444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada luxury real estate market represents one of the most dynamic and resilient segments within North America’s premium property landscape. Luxury properties across major Canadian metropolitan areas continue to attract both domestic and international investors, driven by the country’s stable economic environment, favorable immigration policies, and world-class urban infrastructure. The market encompasses high-end residential properties, luxury condominiums, waterfront estates, and premium commercial real estate developments across key cities including Toronto, Vancouver, Montreal, and Calgary.

Market dynamics indicate sustained growth momentum, with luxury property transactions experiencing a 12.5% year-over-year increase in premium segments. The Canadian luxury real estate sector benefits from strong fundamentals including political stability, robust banking systems, and attractive foreign investment policies. International buyers particularly from Asia-Pacific regions continue to view Canadian luxury properties as safe-haven investments, contributing to market resilience even during global economic uncertainties.

Geographic distribution shows Toronto and Vancouver commanding approximately 68% of total luxury market activity, while emerging markets in Montreal, Ottawa, and Calgary demonstrate accelerating growth patterns. The market’s sophistication has evolved significantly, with luxury developments now incorporating smart home technologies, sustainable building practices, and exclusive amenity packages that cater to affluent buyers’ evolving preferences.

The Canada luxury real estate market refers to the segment of premium residential and commercial properties that command prices significantly above average market rates, typically featuring exceptional locations, superior construction quality, exclusive amenities, and distinctive architectural designs. This market encompasses properties that represent the top tier of real estate offerings across Canadian metropolitan areas, characterized by their exclusivity, prestige, and investment potential.

Luxury real estate in the Canadian context includes waterfront mansions, penthouse condominiums, heritage estates, ski chalets, and premium urban developments that offer sophisticated living experiences. These properties often feature custom finishes, panoramic views, private amenities, and locations in the most desirable neighborhoods. The market serves high-net-worth individuals, international investors, and affluent families seeking premium lifestyle experiences combined with strong investment returns.

Canada’s luxury real estate market demonstrates remarkable resilience and growth potential, supported by strong economic fundamentals and continued international interest. The market has successfully navigated recent global challenges while maintaining its appeal to sophisticated investors seeking stable, appreciating assets in politically secure environments. Premium property segments continue to outperform broader real estate markets, with luxury developments commanding premium pricing and experiencing shorter marketing periods.

Key market drivers include Canada’s reputation as a safe investment destination, favorable immigration policies attracting high-net-worth newcomers, and the country’s strong economic performance relative to global peers. The luxury segment benefits from limited supply in prime locations, creating natural scarcity that supports value appreciation. Technology integration and sustainability features have become essential components of luxury developments, with buyers increasingly demanding smart home capabilities and environmentally conscious design elements.

Market segmentation reveals distinct preferences across different buyer categories, with domestic purchasers favoring established neighborhoods and heritage properties, while international buyers gravitate toward new developments with modern amenities and concierge services. The market’s maturity is evidenced by sophisticated financing options, professional property management services, and specialized marketing approaches tailored to luxury clientele.

Strategic market analysis reveals several critical insights shaping the Canadian luxury real estate landscape. The market demonstrates strong correlation between luxury property performance and broader economic indicators, while maintaining independence from short-term market fluctuations due to the unique characteristics of high-end buyers.

Economic stability serves as the primary driver supporting Canada’s luxury real estate market growth. The country’s robust financial system, stable currency, and strong governance structures create an attractive environment for high-value property investments. Immigration policies that welcome affluent newcomers through investor visa programs contribute significantly to luxury market demand, with new residents often prioritizing premium housing options in major metropolitan areas.

Geographic advantages position Canadian luxury properties as highly desirable assets. Major cities offer world-class amenities, excellent healthcare systems, top-tier educational institutions, and cultural attractions that appeal to international luxury buyers. Waterfront locations and mountain resort areas provide unique lifestyle opportunities that command premium pricing and attract affluent buyers seeking exclusive recreational properties.

