444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada electric vehicle battery anode market represents a critical component of the nation’s rapidly expanding electric mobility ecosystem. As Canada positions itself as a global leader in sustainable transportation solutions, the demand for high-performance battery anode materials has experienced unprecedented growth. The market encompasses various anode technologies including graphite-based anodes, silicon-enhanced anodes, and emerging lithium metal anodes that power electric vehicles across passenger, commercial, and industrial segments.

Market dynamics indicate robust expansion driven by federal and provincial government initiatives supporting electric vehicle adoption. The Canadian market benefits from abundant natural resources, including graphite deposits and advanced manufacturing capabilities that position the country as a strategic supplier in the North American electric vehicle supply chain. Current growth trajectories suggest the market is expanding at a compound annual growth rate of 18.2%, reflecting strong domestic demand and export opportunities.

Regional distribution shows concentrated activity in Ontario, Quebec, and British Columbia, where major automotive manufacturers and battery technology companies have established production facilities. The market serves both domestic electric vehicle production and international supply chains, with Canadian companies increasingly recognized for their sustainable mining practices and advanced material processing technologies. Industry adoption rates indicate that 72% of new electric vehicle projects in Canada incorporate locally-sourced anode materials, demonstrating strong supply chain integration.

The Canada electric vehicle battery anode market refers to the comprehensive ecosystem of companies, technologies, and supply chains involved in the production, processing, and distribution of anode materials specifically designed for electric vehicle battery applications within the Canadian market. This market encompasses the extraction of raw materials, refinement processes, manufacturing of finished anode products, and their integration into battery cells for electric vehicles.

Anode materials serve as the negative electrode in lithium-ion batteries, playing a crucial role in energy storage and release during charging and discharging cycles. In the Canadian context, this market includes traditional graphite anodes, which currently dominate the market, as well as innovative materials such as silicon nanowires, silicon-graphite composites, and next-generation lithium metal anodes that promise enhanced energy density and faster charging capabilities.

The market definition extends beyond material production to include research and development activities, quality testing facilities, supply chain logistics, and strategic partnerships between Canadian companies and international electric vehicle manufacturers. This comprehensive approach positions Canada as both a raw material supplier and a technology innovator in the global electric vehicle battery ecosystem.

Strategic positioning of Canada’s electric vehicle battery anode market reflects the nation’s commitment to sustainable transportation and clean energy technologies. The market has evolved from primarily serving as a raw material supplier to becoming a comprehensive hub for advanced anode material development and manufacturing. Key market participants include established mining companies, innovative material technology firms, and strategic partnerships with international battery manufacturers.

Growth drivers encompass multiple factors including government incentives for electric vehicle adoption, substantial investments in battery manufacturing facilities, and Canada’s abundant natural resources. The federal government’s commitment to achieving net-zero emissions by 2050 has catalyzed significant investment in the electric vehicle supply chain, with anode materials representing a critical component of this strategy.

Market segmentation reveals diverse applications across passenger electric vehicles, commercial electric trucks, electric buses, and energy storage systems. Technology segments include conventional graphite anodes, silicon-enhanced anodes, and emerging solid-state battery anodes. The market serves both domestic consumption and export markets, with 45% of production destined for international customers, primarily in the United States and Asia-Pacific regions.

Competitive landscape features a mix of established Canadian mining companies expanding into value-added processing, international battery material companies establishing Canadian operations, and innovative startups developing next-generation anode technologies. Strategic partnerships and joint ventures have become increasingly common as companies seek to integrate vertically and secure supply chain stability.

Technology evolution in the Canadian electric vehicle battery anode market demonstrates significant advancement beyond traditional graphite-based solutions. The market has witnessed increased adoption of silicon-graphite composite anodes that offer improved energy density while maintaining cost-effectiveness. These technological improvements have resulted in 35% better energy storage capacity compared to conventional graphite anodes, making Canadian-produced materials increasingly attractive to international battery manufacturers.

