444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada electric vehicle battery manufacturing equipment market represents a rapidly evolving sector that has emerged as a cornerstone of the nation’s automotive transformation strategy. Manufacturing equipment specifically designed for electric vehicle battery production encompasses sophisticated machinery, automated systems, and precision tools essential for creating high-performance lithium-ion batteries and next-generation energy storage solutions.

Market dynamics indicate that Canada’s strategic positioning in the global electric vehicle supply chain has accelerated demand for advanced battery manufacturing equipment. The country’s abundant natural resources, including critical minerals like lithium, cobalt, and nickel, combined with supportive government policies, have created an attractive environment for battery manufacturing investments. Equipment manufacturers are experiencing unprecedented demand for coating machines, cell assembly systems, formation and testing equipment, and quality control technologies.

Growth projections suggest the market is expanding at a compound annual growth rate of 12.8%, driven by major automotive manufacturers establishing battery production facilities across Ontario, Quebec, and other provinces. Technology adoption rates for automated battery manufacturing equipment have reached 78% among large-scale facilities, reflecting the industry’s commitment to precision, efficiency, and scalability.

Regional concentration shows that Ontario accounts for approximately 45% of battery manufacturing equipment installations, followed by Quebec with significant investments in cathode material processing equipment. The market encompasses various equipment categories, from electrode preparation machinery to final battery pack assembly systems, each requiring specialized engineering and advanced automation capabilities.

The Canada electric vehicle battery manufacturing equipment market refers to the comprehensive ecosystem of specialized machinery, automated systems, and precision tools designed specifically for producing electric vehicle batteries within Canadian manufacturing facilities. This market encompasses equipment used throughout the entire battery production process, from raw material processing to final battery pack assembly and testing.

Manufacturing equipment in this context includes electrode coating machines, cell winding and stacking systems, electrolyte filling equipment, formation and aging chambers, battery management system integration tools, and comprehensive quality control testing apparatus. Advanced automation technologies, including robotics, artificial intelligence-driven quality control, and integrated manufacturing execution systems, form integral components of modern battery production lines.

Market scope extends beyond traditional manufacturing machinery to include environmental control systems, safety equipment, material handling solutions, and specialized tooling required for various battery chemistries and form factors. The equipment serves multiple battery types, including lithium-ion, solid-state, and emerging battery technologies, each requiring specific manufacturing approaches and specialized equipment configurations.

Canada’s electric vehicle battery manufacturing equipment market has experienced remarkable transformation, positioning the country as a significant player in North America’s battery supply chain ecosystem. Strategic investments from major automotive manufacturers and battery producers have catalyzed demand for sophisticated manufacturing equipment capable of producing high-quality, cost-effective battery solutions.

Market expansion has been fueled by government initiatives supporting clean technology adoption, substantial foreign direct investment, and the establishment of integrated battery manufacturing hubs. Equipment procurement patterns show increasing preference for fully automated production lines, with automation levels reaching 82% in new facility installations. This trend reflects manufacturers’ focus on achieving consistent quality, reducing production costs, and meeting stringent safety standards.

Technology integration has become increasingly sophisticated, with manufacturers adopting Industry 4.0 principles, predictive maintenance systems, and real-time quality monitoring capabilities. Supply chain localization efforts have intensified, with 65% of equipment suppliers establishing Canadian operations or partnerships to support growing demand and reduce dependency on international supply chains.

Competitive dynamics show a mix of established international equipment manufacturers and emerging Canadian technology companies developing specialized solutions for battery production. The market demonstrates strong growth potential, supported by committed investments in electric vehicle adoption and renewable energy storage applications.

Strategic positioning analysis reveals several critical insights shaping Canada’s electric vehicle battery manufacturing equipment market. Government support through various incentive programs and strategic partnerships has created a favorable investment climate, attracting significant capital commitments from global battery manufacturers.

Market maturation indicators suggest the industry is transitioning from initial capacity building to optimization and efficiency improvement phases. Equipment utilization rates have reached 87% across operational facilities, demonstrating strong demand for battery production capacity.