Investment security represents another crucial driver, with Canadian real estate offering transparent legal frameworks, clear property rights, and established transaction processes. The luxury segment benefits from professional property management services, sophisticated financing options, and active resale markets that provide liquidity for investors. Currency stability and favorable exchange rates for international buyers enhance the market’s appeal to foreign investors seeking portfolio diversification.

Infrastructure development continues to support luxury market growth, with major cities investing in transportation networks, cultural facilities, and urban amenities that enhance property values in premium locations. The emergence of new luxury neighborhoods and the revitalization of historic districts create additional opportunities for high-end development and investment.

Regulatory challenges present significant constraints for the Canadian luxury real estate market. Government policies targeting foreign ownership, including additional transfer taxes and empty homes taxes in major cities, have created complexity for international buyers and impacted transaction volumes. Financing restrictions implemented through stress testing requirements and lending guidelines have affected buyer qualification processes, particularly for highly leveraged luxury purchases.

Supply limitations in prime locations constrain market growth, with zoning restrictions and lengthy approval processes limiting new luxury development opportunities. Construction costs have escalated significantly, affecting development economics and ultimately impacting pricing for end buyers. Labor shortages in skilled trades and premium materials sourcing challenges further complicate luxury project delivery timelines.

Market volatility concerns arise from the luxury segment’s sensitivity to economic cycles and geopolitical events. Interest rate fluctuations impact buyer affordability and investment returns, while global economic uncertainties can reduce international buyer activity. The concentration of luxury market activity in Toronto and Vancouver creates vulnerability to local market disruptions or policy changes affecting these key metropolitan areas.

Competition factors include alternative investment opportunities that may attract capital away from real estate, such as financial markets or international property markets offering different risk-return profiles. The luxury market’s dependence on high-net-worth individuals makes it susceptible to changes in wealth distribution and economic conditions affecting affluent buyer segments.

Emerging markets across Canada present substantial growth opportunities for luxury real estate development and investment. Cities like Montreal, Ottawa, and Calgary demonstrate increasing sophistication in luxury offerings while maintaining more accessible pricing compared to Toronto and Vancouver. Resort destinations including Whistler, Banff, and Muskoka regions offer unique opportunities for luxury recreational properties that serve both domestic and international markets.

Technology integration creates opportunities for luxury developers to differentiate their offerings through smart building systems, advanced security features, and integrated lifestyle management services. Sustainable luxury represents a growing market segment, with environmentally conscious buyers willing to pay premiums for properties featuring renewable energy systems, sustainable materials, and carbon-neutral operations.

Demographic shifts present opportunities as wealthy millennials enter prime buying years with different preferences than previous generations. This cohort values experiences, technology integration, and urban amenities, creating demand for luxury properties in mixed-use developments with comprehensive lifestyle offerings. Immigration trends continue to bring affluent newcomers to Canada, creating sustained demand for luxury properties in gateway cities.

Investment diversification opportunities exist through luxury real estate investment trusts, fractional ownership models, and international partnership structures that make luxury properties accessible to broader investor bases. The development of luxury rental markets provides additional revenue streams for property owners while serving affluent tenants seeking flexible housing solutions.

Supply and demand dynamics in Canada’s luxury real estate market reflect the interplay between limited premium inventory and sustained buyer interest from both domestic and international sources. Inventory constraints in prime locations create competitive conditions that support price appreciation, while new luxury developments must meet increasingly sophisticated buyer expectations regarding amenities, technology, and design quality.

Buyer behavior patterns show distinct preferences across different market segments, with domestic luxury buyers often prioritizing established neighborhoods, heritage properties, and proximity to cultural amenities. International buyers typically focus on new developments, branded residences, and properties offering comprehensive concierge services. The market experiences seasonal fluctuations, with peak activity during spring and summer months when property viewing conditions are optimal.

Pricing dynamics demonstrate the luxury market’s relative independence from broader real estate trends, with premium properties maintaining value stability even during market corrections. Market liquidity varies significantly by location and property type, with prime urban locations and unique properties experiencing faster transaction cycles compared to specialized luxury segments.

