444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada life and non-life insurance market represents a cornerstone of the nation’s financial services sector, providing comprehensive coverage solutions to millions of individuals, families, and businesses across the country. Market dynamics indicate robust growth driven by evolving consumer needs, regulatory developments, and technological innovations that are reshaping the insurance landscape. The sector encompasses a diverse range of products including term life insurance, whole life policies, property and casualty coverage, health insurance, and specialized commercial lines.

Digital transformation has emerged as a key catalyst, with insurers investing heavily in technology platforms to enhance customer experience and streamline operations. The market demonstrates strong resilience, with premium growth rates consistently outpacing inflation and reflecting increased awareness of insurance benefits among Canadian consumers. Regulatory frameworks continue to evolve, supporting market stability while encouraging innovation and competition among established players and emerging insurtech companies.

Regional distribution shows concentration in major urban centers, with Ontario and Quebec representing significant market shares of approximately 65% of total insurance activities. The market benefits from Canada’s stable economic environment, aging population demographics, and increasing focus on financial security and risk management across all sectors of society.

The Canada life and non-life insurance market refers to the comprehensive ecosystem of insurance providers, products, and services that offer financial protection against various risks including death, disability, property damage, liability, and health-related expenses. This market encompasses both individual and group insurance solutions, serving personal and commercial clients through diverse distribution channels including direct sales, brokers, agents, and digital platforms.

Life insurance components include term life, permanent life, universal life, and annuity products designed to provide financial security for beneficiaries and retirement planning solutions. Non-life insurance covers property and casualty lines including auto insurance, home insurance, commercial property, liability coverage, and specialized business insurance products. The market operates under provincial and federal regulatory oversight, ensuring consumer protection while maintaining competitive market conditions.

Market performance demonstrates consistent expansion across both life and non-life segments, driven by demographic trends, economic growth, and evolving risk awareness among Canadian consumers. The sector benefits from strong regulatory frameworks, technological advancement, and increasing penetration of insurance products in underserved market segments. Digital adoption rates have accelerated significantly, with online policy purchases increasing by approximately 40% over recent years.

Competitive landscape features a mix of large multinational insurers, domestic companies, and emerging insurtech firms leveraging technology to capture market share. The market shows particular strength in auto insurance, which represents the largest non-life segment, and group life insurance driven by employee benefits expansion. Premium collection efficiency has improved substantially, with digital payment adoption reaching over 75% of transactions.

Future prospects remain positive, supported by population growth, urbanization trends, and increasing awareness of insurance benefits among younger demographics. The market continues to evolve through product innovation, enhanced customer service capabilities, and strategic partnerships between traditional insurers and technology providers.

Strategic developments reveal several critical trends shaping the Canadian insurance landscape. The market demonstrates strong resilience and adaptability, with insurers successfully navigating economic uncertainties while maintaining growth trajectories.

Demographic transformation serves as the primary growth engine, with Canada’s aging population creating sustained demand for life insurance, annuities, and health coverage products. The baby boomer generation represents a significant customer segment requiring comprehensive insurance solutions for retirement planning and wealth transfer strategies. Additionally, increasing life expectancy rates drive demand for long-term care insurance and extended coverage periods.

Economic prosperity and rising disposable incomes enable more Canadians to invest in comprehensive insurance coverage beyond basic mandatory requirements. The growth of the middle class, particularly in urban centers, creates opportunities for premium insurance products and enhanced coverage options. Employment growth in professional sectors drives group insurance expansion through employer-sponsored benefits programs.

Regulatory mandates continue to support market growth, with provincial requirements for auto insurance and increasing emphasis on professional liability coverage across various industries. Climate change awareness drives demand for enhanced property insurance coverage, while evolving cyber threats create new market segments for specialized business insurance products. Technology adoption facilitates easier access to insurance products, reducing barriers to entry for new customers and enabling insurers to reach previously underserved markets.

