444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada electric vehicle battery manufacturing market represents a transformative sector within the nation’s automotive and clean technology landscape. Canada’s strategic positioning in the global electric vehicle supply chain has gained significant momentum, driven by abundant natural resources, government incentives, and increasing investments from major automotive manufacturers. The market encompasses the production of lithium-ion batteries, solid-state batteries, and emerging battery technologies specifically designed for electric vehicles, energy storage systems, and hybrid automotive applications.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 18.5% as manufacturers establish production facilities across key provinces. Ontario and Quebec have emerged as primary manufacturing hubs, leveraging their proximity to major automotive centers and established supply chains. The market benefits from Canada’s rich mineral resources, including lithium, cobalt, and nickel deposits, which are essential components in battery manufacturing processes.

Government support initiatives have accelerated market development through substantial investments in clean technology infrastructure and manufacturing incentives. The federal government’s commitment to achieving net-zero emissions by 2050 has created favorable conditions for battery manufacturing expansion. Provincial governments have implemented complementary policies, including tax incentives, research grants, and streamlined regulatory processes to attract international battery manufacturers and technology companies.

The Canada electric vehicle battery manufacturing market refers to the comprehensive ecosystem of companies, facilities, and supply chains involved in producing energy storage systems specifically designed for electric vehicles within Canadian borders. This market encompasses the entire value chain from raw material processing and cell manufacturing to battery pack assembly and recycling operations, representing a critical component of Canada’s transition toward sustainable transportation solutions.

Battery manufacturing in this context includes various technologies such as lithium-ion batteries, nickel-metal hydride systems, and emerging solid-state battery technologies. The market serves multiple vehicle categories including passenger cars, commercial vehicles, buses, and specialty electric vehicles. Manufacturing operations range from component production and cell assembly to complete battery pack integration and testing facilities.

Strategic importance extends beyond domestic vehicle production, as Canada positions itself as a key supplier for North American automotive manufacturers and global electric vehicle markets. The market includes both domestic companies and international manufacturers establishing Canadian operations to serve regional and export markets.

Canada’s electric vehicle battery manufacturing sector has emerged as a cornerstone of the nation’s clean technology strategy, attracting significant investments from global automotive leaders and battery technology companies. Market expansion is driven by favorable government policies, abundant natural resources, and strategic geographic positioning within the North American automotive supply chain.

Key market drivers include increasing electric vehicle adoption rates, which have reached 8.2% of new vehicle sales nationally, and substantial government commitments to clean transportation infrastructure. Major manufacturers including General Motors, Ford, and Stellantis have announced significant battery manufacturing investments across Canadian provinces, creating a robust foundation for market growth.

Technological advancement remains a critical focus area, with Canadian research institutions and manufacturers collaborating on next-generation battery technologies. Supply chain integration has strengthened through partnerships between mining companies, battery manufacturers, and automotive assemblers, creating a vertically integrated ecosystem that enhances competitiveness and reduces dependency on international suppliers.

Regional distribution shows concentrated activity in Ontario and Quebec, which collectively account for 72% of announced manufacturing capacity. These provinces benefit from established automotive manufacturing infrastructure, skilled workforce availability, and proximity to major North American markets.

Market insights reveal several critical trends shaping Canada’s electric vehicle battery manufacturing landscape:

Government policy support serves as the primary catalyst for market expansion, with federal and provincial governments implementing comprehensive strategies to establish Canada as a global leader in clean technology manufacturing. The federal government’s commitment to banning internal combustion engine vehicle sales by 2035 has created long-term market certainty that encourages substantial capital investments from manufacturers.

Natural resource advantages position Canada uniquely in the global battery supply chain, with significant deposits of lithium, cobalt, nickel, and graphite essential for battery production. Mining operations across provinces provide secure access to critical materials, reducing supply chain risks and transportation costs compared to international sourcing alternatives.

Strategic geographic location offers manufacturers efficient access to major North American automotive markets, with established transportation infrastructure and trade agreements facilitating cross-border commerce. Proximity to major automotive centers in Michigan, Ontario, and other key regions enables just-in-time delivery and integrated supply chain operations.

