444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada hospitality real estate market represents a dynamic and evolving sector that encompasses hotels, resorts, restaurants, entertainment venues, and other accommodation facilities across the nation. This market has demonstrated remarkable resilience and adaptability, particularly following the challenges posed by global disruptions to the travel and tourism industry. Market dynamics indicate sustained growth driven by domestic tourism recovery, international visitor returns, and strategic investments in hospitality infrastructure.

Regional distribution across Canada shows significant concentration in major metropolitan areas including Toronto, Vancouver, Montreal, and Calgary, with emerging opportunities in secondary markets and resort destinations. The market benefits from Canada’s stable political environment, strong currency position, and reputation as a premier travel destination. Investment patterns reveal increasing interest from both domestic and international investors seeking stable returns in the hospitality sector.

Growth projections suggest the market will expand at a compound annual growth rate of 6.2% over the forecast period, supported by infrastructure development, tourism promotion initiatives, and evolving consumer preferences for experiential travel. The sector’s recovery trajectory demonstrates the underlying strength of Canada’s hospitality real estate fundamentals and long-term investment appeal.

The Canada hospitality real estate market refers to the comprehensive ecosystem of commercial real estate properties specifically designed, developed, and operated to provide accommodation, dining, entertainment, and related services to travelers and local consumers. This market encompasses various property types including full-service hotels, limited-service hotels, extended-stay facilities, luxury resorts, boutique accommodations, restaurants, conference centers, and mixed-use developments with hospitality components.

Investment characteristics of this market include revenue generation through room rates, food and beverage sales, event hosting, and ancillary services. Properties within this sector typically require specialized management expertise, adherence to hospitality industry standards, and continuous capital investment to maintain competitive positioning. The market operates within a framework of provincial regulations, municipal zoning requirements, and industry-specific compliance standards that govern development, operation, and investment activities.

Market fundamentals in Canada’s hospitality real estate sector demonstrate strong recovery momentum following recent industry challenges. The market benefits from Canada’s position as a stable, politically secure destination with diverse tourism attractions ranging from urban centers to natural wilderness areas. Investment activity has intensified as institutional investors recognize the sector’s long-term growth potential and income-generating capabilities.

Key performance indicators show occupancy rates recovering to 78% across major markets, with average daily rates showing steady improvement. The market attracts diverse investor profiles including real estate investment trusts, pension funds, private equity firms, and individual investors seeking exposure to the hospitality sector. Development pipeline activity indicates continued confidence in market fundamentals, with new projects focusing on sustainable design, technology integration, and enhanced guest experiences.

Strategic positioning within North American hospitality markets remains competitive, with Canada offering attractive investment fundamentals including currency stability, regulatory transparency, and strong tourism infrastructure. The market’s evolution reflects changing consumer preferences toward authentic experiences, sustainable practices, and technology-enabled services that enhance guest satisfaction and operational efficiency.

Market segmentation reveals distinct performance patterns across different hospitality real estate categories and geographic regions. The following insights highlight critical market dynamics:

Tourism recovery serves as the primary catalyst driving Canada’s hospitality real estate market growth. International visitor arrivals have shown consistent improvement, with domestic tourism providing a stable foundation for market performance. Government initiatives supporting tourism promotion and infrastructure development create favorable conditions for hospitality real estate investment and development.

Economic stability and Canada’s reputation as a safe, welcoming destination continue attracting international visitors and investors. The country’s diverse tourism offerings, from urban cultural experiences to outdoor adventure opportunities, support year-round demand for hospitality accommodations. Business travel recovery contributes significantly to urban hotel performance, with corporate events and conferences returning to pre-pandemic levels.

Investment capital availability from institutional sources provides liquidity for market transactions and development projects. Low interest rate environments have historically supported hospitality real estate investment, while currency stability attracts international investment flows. Demographic trends including aging populations with increased leisure time and younger generations prioritizing experiential spending drive sustained demand for hospitality services.

Infrastructure development including transportation improvements, airport expansions, and destination marketing initiatives enhance market accessibility and attractiveness. Provincial and municipal support for tourism development creates favorable regulatory environments for hospitality real estate projects.

Regulatory complexity across different provinces and municipalities creates challenges for multi-market operators and investors. Varying zoning requirements, development approval processes, and operational regulations can impact project timelines and investment returns. Labor market constraints in the hospitality sector affect property operations and service quality, with skilled worker shortages particularly acute in certain regions.

