444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada oil and gas industry market represents one of the most significant energy sectors globally, characterized by vast reserves, advanced extraction technologies, and substantial economic contributions. Canada’s energy landscape encompasses conventional oil and gas production, oil sands operations, and emerging renewable energy initiatives. The industry demonstrates remarkable resilience with consistent growth rates averaging approximately 4.2% annually across various segments, driven by technological innovations and increasing global energy demand.

Western Canada dominates the sector, particularly Alberta’s oil sands region, which contains the world’s third-largest proven oil reserves. The industry’s infrastructure includes extensive pipeline networks, refineries, and processing facilities that support both domestic consumption and international exports. Natural gas production has experienced significant expansion, with unconventional resources contributing approximately 78% of total production, reflecting the industry’s technological advancement and resource optimization capabilities.

Market dynamics indicate strong positioning for long-term growth, supported by government policies promoting energy security and economic development. The sector employs hundreds of thousands of Canadians directly and indirectly, contributing substantially to federal and provincial tax revenues while maintaining Canada’s position as a leading global energy supplier.

The Canada oil and gas industry market refers to the comprehensive ecosystem encompassing exploration, extraction, processing, refining, and distribution of petroleum and natural gas resources within Canadian territories. This market includes upstream activities such as drilling and production, midstream operations involving transportation and storage, and downstream processes including refining and marketing of petroleum products.

Industry scope extends beyond traditional extraction to include supporting services, equipment manufacturing, technology development, and environmental management solutions. The market encompasses both conventional resources found in traditional reservoirs and unconventional sources such as oil sands, tight oil, and shale gas formations that require specialized extraction techniques.

Regulatory framework governs all aspects of operations, ensuring environmental protection, safety standards, and resource management while facilitating economic development and energy security objectives for Canada and its trading partners.

Canada’s oil and gas sector maintains its position as a cornerstone of the national economy, demonstrating robust performance across multiple operational segments. The industry benefits from abundant natural resources, advanced technological capabilities, and strategic geographic positioning for North American and global market access. Production efficiency has improved significantly, with operational costs reduced by approximately 35% over the past decade through technological innovations and process optimization.

Market fundamentals remain strong, supported by increasing global energy demand and Canada’s reputation as a reliable energy supplier. The sector has successfully adapted to market volatility through operational excellence, cost management, and strategic investments in sustainable technologies. Export capabilities continue expanding with new pipeline infrastructure and transportation solutions enhancing market reach.

Future prospects indicate continued growth potential, driven by emerging technologies, environmental stewardship initiatives, and strategic partnerships with international markets. The industry’s commitment to reducing environmental impact while maintaining economic competitiveness positions Canada favorably in the evolving global energy landscape.

Strategic positioning of Canada’s oil and gas industry reveals several critical insights that define current market dynamics and future opportunities:

Primary growth drivers propelling Canada’s oil and gas industry forward encompass both domestic and international factors that create favorable market conditions. Global energy demand continues rising, particularly in emerging economies, creating sustained demand for Canadian energy exports. The industry benefits from Canada’s political stability, established regulatory framework, and reputation as a reliable energy supplier.

Technological advancement serves as a crucial driver, enabling more efficient extraction from challenging resources while reducing operational costs. Enhanced oil recovery techniques, horizontal drilling, and hydraulic fracturing have unlocked previously inaccessible reserves, significantly expanding production potential. Digital transformation initiatives incorporating artificial intelligence, IoT sensors, and predictive analytics optimize operations and improve safety outcomes.

Infrastructure development continues driving market expansion through new pipeline projects, processing facilities, and export terminals that enhance market access. Government support for energy infrastructure projects, combined with private sector investment, creates a foundation for sustained growth. Energy security concerns globally have increased demand for stable, democratic suppliers like Canada, particularly following recent geopolitical disruptions in traditional energy markets.

Environmental stewardship initiatives paradoxically drive innovation and efficiency improvements, as companies invest in cleaner technologies and sustainable practices that often result in cost savings and operational improvements.

