444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada endoscopy equipment market represents a dynamic and rapidly evolving segment of the country’s healthcare technology landscape. This specialized market encompasses a comprehensive range of medical devices designed for minimally invasive diagnostic and therapeutic procedures, including flexible and rigid endoscopes, visualization systems, and associated accessories. Healthcare providers across Canada are increasingly adopting advanced endoscopic technologies to enhance patient outcomes while reducing procedural complications and recovery times.

Market dynamics indicate robust growth driven by an aging population, increasing prevalence of gastrointestinal disorders, and rising demand for early disease detection. The Canadian healthcare system’s emphasis on preventive care and screening programs has significantly boosted the adoption of endoscopic procedures. Technological advancements in high-definition imaging, artificial intelligence integration, and wireless capsule endoscopy are reshaping the market landscape, with growth rates projected at approximately 6.2% CAGR over the forecast period.

Regional distribution shows concentrated demand in major metropolitan areas including Toronto, Vancouver, and Montreal, where leading healthcare institutions drive innovation adoption. The market benefits from government healthcare initiatives and substantial investments in medical infrastructure modernization. Private healthcare facilities are also contributing to market expansion, particularly in specialized gastroenterology and surgical centers.

The Canada endoscopy equipment market refers to the comprehensive ecosystem of medical devices, instruments, and technologies used for internal body examination and minimally invasive surgical procedures within the Canadian healthcare system. This market encompasses various categories of endoscopic equipment including gastrointestinal endoscopes, bronchoscopes, arthroscopes, laparoscopes, and associated visualization and documentation systems.

Endoscopy equipment enables healthcare professionals to visualize internal organs and body cavities through natural openings or small incisions, facilitating accurate diagnosis and therapeutic interventions. The market includes both reusable and disposable endoscopic devices, ranging from traditional fiber-optic systems to advanced digital platforms with enhanced imaging capabilities. Integration capabilities with hospital information systems and electronic health records further define the modern endoscopy equipment landscape in Canada.

Canada’s endoscopy equipment market demonstrates exceptional growth potential driven by demographic shifts, technological innovation, and evolving healthcare delivery models. The market encompasses diverse product categories serving multiple medical specialties, with gastrointestinal endoscopy representing the largest segment due to widespread screening programs and diagnostic applications.

Key market drivers include the increasing incidence of chronic diseases, government support for healthcare modernization, and growing awareness of minimally invasive procedures among patients and healthcare providers. Technological convergence with artificial intelligence, machine learning, and advanced imaging technologies is creating new opportunities for market expansion, with adoption rates increasing by approximately 15% annually in major healthcare centers.

Competitive dynamics feature both international medical device manufacturers and emerging Canadian technology companies developing innovative endoscopic solutions. The market benefits from strong regulatory frameworks and quality standards that ensure patient safety while promoting innovation. Healthcare digitization initiatives across provinces are accelerating the integration of advanced endoscopy systems with broader hospital technology infrastructures.

Strategic market insights reveal several critical trends shaping the Canadian endoscopy equipment landscape:

Primary market drivers propelling the Canada endoscopy equipment market include demographic, technological, and healthcare policy factors that create sustained demand for advanced medical devices.

Aging population dynamics represent the most significant driver, with Canadians over 65 requiring increased medical screening and diagnostic procedures. Gastrointestinal disorders, respiratory conditions, and orthopedic issues become more prevalent with age, directly correlating with endoscopy equipment utilization. Preventive healthcare initiatives promoted by provincial health authorities emphasize early detection through regular screening programs, particularly for colorectal cancer prevention.

Technological advancement serves as a crucial driver, with healthcare providers seeking equipment that offers superior imaging quality, enhanced diagnostic capabilities, and improved patient comfort. Minimally invasive surgery trends continue gaining momentum as patients and surgeons recognize benefits including reduced recovery times, lower complication rates, and improved cosmetic outcomes. Healthcare digitization initiatives across Canada are driving demand for connected endoscopy systems that integrate seamlessly with electronic health records and hospital information systems.

