444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada hybrid electric vehicle battery market represents a rapidly evolving sector within the nation’s automotive and clean energy landscape. Market dynamics indicate substantial growth potential driven by increasing environmental consciousness, government incentives, and technological advancements in battery chemistry. The market encompasses various battery technologies including lithium-ion, nickel-metal hydride, and emerging solid-state solutions specifically designed for hybrid electric vehicles operating in Canadian conditions.

Regional distribution shows concentrated activity in Ontario, Quebec, and British Columbia, where major automotive manufacturing facilities and research institutions drive innovation. The market benefits from Canada’s abundant natural resources, particularly lithium and cobalt deposits, positioning the country as a strategic player in the North American battery supply chain. Growth projections suggest the market will expand at a compound annual growth rate of 12.4% through the forecast period, supported by federal and provincial clean transportation initiatives.

Technology adoption patterns reveal increasing preference for advanced lithium-ion battery systems offering improved energy density and cold-weather performance. Canadian consumers demonstrate growing acceptance of hybrid vehicles, with hybrid vehicle sales representing 8.7% of total automotive sales in recent periods. The market landscape includes both domestic battery manufacturing capabilities and strategic partnerships with international technology providers.

The Canada hybrid electric vehicle battery market refers to the comprehensive ecosystem encompassing the development, manufacturing, distribution, and servicing of battery systems specifically designed for hybrid electric vehicles within Canadian territory. This market includes primary battery manufacturers, component suppliers, automotive integrators, recycling services, and supporting infrastructure providers focused on hybrid vehicle applications.

Market scope extends beyond traditional battery cells to include battery management systems, thermal management solutions, charging infrastructure, and aftermarket services. The definition encompasses both original equipment manufacturer batteries and replacement battery systems, reflecting the complete lifecycle of hybrid vehicle battery solutions. Technological boundaries include various hybrid configurations from mild hybrid systems to plug-in hybrid electric vehicles requiring different battery specifications and performance characteristics.

Strategic analysis reveals the Canada hybrid electric vehicle battery market positioned for significant expansion driven by converging factors including regulatory support, technological advancement, and shifting consumer preferences. The market demonstrates strong fundamentals with established automotive manufacturing base, abundant raw material resources, and growing clean technology expertise.

Key performance indicators highlight robust demand growth with hybrid vehicle adoption rates increasing 15.3% annually across major Canadian metropolitan areas. Government initiatives including federal zero-emission vehicle mandates and provincial incentive programs create favorable market conditions. Investment flows into battery manufacturing facilities and research development programs indicate strong industry confidence in long-term market potential.

Competitive positioning shows Canadian companies developing specialized solutions for cold-climate performance, addressing unique market requirements. The market benefits from proximity to major North American automotive hubs while maintaining distinct regulatory and consumer preference characteristics. Future trajectories point toward increased domestic manufacturing capacity and enhanced integration with renewable energy systems.

Market intelligence reveals several critical insights shaping the Canada hybrid electric vehicle battery landscape:

Primary growth drivers propelling the Canada hybrid electric vehicle battery market include comprehensive government policy support creating favorable operating environment. Federal zero-emission vehicle regulations mandate increasing percentages of clean vehicle sales, directly stimulating hybrid vehicle demand and associated battery requirements. Provincial incentive programs provide consumer rebates and tax advantages making hybrid vehicles more financially attractive compared to conventional alternatives.

Environmental consciousness among Canadian consumers continues expanding, with sustainability considerations increasingly influencing vehicle purchase decisions. Climate change awareness and air quality concerns in major urban centers drive preference for cleaner transportation alternatives. Corporate sustainability initiatives by Canadian businesses include fleet electrification programs incorporating hybrid vehicles as transitional solutions toward full electrification.

Technological advancement in battery chemistry and manufacturing processes improves hybrid vehicle performance while reducing costs. Enhanced energy density, faster charging capabilities, and improved cold-weather performance address traditional hybrid vehicle limitations. Supply chain localization efforts reduce dependence on international battery suppliers while supporting domestic manufacturing capabilities and job creation objectives.