According to MarkWide Research, market dynamics indicate increasing sophistication in luxury buyer expectations, with technology integration and sustainability features becoming standard requirements rather than premium options. The research highlights growing demand for properties offering comprehensive lifestyle management services and exclusive community amenities that enhance the ownership experience.

Comprehensive market analysis for the Canadian luxury real estate sector employs multiple research methodologies to ensure accurate and actionable insights. Primary research includes extensive interviews with luxury real estate professionals, developers, property managers, and high-net-worth buyers to understand market trends, preferences, and challenges from industry participants’ perspectives.

Secondary research incorporates analysis of transaction data, property listings, development permits, and regulatory filings to quantify market activity and identify emerging trends. Market surveys conducted among luxury property owners, potential buyers, and industry professionals provide insights into satisfaction levels, future purchase intentions, and evolving preferences in luxury real estate features and amenities.

Data collection methods include real-time market monitoring systems, luxury property database analysis, and collaboration with leading real estate brokerages specializing in high-end properties. Geographic analysis covers major metropolitan markets while also examining emerging luxury destinations and resort communities that contribute to the overall market landscape.

Analytical frameworks employ statistical modeling, trend analysis, and comparative market studies to identify patterns and project future market developments. The methodology ensures comprehensive coverage of market segments, buyer categories, and regional variations that characterize Canada’s diverse luxury real estate landscape.

Toronto metropolitan area dominates Canada’s luxury real estate market, accounting for approximately 42% of national luxury transaction volume. The region benefits from its status as Canada’s financial capital, attracting high-net-worth professionals and international business leaders. Prime neighborhoods including Yorkville, Forest Hill, and Rosedale command premium pricing, while waterfront developments along Lake Ontario offer luxury condominium options with spectacular views and resort-style amenities.

Vancouver region represents the second-largest luxury market, capturing roughly 26% of national activity through its combination of natural beauty, mild climate, and Pacific Rim connectivity. West Vancouver and Shaughnessy neighborhoods feature some of Canada’s most expensive residential properties, while downtown luxury condominiums attract both domestic and international buyers seeking urban sophistication with mountain and ocean views.

Montreal luxury market demonstrates accelerating growth, with the city’s European charm, cultural richness, and relatively accessible pricing attracting affluent buyers. Westmount and Outremont represent traditional luxury enclaves, while downtown developments offer modern luxury options. The market benefits from Quebec’s investor immigration programs and the city’s growing reputation as a technology and aerospace hub.

Calgary and Edmonton markets reflect Alberta’s resource-based economy, with luxury properties concentrated in prestigious neighborhoods and acreage properties surrounding urban centers. Resort markets including Whistler, Banff, and Muskoka regions serve specialized luxury segments focused on recreational properties and vacation homes that attract both domestic and international buyers seeking unique Canadian lifestyle experiences.

Market leadership in Canada’s luxury real estate sector is characterized by specialized brokerages, boutique development firms, and international luxury brands that cater to high-net-worth clientele. The competitive environment emphasizes service quality, market expertise, and exclusive property access rather than traditional volume-based metrics.

Competitive differentiation focuses on market expertise, exclusive property access, international marketing capabilities, and comprehensive client services including property management, investment advisory, and lifestyle concierge services. Technology adoption among leading competitors includes virtual reality property tours, drone photography, and sophisticated digital marketing platforms that reach global luxury buyer audiences.

