444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada geospatial imagery analytics market represents a rapidly expanding sector that leverages advanced satellite imagery, aerial photography, and geographic information systems to provide actionable insights across multiple industries. This sophisticated market encompasses the collection, processing, and analysis of spatial data to support decision-making in sectors ranging from agriculture and forestry to urban planning and natural resource management. Canadian organizations are increasingly recognizing the strategic value of geospatial analytics for optimizing operations, enhancing environmental monitoring, and supporting sustainable development initiatives.

Market dynamics indicate robust growth driven by technological advancements in satellite imagery resolution, artificial intelligence integration, and cloud-based analytics platforms. The market benefits from Canada’s vast geographical expanse, diverse natural resources, and strong commitment to environmental stewardship. Growth projections suggest the market will expand at a compound annual growth rate of 12.3% over the forecast period, reflecting increasing adoption across government agencies, private enterprises, and research institutions.

Key market drivers include the growing need for precision agriculture solutions, enhanced environmental monitoring capabilities, and improved infrastructure planning tools. The integration of machine learning algorithms with geospatial data has created new opportunities for predictive analytics and automated pattern recognition. Canadian companies are leveraging these technologies to gain competitive advantages in resource exploration, crop yield optimization, and disaster response planning.

The Canada geospatial imagery analytics market refers to the comprehensive ecosystem of technologies, services, and solutions that capture, process, and analyze spatial data derived from satellite imagery, aerial photography, and other remote sensing technologies to generate actionable insights for various applications across Canadian industries and government sectors.

Geospatial imagery analytics combines advanced image processing techniques with geographic information systems to extract meaningful patterns, trends, and intelligence from spatial data. This market encompasses software platforms, data acquisition services, analytical tools, and consulting services that enable organizations to make informed decisions based on location-based intelligence. Core components include satellite data procurement, image preprocessing, feature extraction, pattern recognition, and predictive modeling capabilities.

Market participants include technology providers, data vendors, consulting firms, and end-users across sectors such as agriculture, forestry, mining, oil and gas, government agencies, and environmental organizations. The market facilitates the transformation of raw geospatial data into valuable business intelligence that supports strategic planning, operational optimization, and regulatory compliance initiatives throughout Canada.

Canada’s geospatial imagery analytics market demonstrates exceptional growth potential driven by increasing demand for location-based intelligence across diverse industry verticals. The market benefits from Canada’s leadership in space technology, strong research and development capabilities, and progressive regulatory environment that supports innovation in geospatial technologies. Market penetration has reached approximately 34% adoption rate among large enterprises, with significant growth opportunities in small and medium-sized businesses.

Technology advancement remains a primary growth catalyst, with artificial intelligence and machine learning integration enabling more sophisticated analytical capabilities. Cloud-based platforms are democratizing access to geospatial analytics, reducing barriers to entry for smaller organizations. Government initiatives supporting digital transformation and smart city development are creating substantial market opportunities for geospatial solution providers.

Competitive landscape features a mix of international technology giants, specialized Canadian companies, and emerging startups focused on niche applications. The market shows strong collaboration between public and private sectors, with government agencies serving as both major customers and technology development partners. Investment activity has increased by 28% year-over-year, reflecting growing investor confidence in the sector’s long-term prospects.

Strategic market insights reveal several critical trends shaping the Canada geospatial imagery analytics landscape:

Technology integration trends indicate increasing convergence between geospatial analytics and emerging technologies such as Internet of Things sensors, edge computing, and 5G connectivity. These developments are enabling real-time analytics capabilities and expanding the scope of geospatial applications across various industries.

Primary market drivers propelling growth in Canada’s geospatial imagery analytics market include several interconnected factors that create sustained demand for advanced spatial intelligence solutions.

Government digitization initiatives represent a significant growth driver, with federal and provincial agencies investing heavily in digital transformation programs. These initiatives emphasize data-driven decision making and require sophisticated geospatial analytics capabilities to support policy development, resource management, and service delivery optimization. Public sector adoption has increased by 31% over the past two years, establishing government agencies as key market catalysts.