Cost considerations remain significant barriers to widespread hybrid vehicle adoption, with battery systems representing substantial portion of total vehicle cost. Initial purchase prices for hybrid vehicles typically exceed conventional vehicle alternatives, despite long-term operational savings. Consumer perception challenges include concerns about battery replacement costs and uncertainty regarding long-term reliability in harsh Canadian climate conditions.

Infrastructure limitations in rural and remote Canadian regions restrict plug-in hybrid vehicle practicality, limiting market expansion beyond major metropolitan areas. Charging station availability and electrical grid capacity constraints affect consumer confidence in hybrid vehicle technology. Technical complexity associated with hybrid vehicle maintenance and repair requires specialized training and equipment, potentially increasing ownership costs.

Supply chain vulnerabilities expose the market to international material price volatility and geopolitical risks affecting critical battery component availability. Raw material processing capacity limitations within Canada require continued dependence on international suppliers for refined battery materials. Regulatory uncertainty regarding future emission standards and incentive program continuity creates planning challenges for manufacturers and consumers.

Domestic manufacturing expansion presents significant opportunities for Canadian companies to capture increasing value within the hybrid vehicle battery supply chain. Government support for clean technology manufacturing and strategic mineral processing creates favorable conditions for facility development. Export potential to neighboring United States markets offers scale advantages and revenue diversification opportunities for Canadian battery manufacturers.

Technology innovation in cold-climate battery solutions positions Canadian companies as global leaders in specialized applications. Research partnerships between industry and academic institutions generate intellectual property and competitive advantages in harsh environment battery performance. Circular economy development through battery recycling and second-life applications creates new revenue streams while addressing environmental concerns.

Fleet electrification programs by government agencies and commercial organizations provide stable demand for hybrid vehicle batteries. Public transportation, delivery services, and corporate fleets represent substantial market opportunities with predictable replacement cycles. Integration opportunities with renewable energy systems and smart grid technologies expand battery system applications beyond transportation markets.

Demand-supply dynamics in the Canada hybrid electric vehicle battery market reflect complex interactions between consumer adoption rates, manufacturing capacity, and regulatory requirements. MarkWide Research analysis indicates growing alignment between supply capabilities and market demand, with domestic production capacity expanding to meet projected requirements. Supply chain optimization efforts focus on reducing import dependence while maintaining cost competitiveness.

Price dynamics demonstrate gradual cost reduction trends as manufacturing scales increase and technology matures. Battery cost per kilowatt-hour continues declining, improving hybrid vehicle affordability and market accessibility. Competition intensity increases as international battery manufacturers establish Canadian operations while domestic companies expand capabilities and market presence.

Innovation cycles accelerate as companies invest in next-generation battery technologies including solid-state solutions and advanced lithium-ion chemistries. Research and development spending increases 18.6% annually across the sector, reflecting industry commitment to technological leadership. Market consolidation trends emerge as smaller players seek partnerships or acquisition opportunities with larger integrated manufacturers.

Comprehensive research approach employed for analyzing the Canada hybrid electric vehicle battery market incorporates multiple data sources and analytical methodologies. Primary research includes structured interviews with industry executives, government officials, and technology experts across the hybrid vehicle ecosystem. Secondary research encompasses analysis of government publications, industry reports, patent filings, and financial disclosures from publicly traded companies.

Data collection methods include surveys of automotive dealers, fleet operators, and consumers to understand adoption patterns and preference drivers. Market sizing calculations utilize bottom-up analysis based on vehicle sales data, battery replacement rates, and pricing information. Validation processes cross-reference findings across multiple sources to ensure accuracy and reliability of market insights and projections.

Analytical frameworks apply quantitative modeling techniques to project market growth scenarios under different policy and technology development assumptions. Qualitative analysis examines competitive positioning, regulatory impacts, and technological trends affecting market evolution. Expert consultation with industry specialists provides context and validation for research findings and market forecasts.