Government initiatives represent the primary catalyst driving Canada’s electric vehicle battery anode market expansion. Federal commitments to electric vehicle adoption, including mandates requiring 100% zero-emission vehicle sales by 2035, have created substantial demand for domestic battery components. Provincial governments have complemented federal efforts with additional incentives, tax credits, and infrastructure investments that support the entire electric vehicle ecosystem.

Automotive industry transformation has accelerated demand for high-performance anode materials as traditional automakers transition to electric vehicle production. Major automotive manufacturers have announced significant investments in Canadian electric vehicle production facilities, creating direct demand for locally-sourced battery components. This industrial transformation has been supported by strategic partnerships between Canadian material suppliers and international automotive companies seeking supply chain security and sustainability.

Resource abundance provides Canada with fundamental competitive advantages in anode material production. The country’s extensive graphite deposits, particularly in Quebec and Ontario, offer high-quality raw materials essential for battery anode manufacturing. Additionally, Canada’s advanced mining technologies and environmental regulations ensure sustainable extraction practices that meet increasingly stringent international standards for responsible sourcing.

Technological innovation continues driving market growth as Canadian companies develop advanced anode materials with superior performance characteristics. Research and development investments have yielded breakthrough technologies including silicon nanowire anodes and graphene-enhanced materials that offer significantly improved energy density and charging speeds. These innovations position Canadian companies at the forefront of next-generation battery technology development.

Capital intensity represents a significant barrier to entry in the Canadian electric vehicle battery anode market. Establishing advanced processing facilities requires substantial upfront investments in specialized equipment, quality control systems, and environmental compliance infrastructure. These high capital requirements can limit market participation to well-funded companies and may slow overall market expansion, particularly for smaller innovative firms developing breakthrough technologies.

Technical complexity in anode material production presents ongoing challenges for market participants. Manufacturing high-performance anode materials requires precise control of chemical processes, particle size distribution, and surface characteristics. Quality consistency remains critical as automotive applications demand extremely reliable performance standards. Technical challenges become more pronounced with advanced materials such as silicon-graphite composites that require sophisticated manufacturing processes.

Supply chain dependencies create potential vulnerabilities despite Canada’s resource advantages. While the country possesses abundant raw materials, certain specialized chemicals and processing equipment must be imported, creating potential supply chain disruptions. International trade tensions and shipping delays can impact production schedules and increase costs, particularly for companies serving time-sensitive automotive manufacturing requirements.

Regulatory complexity adds operational challenges as companies must navigate multiple jurisdictions and evolving standards. Environmental regulations, mining permits, and automotive industry certifications require significant compliance investments and ongoing monitoring. Additionally, international trade regulations and potential tariffs can impact export opportunities and competitive positioning in global markets.

Export expansion presents substantial growth opportunities as global demand for responsibly-sourced anode materials continues increasing. Canadian companies benefit from the country’s reputation for environmental stewardship and sustainable mining practices, positioning them favorably in markets where supply chain transparency is increasingly valued. The United States market, in particular, offers significant opportunities through trade agreements and shared sustainability goals.

Technology advancement opportunities abound in next-generation anode materials development. Canadian research institutions and companies are well-positioned to lead innovation in solid-state battery anodes, lithium metal anodes, and other breakthrough technologies. These advanced materials promise significantly improved performance characteristics and could command premium pricing in global markets, enhancing profitability for Canadian producers.

Vertical integration strategies offer opportunities for Canadian companies to capture additional value throughout the supply chain. Companies can expand from raw material extraction into value-added processing, finished anode production, and even battery cell manufacturing. This integration approach can improve margins, ensure quality control, and provide greater supply chain security for downstream customers.

Strategic partnerships with international automotive manufacturers and battery companies present opportunities for long-term growth and market stability. These partnerships can provide guaranteed demand, technology sharing opportunities, and access to global distribution networks. Canadian companies’ reputation for reliability and sustainability makes them attractive partners for international companies seeking supply chain diversification.