Climate change imperatives drive substantial demand for environmental monitoring and analysis capabilities. Canadian organizations require advanced geospatial tools to assess environmental impacts, monitor ecosystem changes, and support sustainability initiatives. The growing focus on carbon footprint reduction and environmental compliance creates ongoing demand for specialized analytics solutions.

Agricultural modernization continues to fuel market growth as Canadian farmers adopt precision agriculture techniques to optimize crop yields and resource utilization. The integration of satellite imagery with ground-based sensors enables comprehensive farm management solutions that improve productivity while reducing environmental impact.

Infrastructure development needs across Canada’s vast territory require sophisticated planning and monitoring tools. Geospatial analytics support infrastructure projects from initial planning through construction and ongoing maintenance, creating sustained demand for analytical capabilities.

Market restraints present challenges that may limit the pace of growth in Canada’s geospatial imagery analytics market, requiring strategic approaches to overcome barriers to adoption.

High implementation costs represent a significant barrier for smaller organizations seeking to adopt geospatial analytics solutions. The initial investment in software licenses, data acquisition, and staff training can be substantial, particularly for specialized applications requiring high-resolution imagery and advanced analytical capabilities. Cost concerns affect approximately 47% of potential adopters in the small and medium enterprise segment.

Technical complexity challenges organizations lacking specialized expertise in geospatial technologies. The integration of multiple data sources, complex analytical workflows, and interpretation of results require skilled personnel that may be difficult to recruit and retain. This skills gap limits market penetration in certain sectors and geographic regions.

Data privacy and security concerns create hesitation among organizations handling sensitive information. Geospatial data often contains location-specific details that raise privacy considerations, particularly in applications involving personal or proprietary information. Regulatory compliance requirements add complexity to implementation processes.

Weather dependency affects optical satellite imagery acquisition, particularly in Canada’s northern regions where cloud cover and seasonal variations can limit data availability. This constraint impacts real-time applications and requires alternative data sources or analytical approaches to maintain consistent service levels.

Emerging opportunities in Canada’s geospatial imagery analytics market present significant potential for growth and innovation across multiple dimensions of the industry ecosystem.

Artificial intelligence integration creates transformative opportunities for automated analysis and pattern recognition capabilities. Machine learning algorithms can process vast amounts of geospatial data to identify trends, anomalies, and predictive insights that would be impossible to detect through manual analysis. AI-powered solutions show 67% higher accuracy rates in change detection applications compared to traditional methods.

Edge computing deployment enables real-time processing of geospatial data closer to collection points, reducing latency and enabling immediate decision-making capabilities. This technology advancement opens opportunities for time-critical applications such as emergency response, autonomous vehicle navigation, and industrial monitoring systems.

Small satellite constellations are revolutionizing data acquisition by providing more frequent revisit times and lower-cost imagery options. These developments democratize access to satellite data and create opportunities for new applications requiring high temporal resolution monitoring capabilities.

Cross-industry collaboration opportunities emerge as organizations recognize the value of combining geospatial insights with domain-specific expertise. Partnerships between technology providers and industry specialists create innovative solutions tailored to specific market needs and use cases.

International expansion presents opportunities for Canadian geospatial companies to leverage their expertise in challenging environments and resource management applications to serve global markets with similar geographic and climatic characteristics.

Market dynamics in Canada’s geospatial imagery analytics sector reflect complex interactions between technological advancement, regulatory evolution, and changing customer requirements that shape competitive positioning and growth trajectories.

Technology convergence drives market evolution as geospatial analytics platforms integrate with complementary technologies such as IoT sensors, blockchain for data verification, and augmented reality for visualization. This convergence creates new value propositions and expands addressable market opportunities while requiring companies to develop broader technological capabilities.

Regulatory landscape evolution influences market development through policies supporting open data initiatives, privacy protection requirements, and industry-specific compliance standards. Government agencies are increasingly mandating the use of geospatial analytics for environmental impact assessments and resource management decisions, creating stable demand drivers.

Customer sophistication continues to increase as organizations develop internal expertise and more demanding requirements for geospatial solutions. This trend drives demand for advanced analytical capabilities, custom solutions, and integrated platforms that can handle complex workflows and multiple data sources.

Competitive intensity has increased as the market attracts new entrants and established technology companies expand their geospatial capabilities. This competition drives innovation, improves solution quality, and creates pricing pressure that benefits end customers while challenging profit margins for solution providers.

