444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada Electric Vehicle Nickel Metal Hydride Battery Market represents a specialized segment within the broader electric vehicle ecosystem, focusing on mature battery technology that continues to serve specific applications in the Canadian automotive landscape. Nickel Metal Hydride (NiMH) batteries have established themselves as reliable energy storage solutions, particularly in hybrid electric vehicles and certain commercial applications where proven performance outweighs cutting-edge technology requirements.

Market dynamics in Canada reflect a unique positioning where NiMH technology maintains relevance despite the rapid advancement of lithium-ion alternatives. The Canadian market demonstrates steady adoption rates of 12% annually in specific vehicle categories, particularly among fleet operators who prioritize reliability and established maintenance protocols. Regional distribution shows concentrated activity in Ontario and Quebec, representing approximately 68% of total market activity, driven by automotive manufacturing presence and supportive provincial policies.

Technology maturity characterizes this market segment, with NiMH batteries offering proven durability in Canada’s challenging climate conditions. The market benefits from established supply chains, mature manufacturing processes, and comprehensive recycling infrastructure that appeals to environmentally conscious consumers and fleet operators. Performance reliability in extreme temperature variations makes NiMH technology particularly suitable for Canadian operating conditions, maintaining consistent performance across diverse geographic regions.

The Canada Electric Vehicle Nickel Metal Hydride Battery Market refers to the specialized segment encompassing the production, distribution, and application of NiMH battery technology specifically designed for electric and hybrid vehicles operating within Canadian territory. This market represents the intersection of mature battery technology with evolving transportation electrification needs, focusing on applications where NiMH batteries provide optimal performance characteristics.

Nickel Metal Hydride batteries utilize a chemical composition featuring nickel oxyhydroxide positive electrodes and hydrogen-absorbing alloy negative electrodes, creating reliable energy storage systems with proven longevity. In the Canadian context, this technology serves hybrid electric vehicles, certain commercial electric applications, and specialized transportation solutions where established performance metrics outweigh the need for latest-generation battery chemistry.

Market scope encompasses manufacturing facilities, supply chain networks, research and development activities, and end-user applications across Canada’s diverse geographic and climatic regions. The definition includes both domestic production capabilities and imported battery systems, reflecting the integrated nature of North American automotive supply chains and the specific requirements of Canadian vehicle operators.

Strategic positioning of the Canada Electric Vehicle Nickel Metal Hydride Battery Market reflects a mature technology segment that continues to serve specific applications within the broader electric vehicle ecosystem. The market demonstrates resilience through established performance characteristics, proven reliability, and cost-effective solutions for particular vehicle categories and operational requirements.

Key market drivers include the continued production of hybrid electric vehicles, fleet operator preferences for proven technology, and the suitability of NiMH batteries for Canadian climate conditions. Adoption rates show sustained growth of 8.5% in commercial applications, while passenger vehicle applications maintain steady demand in specific market segments. The market benefits from mature supply chains, established recycling infrastructure, and comprehensive technical support networks.

Competitive landscape features established battery manufacturers with proven NiMH technology capabilities, automotive OEMs integrating these systems into specific vehicle platforms, and specialized service providers supporting maintenance and recycling operations. Market concentration shows 75% of activity focused in central Canada, reflecting automotive manufacturing clusters and supportive infrastructure development.

Future trajectory indicates continued relevance for NiMH technology in specific applications, with market evolution focusing on performance optimization, cost efficiency improvements, and enhanced integration with vehicle systems. The market maintains strategic importance as part of Canada’s diversified approach to transportation electrification, serving applications where mature technology provides optimal solutions.

Technology positioning reveals that NiMH batteries maintain competitive advantages in specific applications despite the prominence of lithium-ion alternatives. Performance characteristics include superior temperature tolerance, established safety profiles, and proven longevity that appeals to conservative fleet operators and specific vehicle applications requiring reliable, predictable performance.

Hybrid vehicle production continues to drive demand for NiMH battery systems, particularly in vehicle platforms where manufacturers prioritize proven technology over cutting-edge alternatives. Automotive OEMs maintain NiMH integration in specific hybrid models, supporting continued market demand through established production volumes and consumer acceptance of mature technology solutions.