Ontario market dominates the Canada hybrid electric vehicle battery landscape, accounting for approximately 42% of national market activity. The province benefits from established automotive manufacturing infrastructure, major research universities, and supportive provincial policies. Toronto metropolitan area serves as the primary hub for battery technology companies and automotive suppliers, while Windsor region provides manufacturing expertise and cross-border trade advantages.

Quebec province represents the second-largest regional market with 28% market share, driven by strong government support for clean technology and abundant hydroelectric power resources. Montreal serves as a research and development center with several universities conducting advanced battery research. Provincial incentives for electric and hybrid vehicles create favorable market conditions supporting battery demand growth.

British Columbia captures 18% of market activity, benefiting from environmental consciousness among consumers and progressive clean transportation policies. Vancouver region demonstrates high hybrid vehicle adoption rates while supporting battery technology startups and research initiatives. Western provinces including Alberta and Saskatchewan show growing market potential driven by resource sector fleet electrification and urban air quality concerns.

Atlantic provinces represent emerging market opportunities with increasing government focus on clean technology development and renewable energy integration. Regional universities contribute specialized research capabilities while local companies explore battery manufacturing and recycling opportunities. Northern territories present unique market challenges and opportunities related to remote community energy storage and transportation applications.

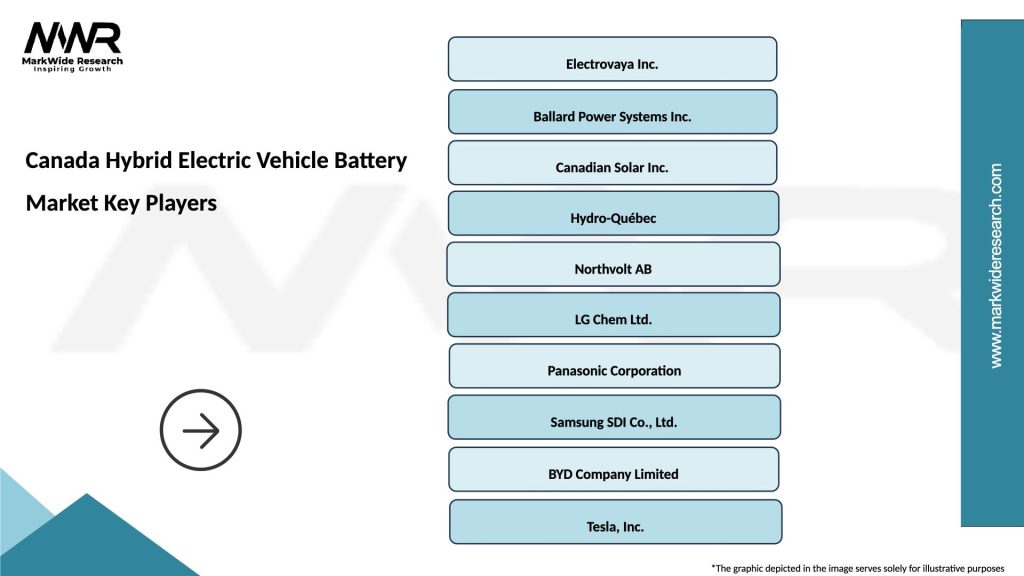

Market leadership in the Canada hybrid electric vehicle battery sector includes both international companies with Canadian operations and domestic technology developers. The competitive environment reflects diverse approaches ranging from large-scale manufacturing to specialized technology solutions:

Competitive strategies focus on technology differentiation, cost optimization, and strategic partnerships with automotive manufacturers. Companies invest heavily in research and development while establishing local manufacturing capabilities to serve Canadian market requirements. Market positioning emphasizes cold-weather performance, reliability, and integration with Canadian automotive manufacturing processes.

