444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The forklift market in Canada is a highly competitive industry that has seen steady growth in recent years. The growth in the Canadian forklift market is driven by the expansion of the manufacturing sector, which is the primary user of forklifts in the country. The forklift market in Canada is expected to grow at a CAGR of 4.2% during the forecast period from 2021 to 2026. The Canadian forklift market was valued at USD 1.15 billion in 2020 and is expected to reach USD 1.44 billion by 2026.

Meaning

Forklifts are material handling equipment that are used to move heavy goods and materials in warehouses, manufacturing facilities, and other industrial settings. Forklifts are essential to the smooth functioning of these industries, as they allow for the safe and efficient movement of materials.

Executive Summary

The forklift market in Canada is expected to see steady growth in the coming years, driven by the expansion of the manufacturing sector. The market is expected to grow at a CAGR of 4.2% during the forecast period from 2021 to 2026. The Canadian forklift market was valued at USD 1.15 billion in 2020 and is expected to reach USD 1.44 billion by 2026. The market is highly competitive, with a few major players dominating the industry.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

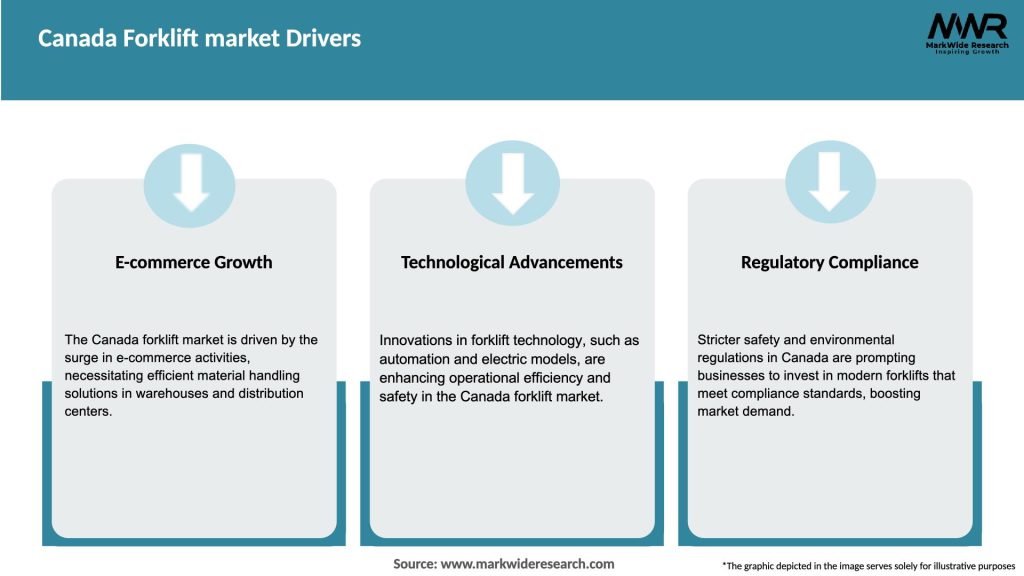

Market Drivers

The growth of the manufacturing sector in Canada is one of the primary drivers of the forklift market. As manufacturing companies expand their operations and increase their production capacity, the demand for material handling equipment such as forklifts also increases.

The increasing focus on environmental sustainability has led to a growing demand for eco-friendly material handling equipment. The electric forklift segment is expected to see the highest growth during the forecast period, driven by the increasing demand for eco-friendly equipment.

The growing adoption of automation in material handling has also driven the growth of the forklift market. Automated guided vehicles (AGVs) and other forms of automation are increasingly being used in warehouses and manufacturing facilities, which has increased the demand for forklifts that can be integrated with these systems.

Market Restraints

The high initial investment required for forklifts is one of the primary restraints to market growth. Forklifts can be expensive, especially for small and medium-sized businesses, which may limit their adoption.

Forklifts require regular maintenance and repairs, which can be costly. These costs can be a deterrent for some businesses, especially those with limited budgets.

Forklifts can be dangerous if not used properly. Safety concerns, such as the risk of accidents and injuries, can be a barrier to adoption for some businesses.

Market Opportunities

The increasing demand for eco-friendly material handling equipment presents a significant opportunity for the electric forklift segment. Electric forklifts are more energy-efficient and emit less pollution than their internal combustion engine (ICE) counterparts, making them an attractive option for businesses looking to reduce their environmental impact.

The growth of e-commerce has led to an increase in the demand for warehousing and distribution facilities. This presents an opportunity for the forklift market, as these facilities require a large number of forklifts to handle the movement of goods.

The adoption of advanced technologies such as automation, artificial intelligence (AI), and the Internet of Things (IoT) in material handling presents an opportunity for the forklift market. Forklifts that can be integrated with these technologies are likely to see increased demand in the coming years.