Supply and demand dynamics in the Canadian electric vehicle battery anode market reflect the broader transformation of the automotive industry toward electrification. Demand growth significantly outpaces current supply capacity, creating opportunities for market expansion and new entrant participation. This supply-demand imbalance has resulted in premium pricing for high-quality anode materials and has encouraged investment in additional production capacity.

Competitive dynamics feature intense competition between established mining companies expanding into value-added processing and specialized battery material companies. Competition focuses on product quality, supply chain reliability, and technological innovation rather than solely on price. Companies differentiate themselves through sustainable production practices, advanced material properties, and comprehensive customer support services.

Innovation dynamics drive continuous improvement in anode material performance and production efficiency. According to MarkWide Research analysis, the market has witnessed accelerated technology development cycles as companies race to commercialize next-generation materials. Research and development investments have increased substantially, with companies allocating significant resources to breakthrough technologies that could reshape the competitive landscape.

Investment dynamics reflect strong confidence in the market’s long-term growth potential. Private equity, venture capital, and strategic investors have committed substantial funding to Canadian anode material companies. Government support through grants, tax incentives, and loan guarantees has further enhanced the investment climate, enabling companies to scale operations and pursue ambitious expansion plans.

Primary research methodologies employed in analyzing the Canadian electric vehicle battery anode market include comprehensive interviews with industry executives, technical specialists, and government officials. These interviews provide insights into market trends, competitive dynamics, and regulatory developments that shape industry evolution. Survey research among market participants captures quantitative data on production capacity, investment plans, and technology adoption rates.

Secondary research encompasses analysis of industry reports, government publications, patent filings, and academic research papers. Financial analysis of public companies provides insights into market performance, investment trends, and competitive positioning. Trade association data and industry conference proceedings offer additional perspectives on market developments and future outlook.

Market modeling techniques incorporate multiple data sources to develop comprehensive market size estimates and growth projections. Statistical analysis identifies key market drivers and their relative impact on market development. Scenario modeling evaluates potential market outcomes under different regulatory, technological, and economic conditions.

Validation processes ensure research accuracy through triangulation of multiple data sources and expert review. Industry experts validate findings and provide feedback on market analysis conclusions. Continuous monitoring of market developments ensures research remains current and relevant to stakeholder decision-making requirements.

Ontario dominates the Canadian electric vehicle battery anode market, accounting for approximately 42% of national production capacity. The province benefits from proximity to major automotive manufacturing centers, established supply chains, and supportive government policies. Key companies have established processing facilities in the region, taking advantage of skilled workforce availability and transportation infrastructure. Ontario’s strategic location provides efficient access to both domestic and United States markets.

Quebec represents the second-largest regional market, contributing 35% of national anode material production. The province’s abundant graphite resources and hydroelectric power provide competitive advantages for energy-intensive processing operations. Quebec’s focus on sustainable development and clean energy aligns well with the environmental requirements of modern battery manufacturing. Several international companies have chosen Quebec for their North American operations due to these advantages.

British Columbia accounts for 15% of market activity, primarily focused on innovative material technologies and research and development activities. The province’s strong technology sector and proximity to Asian markets provide unique opportunities for advanced material development and export. Several startup companies developing next-generation anode technologies have established operations in British Columbia, benefiting from the region’s innovation ecosystem.

Other provinces contribute the remaining 8% of market activity, primarily through raw material extraction and specialized processing operations. Saskatchewan and Manitoba possess significant mineral resources that support the broader supply chain, while Atlantic provinces are exploring opportunities in marine-based material extraction and processing technologies.

Market leadership in the Canadian electric vehicle battery anode market is distributed among several key players, each bringing unique strengths and competitive advantages. The competitive landscape features established mining companies that have expanded into value-added processing, international battery material specialists establishing Canadian operations, and innovative technology companies developing breakthrough anode materials.

Strategic positioning among competitors varies significantly, with some companies focusing on cost leadership through efficient operations while others pursue differentiation through advanced technology and superior product performance. Vertical integration strategies have become increasingly common as companies seek to control quality and capture additional value throughout the supply chain.