Fleet operator preferences significantly influence market dynamics, with commercial operators valuing the predictable performance characteristics and established maintenance protocols associated with NiMH technology. Total cost of ownership considerations favor NiMH batteries in applications where initial cost advantages and proven reliability outweigh energy density limitations, particularly in urban delivery vehicles and commercial transportation applications.

Climate suitability represents a crucial market driver specific to Canadian conditions, where NiMH batteries demonstrate superior performance in extreme temperature variations compared to some alternative technologies. Cold weather performance maintains consistent energy delivery and charging characteristics, making NiMH technology particularly suitable for Canadian operating environments across diverse geographic regions.

Supply chain maturity provides market stability through established manufacturing processes, proven quality control systems, and comprehensive technical support networks. Infrastructure advantages include existing recycling facilities, trained technician networks, and established parts availability that reduces operational risks for fleet operators and individual consumers choosing NiMH-powered vehicles.

Technology evolution presents significant challenges as lithium-ion and emerging battery technologies offer superior energy density, faster charging capabilities, and enhanced performance characteristics that appeal to consumers seeking cutting-edge electric vehicle experiences. Market perception increasingly views NiMH technology as outdated, limiting adoption in passenger vehicle segments where consumers prioritize latest-generation features.

Energy density limitations restrict NiMH battery applications in vehicles requiring maximum range capabilities or compact battery packaging. Weight considerations become particularly relevant in passenger vehicles where consumers expect optimal performance characteristics, making NiMH technology less competitive in applications where space and weight constraints are critical factors.

Charging speed constraints limit market appeal as consumers increasingly expect rapid charging capabilities that NiMH technology cannot match compared to advanced lithium-ion systems. Infrastructure development focuses primarily on supporting faster-charging battery technologies, potentially limiting long-term infrastructure compatibility for NiMH-powered vehicles.

Investment priorities in research and development increasingly favor next-generation battery technologies, potentially limiting continued innovation and performance improvements in NiMH systems. Manufacturing focus shifts toward lithium-ion and emerging technologies may reduce economies of scale for NiMH production, potentially impacting cost competitiveness over time.

Specialized applications present significant opportunities where NiMH technology advantages align with specific operational requirements. Commercial vehicle segments offer expansion potential in applications where proven reliability, established maintenance protocols, and cost-effective operation outweigh energy density considerations, particularly in urban delivery, municipal services, and specialized transportation applications.

Retrofit markets provide opportunities for NiMH battery systems in existing vehicle conversions and aftermarket applications. Fleet modernization programs may favor NiMH technology where operators prioritize proven performance over cutting-edge capabilities, creating market opportunities in government fleets, utility vehicles, and specialized commercial applications.

Export potential exists for Canadian-manufactured NiMH battery systems, particularly to markets where climate conditions and operational requirements favor mature, reliable battery technology. International partnerships could leverage Canadian manufacturing capabilities and cold-weather expertise to serve global markets with similar operational challenges.

Recycling and circular economy opportunities expand as the installed base of NiMH batteries reaches end-of-life stages. Material recovery and reprocessing capabilities could create additional revenue streams while supporting environmental sustainability objectives, positioning Canada as a leader in battery recycling and circular economy practices.

Competitive positioning within the broader electric vehicle battery landscape requires NiMH technology to emphasize specific advantages while acknowledging limitations compared to newer alternatives. Market segmentation increasingly focuses on applications where NiMH characteristics provide optimal solutions rather than competing directly with lithium-ion technology in all applications.

Supply chain evolution reflects the mature nature of NiMH technology, with established supplier networks, proven manufacturing processes, and comprehensive quality control systems. Cost structures benefit from manufacturing scale and material availability, though potential challenges exist as industry focus shifts toward alternative technologies and associated supply chain investments.

Technology integration continues to evolve as vehicle manufacturers optimize NiMH battery systems within hybrid powertrains and specialized applications. Performance enhancements focus on incremental improvements in efficiency, durability, and integration rather than revolutionary advances, reflecting the mature nature of the technology platform.

