444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada location-based services market represents a rapidly evolving technological landscape that leverages geographic positioning data to deliver personalized and contextually relevant services to users across various industries. This dynamic market encompasses a comprehensive range of applications including navigation systems, location-aware advertising, asset tracking, emergency services, and geofencing solutions that are transforming how businesses and consumers interact with their physical environment.

Market dynamics indicate that the Canadian location-based services sector is experiencing unprecedented growth, driven by the widespread adoption of smartphones, improved GPS accuracy, and the integration of advanced technologies such as 5G networks and Internet of Things (IoT) devices. The market demonstrates robust expansion with a projected compound annual growth rate (CAGR) of 23.7% through the forecast period, reflecting the increasing demand for location-intelligent solutions across multiple sectors.

Geographic positioning technology has become integral to Canada’s digital infrastructure, with applications spanning from retail and transportation to healthcare and public safety. The market benefits from Canada’s advanced telecommunications infrastructure, high smartphone penetration rates exceeding 85% of the population, and supportive government initiatives promoting digital innovation and smart city development.

Industry adoption patterns reveal that retail, transportation, and logistics sectors lead the implementation of location-based services, while emerging applications in healthcare, agriculture, and environmental monitoring are creating new growth opportunities. The integration of artificial intelligence and machine learning capabilities is enhancing the precision and predictive capabilities of location-based solutions.

The Canada location-based services market refers to the comprehensive ecosystem of technologies, applications, and services that utilize geographic positioning information to provide location-aware functionality to users and businesses across Canadian territories. These services leverage various positioning technologies including Global Positioning System (GPS), cellular triangulation, Wi-Fi positioning, and Bluetooth beacons to determine precise location coordinates and deliver contextually relevant information or services.

Location-based services encompass a broad spectrum of applications that range from basic navigation and mapping to sophisticated geospatial analytics and location intelligence platforms. The market includes both consumer-facing applications such as ride-sharing services, location-based social networking, and proximity marketing, as well as enterprise solutions including fleet management, asset tracking, workforce optimization, and location-based business intelligence.

Core components of the market include positioning technologies, geographic information systems (GIS), mapping platforms, location analytics software, and various hardware components such as GPS receivers, sensors, and communication modules. The integration of these components creates comprehensive solutions that enable businesses to leverage location data for operational efficiency, customer engagement, and strategic decision-making.

Strategic market analysis reveals that Canada’s location-based services market is positioned for substantial growth, driven by technological advancement, increasing mobile device adoption, and growing demand for location-intelligent applications across diverse industry verticals. The market demonstrates strong fundamentals with expanding use cases and improving technology infrastructure supporting widespread adoption.

Key growth drivers include the proliferation of smartphones and connected devices, advancement in positioning accuracy through technologies like Real-Time Kinematic (RTK) GPS, and the deployment of 5G networks enabling enhanced location services capabilities. The market benefits from increasing enterprise adoption rates of 34% annually as businesses recognize the strategic value of location intelligence.

Market segmentation analysis indicates that navigation and mapping services currently dominate market share, while emerging segments such as indoor positioning, augmented reality location services, and IoT-based tracking solutions are experiencing rapid growth. The retail and e-commerce sector represents the largest application segment, leveraging location services for personalized marketing and supply chain optimization.

Competitive landscape features a mix of global technology giants, specialized location services providers, and innovative Canadian startups developing niche solutions. The market demonstrates healthy competition with continuous innovation in accuracy, battery efficiency, and integration capabilities driving technological advancement and market expansion.

Market intelligence reveals several critical insights that define the current state and future trajectory of Canada’s location-based services market:

Technological advancement serves as the primary catalyst driving Canada’s location-based services market expansion. The widespread deployment of 5G networks is enabling ultra-low latency location services with centimeter-level accuracy, opening new possibilities for applications in autonomous vehicles, industrial automation, and augmented reality experiences.

