444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Canada kyphoplasty market is a pivotal segment within the orthopedic medical devices industry, serving patients suffering from vertebral compression fractures (VCFs) caused by osteoporosis or trauma. Kyphoplasty procedures involve the minimally invasive restoration of vertebral body height and stabilization of fractures using bone cement. With an aging population and increasing incidence of osteoporosis-related fractures in Canada, the demand for kyphoplasty procedures is witnessing steady growth.

Meaning

Kyphoplasty is a minimally invasive surgical procedure used to treat vertebral compression fractures (VCFs) by restoring vertebral body height and stability. The procedure involves the insertion of a balloon tamp into the fractured vertebra, followed by inflation to create a void within the bone. Bone cement is then injected into the void to stabilize the fracture and relieve pain. In Canada, kyphoplasty procedures are performed by orthopedic surgeons and interventional radiologists to improve patient mobility and quality of life.

Executive Summary

The Canada kyphoplasty market is experiencing robust growth driven by factors such as the aging population, increasing prevalence of osteoporosis, and growing awareness about minimally invasive spinal procedures. Despite challenges such as regulatory hurdles and healthcare infrastructure constraints, the market presents lucrative opportunities for medical device manufacturers and healthcare providers. Understanding key market insights and trends is essential for stakeholders to capitalize on growth prospects and address market challenges effectively.

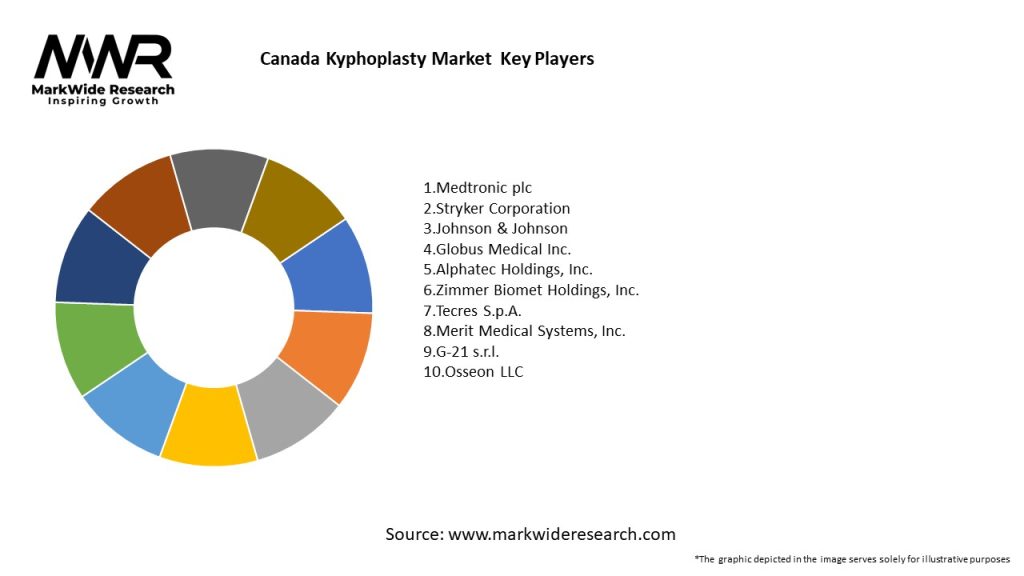

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Canada Kyphoplasty market is influenced by various dynamic factors:

Regional Analysis

The Canada Kyphoplasty market can be analyzed regionally, highlighting key areas with distinct characteristics:

Competitive Landscape

Leading Companies in the Canada Kyphoplasty Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

