444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada ophthalmology drugs and devices market represents a dynamic and rapidly evolving healthcare sector focused on treating various eye conditions and visual impairments. This comprehensive market encompasses a wide range of therapeutic solutions, from prescription medications for glaucoma and diabetic retinopathy to advanced surgical devices and diagnostic equipment. Market dynamics indicate robust growth driven by an aging population, increasing prevalence of eye diseases, and continuous technological innovations in ophthalmic care.

Healthcare infrastructure in Canada supports advanced ophthalmic treatments through both public and private healthcare systems. The market benefits from strong regulatory frameworks, research initiatives, and collaborative efforts between healthcare providers and pharmaceutical companies. Growth projections suggest the market will expand at a compound annual growth rate of 6.2% over the forecast period, reflecting increasing demand for innovative eye care solutions.

Technological advancement continues to reshape the landscape, with emerging treatments for age-related macular degeneration, innovative drug delivery systems, and minimally invasive surgical techniques gaining significant traction. The integration of artificial intelligence in diagnostic devices and personalized medicine approaches further enhances market potential, positioning Canada as a key player in the North American ophthalmology sector.

The Canada ophthalmology drugs and devices market refers to the comprehensive healthcare sector encompassing all pharmaceutical products, medical devices, diagnostic equipment, and therapeutic solutions specifically designed for the prevention, diagnosis, and treatment of eye-related conditions and visual disorders within the Canadian healthcare system.

This market segment includes prescription medications for conditions such as glaucoma, diabetic retinopathy, age-related macular degeneration, and dry eye syndrome, alongside sophisticated medical devices including surgical instruments, diagnostic equipment, contact lenses, and intraocular lenses. Regulatory oversight by Health Canada ensures product safety and efficacy while maintaining high standards for market entry and continued compliance.

Market participants range from multinational pharmaceutical companies and medical device manufacturers to specialized ophthalmic equipment providers and local distributors. The sector serves diverse stakeholders including ophthalmologists, optometrists, hospitals, surgical centers, and ultimately, millions of Canadian patients requiring eye care services across urban and rural communities.

Strategic analysis reveals the Canada ophthalmology drugs and devices market as a high-growth sector characterized by increasing demand for advanced eye care solutions. Key market drivers include demographic shifts toward an aging population, rising prevalence of diabetes-related eye complications, and growing awareness of preventive eye care measures among Canadian consumers.

Market segmentation demonstrates strong performance across multiple categories, with anti-glaucoma medications representing approximately 28% of the pharmaceutical segment, while surgical devices and diagnostic equipment continue gaining market share. Innovation trends focus on drug delivery systems, minimally invasive procedures, and digital health integration, creating new opportunities for market expansion.

Competitive dynamics feature established pharmaceutical giants alongside emerging biotechnology companies, fostering an environment of continuous innovation and strategic partnerships. Regional distribution shows concentration in major metropolitan areas while expanding access to rural communities through telemedicine and mobile eye care initiatives. Future projections indicate sustained growth momentum supported by healthcare system investments and technological advancement.

Market intelligence reveals several critical insights shaping the Canada ophthalmology drugs and devices landscape:

Demographic transformation serves as the primary catalyst for market expansion, with Canada’s aging population creating unprecedented demand for ophthalmic care services. Statistical projections indicate that individuals over 65 will comprise nearly 25% of the population by 2030, directly correlating with increased incidence of age-related eye conditions including cataracts, glaucoma, and macular degeneration.

Diabetes prevalence continues rising across Canadian provinces, driving demand for diabetic retinopathy treatments and monitoring devices. Healthcare authorities report that diabetic eye complications affect approximately 40% of diabetes patients, creating substantial market opportunities for specialized pharmaceutical interventions and diagnostic equipment.

Technological innovation accelerates market growth through development of breakthrough treatments and advanced medical devices. Investment patterns show increased funding for research initiatives focusing on gene therapy, sustained-release drug delivery systems, and artificial intelligence applications in ophthalmology. Consumer awareness regarding preventive eye care and early intervention strategies further stimulates market demand, supported by public health campaigns and professional education initiatives.

Healthcare system evolution toward value-based care models encourages adoption of cost-effective treatments with improved patient outcomes. Reimbursement policies increasingly favor innovative therapies demonstrating superior clinical efficacy and long-term economic benefits, creating favorable conditions for market participants introducing advanced ophthalmic solutions.

