444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada house insurance market represents a fundamental pillar of the nation’s financial services sector, providing essential property protection for millions of homeowners across the country. Market dynamics indicate robust growth driven by increasing property values, evolving risk landscapes, and enhanced consumer awareness regarding comprehensive coverage options. The market demonstrates steady expansion with a projected compound annual growth rate of 4.2% CAGR through the forecast period, reflecting strong underlying demand for residential property insurance solutions.

Regional distribution across Canada shows significant concentration in major metropolitan areas including Toronto, Vancouver, Montreal, and Calgary, where property values and insurance penetration rates remain highest. Market participation encompasses both established national insurers and regional specialists, creating a competitive landscape that benefits consumers through diverse product offerings and competitive pricing structures. The sector’s resilience has been particularly evident during recent economic uncertainties, with claim frequency and settlement patterns maintaining stability despite external pressures.

Technology integration continues reshaping the market landscape, with digital platforms and automated underwriting processes improving customer experience and operational efficiency. Climate-related risks increasingly influence product development and pricing strategies, as insurers adapt to changing weather patterns and natural disaster frequencies across different Canadian regions.

The Canada house insurance market refers to the comprehensive ecosystem of insurance products, services, and providers that offer financial protection for residential properties against various risks including fire, theft, natural disasters, and liability claims. This market encompasses homeowner’s insurance policies, condominium insurance, tenant insurance, and specialized coverage options designed to protect Canadian residents’ most significant financial investments.

Coverage components typically include dwelling protection, personal property coverage, additional living expenses, and personal liability protection, creating comprehensive risk management solutions for property owners. Market participants include national insurance companies, regional providers, mutual insurance companies, and specialized insurers offering tailored products for specific property types and risk profiles.

Regulatory oversight operates through provincial insurance regulators who ensure consumer protection, market stability, and fair pricing practices across different jurisdictions. The market’s structure reflects Canada’s federal system, with provincial regulations creating distinct regional characteristics while maintaining national industry standards and best practices.

Strategic positioning within Canada’s house insurance market reveals a mature yet evolving sector characterized by steady growth, technological innovation, and increasing consumer sophistication. Market leaders continue investing in digital transformation initiatives, enhanced customer service capabilities, and risk assessment technologies to maintain competitive advantages in an increasingly crowded marketplace.

Consumer behavior trends indicate growing demand for customizable coverage options, transparent pricing structures, and streamlined claims processing experiences. Premium growth averaging 3.8% annually reflects balanced market conditions where insurers maintain profitability while providing competitive rates to attract and retain customers across diverse demographic segments.

Emerging opportunities include smart home technology integration, usage-based insurance models, and enhanced risk prevention services that create value for both insurers and policyholders. Market consolidation continues at a measured pace, with strategic acquisitions and partnerships enabling companies to expand geographic reach and enhance service capabilities.

Future outlook suggests continued market expansion driven by population growth, urbanization trends, and increasing property values across major Canadian markets. Innovation focus centers on improving customer experience, enhancing risk assessment accuracy, and developing products that address evolving consumer needs and risk profiles.

Market penetration across Canada demonstrates strong adoption rates, with approximately 78% of homeowners maintaining active house insurance coverage, reflecting both regulatory requirements and consumer awareness of property protection importance. Premium distribution varies significantly across provinces, influenced by local risk factors, property values, and regulatory environments.

Property value appreciation across Canadian real estate markets creates natural demand growth for house insurance coverage, as homeowners seek to protect increasingly valuable assets. Urbanization trends concentrate population growth in major metropolitan areas where property values and insurance requirements remain highest, driving sustained market expansion.

Regulatory requirements mandate insurance coverage for mortgaged properties, ensuring consistent baseline demand while encouraging comprehensive coverage adoption. Climate change impacts increase awareness of natural disaster risks, motivating homeowners to secure adequate protection against weather-related damages and losses.

Technology advancement enables insurers to offer enhanced services, streamlined processes, and competitive pricing structures that attract new customers and improve retention rates. Smart home adoption creates opportunities for risk reduction partnerships and innovative coverage options that benefit both insurers and policyholders.

Economic stability supports consistent premium payments and market growth, while low interest rates encourage home purchases that generate new insurance policy demand. Consumer education initiatives increase awareness of coverage options and benefits, driving demand for comprehensive protection beyond basic requirements.