Seasonal demand variations in many Canadian markets create revenue volatility and operational challenges for hospitality properties. Winter weather conditions in certain regions limit tourism activity and require specialized facility management approaches. Competition from alternative accommodations including short-term rental platforms affects traditional hotel demand and pricing power.

Capital intensity requirements for hospitality real estate development and ongoing maintenance represent significant financial commitments. Properties require continuous investment in renovations, technology upgrades, and amenity enhancements to remain competitive. Economic sensitivity of the hospitality sector to broader economic conditions creates cyclical performance patterns that affect investment stability.

Environmental regulations and sustainability requirements increase development costs and operational complexity, though they also create long-term value through improved efficiency and market positioning.

Sustainable development presents significant opportunities for hospitality real estate investors and developers. Growing consumer awareness of environmental issues drives demand for eco-friendly accommodations, creating premium positioning opportunities for green-certified properties. Technology integration offers potential for operational efficiency improvements and enhanced guest experiences through smart building systems, mobile applications, and automated services.

Secondary market expansion provides growth opportunities as travelers seek authentic experiences beyond major urban centers. Rural and small-town destinations offer development potential with lower land costs and unique positioning opportunities. Indigenous tourism represents an emerging market segment with cultural significance and growth potential across Canada.

Mixed-use development strategies allow for risk diversification and multiple revenue streams through combining hospitality with residential, retail, or office components. Adaptive reuse projects converting historic buildings or underutilized structures into hospitality properties offer unique positioning and potential cost advantages.

Corporate housing demand from companies relocating employees or managing temporary assignments creates opportunities for extended-stay and serviced apartment developments. Health and wellness tourism growth opens opportunities for specialized resort and spa developments targeting this expanding market segment.

Supply and demand equilibrium in Canada’s hospitality real estate market reflects complex interactions between tourism patterns, economic conditions, and investment activity. Demand drivers include domestic tourism growth, international visitor recovery, business travel resumption, and special events hosting. Supply factors encompass new development completions, property conversions, and facility closures or repositioning.

Pricing dynamics vary significantly across property types and geographic markets, with luxury and boutique properties commanding premium rates while economy segments compete primarily on value proposition. Occupancy patterns show seasonal variations in resort markets and more stable performance in business-oriented urban locations.

Investment flows demonstrate both domestic and international interest, with institutional investors seeking stable income-producing assets and development opportunities. MarkWide Research analysis indicates that foreign investment represents approximately 35% of total transaction volume in major Canadian hospitality real estate markets.

Operational efficiency improvements through technology adoption and sustainable practices create competitive advantages and improved financial performance. Properties implementing comprehensive technology solutions report operational cost reductions of up to 20% while enhancing guest satisfaction scores.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Canada’s hospitality real estate market. Primary research includes extensive interviews with industry stakeholders including hotel operators, real estate investors, developers, property managers, and hospitality consultants across major Canadian markets.

Secondary research incorporates analysis of publicly available data from government tourism agencies, real estate transaction databases, hospitality industry reports, and economic indicators. Market surveys capture insights from property owners, investors, and industry professionals regarding market conditions, investment strategies, and performance expectations.

Data validation processes ensure accuracy through cross-referencing multiple sources and verification with industry experts. Quantitative analysis examines historical performance trends, occupancy rates, average daily rates, revenue per available room, and transaction volumes across different market segments and geographic regions.

Qualitative assessment evaluates market dynamics, regulatory environments, competitive positioning, and emerging trends that influence investment decisions and property performance. Forward-looking analysis incorporates scenario planning and trend extrapolation to provide insights into future market conditions and opportunities.

Ontario market represents the largest segment of Canada’s hospitality real estate sector, with Toronto serving as the primary hub for business travel and urban tourism. The province benefits from diverse tourism attractions, strong transportation infrastructure, and proximity to major U.S. markets. Market share analysis indicates Ontario accounts for approximately 42% of national hospitality real estate investment activity.

British Columbia demonstrates strong performance driven by Vancouver’s international gateway status and the province’s natural tourism attractions. Resort properties in Whistler and other mountain destinations provide seasonal revenue opportunities, while urban Vancouver hotels benefit from business travel and cruise ship tourism. The province’s occupancy rates average 76% across all property types.

Quebec market offers unique cultural tourism opportunities with Montreal and Quebec City serving as primary destinations. The province’s distinct cultural identity and European-influenced architecture create competitive advantages in attracting international visitors. French-language requirements and cultural considerations influence property operations and investment strategies.