Regulatory complexity presents significant challenges for market participants, particularly smaller companies seeking to introduce innovative products. Health Canada’s stringent approval processes, while ensuring patient safety, can extend product development timelines and increase associated costs, potentially limiting market entry for breakthrough technologies.

Healthcare budget constraints across provincial systems create pressure on ophthalmic care funding, particularly for expensive specialty treatments and advanced medical devices. Reimbursement limitations may restrict patient access to cutting-edge therapies, potentially slowing market adoption rates for premium-priced innovations.

Geographic accessibility remains a persistent challenge, with rural and remote communities experiencing limited access to specialized ophthalmic care. Healthcare infrastructure disparities between urban and rural areas create uneven market distribution, potentially constraining overall growth potential and limiting patient outcomes in underserved regions.

Competition intensity from established pharmaceutical companies and medical device manufacturers creates barriers for new market entrants. Market consolidation trends may limit opportunities for smaller players while increasing competitive pressure on pricing and innovation cycles. Patent protection challenges and generic competition further impact revenue potential for branded pharmaceutical products in the ophthalmic sector.

Emerging therapeutic areas present substantial growth opportunities, particularly in gene therapy applications for inherited retinal diseases and innovative treatments for dry eye syndrome. Research breakthroughs in regenerative medicine and stem cell therapies offer potential for addressing previously untreatable conditions, creating new market segments with significant revenue potential.

Digital health integration opens pathways for telemedicine applications, remote monitoring devices, and AI-powered diagnostic tools. Technology convergence between traditional ophthalmology and digital health platforms creates opportunities for comprehensive care solutions, particularly valuable for serving rural Canadian communities with limited access to specialist care.

Personalized medicine approaches represent a transformative opportunity, enabling tailored treatments based on individual genetic profiles and disease characteristics. Pharmacogenomics applications in ophthalmology promise improved treatment efficacy while reducing adverse effects, potentially commanding premium pricing and enhanced patient outcomes.

International expansion opportunities exist for Canadian companies developing innovative ophthalmic solutions, with potential for export to global markets. Strategic partnerships with international pharmaceutical companies and medical device manufacturers can accelerate market access while leveraging Canada’s reputation for healthcare innovation and regulatory excellence.

Supply chain evolution reflects increasing sophistication in pharmaceutical manufacturing and medical device production, with emphasis on quality assurance and regulatory compliance. Distribution networks continue adapting to serve diverse geographic markets while maintaining cold chain integrity for temperature-sensitive ophthalmic medications.

Pricing dynamics demonstrate tension between innovation costs and healthcare affordability, with provincial formularies increasingly scrutinizing cost-effectiveness of new treatments. Value-based pricing models gain traction as healthcare systems seek to balance access to innovative therapies with budget sustainability.

Competitive landscape features ongoing consolidation through mergers and acquisitions, creating larger entities with enhanced research capabilities and market reach. Innovation cycles accelerate as companies compete to develop next-generation treatments and diagnostic technologies, driving continuous advancement in ophthalmic care standards.

Regulatory environment evolves to accommodate emerging technologies while maintaining safety standards, with Health Canada implementing adaptive pathways for breakthrough therapies. Market access strategies increasingly focus on demonstrating real-world evidence and long-term value propositions to secure favorable reimbursement decisions across provincial healthcare systems.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes extensive interviews with key opinion leaders, healthcare professionals, pharmaceutical executives, and medical device manufacturers across Canadian markets to gather firsthand insights into market trends and challenges.

Secondary research encompasses analysis of Health Canada regulatory databases, provincial healthcare statistics, pharmaceutical sales data, and medical device utilization reports. Data triangulation methods validate findings across multiple sources, ensuring robust analytical foundations for market projections and strategic recommendations.

Quantitative analysis utilizes statistical modeling techniques to project market growth rates, segment performance, and competitive dynamics. Qualitative assessment incorporates expert opinions, industry surveys, and stakeholder feedback to provide contextual understanding of market drivers and barriers.

Market segmentation analysis examines therapeutic categories, device classifications, geographic distribution, and end-user preferences through detailed data collection and analytical frameworks. Forecasting models integrate demographic trends, epidemiological data, and healthcare policy developments to project future market scenarios and growth opportunities.

Ontario dominates the Canadian ophthalmology drugs and devices market, accounting for approximately 38% of total market activity due to its large population base and concentration of healthcare facilities. Toronto metropolitan area serves as a major hub for ophthalmic research, clinical trials, and specialty care delivery, attracting significant pharmaceutical and medical device investments.