Premium affordability concerns challenge market growth, particularly among first-time homebuyers and lower-income demographics who may opt for minimal coverage to reduce costs. Economic uncertainties can pressure consumers to reduce insurance spending, potentially impacting premium growth and coverage adequacy across market segments.

Regulatory complexity across provincial jurisdictions creates operational challenges for national insurers, requiring significant compliance investments and potentially limiting market entry for smaller providers. Claims inflation driven by construction costs and labor shortages pressures insurers to increase premiums, potentially reducing market accessibility.

Natural disaster frequency increases claim costs and risk exposure, forcing insurers to implement stricter underwriting standards or exclude certain coverage types in high-risk areas. Fraud concerns require substantial investigation resources and may lead to more restrictive claims processes that impact customer satisfaction.

Competition intensity limits pricing flexibility and margin expansion opportunities, particularly in mature markets where differentiation becomes increasingly challenging. Technology investment requirements strain smaller insurers’ resources, potentially leading to market consolidation or reduced competitive diversity.

Digital transformation presents significant opportunities for insurers to enhance customer experience, reduce operational costs, and develop innovative products that meet evolving consumer expectations. Smart home integration enables risk prevention services and usage-based insurance models that create value for both parties while differentiating market offerings.

Demographic shifts toward younger, tech-savvy homeowners create demand for digital-first insurance experiences and customizable coverage options. Climate adaptation services including risk assessment, prevention consulting, and resilience planning represent emerging revenue streams that complement traditional insurance products.

Partnership opportunities with real estate professionals, home builders, and technology providers enable insurers to reach new customers and enhance service delivery capabilities. Data analytics advancement improves risk assessment accuracy, enables personalized pricing, and supports proactive customer engagement strategies.

Market expansion into underserved regions and demographic segments offers growth potential, particularly through innovative distribution channels and tailored product offerings. Sustainability initiatives align with consumer values while potentially reducing long-term risk exposure through green building incentives and environmental protection programs.

Competitive forces within Canada’s house insurance market create dynamic pricing environments where insurers balance profitability requirements with customer acquisition and retention objectives. Market concentration among leading providers influences pricing strategies and service standards across the industry, while regional specialists maintain competitive pressure through localized expertise and customer relationships.

Regulatory evolution continues shaping market structure and operational requirements, with provincial authorities adapting rules to address emerging risks and consumer protection needs. Technology disruption accelerates traditional business model transformation, requiring established insurers to invest heavily in digital capabilities while creating opportunities for innovative market entrants.

Consumer expectations increasingly demand seamless digital experiences, transparent pricing, and rapid claims resolution, forcing insurers to prioritize customer experience investments. Risk landscape changes driven by climate patterns, construction practices, and lifestyle trends require continuous product adaptation and underwriting refinement.

Economic cycles influence both demand patterns and claim frequencies, requiring insurers to maintain flexible strategies that adapt to changing market conditions. Distribution channel evolution sees growing importance of direct-to-consumer platforms while traditional broker relationships remain significant for complex coverage needs.

Comprehensive analysis of Canada’s house insurance market employs multiple research methodologies to ensure accuracy and depth of insights. Primary research includes structured interviews with industry executives, regulatory officials, and consumer representatives to gather firsthand perspectives on market trends and challenges.

Secondary research encompasses analysis of regulatory filings, industry reports, company financial statements, and market statistics from authoritative sources. Data validation processes ensure information accuracy through cross-referencing multiple sources and expert verification of key findings and projections.

Market modeling utilizes statistical analysis techniques to project growth trends, identify emerging patterns, and assess competitive dynamics across different market segments. Regional analysis examines provincial variations in market structure, regulatory requirements, and consumer behavior patterns to provide comprehensive geographic insights.

Trend analysis evaluates historical performance data to identify cyclical patterns, growth drivers, and potential disruption factors affecting future market development. Stakeholder consultation ensures research findings reflect diverse perspectives from insurers, regulators, consumers, and industry experts across Canada’s house insurance ecosystem.

Ontario market dominates Canada’s house insurance landscape, representing approximately 38% of national premium volume due to population concentration and high property values in the Greater Toronto Area. Market characteristics include intense competition, sophisticated consumer demands, and regulatory complexity that influences product development and pricing strategies.

Quebec’s unique regulatory environment creates distinct market dynamics with provincial oversight and language requirements that influence insurer operations and customer engagement approaches. British Columbia demonstrates strong growth potential driven by continued population influx and property value appreciation, particularly in Vancouver and surrounding metropolitan areas.

