444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada hair salon market represents a dynamic and evolving segment of the country’s personal care and beauty industry. Hair salons across Canada have experienced significant transformation in recent years, driven by changing consumer preferences, technological advancements, and evolving beauty trends. The market encompasses a diverse range of establishments, from independent boutique salons to large franchise operations, each catering to specific demographic segments and service preferences.

Market dynamics indicate robust growth potential, with the sector experiencing a steady annual growth rate of 4.2% over the past five years. This expansion reflects increasing consumer spending on personal grooming services, rising awareness of professional hair care benefits, and the growing popularity of specialized treatments. Urban centers like Toronto, Vancouver, and Montreal continue to drive market expansion, while smaller cities and rural areas present emerging opportunities for salon operators.

Consumer behavior patterns show a marked shift toward premium services and personalized experiences. Canadian consumers increasingly seek salons offering comprehensive beauty solutions, including advanced hair treatments, color services, and styling expertise. The integration of digital technologies for appointment booking, customer management, and service customization has become a critical differentiator in the competitive landscape.

The Canada hair salon market refers to the comprehensive ecosystem of professional hair care service providers operating across the country, encompassing full-service salons, specialty hair care establishments, and franchise operations that offer cutting, styling, coloring, and treatment services to consumers. This market includes traditional barbershops, modern unisex salons, high-end beauty establishments, and quick-service hair care outlets that collectively serve Canada’s diverse population with varying hair care needs and preferences.

Professional hair salons in Canada provide essential personal care services that extend beyond basic haircuts to include complex chemical treatments, advanced styling techniques, hair health consultations, and specialized services for different hair types and textures. The market encompasses both independent operators and franchise systems, creating a competitive environment that drives innovation in service delivery, customer experience, and business operations.

Canada’s hair salon industry demonstrates remarkable resilience and adaptability, positioning itself as a cornerstone of the country’s beauty and personal care sector. The market has successfully navigated recent challenges while embracing technological innovations and evolving consumer expectations. Key performance indicators reveal sustained growth momentum, with salon revenues showing consistent upward trends across major metropolitan areas.

Market segmentation reveals distinct consumer preferences across different regions and demographic groups. Urban markets favor premium services and innovative treatments, while suburban and rural areas prioritize convenience and value-oriented offerings. The rise of specialized services has created new revenue streams, with color treatments and chemical services accounting for approximately 45% of total salon revenues.

Competitive dynamics continue to evolve as independent salons compete with franchise operations and emerging digital-native brands. The integration of technology platforms for scheduling, customer relationship management, and service customization has become essential for maintaining competitive advantage. Sustainability initiatives and eco-friendly practices are increasingly important factors in consumer decision-making processes.

Strategic analysis of the Canada hair salon market reveals several critical insights that shape industry dynamics and future growth potential:

Consumer lifestyle changes represent the primary driver of growth in Canada’s hair salon market. Increasing disposable income among Canadian households has enabled greater spending on personal care services, with consumers viewing professional hair care as an essential rather than discretionary expense. Social media influence has significantly impacted consumer behavior, driving demand for trendy hairstyles and professional styling services that enhance personal image and social presence.

Demographic trends continue to fuel market expansion, particularly the growing multicultural population that requires specialized hair care services. The aging baby boomer generation represents a substantial market segment seeking regular professional hair maintenance, while younger demographics drive demand for innovative treatments and fashion-forward styling services. Women’s workforce participation has created a substantial customer base that values professional appearance and time-saving beauty solutions.

Technological advancements in hair care products and treatment methods have expanded service offerings and improved customer satisfaction. Advanced coloring techniques, chemical treatments, and styling tools enable salons to provide superior results and justify premium pricing. The integration of digital platforms for appointment scheduling and customer communication has enhanced operational efficiency and customer convenience, driving increased service utilization.

