444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Canada residential real estate market has been experiencing steady growth and remains an attractive investment option for both domestic and international buyers. The market is characterized by a diverse range of properties, including single-family homes, condominiums, townhouses, and rental apartments. Canada’s strong economy, stable political environment, and high quality of life make it an ideal destination for real estate investment.

Meaning

Residential real estate refers to properties that are designed and used primarily for housing purposes. These properties include houses, apartments, and other dwellings where people live. The Canada residential real estate market focuses on the buying, selling, and renting of these properties across the country.

Executive Summary

The Canada residential real estate market has witnessed robust growth in recent years, driven by various factors such as population growth, low mortgage rates, and increased demand for housing. The market offers a wide range of options for buyers, catering to different preferences and budgets. However, it also faces challenges such as rising prices, affordability issues, and regulatory changes. Despite these challenges, the market continues to provide opportunities for investors and industry participants.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Canada residential real estate market is influenced by a complex interplay of various factors. Supply and demand dynamics, economic conditions, government policies, and consumer preferences all shape the market’s dynamics. Market participants need to stay informed about these factors to make informed decisions and navigate the ever-changing landscape.

Regional Analysis

The Canadian residential real estate market exhibits regional variations in terms of demand, prices, and market conditions. Major cities like Vancouver, Toronto, and Montreal have experienced significant price appreciation and high demand, driven by factors such as population growth, foreign investment, and economic opportunities. In contrast, smaller cities and rural areas may offer more affordable options and attractive investment opportunities. It is essential for investors and industry participants to understand the unique dynamics of each region before making investment decisions.

Competitive Landscape

Leading Companies in the Canada Residential Real Estate Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Canada residential real estate market can be segmented based on various factors, including property types, price ranges, and geographic regions. Property types include single-family homes, condominiums, townhouses, and rental apartments. Price ranges vary from affordable housing options to luxury properties catering to high-net-worth individuals. Geographic segmentation involves analyzing market conditions and trends in different regions, such as urban versus rural areas or specific cities.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the Canada residential real estate market. During the initial phase of the pandemic, market activity slowed down due to lockdowns, travel restrictions, and economic uncertainty. However, the market rebounded strongly as restrictions eased, fueled by pent-up demand, low interest rates, and changing housing preferences. The pandemic also highlighted the importance of adaptable living spaces and the need for homes that can accommodate remote work and flexible lifestyles.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Canada residential real estate market is expected to continue its growth trajectory in the coming years, driven by population growth, urbanization, and favorable economic conditions. While challenges such as affordability issues and regulatory changes persist, market participants are likely to find opportunities in rental markets, affordable housing initiatives, renovation services, sustainable housing, and the second-home market. Technology advancements, changing demographics, and evolving lifestyles will shape the market’s future dynamics, necessitating adaptability and innovation from industry participants.

Conclusion

The Canada residential real estate market offers a diverse range of opportunities for investors, developers, and industry participants. It benefits from a stable political environment, a strong economy, and a high quality of life. While challenges such as affordability issues and supply constraints exist, the market continues to attract buyers and provide investment potential. Understanding market trends, regional dynamics, and consumer preferences is crucial for making informed decisions and capitalizing on the opportunities available in this dynamic and competitive market.

What is Canada Residential Real Estate?

Canada Residential Real Estate refers to the market segment that encompasses the buying, selling, and renting of residential properties such as single-family homes, condominiums, and townhouses across Canada.

What are the key players in the Canada Residential Real Estate Market?

Key players in the Canada Residential Real Estate Market include companies like Royal LePage, RE/MAX, and Century 21, which provide real estate services and listings, among others.

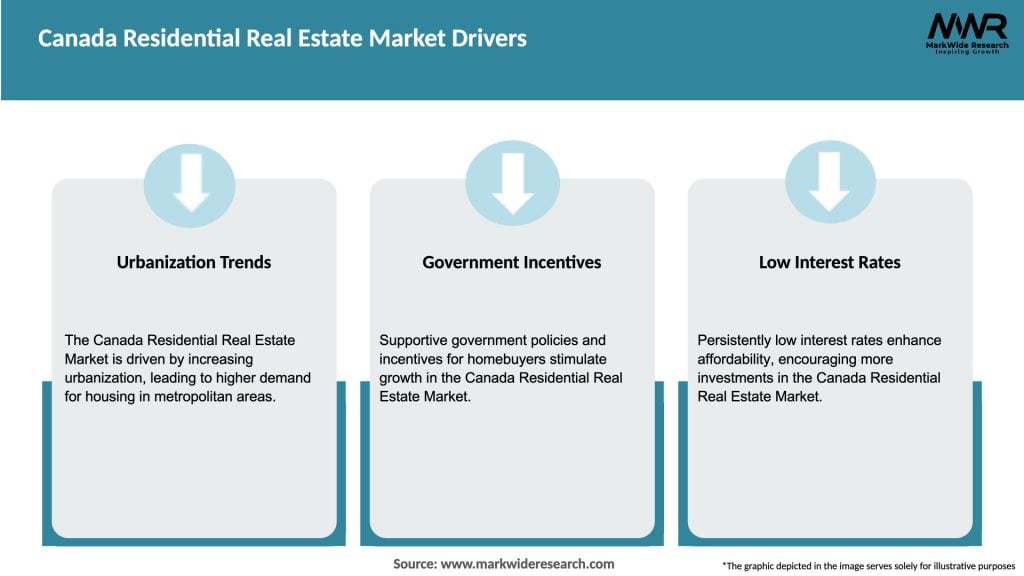

What are the main drivers of the Canada Residential Real Estate Market?

The main drivers of the Canada Residential Real Estate Market include low interest rates, population growth, and urbanization, which increase demand for housing in major cities.

What challenges does the Canada Residential Real Estate Market face?

Challenges in the Canada Residential Real Estate Market include affordability issues, regulatory changes, and fluctuating market conditions that can impact buyer confidence.

What opportunities exist in the Canada Residential Real Estate Market?

Opportunities in the Canada Residential Real Estate Market include the growing demand for sustainable housing, the rise of remote work leading to increased interest in suburban areas, and potential investments in rental properties.

What trends are shaping the Canada Residential Real Estate Market?

Trends shaping the Canada Residential Real Estate Market include the increasing popularity of smart home technology, a shift towards eco-friendly building practices, and the rise of co-living spaces as urban living evolves.

Canada Residential Real Estate Market

| Segmentation Details | Description |

|---|---|

| Property Type | Single-Family Homes, Condominiums, Townhouses, Duplexes |

| Buyer Type | First-Time Buyers, Investors, Retirees, Families |

| Financing Method | Conventional Loans, FHA Loans, VA Loans, Cash Purchases |

| Market Segment | Luxury, Affordable, Mid-Range, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Canada Residential Real Estate Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at