Partnership ecosystems are becoming increasingly important as no single company can provide comprehensive solutions across all market segments. Strategic alliances between data providers, technology companies, and industry specialists create competitive advantages and enable market expansion into new applications and geographic regions.

Research methodology for analyzing Canada’s geospatial imagery analytics market employs a comprehensive approach combining primary research, secondary data analysis, and expert insights to provide accurate and actionable market intelligence.

Primary research activities include structured interviews with industry executives, technology providers, end-users, and government officials to gather firsthand insights into market trends, challenges, and opportunities. Survey methodologies capture quantitative data on adoption rates, spending patterns, and technology preferences across different industry segments and geographic regions.

Secondary research encompasses analysis of industry reports, government publications, academic studies, and company financial statements to establish market context and validate primary research findings. This approach ensures comprehensive coverage of market dynamics and provides historical perspective on industry evolution.

Expert consultation involves engagement with technology specialists, industry analysts, and academic researchers to validate findings and provide specialized insights into emerging trends and future market directions. MarkWide Research leverages its network of industry experts to ensure research accuracy and relevance.

Data validation processes include cross-referencing multiple sources, statistical analysis of survey responses, and peer review of research findings to ensure reliability and accuracy of market insights. Triangulation methodologies confirm key findings through multiple independent data sources.

Market modeling employs statistical techniques and forecasting methodologies to project future market trends and quantify growth opportunities. These models incorporate multiple variables including technology adoption curves, economic indicators, and regulatory developments to provide robust market projections.

Regional analysis of Canada’s geospatial imagery analytics market reveals distinct patterns of adoption, growth, and opportunity distribution across different provinces and territories, reflecting varying economic priorities, geographic characteristics, and technological infrastructure development.

Ontario dominates the market with approximately 38% market share, driven by the concentration of technology companies, government agencies, and research institutions in the Toronto-Ottawa corridor. The province benefits from strong venture capital availability, skilled workforce concentration, and proximity to major customers across multiple industry sectors.

Alberta represents the second-largest regional market with 22% market share, primarily driven by oil and gas industry applications, agricultural technology adoption, and environmental monitoring requirements. The province’s resource-based economy creates substantial demand for geospatial analytics in exploration, production optimization, and environmental compliance applications.

British Columbia accounts for 18% of market activity, with strong growth in forestry applications, environmental monitoring, and smart city initiatives. The province’s diverse geography and environmental priorities drive demand for sophisticated monitoring and analysis capabilities across multiple sectors.

Quebec maintains a 12% market share with particular strength in aerospace and defense applications, leveraging the province’s aerospace industry cluster and government research facilities. Growing adoption in agriculture and infrastructure planning applications supports continued market expansion.

Prairie provinces collectively represent 7% of market activity, with Saskatchewan and Manitoba showing strong growth in agricultural applications and resource exploration. The region’s agricultural focus creates sustained demand for precision farming and crop monitoring solutions.

Atlantic provinces account for 3% of market share but demonstrate rapid growth in marine applications, fisheries management, and coastal monitoring. The region’s maritime focus creates unique opportunities for specialized geospatial analytics applications.

Competitive landscape in Canada’s geospatial imagery analytics market features a diverse ecosystem of international technology leaders, specialized Canadian companies, and emerging startups that compete across different market segments and application areas.

Market positioning varies significantly among competitors, with some focusing on comprehensive platforms while others specialize in niche applications or specific data types. Competitive differentiation occurs through factors such as data quality, analytical capabilities, ease of use, industry expertise, and customer support quality.

Strategic partnerships play crucial roles in competitive positioning, with companies forming alliances to combine complementary capabilities, expand market reach, and develop integrated solutions. These partnerships often involve data providers, technology companies, and industry specialists working together to address complex customer requirements.