Economic sensitivity remains a significant constraint for the Canada hair salon market, as personal care services are often among the first expenses reduced during economic downturns. Price competition from discount chains and quick-service providers puts pressure on independent salons’ profit margins, forcing them to compete on value rather than premium positioning.

Skilled labor shortages present ongoing challenges for salon operators, with experienced stylists and colorists in high demand across the industry. The time-intensive nature of professional training and certification requirements limits the available talent pool, while competitive salary expectations increase operational costs. Staff retention issues are particularly acute in urban markets where stylists frequently move between establishments seeking better compensation or working conditions.

Regulatory compliance requirements impose additional operational burdens on salon operators, including health and safety standards, chemical handling protocols, and licensing requirements. The complexity of provincial regulations varies across Canada, creating challenges for multi-location operators. Insurance costs and liability concerns related to chemical treatments and customer safety add to operational expenses and complexity.

Emerging market segments present substantial growth opportunities for Canadian hair salon operators. The increasing male grooming market represents an underserved demographic with growing demand for professional hair care services beyond traditional barbering. Senior demographics offer consistent revenue potential as aging populations require regular professional hair maintenance and specialized services for age-related hair changes.

Technology integration opportunities extend beyond basic scheduling systems to include artificial intelligence for personalized service recommendations, virtual reality for style previews, and advanced customer analytics for targeted marketing. The development of subscription-based service models could provide predictable revenue streams while enhancing customer loyalty and retention.

Geographic expansion into underserved markets, particularly smaller cities and rural communities, offers growth potential for established salon brands. The rise of mobile and on-demand services creates opportunities to reach customers who cannot easily access traditional salon locations. Corporate partnerships with employers, hotels, and event venues could generate additional revenue streams through group services and special occasion styling.

Competitive intensity within the Canada hair salon market continues to escalate as operators seek to differentiate their services and capture market share. Independent salons leverage personalized service and local community connections to compete against franchise operations that offer standardized services and brand recognition. The emergence of hybrid business models combining traditional salon services with retail product sales and educational workshops creates additional revenue opportunities.

Consumer expectations have evolved significantly, with customers demanding not only technical expertise but also exceptional customer experiences, convenient scheduling options, and transparent pricing. The integration of social media marketing has become essential for salon success, with visual platforms like Instagram driving customer acquisition and retention. Online reviews and reputation management significantly influence consumer choice and salon performance.

Supply chain dynamics affect salon operations through product availability, pricing fluctuations, and quality considerations. Professional hair care product manufacturers increasingly offer exclusive salon partnerships and training programs, creating competitive advantages for participating establishments. Equipment financing and leasing options enable salons to access advanced styling tools and treatment technologies without significant capital investments.

Comprehensive market analysis of the Canada hair salon industry employs multiple research methodologies to ensure accurate and reliable insights. Primary research includes extensive surveys of salon operators, customer interviews, and industry expert consultations to gather firsthand market intelligence and trend identification.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, and financial performance indicators from publicly available sources. Market segmentation analysis utilizes demographic data, consumer spending patterns, and regional economic indicators to identify growth opportunities and market dynamics.

Quantitative analysis methods include statistical modeling, trend analysis, and comparative performance evaluation across different market segments and geographic regions. Qualitative research techniques such as focus groups and in-depth interviews provide insights into consumer preferences, decision-making processes, and emerging trends that quantitative data alone cannot capture.

Ontario market dominates the Canadian hair salon landscape, representing approximately 38% of national salon revenues due to its large population base and concentration of urban centers. Toronto metropolitan area serves as the industry’s innovation hub, with premium salons and emerging trends often originating in this market before spreading to other regions. The province’s diverse demographic composition drives demand for specialized services catering to various cultural hair care needs.

British Columbia demonstrates strong market performance, particularly in Vancouver and surrounding areas, where lifestyle-conscious consumers prioritize personal appearance and wellness services. The province’s tourism industry contributes to salon revenues through visitor services and special occasion styling. Quebec market maintains distinct characteristics influenced by French culture and language preferences, with local salon chains and independent operators serving the unique needs of francophone consumers.