Skilled workforce availability supports manufacturing expansion through established automotive manufacturing expertise and growing clean technology capabilities. Educational institutions have developed specialized programs in battery technology, materials science, and advanced manufacturing to meet industry workforce requirements.

Clean energy infrastructure provides manufacturers with access to renewable electricity sources, supporting sustainable manufacturing operations and reducing carbon footprints associated with battery production processes.

High capital investment requirements present significant barriers for new market entrants, as battery manufacturing facilities require substantial upfront investments in specialized equipment, clean room facilities, and advanced automation systems. Smaller companies may struggle to compete with established manufacturers that possess greater financial resources and economies of scale.

Technical complexity in battery manufacturing processes demands sophisticated quality control systems, precise environmental controls, and highly skilled technical personnel. Manufacturing challenges include maintaining consistent cell quality, managing thermal properties, and ensuring safety standards throughout production processes.

Supply chain dependencies for certain specialized materials and components remain concentrated in international markets, creating potential vulnerabilities despite Canada’s natural resource advantages. Critical components such as separators, electrolytes, and advanced cathode materials may require international sourcing.

Regulatory compliance requirements across multiple jurisdictions add complexity to manufacturing operations, particularly for companies serving both domestic and international markets. Safety regulations, environmental standards, and transportation requirements create ongoing compliance obligations that require dedicated resources.

Market competition from established international manufacturers with proven track records and existing customer relationships poses challenges for new Canadian operations seeking to establish market presence and secure long-term supply contracts.

Export market potential represents substantial growth opportunities as North American automotive manufacturers seek to diversify their battery supply chains and reduce dependencies on overseas suppliers. Trade agreements such as USMCA provide preferential access to United States markets, creating competitive advantages for Canadian manufacturers.

Technology innovation opportunities exist in developing next-generation battery technologies, including solid-state batteries, improved lithium-ion chemistries, and sustainable manufacturing processes. Research partnerships between Canadian universities, government laboratories, and industry players can accelerate technology development and commercialization.

Circular economy development presents opportunities for companies to establish comprehensive battery recycling operations, recovering valuable materials and reducing environmental impacts. End-of-life battery management will become increasingly important as electric vehicle adoption accelerates and first-generation batteries reach replacement cycles.

Energy storage applications beyond automotive markets offer diversification opportunities, including grid-scale energy storage, residential battery systems, and commercial energy storage solutions. Market expansion into these sectors can provide additional revenue streams and reduce dependency on automotive market cycles.

Indigenous partnerships in resource extraction and manufacturing operations can provide access to mineral resources while supporting reconciliation objectives and community economic development initiatives.

Market dynamics in Canada’s electric vehicle battery manufacturing sector reflect the interplay between government policy initiatives, technological advancement, and global supply chain considerations. Policy stability has created long-term investment confidence, with manufacturers committing to multi-billion dollar facility developments based on sustained government support for clean technology manufacturing.

Competitive positioning has evolved rapidly as international manufacturers establish Canadian operations to serve North American markets while benefiting from favorable operating conditions. Market consolidation trends show larger manufacturers acquiring smaller technology companies and forming strategic partnerships to accelerate market entry and technology development.

Supply chain dynamics emphasize vertical integration strategies, with companies seeking to control critical supply chain elements from raw material processing through finished battery production. MarkWide Research analysis indicates that integrated supply chain operations can reduce production costs by 15-20% while improving quality control and delivery reliability.

Technology evolution continues to drive market dynamics, with manufacturers investing heavily in research and development to improve battery performance, reduce costs, and develop sustainable manufacturing processes. Innovation cycles are accelerating as companies compete to develop breakthrough technologies that provide competitive advantages in performance, cost, or sustainability metrics.

Research methodology for analyzing Canada’s electric vehicle battery manufacturing market employs comprehensive primary and secondary research approaches to provide accurate market insights and projections. Primary research includes structured interviews with industry executives, government officials, technology experts, and supply chain partners to gather firsthand market intelligence and validate secondary research findings.

Secondary research encompasses analysis of government publications, industry reports, company financial statements, patent filings, and regulatory documents to establish market baselines and identify emerging trends. Data validation processes ensure accuracy through cross-referencing multiple sources and expert review of findings.

