emerging opportunities as manufacturers integrate connectivity and smart features. Energy efficiency and convenience benefits drive adoption while recipe integration and cooking automation appeal to busy households.

Industry participants across the Canadian smart home ecosystem realize significant benefits through market participation, technological innovation, and strategic positioning.

Device Manufacturers benefit from expanding market opportunities, recurring revenue through software and services, and brand differentiation through innovative features. Product lifecycle extension through software updates and feature additions creates sustained customer relationships. Integration partnerships with service providers and retailers expand distribution channels and market reach.

Service Providers including telecommunications companies and security firms leverage smart home offerings to reduce customer churn, increase average revenue per user, and create competitive differentiation. Bundled service packages combining internet, television, and smart home services improve customer retention while generating additional revenue streams.

Retailers and Installers capitalize on growing demand for professional consultation, installation, and ongoing support services. High-margin services complement product sales while creating customer relationships for future upgrades and expansions. Specialized expertise in smart home integration becomes a competitive advantage.

Consumers realize benefits including enhanced security, energy savings, convenience, and lifestyle improvements. Property value increases from smart home installations provide long-term financial benefits while immediate operational savings offset initial investment costs. Insurance discounts and utility rebates further improve return on investment.

Utility Companies benefit from demand response capabilities, grid stability improvements, and customer engagement opportunities through smart home energy management systems.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the Canadian smart home landscape reflect evolving consumer preferences, technological capabilities, and industry dynamics.

Voice Control Dominance continues expanding as consumers embrace hands-free interaction with smart home systems. Natural language processing improvements enable more sophisticated commands and conversational interfaces. Multi-language support addresses Canada’s bilingual requirements while dialect recognition enhances user experiences.

Ecosystem Consolidation drives consumers toward integrated platforms rather than fragmented device collections. Single-app control for multiple device categories simplifies user experiences while reducing complexity. Platform loyalty increases as consumers invest in comprehensive ecosystems from preferred providers.

Edge Computing Integration addresses privacy concerns while improving response times and reducing cloud dependency. Local processing capabilities enable smart home functions during internet outages while keeping sensitive data on-premises. This trend particularly appeals to privacy-conscious Canadian consumers.

Subscription Service Models gain traction as companies seek recurring revenue streams beyond hardware sales. Premium features including advanced analytics, extended warranties, and professional support create ongoing customer relationships. According to MarkWide Research analysis, subscription-based services show 23% annual growth in customer adoption.

Sustainability Focus influences product development and marketing strategies as environmentally conscious consumers prioritize energy-efficient solutions. Carbon footprint tracking and renewable energy integration become important differentiating features.

Industry developments demonstrate the dynamic nature of the Canadian smart home market with significant technological advances, strategic partnerships, and regulatory changes shaping future growth.

5G Network Deployment across major Canadian cities enables more sophisticated smart home applications requiring high-bandwidth, low-latency connectivity. Enhanced capabilities include real-time video analytics, augmented reality interfaces, and complex automation scenarios. Telecommunications providers leverage 5G infrastructure to offer premium smart home services.

Matter Protocol Adoption addresses interoperability challenges by creating universal standards for device communication across different ecosystems. Industry collaboration between major technology companies promises improved compatibility and simplified setup processes. Canadian consumers benefit from reduced vendor lock-in and expanded device choices.

Artificial Intelligence Integration advances through machine learning algorithms that adapt to user behavior patterns and preferences. Predictive capabilities enable proactive system adjustments for energy optimization, security monitoring, and maintenance scheduling. Natural language processing improvements enhance voice control accuracy and functionality.

Privacy Regulation Evolution including updates to Canadian privacy laws influences product development and data handling practices. Compliance requirements drive investment in local data processing, encryption technologies, and transparent privacy controls. Industry participants adapt business models to address regulatory requirements while maintaining functionality.

Utility Partnership Programs expand as energy companies recognize smart home technologies’ potential for demand management and grid optimization. Rebate programs and time-of-use integration create additional value propositions for consumers.