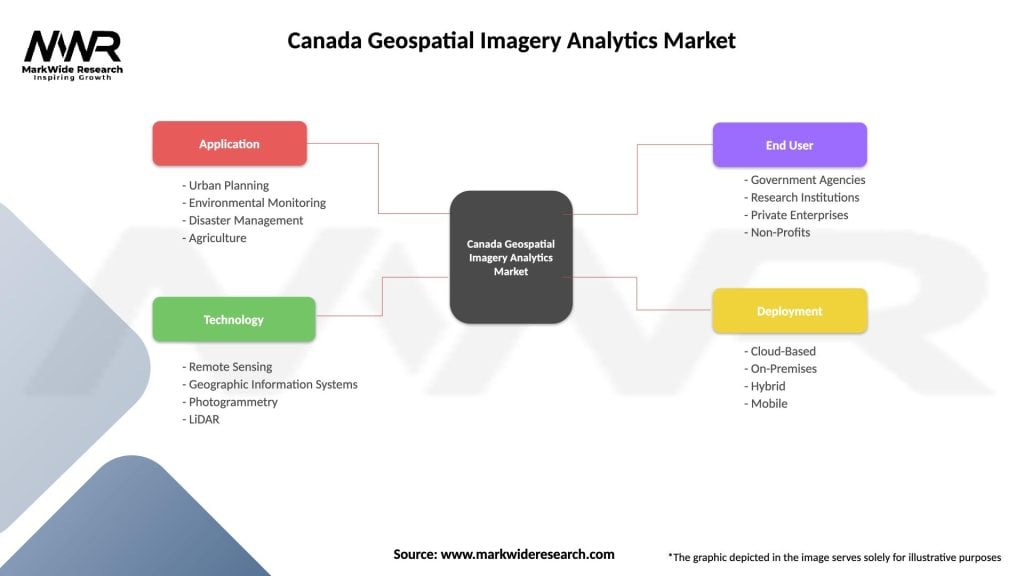

Market segmentation analysis reveals distinct categories within Canada’s geospatial imagery analytics market, each characterized by specific customer requirements, technology needs, and growth dynamics that influence strategic positioning and development priorities.

By Technology:

By Application:

By End-User:

Category-wise analysis provides detailed insights into specific market segments within Canada’s geospatial imagery analytics ecosystem, revealing unique characteristics, growth patterns, and strategic considerations for each major category.

Agricultural Applications represent the largest and fastest-growing category, driven by the need for precision farming techniques and sustainable agricultural practices. Crop monitoring solutions enable farmers to optimize irrigation, fertilizer application, and pest management through detailed field analysis. Advanced analytics platforms integrate satellite imagery with weather data and soil information to provide comprehensive farm management insights. Adoption rates in large-scale farming operations exceed 58%, with continued growth expected as technology costs decrease and capabilities expand.

Environmental Monitoring applications address critical needs for climate change assessment, pollution tracking, and ecosystem health evaluation. These solutions support regulatory compliance, environmental impact assessment, and conservation planning initiatives. Government agencies represent primary customers, with increasing adoption by private companies seeking to demonstrate environmental responsibility and comply with sustainability requirements.

Infrastructure and Urban Planning categories show strong growth as Canadian cities invest in smart city technologies and infrastructure modernization. Geospatial analytics support traffic optimization, utility planning, and development assessment applications. Municipal adoption has increased by 26% annually as cities recognize the value of data-driven planning and management approaches.

Natural Resources applications leverage geospatial analytics for exploration, production optimization, and environmental compliance in mining, oil and gas, and forestry sectors. These applications often require specialized analytical capabilities and high-resolution data to support critical business decisions.

Industry participants and stakeholders in Canada’s geospatial imagery analytics market realize substantial benefits that justify investment and drive continued adoption across diverse application areas and organizational types.

Operational Efficiency Gains represent primary benefits for organizations implementing geospatial analytics solutions. Automated monitoring capabilities reduce manual inspection requirements, lower operational costs, and improve accuracy of data collection and analysis processes. Organizations typically achieve 35-45% efficiency improvements in monitoring and assessment activities through geospatial analytics implementation.

Enhanced Decision Making capabilities result from access to comprehensive, timely, and accurate spatial intelligence. Decision makers gain visibility into patterns, trends, and relationships that would be impossible to detect through traditional analysis methods. Data-driven insights support more informed strategic planning, risk assessment, and resource allocation decisions across all industry sectors.

