444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada payment gateway market represents a dynamic and rapidly evolving sector within the nation’s financial technology landscape. Payment gateways serve as critical infrastructure components that facilitate secure online transactions between consumers, merchants, and financial institutions across the Canadian digital commerce ecosystem. The market has experienced substantial growth driven by accelerating e-commerce adoption, increasing consumer preference for digital payments, and the widespread implementation of contactless payment solutions.

Digital transformation initiatives across various industries have significantly contributed to the expansion of payment gateway services in Canada. The market encompasses a diverse range of solutions including traditional credit card processing, mobile payment platforms, cryptocurrency gateways, and emerging buy-now-pay-later services. Canadian businesses are increasingly recognizing the importance of robust payment processing capabilities to enhance customer experience and drive revenue growth.

Market dynamics indicate strong momentum with the sector experiencing a 12.3% compound annual growth rate as businesses prioritize seamless payment experiences. The integration of advanced technologies such as artificial intelligence, machine learning, and blockchain has revolutionized payment processing capabilities, enabling enhanced security measures and improved transaction efficiency. Regulatory compliance with Canadian financial standards and international payment card industry requirements continues to shape market development and innovation strategies.

The Canada payment gateway market refers to the comprehensive ecosystem of technology platforms and services that enable secure electronic payment processing for online and offline transactions within the Canadian marketplace. Payment gateways act as intermediary services that authorize and process payment transactions between customers, merchants, and financial institutions while ensuring data security and regulatory compliance.

These platforms encompass various payment methods including credit cards, debit cards, digital wallets, bank transfers, and alternative payment solutions. The market includes both domestic Canadian providers and international companies offering localized services to meet specific regulatory and consumer preferences within the Canadian market. Integration capabilities with e-commerce platforms, point-of-sale systems, and enterprise resource planning software form essential components of modern payment gateway solutions.

Functionality extends beyond basic transaction processing to include fraud detection, risk management, analytics, reporting, and customer support services. The market serves diverse sectors including retail, hospitality, healthcare, education, and government agencies, each requiring specialized payment processing capabilities tailored to their unique operational requirements and compliance obligations.

Canada’s payment gateway market demonstrates robust growth trajectory supported by increasing digitalization across business sectors and evolving consumer payment preferences. The market benefits from strong technological infrastructure, supportive regulatory framework, and high consumer adoption of digital payment methods. Key market participants include established international providers alongside innovative Canadian fintech companies developing specialized solutions for local market needs.

E-commerce expansion continues to drive demand for sophisticated payment processing capabilities, with businesses seeking comprehensive solutions that support multiple payment methods and currencies. The market has witnessed significant investment in security technologies and compliance frameworks to address growing concerns about data protection and fraud prevention. Mobile payment adoption has accelerated substantially, with 78% of Canadian consumers regularly using mobile payment applications for various transactions.

Competitive landscape features intense innovation as providers differentiate through advanced analytics, artificial intelligence integration, and enhanced user experience design. The market outlook remains positive with continued growth expected across all major segments, driven by ongoing digital transformation initiatives and increasing consumer comfort with electronic payment methods.

Strategic analysis reveals several critical insights shaping the Canadian payment gateway market landscape:

E-commerce growth represents the primary catalyst driving payment gateway market expansion in Canada. The sustained increase in online shopping, accelerated by changing consumer behaviors and business digitalization initiatives, creates substantial demand for reliable payment processing solutions. Canadian e-commerce has experienced unprecedented growth with online retail penetration reaching 15.6% of total retail sales, significantly above historical averages.

Digital transformation across traditional industries continues to fuel market growth as businesses modernize their payment infrastructure. Organizations recognize that seamless payment experiences directly impact customer satisfaction, retention, and revenue generation. Small and medium enterprises particularly benefit from accessible payment gateway solutions that previously required significant capital investment and technical expertise.

Consumer preference shifts toward contactless and mobile payments have accelerated adoption of advanced payment technologies. The convenience, speed, and perceived safety of digital payment methods have fundamentally altered consumer expectations and purchasing behaviors. Regulatory support for open banking initiatives and digital payment innovation creates favorable conditions for market expansion and technological advancement.

Cross-border commerce growth drives demand for payment gateways capable of handling multiple currencies and international payment methods. Canadian businesses increasingly serve global markets, requiring sophisticated payment processing capabilities that support diverse regional preferences and regulatory requirements.