Regulatory challenges present significant constraints on industry growth, with complex approval processes for new projects often extending development timelines and increasing costs. Environmental regulations continue tightening, requiring substantial investments in compliance systems and clean technologies that impact short-term profitability while supporting long-term sustainability objectives.

Transportation bottlenecks limit market access and price realization for Canadian producers, particularly regarding pipeline capacity constraints that affect crude oil and natural gas exports. Market access limitations to tidewater and international markets create pricing disadvantages compared to other global suppliers with better transportation infrastructure.

Capital intensity requirements for oil sands and unconventional resource development demand substantial upfront investments with long payback periods, making projects sensitive to commodity price volatility. Labor shortages in specialized technical roles create operational challenges and increase wage pressures across the industry.

Public perception and social license concerns influence project approvals and operational permissions, requiring extensive community engagement and environmental impact mitigation measures. Climate policy uncertainty creates planning challenges for long-term investments, as companies navigate evolving carbon pricing mechanisms and emission reduction requirements.

Emerging market opportunities present substantial growth potential for Canada’s oil and gas sector, particularly in Asian markets experiencing rapid economic development and energy demand growth. Liquefied natural gas (LNG) exports represent a transformative opportunity, with several proposed facilities positioned to capture growing global LNG demand, particularly from Asia-Pacific markets seeking cleaner-burning alternatives to coal.

Carbon capture and storage technologies offer dual benefits of reducing environmental impact while creating new revenue streams through carbon credit markets. Hydrogen production from natural gas presents opportunities to participate in the emerging clean energy economy while leveraging existing infrastructure and expertise.

Digital transformation initiatives create opportunities for operational optimization, predictive maintenance, and enhanced safety performance through advanced analytics and automation technologies. Strategic partnerships with international energy companies and technology providers can accelerate innovation and market access while sharing development risks and costs.

Indigenous partnerships offer sustainable development models that combine traditional knowledge with modern technology while creating economic opportunities for Indigenous communities. Renewable energy integration allows oil and gas companies to diversify their portfolios while reducing operational emissions through solar, wind, and geothermal power sources.

Complex market dynamics shape Canada’s oil and gas industry through interconnected factors influencing supply, demand, pricing, and investment decisions. Commodity price volatility remains a fundamental dynamic, with global oil and gas prices affecting project economics, investment flows, and operational strategies across the sector.

Geopolitical factors significantly impact market dynamics, as international conflicts, trade policies, and diplomatic relationships influence energy flows and pricing mechanisms. Currency fluctuations between the Canadian dollar and US dollar affect competitiveness and profitability, particularly for export-oriented operations.

Seasonal demand patterns create cyclical dynamics, with natural gas demand peaking during winter heating seasons and gasoline consumption varying with driving patterns. Technological disruption continuously reshapes operational capabilities, with innovations in extraction, processing, and transportation creating competitive advantages for early adopters.

Environmental regulations create dynamic compliance requirements that influence operational costs, project timelines, and strategic planning decisions. Market consolidation trends affect competitive dynamics as companies pursue mergers, acquisitions, and strategic partnerships to achieve economies of scale and operational synergies.

Comprehensive research methodology employed for analyzing Canada’s oil and gas industry market incorporates multiple data sources, analytical frameworks, and validation techniques to ensure accuracy and reliability. Primary research includes extensive interviews with industry executives, government officials, regulatory bodies, and technical experts across all segments of the value chain.

Secondary research encompasses analysis of government statistics, industry reports, financial statements, regulatory filings, and academic studies to establish baseline data and identify trends. Quantitative analysis utilizes statistical modeling, trend analysis, and forecasting techniques to project market developments and assess scenario outcomes.

Qualitative assessment incorporates expert opinions, stakeholder perspectives, and industry insights to understand market dynamics beyond numerical data. Data validation processes include cross-referencing multiple sources, expert review panels, and sensitivity analysis to ensure research accuracy and reliability.

Market segmentation analysis examines different industry components, geographic regions, and operational categories to provide comprehensive market understanding. Competitive intelligence gathering includes company analysis, strategic assessment, and performance benchmarking across key market participants.