Quebec represents the second-largest regional market with 23% market share, supported by strong healthcare infrastructure and research institutions. Montreal’s biotechnology sector contributes significantly to ophthalmic innovation, with several companies developing novel therapeutic approaches and diagnostic technologies for global markets.

Western provinces including British Columbia and Alberta collectively account for 28% of market activity, with Vancouver and Calgary emerging as important centers for ophthalmic care delivery. British Columbia’s aging population drives particular demand for age-related eye condition treatments, while Alberta’s resource-based economy supports healthcare infrastructure investments.

Atlantic provinces represent 8% of the market but demonstrate strong growth potential as healthcare access initiatives expand specialty care availability. Rural access programs in these regions create opportunities for telemedicine solutions and mobile eye care services, addressing geographic barriers to treatment access.

Market leadership features a diverse mix of multinational pharmaceutical companies, specialized ophthalmic device manufacturers, and emerging biotechnology firms. Competitive positioning reflects companies’ abilities to navigate regulatory requirements while delivering innovative solutions addressing unmet clinical needs.

Strategic partnerships between pharmaceutical companies and medical device manufacturers create synergistic opportunities for comprehensive treatment solutions. Innovation focus emphasizes development of combination therapies, sustained-release formulations, and minimally invasive surgical techniques to differentiate market offerings.

Therapeutic segmentation reveals diverse market categories addressing specific ophthalmic conditions and treatment approaches:

By Drug Class:

By Device Category:

By End User:

Pharmaceutical categories demonstrate varying growth trajectories based on disease prevalence and treatment innovation. Anti-VEGF medications represent the fastest-growing segment, driven by increasing diabetic retinopathy cases and expanding treatment indications for various retinal conditions.

Glaucoma treatments maintain steady market presence with consistent demand growth of 4.8% annually, supported by aging demographics and improved screening programs. Combination therapies gain preference among healthcare providers for their convenience and improved patient compliance rates.

Surgical device categories experience robust growth through technological advancement and increasing surgical volumes. Minimally invasive procedures drive demand for specialized instruments and equipment, while premium intraocular lenses capture growing market share among patients seeking enhanced visual outcomes.

Diagnostic equipment benefits from emphasis on early detection and preventive care, with optical coherence tomography systems showing particular strength in specialist practices. Artificial intelligence integration creates new opportunities for enhanced diagnostic accuracy and workflow efficiency in clinical settings.

Healthcare providers benefit from access to innovative treatment options that improve patient outcomes while potentially reducing long-term care costs. Advanced diagnostic capabilities enable earlier intervention and more precise treatment planning, enhancing clinical effectiveness and patient satisfaction rates.

Pharmaceutical companies gain opportunities for revenue growth through development of specialized ophthalmic treatments addressing unmet medical needs. Market exclusivity periods for innovative drugs provide competitive advantages while patent protection supports research and development investment recovery.

Medical device manufacturers benefit from technological advancement opportunities and expanding market demand for sophisticated equipment. Innovation cycles create continuous opportunities for product differentiation and premium pricing strategies in specialized market segments.

Patients experience improved treatment outcomes through access to cutting-edge therapies and advanced medical technologies. Quality of life improvements result from better vision preservation and restoration, while treatment convenience increases through sustained-release formulations and minimally invasive procedures.

Healthcare systems achieve better resource utilization through cost-effective treatments that prevent disease progression and reduce complications. Economic benefits include reduced disability costs and improved workforce productivity through better vision health outcomes across the population.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalized medicine emerges as a transformative trend, with genetic testing and biomarker analysis enabling tailored treatment approaches for individual patients. Pharmacogenomics applications in ophthalmology promise improved drug efficacy while minimizing adverse reactions, creating opportunities for premium-priced therapeutic solutions.

Artificial intelligence integration revolutionizes diagnostic capabilities through automated image analysis and predictive modeling. Machine learning algorithms enhance screening accuracy for diabetic retinopathy and age-related macular degeneration, while reducing healthcare provider workload and improving patient access to specialist care.

Sustained-release drug delivery systems gain prominence as alternatives to frequent injection regimens, improving patient compliance and treatment outcomes. Biodegradable implants and innovative formulations extend therapeutic duration while reducing treatment burden for chronic conditions requiring long-term management.

Minimally invasive procedures continue advancing through technological innovation, offering patients reduced recovery times and improved safety profiles. Micro-incision techniques and advanced surgical instruments enable precise interventions with minimal tissue disruption, driving adoption among both healthcare providers and patients.