Security concerns and fraud risks present significant challenges for payment gateway market growth. High-profile data breaches and increasing sophistication of cyber attacks create hesitation among some businesses and consumers regarding digital payment adoption. Compliance costs associated with maintaining robust security infrastructure can be substantial, particularly for smaller market participants.

Regulatory complexity across different jurisdictions creates implementation challenges for payment gateway providers. Navigating varying provincial regulations, federal requirements, and international standards requires significant legal and technical expertise. Integration difficulties with legacy systems and existing business processes can slow adoption rates and increase implementation costs.

Market saturation in certain segments leads to intense price competition and margin pressure. Established players with significant scale advantages can make market entry challenging for new participants. Technical complexity of modern payment systems requires specialized knowledge and ongoing maintenance that may overwhelm smaller businesses without dedicated IT resources.

Economic uncertainty and changing business conditions can impact investment in new payment technologies. Businesses may delay technology upgrades during periods of financial constraint, affecting overall market growth rates and innovation adoption.

Artificial intelligence integration presents substantial opportunities for payment gateway innovation. Advanced machine learning algorithms can enhance fraud detection, optimize transaction routing, and provide predictive analytics for business intelligence. AI-powered solutions enable real-time risk assessment and personalized payment experiences that improve both security and user satisfaction.

Cryptocurrency adoption creates new market segments as businesses seek to accept digital currencies alongside traditional payment methods. The growing acceptance of blockchain-based payments opens opportunities for specialized gateway providers focused on cryptocurrency processing and compliance. Central bank digital currency development may create additional market opportunities as governments explore digital payment infrastructure.

Internet of Things expansion enables payment integration into connected devices and smart systems. Opportunities exist for developing payment solutions embedded in automotive systems, smart home devices, and industrial equipment. Voice-activated payments and biometric authentication represent emerging technologies that could reshape payment gateway capabilities.

Vertical specialization offers opportunities for payment gateway providers to develop industry-specific solutions. Healthcare, education, government, and other sectors have unique payment processing requirements that create opportunities for specialized service offerings. According to MarkWide Research, specialized vertical solutions demonstrate 23% higher customer retention rates compared to generic payment platforms.

Competitive intensity continues to reshape the Canadian payment gateway landscape as established players and emerging fintech companies compete for market share. Innovation cycles have accelerated with providers continuously enhancing their offerings through advanced features, improved user interfaces, and expanded integration capabilities. Price competition remains significant, particularly in commodity payment processing segments where differentiation is limited.

Technology convergence creates both opportunities and challenges as payment gateways integrate with broader financial technology ecosystems. The boundaries between payment processing, banking services, and financial management tools continue to blur, requiring providers to expand their capabilities and partnerships. Platform consolidation trends indicate that businesses prefer comprehensive solutions over multiple specialized providers.

Customer expectations continue to evolve with demands for faster processing, enhanced security, and seamless user experiences. The rise of instant payment expectations challenges traditional processing timeframes and requires significant infrastructure investment. Omnichannel consistency becomes increasingly important as customers expect identical payment experiences across all touchpoints.

Partnership ecosystems play crucial roles in market dynamics as payment gateway providers collaborate with banks, technology companies, and merchant service providers. Strategic alliances enable expanded service offerings and market reach while sharing development costs and risks.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Canadian payment gateway market. Primary research includes extensive interviews with industry executives, technology providers, merchant users, and regulatory officials to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, regulatory filings, company financial statements, and technology documentation to validate primary findings and identify quantitative trends. Market surveys conducted among businesses of various sizes provide insights into adoption patterns, satisfaction levels, and future requirements for payment gateway services.

Data triangulation methods ensure research accuracy by comparing findings across multiple sources and methodologies. Expert validation processes involve review by industry specialists and academic researchers to confirm analytical conclusions and market projections. Quantitative analysis includes statistical modeling of market trends, growth patterns, and competitive dynamics to support strategic recommendations.

Continuous monitoring of market developments, regulatory changes, and technology innovations ensures research remains current and relevant. Stakeholder feedback mechanisms enable ongoing refinement of research methodologies and analytical frameworks to maintain research quality and relevance.