Risk Mitigation Benefits include improved ability to identify and respond to potential problems before they become critical issues. Environmental monitoring applications enable early detection of pollution, ecosystem changes, or natural disasters. Predictive capabilities allow organizations to implement preventive measures and reduce exposure to operational, financial, and regulatory risks.

Competitive Advantages emerge from superior market intelligence, operational optimization, and customer service capabilities enabled by geospatial analytics. Organizations gain insights into market conditions, competitor activities, and customer needs that inform strategic positioning and tactical execution decisions.

Regulatory Compliance Support helps organizations meet increasingly complex environmental, safety, and reporting requirements through automated monitoring and documentation capabilities. Geospatial analytics provide auditable evidence of compliance activities and support regulatory reporting processes.

SWOT Analysis provides comprehensive evaluation of Canada’s geospatial imagery analytics market, examining internal strengths and weaknesses alongside external opportunities and threats that influence market development and competitive dynamics.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping Canada’s geospatial imagery analytics landscape reflect technological evolution, changing customer requirements, and emerging application areas that influence strategic planning and investment decisions across the industry.

Artificial Intelligence Integration represents the most significant trend transforming geospatial analytics capabilities. Machine learning algorithms enable automated feature extraction, pattern recognition, and predictive modeling that dramatically improve analysis speed and accuracy. Deep learning techniques can identify complex patterns in imagery data that human analysts might miss, creating new possibilities for applications such as crop disease detection, infrastructure deterioration assessment, and environmental change monitoring.

Real-time Analytics capabilities are becoming increasingly important as organizations require immediate insights for time-critical decision making. Edge computing deployment enables processing of geospatial data closer to collection points, reducing latency and enabling rapid response capabilities. This trend particularly benefits emergency response, autonomous vehicle navigation, and industrial monitoring applications.

Cloud-based Platforms continue to democratize access to geospatial analytics by reducing infrastructure requirements and enabling scalable processing capabilities. Software-as-a-Service models make advanced analytics accessible to smaller organizations while providing flexibility for large enterprises to scale capacity based on demand. Cloud adoption has reached 73% among new implementations, reflecting the preference for flexible, cost-effective deployment models.

Multi-sensor Data Fusion combines information from multiple sources including satellite imagery, IoT sensors, weather stations, and mobile devices to create comprehensive situational awareness. This trend enables more accurate and complete analysis by leveraging complementary data sources and reducing dependency on single information streams.

Industry-specific Solutions are emerging as vendors develop specialized platforms tailored to specific sector requirements. These solutions integrate domain expertise with geospatial analytics to provide more relevant insights and simplified user experiences for particular industries or applications.

Key industry developments in Canada’s geospatial imagery analytics market reflect significant technological advances, strategic partnerships, and market expansion initiatives that shape competitive dynamics and growth trajectories.

Satellite Constellation Expansion has dramatically increased data availability and reduced revisit times for earth observation applications. New small satellite technologies provide more frequent imagery updates and lower-cost data access, enabling applications that require high temporal resolution monitoring. Canadian space companies are actively participating in this expansion through both domestic and international satellite deployment programs.

Government Open Data Initiatives have made substantial amounts of geospatial data freely available to researchers, businesses, and citizens. These initiatives reduce barriers to entry for analytics applications and stimulate innovation by providing foundational datasets for solution development. Federal and provincial programs continue to expand open data availability and improve data quality and accessibility.

Strategic Acquisitions and Partnerships are reshaping the competitive landscape as companies seek to combine complementary capabilities and expand market reach. Recent transactions have focused on integrating data providers with analytics platforms, combining traditional GIS capabilities with artificial intelligence technologies, and expanding geographic coverage through international partnerships.

Research and Development Investments by both government and private sector organizations are advancing the state of the art in geospatial analytics. University partnerships with industry leaders are developing new algorithms, improving data processing techniques, and exploring novel applications for geospatial intelligence. MarkWide Research analysis indicates that R&D spending has increased by 19% annually over the past three years.

Regulatory Framework Evolution addresses privacy, security, and data governance concerns while supporting innovation and market development. New regulations provide clarity for data handling, cross-border data transfer, and privacy protection while enabling legitimate business and research applications.