Market modeling techniques incorporate economic indicators, policy impact assessments, and technology adoption curves to develop realistic growth projections and scenario analyses. Quantitative analysis includes statistical modeling of market drivers, correlation analysis of key variables, and sensitivity testing of growth assumptions.

Industry expert consultation provides qualitative insights into market dynamics, competitive positioning, and future development scenarios. Expert panels include representatives from manufacturing companies, research institutions, government agencies, and financial organizations with direct market involvement.

Continuous monitoring of market developments ensures research findings remain current and relevant, with regular updates incorporating new investments, policy changes, and technological breakthroughs that impact market dynamics.

Ontario dominates Canada’s electric vehicle battery manufacturing landscape, accounting for 45% of announced manufacturing capacity and hosting major facilities from international manufacturers. The province’s advantages include proximity to automotive manufacturing centers, established supply chains, skilled workforce availability, and supportive provincial policies. Windsor-Essex region has emerged as a key manufacturing hub, leveraging its automotive heritage and cross-border connectivity with Michigan.

Quebec represents the second-largest regional market, capturing 27% of manufacturing capacity through strategic investments in battery materials processing and cell manufacturing. The province’s competitive advantages include abundant hydroelectric power, mining industry expertise, and strong research institutions. Montreal and Quebec City regions have attracted significant investments in battery technology development and manufacturing operations.

British Columbia focuses on battery materials processing and technology development, leveraging its mining industry expertise and proximity to Asian markets. The province’s role in the supply chain emphasizes upstream processing of critical minerals and development of sustainable extraction technologies. Vancouver region serves as a hub for battery technology research and international business development.

Prairie provinces contribute through mining operations and emerging manufacturing opportunities, with Saskatchewan and Manitoba providing critical mineral resources including lithium and nickel. Resource development projects in these provinces support the broader Canadian battery manufacturing ecosystem through secure domestic supply chains.

Atlantic Canada explores opportunities in battery recycling and specialized manufacturing applications, with Nova Scotia and New Brunswick investigating potential roles in the growing battery manufacturing supply chain.

The competitive landscape in Canada’s electric vehicle battery manufacturing market features a mix of international manufacturers, domestic companies, and strategic partnerships that collectively shape market development and competitive dynamics.

Strategic partnerships between automotive manufacturers, battery companies, and mining operations create integrated value chains that enhance competitive positioning. Joint ventures and technology licensing agreements enable companies to access specialized expertise while sharing investment risks and development costs.

Emerging Canadian companies focus on specialized technologies, sustainable manufacturing processes, and niche applications that complement larger manufacturers’ operations while developing unique market positions.

By Battery Type:

By Application:

By Manufacturing Process:

Lithium-Ion Battery Manufacturing represents the core focus of Canadian market development, with manufacturers investing in proven technologies that serve immediate market demands. Production capabilities emphasize high-energy density cells suitable for passenger vehicle applications, with manufacturing processes optimized for quality, safety, and cost efficiency. Technology improvements focus on extending battery life, reducing charging times, and improving thermal management characteristics.

Battery Materials Processing leverages Canada’s natural resource advantages to create integrated supply chains that reduce costs and improve supply security. Processing facilities focus on lithium, cobalt, nickel, and graphite processing to produce battery-grade materials for domestic and export markets. Sustainable processing techniques emphasize environmental responsibility and circular economy principles.

Energy Storage Applications represent growing diversification opportunities beyond automotive markets, with manufacturers developing products for grid-scale storage, residential systems, and commercial applications. Market development in this category benefits from government incentives for renewable energy integration and grid modernization initiatives.

Research and Development activities focus on next-generation technologies including solid-state batteries, improved cathode materials, and sustainable manufacturing processes. Collaborative research between industry and academic institutions accelerates technology development and commercialization timelines.

Manufacturers benefit from Canada’s stable political environment, skilled workforce, and abundant natural resources that provide competitive advantages in global markets. Government incentives and supportive policies reduce investment risks while providing long-term market certainty for capacity planning and expansion decisions.