Western Canada dominates the oil and gas landscape, with Alberta accounting for approximately 85% of national oil production and significant natural gas output. The province’s oil sands region contains vast reserves requiring specialized extraction technologies, while conventional oil and gas production continues in established fields. British Columbia leads in natural gas production, particularly from unconventional shale formations in the northeast region.

Saskatchewan contributes substantially to both oil and gas production, with enhanced oil recovery techniques extending the life of mature fields while new horizontal drilling projects access tight oil formations. The province’s strategic location provides access to multiple pipeline systems and export routes.

Eastern Canada presents emerging opportunities, with offshore Newfoundland and Labrador producing approximately 12% of national oil output from deepwater projects. New Brunswick and Nova Scotia are exploring unconventional gas potential while developing offshore wind resources that complement traditional energy production.

Northern territories contain significant untapped resources, though development faces challenges related to infrastructure, environmental sensitivity, and remote locations. Arctic regions hold substantial potential for future development as technology advances and climate change affects accessibility.

Canada’s oil and gas competitive landscape features a diverse mix of integrated oil companies, independent producers, and specialized service providers competing across various market segments. Major integrated companies maintain significant market presence through diversified operations spanning upstream production, midstream transportation, and downstream refining.

Competitive dynamics emphasize operational efficiency, cost management, environmental performance, and technological innovation as key differentiating factors in the marketplace.

Market segmentation of Canada’s oil and gas industry reveals distinct operational categories, each with unique characteristics, challenges, and opportunities:

By Resource Type:

By Operational Segment:

Oil sands operations represent Canada’s most distinctive energy sector, with production techniques and environmental management practices that are unique globally. Surface mining and in-situ extraction methods each present different operational profiles, with in-situ techniques showing faster growth rates due to lower environmental impact and reduced capital requirements.

Conventional oil production benefits from established infrastructure and operational expertise, though declining reserves in mature fields drive innovation in enhanced oil recovery techniques. Waterflood and chemical injection programs extend field life while improving recovery factors.

Natural gas sector demonstrates strong growth potential, particularly in unconventional resources where horizontal drilling efficiency has improved by approximately 40% over five years. Liquids-rich gas plays provide additional revenue streams through natural gas liquids production.

Offshore operations in Atlantic Canada showcase advanced deepwater technology and project management capabilities, with production efficiency rates exceeding 90% uptime through sophisticated monitoring and maintenance programs.

Pipeline transportation remains critical for market access, with capacity utilization rates averaging 85-95% across major systems, indicating strong demand for additional infrastructure development.

Economic benefits for industry participants include substantial revenue generation, employment opportunities, and contribution to government revenues through royalties and taxes. Upstream producers benefit from abundant resource base, established infrastructure, and favorable regulatory environment that supports long-term investment planning.

Service companies gain from technological leadership opportunities, specialized expertise development, and export potential for Canadian oilfield services and equipment. Transportation companies benefit from stable, long-term contracts and strategic infrastructure assets that generate consistent cash flows.

Regional communities receive economic development through direct employment, local procurement, and infrastructure investments that support broader economic activity. Indigenous communities increasingly participate through partnership agreements, employment opportunities, and business development initiatives.

Government stakeholders benefit from substantial tax revenues, royalty payments, and economic activity that supports public services and infrastructure development. International partners gain access to reliable energy supplies from a stable, democratic country with strong rule of law and contract sanctity.

Technology providers find opportunities to develop and commercialize innovative solutions for challenging operational environments, creating intellectual property and export opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation emerges as a dominant trend, with companies implementing advanced analytics, artificial intelligence, and automation technologies to optimize operations and reduce costs. Predictive maintenance programs utilizing IoT sensors and machine learning algorithms improve equipment reliability while reducing downtime.

Environmental stewardship initiatives drive innovation in clean technologies, with companies investing in carbon capture and storage, methane emission reduction, and renewable energy integration. ESG (Environmental, Social, Governance) considerations increasingly influence investment decisions and operational strategies.

Operational efficiency improvements continue through lean manufacturing principles, process optimization, and workforce productivity enhancements. Drilling efficiency gains in unconventional resources demonstrate productivity improvements of approximately 25% annually through technological advancement and operational learning.