By Material Type: The Canadian electric vehicle battery anode market segments into several distinct material categories, each serving specific performance and cost requirements. Natural graphite anodes currently dominate the market due to their established performance characteristics and cost-effectiveness. Synthetic graphite anodes serve premium applications requiring superior consistency and performance. Silicon-graphite composite anodes represent the fastest-growing segment, offering enhanced energy density for next-generation electric vehicles.

By Application: Market segmentation by application reveals diverse end-use requirements and growth patterns. Passenger electric vehicles represent the largest application segment, driven by consumer adoption and government incentives. Commercial electric vehicles including delivery trucks and buses constitute a rapidly growing segment with specific performance requirements. Energy storage systems for grid applications represent an emerging opportunity with substantial long-term potential.

By Technology: Technology-based segmentation reflects the market’s evolution toward advanced materials and manufacturing processes. Conventional processing technologies serve established market requirements with proven reliability. Advanced processing technologies enable production of high-performance materials with superior characteristics. Emerging technologies including nanotechnology applications promise breakthrough performance improvements.

By End-User: End-user segmentation encompasses the diverse customer base for Canadian anode materials. Domestic battery manufacturers represent a growing segment as Canadian companies establish local production capabilities. International battery manufacturers constitute the largest customer segment, primarily located in Asia and North America. Automotive manufacturers increasingly source materials directly to ensure supply chain security and quality control.

Natural Graphite Category: This segment maintains market leadership due to abundant Canadian resources and established processing capabilities. Natural graphite anodes offer excellent performance characteristics at competitive costs, making them suitable for mainstream electric vehicle applications. Canadian producers benefit from high-quality ore deposits and environmentally responsible extraction practices that meet international sustainability standards. The category shows steady growth with 12% annual expansion driven by increasing electric vehicle production.

Synthetic Graphite Category: Premium applications drive demand for synthetic graphite anodes that offer superior consistency and performance characteristics. This category serves high-end electric vehicles and specialized applications requiring exceptional reliability. Canadian companies have invested in advanced synthetic graphite production technologies, positioning themselves competitively in this value-added segment. Market growth reaches 15% annually as automotive manufacturers increasingly specify synthetic materials for premium vehicle lines.

Silicon-Enhanced Category: The fastest-growing category features silicon-graphite composite anodes that provide significantly improved energy density compared to conventional materials. Canadian companies are pioneering innovative silicon integration technologies that maintain structural stability while enhancing performance. This category attracts premium pricing due to superior performance characteristics and represents the future direction of anode technology development. Growth rates exceed 25% annually as next-generation electric vehicles adopt these advanced materials.

Emerging Technologies Category: Next-generation anode materials including lithium metal anodes and solid-state compatible materials represent significant future opportunities. Canadian research institutions and companies are actively developing these breakthrough technologies that promise revolutionary performance improvements. While currently representing a small market segment, these technologies could reshape the competitive landscape as they achieve commercial viability.

For Mining Companies: Participation in the electric vehicle battery anode market enables traditional mining companies to capture significantly higher value from their mineral resources. Value-added processing of graphite and other materials commands premium pricing compared to raw material sales. Companies benefit from stable, long-term demand contracts with battery manufacturers and automotive companies, providing revenue predictability and supporting investment in advanced processing capabilities.

For Battery Manufacturers: Access to high-quality Canadian anode materials provides supply chain security and supports sustainability goals. Canadian suppliers offer reliable delivery, consistent quality, and environmentally responsible production practices that align with corporate sustainability commitments. Proximity to North American markets reduces transportation costs and delivery times while supporting supply chain resilience.

For Automotive Companies: Canadian anode material suppliers provide strategic supply chain diversification and support for sustainability initiatives. Long-term partnerships with Canadian companies offer price stability and guaranteed supply security for critical battery components. Additionally, Canadian suppliers’ focus on innovation supports automotive companies’ development of next-generation electric vehicles with improved performance characteristics.