Government policy support serves as the primary catalyst driving Canada’s electric vehicle battery manufacturing equipment market expansion. Federal and provincial incentives have created compelling investment opportunities, encouraging both domestic and international manufacturers to establish production facilities equipped with state-of-the-art manufacturing systems.

Automotive industry transformation represents another significant driver, with major automakers committing to electric vehicle production targets and establishing integrated supply chains. OEM requirements for high-quality, cost-competitive batteries have intensified demand for precision manufacturing equipment capable of meeting stringent automotive standards and production volumes.

Resource availability provides Canada with unique competitive advantages, including access to critical battery materials and renewable energy sources. Mining sector integration enables vertical supply chain development, creating demand for specialized equipment that can process raw materials into battery-grade components within Canadian facilities.

Technology advancement in battery chemistry and manufacturing processes drives continuous equipment upgrades and new system installations. Innovation requirements for next-generation battery technologies, including solid-state batteries and advanced lithium-ion formulations, necessitate sophisticated manufacturing equipment capable of handling diverse production requirements.

Economic factors including job creation objectives, export potential, and industrial diversification goals support sustained investment in battery manufacturing infrastructure. Strategic positioning within North American supply chains enhances Canada’s attractiveness as a manufacturing hub, driving equipment procurement and facility development.

Capital intensity represents the most significant restraint affecting Canada’s electric vehicle battery manufacturing equipment market. High initial investment requirements for comprehensive battery production lines can exceed hundreds of millions of dollars, creating barriers for smaller manufacturers and limiting market participation to well-capitalized organizations.

Technical complexity associated with battery manufacturing equipment presents operational challenges requiring specialized expertise and extensive training programs. Skilled labor shortages in advanced manufacturing sectors can limit equipment utilization efficiency and create bottlenecks in production scaling efforts.

Supply chain dependencies on international equipment manufacturers create potential vulnerabilities, particularly for specialized components and advanced automation systems. Delivery timelines for custom manufacturing equipment can extend 18-24 months, potentially delaying facility commissioning and production ramp-up schedules.

Technology obsolescence risks associated with rapidly evolving battery technologies can impact equipment investment decisions. Manufacturing flexibility requirements necessitate equipment capable of adapting to changing battery chemistries and form factors, potentially increasing system complexity and costs.

Regulatory compliance requirements for safety, environmental, and quality standards add complexity to equipment selection and installation processes. Certification processes for new manufacturing equipment can be time-consuming and costly, particularly for innovative technologies without established track records.

Emerging battery technologies present substantial opportunities for specialized manufacturing equipment development and deployment. Solid-state battery production requires entirely new manufacturing approaches, creating demand for innovative equipment solutions and positioning early adopters for competitive advantages.

Recycling integration opportunities are expanding as battery end-of-life management becomes increasingly important. Circular economy initiatives drive demand for equipment capable of processing recycled materials and integrating recovered components into new battery production processes.

Export market development offers significant growth potential, with Canadian-manufactured batteries and components finding markets throughout North America and beyond. Trade agreement advantages position Canadian manufacturers favorably in international markets, supporting equipment investment justification.

Research and development partnerships between equipment manufacturers, battery producers, and academic institutions create opportunities for innovative solution development. Technology commercialization programs support the transition from laboratory-scale innovations to commercial manufacturing applications.

Energy storage applications beyond automotive markets, including grid-scale storage and residential systems, expand the addressable market for battery manufacturing equipment. Diversified applications provide risk mitigation and additional revenue streams for equipment investments.

Automation advancement opportunities include integration of artificial intelligence, machine learning, and advanced robotics to improve manufacturing efficiency and quality control. Industry 4.0 implementation enables predictive maintenance, real-time optimization, and enhanced production visibility.

Competitive dynamics within Canada’s electric vehicle battery manufacturing equipment market reflect a complex interplay of established international suppliers and emerging domestic technology providers. Market consolidation trends show larger equipment manufacturers acquiring specialized technology companies to expand their solution portfolios and strengthen market positions.

Technology evolution drives continuous market transformation, with manufacturers regularly updating equipment specifications to accommodate new battery chemistries and production requirements. Innovation cycles have accelerated, with equipment upgrade frequencies increasing by 35% compared to traditional automotive manufacturing sectors.