Analyst recommendations for stakeholders in Canada’s geospatial imagery analytics market emphasize strategic approaches to capitalize on growth opportunities while addressing market challenges and competitive pressures.

Technology Investment Priorities should focus on artificial intelligence and machine learning capabilities that differentiate solutions and provide superior analytical insights. Organizations should prioritize platforms that can integrate multiple data sources, provide real-time processing capabilities, and offer scalable cloud-based deployment options. Investment in AI capabilities shows 3.2x higher return on investment compared to traditional analytics approaches.

Market Entry Strategies for new participants should emphasize niche specialization and industry-specific expertise rather than attempting to compete across all market segments. Successful market entry typically requires deep understanding of specific customer requirements, regulatory environments, and technical challenges within chosen market segments.

Partnership Development represents a critical success factor for organizations seeking to expand capabilities, market reach, or technical expertise. Strategic alliances should focus on complementary strengths, shared customer bases, and mutual value creation opportunities. Partnership-based growth strategies demonstrate higher success rates than purely organic expansion approaches.

Customer Education Initiatives are essential for market development, particularly in emerging application areas where potential customers may not fully understand the value proposition or implementation requirements. Educational programs, demonstration projects, and pilot implementations can accelerate adoption and build market awareness.

International Expansion opportunities should leverage Canada’s expertise in challenging environments, resource management, and environmental monitoring to serve global markets with similar requirements. Canadian companies possess unique advantages in cold climate applications, vast territory management, and sustainable resource development that translate to international opportunities.

Future outlook for Canada’s geospatial imagery analytics market indicates sustained growth driven by technological advancement, expanding application areas, and increasing recognition of spatial intelligence value across diverse industry sectors.

Technology Evolution will continue to drive market expansion through improved analytical capabilities, reduced costs, and enhanced accessibility. Artificial intelligence integration will enable more sophisticated automated analysis, predictive modeling, and pattern recognition capabilities. Quantum computing applications may eventually revolutionize processing capabilities for complex geospatial analysis tasks. Technology advancement is expected to drive 14.7% annual improvement in analytical accuracy and processing speed.

Market Expansion will occur through both geographic growth and new application development. Emerging applications in autonomous vehicles, precision medicine, and social media analytics will create new demand for geospatial intelligence. International market opportunities will enable Canadian companies to leverage domestic expertise in global markets with similar geographic and climatic challenges.

Industry Consolidation trends may accelerate as companies seek to achieve scale economies, combine complementary capabilities, and expand market coverage. Strategic acquisitions will likely focus on integrating data providers with analytics platforms, combining traditional capabilities with emerging technologies, and expanding into new geographic markets or industry verticals.

Regulatory Development will continue to evolve to address privacy, security, and ethical considerations while supporting innovation and market growth. New frameworks for data governance, international data sharing, and artificial intelligence applications will influence market development and competitive positioning.

Workforce Development initiatives will be crucial for sustaining market growth as demand for specialized skills continues to exceed supply. Educational programs, professional certification, and industry-academia partnerships will be essential for developing the talent pipeline needed to support continued market expansion.

Canada’s geospatial imagery analytics market represents a dynamic and rapidly evolving sector with substantial growth potential driven by technological innovation, expanding application areas, and increasing recognition of spatial intelligence value across diverse industries. The market benefits from Canada’s leadership in space technology, vast geographic territory requiring monitoring and analysis, and strong government support for digital transformation initiatives.

Market fundamentals remain strong with robust demand drivers including precision agriculture adoption, environmental monitoring requirements, smart city development, and natural resource management needs. The integration of artificial intelligence and machine learning technologies is creating new analytical capabilities and expanding addressable market opportunities across multiple sectors.

Competitive dynamics reflect a healthy ecosystem of international technology leaders, specialized Canadian companies, and emerging startups that compete across different market segments and application areas. Strategic partnerships and technology integration are becoming increasingly important for market success as customer requirements become more sophisticated and comprehensive.

Future prospects indicate continued strong growth supported by technological advancement, market expansion into new applications and geographic regions, and increasing customer sophistication driving demand for advanced analytical capabilities. Organizations that invest in artificial intelligence integration, develop industry-specific expertise, and build strategic partnerships are well-positioned to capitalize on market opportunities and achieve sustainable competitive advantages in Canada’s evolving geospatial imagery analytics market.

