444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

Canada is one of the leading agricultural nations in the world, known for its vast agricultural lands and high-quality crop production. The crop protection chemicals market in Canada plays a crucial role in supporting the country’s agricultural sector by providing solutions for pest control, weed management, and disease prevention. These chemicals, also known as agrochemicals or pesticides, are essential for ensuring crop health and maximizing agricultural productivity.

Meaning

Crop protection chemicals refer to a diverse range of substances used to protect crops from pests, diseases, and weeds. They include herbicides, insecticides, fungicides, and other chemical formulations designed to control or eliminate harmful organisms that can damage or reduce crop yields. The use of crop protection chemicals is carefully regulated to ensure their safe and effective application while minimizing any potential adverse environmental or health impacts.

Executive Summary

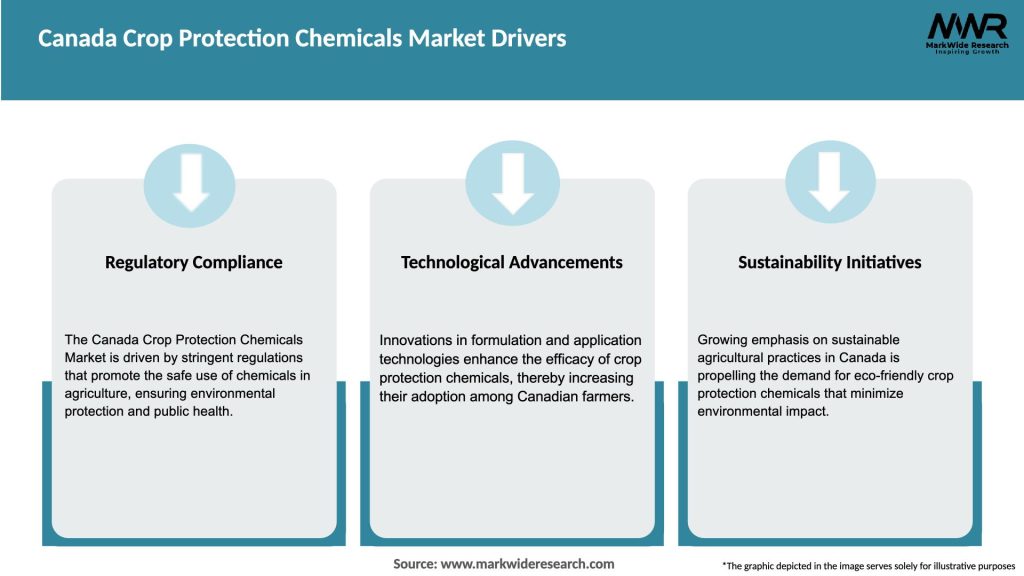

The Canada crop protection chemicals market is witnessing steady growth, driven by the increasing need for agricultural productivity enhancement and the rising demand for high-quality crops. The market is characterized by the presence of several domestic and international players offering a wide range of crop protection solutions. Government initiatives to promote sustainable farming practices and advancements in technology are also contributing to market growth.

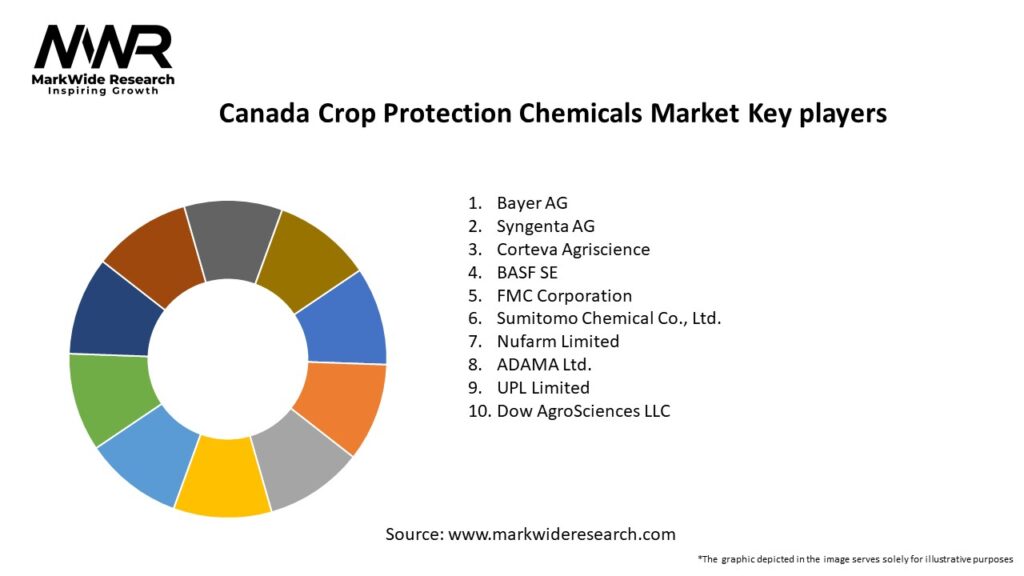

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Canada crop protection chemicals market is dynamic, driven by various factors such as agricultural productivity needs, technological advancements, regulations, and environmental concerns. The market is influenced by changing consumer preferences, government policies, and the need for sustainable farming practices. Ongoing research and development activities, along with industry collaborations, contribute to the evolving landscape of crop protection chemicals.