Telemedicine expansion addresses geographic access challenges while improving care coordination between specialists and primary care providers. Remote monitoring capabilities enable continuous patient assessment and early intervention, particularly valuable for managing chronic conditions like glaucoma and diabetic retinopathy.

Regulatory advancement through Health Canada’s progressive approval pathways accelerates access to breakthrough therapies. Priority review designations for innovative treatments reduce approval timelines while maintaining safety standards, encouraging pharmaceutical investment in ophthalmic research and development.

Strategic partnerships between pharmaceutical companies and technology firms create synergistic opportunities for comprehensive treatment solutions. Collaboration initiatives focus on developing integrated platforms combining drug therapy with digital health monitoring and patient engagement tools.

Research breakthroughs in gene therapy applications show promising results for inherited retinal diseases, with several Canadian institutions leading clinical trials. Stem cell research advances offer potential for regenerative treatments addressing previously untreatable conditions affecting retinal function.

Investment increases in ophthalmic research and development reflect growing market confidence and innovation potential. Venture capital funding supports emerging companies developing novel therapeutic approaches and advanced medical devices for specialized market segments.

Healthcare policy evolution toward value-based care models influences reimbursement decisions and market access strategies. Real-world evidence requirements drive companies to demonstrate long-term clinical and economic benefits of innovative treatments through comprehensive data collection and analysis.

Market participants should prioritize development of combination therapies addressing multiple aspects of complex ophthalmic conditions. MarkWide Research analysis indicates that integrated treatment approaches demonstrate superior patient outcomes while creating competitive differentiation opportunities in crowded therapeutic categories.

Investment strategies should focus on digital health integration and artificial intelligence applications to enhance diagnostic accuracy and treatment monitoring capabilities. Technology convergence creates opportunities for comprehensive care platforms that address both clinical needs and healthcare system efficiency requirements.

Geographic expansion strategies should emphasize rural and remote market access through telemedicine solutions and mobile care delivery models. Partnership approaches with provincial healthcare systems can facilitate broader market penetration while addressing unmet needs in underserved communities.

Regulatory preparation requires early engagement with Health Canada to understand evolving requirements for innovative treatments and medical devices. Adaptive clinical trial designs and real-world evidence generation should be integrated into development strategies to support regulatory submissions and reimbursement applications.

Competitive positioning should emphasize unique value propositions demonstrating superior clinical outcomes and economic benefits. Evidence generation through post-market studies and registry data collection supports long-term market access and pricing strategies in value-based healthcare environments.

Market projections indicate sustained growth momentum driven by demographic trends and technological advancement. Long-term forecasts suggest the market will maintain robust expansion with annual growth rates of 6.2% through 2030, supported by increasing disease prevalence and innovation in treatment approaches.

Therapeutic advancement will focus on personalized medicine applications and regenerative treatments addressing currently untreatable conditions. Gene therapy commercialization represents a significant opportunity, with several treatments expected to receive regulatory approval within the next five years, creating new market segments with substantial revenue potential.

Technology integration will accelerate through artificial intelligence applications and digital health platforms, transforming both diagnostic capabilities and treatment monitoring. MWR projections indicate that AI-powered solutions will capture 15% market share by 2028, driven by improved accuracy and efficiency in clinical applications.

Market consolidation may continue through strategic acquisitions and partnerships, creating larger entities with enhanced research capabilities and global reach. Innovation cycles will accelerate as companies compete to develop next-generation treatments and maintain competitive advantages in rapidly evolving therapeutic categories.

Healthcare system evolution toward value-based care will influence market dynamics, with emphasis on treatments demonstrating long-term clinical and economic benefits. Outcome-based pricing models may become more prevalent, requiring companies to demonstrate real-world effectiveness and cost-effectiveness in diverse patient populations.

The Canada ophthalmology drugs and devices market represents a dynamic and rapidly expanding healthcare sector positioned for sustained growth through demographic trends, technological innovation, and evolving treatment paradigms. Market fundamentals remain strong, supported by universal healthcare coverage, robust regulatory frameworks, and increasing awareness of preventive eye care importance.

Strategic opportunities abound for market participants willing to invest in innovative solutions addressing unmet clinical needs and geographic access challenges. Technology convergence between traditional ophthalmology and digital health platforms creates pathways for comprehensive care solutions that improve patient outcomes while enhancing healthcare system efficiency.

Future success will depend on companies’ abilities to navigate regulatory requirements, demonstrate clinical and economic value, and adapt to evolving healthcare delivery models. MarkWide Research analysis suggests that organizations focusing on personalized medicine, digital health integration, and value-based care approaches will capture the greatest market opportunities in this expanding sector.