Alberta’s hospitality market benefits from Calgary and Edmonton’s business travel demand, while mountain resort destinations provide recreational tourism opportunities. The province’s energy sector creates corporate travel demand, though economic cycles influence market performance. Average daily rates in Calgary business hotels exceed national averages by 12%.

Atlantic provinces present emerging opportunities with growing tourism interest in coastal destinations and cultural attractions. Lower property acquisition costs and government tourism promotion initiatives support market development potential.

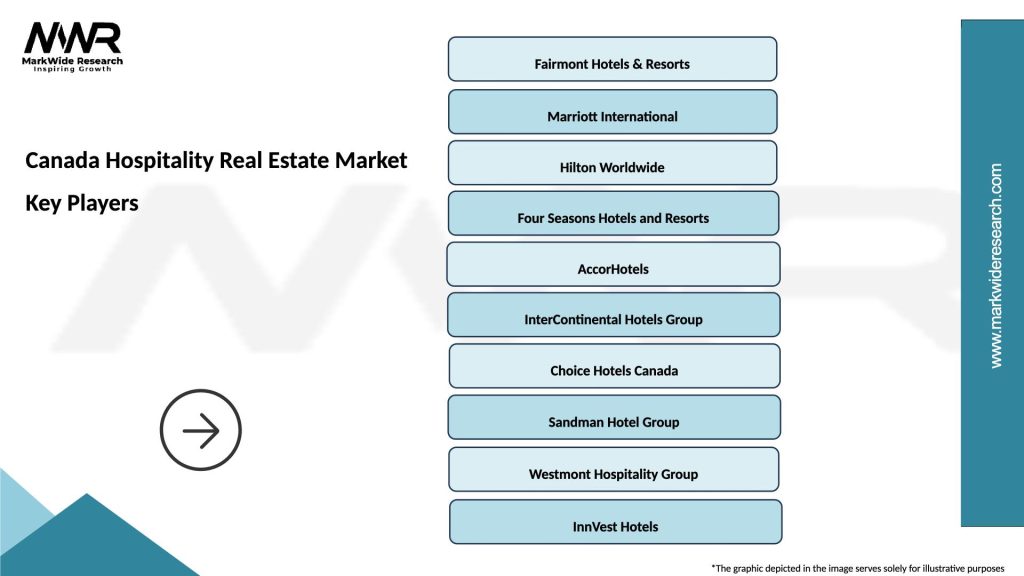

Market leadership in Canada’s hospitality real estate sector includes a diverse mix of domestic and international operators, investors, and developers. The competitive environment encompasses various stakeholder categories:

Competitive strategies focus on operational excellence, technology integration, sustainability initiatives, and unique guest experience delivery. Market consolidation trends indicate increasing institutional ownership while maintaining opportunities for specialized operators and boutique properties.

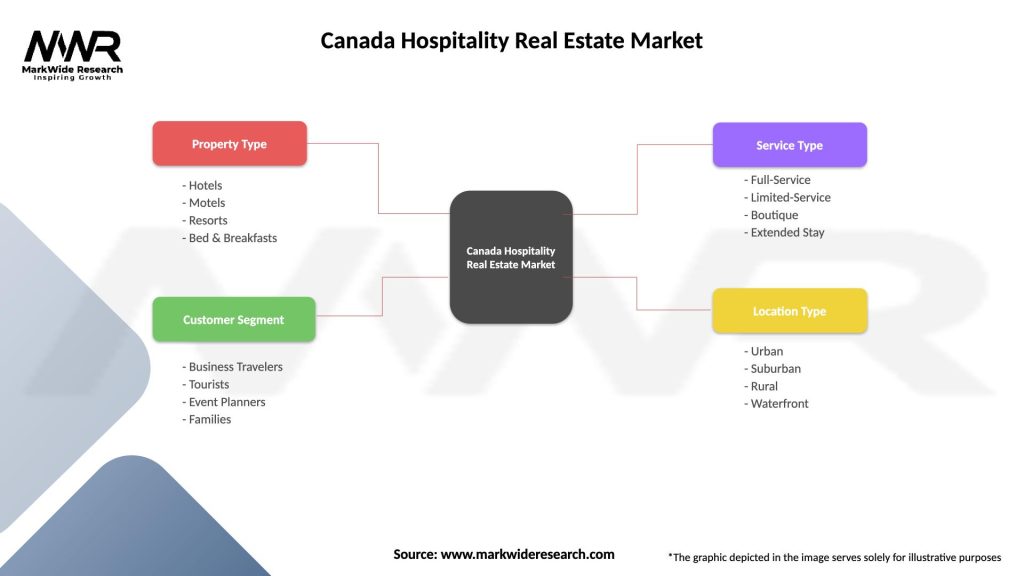

Property type segmentation reveals distinct performance characteristics and investment considerations across different hospitality real estate categories:

By Property Type:

By Location Category:

Luxury segment performance demonstrates resilience with high-net-worth travelers returning to premium accommodations and experiences. These properties command the highest average daily rates and maintain strong profit margins through exclusive amenities and personalized services. Occupancy rates in luxury properties average 72% annually, with peak season performance significantly higher.