Alberta market shows resilience despite economic volatility, with steady growth rates of 4.8% annually supported by diversified economic base and continued residential development. Atlantic provinces present emerging opportunities as economic development initiatives attract new residents and stimulate housing market activity.

Prairie provinces maintain stable market conditions with moderate growth rates and competitive pricing environments that benefit consumers. Northern territories represent specialized market segments requiring tailored coverage options and distribution strategies adapted to unique geographic and demographic characteristics.

Regional risk profiles vary significantly based on climate patterns, natural disaster exposure, and local construction practices, influencing product design and pricing strategies across different geographic markets.

Market leadership remains concentrated among established national insurers who leverage scale advantages, brand recognition, and comprehensive distribution networks to maintain competitive positions. Strategic differentiation focuses on customer service excellence, digital capabilities, and specialized product offerings that address specific consumer segments and risk profiles.

Competitive strategies increasingly emphasize technology investment, customer experience enhancement, and strategic partnerships that expand market reach and service capabilities. Market consolidation continues through selective acquisitions and mergers that create operational synergies and enhanced competitive positioning.

Coverage type segmentation reveals distinct market preferences and growth patterns across different insurance product categories. Comprehensive homeowner policies dominate market share due to consumer preference for broad protection and lender requirements for mortgaged properties.

By Coverage Type:

By Property Type:

By Distribution Channel:

Homeowner’s insurance category maintains dominant market position with consistent growth rates of 4.1% annually, driven by new home construction and property value appreciation across major Canadian markets. Product innovation focuses on enhanced coverage options, smart home integration, and personalized risk assessment capabilities.

Condominium insurance represents the fastest-growing segment with annual expansion of 6.3% reflecting urbanization trends and increasing high-density residential development in major metropolitan areas. Coverage complexity requires specialized expertise and tailored products addressing unique ownership structures and shared risk factors.

Tenant insurance adoption shows steady improvement with penetration rates reaching 42% among Canadian renters, supported by landlord requirements and increased consumer awareness of personal property protection needs. Digital distribution proves particularly effective for this demographic, enabling convenient purchasing and policy management.

Seasonal property coverage demonstrates resilience despite economic pressures, with cottage and vacation home owners maintaining insurance protection for valuable recreational assets. Risk assessment challenges include remote locations, seasonal occupancy patterns, and specialized construction considerations requiring expert underwriting approaches.

Premium pricing trends vary significantly across categories, with comprehensive homeowner policies showing moderate increases while specialized coverage types experience more dynamic pricing based on risk exposure and competitive factors.

Insurance companies benefit from stable demand patterns, predictable revenue streams, and opportunities for cross-selling additional financial products to established customer bases. Technology investments enable operational efficiency improvements, enhanced risk assessment capabilities, and superior customer experience delivery that supports competitive differentiation.

Consumers gain essential financial protection for their most significant assets while accessing increasingly sophisticated coverage options and service delivery methods. Digital platforms provide convenient policy management, claims reporting, and customer service access that improves overall insurance experience and satisfaction levels.

Real estate professionals leverage insurance partnerships to provide comprehensive services to home buyers and sellers, creating additional revenue opportunities and enhanced client relationships. Mortgage lenders ensure asset protection through insurance requirements while potentially offering competitive rates through preferred provider relationships.

Government stakeholders benefit from reduced disaster recovery costs and improved community resilience through widespread insurance coverage and risk prevention initiatives. Economic stability improves through insurance industry employment, tax contributions, and support for construction and repair industries following claim events.

Technology providers find growing opportunities to supply innovative solutions for risk assessment, customer engagement, and operational efficiency improvement across the insurance value chain.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-first customer experience emerges as the dominant trend reshaping how insurers interact with policyholders throughout the insurance lifecycle. Mobile applications increasingly serve as primary touchpoints for policy management, claims reporting, and customer service interactions, with user adoption rates exceeding 68% among customers under 50 years old.

Personalization capabilities enable insurers to offer customized coverage options and pricing based on individual risk profiles, lifestyle factors, and property characteristics. Data analytics advancement supports more accurate risk assessment while enabling proactive customer engagement and retention strategies.

Sustainability focus influences product development with green building discounts, energy efficiency incentives, and climate resilience programs becoming standard offerings. Smart home technology integration creates opportunities for risk prevention partnerships and usage-based insurance models that benefit both insurers and policyholders.