Smartphone proliferation continues to fuel market growth as mobile devices become increasingly sophisticated with multiple positioning technologies including GPS, GLONASS, Galileo, and BeiDou constellation support. The integration of advanced sensors such as accelerometers, gyroscopes, and magnetometers enhances location accuracy and enables indoor positioning capabilities.

Digital transformation initiatives across industries are driving demand for location intelligence solutions. Businesses are recognizing the strategic value of location data for optimizing operations, enhancing customer experiences, and gaining competitive advantages through geospatial analytics and location-based insights.

Government support through smart city initiatives, digital infrastructure investments, and regulatory frameworks promoting innovation is creating favorable market conditions. Federal and provincial programs supporting technology adoption and digital innovation are accelerating market development and encouraging private sector investment.

Consumer expectations for personalized and contextually relevant services are pushing businesses to implement location-based solutions. The demand for real-time information, personalized recommendations, and location-aware services is driving continuous innovation and market expansion across multiple sectors.

Privacy concerns represent a significant challenge for the location-based services market, as consumers and regulatory bodies express increasing concern about location data collection, storage, and usage. Stringent privacy regulations and consumer awareness are requiring service providers to implement comprehensive data protection measures and transparent privacy policies.

Technical limitations in certain environments continue to constrain market growth. Indoor positioning accuracy, signal interference in urban environments, and battery consumption issues in mobile devices present ongoing challenges that require continued technological innovation and infrastructure investment.

Infrastructure dependencies create potential vulnerabilities and limitations for location-based services. Reliance on satellite systems, cellular networks, and internet connectivity can result in service disruptions and accuracy limitations in remote or challenging geographic areas.

Implementation costs for enterprise solutions can be substantial, particularly for small and medium-sized businesses. The complexity of integration, ongoing maintenance requirements, and need for specialized expertise can create barriers to adoption for organizations with limited technical resources or budgets.

Cybersecurity risks associated with location data transmission and storage present ongoing challenges. The sensitive nature of location information requires robust security measures, encryption protocols, and secure communication channels to protect against data breaches and unauthorized access.

Emerging technologies present substantial opportunities for market expansion and innovation. The integration of artificial intelligence, machine learning, and edge computing capabilities is enabling more sophisticated location analytics, predictive services, and autonomous decision-making applications that create new market segments and revenue streams.

Industry-specific solutions offer significant growth potential as vertical markets recognize the unique value of customized location-based services. Healthcare applications including patient tracking, asset management, and emergency response systems represent particularly promising opportunities for specialized solution development.

Internet of Things integration is creating expansive opportunities for location-enabled devices and applications. The proliferation of connected sensors, smart devices, and industrial IoT implementations is driving demand for comprehensive location intelligence platforms that can manage and analyze data from diverse sources.

Autonomous systems development presents transformative opportunities for location-based services. Applications in autonomous vehicles, drone operations, and robotic systems require highly accurate and reliable positioning services, creating demand for advanced location technologies and specialized solutions.

Cross-border applications offer opportunities for Canadian companies to expand internationally while serving the growing demand for location services in global markets. The expertise developed in Canada’s advanced telecommunications environment positions local companies well for international expansion and partnership opportunities.

Competitive dynamics in Canada’s location-based services market are characterized by intense innovation competition, strategic partnerships, and continuous technological advancement. Market participants are focusing on differentiation through accuracy improvements, battery efficiency optimization, and specialized application development to maintain competitive advantages.

Technology evolution is reshaping market dynamics as new positioning technologies, improved algorithms, and enhanced integration capabilities emerge. The transition from traditional GPS-based services to multi-constellation, multi-sensor positioning systems is improving accuracy and reliability while expanding application possibilities.

Regulatory environment influences market dynamics through privacy legislation, data protection requirements, and industry-specific regulations. MarkWide Research analysis indicates that regulatory compliance is driving innovation in privacy-preserving technologies and transparent data handling practices.

Partnership ecosystems are becoming increasingly important as companies collaborate to deliver comprehensive solutions. Strategic alliances between technology providers, telecommunications companies, and industry specialists are creating integrated platforms that address complex customer requirements and expand market reach.