Government healthcare investments and infrastructure modernization programs provide substantial market support, with federal and provincial funding allocated for medical equipment upgrades. Private healthcare expansion in specialized areas creates additional demand channels, particularly for premium endoscopy equipment in ambulatory surgical centers and specialized clinics.

Market restraints present significant challenges that may limit the growth potential of Canada’s endoscopy equipment market, requiring strategic approaches from manufacturers and healthcare providers.

High capital costs associated with advanced endoscopy systems create budget constraints for healthcare institutions, particularly smaller hospitals and clinics operating with limited financial resources. Maintenance and service expenses add to the total cost of ownership, requiring ongoing budget allocations that may strain healthcare facility finances. Training requirements for sophisticated equipment necessitate substantial investments in staff education and certification programs.

Regulatory complexities can delay product approvals and market entry, with Health Canada requirements demanding extensive clinical data and safety documentation. Reimbursement challenges may limit adoption of newer technologies if provincial health insurance programs do not provide adequate coverage for advanced procedures. Competition from refurbished equipment markets offers cost-effective alternatives that may reduce demand for new systems.

Technical complexity of modern endoscopy equipment requires specialized technical support and may create operational challenges for healthcare facilities lacking adequate IT infrastructure. Infection control concerns and sterilization requirements add operational complexity and costs, particularly for reusable endoscopic devices. Supply chain disruptions can impact equipment availability and service support, affecting healthcare provider confidence in technology investments.

Emerging opportunities in the Canada endoscopy equipment market present substantial potential for growth and innovation across multiple dimensions of healthcare delivery and technology development.

Artificial intelligence integration represents a transformative opportunity, with AI-powered diagnostic assistance and automated image analysis capabilities enhancing physician decision-making and improving diagnostic accuracy. Machine learning algorithms can identify subtle pathological changes that might be missed during traditional visual examination, potentially revolutionizing early disease detection rates by approximately 25-30% according to recent studies.

Telemedicine expansion creates opportunities for remote endoscopy consultation and training programs, particularly beneficial for rural and underserved communities across Canada’s vast geography. Mobile endoscopy units equipped with advanced portable systems can extend specialized care to remote locations, addressing healthcare accessibility challenges. Home-based monitoring through capsule endoscopy and wearable devices offers new service delivery models.

Sustainability initiatives drive demand for environmentally friendly endoscopy solutions, including biodegradable accessories and energy-efficient systems. Digital pathology integration enables seamless workflow connectivity between endoscopy procedures and laboratory analysis. Robotic-assisted endoscopy represents an emerging frontier with potential for enhanced precision and reduced operator fatigue during complex procedures.

Market dynamics in the Canada endoscopy equipment sector reflect complex interactions between technological innovation, healthcare policy, demographic trends, and economic factors that collectively shape market evolution.

Supply-demand equilibrium is influenced by healthcare capacity planning and equipment replacement cycles, with major hospitals typically upgrading endoscopy systems every 7-10 years. Technology adoption patterns show accelerated uptake of digital systems over traditional analog equipment, with digital penetration reaching approximately 78% of installed base in major Canadian healthcare centers. Competitive pressures drive continuous innovation and price optimization strategies among equipment manufacturers.

Healthcare provider preferences increasingly favor integrated solutions that offer comprehensive workflow management, from patient scheduling through procedure documentation and follow-up care coordination. Interoperability requirements mandate compatibility with existing hospital information systems and electronic health record platforms. Service and support expectations have evolved to include predictive maintenance, remote diagnostics, and rapid response technical support.

Regulatory dynamics continue evolving with updated safety standards and cybersecurity requirements for connected medical devices. Market consolidation trends among healthcare providers create opportunities for standardized equipment procurement and volume-based pricing negotiations. Innovation cycles are accelerating, with new product introductions occurring more frequently as manufacturers compete for market share in this growing segment.

