444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Canada Fine Art Insurance market refers to the specialized insurance coverage designed to protect valuable artwork and collectibles against various risks. It provides financial protection for art collectors, galleries, museums, and artists in the event of theft, damage, loss, or other perils. Fine art insurance plays a crucial role in preserving and safeguarding Canada’s rich cultural heritage and artistic assets.

Meaning

Fine art insurance is a type of coverage that offers financial protection for valuable artwork and collectibles. It is specifically tailored to the unique risks associated with owning and displaying fine art. This insurance ensures that artists, collectors, and cultural institutions can mitigate potential financial losses resulting from theft, damage, or loss of their artworks.

Executive Summary

The Canada Fine Art Insurance market has witnessed steady growth in recent years. With the increasing value and demand for fine art, there is a growing need for insurance coverage to protect these valuable assets. The market is driven by factors such as the rising number of high-net-worth individuals, expanding art market, and increased awareness about the need for insurance among art collectors and institutions. However, challenges such as high premiums, complex valuation processes, and limited coverage options restrict market growth to some extent. Nevertheless, the market presents significant opportunities for insurers to develop innovative products and expand their customer base.

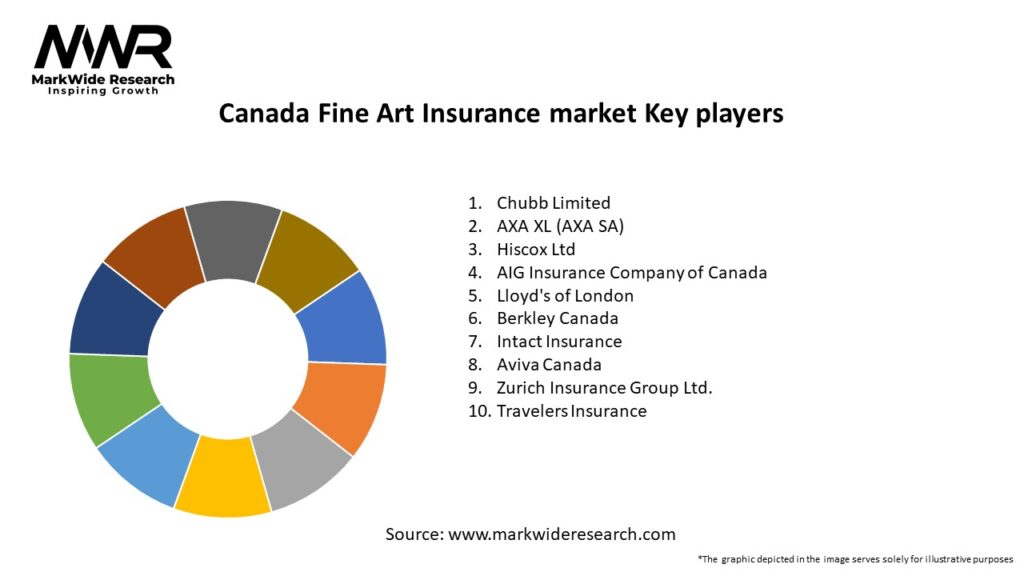

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Canada Fine Art Insurance market operates in a dynamic environment influenced by various factors. Market dynamics are shaped by the value and demand for fine art, the behavior of high-net-worth individuals, the growth of the art market, and the evolving risk landscape. Insurers in this market must adapt to changing customer needs, leverage technology for efficient operations, and provide personalized solutions to stay competitive.

Regional Analysis

The Canada Fine Art Insurance market exhibits regional variations based on factors such as the concentration of art collectors, museums, galleries, and cultural institutions. Regions with a vibrant art scene, such as Toronto, Vancouver, and Montreal, have a higher demand for fine art insurance. These cities are home to renowned art galleries, auction houses, and cultural events, attracting art collectors and institutions from across the country.

Competitive Landscape

Leading Companies: Canada Fine Art Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