For Government Stakeholders: The electric vehicle battery anode market supports multiple policy objectives including economic development, environmental protection, and energy security. Industry development creates high-value employment opportunities and supports regional economic diversification. Export opportunities generate foreign exchange earnings while domestic supply capabilities reduce dependence on international suppliers for critical materials.

For Investors: The market offers attractive investment opportunities with strong growth prospects and government support. Companies benefit from multiple revenue streams including domestic sales, exports, and technology licensing opportunities. The industry’s strategic importance ensures continued government support and favorable regulatory treatment, reducing investment risks.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration has emerged as a defining trend in the Canadian electric vehicle battery anode market. Companies increasingly emphasize carbon-neutral production processes, renewable energy utilization, and circular economy principles in their operations. This trend reflects growing consumer and corporate awareness of environmental impact and positions Canadian companies favorably in markets where sustainability credentials are valued. The trend has driven innovation in processing technologies and supply chain optimization.

Technology Convergence represents another significant trend as traditional boundaries between material types blur. Companies are developing hybrid anode materials that combine the benefits of different technologies, such as silicon-graphite composites that offer improved energy density while maintaining structural stability. This convergence trend accelerates innovation cycles and creates opportunities for companies with diverse technology capabilities.

Supply Chain Localization has gained momentum as automotive companies seek to reduce dependence on distant suppliers and improve supply chain resilience. This trend benefits Canadian companies through increased domestic demand and opportunities for long-term partnership agreements. MWR analysis indicates that supply chain localization efforts have resulted in increased investment in North American production capacity.

Digital Integration throughout the supply chain enhances operational efficiency and quality control. Companies are implementing advanced analytics, artificial intelligence, and Internet of Things technologies to optimize production processes and predict maintenance requirements. This digital transformation trend improves competitiveness and enables more responsive customer service.

Collaborative Innovation between companies, research institutions, and government agencies accelerates technology development and commercialization. Joint research projects, shared facilities, and collaborative funding mechanisms enable smaller companies to access advanced technologies and compete effectively with larger international competitors.

Major Investment Announcements have characterized recent industry development, with several companies announcing substantial capacity expansion projects. These investments reflect confidence in long-term market growth and position Canadian companies to serve increasing domestic and international demand. Investment projects focus on advanced processing capabilities and next-generation material technologies that command premium pricing.

Strategic Partnership Formation has accelerated as companies seek to strengthen their competitive positions and access new markets. Partnerships between Canadian material suppliers and international automotive companies provide guaranteed demand and technology sharing opportunities. These collaborations often include joint research and development initiatives that advance material technology and processing capabilities.

Technology Breakthrough Achievements by Canadian companies have garnered international attention and validated the country’s innovation capabilities. Recent developments include advanced silicon nanowire technologies, improved graphite purification processes, and breakthrough solid-state battery compatible materials. These achievements position Canadian companies as technology leaders rather than solely raw material suppliers.

Regulatory Framework Evolution has provided greater clarity and support for industry development. Government initiatives include streamlined permitting processes, enhanced research and development tax credits, and direct financial support for strategic projects. These regulatory improvements reduce investment risks and encourage long-term planning and capacity expansion.

Market Access Expansion through trade agreements and international partnerships has opened new opportunities for Canadian companies. Recent agreements facilitate exports to key markets while ensuring access to essential imported materials and equipment. These developments strengthen Canada’s position in global supply chains and support industry growth objectives.

Investment Prioritization should focus on advanced processing technologies that enable production of next-generation anode materials. Companies should prioritize investments in silicon integration capabilities and solid-state battery compatible materials that will drive future market growth. Strategic investments in research and development capabilities will position companies for long-term competitive advantage as technology continues evolving rapidly.

Partnership Strategy Development represents a critical success factor for Canadian companies seeking to compete effectively in global markets. Companies should pursue strategic partnerships with international automotive manufacturers and battery companies to secure long-term demand and access advanced technologies. These partnerships should include joint research and development initiatives that advance material capabilities and market applications.