Mid-scale properties represent the largest segment by room count and provide stable investment returns through consistent demand from business and leisure travelers. These properties balance service levels with operational efficiency, targeting price-conscious guests seeking reliable accommodations. Market penetration of mid-scale properties accounts for approximately 45% of total room inventory across Canada.

Economy segment focuses on basic accommodation needs with streamlined operations and competitive pricing. These properties serve price-sensitive travelers and provide entry-level investment opportunities in the hospitality sector. Performance metrics emphasize occupancy optimization over rate premiums.

Extended-stay category benefits from corporate relocation trends and long-term travel patterns. These properties offer apartment-style amenities and generate revenue through extended guest stays, creating more predictable cash flows than traditional hotels.

Investors benefit from hospitality real estate through diversified income streams, inflation protection characteristics, and potential for capital appreciation. The sector provides exposure to tourism and business travel trends while offering tangible asset ownership with operational flexibility.

Operators gain advantages through brand recognition, operational economies of scale, and access to distribution channels that enhance revenue generation capabilities. Management efficiencies through standardized procedures and technology systems improve profitability and guest satisfaction.

Local communities benefit from hospitality real estate development through job creation, tax revenue generation, and economic activity stimulation. Tourism-related businesses gain from increased visitor traffic and spending in local markets.

Guests receive value through improved accommodation options, enhanced amenities, and competitive pricing resulting from market competition and operational improvements. Service quality improvements benefit from industry investment in staff training and facility upgrades.

Government stakeholders benefit from increased tourism revenue, employment opportunities, and tax base expansion resulting from hospitality real estate development and operations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration represents a dominant trend with properties implementing green building practices, renewable energy systems, and waste reduction programs. MWR research indicates that 68% of new hospitality developments incorporate significant sustainability features, responding to both investor requirements and guest preferences.

Technology advancement continues transforming hospitality operations through mobile check-in systems, smart room controls, artificial intelligence applications, and contactless service delivery. These innovations improve operational efficiency while enhancing guest convenience and safety.

Experiential focus drives property development toward unique, locally-inspired accommodations that provide authentic cultural experiences. Boutique properties and specialized resorts emphasize distinctive character and personalized services to differentiate from standardized chain offerings.

Health and wellness amenities gain prominence as travelers prioritize physical and mental well-being during their stays. Properties incorporate fitness facilities, spa services, healthy dining options, and wellness programming to attract health-conscious guests.

Flexible space design responds to changing work patterns and multi-purpose facility needs. Properties adapt common areas and guest rooms to accommodate remote work, social distancing requirements, and varied guest activities.

Major acquisitions and portfolio transactions demonstrate continued investor confidence in Canadian hospitality real estate fundamentals. Institutional investment activity includes pension fund acquisitions of hotel portfolios and real estate investment trust expansion strategies.

Development pipeline projects focus on mixed-use developments that combine hospitality with residential, retail, or office components. These integrated projects provide diversified revenue streams and enhanced investment returns through multiple income sources.

Brand expansion initiatives by international hotel companies increase market competition while providing guests with additional accommodation options. Franchise development allows local investors to access established brand systems and operational expertise.

Technology partnerships between hospitality operators and technology companies accelerate innovation adoption and operational improvements. These collaborations focus on guest experience enhancement, operational efficiency, and revenue optimization.

Sustainability certifications become increasingly important for property positioning and investor requirements. Green building standards influence development decisions and operational practices across the hospitality sector.

Investment strategy recommendations emphasize portfolio diversification across property types and geographic markets to mitigate risk and optimize returns. Market timing considerations suggest favorable conditions for acquisitions as the sector continues recovering from recent challenges.

Due diligence processes should thoroughly evaluate local market conditions, competitive positioning, and regulatory requirements before making investment commitments. Operational expertise becomes increasingly important for successful hospitality real estate investment and management.