Regulatory complexity across different provinces creates operational challenges for insurers seeking to expand their market presence. The fragmented regulatory environment requires significant compliance investments and can slow product innovation cycles. Price sensitivity among consumers, particularly in competitive segments like auto insurance, pressures profit margins and limits premium growth potential.

Economic uncertainties and periodic downturns can reduce consumer spending on discretionary insurance products, particularly affecting life insurance and voluntary coverage segments. Interest rate volatility impacts investment returns for life insurers, affecting product pricing and profitability. The market faces challenges from increasing claim frequencies in certain segments, particularly auto insurance, driven by factors including distracted driving and extreme weather events.

Technology implementation costs represent significant capital investments for traditional insurers seeking to modernize their operations and compete with insurtech entrants. Talent acquisition challenges in specialized areas like actuarial science and data analytics can limit growth capabilities. Consumer skepticism regarding insurance value propositions, particularly among younger demographics, requires substantial marketing and education investments to overcome.

Digital innovation presents unprecedented opportunities for market expansion and operational efficiency improvements. Insurers can leverage artificial intelligence, machine learning, and big data analytics to enhance underwriting accuracy, reduce processing times, and improve customer experience. Telematics technology in auto insurance enables usage-based pricing models that attract younger consumers and promote safer driving behaviors.

Underserved demographics represent significant growth potential, including newcomers to Canada, gig economy workers, and small business owners who may lack adequate insurance coverage. Product innovation opportunities exist in emerging risk areas such as cyber liability, climate-related coverage, and sharing economy insurance products. The growing focus on environmental, social, and governance (ESG) principles creates demand for sustainable insurance products and responsible investment options.

Partnership opportunities with fintech companies, banks, and other financial services providers can expand distribution channels and create integrated financial solutions. Cross-selling potential remains substantial, with many customers holding single-product relationships that could be expanded through targeted marketing and improved customer engagement strategies. International expansion opportunities exist for Canadian insurers with strong domestic market positions and proven operational capabilities.

Competitive intensity continues to shape market dynamics, with established insurers facing pressure from both traditional competitors and emerging insurtech companies. The market demonstrates cyclical patterns influenced by economic conditions, regulatory changes, and catastrophic events that impact claim frequencies and severity. Consolidation trends have created larger, more efficient organizations capable of investing in technology and expanding market reach.

Customer expectations have evolved significantly, with demands for seamless digital experiences, transparent pricing, and personalized products driving operational changes across the industry. Data utilization has become a key competitive differentiator, with insurers leveraging customer information to improve risk assessment, pricing accuracy, and service delivery. The market shows increasing emphasis on customer retention strategies as acquisition costs rise and competition intensifies.

Regulatory evolution continues to influence market dynamics, with provincial authorities balancing consumer protection objectives with market competitiveness goals. Climate change impacts are reshaping risk assessment methodologies and product design, particularly in property insurance segments. Technology adoption rates vary across market segments, creating opportunities for early adopters while challenging traditional business models and operational approaches.

Comprehensive analysis of the Canadian insurance market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes extensive surveys of insurance consumers, interviews with industry executives, and analysis of regulatory filings and financial statements. Secondary research incorporates government statistics, industry association reports, and academic studies to provide comprehensive market context.

Data collection processes utilize both quantitative and qualitative approaches, including statistical analysis of premium volumes, claim ratios, and market share distributions across different segments and regions. Market modeling techniques incorporate economic indicators, demographic trends, and regulatory developments to project future market conditions and growth trajectories.

Validation procedures ensure research accuracy through cross-referencing multiple data sources, expert consultations, and peer review processes. The methodology incorporates real-time market monitoring to capture emerging trends and developments that may impact market dynamics. Regional analysis considers provincial variations in regulations, market conditions, and consumer preferences to provide localized insights and recommendations.

Ontario dominates the Canadian insurance landscape, representing approximately 40% of total market activity driven by the province’s large population, economic diversity, and concentration of corporate headquarters. The region benefits from a mature insurance infrastructure, extensive distribution networks, and sophisticated consumer base with high insurance penetration rates. Toronto’s financial district serves as the operational hub for many major insurers and provides access to specialized talent and resources.

