444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada refrigerated vehicles market represents a critical component of the nation’s cold chain logistics infrastructure, serving diverse industries from food distribution to pharmaceutical transportation. Refrigerated vehicles, commonly known as reefer trucks, maintain temperature-controlled environments essential for preserving perishable goods throughout the supply chain. The Canadian market demonstrates robust growth driven by expanding e-commerce food delivery, stringent food safety regulations, and increasing consumer demand for fresh and frozen products.

Market dynamics indicate significant expansion opportunities across multiple sectors, with the food and beverage industry representing the largest application segment. The market encompasses various vehicle types including light commercial vehicles, medium-duty trucks, heavy-duty trucks, and specialized trailers equipped with advanced refrigeration systems. Technological advancements in refrigeration efficiency, telematics integration, and sustainable cooling solutions are reshaping the competitive landscape.

Regional distribution shows concentrated demand in major metropolitan areas including Toronto, Vancouver, Montreal, and Calgary, where population density and commercial activity drive higher requirements for temperature-controlled transportation. The market benefits from Canada’s extensive agricultural production, particularly in provinces like Ontario, Quebec, and British Columbia, creating substantial demand for farm-to-market cold chain solutions. Growth projections suggest the market will expand at a compound annual growth rate of 6.2% through the forecast period, supported by infrastructure investments and evolving consumer preferences.

The Canada refrigerated vehicles market refers to the comprehensive ecosystem of temperature-controlled transportation solutions designed to maintain specific temperature ranges for perishable goods throughout the distribution process. These specialized vehicles incorporate advanced refrigeration systems, insulation technologies, and monitoring equipment to ensure product integrity from origin to destination.

Refrigerated vehicles serve as mobile cold storage units, enabling the safe transportation of temperature-sensitive products including fresh produce, dairy products, frozen foods, pharmaceuticals, chemicals, and other perishable commodities. The market encompasses various vehicle configurations, from small delivery vans for last-mile distribution to large semi-trailers for long-haul transportation, each designed to meet specific operational requirements and regulatory standards.

Cold chain logistics represents the backbone of modern food distribution systems, with refrigerated vehicles playing an essential role in maintaining unbroken temperature control. The market includes both the vehicles themselves and associated services such as maintenance, monitoring systems, and specialized logistics solutions that ensure compliance with food safety regulations and quality standards.

Market leadership in Canada’s refrigerated vehicles sector is characterized by strong demand fundamentals driven by population growth, urbanization, and evolving consumer preferences for fresh and convenience foods. The market demonstrates resilience through economic cycles, supported by essential nature of food distribution and pharmaceutical logistics requirements.

Key growth drivers include the rapid expansion of online grocery shopping, which has accelerated 42% adoption rates among Canadian consumers, creating increased demand for last-mile cold chain delivery solutions. The food service industry’s recovery and expansion, particularly in quick-service restaurants and meal delivery services, contributes significantly to market growth. Regulatory compliance requirements under the Safe Food for Canadians Regulations drive fleet modernization and technology adoption.

Technology integration emerges as a critical differentiator, with advanced telematics systems, IoT sensors, and predictive maintenance capabilities becoming standard features. The market shows increasing adoption of environmentally sustainable refrigeration technologies, including electric and hybrid powertrains, responding to government emissions reduction targets and corporate sustainability initiatives.

Competitive dynamics feature established commercial vehicle manufacturers expanding their refrigerated offerings alongside specialized cold chain equipment providers. Market consolidation trends indicate strategic partnerships between vehicle manufacturers, refrigeration system suppliers, and logistics service providers to deliver comprehensive solutions.

Market segmentation reveals distinct growth patterns across different vehicle categories and applications, with each segment responding to specific industry requirements and operational constraints:

E-commerce expansion represents the most significant growth driver, with online grocery sales experiencing unprecedented growth rates and creating substantial demand for last-mile refrigerated delivery capabilities. Canadian consumers increasingly expect fresh and frozen products delivered directly to their homes, driving investment in urban distribution networks and specialized delivery vehicles.