Ontario dominates the Canadian payment gateway market, accounting for approximately 42% of total market activity due to its concentration of financial institutions, technology companies, and major retailers. Toronto’s financial district serves as the primary hub for payment processing innovation and houses headquarters for numerous gateway providers and fintech startups.

British Columbia represents the second-largest regional market with 18% market share, driven by strong technology sector presence and high e-commerce adoption rates. Vancouver’s tech ecosystem contributes significantly to payment gateway innovation, particularly in mobile payment solutions and cryptocurrency processing capabilities.

Quebec maintains a substantial market presence with unique linguistic and regulatory requirements that create opportunities for specialized service providers. The province’s distinct business culture and consumer preferences drive demand for localized payment solutions and French-language customer support. Montreal’s fintech sector continues to grow with increasing investment in payment technology startups.

Alberta and Saskatchewan demonstrate strong growth potential driven by resource sector digitalization and increasing e-commerce adoption among traditional industries. Prairie provinces collectively represent 12% of market activity with particular strength in B2B payment processing and agricultural sector applications.

Atlantic Canada shows emerging market potential with government initiatives supporting digital transformation and fintech development. Maritime provinces benefit from supportive regulatory environments and growing technology sectors that create opportunities for payment gateway expansion.

Market leadership is distributed among several key players, each offering distinct value propositions and targeting different market segments:

Competitive differentiation focuses on technology innovation, security features, integration capabilities, and customer service quality. Market consolidation trends continue as larger players acquire specialized providers to expand their service offerings and market reach.

By Deployment Model:

By Business Size:

By Industry Vertical:

E-commerce gateways represent the largest market segment with sustained growth driven by online retail expansion and digital marketplace development. These solutions prioritize seamless checkout experiences, multiple payment method support, and robust fraud protection capabilities. Integration flexibility with popular e-commerce platforms like Shopify, WooCommerce, and Magento remains crucial for market success.

Mobile payment gateways demonstrate the highest growth rates as smartphone adoption and mobile commerce continue expanding. Native mobile applications require specialized payment processing capabilities that optimize for touch interfaces and mobile-specific security requirements. Contactless payment integration has become essential following increased consumer preference for touch-free transactions.

Enterprise payment platforms focus on comprehensive functionality including multi-currency support, advanced reporting, and integration with enterprise resource planning systems. These solutions typically require extensive customization and professional services support. Compliance management features become increasingly important for large organizations operating across multiple jurisdictions.

Specialized vertical solutions continue gaining market traction as providers develop industry-specific features and compliance capabilities. Healthcare payment gateways must address patient privacy requirements while government solutions require enhanced security and audit capabilities. MWR analysis indicates that vertical specialization commands premium pricing of 15-25% compared to generic solutions.

Merchants benefit from enhanced customer experience through streamlined payment processes and reduced checkout abandonment rates. Advanced analytics provide valuable insights into customer behavior, payment preferences, and transaction patterns that inform business strategy and marketing decisions. Fraud protection capabilities reduce financial losses and protect brand reputation while maintaining customer trust.

Financial institutions gain opportunities to expand their service offerings and strengthen customer relationships through payment gateway partnerships. Revenue diversification through payment processing fees provides stable income streams while data insights enable improved risk management and customer segmentation strategies.

Technology providers access growing market opportunities through payment gateway integration and partnership programs. Platform ecosystems benefit from enhanced functionality that increases customer retention and platform value. Developer communities gain access to comprehensive APIs and documentation that accelerate application development and deployment.

Consumers experience improved convenience, security, and choice in payment methods across various channels and devices. Faster transaction processing and enhanced security measures provide confidence in digital payment adoption. Loyalty program integration and personalized payment experiences create additional value for regular customers.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents a transformative trend reshaping payment gateway capabilities. Machine learning algorithms enhance fraud detection accuracy while reducing false positives that impact legitimate transactions. Predictive analytics enable proactive risk management and personalized payment experiences that improve customer satisfaction and conversion rates.

Embedded finance continues gaining momentum as payment capabilities integrate directly into business applications and customer workflows. API-first architectures enable seamless integration with various software platforms, creating invisible payment experiences that reduce friction and improve user adoption. White-label solutions allow businesses to offer payment services under their own branding.

Real-time payments become increasingly important as consumers and businesses expect instant transaction processing and immediate fund availability. Instant settlement capabilities improve cash flow management for merchants while enhancing customer satisfaction. 24/7 processing availability becomes a competitive necessity rather than a premium feature.