Claims process automation reduces settlement times and improves customer satisfaction through AI-powered assessment tools and streamlined approval workflows. Prevention services expand beyond traditional coverage to include risk consulting, home monitoring, and maintenance reminder programs that reduce claim frequency.

Partnership strategies with technology companies, home service providers, and real estate professionals create comprehensive customer value propositions that extend beyond basic insurance coverage.

Regulatory modernization initiatives across multiple provinces aim to streamline approval processes, enhance consumer protection, and adapt oversight frameworks to emerging technologies and business models. Digital identity verification systems improve customer onboarding efficiency while maintaining security standards and fraud prevention capabilities.

Climate risk assessment tools become increasingly sophisticated, incorporating detailed geographic data, weather pattern analysis, and predictive modeling to enhance underwriting accuracy. MarkWide Research analysis indicates growing insurer investment in climate adaptation services and risk prevention programs that complement traditional coverage offerings.

Artificial intelligence deployment accelerates across multiple operational areas including underwriting, claims processing, customer service, and fraud detection, delivering measurable efficiency improvements and cost reductions. Blockchain technology pilots explore applications in policy administration, claims verification, and inter-company data sharing to enhance transparency and reduce processing costs.

Merger and acquisition activity continues reshaping competitive dynamics as companies seek scale advantages, technology capabilities, and geographic expansion opportunities. Strategic partnerships between traditional insurers and insurtech companies create innovation pathways while leveraging established distribution networks and regulatory expertise.

Customer experience investments focus on omnichannel service delivery, real-time communication capabilities, and self-service options that meet evolving consumer expectations for convenience and responsiveness.

Technology investment priorities should focus on customer-facing applications and backend automation systems that deliver measurable improvements in service quality and operational efficiency. Digital transformation strategies require careful balance between innovation speed and system reliability to maintain customer confidence during transition periods.

Risk assessment enhancement through advanced analytics and external data integration can improve underwriting accuracy while enabling more competitive pricing for low-risk customers. Climate adaptation services represent significant growth opportunities that align with consumer values while potentially reducing long-term claim exposure.

Customer segmentation refinement enables more targeted product development and marketing strategies that address specific demographic needs and preferences. Partnership development with complementary service providers can create comprehensive value propositions that differentiate insurers in competitive markets.

Regulatory engagement remains crucial as provincial authorities adapt oversight frameworks to address emerging technologies and evolving market structures. Talent acquisition in technology and data analytics fields becomes increasingly important for maintaining competitive capabilities and innovation momentum.

Market expansion strategies should consider underserved geographic regions and demographic segments where targeted approaches can generate sustainable growth opportunities. Brand positioning around trust, reliability, and customer service excellence remains fundamental to long-term success in mature markets.

Market evolution over the next five years will be characterized by continued digital transformation, enhanced personalization capabilities, and growing integration of smart home technologies into insurance products and services. Growth projections indicate sustained expansion with annual growth rates of 4.5% driven by population growth, property value appreciation, and increasing coverage sophistication.

Technology advancement will enable more accurate risk assessment, streamlined customer experiences, and innovative coverage options that address emerging risks and consumer preferences. MWR projections suggest significant investment in artificial intelligence, data analytics, and customer engagement platforms will reshape competitive dynamics and operational capabilities.

Climate considerations will increasingly influence product design, pricing strategies, and risk management approaches as insurers adapt to changing weather patterns and natural disaster frequencies. Sustainability initiatives will become standard offerings rather than competitive differentiators, reflecting growing consumer awareness and regulatory expectations.

Market consolidation may accelerate as companies seek scale advantages and technology capabilities necessary to compete effectively in increasingly sophisticated markets. New entrants from technology and financial services sectors may challenge traditional business models while creating innovation pressure across the industry.

Consumer expectations will continue evolving toward seamless digital experiences, transparent pricing, and comprehensive service offerings that extend beyond basic insurance coverage to include risk prevention and property management services.

Canada’s house insurance market demonstrates remarkable resilience and adaptability, maintaining steady growth while navigating technological disruption, regulatory evolution, and changing consumer expectations. Market fundamentals remain strong with consistent demand drivers including population growth, property value appreciation, and regulatory requirements supporting sustained expansion across diverse geographic and demographic segments.