Comprehensive research methodology employed for analyzing the Canada endoscopy equipment market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability of market insights and projections.

Primary research activities include structured interviews with key stakeholders across the healthcare ecosystem, including hospital administrators, gastroenterologists, surgical specialists, and procurement managers at major Canadian healthcare institutions. Survey methodologies capture quantitative data on equipment utilization patterns, replacement planning, and technology preferences among healthcare providers. Expert consultations with medical device industry professionals provide insights into technological trends and competitive dynamics.

Secondary research encompasses analysis of government healthcare statistics, medical device regulatory filings, and industry publications to establish market baseline data and historical trends. Financial analysis of publicly traded medical device companies with significant Canadian operations provides insights into market performance and investment patterns. Patent analysis reveals innovation trends and emerging technology developments in endoscopy equipment.

Data validation processes include cross-referencing multiple sources and conducting follow-up interviews to verify key findings. Statistical modeling techniques project market growth scenarios based on demographic trends, healthcare spending patterns, and technology adoption rates. MarkWide Research analytical frameworks ensure comprehensive coverage of market segments and competitive landscape dynamics.

Regional market distribution across Canada reveals significant variations in endoscopy equipment demand, adoption patterns, and growth opportunities influenced by population density, healthcare infrastructure, and economic factors.

Ontario province dominates the market with approximately 42% market share, driven by the Greater Toronto Area’s concentration of major hospitals, specialty clinics, and research institutions. University Health Network and other leading healthcare systems in Ontario serve as early adopters of advanced endoscopy technologies, influencing adoption patterns across the province. Quebec represents the second-largest regional market at approximately 23% share, with Montreal’s healthcare institutions driving demand for French-language compatible systems and specialized gastroenterology equipment.

British Columbia accounts for approximately 15% market share, with Vancouver’s healthcare facilities emphasizing integration with digital health initiatives and telemedicine capabilities. Alberta contributes approximately 12% market share, supported by strong provincial healthcare funding and energy sector-driven economic prosperity. Atlantic provinces collectively represent 5% market share, with opportunities for mobile endoscopy solutions and telemedicine-enabled remote consultation services.

Prairie provinces including Saskatchewan and Manitoba show growing demand for portable and mobile endoscopy solutions to serve rural populations. Northern territories present unique opportunities for specialized equipment designed for remote healthcare delivery and extreme climate conditions. Regional healthcare networks are increasingly coordinating equipment procurement to achieve economies of scale and standardization benefits.

Competitive landscape in the Canada endoscopy equipment market features a diverse mix of global medical device manufacturers, specialized endoscopy companies, and emerging technology innovators competing across multiple product categories and market segments.

Market leaders include established international companies with comprehensive product portfolios and strong Canadian distribution networks:

Competitive strategies focus on technological differentiation, comprehensive service offerings, and strategic partnerships with healthcare providers. Innovation investments emphasize AI integration, improved imaging quality, and enhanced workflow efficiency. Market positioning varies from premium technology leaders to cost-effective solution providers serving different healthcare facility segments.

Market segmentation analysis reveals distinct categories within the Canada endoscopy equipment market, each characterized by specific applications, technology requirements, and growth dynamics.

By Product Type:

By Application:

By End User:

Category-specific analysis provides detailed insights into performance, trends, and opportunities within major segments of the Canada endoscopy equipment market.

Flexible Endoscopes Category: This dominant segment benefits from increasing screening program adoption and technological advances in image quality. High-definition systems are replacing standard definition equipment at an accelerated pace, with upgrade rates reaching approximately 35% annually in major healthcare centers. Narrow-band imaging and other advanced visualization techniques are becoming standard features, enhancing diagnostic accuracy for early cancer detection.

Visualization Systems Category: 4K ultra-high-definition systems are gaining traction among premium healthcare facilities seeking superior image quality for complex procedures. Integration capabilities with hospital information systems and electronic health records drive purchasing decisions. Artificial intelligence features for automated polyp detection and lesion characterization represent emerging value propositions.