Sustainability initiatives influence payment gateway development as providers focus on energy-efficient processing and carbon footprint reduction. Green payment technologies appeal to environmentally conscious businesses and consumers while supporting corporate sustainability goals. Digital receipt systems and paperless processing contribute to environmental conservation efforts.

Open banking implementation creates new opportunities for payment innovation and competition in the Canadian market. Regulatory frameworks enable secure data sharing between financial institutions and third-party providers, fostering innovation in payment services and customer experience. Account-to-account transfers may challenge traditional card-based payment processing models.

Central bank digital currency research and development by the Bank of Canada could significantly impact payment gateway requirements and capabilities. Digital dollar implementation would require substantial infrastructure updates and new processing capabilities across the payment ecosystem. Pilot programs and testing initiatives provide early insights into technical requirements and market implications.

Cryptocurrency adoption accelerates among Canadian businesses seeking to accept digital currency payments. Regulatory clarity improvements encourage mainstream adoption while specialized payment gateways develop comprehensive cryptocurrency processing capabilities. Stablecoin integration offers reduced volatility concerns for business adoption.

Partnership consolidation continues as payment gateway providers form strategic alliances with banks, technology companies, and merchant service providers. Ecosystem integration enables comprehensive service offerings while sharing development costs and market risks. Acquisition activity remains strong as larger players seek to expand capabilities and market reach.

Investment priorities should focus on security enhancement and artificial intelligence integration to maintain competitive advantage in the evolving payment landscape. Cybersecurity capabilities require continuous investment as threat sophistication increases and regulatory requirements become more stringent. Machine learning implementation offers significant opportunities for operational efficiency and customer experience improvement.

Market expansion strategies should emphasize vertical specialization and cross-border capabilities to capture growing business opportunities. Industry-specific solutions command premium pricing while reducing competitive pressure from generic providers. International payment processing capabilities become increasingly important as Canadian businesses expand globally.

Partnership development represents a critical success factor for payment gateway providers seeking to expand their market reach and capabilities. Strategic alliances with technology platforms, financial institutions, and merchant service providers enable comprehensive service offerings and shared market development costs. Integration partnerships with popular business software platforms accelerate customer acquisition and retention.

Technology roadmap planning should incorporate emerging trends including blockchain integration, IoT payment capabilities, and voice-activated transactions. API development remains crucial for enabling flexible integration and supporting diverse customer requirements. Mobile-first design principles should guide all product development initiatives to meet evolving consumer preferences.

Market growth is expected to continue at a robust pace driven by ongoing digital transformation initiatives and evolving consumer payment preferences. E-commerce expansion will remain a primary growth driver as businesses increasingly prioritize online sales channels and omnichannel customer experiences. Technology innovation will accelerate with artificial intelligence, blockchain, and IoT integration creating new market opportunities and competitive advantages.

Regulatory evolution will shape market development as governments implement open banking frameworks and digital currency initiatives. Compliance requirements will continue increasing, creating both challenges and opportunities for payment gateway providers. Consumer protection measures will drive investment in security technologies and fraud prevention capabilities.

Competitive dynamics will intensify as market maturity increases and differentiation becomes more challenging. Consolidation trends are expected to continue as larger players acquire specialized providers to expand their capabilities and market reach. Innovation cycles will accelerate with shorter product development timelines and faster feature deployment.

MarkWide Research projections indicate that the Canadian payment gateway market will maintain strong growth momentum with particular strength in mobile payments, which are expected to represent 65% of total transaction volume within the next five years. Cross-border payment capabilities and cryptocurrency integration will become standard features rather than specialized offerings as market adoption continues expanding across all business segments.

The Canada payment gateway market demonstrates exceptional growth potential driven by digital transformation, evolving consumer preferences, and technological innovation. Market participants benefit from strong infrastructure, supportive regulatory frameworks, and high consumer adoption of digital payment technologies. The competitive landscape continues evolving with established players and emerging fintech companies driving innovation across all market segments.

Strategic success requires continuous investment in security, artificial intelligence, and customer experience enhancement while maintaining regulatory compliance and operational efficiency. Vertical specialization and international expansion capabilities offer significant opportunities for differentiation and premium pricing. The integration of emerging technologies including blockchain, IoT, and voice payments will create new market opportunities and competitive advantages.