Automotive companies gain access to secure battery supply chains that reduce dependencies on international suppliers while supporting their electric vehicle production strategies. Proximity advantages enable just-in-time delivery, reduced transportation costs, and closer collaboration on product development and quality control.

Government stakeholders achieve economic development objectives through job creation, technology transfer, and industrial capacity building that supports broader clean technology and climate policy goals. Tax revenue generation and export earnings contribute to economic growth while advancing environmental sustainability objectives.

Research institutions benefit from industry partnerships that provide funding, real-world application opportunities, and technology commercialization pathways. Academic collaboration enhances research capabilities while supporting workforce development and knowledge transfer initiatives.

Communities hosting manufacturing facilities benefit from job creation, infrastructure development, and economic diversification that provides long-term economic stability and growth opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Vertical integration emerges as a dominant trend, with manufacturers seeking to control supply chains from raw material processing through finished battery production. Integrated operations provide cost advantages, quality control benefits, and supply security that enhance competitive positioning in global markets.

Sustainability focus drives manufacturing process improvements, with companies implementing circular economy principles, renewable energy utilization, and environmentally responsible production methods. Life cycle assessment considerations influence facility design, material selection, and operational practices throughout the manufacturing process.

Technology advancement accelerates through increased research and development investments, with particular emphasis on solid-state batteries, improved energy density, and faster charging capabilities. Innovation partnerships between manufacturers, research institutions, and technology companies accelerate development timelines and commercialization efforts.

Workforce development initiatives expand through partnerships between manufacturers, educational institutions, and government agencies to build specialized skills required for advanced battery manufacturing operations. Training programs focus on technical skills, safety procedures, and quality control processes specific to battery manufacturing environments.

Digital transformation integration includes advanced manufacturing technologies, artificial intelligence applications, and data analytics systems that optimize production processes, predict maintenance requirements, and improve quality control outcomes.

Major investment announcements from international manufacturers have established Canada as a significant player in North American battery manufacturing, with multi-billion dollar facility commitments creating substantial manufacturing capacity. Recent developments include facility groundbreakings, technology partnerships, and supply chain agreements that strengthen market foundations.

Government policy initiatives have expanded support for battery manufacturing through enhanced tax incentives, research funding, and infrastructure development programs. Federal and provincial coordination ensures comprehensive support packages that address multiple aspects of manufacturing development and market competitiveness.

Technology breakthroughs in battery chemistry, manufacturing processes, and recycling technologies have emerged from Canadian research institutions and industry partnerships. Patent applications and technology licensing agreements demonstrate growing innovation capabilities and intellectual property development.

Supply chain partnerships between mining companies, materials processors, and battery manufacturers have created integrated value chains that enhance cost competitiveness and supply security. Strategic agreements ensure long-term material availability while supporting domestic economic development objectives.

International collaborations with technology leaders, research institutions, and manufacturing partners have accelerated knowledge transfer and capability development within Canadian operations.

Investment prioritization should focus on proven lithium-ion technologies while maintaining research capabilities in next-generation battery chemistries to ensure long-term competitiveness. MWR analysis suggests that manufacturers achieving optimal scale efficiency can reduce production costs by 25-30% compared to smaller operations.

Supply chain security requires continued development of domestic processing capabilities for critical materials while maintaining strategic international partnerships for specialized components. Risk mitigation strategies should include multiple supplier relationships and inventory management systems that ensure production continuity.

Workforce development investments should accelerate to meet growing demand for skilled technicians, engineers, and quality control specialists. Educational partnerships and apprenticeship programs provide sustainable pathways for building required capabilities while supporting community economic development.

Technology differentiation through specialized applications, superior performance characteristics, or sustainable manufacturing processes can provide competitive advantages in increasingly crowded markets. Innovation focus should align with market demands and regulatory requirements while building intellectual property portfolios.

Market diversification beyond automotive applications can provide revenue stability and growth opportunities, particularly in energy storage markets that benefit from similar government support and market drivers.

Market expansion is projected to continue at robust rates, driven by accelerating electric vehicle adoption, government policy support, and increasing manufacturing capacity coming online. MarkWide Research projections indicate that Canadian battery manufacturing capacity could achieve significant scale within the next decade, positioning the country as a major North American supplier.