Customer relationships are evolving toward long-term partnerships rather than transactional equipment purchases. Service integration has become increasingly important, with equipment suppliers providing comprehensive support including installation, training, maintenance, and performance optimization services.

Supply chain dynamics show increasing localization efforts, with international equipment manufacturers establishing Canadian operations to better serve the growing market. Partnership strategies between equipment suppliers and battery manufacturers are becoming more sophisticated, involving joint development programs and risk-sharing arrangements.

Investment patterns demonstrate strong confidence in long-term market growth, with committed capital investments reaching record levels across multiple provinces. Financing mechanisms have evolved to support equipment procurement, including leasing options, government-backed loans, and strategic partnerships with financial institutions.

Comprehensive market analysis for Canada’s electric vehicle battery manufacturing equipment market employed multiple research methodologies to ensure accuracy and completeness. Primary research included extensive interviews with equipment manufacturers, battery producers, government officials, and industry experts to gather firsthand insights into market dynamics and trends.

Secondary research encompassed analysis of government reports, industry publications, company financial statements, and technical documentation to validate primary findings and provide comprehensive market context. Data triangulation techniques were employed to cross-verify information from multiple sources and ensure reliability.

Market sizing methodologies combined top-down and bottom-up approaches, analyzing equipment procurement patterns, facility capacity additions, and investment announcements to develop accurate market assessments. Forecasting models incorporated multiple variables including policy changes, technology advancement rates, and economic factors.

Competitive analysis involved detailed examination of major equipment suppliers, their product portfolios, market strategies, and competitive positioning. Technology assessment included evaluation of emerging manufacturing technologies and their potential market impact.

Regional analysis examined provincial differences in market development, policy support, and investment patterns. Stakeholder mapping identified key decision-makers, influencers, and market participants across the value chain.

Ontario dominates Canada’s electric vehicle battery manufacturing equipment market, accounting for approximately 48% of total equipment installations. Strategic advantages include proximity to major automotive manufacturing centers, established supply chains, and significant government support through various incentive programs.

Quebec represents the second-largest regional market, with particular strength in cathode material processing equipment and specialized battery component manufacturing. Hydroelectric power availability provides cost advantages for energy-intensive manufacturing processes, attracting investments in high-capacity production equipment.

British Columbia has emerged as a significant market for battery recycling and critical material processing equipment. Mining industry connections and port access for international trade support specialized equipment installations focused on raw material processing and component manufacturing.

Prairie provinces show growing interest in battery manufacturing equipment, particularly for energy storage applications supporting renewable energy projects. Resource extraction capabilities and available industrial land support large-scale manufacturing facility development.

Atlantic Canada demonstrates potential for specialized equipment applications, particularly in marine battery systems and renewable energy storage. Research institutions in the region contribute to technology development and equipment testing capabilities.

Regional collaboration initiatives are fostering knowledge sharing and supply chain integration across provinces. Interprovincial partnerships support equipment standardization and shared procurement strategies, enhancing overall market efficiency.

Market leadership in Canada’s electric vehicle battery manufacturing equipment sector is shared among several key categories of suppliers, each bringing distinct capabilities and market approaches. International equipment manufacturers maintain strong positions through established technology portfolios and global service networks.

Competitive strategies increasingly focus on providing comprehensive solutions rather than individual equipment pieces. Service integration has become a key differentiator, with suppliers offering training, maintenance, and optimization services to support customer success.

Technology partnerships between equipment manufacturers and battery producers are driving innovation and customization. Collaborative development programs enable equipment suppliers to better understand specific manufacturing requirements and develop targeted solutions.

Technology-based segmentation reveals distinct equipment categories serving different aspects of battery manufacturing processes. Electrode preparation equipment includes coating machines, drying systems, and calendering equipment essential for creating high-quality battery electrodes with precise specifications.

By Equipment Type:

By Application Segment:

By Automation Level:

Coating equipment represents the largest category within Canada’s battery manufacturing equipment market, driven by the critical importance of electrode quality in battery performance. Advanced coating technologies including slot-die coating and gravure coating are gaining adoption for their precision and efficiency advantages.