Investment patterns show increasing venture capital and private equity interest in location-based services companies, particularly those developing innovative applications in emerging sectors such as indoor positioning, augmented reality, and industrial IoT applications.

Comprehensive market analysis employs a multi-faceted research approach combining primary and secondary research methodologies to ensure accurate and reliable market insights. The research framework incorporates quantitative analysis, qualitative assessments, and industry expert consultations to provide comprehensive market understanding.

Primary research activities include structured interviews with industry executives, technology providers, end-users, and market participants across various sectors. Survey methodologies capture market trends, adoption patterns, and future requirements from diverse stakeholder perspectives to ensure representative market insights.

Secondary research encompasses analysis of industry reports, government publications, academic studies, patent filings, and company financial disclosures to establish market context and validate primary research findings. Technology assessment includes evaluation of emerging innovations and their potential market impact.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert review panels, and statistical analysis techniques. Market sizing methodologies employ bottom-up and top-down approaches to establish reliable market estimates and growth projections.

Analytical frameworks include Porter’s Five Forces analysis, SWOT assessment, value chain analysis, and competitive benchmarking to provide comprehensive market understanding and strategic insights for stakeholders across the location-based services ecosystem.

Ontario market leadership is evident in Canada’s location-based services landscape, with the province accounting for approximately 42% of national market activity. The concentration of technology companies, financial institutions, and major corporations in Toronto and Ottawa creates substantial demand for sophisticated location-based solutions and drives innovation in the sector.

British Columbia represents the second-largest regional market, benefiting from Vancouver’s position as a technology hub and the province’s strong presence in natural resources, transportation, and tourism industries. The region shows particular strength in mobile application development and consumer-facing location services.

Quebec’s market demonstrates unique characteristics with strong government support for technology innovation and a growing startup ecosystem focused on location-based solutions. Montreal’s aerospace and transportation industries create specialized demand for high-precision positioning services and industrial applications.

Alberta’s energy sector drives significant demand for location-based services in industrial applications, asset tracking, and workforce management. The province’s vast geographic area and resource extraction activities create opportunities for specialized positioning solutions and remote monitoring applications.

Atlantic provinces show growing adoption of location-based services in maritime industries, tourism, and emergency services. The region’s unique geographic challenges and opportunities in ocean-based industries create demand for specialized positioning and tracking solutions.

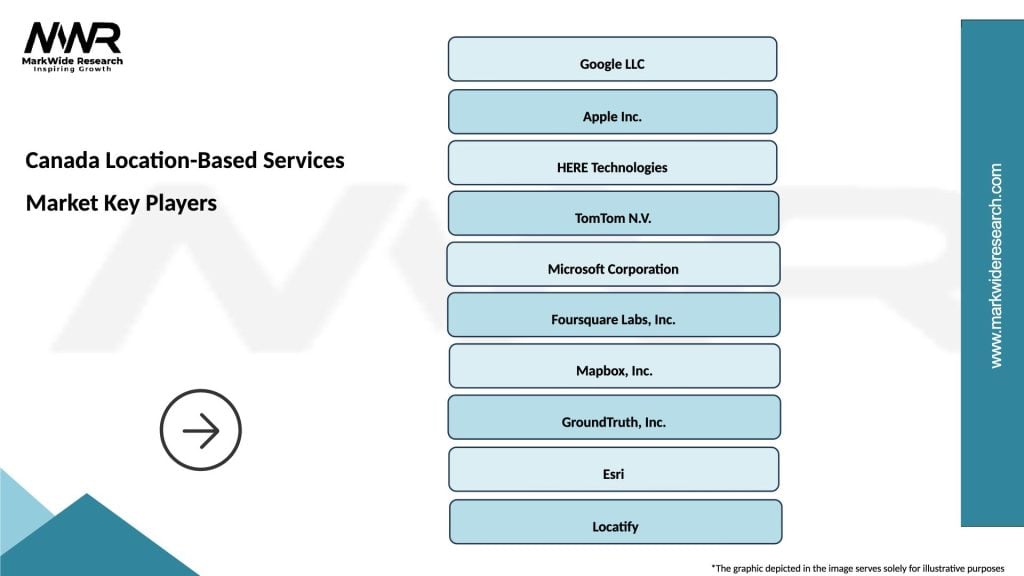

Market leadership in Canada’s location-based services sector features a diverse ecosystem of global technology giants, specialized service providers, and innovative Canadian companies developing cutting-edge solutions:

Innovation focus among market participants centers on accuracy improvements, privacy protection, battery efficiency, and specialized application development. Companies are investing heavily in artificial intelligence, machine learning, and edge computing capabilities to enhance service offerings and maintain competitive differentiation.

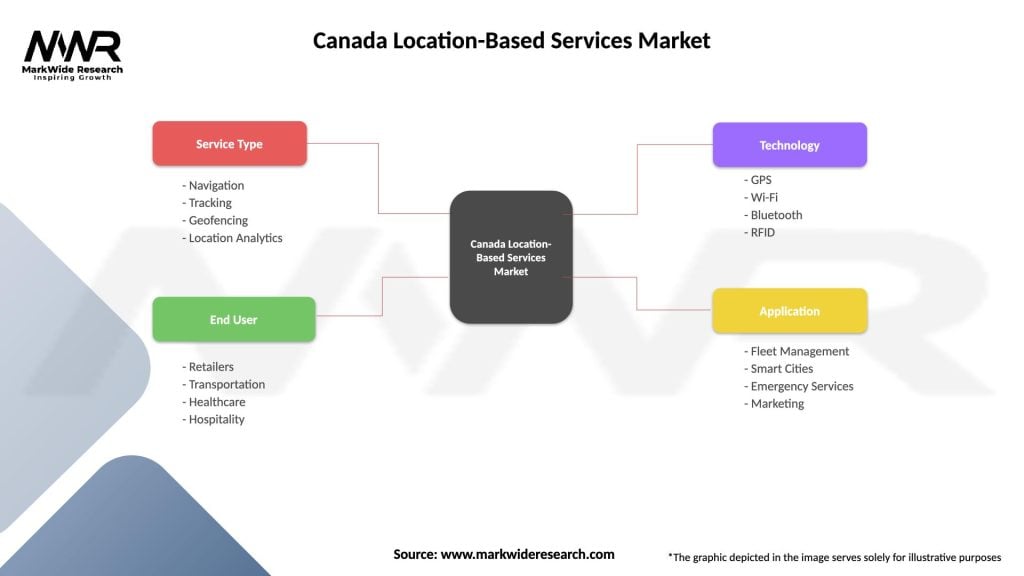

Technology-based segmentation reveals distinct market categories based on positioning technologies and service delivery methods:

Application-based segmentation demonstrates the diverse use cases driving market demand:

Consumer applications dominate market volume with navigation, ride-sharing, and location-based social networking services showing the highest user engagement rates. Mobile applications in this category benefit from widespread smartphone adoption and increasing consumer comfort with location sharing for enhanced service experiences.

Enterprise solutions represent the highest value segment with comprehensive platforms addressing fleet management, workforce optimization, and business intelligence requirements. These solutions typically involve longer implementation cycles but generate higher revenue per customer and demonstrate strong customer retention rates.

Industrial applications show rapid growth in sectors such as construction, mining, and agriculture where precision positioning is critical for operational efficiency. These specialized solutions often require custom development and integration with existing industrial systems and equipment.

Government and public sector applications focus on public safety, emergency services, and smart city initiatives. This segment demonstrates steady growth driven by digital transformation initiatives and increasing emphasis on citizen services and public safety enhancement.

Healthcare applications represent an emerging high-growth category with applications in patient tracking, asset management, and emergency response. Regulatory requirements and privacy considerations create unique challenges but also opportunities for specialized solution development.