Technology investment priorities should focus on systems that improve guest experience while reducing operational costs. Sustainability initiatives provide both operational benefits and market positioning advantages that justify initial investment costs.

Partnership strategies with experienced operators and management companies can provide operational expertise and risk mitigation for investors new to the hospitality sector. Market research should evaluate local tourism trends, competitive dynamics, and development pipeline activity.

Long-term perspective remains essential given the hospitality sector’s cyclical nature and capital-intensive requirements. Exit strategies should be considered during initial investment planning to ensure flexibility and return optimization opportunities.

Growth trajectory for Canada’s hospitality real estate market appears positive, supported by tourism recovery, infrastructure investment, and evolving consumer preferences. MarkWide Research projections indicate sustained expansion with annual growth rates of 5.8% expected over the next five years.

Investment activity is anticipated to remain robust as institutional investors seek stable, income-producing assets with inflation protection characteristics. Development focus will likely emphasize sustainable design, technology integration, and unique guest experiences that command premium pricing.

Market evolution toward experiential travel and authentic accommodations creates opportunities for boutique properties and specialized resorts. Urban markets are expected to benefit from business travel recovery and increased domestic tourism activity.

Technology adoption will continue transforming hospitality operations and guest experiences, with properties investing in smart building systems and automated service delivery. Sustainability requirements from both investors and guests will drive continued investment in environmental performance improvements.

Regional expansion into secondary markets presents growth opportunities as travelers seek new destinations and developers identify underserved markets with development potential.

Canada’s hospitality real estate market demonstrates strong fundamentals and positive growth prospects supported by tourism recovery, investment activity, and evolving industry dynamics. The market benefits from Canada’s stable political environment, diverse tourism attractions, and strong infrastructure that supports both domestic and international visitor activity.

Investment opportunities span various property types and geographic markets, with particular strength in urban centers, resort destinations, and emerging secondary markets. The sector’s evolution toward sustainability, technology integration, and experiential offerings creates differentiation opportunities and competitive advantages for forward-thinking investors and operators.

Market challenges including seasonal variations, regulatory complexity, and competitive pressures require careful consideration and strategic planning. However, the underlying strength of Canada’s tourism industry and hospitality infrastructure provides a solid foundation for continued market growth and investment returns.

Future success in this market will depend on adapting to changing consumer preferences, embracing technological innovations, and maintaining operational excellence while delivering authentic guest experiences. The Canada hospitality real estate market remains well-positioned to capitalize on long-term tourism trends and provide attractive investment opportunities for diverse stakeholder groups.

What is Canada Hospitality Real Estate?

Canada Hospitality Real Estate refers to properties specifically designed for the hospitality industry, including hotels, resorts, and restaurants. This sector plays a crucial role in the tourism and service economy of Canada.

What are the key players in the Canada Hospitality Real Estate Market?

Key players in the Canada Hospitality Real Estate Market include companies like Four Seasons Hotels and Resorts, Marriott International, and Accor Hotels, among others. These companies are involved in various aspects of hospitality real estate, from development to management.

What are the growth factors driving the Canada Hospitality Real Estate Market?

The growth of the Canada Hospitality Real Estate Market is driven by increasing tourism, a growing economy, and rising consumer spending on travel and leisure. Additionally, urbanization and the demand for unique travel experiences contribute to market expansion.

What challenges does the Canada Hospitality Real Estate Market face?

The Canada Hospitality Real Estate Market faces challenges such as fluctuating demand due to economic conditions, competition from alternative accommodations like Airbnb, and regulatory hurdles. These factors can impact profitability and investment in the sector.

What opportunities exist in the Canada Hospitality Real Estate Market?

Opportunities in the Canada Hospitality Real Estate Market include the development of eco-friendly hotels, the rise of experiential travel, and the potential for technology integration in guest services. These trends can attract new investors and enhance guest experiences.

What trends are shaping the Canada Hospitality Real Estate Market?

Trends shaping the Canada Hospitality Real Estate Market include a focus on sustainability, the integration of smart technology in properties, and the growing popularity of boutique hotels. These trends reflect changing consumer preferences and the need for innovation in the industry.

Canada Hospitality Real Estate Market

| Segmentation Details | Description |

|---|---|

| Property Type | Hotels, Motels, Resorts, Bed & Breakfasts |

| Customer Segment | Business Travelers, Tourists, Event Planners, Families |

| Service Type | Full-Service, Limited-Service, Boutique, Extended Stay |

| Location Type | Urban, Suburban, Rural, Waterfront |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Hospitality Real Estate Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at