Prairie provinces including Alberta, Saskatchewan, and Manitoba show steady growth potential driven by resource industry employment and increasing urbanization. Atlantic Canada presents emerging opportunities as economic development and population growth create demand for professional hair care services. Northern territories represent niche markets with limited competition but higher service pricing due to geographic isolation and limited service availability.

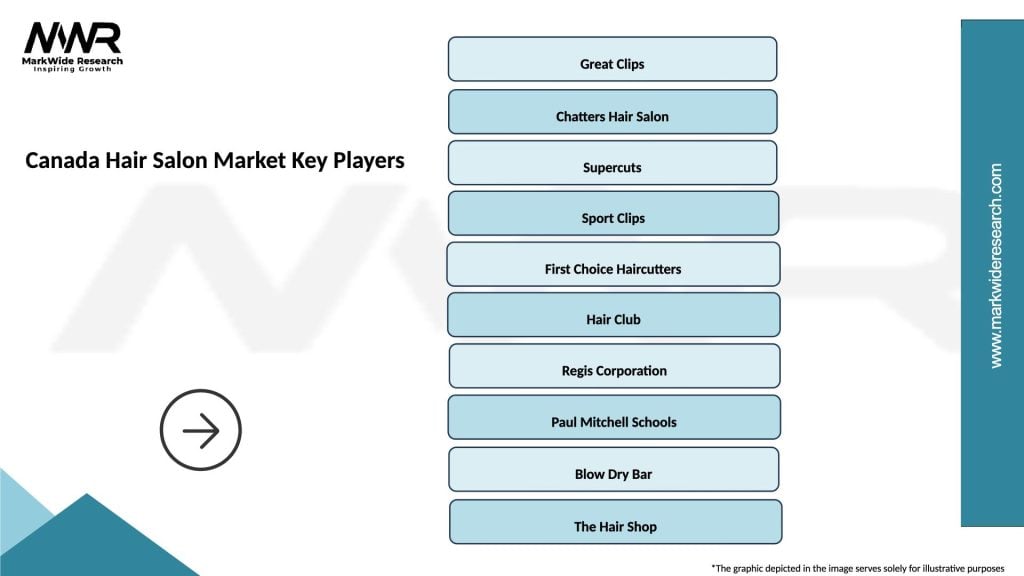

Market leadership in Canada’s hair salon industry is distributed among several key categories of operators, each with distinct competitive advantages and market positioning strategies:

Competitive strategies vary significantly across market segments, with franchise operations emphasizing consistency, convenience, and value while independent salons focus on personalized service, creativity, and premium experiences. Technology adoption has become a key differentiator, with leading operators investing in advanced booking systems, customer relationship management platforms, and digital marketing capabilities.

Service-based segmentation reveals distinct market categories within the Canada hair salon industry:

By Service Type:

By Customer Demographics:

By Price Positioning:

Full-Service Salons continue to dominate the Canadian market, offering comprehensive beauty solutions that extend beyond basic hair services. These establishments typically generate higher average transaction values through service bundling and upselling opportunities. Customer loyalty tends to be stronger in full-service environments where clients develop relationships with specific stylists and receive consistent, personalized attention.

Quick-Service Hair Cutting represents a growing segment driven by consumer demand for convenience and value. These operations focus on efficient service delivery, standardized techniques, and competitive pricing to attract price-sensitive customers and those seeking routine maintenance cuts. Franchise models dominate this category, leveraging economies of scale and operational efficiency.

Specialty Salons catering to specific demographics or service types show strong growth potential. Men’s grooming establishments have experienced particular expansion as male consumers increasingly seek professional styling services beyond traditional barbering. Ethnic hair specialists serve diverse communities with culturally specific techniques and products, creating loyal customer bases in multicultural urban areas.