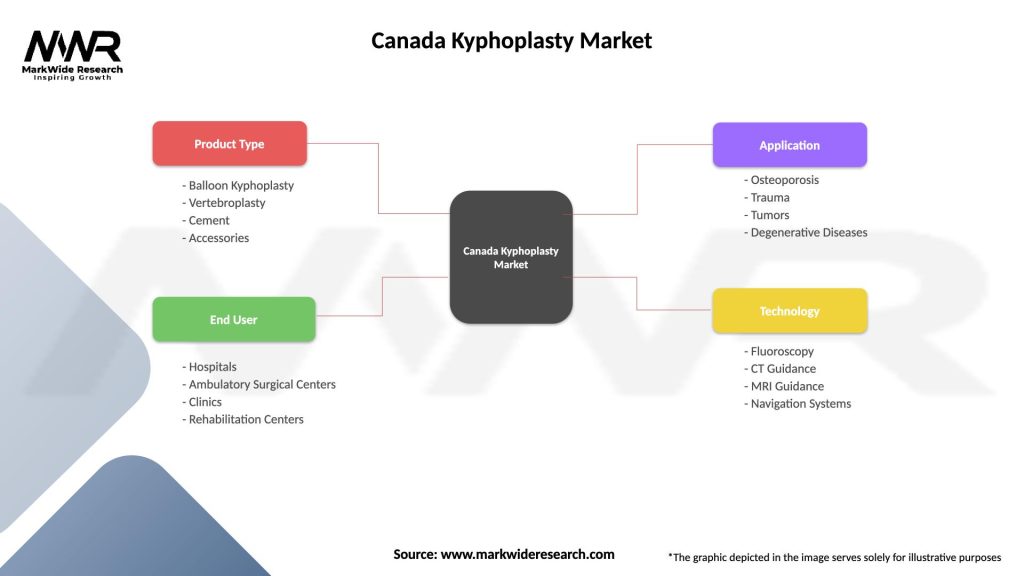

Segmentation

The Canada Kyphoplasty market can be segmented based on procedure type, device type, and end-user:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a multifaceted impact on the Canada Kyphoplasty market:

Key Industry Developments

Analyst Suggestions

Future Outlook

The Canada Kyphoplasty market is set for substantial growth as healthcare providers increasingly recognize the benefits of this minimally invasive procedure. With advancements in technology, a focus on patient-centered care, and ongoing research efforts, the market is expected to evolve and adapt to changing consumer demands. As stakeholders address challenges such as procedural costs and competition from alternative treatments, the future of the kyphoplasty market in Canada appears promising, with opportunities for innovation and enhanced patient care.

Conclusion

The Canada kyphoplasty market presents significant opportunities for industry participants, driven by demographic trends, disease prevalence rates, technological advancements, and healthcare infrastructure developments. By understanding key market insights, leveraging emerging trends, and adopting patient-centric strategies, manufacturers and stakeholders can capitalize on growth opportunities and strengthen their position in the competitive Canadian market.

What is Kyphoplasty?

Kyphoplasty is a minimally invasive surgical procedure used to treat vertebral compression fractures, often caused by osteoporosis. The procedure involves the insertion of a balloon into the fractured vertebra, which is then inflated to restore height and stabilize the bone with cement.

What are the key players in the Canada Kyphoplasty Market?

Key players in the Canada Kyphoplasty Market include Medtronic, Stryker Corporation, and Zimmer Biomet, which are known for their innovative spinal surgery products and technologies. These companies focus on developing advanced solutions for vertebral fractures, enhancing patient outcomes, among others.

What are the growth factors driving the Canada Kyphoplasty Market?

The Canada Kyphoplasty Market is driven by an increasing aging population, rising incidence of osteoporosis, and advancements in minimally invasive surgical techniques. Additionally, growing awareness about effective treatment options for spinal fractures contributes to market growth.

What challenges does the Canada Kyphoplasty Market face?

Challenges in the Canada Kyphoplasty Market include the high cost of procedures and potential complications associated with surgery. Furthermore, there is a need for more extensive clinical data to support the long-term efficacy of kyphoplasty compared to other treatment options.

What opportunities exist in the Canada Kyphoplasty Market?

Opportunities in the Canada Kyphoplasty Market include the development of new technologies and techniques that improve patient outcomes. Additionally, increasing partnerships between healthcare providers and medical device companies can enhance access to kyphoplasty procedures.

What trends are shaping the Canada Kyphoplasty Market?

Trends in the Canada Kyphoplasty Market include the growing preference for outpatient procedures and the integration of advanced imaging technologies for better surgical precision. There is also a rising focus on patient-centered care, which emphasizes personalized treatment plans.

Canada Kyphoplasty Market

| Segmentation Details | Description |

|---|---|

| Product Type | Balloon Kyphoplasty, Vertebroplasty, Cement, Accessories |

| End User | Hospitals, Ambulatory Surgical Centers, Clinics, Rehabilitation Centers |

| Application | Osteoporosis, Trauma, Tumors, Degenerative Diseases |

| Technology | Fluoroscopy, CT Guidance, MRI Guidance, Navigation Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Canada Kyphoplasty Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at