Capsule Endoscopy Category: This innovative segment shows robust growth potential with patient preference for non-invasive procedures driving adoption. Technological improvements in battery life, image quality, and data transmission are expanding clinical applications beyond small bowel examination. Cost-effectiveness compared to traditional endoscopy for certain indications supports market expansion.

Accessories Category: Disposable accessories represent a high-growth segment driven by infection control requirements and procedural volume increases. Advanced therapeutic devices including radiofrequency ablation systems and endoscopic suturing devices expand treatment capabilities. Single-use endoscopes are emerging as alternatives to traditional reusable systems in specific applications.

Industry participants and stakeholders in the Canada endoscopy equipment market realize substantial benefits through strategic positioning and value creation across the healthcare ecosystem.

Healthcare Providers Benefits:

Equipment Manufacturers Benefits:

Patient Benefits:

Comprehensive SWOT analysis reveals strategic positioning factors and market dynamics affecting the Canada endoscopy equipment market.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the Canada endoscopy equipment landscape reflect technological evolution, changing healthcare delivery models, and evolving patient expectations.

Artificial Intelligence Integration represents the most significant trend, with AI-powered diagnostic assistance becoming increasingly sophisticated. Machine learning algorithms can now identify polyps, lesions, and other abnormalities with accuracy rates exceeding 90% in clinical trials. Real-time analysis during procedures provides immediate feedback to physicians, potentially improving diagnostic accuracy and reducing missed lesions.

Miniaturization and Portability trends are making advanced endoscopy capabilities available in smaller healthcare facilities and mobile settings. Portable endoscopy units enable specialized care delivery in rural communities and emergency situations. Wireless connectivity allows remote consultation and expert guidance during procedures, expanding access to specialized expertise.

Single-Use Endoscopes are gaining acceptance as alternatives to traditional reusable systems, driven by infection control concerns and operational simplicity. Cost-effectiveness improvements and performance enhancements are expanding applications beyond initial niche uses. Environmental considerations are driving development of biodegradable single-use devices.

Digital Pathology Integration enables seamless workflow from endoscopic examination through laboratory analysis and diagnosis. Cloud-based platforms facilitate collaboration between healthcare providers and support telemedicine applications. Data analytics capabilities provide insights into procedural outcomes and quality metrics.

Recent industry developments highlight the dynamic nature of the Canada endoscopy equipment market, with significant advances in technology, regulatory approvals, and strategic partnerships shaping market evolution.

Regulatory Approvals: Health Canada has approved several innovative endoscopy technologies, including AI-powered diagnostic systems and advanced therapeutic devices. Expedited review processes for breakthrough technologies are accelerating market entry for innovative solutions. Cybersecurity guidelines for connected medical devices are establishing new compliance requirements.

Technology Launches: Major manufacturers have introduced next-generation endoscopy systems featuring 4K ultra-high-definition imaging, enhanced AI capabilities, and improved ergonomics. Capsule endoscopy innovations include extended battery life and enhanced imaging quality. Robotic-assisted endoscopy systems are entering clinical trials at leading Canadian medical centers.

Strategic Partnerships: Healthcare providers are forming partnerships with technology companies to develop customized solutions and integrated workflows. Academic collaborations between medical device manufacturers and research institutions are driving innovation in endoscopy applications. Service partnerships are expanding technical support and training capabilities across Canada’s geographic expanse.

Investment Activities: Venture capital and private equity investments in endoscopy technology startups are increasing, with focus on AI applications and novel imaging techniques. Government funding for healthcare technology innovation is supporting Canadian companies developing endoscopy solutions. Infrastructure investments in healthcare facilities are creating demand for advanced endoscopy equipment.

Strategic recommendations for market participants in the Canada endoscopy equipment sector focus on positioning for sustainable growth and competitive advantage in an evolving healthcare landscape.