Market Dynamics

The forklift market in Canada is highly competitive, with a few major players dominating the industry. Toyota, Crown Equipment Corporation, and Raymond are some of the major players in the Canadian forklift market.

The market is characterized by the presence of both global and local players. Global players dominate the market, but local players also have a significant presence, particularly in the rental segment.

The market is expected to see steady growth in the coming years, driven by the expansion of the manufacturing sector and the increasing demand for eco-friendly material handling equipment.

Regional Analysis

The Canadian forklift market is divided into five regions: Ontario, Quebec, Western Canada, Atlantic Canada, and Northern Canada. Ontario is the largest market for forklifts in Canada, accounting for more than a third of the market share. Quebec is the second-largest market, followed by Western Canada.

Competitive Landscape

Leading Companies in the Canada Forklift Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The forklift market in Canada can be segmented based on type, end-user, and fuel type.

By Type:

By End-User:

By Fuel Type:

Category-wise Insights

Electric forklifts are expected to see the highest growth during the forecast period, driven by the increasing demand for eco-friendly material handling equipment. The warehousing and distribution segment is the largest end-user of forklifts in Canada, accounting for more than half of the market share.

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

The electric forklift segment is expected to see the highest growth during the forecast period, driven by the increasing demand for eco-friendly material handling equipment. Electric forklifts are more energy-efficient and emit less pollution than their ICE counterparts, making them an attractive option for businesses looking to reduce their environmental impact.

Forklifts that can be integrated with advanced technologies such as automation, AI, and IoT are likely to see increased demand in the coming years. These technologies can improve the efficiency and productivity of material handling operations, making them an attractive option for businesses.

The forklift industry is placing an increased focus on safety, with the development of new technologies and standards aimed at reducing the risk of accidents and injuries. Businesses that prioritize safety in their material handling operations are likely to see increased demand for their services.

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the forklift market in Canada, as it did on many industries around the world. The pandemic led to a slowdown in economic activity, which affected the demand for forklifts in the country.

However, the impact of the pandemic on the forklift market was relatively mild, as the essential nature of the industry meant that it was less affected than other sectors. The increasing adoption of e-commerce also helped to mitigate the impact of the pandemic on the forklift market, as it drove demand for warehousing and distribution facilities.

Key Industry Developments

Many forklift manufacturers are developing eco-friendly forklifts in response to the growing demand for sustainable material handling equipment. These forklifts use alternative fuels or electric power to reduce their environmental impact.

Forklifts are increasingly being integrated with advanced technologies such as automation, AI, and IoT to improve their efficiency and productivity. This trend is likely to continue in the coming years as businesses seek to improve their material handling operations.

Analyst Suggestions

Future Outlook

The forklift market in Canada is expected to see steady growth in the coming years, driven by the expansion of the manufacturing sector and the increasing demand for eco-friendly material handling equipment. The electric forklift segment is expected to see the highest growth, driven by the growing focus on environmental sustainability.

Conclusion

The forklift market in Canada is a highly competitive industry that is expected to see steady growth in the coming years. The expansion of the manufacturing sector and the increasing demand for eco-friendly material handling equipment are the primary drivers of market growth. Businesses that prioritize safety and sustainability in their material handling operations are likely to see increased demand for their services.

What is Forklift?

A forklift is a powered industrial truck used to lift and move materials over short distances. They are commonly used in warehouses, construction sites, and manufacturing facilities for transporting heavy loads.

What are the key players in the Canada Forklift market?

Key players in the Canada Forklift market include Toyota Industries Corporation, Hyster-Yale Materials Handling, Inc., and Crown Equipment Corporation, among others.

What are the main drivers of growth in the Canada Forklift market?

The main drivers of growth in the Canada Forklift market include the increasing demand for efficient material handling solutions, the growth of e-commerce, and advancements in forklift technology.

What challenges does the Canada Forklift market face?

The Canada Forklift market faces challenges such as high operational costs, the need for skilled operators, and regulatory compliance related to safety standards.

What opportunities exist in the Canada Forklift market?

Opportunities in the Canada Forklift market include the adoption of electric forklifts, the integration of automation and IoT technologies, and the expansion of logistics and warehousing sectors.

What trends are shaping the Canada Forklift market?

Trends shaping the Canada Forklift market include the shift towards sustainable and energy-efficient forklifts, the rise of automation in material handling, and the increasing use of advanced safety features.

Canada Forklift market

| Segmentation Details | Description |

|---|---|

| Product Type | Electric Forklifts, Diesel Forklifts, LPG Forklifts, Reach Trucks |

| End User | Construction, Warehousing, Manufacturing, Retail |

| Technology | Automated Guided Vehicles, Telemetry Systems, IoT-Enabled Forklifts, Battery Management Systems |

| Capacity | 1-3 Tons, 3-5 Tons, 5-10 Tons, Above 10 Tons |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Canada Forklift Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at