Cell assembly systems show rapid growth as manufacturers prioritize automation to achieve consistent quality and high production volumes. Winding and stacking equipment with integrated quality control systems are particularly in demand, with automation rates reaching 89% in new installations.

Formation and testing equipment has evolved significantly, incorporating advanced analytics and predictive capabilities. Testing system integration with manufacturing execution systems enables real-time quality monitoring and process optimization, improving overall production efficiency.

Pack assembly equipment demonstrates increasing sophistication as battery management system integration becomes more complex. Modular assembly systems that can accommodate different battery configurations and sizes are gaining preference among manufacturers seeking production flexibility.

Material handling systems have become increasingly important as production volumes scale. Automated material flow systems reduce contamination risks and improve production efficiency, with implementation rates increasing by 42% across major facilities.

Quality control equipment integration throughout production lines reflects the industry’s focus on zero-defect manufacturing. In-line inspection systems and automated testing equipment help ensure consistent product quality and reduce waste.

Equipment manufacturers benefit from sustained demand growth and opportunities to develop specialized solutions for emerging battery technologies. Technology leadership positions enable premium pricing and long-term customer relationships, while service integration provides recurring revenue streams.

Battery producers gain access to advanced manufacturing capabilities that enable cost-effective, high-quality production. Automation benefits include reduced labor costs, improved consistency, and enhanced safety, while advanced equipment enables faster time-to-market for new battery technologies.

Automotive manufacturers benefit from reliable, cost-competitive battery supply chains supported by advanced manufacturing equipment. Quality assurance provided by sophisticated equipment helps meet stringent automotive standards and customer expectations.

Government stakeholders achieve economic development objectives through job creation, technology advancement, and industrial competitiveness enhancement. Strategic positioning in global supply chains supports trade objectives and economic diversification goals.

Research institutions gain opportunities to collaborate on technology development and commercialization projects. Knowledge transfer between academic research and industrial applications accelerates innovation and supports workforce development.

Financial institutions benefit from investment opportunities in growing industrial sectors with strong government support. Risk mitigation through diversified equipment financing portfolios supports sustainable business growth.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation acceleration represents the most significant trend shaping Canada’s electric vehicle battery manufacturing equipment market. Industry 4.0 implementation is driving adoption of smart manufacturing systems that integrate artificial intelligence, machine learning, and advanced robotics to optimize production processes and quality control.

Sustainability integration has become a critical consideration in equipment selection and facility design. Energy-efficient equipment and closed-loop manufacturing processes are gaining preference as manufacturers seek to minimize environmental impact and reduce operational costs.

Modular equipment design is gaining traction as manufacturers require flexibility to adapt to changing battery technologies and market demands. Scalable production systems enable capacity adjustments without complete line replacements, providing cost-effective growth strategies.

Quality control advancement through integrated inspection systems and real-time monitoring capabilities is becoming standard across production lines. Predictive maintenance systems help minimize downtime and optimize equipment performance through data-driven insights.

Supply chain localization efforts are intensifying, with equipment manufacturers establishing Canadian operations and service centers. Domestic sourcing preferences are driving development of local supplier networks and reducing dependency on international supply chains.

Collaborative development between equipment suppliers and battery manufacturers is becoming more common, with joint innovation programs addressing specific manufacturing challenges and technology requirements.

Major facility announcements have accelerated throughout Canada, with several international battery manufacturers committing to large-scale production facilities equipped with state-of-the-art manufacturing equipment. Investment commitments from companies like Stellantis, LG Energy Solution, and Ford Motor Company have catalyzed equipment procurement activities.

Technology partnerships between Canadian research institutions and international equipment manufacturers are advancing next-generation manufacturing capabilities. MarkWide Research analysis indicates these collaborations are accelerating the development of specialized equipment for emerging battery technologies.

Government initiatives including the Strategic Innovation Fund and various provincial programs have provided substantial support for equipment investments and facility development. Policy alignment across federal and provincial levels has created consistent support for battery manufacturing infrastructure development.

Supply chain developments include establishment of equipment service centers and parts distribution networks to support growing installed base. Maintenance capabilities and technical support infrastructure are expanding to ensure optimal equipment performance and minimize production disruptions.