Regional Analysis

The crop protection chemicals market in Canada exhibits regional variations due to differences in climatic conditions, crop patterns, and farming practices. The major agricultural regions in Canada include the Prairie Provinces (Alberta, Saskatchewan, and Manitoba), Ontario, Quebec, and British Columbia. Each region has its specific crop protection needs and market dynamics, influenced by factors such as pest prevalence, crop diversity, and farmer preferences.

Competitive Landscape

Leading Companies: Canada Crop Protection Chemicals Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Canada crop protection chemicals market can be segmented based on product type, crop type, and application method.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had mixed impacts on the Canada crop protection chemicals market. While the agricultural sector remained essential and continued operations, the pandemic disrupted supply chains, affecting the availability and distribution of agrochemical products. Farmers faced challenges in procuring inputs, including crop protection chemicals. However, the pandemic also highlighted the importance of a secure and resilient food supply chain, emphasizing the need for effective crop protection measures to ensure uninterrupted agricultural productivity.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Canada crop protection chemicals market is expected to witness steady growth in the coming years. The increasing need for agricultural productivity enhancement, growing awareness about sustainable farming practices, and technological advancements will drive market growth. Biopesticides and organic alternatives are likely to gain prominence, along with precision agriculture tools and digital farming solutions. Collaboration, research, and development efforts will play a crucial role in driving innovation and addressing emerging challenges. However, industry participants need to navigate evolving regulations and address concerns related to health, safety, and environmental impact to ensure long-term sustainability.

Conclusion

The Canada crop protection chemicals market plays a vital role in supporting the country’s agricultural sector by providing solutions for pest control, disease prevention, and weed management. The market is driven by the increasing need for agricultural productivity enhancement, growing demand for high-quality crops, and technological advancements. However, the industry also faces challenges related to environmental concerns, health and safety issues, resistance development, and cost considerations. By embracing sustainable practices, focusing on innovation, and adapting to changing regulations, industry participants can seize the opportunities presented by the growing market and contribute to the long-term success of Canada’s agricultural sector.

What is Crop Protection Chemicals?

Crop protection chemicals are substances used to protect crops from pests, diseases, and weeds. They include herbicides, insecticides, fungicides, and other chemical agents that enhance agricultural productivity.

What are the key players in the Canada Crop Protection Chemicals Market?

Key players in the Canada Crop Protection Chemicals Market include Bayer Crop Science, Syngenta, Corteva Agriscience, and BASF, among others. These companies are involved in the development and distribution of various crop protection products.

What are the growth factors driving the Canada Crop Protection Chemicals Market?

The growth of the Canada Crop Protection Chemicals Market is driven by increasing agricultural productivity demands, the need for sustainable farming practices, and advancements in chemical formulations. Additionally, the rise in pest resistance and climate change impacts are influencing market dynamics.

What challenges does the Canada Crop Protection Chemicals Market face?

The Canada Crop Protection Chemicals Market faces challenges such as regulatory pressures, environmental concerns, and the growing trend towards organic farming. These factors can limit the use of certain chemicals and require companies to innovate continuously.

What opportunities exist in the Canada Crop Protection Chemicals Market?

Opportunities in the Canada Crop Protection Chemicals Market include the development of biopesticides, integrated pest management solutions, and precision agriculture technologies. These innovations can help meet the evolving needs of farmers while addressing sustainability concerns.

What trends are shaping the Canada Crop Protection Chemicals Market?

Trends in the Canada Crop Protection Chemicals Market include the increasing adoption of digital agriculture, the rise of environmentally friendly products, and the integration of AI in pest management. These trends are reshaping how crop protection is approached in modern farming.

Canada Crop Protection Chemicals Market

| Segmentation Details | Description |

|---|---|

| Product Type | Herbicides, Insecticides, Fungicides, Biopesticides |

| Application | Cereal Crops, Oilseeds, Fruits, Vegetables |

| End Use Industry | Agriculture, Horticulture, Forestry, Turf Management |

| Packaging Type | Bulk, Sachets, Bottles, Drums |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies: Canada Crop Protection Chemicals Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at