Food safety regulations continue to strengthen, with the Canadian Food Inspection Agency implementing stricter temperature monitoring and documentation requirements. These regulatory changes necessitate fleet upgrades and technology investments, driving replacement cycles and modernization initiatives across the industry. Compliance costs create barriers to entry while benefiting established operators with advanced systems.

Agricultural production growth in key provinces supports sustained demand for farm-to-market transportation solutions. Canada’s position as a major agricultural exporter requires efficient cold chain infrastructure to maintain product quality and meet international standards. Seasonal variations in production create peak demand periods that drive capacity expansion and equipment utilization optimization.

Urbanization trends concentrate population in major metropolitan areas, creating dense demand centers that require efficient cold chain distribution networks. The growth of food service establishments, convenience stores, and specialty retailers in urban markets drives consistent demand for refrigerated transportation services. Population growth of 1.4% annually sustains long-term market expansion prospects.

High capital costs associated with refrigerated vehicle acquisition and maintenance create significant barriers for smaller operators and new market entrants. The specialized nature of refrigeration equipment requires substantial upfront investments and ongoing maintenance expenses that can strain operational budgets, particularly for independent operators and regional fleet owners.

Fuel cost volatility impacts operational economics, with refrigerated vehicles typically consuming 25% more fuel than standard commercial vehicles due to auxiliary power requirements for refrigeration systems. Energy costs represent a significant portion of operating expenses, making fleet operators vulnerable to commodity price fluctuations and economic uncertainty.

Driver shortage challenges affect the broader commercial vehicle industry, with specialized requirements for refrigerated transport operations creating additional recruitment and retention difficulties. The need for trained drivers familiar with temperature control systems and cold chain protocols limits available labor pools and increases wage pressures across the sector.

Regulatory complexity across different provinces and municipalities creates compliance challenges for operators serving multiple markets. Varying standards for emissions, weight limits, and operational requirements increase administrative burdens and may necessitate different vehicle specifications for different regions, complicating fleet management and increasing costs.

Electric vehicle adoption presents significant growth opportunities as government incentives and environmental regulations drive demand for zero-emission commercial vehicles. Early adopters of electric refrigerated vehicles can capitalize on regulatory advantages, operational cost savings, and corporate sustainability initiatives while establishing competitive positioning in emerging market segments.

Technology integration opportunities include advanced telematics systems, artificial intelligence for route optimization, and predictive maintenance capabilities that can reduce operational costs and improve service reliability. IoT connectivity enables real-time monitoring and data analytics that create value-added services and operational efficiencies for fleet operators and their customers.

Cross-border trade expansion with the United States creates opportunities for specialized refrigerated transportation services supporting agricultural exports and food imports. The United States-Mexico-Canada Agreement facilitates trade flows that require reliable cold chain infrastructure, benefiting operators with appropriate equipment and regulatory compliance capabilities.

Pharmaceutical logistics growth driven by an aging population and expanding healthcare sector creates demand for specialized temperature-controlled transportation with stringent monitoring and documentation requirements. This high-value segment offers premium pricing opportunities for operators with appropriate certifications and capabilities.

Supply chain evolution toward more direct-to-consumer models fundamentally alters refrigerated vehicle requirements, with increased emphasis on smaller, more maneuverable vehicles capable of efficient urban delivery operations. Traditional hub-and-spoke distribution models are supplementing with micro-fulfillment centers and local distribution networks that require different vehicle specifications and operational approaches.

Seasonal demand patterns create cyclical market dynamics, with peak requirements during harvest seasons and holiday periods driving capacity utilization and pricing power. Fleet operators must balance fixed costs with variable demand, leading to increased adoption of flexible leasing arrangements and shared capacity models that optimize asset utilization across seasonal cycles.

Competitive intensity varies across market segments, with established players dominating long-haul operations while new entrants focus on specialized niches and urban delivery markets. Market consolidation trends indicate strategic acquisitions and partnerships as companies seek scale advantages and comprehensive service capabilities to serve large customers with complex requirements.