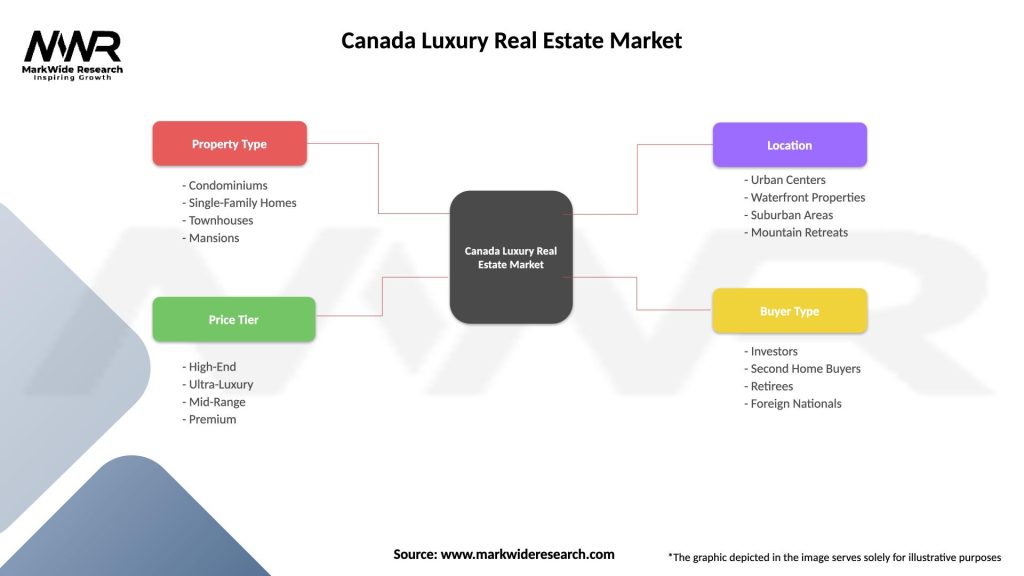

By Property Type: The Canadian luxury real estate market segments into distinct categories serving different buyer preferences and investment objectives. Single-family luxury homes represent the largest segment, including custom-built estates, heritage properties, and waterfront residences that offer privacy, exclusivity, and substantial living spaces. Luxury condominiums appeal to buyers seeking urban convenience, building amenities, and lower maintenance responsibilities while maintaining premium living standards.

By Price Range: Market segmentation reflects varying levels of luxury positioning, with ultra-luxury properties commanding the highest prices and offering unique features, prime locations, and exceptional quality. Entry luxury segments provide access to luxury lifestyle elements at more accessible price points, while super luxury categories feature one-of-a-kind properties with extraordinary characteristics and investment potential.

By Buyer Category: Domestic buyers typically prioritize established neighborhoods, school districts, and proximity to employment centers, while international buyers focus on investment potential, residency pathway opportunities, and properties offering comprehensive management services. Investment buyers evaluate properties based on rental income potential, appreciation prospects, and portfolio diversification benefits.

By Geographic Location: Urban luxury properties concentrate in downtown cores and prestigious neighborhoods of major cities, offering proximity to business districts, cultural amenities, and transportation networks. Suburban luxury focuses on exclusive residential communities with larger properties, privacy, and family-oriented amenities. Resort luxury serves recreational property markets in scenic destinations offering unique lifestyle experiences and seasonal rental opportunities.

Waterfront Properties: Canada’s extensive coastlines and lake systems create exceptional opportunities for luxury waterfront real estate. Lake Ontario and Lake Huron shorelines feature prestigious cottage communities and year-round luxury residences that command premium pricing due to their scarcity and natural beauty. Ocean waterfront properties in British Columbia and Maritime provinces offer unique lifestyle experiences with boating access, private beaches, and spectacular views that attract affluent buyers seeking exclusive recreational properties.

Urban Penthouses: High-rise luxury living represents a sophisticated market segment featuring penthouse units with panoramic city views, private terraces, and exclusive building amenities. Toronto’s Financial District and Vancouver’s Coal Harbour developments exemplify this category, offering residents proximity to business centers while providing resort-style amenities including concierge services, fitness facilities, and rooftop entertainment areas.

Heritage Estates: Historic luxury properties appeal to buyers valuing architectural significance, established neighborhoods, and unique character features. Montreal’s Golden Square Mile and Toronto’s Rosedale neighborhoods showcase heritage luxury homes that combine historical charm with modern renovations, creating distinctive properties that maintain their value through scarcity and cultural significance.

