444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Canada home equity lending market is a thriving sector within the country’s financial industry. Home equity lending refers to the process of borrowing money using the equity built up in one’s home as collateral. This form of lending has gained popularity in Canada due to the steady rise in real estate prices and the increased awareness of homeowners about the value of their properties. Homeowners often leverage their home equity to fund various expenses such as home improvements, education, debt consolidation, and other personal needs.

Meaning

Home equity lending is a financial practice where homeowners borrow money against the equity they have built up in their homes. Equity is the difference between the current market value of a property and the outstanding mortgage balance. By tapping into their home equity, borrowers can access additional funds for various purposes, usually at a lower interest rate compared to other forms of credit.

Executive Summary

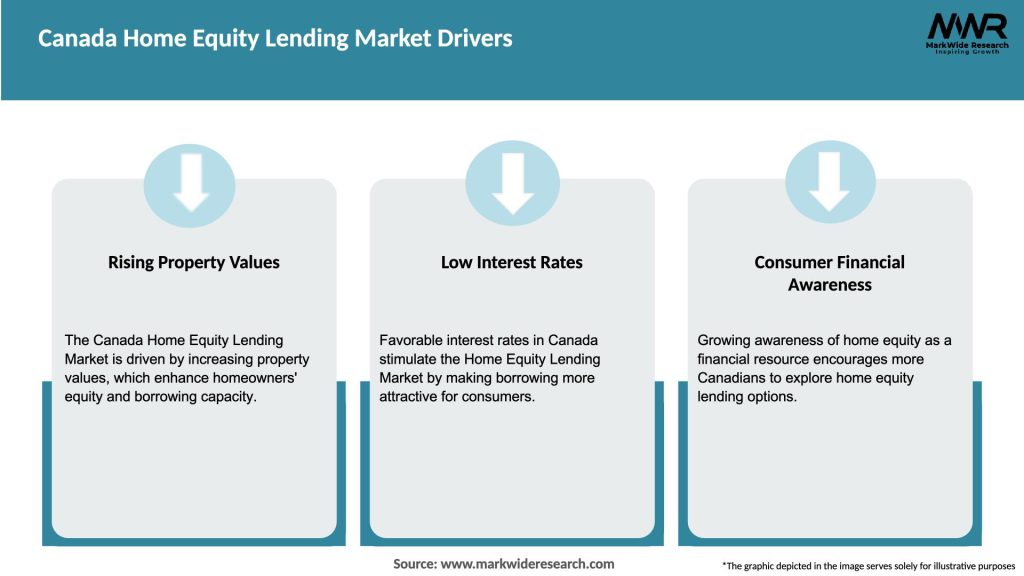

The Canada home equity lending market is witnessing significant growth as more homeowners realize the potential of unlocking the value in their properties. The market is driven by factors such as rising real estate prices, favorable interest rates, and the availability of innovative lending products. However, there are also challenges and opportunities that shape the dynamics of this market. Understanding the market drivers, restraints, and opportunities is crucial for both industry participants and stakeholders.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Canada home equity lending market is dynamic, influenced by various internal and external factors. Changing economic conditions, regulatory updates, and shifts in consumer preferences all play a role in shaping the market’s landscape. Lenders must stay adaptable and responsive to these dynamics to meet borrower demands effectively.

Regional Analysis

The home equity lending market in Canada varies across regions due to differences in real estate prices, economic conditions, and demographic factors. Urban areas with high property values, such as Toronto and Vancouver, tend to have more active home equity lending markets compared to rural regions. However, opportunities exist in all regions as homeowners recognize the potential of their properties’ equity and seek financing options to meet their financial goals.

Competitive Landscape

Leading Companies in the Canada Home Equity Lending Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