Technology disruption accelerates market transformation through autonomous vehicle development, advanced refrigeration systems, and integrated logistics platforms. Early technology adopters gain competitive advantages through operational efficiency improvements and enhanced service capabilities, while traditional operators face pressure to modernize or risk market share erosion.

Primary research methodologies employed comprehensive industry surveys, executive interviews, and stakeholder consultations to gather firsthand insights into market trends, challenges, and opportunities. Direct engagement with fleet operators, equipment manufacturers, and logistics service providers provided detailed understanding of operational requirements and market dynamics across different segments and regions.

Secondary research incorporated extensive analysis of industry publications, government statistics, regulatory filings, and company reports to establish market baselines and validate primary research findings. MarkWide Research analysts utilized proprietary databases and industry contacts to ensure comprehensive coverage of market participants and emerging trends affecting the refrigerated vehicles sector.

Data validation processes included cross-referencing multiple sources, statistical analysis of survey responses, and expert review panels to ensure accuracy and reliability of market insights. Quantitative analysis focused on growth rates, market share distributions, and trend identification while qualitative assessment provided context and strategic implications for market participants.

Market modeling incorporated economic indicators, demographic trends, and industry-specific factors to develop growth projections and scenario analysis. Regional analysis considered provincial differences in regulations, economic conditions, and infrastructure development to provide localized market insights and opportunities assessment.

Ontario market dominates the Canadian refrigerated vehicles sector, accounting for approximately 45% of national demand driven by the Greater Toronto Area’s concentration of population, food processing facilities, and distribution centers. The province’s extensive highway network and proximity to major U.S. markets support both domestic and cross-border cold chain operations, creating sustained demand for various vehicle types and configurations.

Quebec region represents the second-largest market with 22% market share, supported by Montreal’s role as a major distribution hub and the province’s significant agricultural production. French-language requirements and distinct regulatory environment create specific market characteristics that favor local operators and specialized service providers familiar with provincial requirements and cultural preferences.

British Columbia shows strong growth potential with 18% market representation, driven by Vancouver’s position as a Pacific gateway and the province’s diverse agricultural sector including specialty crops and seafood products. The region’s environmental consciousness drives higher adoption rates of sustainable refrigeration technologies and alternative fuel vehicles compared to national averages.

Prairie provinces collectively account for 12% of market demand, with agricultural production and resource extraction activities creating specific requirements for refrigerated transportation. Seasonal demand patterns and long-distance transportation requirements favor larger vehicles and specialized equipment capable of operating in challenging weather conditions and remote locations.

Atlantic Canada represents 3% of national market but shows growth opportunities in seafood transportation and regional food distribution. The region’s island geography and seasonal tourism create unique logistics challenges that require specialized solutions and flexible capacity management approaches.

