444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Canada office real estate market is a vital sector within the country’s commercial real estate industry. It encompasses the buying, selling, leasing, and development of office properties across various regions in Canada. With a robust economy, stable political environment, and a highly educated workforce, Canada has emerged as an attractive destination for businesses to establish their offices.

Meaning

Office real estate refers to commercial properties specifically designed and used for administrative, managerial, and professional purposes. These properties include office buildings, business parks, and coworking spaces, among others. The Canada office real estate market focuses on the demand and supply dynamics of such properties across the country.

Executive Summary

The Canada office real estate market has witnessed steady growth over the years, driven by factors such as economic stability, urbanization, and the increasing presence of multinational corporations. However, the market has also faced challenges due to changing work patterns and technological advancements that have influenced the way businesses operate. Despite these challenges, the market continues to offer lucrative opportunities for investors and stakeholders.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Canada office real estate market is influenced by a complex interplay of various factors. Economic conditions, demographic trends, technological advancements, and regulatory frameworks shape the market dynamics. The demand for office spaces fluctuates with changes in business activities, industry trends, and market forces. Real estate developers, investors, tenants, and government bodies actively engage in this dynamic market to capitalize on opportunities and mitigate risks.

Regional Analysis

The Canada office real estate market exhibits regional variations in terms of demand, supply, and rental rates. Major cities such as Toronto, Vancouver, and Montreal experience robust demand due to their economic significance and thriving business ecosystems. These cities attract multinational corporations, startups, and industry-specific companies, driving the need for office spaces. Other regions, such as Calgary, Edmonton, and Ottawa, also have notable office real estate markets influenced by local economic factors and industry clusters.

Competitive Landscape

Leading Companies in the Canada Office Real Estate Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

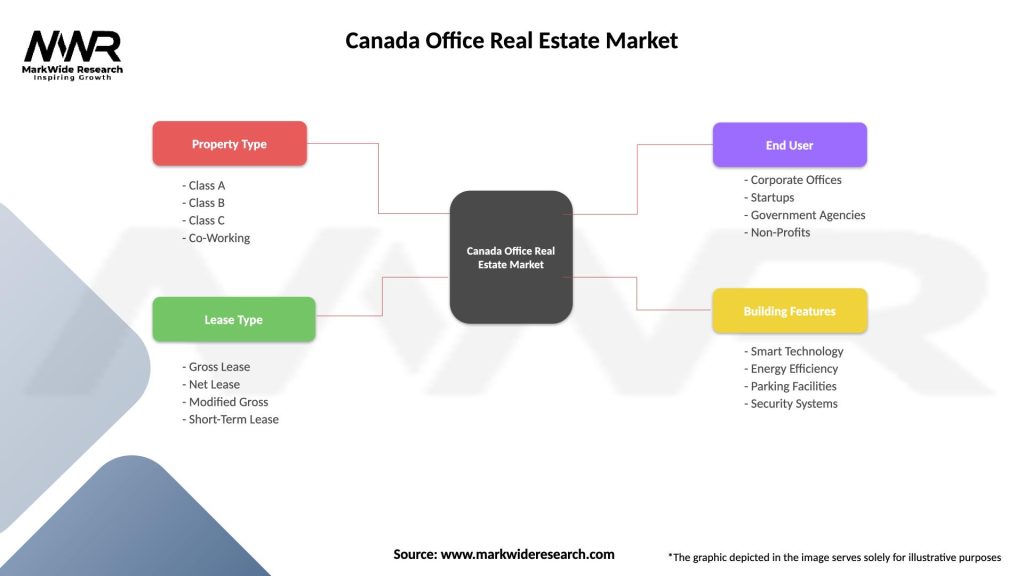

The Canada office real estate market can be segmented based on various factors:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a profound impact on the Canada office real estate market. The sudden shift to remote work and the temporary closures of non-essential businesses resulted in reduced demand for office spaces. Many companies reevaluated their real estate needs, leading to lease renegotiations, downsizing, or exploring flexible office options. However, as vaccination rates increased and businesses adapted to new work models, the market started showing signs of recovery. The pandemic also emphasized the importance of healthy and safe office environments, influencing design and wellness considerations.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Canada office real estate market is expected to witness a gradual recovery from the impacts of the pandemic as vaccination rates increase and businesses adapt to new work models. The demand for office spaces is likely to rebound, driven by economic growth, industry expansion, and the need for collaboration and innovation. However, the market will continue to evolve as technological advancements, sustainability requirements, and changing work patterns influence the dynamics of the office real estate sector.

Conclusion

The Canada office real estate market presents a dynamic landscape with opportunities and challenges for investors, developers, tenants, and other stakeholders. Economic growth, urbanization, and industry clusters drive the demand for office spaces, while changing work patterns and technological advancements reshape the market dynamics. Embracing flexibility, sustainability, technology, and wellness considerations will be key to thriving in the evolving office real estate market. By staying informed and adapting to emerging trends, industry participants can capitalize on opportunities and contribute to the growth and vibrancy of Canada’s office real estate sector.

What is Canada Office Real Estate?

Canada Office Real Estate refers to the sector of the real estate market that focuses on properties used for office purposes, including commercial buildings, coworking spaces, and business centers across Canada.

What are the key players in the Canada Office Real Estate Market?

Key players in the Canada Office Real Estate Market include Brookfield Properties, Cadillac Fairview, and Oxford Properties, among others.

What are the main drivers of the Canada Office Real Estate Market?

The main drivers of the Canada Office Real Estate Market include the growth of the technology sector, increasing demand for flexible workspaces, and urbanization trends that encourage businesses to establish offices in city centers.

What challenges does the Canada Office Real Estate Market face?

Challenges in the Canada Office Real Estate Market include the rise of remote work reducing office space demand, economic fluctuations affecting rental rates, and the need for buildings to meet sustainability standards.

What opportunities exist in the Canada Office Real Estate Market?

Opportunities in the Canada Office Real Estate Market include the development of green buildings, the rise of coworking spaces catering to startups, and the potential for adaptive reuse of older buildings into modern office environments.

What trends are shaping the Canada Office Real Estate Market?

Trends shaping the Canada Office Real Estate Market include the integration of technology in office design, a focus on employee wellness in workspace planning, and the increasing popularity of hybrid work models that influence office layouts.

Canada Office Real Estate Market

| Segmentation Details | Description |

|---|---|

| Property Type | Class A, Class B, Class C, Co-Working |

| Lease Type | Gross Lease, Net Lease, Modified Gross, Short-Term Lease |

| End User | Corporate Offices, Startups, Government Agencies, Non-Profits |

| Building Features | Smart Technology, Energy Efficiency, Parking Facilities, Security Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Canada Office Real Estate Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at