For Equipment Manufacturers: MarkWide Research analysis suggests prioritizing AI integration and digital connectivity features to differentiate products in a competitive market. Investment in Canadian partnerships and local service capabilities will be crucial for success in this geographically diverse market. Flexible pricing models including leasing and service-inclusive packages can address healthcare budget constraints while maintaining revenue growth.

For Healthcare Providers: Strategic equipment planning should consider total cost of ownership including training, maintenance, and upgrade pathways. Standardization across facilities can achieve economies of scale and simplify staff training requirements. Pilot programs for emerging technologies allow evaluation of clinical and economic benefits before major investments.

For Technology Investors: Focus areas should include AI-powered diagnostics, portable endoscopy solutions, and digital health integration platforms. Canadian market entry strategies should account for regulatory requirements and healthcare system characteristics. Partnership approaches with established medical device companies can accelerate market penetration and reduce regulatory risks.

For Policy Makers: Healthcare technology policies should balance innovation promotion with patient safety and cost containment objectives. Rural healthcare initiatives should consider mobile endoscopy solutions and telemedicine integration. Training and education programs will be essential to maximize benefits from advanced endoscopy technologies.

Future market outlook for the Canada endoscopy equipment market indicates sustained growth driven by demographic trends, technological innovation, and evolving healthcare delivery models over the next decade.

Growth projections suggest continued market expansion with compound annual growth rates expected to reach approximately 6.8% through 2030. Demographic drivers including population aging and increasing chronic disease prevalence will sustain demand for endoscopic procedures. Technology adoption rates are expected to accelerate as AI-powered systems demonstrate clinical value and cost-effectiveness.

Technological evolution will likely focus on enhanced automation, improved patient comfort, and expanded diagnostic capabilities. Robotic-assisted endoscopy may become mainstream for complex procedures, while capsule endoscopy applications will expand beyond gastrointestinal examination. Molecular imaging integration could enable real-time tissue characterization and targeted therapy guidance.

Market structure changes may include increased consolidation among equipment manufacturers and healthcare providers. Service-based business models could become more prevalent, with equipment-as-a-service offerings addressing capital budget constraints. Digital health integration will likely become a standard requirement rather than a differentiating feature.

Regional development patterns suggest continued concentration in major metropolitan areas, with innovative solutions emerging for rural and remote healthcare delivery. Cross-border collaboration with the United States may increase, particularly in border regions with shared healthcare resources. MWR forecasts indicate that sustainability considerations will increasingly influence purchasing decisions and product development priorities.

The Canada endoscopy equipment market represents a dynamic and rapidly evolving segment of the healthcare technology landscape, characterized by strong growth fundamentals, technological innovation, and significant opportunities for market participants. Demographic trends including population aging and increasing chronic disease prevalence provide sustained demand drivers, while technological advances in AI integration, imaging quality, and procedural efficiency create compelling value propositions for healthcare providers.

Market dynamics reflect the complex interplay between healthcare policy, technological innovation, and economic factors that shape equipment adoption patterns across Canada’s diverse healthcare system. Regional variations in market development highlight the importance of tailored strategies that address specific provincial characteristics and healthcare delivery models. Competitive landscape evolution suggests opportunities for both established manufacturers and innovative technology companies to capture market share through differentiated offerings and strategic partnerships.

Future success in this market will depend on the ability to navigate regulatory requirements, address healthcare budget constraints, and deliver solutions that demonstrably improve patient outcomes while enhancing operational efficiency. Technology integration capabilities, comprehensive service offerings, and adaptability to changing healthcare delivery models will be critical success factors. The Canada endoscopy equipment market is positioned for continued growth and innovation, offering substantial opportunities for stakeholders committed to advancing healthcare technology and improving patient care across the country.

What is Endoscopy Equipment?

Endoscopy equipment refers to medical devices used to perform endoscopic procedures, which allow doctors to visualize the interior of a patient’s body. This includes instruments such as endoscopes, cameras, and various surgical tools used in gastrointestinal, respiratory, and urological examinations.