Mobile and On-Demand Services represent an emerging category that addresses consumer convenience preferences. These services typically command premium pricing due to their personalized nature and travel requirements. Technology platforms enable efficient scheduling and service delivery, making this model increasingly viable for urban markets.

Salon Operators benefit from multiple revenue streams through service diversification, retail product sales, and customer loyalty programs. Recurring revenue models provide predictable income as clients typically require regular hair maintenance services. The ability to build personal relationships with customers creates competitive advantages and reduces price sensitivity.

Franchise Partners gain access to established business models, training programs, and marketing support that reduce startup risks and operational challenges. Brand recognition and standardized systems enable faster market entry and customer acquisition compared to independent operations.

Professional Stylists enjoy creative fulfillment, flexible scheduling options, and income potential that often exceeds traditional employment opportunities. Career advancement possibilities include salon ownership, education roles, and specialization in high-demand services like color correction or chemical treatments.

Consumers receive professional expertise, personalized service, and access to advanced treatments and products not available for home use. Convenience benefits include online booking, loyalty programs, and comprehensive beauty solutions in single locations.

Product Manufacturers benefit from professional salon channels that provide product education, demonstration opportunities, and brand credibility. Exclusive partnerships with salon chains create competitive advantages and market access for new product launches.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability and Eco-Consciousness have emerged as dominant trends shaping the Canada hair salon market. Green salon practices including organic products, energy-efficient equipment, and waste reduction programs appeal to environmentally aware consumers. Clean beauty movements drive demand for chemical-free treatments and natural hair care solutions, forcing salons to adapt their service offerings and product selections.

Personalization and Customization continue to gain importance as consumers seek unique experiences tailored to their specific needs and preferences. Consultation-based services that analyze individual hair characteristics and lifestyle factors enable salons to provide targeted recommendations and treatments. Technology-assisted customization using apps and digital tools helps stylists create personalized color formulas and style recommendations.

Wellness Integration represents a growing trend as salons expand beyond traditional beauty services to include holistic wellness offerings. Scalp health treatments, stress-relief services, and aromatherapy integration appeal to consumers seeking comprehensive self-care experiences. Mental health awareness has led to recognition of salons as important social spaces that contribute to customer well-being and confidence.

Digital Transformation accelerates across all aspects of salon operations, from customer acquisition to service delivery. Social media marketing has become essential for showcasing work, attracting new clients, and building brand awareness. Virtual consultations and augmented reality tools enable customers to preview styles and colors before committing to treatments.

Franchise Expansion continues to reshape the Canadian hair salon landscape as established brands seek to capitalize on market growth opportunities. International brands are increasingly entering the Canadian market through franchise partnerships and direct investment, bringing new service concepts and operational approaches.

Technology Adoption has accelerated significantly, with MarkWide Research indicating that advanced booking systems and customer management platforms are now standard in most successful salon operations. Artificial intelligence applications for color matching and style recommendations are beginning to appear in premium establishments.

Education and Training initiatives have expanded as industry associations and product manufacturers invest in professional development programs. Specialized certifications for emerging techniques like balayage, keratin treatments, and ethnic hair care create competitive advantages for participating stylists and salons.

Consolidation Activity includes acquisitions of independent salons by franchise operators and the emergence of multi-brand salon companies operating different concepts under single ownership. Private equity investment in salon chains indicates institutional confidence in the sector’s growth potential.

Strategic positioning recommendations for Canadian hair salon operators emphasize the importance of differentiation through specialized services, exceptional customer experiences, and technology integration. Market analysis suggests that salons focusing on specific niches or demographics often achieve stronger financial performance than generalist competitors.

Investment priorities should include staff training and retention programs, as skilled professionals represent the most critical success factor in salon operations. Technology investments in booking systems, customer relationship management, and digital marketing platforms provide measurable returns through improved efficiency and customer acquisition.