Regulatory environment supports NiMH technology through established safety standards, proven environmental profiles, and comprehensive recycling regulations. Policy frameworks may continue to support diverse battery technologies as part of broader transportation electrification strategies, maintaining market opportunities for proven, reliable solutions.

Comprehensive analysis of the Canada Electric Vehicle Nickel Metal Hydride Battery Market employs multiple research methodologies to ensure accurate, reliable, and actionable market intelligence. Primary research includes direct engagement with industry participants, including battery manufacturers, automotive OEMs, fleet operators, and technology suppliers, providing firsthand insights into market dynamics, challenges, and opportunities.

Secondary research encompasses analysis of industry publications, government reports, regulatory filings, and academic studies to establish comprehensive market context and validate primary research findings. Data triangulation ensures accuracy through cross-referencing multiple information sources and verification of key market indicators through independent validation processes.

Market modeling utilizes quantitative analysis techniques to project market trends, identify growth patterns, and assess competitive dynamics. Statistical analysis incorporates historical data, current market conditions, and forward-looking indicators to develop reliable market projections and identify emerging opportunities and challenges.

Expert consultation includes engagement with industry specialists, technology experts, and market analysts to provide additional perspective and validate research findings. Quality assurance processes ensure data accuracy, methodology consistency, and reliable conclusions through systematic review and validation procedures.

Ontario market represents the largest regional segment, accounting for approximately 45% of national market activity, driven by concentrated automotive manufacturing presence, established supply chain networks, and supportive provincial policies for electric vehicle adoption. Manufacturing clusters in the Windsor-Toronto corridor provide strategic advantages for NiMH battery integration and vehicle production, supporting both domestic consumption and export opportunities.

Quebec region contributes 23% of market share, benefiting from hydroelectric power advantages, established automotive manufacturing capabilities, and provincial incentives supporting electric vehicle adoption. Research and development activities in Quebec focus on battery technology optimization and cold-weather performance enhancement, leveraging provincial expertise in materials science and electrochemical systems.

Western provinces collectively represent 22% of market activity, with British Columbia leading adoption in fleet applications and Alberta showing growth in commercial vehicle segments. Resource sector applications provide unique opportunities for NiMH technology in specialized vehicles and equipment where proven reliability outweighs energy density considerations.

Atlantic Canada accounts for 10% of market presence, with opportunities in marine applications, specialized transportation, and government fleet modernization programs. Geographic challenges and climate conditions favor reliable, proven battery technology, creating niche opportunities for NiMH systems in specific applications and operational environments.

Market leadership in the Canada Electric Vehicle Nickel Metal Hydride Battery Market reflects established battery manufacturers with proven NiMH technology capabilities and automotive industry relationships. Competitive positioning emphasizes reliability, cost-effectiveness, and application-specific advantages rather than competing directly with lithium-ion technology across all market segments.

Strategic partnerships between battery suppliers and automotive manufacturers continue to drive market development, with established relationships supporting continued NiMH integration in specific vehicle platforms. Market consolidation reflects industry maturity, with leading suppliers focusing on operational efficiency and application-specific optimization rather than aggressive market expansion.

By Application:

By Vehicle Type:

By End User:

Hybrid Electric Vehicle Category represents the core market segment where NiMH technology maintains strong positioning through established integration with hybrid powertrains. Performance characteristics align well with hybrid vehicle requirements, providing reliable energy storage and power delivery while maintaining cost-effectiveness compared to alternative battery technologies. Consumer acceptance remains strong in this category due to proven reliability and established track record.

Commercial Fleet Category shows increasing adoption as fleet operators recognize total cost of ownership advantages and operational reliability benefits. Maintenance protocols for NiMH systems are well-established, reducing training requirements and operational complexity for fleet management teams. Urban delivery applications particularly benefit from NiMH technology characteristics, including consistent performance in stop-and-go driving conditions.

Specialty Applications Category provides niche opportunities where NiMH technology advantages align with specific operational requirements. Emergency services and utility applications value proven reliability and established performance characteristics, while municipal fleets benefit from cost-effectiveness and mature supply chain support. Cold weather performance makes NiMH technology particularly suitable for Canadian specialty vehicle applications.