Ski Resort Properties: Mountain luxury real estate serves affluent buyers seeking recreational properties in world-class ski destinations. Whistler Village and Banff area developments offer luxury chalets, slope-side condominiums, and exclusive resort communities that provide both personal enjoyment and strong rental income potential during peak seasons.

Developers and Builders benefit from the luxury market’s premium pricing structure, which supports higher profit margins and justifies investments in superior materials, advanced technologies, and exclusive amenities. Luxury projects typically experience strong pre-sales activity and faster absorption rates when properly positioned, while the segment’s stability provides predictable revenue streams for established developers with luxury market expertise.

Real Estate Professionals specializing in luxury properties enjoy higher commission structures, longer client relationships, and opportunities for referral business within affluent networks. Luxury market expertise creates competitive advantages through specialized knowledge of high-end buyer preferences, exclusive property access, and sophisticated marketing capabilities that command premium service fees.

Financial Institutions benefit from luxury real estate financing through higher loan amounts, affluent client relationships, and opportunities for comprehensive wealth management services. Private banking divisions leverage luxury property transactions to develop broader financial relationships with high-net-worth clients, including investment management, estate planning, and international banking services.

Service Providers including property managers, concierge services, and luxury amenity operators benefit from the segment’s emphasis on premium service delivery and willingness to pay for exceptional experiences. Technology providers find opportunities in smart home systems, security solutions, and property management platforms that serve the luxury market’s sophisticated requirements and service expectations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration has emerged as a defining trend in Canadian luxury real estate, with affluent buyers increasingly demanding environmentally responsible properties. LEED certification, renewable energy systems, and sustainable building materials have transitioned from premium options to standard expectations in luxury developments. Net-zero energy homes and carbon-neutral building operations represent the cutting edge of sustainable luxury, appealing to environmentally conscious buyers willing to pay premiums for reduced environmental impact.

Smart Home Technology adoption accelerates across luxury properties, with comprehensive automation systems becoming essential features rather than optional upgrades. Integrated platforms controlling lighting, climate, security, and entertainment systems provide convenience and efficiency that luxury buyers expect. Artificial intelligence integration enables predictive maintenance, energy optimization, and personalized living experiences that enhance property value and owner satisfaction.

Wellness-Focused Amenities reflect growing health consciousness among affluent buyers, with luxury developments incorporating comprehensive fitness facilities, spa services, and outdoor recreation areas. Air quality systems, circadian lighting, and biophilic design elements create healthier living environments that command premium pricing. Community wellness programs and on-site health services add value for residents prioritizing healthy lifestyles.

Flexible Living Spaces accommodate changing work and lifestyle patterns, with luxury properties featuring adaptable room configurations, home office capabilities, and multi-generational living options. MWR analysis indicates growing demand for properties that can serve multiple functions, from remote work headquarters to entertainment venues, reflecting post-pandemic lifestyle changes among affluent buyers.

Regulatory Evolution continues to shape the Canadian luxury real estate landscape, with provincial and municipal governments implementing policies affecting foreign ownership, taxation, and development approval processes. British Columbia’s speculation and vacancy tax, along with Ontario’s non-resident speculation tax, have created new compliance requirements while influencing buyer behavior and market dynamics in key luxury markets.

Technology Platform Development has revolutionized luxury property marketing and transaction processes, with virtual reality tours, drone photography, and artificial intelligence-powered property matching becoming standard tools. Blockchain technology exploration for property transactions and fractional ownership models represents emerging innovation that could transform luxury real estate investment and ownership structures.

International Partnership Expansion sees Canadian luxury real estate firms establishing strategic alliances with global networks to access international buyer markets and provide comprehensive services for cross-border transactions. Branded residence developments featuring international hotel and lifestyle brands create new luxury product categories that appeal to sophisticated buyers seeking recognized quality and service standards.