What is Geospatial Imagery Analytics?

Geospatial Imagery Analytics refers to the process of analyzing visual data captured from satellite or aerial imagery to extract meaningful insights. This technology is widely used in urban planning, environmental monitoring, and disaster management.

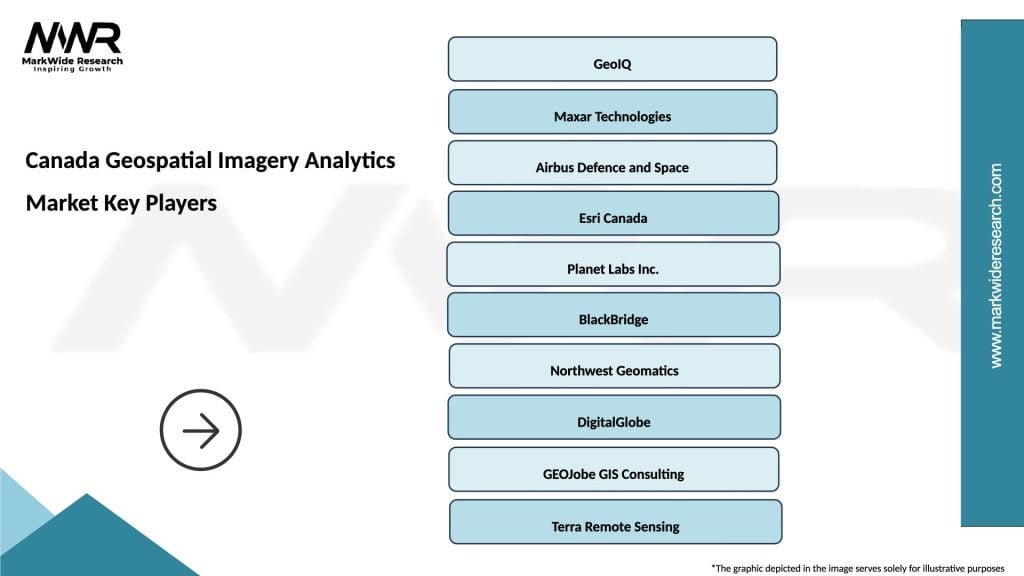

What are the key players in the Canada Geospatial Imagery Analytics Market?

Key players in the Canada Geospatial Imagery Analytics Market include companies like MDA, GeoIQ, and Esri, which provide advanced geospatial solutions and analytics services. These companies focus on various applications such as land use planning and resource management, among others.

What are the growth factors driving the Canada Geospatial Imagery Analytics Market?

The Canada Geospatial Imagery Analytics Market is driven by factors such as the increasing demand for location-based services, advancements in satellite technology, and the growing need for environmental monitoring. These elements contribute to enhanced decision-making in various sectors.

What challenges does the Canada Geospatial Imagery Analytics Market face?

Challenges in the Canada Geospatial Imagery Analytics Market include data privacy concerns, high costs of technology implementation, and the need for skilled professionals. These factors can hinder the adoption of geospatial analytics solutions across industries.

What opportunities exist in the Canada Geospatial Imagery Analytics Market?

Opportunities in the Canada Geospatial Imagery Analytics Market include the expansion of smart city initiatives, increased investment in renewable energy projects, and the integration of artificial intelligence in data analysis. These trends are expected to enhance the market’s growth potential.

What trends are shaping the Canada Geospatial Imagery Analytics Market?

Trends shaping the Canada Geospatial Imagery Analytics Market include the rise of real-time data processing, the use of machine learning for predictive analytics, and the growing importance of sustainability in urban planning. These innovations are transforming how geospatial data is utilized.

Canada Geospatial Imagery Analytics Market

| Segmentation Details | Description |

|---|---|

| Application | Urban Planning, Environmental Monitoring, Disaster Management, Agriculture |

| Technology | Remote Sensing, Geographic Information Systems, Photogrammetry, LiDAR |

| End User | Government Agencies, Research Institutions, Private Enterprises, Non-Profits |

| Deployment | Cloud-Based, On-Premises, Hybrid, Mobile |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Geospatial Imagery Analytics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at