Technology providers benefit from expanding market opportunities across multiple industry verticals, enabling diversified revenue streams and reduced dependency on single market segments. The growing demand for specialized solutions creates opportunities for premium pricing and long-term customer relationships.

End-user organizations realize significant operational benefits including improved efficiency, enhanced customer experiences, and data-driven decision-making capabilities. Location-based services enable cost reduction through optimized routing, asset utilization, and workforce management while creating new revenue opportunities through location-aware services.

Telecommunications providers leverage location-based services to enhance network value and create additional revenue streams beyond traditional connectivity services. The integration of location capabilities with 5G networks enables new service offerings and strengthens customer relationships.

Government agencies benefit from improved public services, enhanced emergency response capabilities, and better resource allocation through location intelligence. Smart city initiatives enabled by location-based services contribute to improved quality of life and operational efficiency in municipal services.

Investors and stakeholders gain exposure to a high-growth technology sector with diverse application opportunities and strong long-term growth prospects driven by digital transformation trends and increasing demand for location intelligence across industries.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration is transforming location-based services through predictive analytics, automated decision-making, and enhanced user experiences. Machine learning algorithms are improving location accuracy, predicting user behavior, and enabling proactive service delivery that anticipates user needs and preferences.

Privacy-preserving technologies are gaining prominence as organizations seek to balance service personalization with user privacy protection. Techniques such as differential privacy, federated learning, and edge computing are enabling location services while minimizing privacy risks and regulatory compliance concerns.

Indoor positioning advancement represents a significant trend as businesses recognize the value of location services within buildings and enclosed spaces. Technologies including ultra-wideband, computer vision, and sensor fusion are enabling centimeter-level accuracy for applications in retail, healthcare, and industrial environments.

Augmented reality integration is creating immersive location-based experiences that overlay digital information onto physical environments. These applications are finding adoption in navigation, retail, tourism, and industrial training, creating new market opportunities and user engagement models.

Edge computing deployment is reducing latency and improving reliability for location-based services by processing data closer to users and devices. This trend is particularly important for real-time applications such as autonomous vehicles, industrial automation, and emergency response systems.

Strategic partnerships between telecommunications providers and location services companies are accelerating market development and service integration. These collaborations are enabling enhanced positioning accuracy through network-based technologies and creating comprehensive service offerings for enterprise customers.

Government initiatives supporting smart city development and digital infrastructure investment are creating substantial market opportunities. Federal and provincial programs promoting innovation and technology adoption are driving demand for location-based solutions in public sector applications.

Technology acquisitions by major market participants are consolidating capabilities and expanding service offerings. These transactions are enabling companies to integrate complementary technologies and accelerate development of comprehensive location intelligence platforms.

Regulatory developments including privacy legislation and data protection requirements are shaping market evolution and driving innovation in privacy-preserving technologies. Industry participants are adapting service models and developing new approaches to comply with evolving regulatory requirements.

Investment activity in Canadian location-based services companies is increasing, with venture capital and private equity firms recognizing the growth potential and market opportunities in this sector. This funding is enabling technology development, market expansion, and international growth initiatives.

Strategic focus on privacy-by-design principles is essential for long-term market success as regulatory requirements and consumer expectations continue to evolve. Companies should prioritize transparent data practices, user consent mechanisms, and privacy-preserving technologies to build trust and ensure compliance.

Investment in emerging technologies including artificial intelligence, edge computing, and advanced positioning systems will be critical for maintaining competitive advantages. MWR analysis suggests that companies investing in next-generation capabilities will capture disproportionate market share as these technologies mature.

Vertical market specialization offers opportunities for differentiation and premium pricing as industries develop specific requirements for location-based services. Companies should consider developing deep expertise in selected verticals rather than pursuing broad horizontal market approaches.

Partnership strategies with telecommunications providers, system integrators, and industry specialists can accelerate market penetration and reduce development costs. Collaborative approaches enable companies to leverage complementary capabilities and access new customer segments.

International expansion should be considered by Canadian companies with proven domestic success, as global markets offer substantial growth opportunities and the potential for technology export and licensing revenue streams.