Technology evolution will drive continued investment in research and development, with particular focus on solid-state batteries, improved energy density, and sustainable manufacturing processes. Innovation cycles are expected to accelerate as competition intensifies and customer demands for performance improvements increase.

Export opportunities will expand as North American automotive manufacturers seek to diversify supply chains and reduce dependencies on overseas suppliers. Trade relationships and preferential access through existing agreements provide competitive advantages for Canadian manufacturers in key export markets.

Circular economy development will become increasingly important as first-generation electric vehicle batteries reach end-of-life cycles, creating opportunities for recycling operations and material recovery systems. Sustainability requirements from customers and regulators will drive continued improvements in environmental performance.

Market maturation will lead to consolidation trends, with successful manufacturers expanding operations while less competitive players exit the market or become acquisition targets. Long-term success will depend on achieving optimal scale, maintaining technology leadership, and developing sustainable competitive advantages.

Canada’s electric vehicle battery manufacturing market represents a strategic opportunity that aligns natural resource advantages, government policy support, and growing market demand to create a competitive and sustainable industry sector. Market development has accelerated significantly through major international investments, technology partnerships, and comprehensive government support programs that provide long-term growth foundations.

Competitive positioning benefits from unique advantages including abundant critical mineral resources, clean energy access, skilled workforce availability, and strategic geographic location within North American supply chains. Government commitment to clean technology manufacturing and climate policy objectives ensures continued policy support and market development incentives.

Future success will depend on continued investment in technology development, workforce capabilities, and supply chain integration while maintaining focus on sustainability and cost competitiveness. Market participants that achieve optimal scale, develop differentiated technologies, and build strong customer relationships will be best positioned to capitalize on expanding opportunities in domestic and export markets. The sector’s evolution from emerging opportunity to established industry pillar reflects Canada’s broader transition toward clean technology leadership and sustainable economic development.

What is Electric Vehicle Battery Manufacturing?

Electric Vehicle Battery Manufacturing refers to the process of producing batteries specifically designed for electric vehicles, which includes various technologies such as lithium-ion, solid-state, and nickel-metal hydride batteries. These batteries are crucial for powering electric vehicles and are a key component in the transition to sustainable transportation.

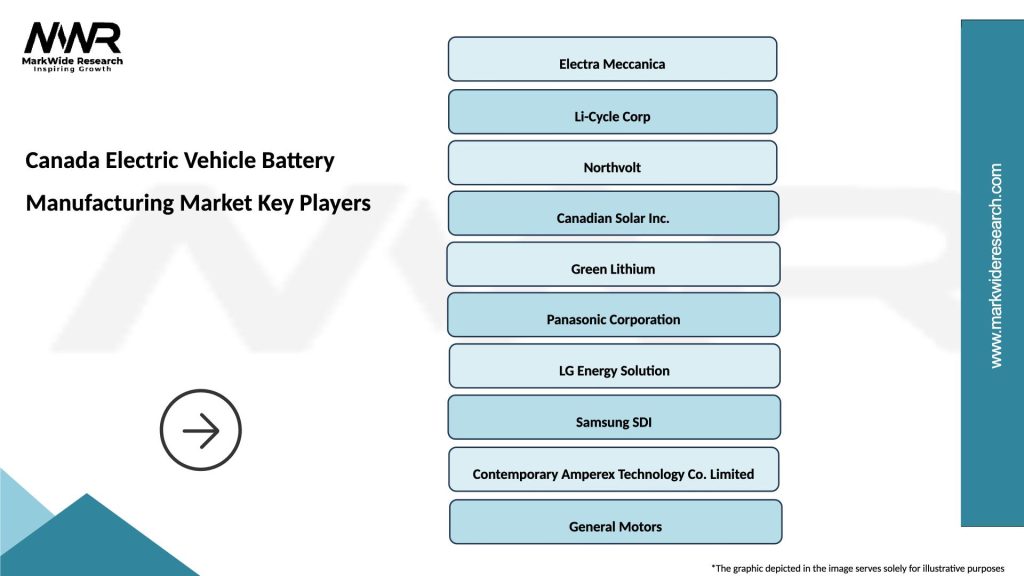

What are the key players in the Canada Electric Vehicle Battery Manufacturing Market?