Sustainable Development Initiatives drive innovation in luxury construction methods, materials, and building operations, with developers competing to achieve the highest environmental standards while maintaining luxury quality and amenities. Green building certification programs specifically designed for luxury properties ensure that environmental responsibility doesn’t compromise the premium living experience that affluent buyers expect.

Market Diversification represents a critical strategy for luxury real estate stakeholders seeking to reduce concentration risk and capture emerging opportunities. Geographic expansion into secondary markets with growing affluent populations can provide growth opportunities while reducing dependence on Toronto and Vancouver markets. Product diversification across different luxury segments, from urban penthouses to resort properties, creates more resilient business models that can weather market fluctuations.

Technology Investment should focus on platforms and systems that enhance the luxury buyer experience while improving operational efficiency. Customer relationship management systems specifically designed for luxury clientele can help maintain long-term relationships and generate referral business. Digital marketing platforms that reach global luxury buyer audiences provide essential tools for competing in international markets.

Service Excellence differentiation becomes increasingly important as luxury buyers demand comprehensive, personalized experiences throughout the property acquisition and ownership process. Concierge services, property management, and lifestyle support services create additional revenue streams while enhancing client satisfaction and retention. Professional development in luxury market expertise ensures that service providers can meet sophisticated buyer expectations and command premium pricing.

Partnership Development with complementary service providers, international networks, and technology platforms can enhance market reach and service capabilities without requiring substantial internal investment. Strategic alliances with luxury brands, financial institutions, and immigration consultants create comprehensive service offerings that appeal to high-net-worth buyers seeking integrated solutions for their Canadian luxury property investments.

Long-term growth prospects for Canada’s luxury real estate market remain positive, supported by fundamental drivers including political stability, economic resilience, and continued international appeal. Demographic trends indicate sustained demand from both domestic wealth accumulation and international immigration, with luxury market activity projected to maintain steady growth rates of 8-12% annually over the next five years.

Market evolution will likely emphasize technology integration, sustainability features, and flexible living spaces that accommodate changing lifestyle preferences among affluent buyers. Smart city development initiatives in major metropolitan areas will enhance luxury property values through improved infrastructure, transportation networks, and urban amenities that support premium living experiences.

International market dynamics suggest continued foreign investment interest, despite regulatory constraints, as Canada maintains its reputation as a stable investment destination. Currency fluctuations and global economic conditions will influence international buyer activity, but the underlying appeal of Canadian luxury properties for portfolio diversification and residency purposes remains strong.

MarkWide Research projections indicate that luxury market growth will increasingly concentrate in emerging metropolitan areas and resort destinations, as Toronto and Vancouver markets mature and pricing reaches levels that encourage geographic diversification. Innovation adoption in construction methods, building materials, and property management systems will create new opportunities for differentiation and value creation in the luxury segment, with successful market participants being those who effectively integrate technological advancement with traditional luxury service excellence.

Canada’s luxury real estate market represents a sophisticated and resilient segment that continues to attract domestic and international investment despite evolving regulatory landscapes and global economic uncertainties. The market’s strength derives from fundamental advantages including political stability, economic resilience, geographic beauty, and world-class urban infrastructure that create enduring appeal for affluent buyers seeking premium properties.

Market dynamics indicate continued evolution toward greater technology integration, sustainability focus, and service sophistication that meets the changing expectations of high-net-worth buyers. Geographic diversification beyond traditional Toronto and Vancouver markets presents significant opportunities for growth, while emerging luxury segments including wellness-focused developments and smart home integration create new value propositions for discerning buyers.

Future success in Canada’s luxury real estate market will depend on stakeholders’ ability to adapt to changing buyer preferences, regulatory requirements, and competitive dynamics while maintaining the service excellence and product quality that define luxury market positioning. The market’s long-term prospects remain compelling for participants who can effectively navigate complexity while delivering exceptional value and experiences to sophisticated clientele seeking Canada’s unique combination of luxury living opportunities and investment security.

What is Canada Luxury Real Estate?

Canada Luxury Real Estate refers to high-end residential properties that offer premium features, locations, and amenities, catering to affluent buyers. This segment includes luxury homes, penthouses, and estates in desirable areas across the country.