Market evolution over the next five years will be characterized by continued technological advancement, expanding application areas, and increasing integration with emerging technologies such as artificial intelligence and Internet of Things platforms. The market is expected to maintain strong growth momentum with a projected CAGR exceeding 20% through the forecast period.

Technology convergence will create more sophisticated and capable location-based services as positioning technologies, communication networks, and computing capabilities continue to advance. The integration of 5G networks, edge computing, and AI will enable new applications and service models that were previously technically unfeasible.

Industry adoption will expand beyond traditional sectors as organizations across diverse industries recognize the strategic value of location intelligence. Healthcare, education, and government sectors are expected to show particularly strong growth as digital transformation initiatives accelerate and specialized solutions mature.

Global competitiveness of Canadian location-based services companies is expected to strengthen as domestic expertise and innovation capabilities position them well for international expansion. The combination of advanced technology infrastructure and supportive business environment creates favorable conditions for continued market leadership.

Regulatory environment will continue to evolve with increasing emphasis on privacy protection and data security, driving innovation in privacy-preserving technologies and creating competitive advantages for companies that successfully balance service capabilities with privacy protection requirements.

Canada’s location-based services market represents a dynamic and rapidly expanding sector with substantial growth potential driven by technological advancement, increasing digital adoption, and expanding application opportunities across diverse industries. The market benefits from strong fundamentals including advanced telecommunications infrastructure, high smartphone penetration, and supportive government policies promoting digital innovation.

Strategic opportunities abound for market participants willing to invest in emerging technologies, develop specialized solutions, and address evolving customer requirements while maintaining focus on privacy protection and regulatory compliance. The integration of artificial intelligence, 5G networks, and Internet of Things capabilities is creating new possibilities for innovative location-based services and applications.

Market challenges including privacy concerns, technical limitations, and competitive pressure require careful navigation and strategic planning. Companies that successfully address these challenges while capitalizing on growth opportunities will be well-positioned for long-term success in this evolving market landscape.

Future prospects remain highly positive as digital transformation trends, smart city initiatives, and increasing demand for location intelligence continue to drive market expansion. The Canada location-based services market is poised for continued growth and innovation, offering substantial opportunities for technology providers, investors, and end-user organizations seeking to leverage the strategic value of location-aware solutions and services.

What is Location-Based Services?

Location-Based Services (LBS) refer to applications and services that utilize geographical data to provide information or services to users based on their location. These services are commonly used in navigation, local search, and location tracking.

What are the key players in the Canada Location-Based Services Market?

Key players in the Canada Location-Based Services Market include companies like Google, Apple, and HERE Technologies, which provide various LBS solutions such as mapping, navigation, and location analytics, among others.

What are the main drivers of the Canada Location-Based Services Market?

The main drivers of the Canada Location-Based Services Market include the increasing adoption of smartphones, the growing demand for real-time data, and the rise of IoT devices that enhance location tracking capabilities across various sectors.

What challenges does the Canada Location-Based Services Market face?

Challenges in the Canada Location-Based Services Market include privacy concerns regarding user data, the need for robust infrastructure to support LBS applications, and competition among service providers that can impact pricing and service quality.

What opportunities exist in the Canada Location-Based Services Market?

Opportunities in the Canada Location-Based Services Market include the expansion of smart city initiatives, advancements in augmented reality applications, and the potential for personalized marketing strategies based on location data.

What trends are shaping the Canada Location-Based Services Market?

Trends shaping the Canada Location-Based Services Market include the integration of artificial intelligence for enhanced data analysis, the growth of location-based advertising, and the increasing use of geofencing technology to engage consumers effectively.

Canada Location-Based Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Navigation, Tracking, Geofencing, Location Analytics |

| End User | Retailers, Transportation, Healthcare, Hospitality |

| Technology | GPS, Wi-Fi, Bluetooth, RFID |

| Application | Fleet Management, Smart Cities, Emergency Services, Marketing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Location-Based Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at