Key players in the Canada Electric Vehicle Battery Manufacturing Market include companies like LG Chem, Panasonic, and Northvolt, which are involved in the production and development of advanced battery technologies. These companies are focusing on enhancing battery performance and sustainability, among others.

What are the growth factors driving the Canada Electric Vehicle Battery Manufacturing Market?

The growth of the Canada Electric Vehicle Battery Manufacturing Market is driven by increasing demand for electric vehicles, advancements in battery technology, and government incentives promoting clean energy. Additionally, the push for reduced carbon emissions is encouraging investments in battery production.

What challenges does the Canada Electric Vehicle Battery Manufacturing Market face?

The Canada Electric Vehicle Battery Manufacturing Market faces challenges such as supply chain disruptions, high production costs, and competition from established global manufacturers. Additionally, the need for sustainable sourcing of raw materials poses a significant challenge.

What opportunities exist in the Canada Electric Vehicle Battery Manufacturing Market?

Opportunities in the Canada Electric Vehicle Battery Manufacturing Market include the potential for innovation in battery recycling technologies, the development of new battery chemistries, and partnerships with automotive manufacturers to enhance electric vehicle offerings. The growing focus on renewable energy integration also presents new avenues for growth.

What trends are shaping the Canada Electric Vehicle Battery Manufacturing Market?

Trends shaping the Canada Electric Vehicle Battery Manufacturing Market include the shift towards solid-state batteries, increased investment in battery research and development, and the rise of local manufacturing initiatives to reduce dependency on imports. Additionally, there is a growing emphasis on sustainability and circular economy practices within the industry.

Canada Electric Vehicle Battery Manufacturing Market

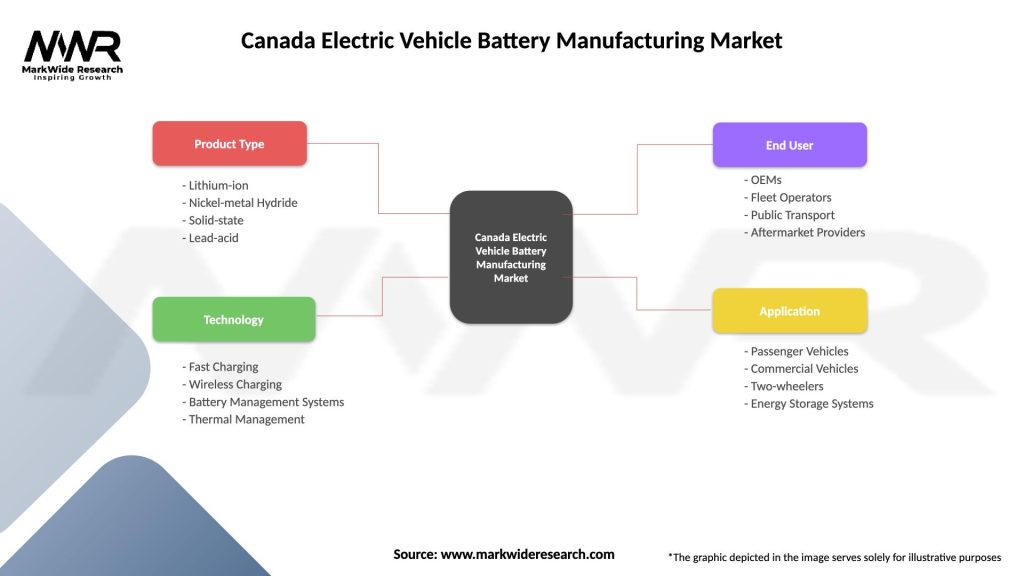

| Segmentation Details | Description |

|---|---|

| Product Type | Lithium-ion, Nickel-metal Hydride, Solid-state, Lead-acid |

| Technology | Fast Charging, Wireless Charging, Battery Management Systems, Thermal Management |

| End User | OEMs, Fleet Operators, Public Transport, Aftermarket Providers |

| Application | Passenger Vehicles, Commercial Vehicles, Two-wheelers, Energy Storage Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Electric Vehicle Battery Manufacturing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at