Technology segmentation reveals diverse battery chemistry preferences across different hybrid vehicle applications:

Vehicle type segmentation demonstrates varying battery requirements across hybrid configurations:

Application segmentation reflects diverse end-user requirements and market dynamics:

Passenger vehicle category dominates market demand with 73% of total battery volume, driven by increasing consumer acceptance of hybrid technology and expanding model availability. Compact and mid-size vehicles represent the largest sub-segments, while luxury hybrid vehicles demonstrate premium battery technology adoption. Consumer preferences increasingly favor plug-in hybrid configurations offering electric driving capability for daily commuting needs.

Commercial vehicle applications show rapid growth potential as businesses seek to reduce operational costs and meet sustainability objectives. Delivery vehicles, service trucks, and urban commercial applications benefit from hybrid technology’s fuel efficiency advantages. Fleet operators demonstrate strong interest in total cost of ownership benefits despite higher initial investment requirements.

Public transportation segment presents specialized requirements for high-capacity, durable battery systems capable of frequent charging cycles. Transit agencies increasingly adopt hybrid bus technology to reduce emissions and operating costs while maintaining service reliability. Government procurement programs support market development through demonstration projects and fleet replacement initiatives.

Aftermarket category emerges as significant opportunity as early hybrid vehicles require battery replacement services. Independent service providers and automotive dealerships develop capabilities for battery maintenance, repair, and replacement. Warranty programs and extended service contracts become important competitive differentiators for battery manufacturers and automotive brands.

Automotive manufacturers benefit from access to advanced battery technologies enabling competitive hybrid vehicle offerings in the Canadian market. Local battery supply chains reduce logistics costs and delivery times while supporting just-in-time manufacturing processes. Technology partnerships with Canadian battery companies provide opportunities for co-development of specialized solutions addressing unique market requirements.

Battery manufacturers gain access to growing market demand supported by government policies and increasing consumer acceptance. Canadian operations provide strategic positioning for North American market expansion while benefiting from skilled workforce and research infrastructure. Resource advantages including access to critical minerals and renewable energy support competitive manufacturing costs.

Government stakeholders achieve environmental and economic development objectives through supporting domestic battery industry growth. Job creation in advanced manufacturing and clean technology sectors contributes to economic diversification goals. Energy security benefits emerge from reduced petroleum dependence and increased integration with renewable energy systems.

Consumers benefit from expanding hybrid vehicle choices, improving performance characteristics, and declining costs. Government incentive programs reduce purchase prices while fuel savings provide ongoing operational benefits. Environmental benefits include reduced emissions and contribution to climate change mitigation objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology convergence drives integration of hybrid vehicle batteries with smart grid systems and renewable energy storage applications. Battery management systems incorporate artificial intelligence and machine learning capabilities to optimize performance and extend operational life. Solid-state battery development accelerates with potential to revolutionize hybrid vehicle performance through improved energy density and safety characteristics.

Sustainability focus intensifies across the battery supply chain with emphasis on responsible sourcing, manufacturing efficiency, and end-of-life recycling. Circular economy principles guide product design and business model development. Carbon footprint reduction becomes critical competitive factor as companies seek to minimize environmental impact throughout battery lifecycle.

Localization trends accelerate as companies establish Canadian manufacturing and research facilities to serve domestic and regional markets. Supply chain resilience considerations drive investment in domestic capabilities. MWR analysis indicates 23% increase in announced battery manufacturing investments across Canada over recent periods.

Digitalization transforms battery manufacturing, monitoring, and service delivery through Internet of Things integration and predictive analytics. Remote diagnostics and over-the-air updates enhance battery performance and customer experience. Data monetization opportunities emerge through battery performance analytics and optimization services.

Manufacturing expansion announcements by major battery companies indicate growing confidence in Canadian market potential. Several international manufacturers establish or expand Canadian operations to serve North American automotive industry requirements. Government partnerships support facility development through funding programs and regulatory streamlining initiatives.

Research breakthroughs at Canadian universities advance battery chemistry and manufacturing processes with potential for commercial applications. Industry-academic partnerships accelerate technology transfer and commercialization timelines. Intellectual property development strengthens Canadian competitive positioning in specialized battery applications.