Innovation programs focused on advanced manufacturing technologies are yielding practical applications in battery production. Pilot projects testing new equipment concepts and production processes are providing valuable insights for commercial implementation.

Workforce development initiatives are expanding to support growing demand for skilled technicians and engineers capable of operating advanced manufacturing equipment. Training partnerships between equipment manufacturers and educational institutions are addressing skill gaps.

Strategic equipment selection should prioritize flexibility and scalability to accommodate evolving battery technologies and market demands. Investment decisions should consider total cost of ownership rather than initial purchase price, including maintenance, training, and upgrade costs over equipment lifecycle.

Partnership development with equipment suppliers should extend beyond transactional relationships to include collaborative innovation and long-term support agreements. Service integration becomes increasingly important as equipment complexity increases and operational efficiency requirements intensify.

Workforce preparation requires proactive investment in training and skill development programs to support advanced manufacturing equipment operation. Talent retention strategies should address competitive market conditions and growing demand for specialized skills.

Technology roadmap alignment between battery development and manufacturing equipment capabilities ensures optimal production efficiency and quality outcomes. Early engagement with equipment suppliers during technology development phases enables better integration and faster commercialization.

Risk management strategies should address supply chain dependencies, technology obsolescence, and market volatility through diversified supplier relationships and flexible equipment configurations. Contingency planning for equipment maintenance and replacement ensures production continuity.

Sustainability considerations should influence equipment selection to support environmental objectives and regulatory compliance. Energy efficiency and waste reduction capabilities provide both environmental and economic benefits.

Market expansion projections for Canada’s electric vehicle battery manufacturing equipment sector remain highly positive, supported by sustained investment commitments and favorable policy environment. Growth acceleration is expected to continue with equipment demand increasing at approximately 15.2% annually through the next five years.

Technology evolution will drive continuous equipment upgrades and new system installations as battery technologies advance. Solid-state battery commercialization and next-generation lithium-ion technologies will require specialized manufacturing equipment, creating new market opportunities.

Capacity expansion across existing facilities and new facility development will sustain equipment demand growth. MWR projections indicate that Canadian battery manufacturing capacity could increase by over 300% within the next decade, driving substantial equipment procurement activities.

Export market development will provide additional growth drivers as Canadian-manufactured batteries and components find markets throughout North America and beyond. Trade relationships and competitive positioning will support sustained market expansion.

Innovation acceleration through continued research and development investments will yield new equipment technologies and manufacturing approaches. Automation advancement and artificial intelligence integration will enhance production efficiency and quality control capabilities.

Supply chain maturation will improve equipment availability, service capabilities, and cost competitiveness. Domestic supplier development will reduce dependencies and enhance market resilience while supporting broader economic development objectives.

Canada’s electric vehicle battery manufacturing equipment market represents a dynamic and rapidly expanding sector positioned at the forefront of the global automotive transformation. Strategic advantages including abundant natural resources, supportive government policies, and proximity to major automotive markets have created compelling conditions for sustained market growth and technological advancement.

Market fundamentals remain strong, with committed investments from major manufacturers, advancing technology capabilities, and growing demand for electric vehicles driving equipment procurement activities. Competitive positioning continues to improve as domestic capabilities expand and international partnerships strengthen supply chain resilience.

Future prospects indicate continued market expansion supported by technology innovation, capacity scaling, and export market development. Strategic focus on automation, sustainability, and quality excellence positions Canadian battery manufacturing for long-term competitiveness in global markets, ensuring sustained demand for advanced manufacturing equipment and supporting the nation’s clean technology leadership objectives.

What is Electric Vehicle Battery Manufacturing Equipment?

Electric Vehicle Battery Manufacturing Equipment refers to the machinery and tools used in the production of batteries specifically designed for electric vehicles. This includes equipment for cell assembly, battery pack formation, and quality testing, which are essential for ensuring the performance and safety of electric vehicle batteries.

What are the key players in the Canada Electric Vehicle Battery Manufacturing Equipment Market?