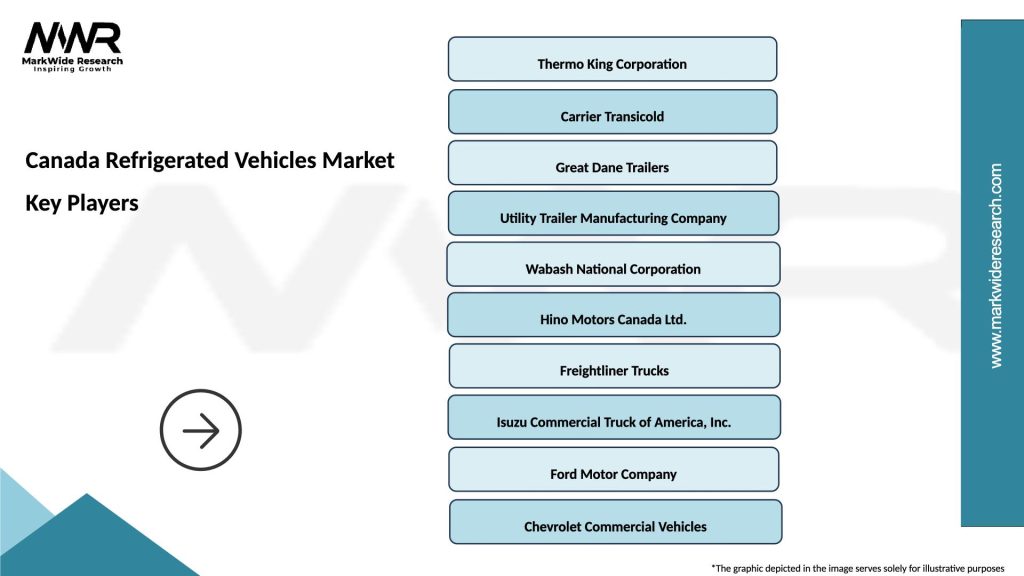

Market leadership features established commercial vehicle manufacturers with strong dealer networks and comprehensive service capabilities competing alongside specialized refrigeration equipment suppliers and integrated logistics service providers:

Competitive strategies focus on technology differentiation, service network expansion, and strategic partnerships to provide comprehensive solutions. Market leaders invest heavily in research and development to advance refrigeration efficiency, reduce environmental impact, and integrate digital technologies that enhance operational capabilities and customer value propositions.

By Vehicle Type:

By Application:

By Technology:

Light commercial vehicles demonstrate the highest growth rates within the refrigerated vehicles market, driven by last-mile delivery requirements and urban distribution needs. These vehicles typically feature compact refrigeration systems optimized for fuel efficiency and maneuverability in congested urban environments. Adoption rates show particular strength in pharmaceutical delivery and specialty food distribution where frequent stops and precise temperature control are essential.

Medium-duty refrigerated trucks serve as the backbone of regional distribution networks, offering optimal balance between payload capacity and operational flexibility. This segment benefits from standardized refrigeration systems and established service networks that reduce total cost of ownership. Fleet operators favor these vehicles for multi-stop routes and mixed-load applications that require reliable temperature control across diverse product categories.

Heavy-duty refrigerated vehicles focus on long-haul efficiency and maximum payload capacity, incorporating advanced aerodynamics and fuel-efficient refrigeration systems. These vehicles typically feature sophisticated monitoring systems and redundant cooling capabilities to ensure product integrity during extended transportation periods. Cross-border operations represent a significant application area requiring compliance with multiple regulatory jurisdictions.

Specialized refrigerated trailers provide flexible capacity solutions that can be paired with various tractor configurations based on operational requirements. This segment shows innovation in multi-temperature zones, advanced insulation materials, and modular refrigeration systems that adapt to different cargo requirements. Leasing arrangements are particularly common in this category, allowing operators to match capacity with seasonal demand patterns.

Fleet operators benefit from improved operational efficiency through advanced refrigeration technologies that reduce fuel consumption and maintenance requirements. Modern refrigerated vehicles incorporate telematics systems that provide real-time monitoring capabilities, enabling proactive maintenance scheduling and optimized route planning. Cost reduction opportunities include lower insurance premiums for vehicles with advanced safety systems and potential tax incentives for environmentally friendly technologies.

Food producers and distributors gain enhanced product quality preservation and extended shelf life through reliable temperature control throughout the distribution process. Advanced monitoring systems provide comprehensive documentation for regulatory compliance and quality assurance programs. Market expansion opportunities emerge through improved cold chain capabilities that enable service to previously inaccessible geographic markets and customer segments.

Consumers benefit from improved product quality, safety, and availability of fresh and frozen products across diverse retail channels. Enhanced cold chain infrastructure supports expanded product selection and competitive pricing through improved distribution efficiency. Convenience factors include reliable home delivery of temperature-sensitive products and consistent product quality across different retail locations.

Environmental stakeholders benefit from technological advances that reduce emissions and improve energy efficiency in commercial transportation. Electric and hybrid refrigerated vehicles contribute to air quality improvements in urban areas while advanced refrigeration systems reduce overall environmental impact. Sustainability initiatives supported by modern refrigerated vehicles align with corporate responsibility goals and regulatory requirements for emissions reduction.