Long-term market prospects remain highly favorable, with demographic trends ensuring sustained demand growth while technological advancement creates continuous opportunities for innovation and market expansion. The Canada ophthalmology drugs and devices market stands poised to deliver significant value to patients, healthcare providers, and industry stakeholders through improved treatment outcomes and enhanced quality of life for millions of Canadians requiring eye care services.

What is Ophthalmology Drugs & Devices?

Ophthalmology Drugs & Devices refer to the medications and instruments used in the diagnosis, treatment, and management of eye diseases and conditions. This includes a range of products such as anti-glaucoma medications, surgical instruments, and diagnostic devices.

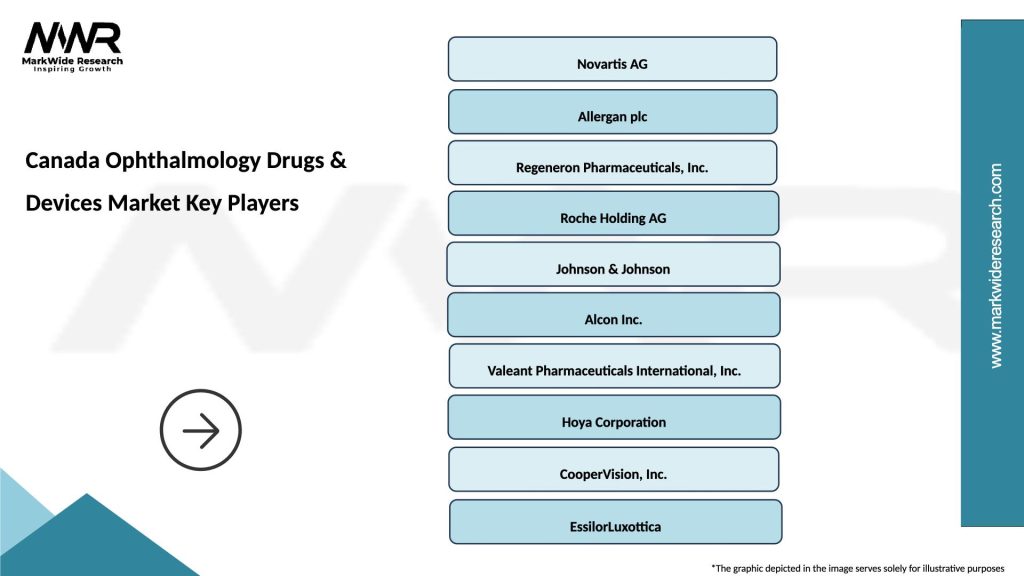

What are the key players in the Canada Ophthalmology Drugs & Devices Market?

Key players in the Canada Ophthalmology Drugs & Devices Market include companies like Novartis, Allergan, and Johnson & Johnson, which are known for their innovative products and extensive research in eye care, among others.

What are the growth factors driving the Canada Ophthalmology Drugs & Devices Market?

The growth of the Canada Ophthalmology Drugs & Devices Market is driven by factors such as the increasing prevalence of eye disorders, advancements in technology, and a growing aging population that requires more eye care solutions.

What challenges does the Canada Ophthalmology Drugs & Devices Market face?

Challenges in the Canada Ophthalmology Drugs & Devices Market include regulatory hurdles, high costs of advanced treatments, and competition from generic drugs that can limit market growth.

What opportunities exist in the Canada Ophthalmology Drugs & Devices Market?

Opportunities in the Canada Ophthalmology Drugs & Devices Market include the development of innovative therapies, increasing investment in research and development, and the potential for telemedicine solutions to enhance patient access to eye care.

What trends are shaping the Canada Ophthalmology Drugs & Devices Market?

Trends in the Canada Ophthalmology Drugs & Devices Market include the rise of minimally invasive surgical techniques, the integration of artificial intelligence in diagnostics, and a focus on personalized medicine to improve treatment outcomes.

Canada Ophthalmology Drugs & Devices Market

| Segmentation Details | Description |

|---|---|

| Product Type | Contact Lenses, Intraocular Lenses, Surgical Instruments, Diagnostic Equipment |

| End User | Hospitals, Eye Clinics, Research Institutions, Optical Retailers |

| Technology | Laser Surgery, Optical Coherence Tomography, Phacoemulsification, Retinal Imaging |

| Application | Cataract Surgery, Glaucoma Treatment, Vision Correction, Retinal Disorders |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Ophthalmology Drugs & Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at