Quebec represents the second-largest regional market with approximately 25% market share, characterized by unique regulatory requirements and cultural preferences that influence product design and distribution strategies. The province’s distinct legal system and language requirements create both opportunities and challenges for insurers. British Columbia accounts for roughly 15% of market activity, with strong growth in property insurance driven by real estate market dynamics and increasing climate-related risks.

Prairie provinces collectively represent significant opportunities in agricultural insurance, commercial coverage, and resource sector-related products. Atlantic Canada shows steady growth potential despite smaller population bases, with opportunities in marine insurance, tourism-related coverage, and specialized regional products. The Northern territories present unique challenges and opportunities related to remote operations, extreme weather conditions, and specialized coverage requirements for resource extraction industries.

Market leadership is distributed among several major players, each with distinct competitive advantages and market positioning strategies. The competitive environment features both domestic champions and international insurers with significant Canadian operations.

Competitive strategies focus on digital transformation, customer experience enhancement, and operational efficiency improvements. Many insurers are investing heavily in technology platforms, data analytics capabilities, and mobile applications to maintain competitive advantages and attract younger customer demographics.

Product segmentation reveals distinct market dynamics across various insurance categories, each with unique growth drivers, competitive landscapes, and regulatory considerations. The market demonstrates strong diversification across both life and non-life segments.

By Product Type:

By Distribution Channel:

Life insurance segment demonstrates steady growth driven by demographic trends and increasing awareness of financial planning needs. Term life insurance remains the most popular product category due to affordability and simplicity, while permanent life insurance products appeal to higher-income segments seeking investment components and estate planning benefits. Group life insurance through employer benefits programs shows consistent expansion as companies enhance employee benefit packages to attract and retain talent.

Auto insurance dominates the non-life segment with mandatory coverage requirements driving consistent demand. The segment faces challenges from increasing claim costs and regulatory pressure on premium rates, while opportunities exist in telematics-based products and usage-based insurance models. Claims frequency has shown concerning trends in some provinces, with distracted driving and extreme weather contributing to increased costs.

Property insurance experiences growth driven by real estate market activity and increasing property values. Climate change impacts create both challenges and opportunities, with insurers developing enhanced coverage options while implementing risk mitigation strategies. Commercial insurance segments show strong performance driven by economic growth and increasing awareness of business risks including cyber liability and professional indemnity coverage.

Insurance companies benefit from stable regulatory environments, diverse market opportunities, and strong consumer demand across multiple product segments. The market provides opportunities for sustainable growth through product innovation, operational efficiency improvements, and strategic partnerships. Technology investments enable cost reduction, improved customer service, and competitive differentiation in increasingly crowded market segments.

Consumers gain access to comprehensive risk protection, financial security, and peace of mind through diverse insurance products tailored to individual and family needs. Digital platforms provide convenient access to insurance products, simplified application processes, and enhanced customer service capabilities. Competitive market conditions ensure reasonable pricing and continuous product innovation to meet evolving consumer needs.

Economic stakeholders benefit from the insurance industry’s role in risk transfer, capital formation, and economic stability. Employment opportunities across the sector support thousands of jobs in sales, underwriting, claims management, and technology development. The industry’s investment activities contribute significantly to capital markets and economic development across Canada.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation continues accelerating across the industry, with insurers investing heavily in artificial intelligence, machine learning, and automation technologies to improve underwriting accuracy and customer service delivery. Customer experience enhancement has become a primary focus, with companies developing omnichannel strategies that integrate digital and traditional touchpoints seamlessly.

Personalization trends are driving product customization and pricing strategies based on individual risk profiles and preferences. Usage-based insurance models, particularly in auto insurance, are gaining traction as telematics technology becomes more sophisticated and consumer acceptance increases. The trend toward on-demand insurance products allows consumers to purchase coverage for specific time periods or activities.