Strengths:

Weaknesses:

Opportunities:

Threats:

Electrification adoption accelerates across urban delivery segments, with major fleet operators conducting pilot programs and early deployments of electric refrigerated vehicles. Government incentives and emissions regulations drive investment in charging infrastructure and vehicle technology development. Battery technology improvements extend operational range and reduce total cost of ownership, making electric options increasingly viable for commercial applications.

Autonomous vehicle development progresses toward commercial deployment, with refrigerated applications presenting attractive use cases for automated long-haul transportation. Advanced driver assistance systems currently available provide safety improvements and operational efficiency gains while full autonomy remains in development phases. Technology integration focuses on seamless connectivity between vehicle systems and logistics management platforms.

Sustainability initiatives expand beyond vehicle electrification to include alternative refrigerants, improved insulation materials, and energy recovery systems. Corporate customers increasingly prioritize environmental performance in vendor selection processes, driving demand for sustainable cold chain solutions. Circular economy principles influence vehicle design and end-of-life management practices throughout the industry.

Data analytics integration transforms fleet management through predictive maintenance, route optimization, and performance monitoring capabilities. Real-time temperature and location data enable proactive problem resolution and enhanced customer service delivery. Artificial intelligence applications include demand forecasting, capacity optimization, and automated compliance reporting that improve operational efficiency and reduce administrative burdens.

Regulatory evolution includes updated food safety standards that require enhanced temperature monitoring and documentation capabilities. The Canadian Food Inspection Agency continues to strengthen cold chain requirements, driving fleet modernization and technology adoption across the industry. Provincial variations in regulations create complexity for multi-jurisdictional operators while providing opportunities for specialized service providers.

Infrastructure investments by government and private sector support cold chain capacity expansion, including specialized terminals, maintenance facilities, and charging infrastructure for electric vehicles. MWR analysis indicates that infrastructure development represents a critical enabler for market growth and technology adoption across different regions and applications.

Strategic partnerships between vehicle manufacturers, refrigeration system suppliers, and logistics service providers create integrated solutions that address complex customer requirements. These collaborations focus on technology integration, service delivery, and comprehensive support capabilities that differentiate market participants and create competitive advantages.

International trade developments including updated trade agreements and border processing improvements facilitate cross-border cold chain operations. Enhanced customs procedures and mutual recognition agreements reduce transit times and improve product quality preservation for international shipments requiring temperature control throughout the transportation process.

Technology investment should prioritize integrated solutions that combine vehicle platforms, refrigeration systems, and digital monitoring capabilities. Fleet operators should evaluate total cost of ownership including fuel efficiency, maintenance requirements, and regulatory compliance capabilities when making equipment decisions. Early adoption of electric and hybrid technologies may provide competitive advantages in urban markets and environmentally conscious customer segments.

Market positioning strategies should focus on specialized capabilities and service differentiation rather than competing solely on price. Operators with expertise in pharmaceutical logistics, organic food distribution, or cross-border transportation can command premium pricing and build sustainable competitive advantages. Certification programs and quality standards provide credibility and market access for specialized applications.

Geographic expansion opportunities exist in underserved markets and emerging demand centers, particularly in secondary cities and rural areas with growing population and economic activity. MarkWide Research recommends careful market analysis and phased expansion approaches that consider local regulations, competition, and infrastructure availability when entering new geographic markets.

Partnership strategies should emphasize complementary capabilities and shared risk approaches that enable market expansion without excessive capital requirements. Strategic alliances with technology providers, maintenance networks, and customer segments can accelerate growth and improve operational efficiency while reducing individual company risk exposure.

Market expansion projections indicate sustained growth driven by demographic trends, urbanization, and evolving consumer preferences for fresh and convenient food options. The compound annual growth rate of 6.2% reflects underlying demand fundamentals and technology-driven efficiency improvements that support market development across multiple segments and applications.