Future market development will be shaped by regulatory evolution, technology advancement, and changing business requirements. Payment gateway providers that successfully balance innovation with security, compliance, and customer experience will capture the greatest market opportunities in Canada’s dynamic digital payment ecosystem.

What is Payment Gateway?

A payment gateway is a technology that facilitates online transactions by securely transmitting payment information between the customer, the merchant, and the payment processor. It plays a crucial role in e-commerce by ensuring that sensitive data is handled safely during the payment process.

What are the key players in the Canada Payment Gateway Market?

Key players in the Canada Payment Gateway Market include companies like Moneris Solutions, PayPal, and Stripe, which provide various payment processing solutions for businesses. These companies offer services that cater to different sectors, including retail, e-commerce, and mobile payments, among others.

What are the growth factors driving the Canada Payment Gateway Market?

The Canada Payment Gateway Market is driven by the increasing adoption of e-commerce, the rise in mobile payment solutions, and the growing demand for secure online transactions. Additionally, advancements in technology and consumer preferences for digital payment methods are contributing to market growth.

What challenges does the Canada Payment Gateway Market face?

The Canada Payment Gateway Market faces challenges such as cybersecurity threats, regulatory compliance issues, and the need for continuous technological upgrades. These factors can hinder the growth of payment gateway services and affect consumer trust.

What opportunities exist in the Canada Payment Gateway Market?

Opportunities in the Canada Payment Gateway Market include the expansion of digital wallets, the integration of artificial intelligence for fraud detection, and the increasing demand for cross-border payment solutions. These trends present avenues for innovation and growth in the sector.

What trends are shaping the Canada Payment Gateway Market?

Trends shaping the Canada Payment Gateway Market include the rise of contactless payments, the integration of blockchain technology for enhanced security, and the growing popularity of subscription-based payment models. These trends reflect changing consumer behaviors and technological advancements.

Canada Payment Gateway Market

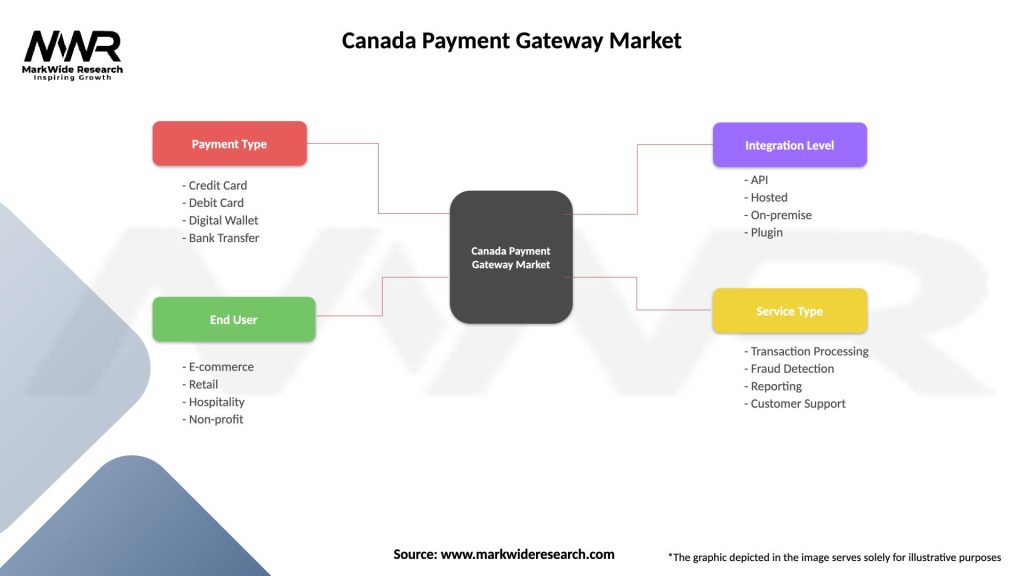

| Segmentation Details | Description |

|---|---|

| Payment Type | Credit Card, Debit Card, Digital Wallet, Bank Transfer |

| End User | E-commerce, Retail, Hospitality, Non-profit |

| Integration Level | API, Hosted, On-premise, Plugin |

| Service Type | Transaction Processing, Fraud Detection, Reporting, Customer Support |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Payment Gateway Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at