Market diversification efforts focus on accessing new international customers, particularly in Asia-Pacific markets seeking reliable energy suppliers. Value chain integration strategies help companies capture additional margins while reducing market exposure risks.

Workforce evolution reflects changing skill requirements, with increased demand for data scientists, automation specialists, and environmental professionals alongside traditional engineering and operational roles.

Recent industry developments demonstrate the sector’s evolution toward greater efficiency, environmental responsibility, and market diversification. Major pipeline projects have received regulatory approvals, enhancing market access and reducing transportation bottlenecks that have historically constrained Canadian producers.

Technological breakthroughs in enhanced oil recovery, carbon capture and storage, and digital operations continue advancing industry capabilities. MarkWide Research analysis indicates that automation and digitization initiatives have contributed to operational cost reductions of approximately 20-30% across various operational segments.

Strategic partnerships between Canadian companies and international energy firms facilitate technology transfer, market access, and risk sharing for large-scale projects. Indigenous equity participation in major projects creates new models for sustainable resource development.

Regulatory developments include streamlined approval processes for certain project types while maintaining environmental protection standards. Carbon pricing mechanisms create incentives for emission reduction investments and clean technology adoption.

Investment trends show increased focus on ESG-compliant projects, operational efficiency improvements, and technology development rather than pure capacity expansion.

Strategic recommendations for industry participants emphasize the importance of operational excellence, environmental stewardship, and market diversification in navigating current challenges and capitalizing on future opportunities. Technology investment should focus on solutions that simultaneously improve operational efficiency and environmental performance.

Market access initiatives require continued investment in transportation infrastructure and international relationship building to reduce dependency on traditional markets. Cost competitiveness remains crucial, with companies needing to achieve break-even points that ensure profitability across commodity price cycles.

Environmental leadership positions companies favorably for future regulatory requirements and investor preferences, with early adoption of clean technologies providing competitive advantages. Stakeholder engagement strategies should prioritize Indigenous partnerships, community relations, and transparent communication about environmental performance.

Workforce development programs must address evolving skill requirements while maintaining operational expertise in traditional areas. Financial discipline through commodity cycles ensures companies maintain flexibility to invest in growth opportunities when market conditions improve.

Innovation partnerships with technology companies, research institutions, and international energy firms accelerate development of next-generation solutions while sharing development costs and risks.

Long-term prospects for Canada’s oil and gas industry remain positive, supported by abundant resources, technological advancement, and strategic positioning for global energy markets. Production growth is expected to continue, with MWR projections indicating steady expansion driven by operational efficiency improvements and new project developments.

Technology evolution will continue transforming operations, with artificial intelligence, automation, and clean technologies becoming standard across the industry. Carbon management capabilities will become increasingly important as companies work to reduce environmental impact while maintaining economic competitiveness.

Market diversification efforts will expand Canada’s customer base, particularly in Asia-Pacific markets seeking reliable energy supplies. LNG export development represents a transformative opportunity that could significantly increase natural gas production and export revenues.

Regulatory environment will continue evolving toward stricter environmental standards, requiring ongoing investment in clean technologies and operational improvements. Indigenous partnerships will become increasingly important for project development and social license maintenance.

Investment patterns will favor projects demonstrating strong ESG performance, operational efficiency, and long-term sustainability. Workforce transformation will continue as companies adapt to new technologies and operational requirements while maintaining safety and environmental standards.

Canada’s oil and gas industry stands at a critical juncture, balancing traditional energy production with evolving environmental expectations and market dynamics. The sector’s fundamental strengths, including abundant resources, technological expertise, and political stability, provide a solid foundation for continued growth and adaptation to changing global energy markets.

Strategic positioning for the future requires continued investment in operational efficiency, environmental stewardship, and market diversification while maintaining the industry’s economic contribution to Canadian prosperity. Technology leadership in areas such as carbon management, digital operations, and enhanced recovery techniques will determine competitive success in an evolving energy landscape.

Collaborative approaches involving industry, government, Indigenous communities, and international partners will be essential for sustainable development that balances economic, environmental, and social objectives. The industry’s ability to adapt, innovate, and maintain social license will ultimately determine its long-term success in contributing to Canada’s energy security and economic prosperity while meeting global climate objectives.