Sustainability focus is influencing both product development and corporate strategies, with insurers developing green insurance products and implementing ESG principles in investment decisions. Partnership strategies between traditional insurers and insurtech companies are creating innovative solutions and expanding market reach. Data analytics capabilities are becoming increasingly sophisticated, enabling better risk assessment, fraud detection, and customer insights that drive business decisions.

Regulatory modernization initiatives across several provinces are streamlining approval processes and encouraging innovation while maintaining consumer protection standards. MarkWide Research analysis indicates that recent regulatory changes have facilitated faster product launches and improved market responsiveness to consumer needs. Digital-first regulatory approaches are reducing administrative burdens and enabling more efficient market operations.

Technology partnerships between established insurers and fintech companies have accelerated, creating innovative distribution channels and enhanced customer experiences. Several major insurers have launched digital subsidiaries or acquired insurtech companies to capture younger demographics and improve operational efficiency. Blockchain technology pilots are exploring applications in claims processing, policy administration, and fraud prevention.

Climate adaptation strategies have become central to industry planning, with insurers developing enhanced risk modeling capabilities and innovative coverage solutions for climate-related exposures. Cyber insurance has emerged as a rapidly growing segment, with specialized products addressing evolving digital risks faced by businesses and individuals. The industry has also seen increased focus on mental health coverage and wellness programs integrated with insurance products.

Strategic recommendations for industry participants emphasize the importance of continued digital transformation investments while maintaining focus on core underwriting disciplines and customer service excellence. Technology adoption should prioritize customer-facing improvements that enhance experience and operational efficiency rather than technology for its own sake. Companies should develop comprehensive data strategies that leverage internal and external data sources to improve decision-making across all business functions.

Market expansion opportunities exist in underserved demographic segments, particularly newcomers to Canada and small business owners who may lack adequate insurance coverage. Product innovation should focus on emerging risk categories while ensuring adequate pricing and risk management capabilities. Companies should consider strategic partnerships with non-traditional players to expand distribution reach and access new customer segments.

Operational excellence initiatives should focus on claims processing efficiency, customer service responsiveness, and regulatory compliance automation. Talent development programs are essential to address skill gaps in technology, data analytics, and digital marketing capabilities. Companies should also invest in change management capabilities to successfully navigate ongoing industry transformation and maintain competitive positioning.

Market prospects remain positive over the medium to long term, supported by favorable demographic trends, economic stability, and continued innovation in products and services. Growth projections indicate sustained expansion at rates of approximately 4-6% annually across most segments, with digital channels and innovative products driving above-average growth rates. The market is expected to benefit from increasing insurance awareness among younger demographics and continued expansion of employee benefits programs.

Technology integration will continue reshaping industry operations, with artificial intelligence and machine learning becoming standard tools for underwriting, claims processing, and customer service. MWR projections suggest that digital channel penetration could reach over 60% of new policy sales within the next five years. Climate change adaptation will drive continued innovation in risk assessment and product development, particularly in property insurance segments.

Regulatory evolution is expected to support market growth while maintaining consumer protection standards, with potential harmonization initiatives reducing interprovincial barriers. Consolidation trends may continue as smaller players seek scale advantages and larger companies pursue growth through acquisition. The market will likely see continued emergence of specialized insurtech companies focusing on specific segments or innovative distribution models, creating both competitive pressure and partnership opportunities for established players.

The Canada life and non-life insurance market demonstrates remarkable resilience and growth potential, supported by strong regulatory frameworks, favorable demographics, and continuous innovation across product and service offerings. The market’s evolution toward digital-first operations, personalized products, and enhanced customer experiences positions it well for sustained growth in an increasingly competitive landscape.

Strategic success will require insurers to balance traditional strengths in risk management and customer service with innovative approaches to technology adoption, product development, and market expansion. The industry’s ability to adapt to changing consumer preferences, regulatory requirements, and emerging risk categories will determine long-term competitiveness and profitability. Collaboration opportunities between traditional insurers, insurtech companies, and other financial services providers will likely drive the next phase of market evolution and growth.