Key players in the Canada Electric Vehicle Battery Manufacturing Equipment Market include companies like Tesla, LG Chem, and Panasonic, which are known for their advancements in battery technology and manufacturing processes. These companies are actively involved in developing innovative solutions to enhance battery efficiency and production capabilities, among others.

What are the growth factors driving the Canada Electric Vehicle Battery Manufacturing Equipment Market?

The growth of the Canada Electric Vehicle Battery Manufacturing Equipment Market is driven by the increasing demand for electric vehicles, advancements in battery technology, and government initiatives promoting sustainable transportation. Additionally, the rise in consumer awareness regarding environmental issues is further propelling market growth.

What challenges does the Canada Electric Vehicle Battery Manufacturing Equipment Market face?

The Canada Electric Vehicle Battery Manufacturing Equipment Market faces challenges such as high manufacturing costs, supply chain disruptions, and the need for continuous innovation to keep up with rapidly evolving technology. These factors can hinder the scalability and affordability of battery production.

What opportunities exist in the Canada Electric Vehicle Battery Manufacturing Equipment Market?

Opportunities in the Canada Electric Vehicle Battery Manufacturing Equipment Market include the potential for partnerships between manufacturers and technology firms to develop advanced battery solutions. Additionally, the growing focus on renewable energy sources and energy storage systems presents avenues for market expansion.

What trends are shaping the Canada Electric Vehicle Battery Manufacturing Equipment Market?

Trends shaping the Canada Electric Vehicle Battery Manufacturing Equipment Market include the shift towards solid-state batteries, increased automation in manufacturing processes, and the integration of artificial intelligence for quality control. These innovations are expected to enhance production efficiency and battery performance.

Canada Electric Vehicle Battery Manufacturing Equipment Market

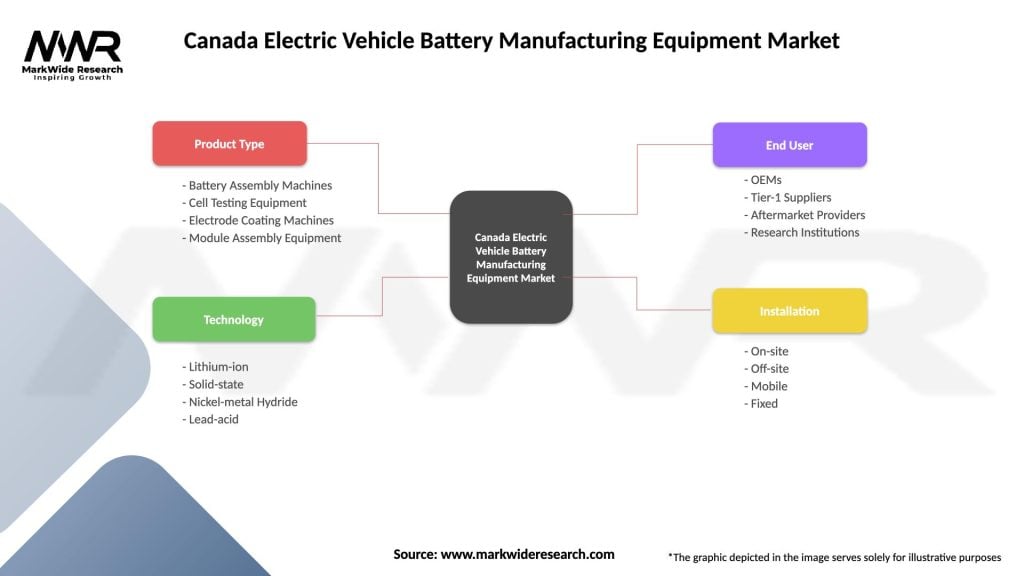

| Segmentation Details | Description |

|---|---|

| Product Type | Battery Assembly Machines, Cell Testing Equipment, Electrode Coating Machines, Module Assembly Equipment |

| Technology | Lithium-ion, Solid-state, Nickel-metal Hydride, Lead-acid |

| End User | OEMs, Tier-1 Suppliers, Aftermarket Providers, Research Institutions |

| Installation | On-site, Off-site, Mobile, Fixed |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Electric Vehicle Battery Manufacturing Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at