Sustainability Leadership should be leveraged as a key differentiator in increasingly conscious global markets. Canadian companies should emphasize their environmental stewardship practices and develop comprehensive sustainability reporting that demonstrates their commitment to responsible production. This positioning will become increasingly valuable as automotive companies face pressure to improve their supply chain sustainability.

Market Diversification across multiple application segments and geographic markets will reduce risk and provide multiple growth opportunities. Companies should develop capabilities to serve diverse market segments including passenger vehicles, commercial vehicles, and energy storage systems. Geographic diversification should balance domestic market development with strategic export opportunities.

Technology Roadmap Development should anticipate future market requirements and position companies for next-generation opportunities. Companies should invest in breakthrough technologies including lithium metal anodes and advanced composite materials that promise revolutionary performance improvements. Early investment in these technologies will provide competitive advantages as they achieve commercial viability.

Long-term growth prospects for the Canadian electric vehicle battery anode market remain exceptionally positive, driven by accelerating electric vehicle adoption and increasing demand for energy storage solutions. MarkWide Research projections indicate sustained growth momentum through the next decade as automotive electrification reaches mainstream adoption levels. The market is expected to benefit from continued government support, technological advancement, and increasing international recognition of Canadian capabilities.

Technology evolution will continue reshaping the competitive landscape as next-generation materials achieve commercial viability. Silicon-enhanced anodes are expected to capture increasing market share as their performance advantages justify premium pricing. Solid-state battery technologies represent longer-term opportunities that could revolutionize anode material requirements and create new market segments for innovative Canadian companies.

Market expansion opportunities will emerge from both domestic electric vehicle production growth and international export demand. Canadian companies are well-positioned to serve North American automotive manufacturers seeking supply chain security and sustainability credentials. Asian markets represent substantial long-term opportunities as environmental regulations drive demand for responsibly-sourced materials.

Industry consolidation may occur as smaller companies seek partnerships or acquisition opportunities to access capital and technology resources necessary for competitive success. This consolidation could create stronger Canadian companies with enhanced capabilities and market presence. Strategic consolidation should strengthen rather than diminish Canada’s competitive position in global markets.

Innovation acceleration will continue as companies invest heavily in research and development to maintain competitive advantages. Breakthrough technologies currently in development could achieve commercial success within the forecast period, potentially disrupting existing market dynamics and creating new opportunities for technology leaders.

The Canada electric vehicle battery anode market represents a strategically important industry positioned for substantial long-term growth. Canada’s abundant natural resources, advanced processing capabilities, and commitment to sustainable development provide fundamental competitive advantages in the global electric vehicle supply chain. The market benefits from strong government support, increasing domestic demand, and growing international recognition of Canadian capabilities and environmental stewardship.

Market dynamics favor continued expansion as electric vehicle adoption accelerates and energy storage applications multiply. Canadian companies have successfully evolved from raw material suppliers to technology innovators, developing advanced anode materials that command premium pricing and serve demanding automotive applications. Strategic partnerships with international companies provide market access and technology sharing opportunities that strengthen competitive positions.

Future success will depend on continued investment in advanced technologies, strategic partnership development, and sustainability leadership. Companies that successfully navigate the transition to next-generation materials while maintaining cost competitiveness will capture the greatest opportunities in this dynamic market. The industry’s strategic importance ensures continued government support and favorable regulatory treatment, reducing investment risks and supporting long-term planning initiatives.

The Canadian electric vehicle battery anode market stands poised to play an increasingly important role in the global transition to sustainable transportation, offering substantial opportunities for companies, investors, and stakeholders committed to innovation, sustainability, and excellence in this critical industry segment.

What is Electric Vehicle Battery Anode?

Electric Vehicle Battery Anode refers to the component in a battery that allows the flow of lithium ions during the charging and discharging process. It plays a crucial role in the performance and efficiency of electric vehicle batteries.