Aftermarket Category represents growing opportunities as the installed base of NiMH-powered vehicles requires replacement batteries and upgrade solutions. Service networks are well-established for NiMH technology, providing comprehensive support for aftermarket applications and ensuring continued vehicle operation throughout extended service lives.

Battery Manufacturers benefit from established production processes, mature supply chains, and proven quality control systems that reduce operational risks and development costs. Manufacturing efficiency advantages include optimized production lines, established supplier relationships, and comprehensive technical expertise that supports consistent product quality and reliable delivery schedules.

Automotive OEMs gain advantages through proven integration processes, established performance characteristics, and reliable supply chain relationships. Risk mitigation benefits include predictable technology performance, established safety profiles, and comprehensive technical support that reduces development time and integration complexity for specific vehicle platforms.

Fleet Operators realize significant benefits through total cost of ownership advantages, established maintenance protocols, and proven reliability in operational environments. Operational efficiency improvements include predictable maintenance schedules, established technician training programs, and comprehensive parts availability that reduces downtime and operational disruption.

Service Providers benefit from established technical expertise, proven diagnostic procedures, and comprehensive training programs that support efficient service delivery. Business opportunities include specialized maintenance services, recycling operations, and technical support services that leverage established NiMH technology knowledge and infrastructure.

End Users gain advantages through cost-effective solutions, proven reliability, and established service networks that ensure continued vehicle operation and support. Consumer benefits include predictable operating costs, reliable performance characteristics, and comprehensive service availability that reduces ownership risks and operational concerns.

Strengths:

Weaknesses:

Opportunities:

Threats:

Application Specialization emerges as a dominant trend, with market focus shifting toward specific applications where NiMH technology provides optimal solutions rather than competing across all electric vehicle segments. Niche positioning emphasizes proven reliability, cost-effectiveness, and operational advantages in targeted market segments, creating sustainable competitive positioning for mature technology.

Fleet Integration shows accelerating adoption as commercial operators recognize total cost of ownership advantages and operational reliability benefits. Government fleets and municipal applications increasingly adopt NiMH technology for specific vehicle categories, driven by proven performance and established maintenance protocols that align with public sector operational requirements.

Cold Weather Optimization represents a growing trend specific to Canadian market conditions, with continued development focusing on enhanced performance in extreme temperature environments. Climate adaptation improvements include optimized charging protocols, enhanced thermal management, and improved cold-weather starting capabilities that leverage Canada’s unique operational challenges as competitive advantages.

Circular Economy Integration gains momentum as recycling infrastructure and material recovery processes become increasingly sophisticated. Sustainability focus includes comprehensive lifecycle management, material reuse programs, and closed-loop manufacturing processes that position NiMH technology as environmentally responsible choice for specific applications.

Service Network Expansion continues to develop comprehensive support infrastructure for NiMH-powered vehicles. Technical expertise development includes specialized training programs, diagnostic equipment advancement, and parts availability optimization that ensures continued operational support for existing and new NiMH applications.

Manufacturing Consolidation continues as industry participants focus resources on core competencies and strategic market segments. Production optimization initiatives emphasize efficiency improvements, quality enhancement, and cost reduction strategies that maintain competitive positioning in targeted applications while acknowledging market evolution toward alternative technologies.

Partnership Evolution reflects changing relationships between battery suppliers and automotive manufacturers, with agreements increasingly focused on specific applications and specialized requirements. Strategic alliances emphasize long-term support for existing platforms while acknowledging transition toward alternative technologies for future vehicle development programs.

Technology Enhancement continues through incremental improvements in performance, durability, and integration capabilities. Development focus includes optimized cell chemistry, enhanced thermal management, and improved manufacturing processes that extend technology relevance and competitive positioning in targeted market segments.

Regulatory Adaptation includes updated safety standards, environmental regulations, and recycling requirements that reflect mature technology status and established operational experience. Compliance frameworks provide clear guidelines for continued operation while supporting transition toward comprehensive sustainability practices and circular economy integration.

