444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Canada POS Terminal Market refers to the industry involved in the manufacturing, distribution, and usage of point-of-sale (POS) terminals in Canada. POS terminals are electronic devices used in retail stores, restaurants, and other businesses to process transactions and facilitate customer payments. These terminals play a crucial role in streamlining operations, improving customer service, and enhancing overall efficiency.

Meaning

A POS terminal, also known as a cash register or checkout terminal, is a hardware device that enables businesses to accept payments from customers for goods and services. It typically consists of a computer or tablet, a cash drawer, a barcode scanner, and a receipt printer. POS terminals can be either stationary or mobile, providing flexibility and convenience to businesses in various industries.

Executive Summary

The Canada POS Terminal Market has witnessed significant growth in recent years, driven by the increasing adoption of digital payment solutions and the need for enhanced transaction security. The market has also benefited from advancements in technology, such as the integration of cloud-based software and the introduction of contactless payment options. This executive summary provides a concise overview of the key insights, drivers, restraints, opportunities, and trends shaping the market.

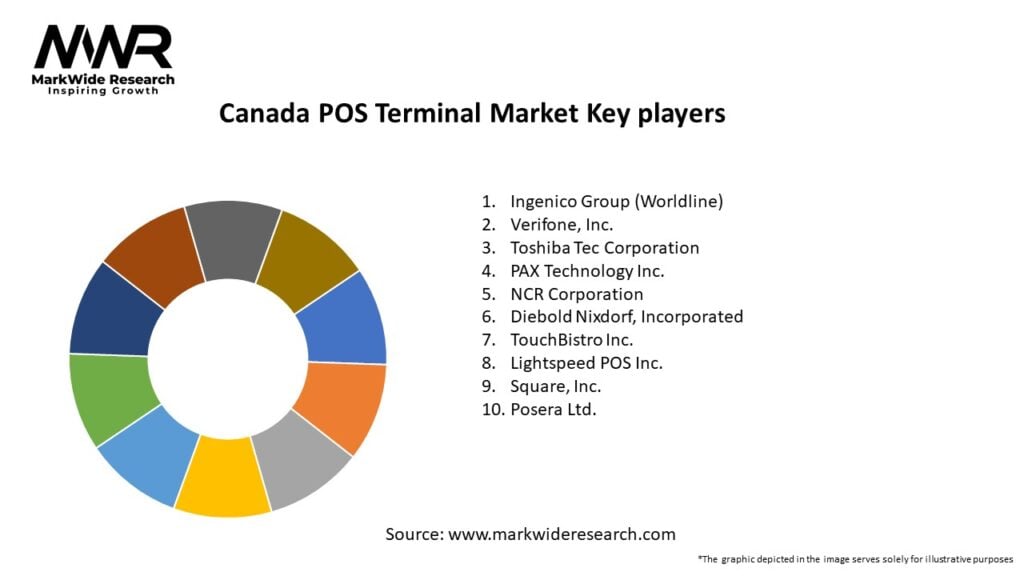

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Canada POS Terminal Market is characterized by intense competition among key players striving to gain a larger market share. The market dynamics are influenced by factors such as changing consumer preferences, technological advancements, regulatory environment, and strategic alliances among industry participants. Vendors are focusing on product differentiation, pricing strategies, and after-sales service to stay competitive in the market.

Regional Analysis

The Canada POS Terminal Market can be segmented into different regions, including Western Canada, Central Canada, Atlantic Canada, and Northern Canada. Western Canada, consisting of provinces such as British Columbia and Alberta, is witnessing significant growth due to its thriving retail and hospitality sectors. Central Canada, encompassing Ontario and Quebec, remains a key region for POS terminal adoption, driven by its large population and diverse range of businesses. Atlantic Canada and Northern Canada present growth opportunities, with businesses in these regions increasingly embracing digital payment solutions.

Competitive Landscape

Leading Companies in the Canada POS Terminal Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Canada POS Terminal Market can be segmented based on terminal type, deployment type, end-user industry, and region. Terminal types include fixed POS terminals and mobile POS terminals. Deployment types encompass on-premise and cloud-based solutions. The end-user industries served by POS terminal providers range from retail and hospitality to healthcare, entertainment, and transportation.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a profound impact on the Canada POS Terminal Market. The restrictions imposed to curb the spread of the virus led to a significant decline in in-store transactions, forcing businesses to adapt to contactless payment methods and e-commerce solutions. The pandemic accelerated the adoption of POS terminals equipped with contactless payment options, such as NFC and QR code scanning. It also highlighted the importance of hygiene and safety measures, leading to increased demand for touchless payment solutions. Despite the initial challenges, the pandemic served as a catalyst for digital payment adoption and encouraged businesses to invest in POS technology to ensure continuity and resilience.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Canada POS Terminal Market is poised for significant growth in the coming years. The increasing consumer preference for digital payments, the integration of advanced technologies, and the expanding retail and hospitality sectors are expected to drive market growth. The market will also witness further advancements in POS technology, such as the integration of blockchain for enhanced security and the utilization of data analytics and AI for personalized customer experiences. With the rise of mobile commerce and the continued evolution of payment methods, POS terminals will play a crucial role in facilitating seamless and secure transactions across various industries.

Conclusion

The Canada POS Terminal Market is experiencing a transformational shift due to the increasing adoption of digital payments, advancements in technology, and changing consumer preferences. POS terminals have become an integral part of businesses, enabling them to streamline operations, enhance security, and provide improved customer experiences. While the market presents numerous opportunities, businesses need to overcome challenges such as high initial investment, security concerns, and the need for technical expertise. By staying abreast of market trends, embracing innovation, and focusing on customer-centric solutions, businesses can harness the potential of the Canada POS Terminal Market and thrive in the digital economy.

What is POS Terminal?

A POS terminal is a device used to process card payments at retail locations, enabling transactions between customers and merchants. These terminals can handle various payment methods, including credit cards, debit cards, and mobile payments.

What are the key players in the Canada POS Terminal Market?

Key players in the Canada POS Terminal Market include Moneris Solutions, Square, and Ingenico Group, which provide a range of payment processing solutions and technologies for businesses, among others.

What are the growth factors driving the Canada POS Terminal Market?

The growth of the Canada POS Terminal Market is driven by the increasing adoption of cashless payments, the rise of e-commerce, and advancements in payment technologies such as contactless payments and mobile wallets.

What challenges does the Canada POS Terminal Market face?

Challenges in the Canada POS Terminal Market include the high costs associated with advanced POS systems, security concerns regarding data breaches, and the need for continuous updates to comply with evolving regulations.

What opportunities exist in the Canada POS Terminal Market?

Opportunities in the Canada POS Terminal Market include the expansion of small and medium-sized enterprises adopting POS systems, the integration of AI and analytics for better customer insights, and the growth of omnichannel retailing.

What trends are shaping the Canada POS Terminal Market?

Trends in the Canada POS Terminal Market include the increasing use of mobile POS systems, the integration of loyalty programs within POS solutions, and the shift towards cloud-based POS systems for enhanced flexibility and scalability.

Canada POS Terminal Market

| Segmentation Details | Description |

|---|---|

| Product Type | Mobile Terminals, Fixed Terminals, Self-Service Kiosks, Cloud-Based Terminals |

| End User | Retail, Hospitality, Healthcare, Transportation |

| Technology | Contactless Payment, NFC, EMV, Magnetic Stripe |

| Distribution Channel | Direct Sales, Online Retail, Distributors, Value-Added Resellers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Canada POS Terminal Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at