444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

Nutraceuticals have become an increasingly popular trend in the healthcare industry in recent years, and the Canadian market is no exception. With a growing aging population and increased focus on preventative healthcare, the Canada nutraceuticals market has seen steady growth in recent years. This article will provide a comprehensive overview of the Canada nutraceuticals market, including key market insights, drivers, restraints, opportunities, and future outlook.

Meaning of Nutraceuticals

Before diving into the Canada nutraceuticals market, it’s important to understand what exactly nutraceuticals are. Nutraceuticals are food or food-derived products that are taken in supplement form to provide health benefits beyond basic nutrition. These can include vitamins, minerals, herbs, and other natural ingredients that are marketed as providing a wide range of health benefits, including immune system support, weight management, and cardiovascular health.

Executive Summary

The Canada nutraceuticals market is projected to grow at a CAGR of 8.5% during the forecast period (2021-2026). The growing aging population, increased focus on preventative healthcare, and rising consumer awareness about the benefits of nutraceuticals are among the key drivers of this growth. However, stringent regulatory policies and high costs associated with research and development may hinder market growth. The dietary supplements segment is expected to dominate the market, while the functional food and beverage segment is expected to grow at the highest rate during the forecast period.

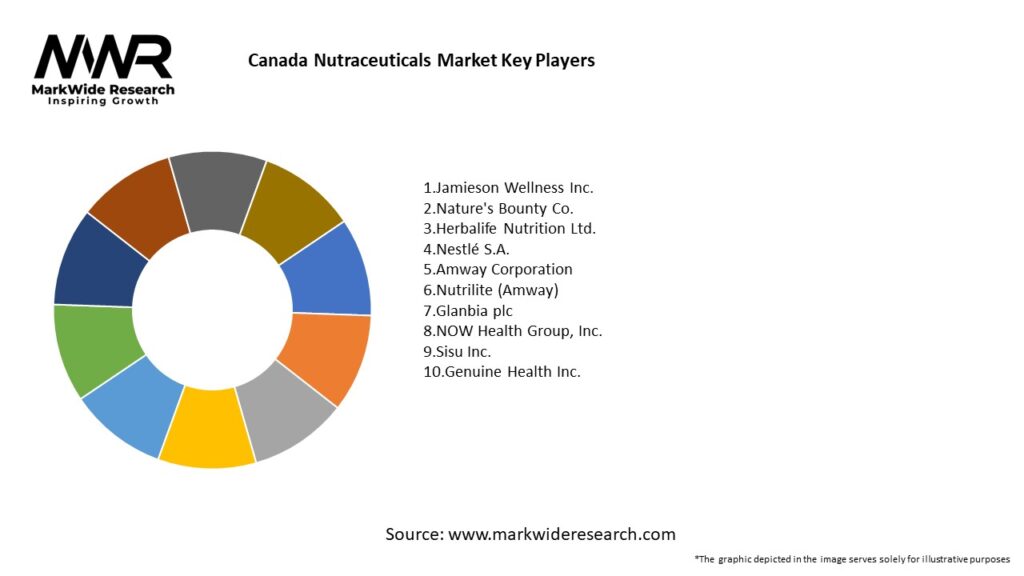

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

As the Canadian population ages, there is an increased demand for products that can support healthy aging and prevent age-related diseases. Nutraceuticals, with their wide range of health benefits, are well-positioned to meet this demand. The growing aging population is therefore a key driver of growth in the Canada nutraceuticals market.

Preventative healthcare has become a key focus in recent years, as healthcare costs continue to rise and individuals seek to prevent disease before it occurs. Nutraceuticals, with their focus on promoting overall health and wellness, are a natural fit for this trend. As a result, the increased focus on preventative healthcare is driving growth in the Canada nutraceuticals market.

As consumers become more health-conscious, they are increasingly seeking out products that can provide a wide range of health benefits. Nutraceuticals, with their natural ingredients and broad range of health benefits, are well-positioned to meet this demand. As a result, rising consumer awareness about the benefits of nutraceuticals is driving growth in the Canada nutraceuticals market.