Market Repositioning strategies emphasize specific advantages and targeted applications rather than broad market competition. Commercial focus shifts toward fleet applications, specialized vehicles, and niche markets where NiMH characteristics provide optimal solutions and sustainable competitive advantages.

Strategic Focus recommendations emphasize application specialization and niche market development rather than broad market competition with lithium-ion technology. MarkWide Research analysis suggests that market participants should concentrate on segments where NiMH advantages provide sustainable competitive positioning, particularly in fleet applications and specialized vehicle categories.

Investment Priorities should focus on operational efficiency, service network enhancement, and recycling infrastructure development rather than revolutionary technology advancement. Resource allocation recommendations include manufacturing optimization, supply chain efficiency improvements, and comprehensive customer support programs that leverage established technology advantages.

Partnership Development strategies should emphasize long-term relationships with fleet operators, specialty vehicle manufacturers, and service providers who value proven reliability over cutting-edge performance. Collaboration opportunities include government fleet programs, municipal vehicle applications, and specialized transportation solutions where NiMH characteristics align with operational requirements.

Market Positioning should clearly communicate specific advantages and targeted applications while acknowledging technology limitations and market evolution. Communication strategies should emphasize total cost of ownership benefits, proven reliability, and operational advantages in specific applications rather than competing directly with advanced battery technologies across all market segments.

Future Planning should include transition strategies and portfolio diversification while maintaining focus on current market opportunities. Long-term considerations include technology evolution planning, market transition management, and strategic positioning for continued relevance in specialized applications and niche market segments.

Market Evolution indicates continued relevance for NiMH technology in specialized applications while acknowledging overall market transition toward advanced battery technologies. Projected growth shows steady expansion of 6-8% annually in targeted segments, particularly fleet applications and specialty vehicles where proven reliability provides sustainable competitive advantages.

Technology Development will likely focus on incremental improvements and application-specific optimization rather than revolutionary advances. Innovation priorities include enhanced cold-weather performance, improved integration capabilities, and optimized manufacturing processes that maintain cost-effectiveness while extending technology relevance in targeted market segments.

Market Segmentation will continue to evolve toward specialized applications and niche markets where NiMH characteristics provide optimal solutions. Growth opportunities include government fleet modernization, municipal vehicle applications, and specialized transportation solutions that prioritize proven performance over cutting-edge capabilities.

Industry Structure will likely experience continued consolidation as market participants focus resources on core competencies and strategic segments. Competitive positioning will emphasize operational efficiency, customer service excellence, and application-specific expertise rather than broad market competition with alternative technologies.

Regulatory Environment will continue to support diverse battery technologies while emphasizing sustainability and circular economy principles. Policy frameworks may maintain support for proven technologies in specific applications while encouraging overall market transition toward advanced solutions, creating continued opportunities for NiMH technology in targeted segments.

The Canada Electric Vehicle Nickel Metal Hydride Battery Market represents a mature technology segment that maintains strategic relevance through specialized applications and proven performance characteristics. Market positioning emphasizes reliability, cost-effectiveness, and operational advantages in targeted segments rather than broad competition with advanced battery technologies across all electric vehicle applications.

Strategic opportunities exist in fleet applications, specialty vehicles, and niche markets where NiMH technology advantages align with specific operational requirements. Sustainable growth depends on continued focus on application specialization, operational efficiency, and customer service excellence while acknowledging market evolution toward alternative technologies in mainstream applications.

Future success requires strategic positioning that leverages established advantages while adapting to changing market conditions and customer requirements. The market will likely continue to serve important roles in Canada’s diversified approach to transportation electrification, providing proven solutions where reliability and cost-effectiveness outweigh energy density and charging speed considerations.

What is Electric Vehicle Nickel Metal Hydride Battery?

Electric Vehicle Nickel Metal Hydride Battery refers to a type of rechargeable battery commonly used in hybrid and electric vehicles. These batteries are known for their high energy density and ability to withstand numerous charge cycles, making them suitable for automotive applications.