What is Canada Oil and Gas?

Canada Oil and Gas refers to the exploration, extraction, and production of oil and natural gas resources within Canada. This sector plays a crucial role in the country’s economy, contributing significantly to energy supply and employment.

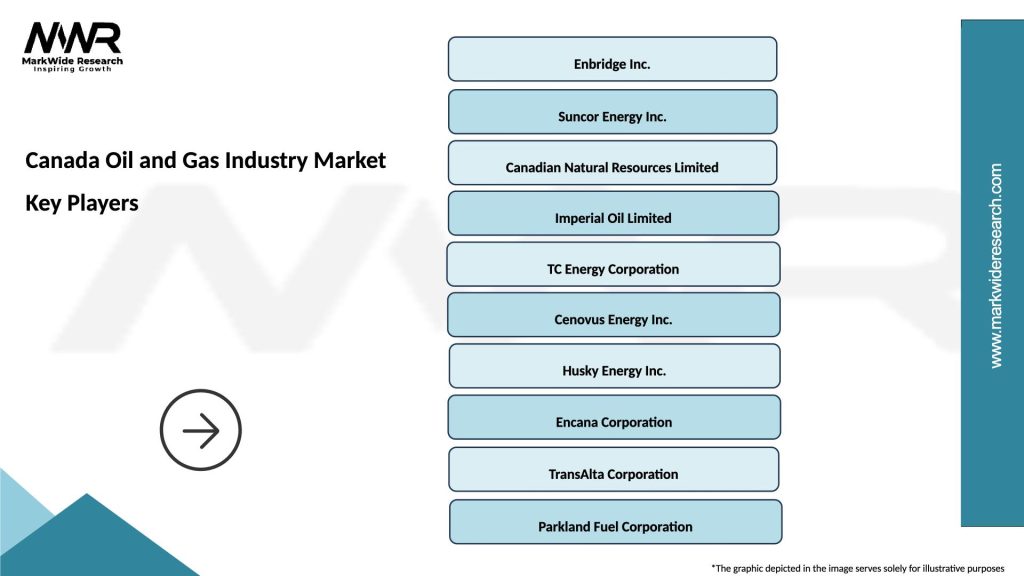

What are the key players in the Canada Oil and Gas Industry Market?

Key players in the Canada Oil and Gas Industry Market include companies such as Suncor Energy, Canadian Natural Resources Limited, and Cenovus Energy, among others. These companies are involved in various aspects of oil and gas production, from exploration to refining.

What are the main drivers of the Canada Oil and Gas Industry Market?

The main drivers of the Canada Oil and Gas Industry Market include the increasing global demand for energy, advancements in extraction technologies, and the country’s vast natural resources. Additionally, geopolitical factors and trade agreements can influence market dynamics.

What challenges does the Canada Oil and Gas Industry Market face?

The Canada Oil and Gas Industry Market faces challenges such as regulatory hurdles, environmental concerns, and fluctuating oil prices. These factors can impact investment decisions and operational costs for companies in the sector.

What opportunities exist in the Canada Oil and Gas Industry Market?

Opportunities in the Canada Oil and Gas Industry Market include the potential for renewable energy integration, technological innovations in extraction methods, and expanding markets for liquefied natural gas (LNG). These factors can enhance the sector’s sustainability and profitability.

What trends are shaping the Canada Oil and Gas Industry Market?

Trends shaping the Canada Oil and Gas Industry Market include a shift towards cleaner energy sources, increased investment in carbon capture technologies, and a focus on sustainability practices. These trends reflect the industry’s response to environmental challenges and changing consumer preferences.

Canada Oil and Gas Industry Market

| Segmentation Details | Description |

|---|---|

| Type | Upstream, Midstream, Downstream, Oil Sands |

| Technology | Hydraulic Fracturing, Enhanced Oil Recovery, Seismic Imaging, Drilling Automation |

| End User | Refineries, Petrochemical Plants, Power Generation, Industrial Users |

| Service Type | Exploration, Production, Transportation, Maintenance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Oil and Gas Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at