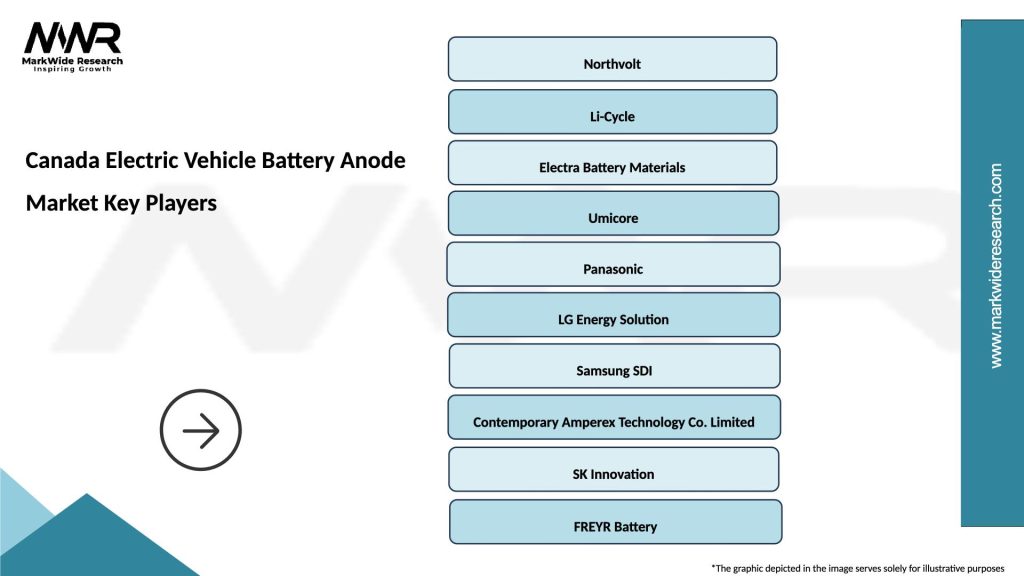

What are the key players in the Canada Electric Vehicle Battery Anode Market?

Key players in the Canada Electric Vehicle Battery Anode Market include companies like Northern Graphite Corporation, Talga Resources, and NanoXplore, among others. These companies are involved in the production and development of advanced anode materials for electric vehicle batteries.

What are the growth factors driving the Canada Electric Vehicle Battery Anode Market?

The growth of the Canada Electric Vehicle Battery Anode Market is driven by the increasing demand for electric vehicles, advancements in battery technology, and government initiatives promoting sustainable transportation. Additionally, the rising focus on reducing carbon emissions is propelling market growth.

What challenges does the Canada Electric Vehicle Battery Anode Market face?

The Canada Electric Vehicle Battery Anode Market faces challenges such as the high cost of raw materials, supply chain disruptions, and competition from alternative battery technologies. These factors can hinder the growth and adoption of electric vehicle battery anodes.

What opportunities exist in the Canada Electric Vehicle Battery Anode Market?

Opportunities in the Canada Electric Vehicle Battery Anode Market include the development of new materials that enhance battery performance and the expansion of recycling technologies for battery components. Additionally, increasing investments in electric vehicle infrastructure present significant growth potential.

What trends are shaping the Canada Electric Vehicle Battery Anode Market?

Trends shaping the Canada Electric Vehicle Battery Anode Market include the shift towards silicon-based anodes, innovations in battery manufacturing processes, and the integration of artificial intelligence in battery management systems. These trends are expected to enhance battery efficiency and longevity.

Canada Electric Vehicle Battery Anode Market

| Segmentation Details | Description |

|---|---|

| Product Type | Graphite, Silicon, Lithium, Composite |

| End User | OEMs, Tier-1 Suppliers, Aftermarket Providers, Vehicle Assemblers |

| Technology | Dry Coating, Wet Coating, Chemical Vapor Deposition, Sintering |

| Application | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Electric Vehicle Battery Anode Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at