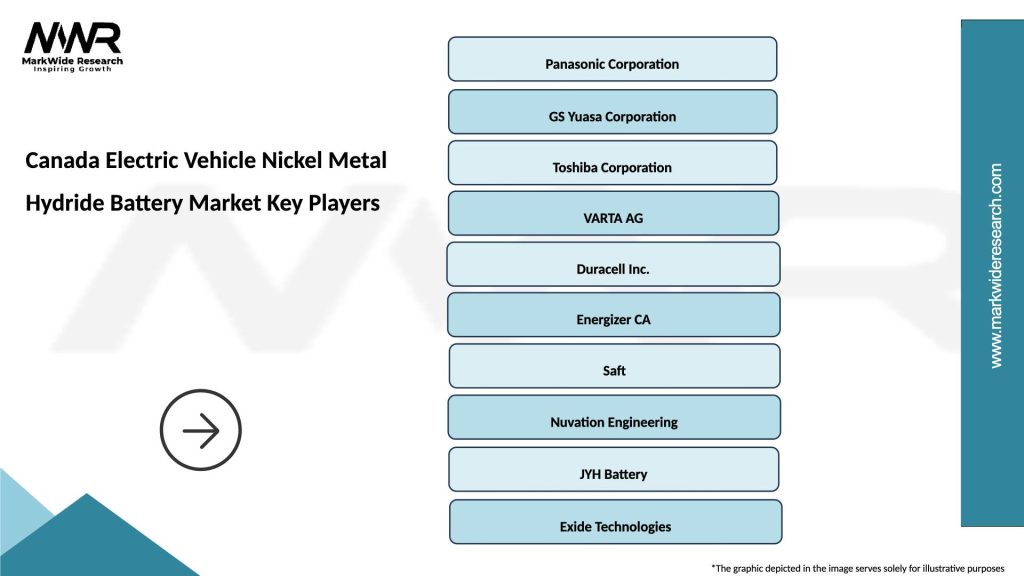

What are the key players in the Canada Electric Vehicle Nickel Metal Hydride Battery Market?

Key players in the Canada Electric Vehicle Nickel Metal Hydride Battery Market include Panasonic, LG Chem, and BYD, among others. These companies are involved in the production and development of advanced battery technologies for electric vehicles.

What are the growth factors driving the Canada Electric Vehicle Nickel Metal Hydride Battery Market?

The growth of the Canada Electric Vehicle Nickel Metal Hydride Battery Market is driven by increasing demand for electric vehicles, advancements in battery technology, and government initiatives promoting sustainable transportation. Additionally, rising consumer awareness about environmental issues contributes to market expansion.

What challenges does the Canada Electric Vehicle Nickel Metal Hydride Battery Market face?

The Canada Electric Vehicle Nickel Metal Hydride Battery Market faces challenges such as competition from lithium-ion batteries, which offer higher energy density and lower weight. Additionally, the recycling and disposal of nickel metal hydride batteries pose environmental concerns.

What opportunities exist in the Canada Electric Vehicle Nickel Metal Hydride Battery Market?

Opportunities in the Canada Electric Vehicle Nickel Metal Hydride Battery Market include the potential for innovation in battery recycling technologies and the development of new applications in energy storage systems. The growing trend towards renewable energy sources also presents avenues for market growth.

What trends are shaping the Canada Electric Vehicle Nickel Metal Hydride Battery Market?

Trends shaping the Canada Electric Vehicle Nickel Metal Hydride Battery Market include the increasing integration of smart technologies in battery management systems and the shift towards more sustainable materials in battery production. Additionally, the rise of electric vehicle adoption is influencing battery design and performance requirements.

Canada Electric Vehicle Nickel Metal Hydride Battery Market

| Segmentation Details | Description |

|---|---|

| Product Type | Hybrid Electric Vehicles, Plug-in Hybrid Electric Vehicles, Electric Buses, Electric Motorcycles |

| End User | Public Transport, Fleet Operators, Individual Consumers, Government Agencies |

| Technology | Regenerative Braking, Energy Recovery Systems, Battery Management Systems, Fast Charging |

| Application | Urban Mobility, Long-Distance Travel, Commercial Transport, Emergency Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Electric Vehicle Nickel Metal Hydride Battery Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at