Competitive dynamics continue evolving as established insurers invest heavily in digital transformation while new entrants challenge traditional business models through innovative approaches and technology-enabled solutions. Consumer benefits multiply through enhanced service delivery, expanded coverage options, and increasingly sophisticated risk management capabilities that provide comprehensive protection for Canadian homeowners.

Future success will depend on insurers’ ability to balance innovation with operational reliability, customer service excellence with cost efficiency, and growth ambitions with risk management discipline. Strategic positioning around technology leadership, customer experience excellence, and comprehensive value propositions will determine competitive advantage in an increasingly sophisticated and demanding marketplace.

The Canada house insurance market stands well-positioned for continued growth and evolution, supported by strong regulatory frameworks, sophisticated consumer markets, and ongoing innovation that benefits all stakeholders in this essential financial services sector.

What is House Insurance?

House insurance, also known as homeowners insurance, provides financial protection against damage to a home and its contents. It typically covers risks such as fire, theft, and natural disasters, ensuring homeowners can recover from unexpected events.

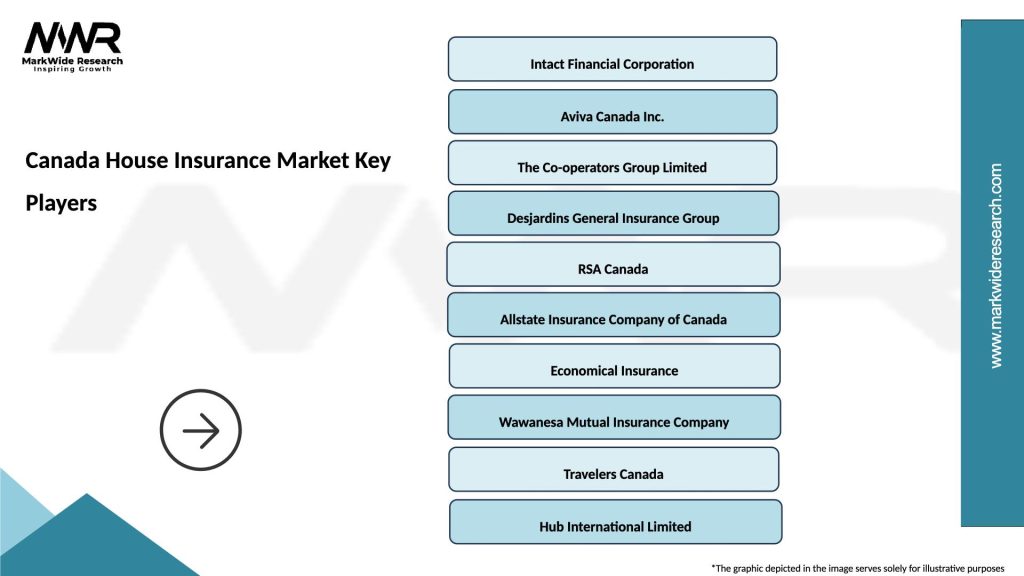

What are the key players in the Canada House Insurance Market?

Key players in the Canada House Insurance Market include Intact Financial Corporation, Aviva Canada, and The Co-operators. These companies offer a range of policies and services tailored to meet the needs of Canadian homeowners, among others.

What are the main drivers of the Canada House Insurance Market?

The main drivers of the Canada House Insurance Market include the increasing frequency of extreme weather events, rising property values, and a growing awareness of the importance of home protection. These factors contribute to a higher demand for comprehensive insurance coverage.

What challenges does the Canada House Insurance Market face?

The Canada House Insurance Market faces challenges such as rising claims costs due to climate change, regulatory pressures, and competition from insurtech companies. These factors can impact profitability and market stability.

What opportunities exist in the Canada House Insurance Market?

Opportunities in the Canada House Insurance Market include the adoption of technology for better risk assessment and customer service, as well as the potential for new products tailored to emerging risks. Insurers can also explore partnerships with smart home technology providers.

What trends are shaping the Canada House Insurance Market?

Trends shaping the Canada House Insurance Market include the integration of artificial intelligence in underwriting processes, the rise of personalized insurance products, and an increased focus on sustainability. These trends are influencing how insurers assess risk and engage with customers.

Canada House Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Homeowners, Renters, Condo, Landlord |

| Coverage Type | Liability, Personal Property, Additional Living Expenses, Dwelling |

| Customer Type | First-Time Buyers, Investors, Families, Seniors |

| Distribution Channel | Direct, Brokers, Online, Agents |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada House Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at