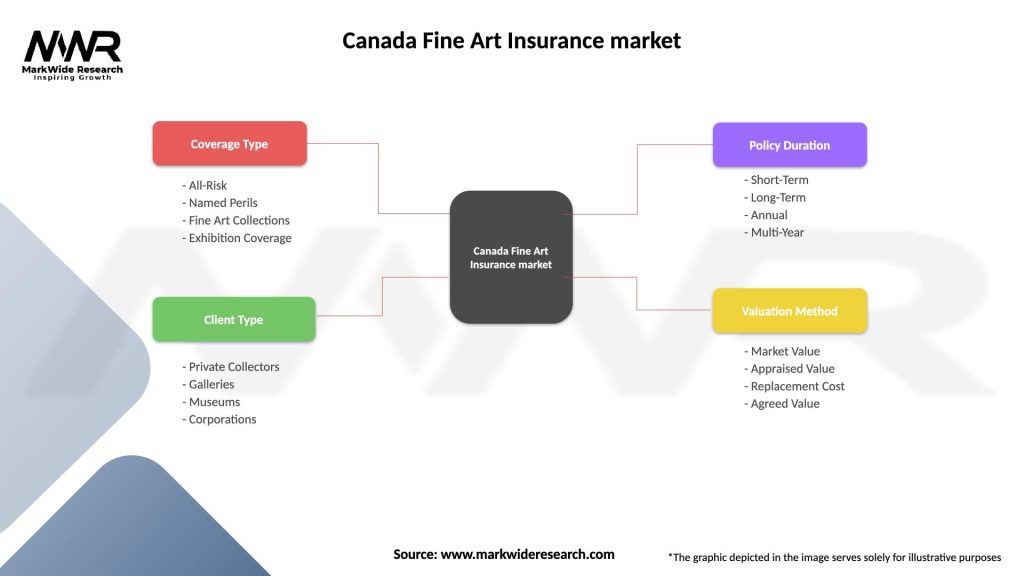

Segmentation

The Canada Fine Art Insurance market can be segmented based on the type of coverage, customer type, and end-use application.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the Canada Fine Art Insurance market. The art industry faced challenges due to temporary closures of galleries, cancellation of art fairs, and disruptions in art logistics. The pandemic also highlighted the importance of comprehensive insurance coverage for art collectors and institutions. The market witnessed an increased interest in coverage against risks such as business interruption, cancellation of exhibitions, and transit-related challenges due to travel restrictions. Insurers responded by adapting their coverage options to address the evolving needs of the art community during the pandemic.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Canada Fine Art Insurance market is expected to witness continued growth in the coming years. Factors such as the increasing value of fine art assets, rising awareness about risks, and the growing number of high-net-worth individuals investing in art are expected to drive market expansion. Insurers will need to adapt to changing customer needs, develop innovative coverage options, and leverage technology to stay competitive in this evolving market. The integration of blockchain technology, the expansion of cyber insurance coverage, and a focus on loss prevention and risk management are expected to shape the future landscape of the fine art insurance industry.

Conclusion

The Canada Fine Art Insurance market plays a critical role in providing financial protection to art collectors, galleries, museums, and artists. With the increasing value of fine art assets and the growing awareness about the risks associated with owning and displaying artworks, the demand for insurance coverage has been steadily increasing. While challenges such as high premiums and complex valuation processes exist, insurers have opportunities to innovate and collaborate with art professionals to provide comprehensive coverage options. The future outlook for the market remains positive, with the potential for continued growth driven by market trends, technological advancements, and the evolving needs of the art community.

What is Fine Art Insurance?

Fine Art Insurance is a specialized type of insurance that protects artworks, including paintings, sculptures, and collectibles, against risks such as theft, damage, and loss. This insurance is essential for collectors, galleries, and museums to safeguard their valuable assets.

What are the key players in the Canada Fine Art Insurance market?

Key players in the Canada Fine Art Insurance market include companies like Hiscox, Chubb, and AXA Art, which offer tailored insurance solutions for art collectors and institutions. These companies provide coverage options that cater to the unique needs of the fine art sector, among others.

What are the growth factors driving the Canada Fine Art Insurance market?

The Canada Fine Art Insurance market is driven by increasing art investments, a growing number of art collectors, and the rising value of artworks. Additionally, the expansion of online art sales platforms has heightened the need for comprehensive insurance coverage.

What challenges does the Canada Fine Art Insurance market face?

Challenges in the Canada Fine Art Insurance market include the difficulty in accurately valuing artworks, the risk of fraud, and the complexities of insuring unique and high-value items. These factors can complicate underwriting processes and claims management.

What opportunities exist in the Canada Fine Art Insurance market?

Opportunities in the Canada Fine Art Insurance market include the potential for innovative insurance products that cater to emerging art forms, such as digital art and NFTs. Additionally, partnerships with art institutions and galleries can enhance market reach and customer engagement.

What trends are shaping the Canada Fine Art Insurance market?

Trends in the Canada Fine Art Insurance market include the increasing use of technology for art valuation and risk assessment, as well as a growing emphasis on sustainability in art practices. Furthermore, the rise of online platforms for art sales is influencing insurance needs and coverage options.

Canada Fine Art Insurance market

| Segmentation Details | Description |

|---|---|

| Coverage Type | All-Risk, Named Perils, Fine Art Collections, Exhibition Coverage |

| Client Type | Private Collectors, Galleries, Museums, Corporations |

| Policy Duration | Short-Term, Long-Term, Annual, Multi-Year |

| Valuation Method | Market Value, Appraised Value, Replacement Cost, Agreed Value |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies: Canada Fine Art Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at