444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Canada online trading platform market encompasses a burgeoning landscape of digital platforms that facilitate the buying and selling of financial instruments such as stocks, bonds, currencies, and commodities. With the proliferation of internet connectivity and the advent of advanced trading technologies, online trading platforms have emerged as preferred avenues for investors to access financial markets, execute trades, and manage their investment portfolios remotely.

Meaning

Online trading platforms in Canada serve as virtual marketplaces where investors can engage in the buying and selling of various financial instruments via electronic mediums such as computers, smartphones, and tablets. These platforms offer users access to real-time market data, research tools, and trading functionalities, empowering them to make informed investment decisions and execute trades with ease and convenience.

Executive Summary

The Canada online trading platform market is experiencing rapid growth driven by factors such as technological advancements, shifting investor preferences, and the democratization of financial markets. As digitalization continues to reshape the investment landscape, online trading platforms present lucrative opportunities for investors and industry participants alike. However, regulatory scrutiny, cybersecurity concerns, and market volatility pose challenges that necessitate careful navigation and strategic planning.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Canada online trading platform market operates within a dynamic environment characterized by rapid technological advancements, evolving regulatory landscapes, and shifting investor behaviors. These dynamics underscore the need for platform providers to remain agile, responsive, and innovative in meeting the evolving needs and preferences of investors while ensuring compliance with regulatory requirements.

Regional Analysis

The online trading platform market in Canada exhibits regional variations influenced by factors such as demographic trends, economic conditions, and regulatory frameworks. Key regions such as Ontario, Quebec, British Columbia, and Alberta serve as hubs for financial services and technology innovation, driving market growth and innovation within the online trading sector.

Competitive Landscape

Leading Companies in Canada Online Trading Platform Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

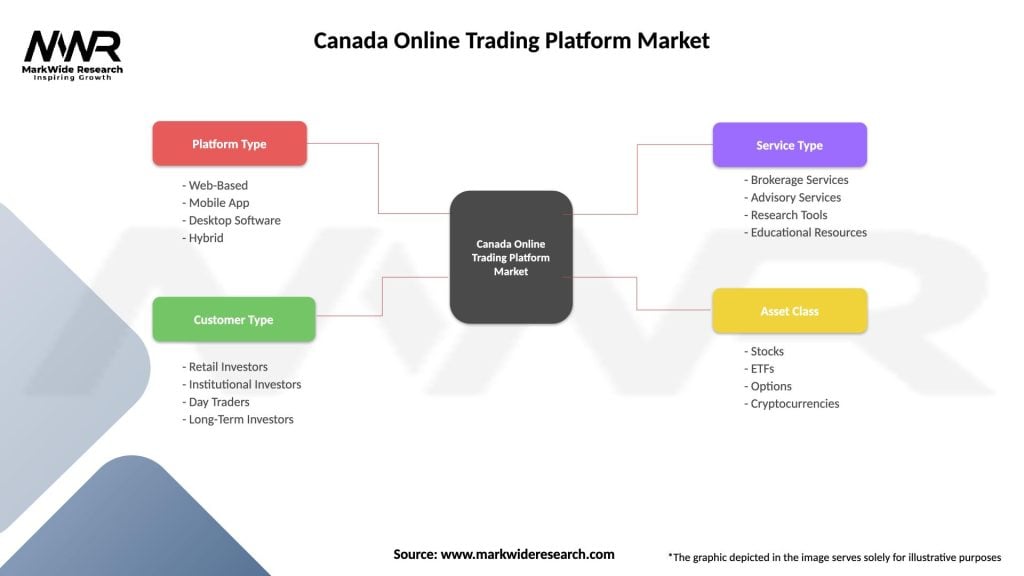

Segmentation

The online trading platform market in Canada can be segmented based on various criteria, including investor demographics, investment products, trading strategies, and technological platforms, enabling providers to tailor offerings and services to specific market segments and customer preferences.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has accelerated digitalization trends within the Canada online trading platform market, as lockdown measures, remote work arrangements, and social distancing protocols drive investor adoption of online trading solutions. The pandemic underscores the importance of resilient, technologically-enabled platforms capable of supporting remote trading activities and maintaining market liquidity amidst economic uncertainty.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Canada online trading platform market is poised for continued growth and innovation, driven by technological advancements, regulatory reforms, and shifting investor preferences. As digitalization reshapes the financial services industry, online trading platforms will play an increasingly integral role in democratizing access to financial markets, empowering investors, and driving capital formation in the digital economy.

Conclusion

In conclusion, the Canada online trading platform market represents a dynamic and evolving ecosystem characterized by technological innovation, regulatory scrutiny, and changing investor behaviors. While presenting abundant opportunities for industry participants, the market is not without its share of challenges, including cybersecurity risks, regulatory complexities, and market volatility. By embracing innovation, prioritizing investor protection, and fostering collaboration, online trading platform providers can navigate through uncertainties and capitalize on emerging trends to drive sustainable growth and success in the years ahead.

What is Canada Online Trading Platform?

Canada Online Trading Platform refers to digital platforms that facilitate the buying and selling of financial securities, such as stocks and bonds, through the internet. These platforms provide users with tools for trading, research, and portfolio management.

What are the key players in the Canada Online Trading Platform Market?

Key players in the Canada Online Trading Platform Market include Questrade, Wealthsimple, and Interactive Brokers, among others. These companies offer various services such as commission-free trading, investment advice, and advanced trading tools.

What are the growth factors driving the Canada Online Trading Platform Market?

The Canada Online Trading Platform Market is driven by increasing internet penetration, a growing interest in personal finance among consumers, and the rise of mobile trading applications. Additionally, the demand for low-cost trading options is contributing to market growth.

What challenges does the Canada Online Trading Platform Market face?

Challenges in the Canada Online Trading Platform Market include regulatory compliance, cybersecurity threats, and market volatility. These factors can impact user trust and the overall stability of trading platforms.

What opportunities exist in the Canada Online Trading Platform Market?

Opportunities in the Canada Online Trading Platform Market include the expansion of cryptocurrency trading, the integration of artificial intelligence for personalized trading experiences, and the potential for partnerships with financial institutions. These trends can enhance user engagement and broaden service offerings.

What trends are shaping the Canada Online Trading Platform Market?

Trends in the Canada Online Trading Platform Market include the rise of social trading, where users can follow and copy the trades of experienced investors, and the increasing use of robo-advisors for automated investment management. Additionally, there is a growing emphasis on user-friendly interfaces and educational resources for novice traders.

Canada Online Trading Platform Market

| Segmentation Details | Description |

|---|---|

| Platform Type | Web-Based, Mobile App, Desktop Software, Hybrid |

| Customer Type | Retail Investors, Institutional Investors, Day Traders, Long-Term Investors |

| Service Type | Brokerage Services, Advisory Services, Research Tools, Educational Resources |

| Asset Class | Stocks, ETFs, Options, Cryptocurrencies |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Canada Online Trading Platform Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at