Strategic acquisitions and partnerships reshape competitive landscape as companies seek to expand capabilities and market presence. International companies acquire Canadian technology firms while domestic companies form alliances with global partners. Vertical integration strategies emerge as companies seek greater control over supply chains and cost structures.

Regulatory developments include updated safety standards, environmental regulations, and trade policies affecting battery manufacturing and importation. Provincial governments announce enhanced incentive programs and infrastructure investments supporting hybrid vehicle adoption. Federal initiatives focus on critical mineral processing and battery recycling capabilities.

Strategic recommendations for industry participants emphasize the importance of developing specialized capabilities addressing unique Canadian market requirements. Companies should invest in cold-climate battery solutions and establish partnerships with automotive manufacturers to ensure market access. Technology differentiation through superior performance in harsh environmental conditions provides sustainable competitive advantages.

Market entry strategies should consider regional variations in demand patterns, regulatory requirements, and infrastructure availability. New entrants benefit from partnerships with established Canadian companies possessing local market knowledge and relationships. Phased expansion approaches allow companies to test market response while building operational capabilities.

Investment priorities should focus on research and development capabilities, manufacturing efficiency, and supply chain optimization. Companies must balance cost competitiveness with quality and performance requirements. Sustainability initiatives become increasingly important for market acceptance and regulatory compliance.

Risk management strategies should address supply chain vulnerabilities, technology obsolescence, and regulatory changes. Diversification across market segments and geographic regions reduces concentration risks. Financial planning must account for long development timelines and capital-intensive manufacturing requirements.

Long-term projections indicate continued expansion of the Canada hybrid electric vehicle battery market driven by technological advancement, policy support, and changing consumer preferences. MarkWide Research forecasts suggest the market will experience sustained growth with compound annual growth rates exceeding 11% through the next decade. Government commitments to net-zero emissions create favorable long-term policy environment supporting market development.

Technology evolution will likely favor advanced lithium-ion chemistries and emerging solid-state solutions offering improved performance and safety characteristics. Manufacturing processes will become more efficient and environmentally sustainable while costs continue declining. Integration opportunities with renewable energy systems and smart infrastructure expand battery applications beyond transportation markets.

Market maturation will bring increased competition, consolidation, and specialization as companies focus on core competencies and competitive advantages. Canadian companies are expected to develop leadership positions in cold-climate applications and sustainable manufacturing practices. Export opportunities to international markets will support domestic industry growth and scale development.

Infrastructure development including charging networks and recycling facilities will support market expansion while addressing operational challenges. Public-private partnerships will likely play important roles in infrastructure investment and deployment. Regulatory frameworks will continue evolving to support market development while ensuring safety and environmental protection.

Market assessment reveals the Canada hybrid electric vehicle battery market positioned for significant growth supported by favorable policy environment, technological advancement, and increasing consumer acceptance. The market benefits from unique competitive advantages including abundant natural resources, established manufacturing infrastructure, and specialized expertise in cold-climate applications. Strategic positioning of Canadian companies in specialized market segments provides opportunities for sustainable competitive advantages.

Growth trajectory indicates robust expansion potential driven by government mandates, environmental consciousness, and improving technology cost-performance ratios. The market demonstrates strong fundamentals with increasing investment, expanding manufacturing capacity, and growing domestic demand. International opportunities provide additional growth potential as Canadian companies leverage specialized capabilities in global markets.

Success factors for market participants include technology innovation, cost competitiveness, strategic partnerships, and operational excellence. Companies must navigate complex regulatory environments while meeting diverse customer requirements across multiple market segments. Long-term sustainability depends on continued investment in research and development, manufacturing efficiency, and circular economy principles that position the Canada hybrid electric vehicle battery market for continued expansion and global competitiveness.

What is Hybrid Electric Vehicle Battery?