What are the key players in the Canada Endoscopy Equipment Market?

Key players in the Canada Endoscopy Equipment Market include companies like Olympus Corporation, Medtronic, and Boston Scientific. These companies are known for their innovative endoscopic technologies and comprehensive product offerings, among others.

What are the growth factors driving the Canada Endoscopy Equipment Market?

The growth of the Canada Endoscopy Equipment Market is driven by factors such as the increasing prevalence of gastrointestinal disorders, advancements in minimally invasive surgical techniques, and a growing aging population requiring diagnostic procedures.

What challenges does the Canada Endoscopy Equipment Market face?

Challenges in the Canada Endoscopy Equipment Market include high costs associated with advanced equipment, stringent regulatory requirements, and the need for continuous training of healthcare professionals to effectively use new technologies.

What opportunities exist in the Canada Endoscopy Equipment Market?

Opportunities in the Canada Endoscopy Equipment Market include the development of innovative technologies such as robotic-assisted endoscopy and the expansion of telemedicine, which can enhance patient access to endoscopic procedures.

What trends are shaping the Canada Endoscopy Equipment Market?

Trends shaping the Canada Endoscopy Equipment Market include the increasing adoption of single-use endoscopes to reduce infection risks, the integration of artificial intelligence for improved diagnostics, and a focus on patient-centered care in endoscopic practices.

Canada Endoscopy Equipment Market

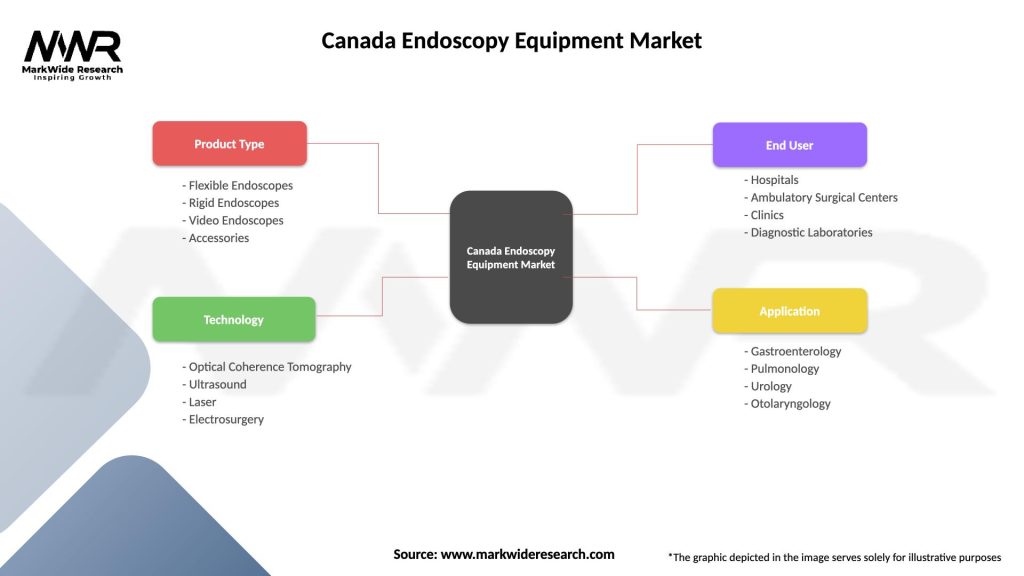

| Segmentation Details | Description |

|---|---|

| Product Type | Flexible Endoscopes, Rigid Endoscopes, Video Endoscopes, Accessories |

| Technology | Optical Coherence Tomography, Ultrasound, Laser, Electrosurgery |

| End User | Hospitals, Ambulatory Surgical Centers, Clinics, Diagnostic Laboratories |

| Application | Gastroenterology, Pulmonology, Urology, Otolaryngology |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Endoscopy Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at