Technology transformation will accelerate through the forecast period, with electric vehicles achieving cost parity by 2028 in urban delivery applications and autonomous systems beginning commercial deployment in long-haul operations. Advanced refrigeration systems incorporating artificial intelligence and predictive analytics will become standard features that improve operational efficiency and reduce environmental impact.

Regulatory evolution toward stricter environmental standards and enhanced food safety requirements will drive fleet modernization and technology adoption. Government incentives for zero-emission vehicles and infrastructure development will support market transition while creating opportunities for early adopters and technology leaders.

Market consolidation trends suggest continued strategic acquisitions and partnerships as companies seek scale advantages and comprehensive service capabilities. Smaller operators may focus on specialized niches or regional markets while larger players develop integrated solutions that serve complex customer requirements across multiple geographic markets and application segments.

Canada’s refrigerated vehicles market demonstrates strong fundamentals supported by essential cold chain requirements, regulatory drivers, and evolving consumer preferences that create sustained demand across multiple industry segments. The market benefits from technological advancement, infrastructure development, and strategic positioning within North American trade networks that provide growth opportunities and competitive advantages.

Strategic success in this market requires balanced approaches that combine operational efficiency, technology adoption, and customer service excellence while managing capital requirements and regulatory compliance challenges. Market participants must navigate seasonal demand variations, competitive pressures, and evolving technology landscapes while building sustainable business models that serve diverse customer requirements.

Future growth prospects remain positive, driven by demographic trends, e-commerce expansion, and infrastructure investments that support market development. The transition toward sustainable transportation solutions creates both challenges and opportunities for market participants, with early adopters positioned to benefit from regulatory advantages and customer preferences for environmentally responsible logistics solutions. Long-term success will depend on strategic positioning, operational excellence, and continuous adaptation to evolving market conditions and customer requirements in Canada’s dynamic refrigerated vehicles market.

What is Refrigerated Vehicles?

Refrigerated vehicles are specialized transportation units designed to maintain a controlled temperature for perishable goods. They are commonly used in the food and pharmaceutical industries to ensure the safe delivery of temperature-sensitive products.

What are the key players in the Canada Refrigerated Vehicles Market?

Key players in the Canada Refrigerated Vehicles Market include Thermo King, Carrier Transicold, and Utility Trailer Manufacturing Company, among others. These companies are known for their innovative refrigeration technologies and extensive distribution networks.

What are the main drivers of the Canada Refrigerated Vehicles Market?

The main drivers of the Canada Refrigerated Vehicles Market include the increasing demand for fresh food delivery, the growth of e-commerce in food distribution, and stringent regulations on food safety. These factors are pushing companies to invest in efficient refrigerated transport solutions.

What challenges does the Canada Refrigerated Vehicles Market face?

The Canada Refrigerated Vehicles Market faces challenges such as high operational costs, maintenance issues, and the need for skilled drivers. Additionally, fluctuating fuel prices can impact the overall profitability of refrigerated transport.

What opportunities exist in the Canada Refrigerated Vehicles Market?

Opportunities in the Canada Refrigerated Vehicles Market include advancements in electric refrigeration technology and the growing trend of sustainable logistics. Companies are increasingly looking to adopt eco-friendly vehicles to meet consumer demand for greener transportation options.

What trends are shaping the Canada Refrigerated Vehicles Market?

Trends shaping the Canada Refrigerated Vehicles Market include the integration of IoT technology for real-time temperature monitoring and the rise of automated refrigerated delivery systems. These innovations are enhancing efficiency and reliability in the transportation of perishable goods.

Canada Refrigerated Vehicles Market

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Vans, Trucks, Trailers, Buses |

| Temperature Control Technology | Refrigeration Units, Insulation Systems, Thermoelectric Systems, Cryogenic Systems |

| End User | Food Distribution, Pharmaceutical Transport, Floral Delivery, Grocery Retail |

| Fuel Type | Diesel, Electric, Hybrid, Gasoline |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Refrigerated Vehicles Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at