444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The factoring services market in Canada plays a vital role in providing working capital solutions to businesses across various industries. Factoring, also known as accounts receivable financing, involves the sale of accounts receivable to a third-party financial institution, known as a factor, in exchange for immediate cash. This market facilitates cash flow management, reduces credit risk, and supports business growth by providing businesses with access to funds tied up in outstanding invoices.

Meaning

Factoring services in Canada refer to the financial practice of converting accounts receivable into immediate cash by selling invoices to specialized financial institutions called factors. Businesses use factoring to improve cash flow, mitigate credit risk, and accelerate growth without taking on additional debt. Factors provide advances against outstanding invoices, typically ranging from 70% to 90% of the invoice value, and assume responsibility for collecting payment from customers.

Executive Summary

The factoring services market in Canada is experiencing steady growth, driven by factors such as increasing demand for working capital solutions, the growing popularity of alternative financing options, and the need for efficient cash flow management among businesses. While the market offers significant opportunities for factors and businesses alike, challenges such as regulatory compliance, credit risk management, and market competition need to be addressed to sustain growth and ensure the stability of the factoring ecosystem.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The factoring services market in Canada operates within a dynamic and evolving ecosystem shaped by factors such as economic conditions, technological advancements, regulatory developments, and market competition. These dynamics influence the demand for factoring services, the competitive landscape, and the overall growth and sustainability of the factoring industry in Canada.

Regional Analysis

The factoring services market in Canada exhibits regional variations in terms of market demand, industry composition, regulatory environment, and competitive landscape. Key regions such as Ontario, Quebec, Alberta, and British Columbia represent significant market opportunities for factors, with diverse industries and business sectors driving demand for factoring services across the country.

Competitive Landscape

Leading Companies in Canada Factoring Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

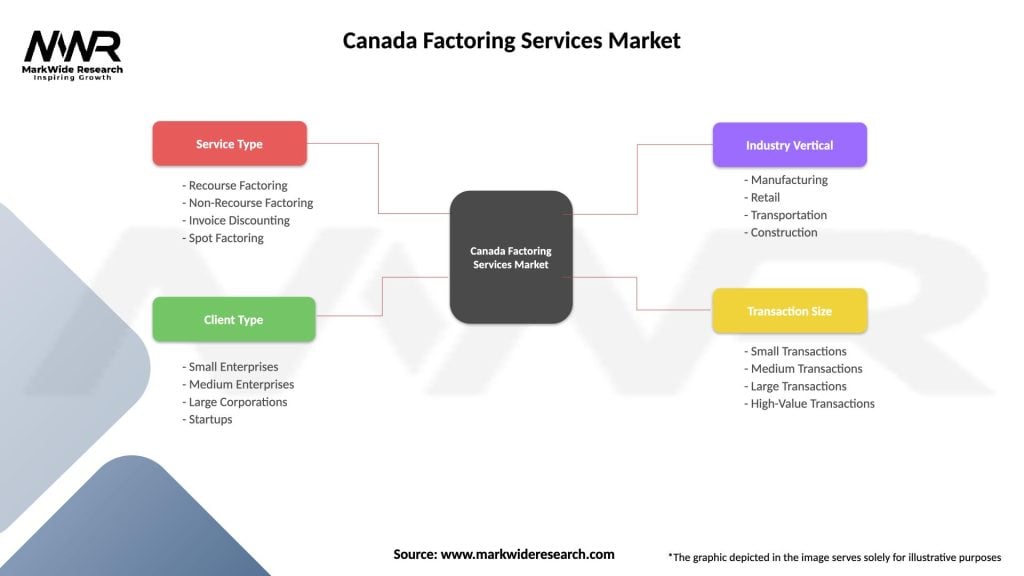

Segmentation

The factoring services market in Canada can be segmented based on factors such as industry verticals, invoice volume, geographic regions, and client profiles. Segmentation enables factors to tailor their offerings, pricing structures, and marketing strategies to specific customer segments, enhancing relevance, targeting, and customer satisfaction.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the factoring services market in Canada, causing disruptions to supply chains, business operations, and cash flow management. While the initial phase of the pandemic led to uncertainty and volatility in the factoring industry, factors quickly adapted to the changing landscape by implementing remote operations, digital solutions, and flexible financing options to support businesses through the crisis.

Key Industry Developments

Analyst Suggestions

Future Outlook

The factoring services market in Canada is expected to rebound and resume growth trajectory as businesses recover from the impacts of the pandemic, economic activity resumes, and demand for working capital solutions rebounds. Factors such as technological innovation, regulatory evolution, and industry collaboration will continue to shape the future of the factoring industry in Canada, driving innovation, expansion, and sustainability.

Conclusion

The factoring services market in Canada plays a crucial role in supporting businesses’ working capital needs, enhancing cash flow management, and fueling economic growth. Despite challenges posed by regulatory compliance, credit risk management, and market competition, the factoring industry in Canada remains resilient, adaptable, and well-positioned for future growth and innovation. By embracing technology, collaboration, and customer-centricity, factors can navigate uncertainty, seize opportunities, and contribute to a vibrant and dynamic factoring ecosystem that benefits businesses, industries, and the Canadian economy as a whole.

What is Factoring Services?

Factoring services involve the sale of accounts receivable to a third party, known as a factor, to improve cash flow. This financial solution is commonly used by businesses to manage their working capital and reduce the risk of bad debts.

What are the key players in the Canada Factoring Services Market?

Key players in the Canada Factoring Services Market include companies like FundThrough, Triumph Business Capital, and Canadian Factoring Company, among others. These firms provide various factoring solutions tailored to different industries, including manufacturing and retail.

What are the growth factors driving the Canada Factoring Services Market?

The Canada Factoring Services Market is driven by factors such as the increasing need for cash flow management among small and medium-sized enterprises (SMEs) and the growing demand for alternative financing solutions. Additionally, the rise in e-commerce has led to more businesses seeking factoring services to manage their receivables efficiently.

What challenges does the Canada Factoring Services Market face?

Challenges in the Canada Factoring Services Market include the potential for high fees associated with factoring services and the risk of dependency on external financing. Furthermore, businesses may face difficulties in finding reputable factoring companies that align with their specific needs.

What opportunities exist in the Canada Factoring Services Market?

Opportunities in the Canada Factoring Services Market include the expansion of digital platforms that facilitate faster and more efficient factoring processes. Additionally, there is potential for growth in niche markets, such as startups and tech companies, that require flexible financing options.

What trends are shaping the Canada Factoring Services Market?

Trends in the Canada Factoring Services Market include the increasing adoption of technology-driven solutions, such as online factoring platforms and automated credit assessments. Moreover, there is a growing emphasis on customer service and personalized solutions to meet the diverse needs of businesses.

Canada Factoring Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Recourse Factoring, Non-Recourse Factoring, Invoice Discounting, Spot Factoring |

| Client Type | Small Enterprises, Medium Enterprises, Large Corporations, Startups |

| Industry Vertical | Manufacturing, Retail, Transportation, Construction |

| Transaction Size | Small Transactions, Medium Transactions, Large Transactions, High-Value Transactions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Canada Factoring Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at