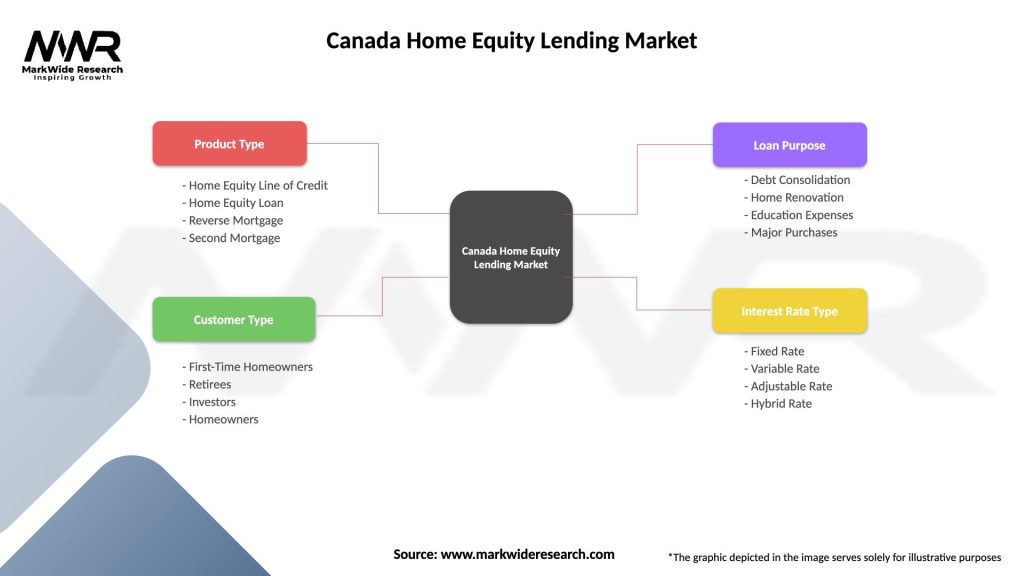

Segmentation

The Canada home equity lending market can be segmented based on various factors, including loan types, borrower profiles, and loan-to-value ratios. Common loan types include home equity loans and home equity lines of credit (HELOCs), each offering distinct features and benefits to borrowers. Borrower profiles can range from first-time borrowers to retirees seeking a reverse mortgage. Loan-to-value ratios determine the maximum amount borrowers can access based on their property’s appraised value and outstanding mortgage balance.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the Canada home equity lending market. During the initial stages of the pandemic, there was a decline in lending activity as economic uncertainty and lockdown measures affected borrower confidence. However, as the economy stabilized and interest rates remained low, the market experienced a rebound, with homeowners leveraging their home equity to access funds for pandemic-related expenses, home improvements, and debt consolidation.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Canada home equity lending market is expected to continue growing in the coming years, driven by factors such as sustained real estate price appreciation and evolving borrower needs. As the market becomes more competitive, lenders will focus on providing differentiated products, improved customer experiences, and digital innovation. Regulatory changes will also shape the market, potentially impacting loan availability and terms. Overall, the outlook for the Canada home equity lending market remains positive, with opportunities for lenders and borrowers alike.

Conclusion

The Canada home equity lending market presents significant opportunities for borrowers and lenders alike. Rising property values, favorable interest rates, and innovative loan products have contributed to the market’s growth. While economic uncertainties and regulatory constraints pose challenges, the market’s dynamics continue to evolve, with changing borrower preferences and advancements in technology. By staying responsive to market trends, focusing on responsible lending practices, and offering tailored loan solutions, industry participants can thrive in this dynamic and competitive market, while borrowers can leverage their home equity to meet their financial goals.

What is Home Equity Lending?

Home equity lending refers to the process of borrowing against the equity built up in a home. This type of lending allows homeowners to access funds for various purposes, such as home improvements, debt consolidation, or education expenses.

What are the key players in the Canada Home Equity Lending Market?

Key players in the Canada Home Equity Lending Market include major banks like Royal Bank of Canada and Toronto-Dominion Bank, as well as credit unions and alternative lenders. These institutions offer various home equity products to meet consumer needs, among others.

What are the growth factors driving the Canada Home Equity Lending Market?

The Canada Home Equity Lending Market is driven by factors such as rising home values, increased consumer confidence, and a growing demand for home renovation financing. Additionally, low-interest rates have made borrowing more attractive for homeowners.

What challenges does the Canada Home Equity Lending Market face?

Challenges in the Canada Home Equity Lending Market include regulatory scrutiny, potential economic downturns affecting home values, and rising interest rates that may deter borrowing. These factors can impact lenders’ risk assessments and consumer borrowing behavior.

What opportunities exist in the Canada Home Equity Lending Market?

Opportunities in the Canada Home Equity Lending Market include the development of innovative lending products and services tailored to younger homeowners. Additionally, the increasing trend of remote work may lead to more investments in home improvements, driving demand for home equity loans.

What trends are shaping the Canada Home Equity Lending Market?

Trends in the Canada Home Equity Lending Market include the rise of digital lending platforms that streamline the application process and enhance customer experience. Furthermore, there is a growing focus on sustainable home improvements, which may influence borrowing decisions.

Canada Home Equity Lending Market

| Segmentation Details | Description |

|---|---|

| Product Type | Home Equity Line of Credit, Home Equity Loan, Reverse Mortgage, Second Mortgage |

| Customer Type | First-Time Homeowners, Retirees, Investors, Homeowners |

| Loan Purpose | Debt Consolidation, Home Renovation, Education Expenses, Major Purchases |

| Interest Rate Type | Fixed Rate, Variable Rate, Adjustable Rate, Hybrid Rate |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Canada Home Equity Lending Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at