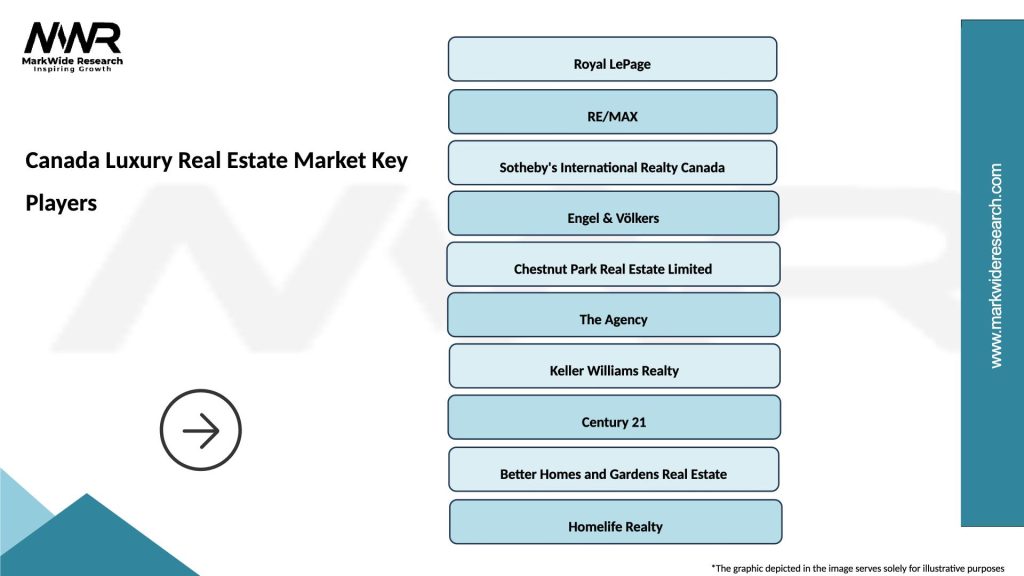

What are the key players in the Canada Luxury Real Estate Market?

Key players in the Canada Luxury Real Estate Market include companies like Sotheby’s International Realty, Engel & Völkers, and RE/MAX Collection, which specialize in high-end properties. These firms provide tailored services to meet the unique needs of luxury buyers and sellers, among others.

What are the main drivers of the Canada Luxury Real Estate Market?

The Canada Luxury Real Estate Market is driven by factors such as increasing wealth among high-net-worth individuals, a strong demand for premium properties in urban centers, and the appeal of Canada as a safe and attractive place to live. Additionally, foreign investment plays a significant role in this market.

What challenges does the Canada Luxury Real Estate Market face?

Challenges in the Canada Luxury Real Estate Market include fluctuating economic conditions, changes in government regulations regarding foreign ownership, and the impact of rising interest rates on luxury home purchases. These factors can create uncertainty for both buyers and sellers.

What opportunities exist in the Canada Luxury Real Estate Market?

Opportunities in the Canada Luxury Real Estate Market include the growing trend of sustainable luxury homes, increased interest in vacation properties, and the potential for urban redevelopment projects. These trends can attract new buyers and investors looking for unique offerings.

What trends are shaping the Canada Luxury Real Estate Market?

Trends shaping the Canada Luxury Real Estate Market include a rise in demand for smart home technology, a focus on wellness amenities, and the popularity of eco-friendly building practices. These trends reflect changing consumer preferences and the desire for modern, sustainable living environments.

Canada Luxury Real Estate Market

| Segmentation Details | Description |

|---|---|

| Property Type | Condominiums, Single-Family Homes, Townhouses, Mansions |

| Price Tier | High-End, Ultra-Luxury, Mid-Range, Premium |

| Location | Urban Centers, Waterfront Properties, Suburban Areas, Mountain Retreats |

| Buyer Type | Investors, Second Home Buyers, Retirees, Foreign Nationals |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Luxury Real Estate Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at