Market Restraints

The nutraceuticals industry is subject to stringent regulatory policies in Canada, which can make it difficult for companies to bring new products to market. This can slow down the pace of innovation and hinder market growth. Companies must comply with regulations related to product safety, efficacy, and labeling, which can be time-consuming and costly.

Developing new nutraceutical products can be costly, as companies must invest in research and development to ensure their products are safe and effective. This can be a barrier to entry for smaller companies, who may not have the resources to invest in R&D. Additionally, the high costs associated with R&D can result in higher prices for consumers, which may limit market growth.

Market Opportunities

As consumers become more health-conscious and environmentally aware, there is a growing demand for plant-based and organic nutraceuticals. Plant-based nutraceuticals are derived from natural sources, such as fruits, vegetables, and herbs, and are seen as a healthier and more sustainable alternative to traditional pharmaceuticals. As a result, companies that offer plant-based and organic nutraceuticals may be well-positioned to capitalize on this trend.

The COVID-19 pandemic has accelerated the adoption of e-commerce channels in Canada, as more consumers turn to online shopping to avoid crowded stores and reduce their risk of exposure to the virus. This presents an opportunity for nutraceutical companies to expand their online presence and reach a wider audience.

Market Dynamics

The Canada nutraceuticals market is highly competitive, with a large number of players operating in the market. Companies must differentiate themselves through product innovation, quality, and branding to remain competitive. Additionally, partnerships and collaborations between companies can help to drive growth and expand market reach.

Regional Analysis

The Canada nutraceuticals market is segmented by region into Western Canada, Central Canada, and Eastern Canada. Central Canada accounted for the largest share of the market in 2020, due to its large population and high consumer awareness about the benefits of nutraceuticals. However, Western Canada is expected to grow at the highest rate during the forecast period, driven by increasing demand for plant-based and organic nutraceuticals.

Competitive Landscape

Leading Companies in the Canada Nutraceuticals Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Canada nutraceuticals market is segmented by product type into dietary supplements, functional food and beverages, and personal care and pharmaceuticals. The dietary supplements segment accounted for the largest share of the market in 2020, due to the wide range of products available in this category and the high consumer demand for supplements that support overall health and wellness.

Category-wise Insights

The dietary supplements segment is expected to dominate the Canada nutraceuticals market during the forecast period, due to the high demand for products that support overall health and wellness. Vitamins and minerals are the most commonly consumed dietary supplements in Canada, followed by herbal and botanical supplements.

The functional food and beverages segment is expected to grow at the highest rate during the forecast period, driven by increasing consumer demand for products that provide specific health benefits, such as immune system support and digestive health.

The personal care and pharmaceuticals segment is expected to grow at a slower rate during the forecast period, due to the higher costs associated with developing and marketing these products.

Key Benefits for Industry Participants and Stakeholders

The growing demand for nutraceuticals presents an opportunity for industry participants and stakeholders to expand their market reach and increase revenue.

As consumers become more health-conscious, there is an increased demand for products that support overall health and wellness. Nutraceuticals, with their focus on promoting health and preventing disease, are well-positioned to meet this demand.

Innovation and product development are key drivers of growth in the nutraceuticals industry. Companies that invest in R&D and develop new and innovative products may be well-positioned to gain market share and increase revenue.

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

As consumers become more health-conscious and environmentally aware, there is a growing demand for plant-based and organic nutraceuticals. Companies that offer these products may be well-positioned to capitalize on this trend.

Functional beverages, which provide specific health benefits in addition to hydration, are becoming increasingly popular among consumers. This presents an opportunity for nutraceutical companies to develop and market new functional beverage products.

Consumers are increasingly seeking out products made with natural ingredients, as they are seen as safer and healthier alternatives to synthetic ingredients. Nutraceutical companies that use natural ingredients in their products may be well-positioned to meet this demand.