Strategic recommendations for market participants focus on addressing current challenges while capitalizing on emerging opportunities within the Canadian smart home sector.

Prioritize Privacy and Security by implementing robust cybersecurity measures, transparent data practices, and local processing capabilities. Consumer trust represents a critical success factor requiring ongoing investment in security infrastructure and clear communication about data handling practices. Companies should obtain relevant security certifications and undergo regular audits to demonstrate commitment to privacy protection.

Simplify User Experiences through intuitive interfaces, streamlined setup processes, and comprehensive customer support. Complexity reduction initiatives should focus on plug-and-play installation, automated device discovery, and guided configuration processes. Professional installation services and ongoing technical support create competitive advantages while addressing consumer concerns about technical complexity.

Develop Integrated Ecosystems rather than standalone products to meet consumer preferences for comprehensive solutions. Platform strategies should emphasize compatibility, scalability, and unified control interfaces. Strategic partnerships between device manufacturers, software developers, and service providers enable complete solution offerings.

Target Underserved Segments including rural markets, seniors, and budget-conscious consumers through tailored products and services. Market expansion opportunities exist in addressing specific needs of different demographic groups with appropriate pricing, features, and support models. MWR data suggests 31% growth potential in previously underserved market segments.

Invest in Local Partnerships with Canadian retailers, installers, and service providers to build strong distribution networks and customer relationships.

Future outlook for the Canadian smart home market indicates sustained growth driven by technological advancement, changing consumer behaviors, and supportive market conditions through the forecast period.

Market expansion will continue across all product categories with security systems maintaining leadership while energy management and healthcare applications show accelerating growth. Penetration rates are projected to reach 45% of Canadian households within the next five years as prices decline and user experiences improve. Urban markets will approach saturation while rural adoption accelerates with infrastructure improvements.

Technology evolution will focus on artificial intelligence integration, edge computing capabilities, and enhanced interoperability. Machine learning algorithms will enable more sophisticated automation and personalization while reducing user intervention requirements. Voice control will become more natural and context-aware while supporting multiple languages and dialects relevant to Canadian demographics.

Service model transformation will shift toward comprehensive managed services combining devices, installation, monitoring, and ongoing support. Subscription-based offerings will expand beyond basic monitoring to include predictive maintenance, energy optimization, and lifestyle services. Professional service providers will play increasingly important roles in market development and customer satisfaction.

Regulatory environment will continue evolving with enhanced privacy protections, cybersecurity standards, and energy efficiency requirements. Industry standards will mature to address interoperability, security, and performance requirements while supporting innovation and competition.

Market consolidation may occur as smaller players struggle to compete with comprehensive ecosystem providers, while strategic partnerships and acquisitions reshape competitive dynamics.

The Canada smart home market represents a dynamic and rapidly evolving sector with substantial growth potential driven by technological innovation, changing consumer preferences, and supportive market conditions. Market fundamentals remain strong with increasing consumer awareness, improving infrastructure, and declining technology costs creating favorable adoption conditions across diverse demographic segments and geographic regions.

Key success factors for market participants include addressing privacy and security concerns, simplifying user experiences, developing integrated ecosystem solutions, and building strong local partnerships. Companies that effectively balance innovation with practical consumer needs while maintaining competitive pricing will capture the greatest market opportunities. Strategic focus on underserved segments including rural markets, seniors, and budget-conscious consumers offers significant expansion potential.

Future market development will be characterized by continued technology advancement, service model evolution, and regulatory maturation. The integration of artificial intelligence, edge computing, and enhanced interoperability standards will drive next-generation smart home capabilities while addressing current market limitations. MarkWide Research projects sustained growth momentum with expanding applications in healthcare, energy management, and commercial sectors creating new revenue opportunities for industry participants.

The Canadian smart home market’s trajectory indicates a maturing industry with strong fundamentals, diverse growth opportunities, and increasing consumer acceptance positioning it for continued expansion and innovation in the years ahead.