Hybrid Electric Vehicle Battery refers to the energy storage systems used in hybrid vehicles, which combine an internal combustion engine with an electric propulsion system. These batteries are crucial for improving fuel efficiency and reducing emissions in the automotive sector.

What are the key players in the Canada Hybrid Electric Vehicle Battery Market?

Key players in the Canada Hybrid Electric Vehicle Battery Market include companies like LG Chem, Panasonic, and A123 Systems, which are known for their advancements in battery technology and production capabilities, among others.

What are the growth factors driving the Canada Hybrid Electric Vehicle Battery Market?

The growth of the Canada Hybrid Electric Vehicle Battery Market is driven by increasing environmental regulations, rising consumer demand for fuel-efficient vehicles, and advancements in battery technology that enhance performance and reduce costs.

What challenges does the Canada Hybrid Electric Vehicle Battery Market face?

Challenges in the Canada Hybrid Electric Vehicle Battery Market include high production costs, limited charging infrastructure, and concerns regarding battery disposal and recycling, which can hinder market growth.

What opportunities exist in the Canada Hybrid Electric Vehicle Battery Market?

Opportunities in the Canada Hybrid Electric Vehicle Battery Market include the potential for innovation in battery chemistry, the expansion of electric vehicle models, and government incentives promoting the adoption of hybrid vehicles.

What trends are shaping the Canada Hybrid Electric Vehicle Battery Market?

Trends in the Canada Hybrid Electric Vehicle Battery Market include the shift towards solid-state batteries, increased investment in research and development, and a growing focus on sustainability and recycling initiatives within the battery supply chain.

Canada Hybrid Electric Vehicle Battery Market

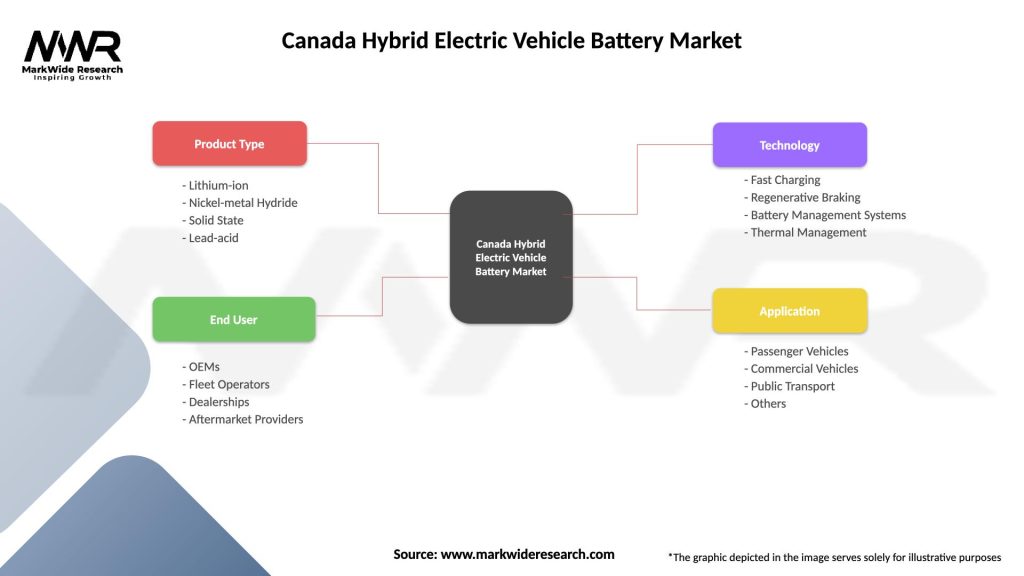

| Segmentation Details | Description |

|---|---|

| Product Type | Lithium-ion, Nickel-metal Hydride, Solid State, Lead-acid |

| End User | OEMs, Fleet Operators, Dealerships, Aftermarket Providers |

| Technology | Fast Charging, Regenerative Braking, Battery Management Systems, Thermal Management |

| Application | Passenger Vehicles, Commercial Vehicles, Public Transport, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Hybrid Electric Vehicle Battery Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at