COVID-19 Impact

The COVID-19 pandemic has had a significant impact on the Canada nutraceuticals market. While the pandemic initially led to a surge in demand for immune system-boosting supplements, such as vitamins and probiotics, the market has since stabilized. The pandemic has also accelerated the adoption of e-commerce channels, as more consumers turn to online shopping to avoid crowded stores.

Key Industry Developments

In February 2021, Nestle Health Science announced a partnership with Mosaic Health Solutions to develop a range of nutritional solutions for patients with chronic diseases.

Several companies have recently launched new nutraceutical products, including Herbalife Nutrition Ltd., which launched a new line of immune-supporting products in October 2020.

Analyst Suggestions

Innovation and product development are key drivers of growth in the nutraceuticals industry. Companies that invest in R&D and develop new and innovative products may be well-positioned to gain market share and increase revenue.

The COVID-19 pandemic has accelerated the adoption of e-commerce channels in Canada, making it important for nutraceutical companies to expand their online presence and reach a wider audience.

Future Outlook

The Canada nutraceuticals market is expected to continue to grow at a steady pace in the coming years, driven by the growing aging population, increased focus on preventative healthcare, and rising consumer awareness about the benefits of nutraceuticals. The dietary supplements segment is expected to continue to dominate the market, while the functional food and beverage segment is expected to grow at the highest rate during the forecast period.

Conclusion

The Canada nutraceuticals market presents a significant opportunity for industry participants and stakeholders, driven by the growing demand for products that support overall health and wellness. While there are challenges associated with regulation and R % D, there are also opportunities for companies that invest in innovation and product development, particularly in the areas of plant-based and organic nutraceuticals, functional beverages, and natural ingredients. Expanding e-commerce channels and partnerships with other companies may also help to drive growth and expand market reach.

Overall, the Canada nutraceuticals market is poised for continued growth in the coming years, driven by a range of factors including the growing aging population, increased focus on preventative healthcare, and rising consumer awareness about the benefits of nutraceuticals. Companies that are able to differentiate themselves through innovation, quality, and branding may be well-positioned to gain market share and increase revenue in this exciting and dynamic industry.

What is Nutraceuticals?

Nutraceuticals refer to products derived from food sources that offer health benefits, including the prevention and treatment of diseases. They encompass a wide range of products such as dietary supplements, functional foods, and herbal products.

What are the key players in the Canada Nutraceuticals Market?

Key players in the Canada Nutraceuticals Market include Jamieson Wellness Inc., Herbalife Nutrition Ltd., and GNC Holdings, among others. These companies are known for their diverse product offerings and strong market presence.

What are the growth factors driving the Canada Nutraceuticals Market?

The Canada Nutraceuticals Market is driven by increasing consumer awareness of health and wellness, a growing aging population, and rising demand for preventive healthcare solutions. Additionally, the trend towards natural and organic products is boosting market growth.

What challenges does the Canada Nutraceuticals Market face?

The Canada Nutraceuticals Market faces challenges such as regulatory hurdles, quality control issues, and competition from pharmaceutical products. Additionally, consumer skepticism regarding product efficacy can hinder market expansion.

What opportunities exist in the Canada Nutraceuticals Market?

Opportunities in the Canada Nutraceuticals Market include the development of innovative products targeting specific health concerns, expansion into e-commerce channels, and increasing collaborations between nutraceutical companies and healthcare professionals.

What trends are shaping the Canada Nutraceuticals Market?

Trends in the Canada Nutraceuticals Market include a rise in plant-based supplements, personalized nutrition, and the integration of technology in product development. Additionally, sustainability and eco-friendly packaging are becoming increasingly important to consumers.

Canada Nutraceuticals Market

| Segmentation Details | Description |

|---|---|

| Product Type | Vitamins, Minerals, Herbal Supplements, Probiotics |

| End User | Adults, Seniors, Athletes, Children |

| Distribution Channel | Online Retail, Pharmacies, Supermarkets, Health Stores |

| Form | Tablets, Capsules, Powders, Liquids |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Canada Nutraceuticals Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at