What is Life And Non-Life Insurance?

Life and non-life insurance refers to the two main categories of insurance products. Life insurance provides financial protection to beneficiaries upon the policyholder’s death, while non-life insurance covers various risks such as property damage, liability, and health-related expenses.

What are the key players in the Canada Life And Non-Life Insurance Market?

Key players in the Canada Life And Non-Life Insurance Market include Manulife Financial Corporation, Sun Life Financial, Intact Financial Corporation, and Aviva Canada, among others.

What are the main drivers of the Canada Life And Non-Life Insurance Market?

The main drivers of the Canada Life And Non-Life Insurance Market include an increasing awareness of the importance of insurance, a growing aging population, and advancements in technology that enhance customer service and product offerings.

What challenges does the Canada Life And Non-Life Insurance Market face?

Challenges in the Canada Life And Non-Life Insurance Market include regulatory compliance complexities, competition from insurtech companies, and the need to adapt to changing consumer preferences and behaviors.

What opportunities exist in the Canada Life And Non-Life Insurance Market?

Opportunities in the Canada Life And Non-Life Insurance Market include the potential for product innovation, the expansion of digital insurance solutions, and the increasing demand for personalized insurance products tailored to individual needs.

What trends are shaping the Canada Life And Non-Life Insurance Market?

Trends shaping the Canada Life And Non-Life Insurance Market include the rise of digital platforms for policy management, the integration of artificial intelligence in underwriting processes, and a growing focus on sustainability and ESG factors in insurance offerings.

Canada Life And Non-Life Insurance Market

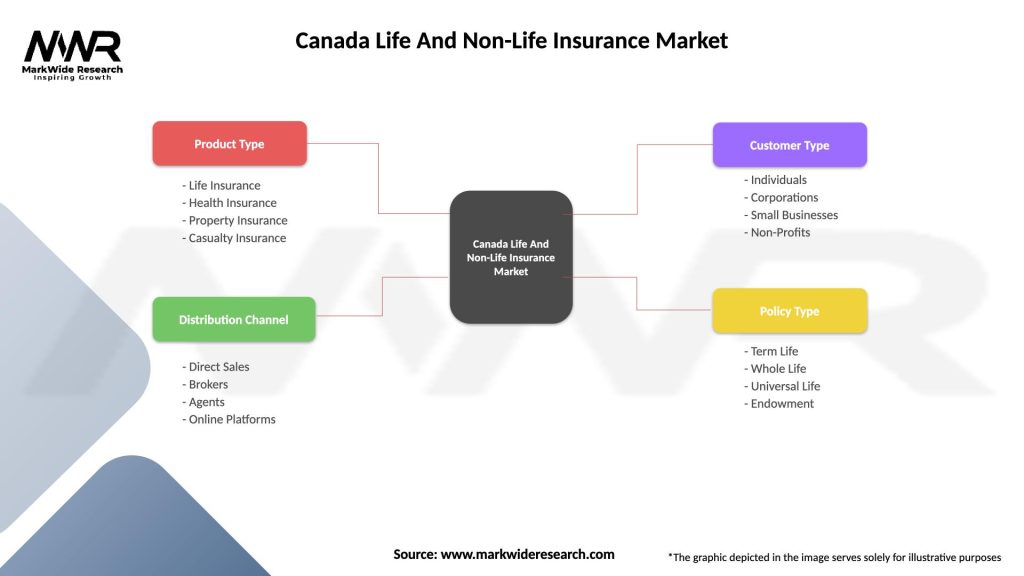

| Segmentation Details | Description |

|---|---|

| Product Type | Life Insurance, Health Insurance, Property Insurance, Casualty Insurance |

| Distribution Channel | Direct Sales, Brokers, Agents, Online Platforms |

| Customer Type | Individuals, Corporations, Small Businesses, Non-Profits |

| Policy Type | Term Life, Whole Life, Universal Life, Endowment |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Life And Non-Life Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at