What is Smart Home?

Smart Home refers to a residential setup where appliances and devices are interconnected and can be controlled remotely through a smartphone or other networked devices. This includes systems for lighting, heating, security, and entertainment, enhancing convenience and energy efficiency.

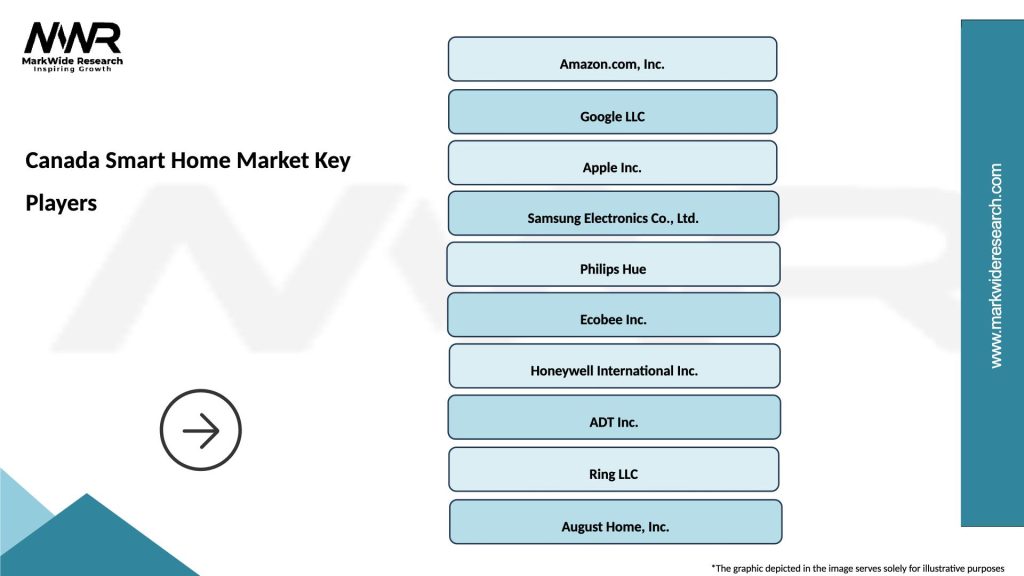

What are the key players in the Canada Smart Home Market?

Key players in the Canada Smart Home Market include companies like Ecobee, which specializes in smart thermostats, and Lutron, known for its smart lighting solutions. Other notable companies are Google Nest and Amazon, which offer a range of smart home devices and ecosystems, among others.

What are the growth factors driving the Canada Smart Home Market?

The Canada Smart Home Market is driven by increasing consumer demand for energy efficiency, advancements in IoT technology, and the growing popularity of home automation systems. Additionally, rising awareness of home security and convenience features contributes to market growth.

What challenges does the Canada Smart Home Market face?

Challenges in the Canada Smart Home Market include concerns over data privacy and security, as well as the complexity of integrating various devices and systems. Additionally, high initial costs and a lack of standardization can hinder widespread adoption.

What future opportunities exist in the Canada Smart Home Market?

Future opportunities in the Canada Smart Home Market include the integration of artificial intelligence for smarter automation and the expansion of smart home products into new segments like healthcare and energy management. The increasing trend of remote work also presents new avenues for smart home solutions.

What trends are shaping the Canada Smart Home Market?

Trends in the Canada Smart Home Market include the rise of voice-activated devices, increased focus on energy-efficient solutions, and the growing popularity of smart home ecosystems that allow for seamless integration of various devices. Additionally, sustainability and eco-friendly products are becoming more prominent.

Canada Smart Home Market

| Segmentation Details | Description |

|---|---|

| Product Type | Smart Speakers, Smart Thermostats, Smart Cameras, Smart Lighting |

| Technology | Wi-Fi, Zigbee, Z-Wave, Bluetooth |

| End User | Residential, Commercial, Hospitality, Education |

| Installation | DIY, Professional, Integrated, Retrofit |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Smart Home Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at