Geographic expansion strategies should consider underserved markets in smaller cities and suburban areas where competition may be less intense and operating costs lower. Franchise opportunities offer proven business models and support systems that can accelerate growth while reducing operational risks.

Service diversification into complementary areas such as skincare, nail services, or wellness treatments can increase average transaction values and customer visit frequency. Retail integration through professional product sales provides additional revenue streams and enhances customer convenience.

Long-term growth prospects for the Canada hair salon market remain positive, supported by demographic trends, increasing consumer focus on personal appearance, and ongoing service innovation. Market maturation is expected to favor operators who successfully differentiate their offerings and build strong customer relationships.

Technology integration will continue to transform salon operations, with MWR projecting that advanced digital platforms will become standard across all market segments within the next five years. Artificial intelligence and machine learning applications for personalized service recommendations and operational optimization represent significant opportunities for forward-thinking operators.

Demographic shifts including population aging and increasing cultural diversity will create new service demands and market opportunities. The growing male grooming segment is projected to expand at approximately 6.5% annually over the next decade, representing substantial growth potential for specialized operators.

Sustainability requirements will likely become more stringent as environmental regulations evolve and consumer expectations increase. Eco-friendly operations and clean beauty services are expected to transition from competitive advantages to market necessities, requiring proactive adaptation by salon operators.

Canada’s hair salon market demonstrates remarkable resilience and adaptability, positioning itself for continued growth despite economic uncertainties and evolving consumer preferences. The industry’s ability to embrace technological innovation while maintaining the personal touch that defines professional hair care services creates a sustainable competitive advantage in the broader beauty and personal care sector.

Strategic success factors for salon operators include investment in skilled professionals, adoption of digital technologies, and development of specialized services that address specific customer needs. The market’s fragmented nature provides opportunities for both independent operators and franchise systems to thrive through differentiated positioning and exceptional service delivery.

Future market evolution will likely favor operators who successfully balance traditional salon expertise with modern convenience and technology integration. As consumer expectations continue to rise and competition intensifies, the ability to create memorable experiences and build lasting customer relationships will determine long-term success in Canada’s dynamic hair salon market.

What is Hair Salon?

A hair salon is a business that provides various hair care services, including cutting, coloring, and styling. These establishments cater to a diverse clientele, offering personalized services to meet individual hair needs and preferences.

What are the key players in the Canada Hair Salon Market?

Key players in the Canada Hair Salon Market include Chatters Hair Salon, Great Clips, and First Choice Haircutters. These companies are known for their extensive service offerings and widespread presence across the country, among others.

What are the growth factors driving the Canada Hair Salon Market?

The Canada Hair Salon Market is driven by increasing consumer demand for personal grooming and hair care services, along with the rising popularity of hair coloring and styling trends. Additionally, the growth of social media influences consumer choices and promotes salon services.

What challenges does the Canada Hair Salon Market face?

The Canada Hair Salon Market faces challenges such as high competition among salons and the impact of economic fluctuations on consumer spending. Additionally, the ongoing need for skilled professionals can limit growth opportunities for some salons.

What opportunities exist in the Canada Hair Salon Market?

Opportunities in the Canada Hair Salon Market include the expansion of mobile salon services and the integration of eco-friendly products. Furthermore, the increasing focus on wellness and self-care presents avenues for salons to diversify their service offerings.

What trends are shaping the Canada Hair Salon Market?

Trends in the Canada Hair Salon Market include the rise of digital booking systems and personalized hair care consultations. Additionally, there is a growing emphasis on sustainable practices and the use of organic products in salon services.

Canada Hair Salon Market

| Segmentation Details | Description |

|---|---|

| Service Type | Haircut, Coloring, Styling, Treatments |

| Customer Type | Men, Women, Children, Seniors |

| Price Tier | Budget, Mid-range, Premium, Luxury |

| Location Type | Urban, Suburban, Rural, Franchise |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Hair Salon Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at