444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada construction equipment market represents a dynamic and rapidly evolving sector that plays a crucial role in the nation’s infrastructure development and economic growth. This comprehensive market encompasses a wide range of heavy machinery, specialized tools, and advanced equipment solutions designed to support construction, mining, forestry, and infrastructure projects across the country. Market dynamics indicate robust growth driven by increasing urbanization, government infrastructure investments, and technological advancements in equipment manufacturing.

Construction equipment demand in Canada has experienced significant momentum, with the market demonstrating resilience despite economic fluctuations. The sector benefits from substantial government spending on infrastructure projects, including transportation networks, residential developments, and commercial construction initiatives. Equipment manufacturers are increasingly focusing on sustainable technologies, fuel-efficient machinery, and smart automation features to meet evolving customer demands and environmental regulations.

Regional distribution shows that Ontario and Alberta lead in equipment adoption, accounting for approximately 45% of total market share, while British Columbia and Quebec contribute significantly to overall market growth. The market is characterized by strong rental penetration rates, with equipment rental services representing nearly 35% of total equipment utilization across various construction segments.

The Canada construction equipment market refers to the comprehensive ecosystem of heavy machinery, tools, and specialized equipment used in construction, infrastructure development, mining, and related industrial activities throughout Canadian provinces and territories. This market encompasses both new equipment sales and rental services, including excavators, bulldozers, cranes, loaders, compactors, and various specialized construction machinery designed to enhance productivity and efficiency in construction projects.

Market scope extends beyond traditional construction applications to include forestry equipment, mining machinery, and infrastructure maintenance tools. The definition encompasses equipment manufacturing, distribution, rental services, maintenance, and aftermarket support services that collectively form the construction equipment value chain in Canada.

Canada’s construction equipment market demonstrates strong fundamentals supported by robust infrastructure spending, technological innovation, and increasing adoption of sustainable construction practices. The market benefits from government initiatives focused on transportation infrastructure, housing development, and green building projects that drive consistent equipment demand across multiple sectors.

Key market drivers include urbanization trends, with approximately 82% of Canadians living in urban areas requiring continuous infrastructure development and maintenance. The market shows particular strength in equipment rental services, which have grown significantly as construction companies seek flexible, cost-effective solutions for project-specific requirements.

Technology integration represents a major market trend, with manufacturers introducing advanced telematics, GPS tracking, and automated systems that improve operational efficiency and reduce environmental impact. The market is experiencing increased demand for electric and hybrid equipment solutions, reflecting Canada’s commitment to environmental sustainability and carbon reduction goals.

Market analysis reveals several critical insights that shape the Canadian construction equipment landscape:

Infrastructure development initiatives serve as the primary catalyst for construction equipment demand in Canada. Government commitments to transportation infrastructure, including highway expansion, bridge construction, and public transit systems, create sustained demand for heavy machinery and specialized equipment. Federal and provincial infrastructure programs allocate substantial resources toward modernizing aging infrastructure and supporting economic growth through construction activities.

Urbanization trends continue driving equipment demand as Canadian cities expand and require continuous development of residential, commercial, and industrial facilities. The growing population concentration in major metropolitan areas necessitates ongoing construction projects that rely heavily on advanced equipment solutions for efficient project completion.

Resource sector activity in mining, oil and gas, and forestry industries generates significant demand for specialized construction equipment. These sectors require robust, durable machinery capable of operating in challenging environments while maintaining high productivity levels. Equipment manufacturers respond by developing specialized solutions tailored to Canadian resource sector requirements.

Technological advancement drives market growth as construction companies seek equipment with enhanced capabilities, improved fuel efficiency, and advanced safety features. The integration of GPS tracking, automated systems, and predictive maintenance technologies creates value propositions that justify equipment investments and upgrades.

High capital costs represent a significant barrier for smaller construction companies seeking to acquire new equipment. The substantial investment required for modern construction machinery often necessitates financing arrangements or rental agreements that may impact cash flow and operational flexibility. Equipment prices continue rising due to advanced technology integration and manufacturing cost increases.

Skilled operator shortage poses ongoing challenges for equipment utilization across the construction industry. The aging workforce and limited training programs create gaps in qualified equipment operators, potentially limiting project efficiency and equipment deployment. Training requirements for advanced equipment systems add complexity and cost to workforce development initiatives.

Seasonal construction patterns in Canada create cyclical demand fluctuations that impact equipment utilization rates and rental revenues. Winter weather conditions limit construction activity in many regions, leading to reduced equipment demand during several months annually. Equipment owners must manage seasonal variations through strategic planning and diversified service offerings.

Environmental regulations increasingly impact equipment specifications and operational requirements. Emission standards, noise restrictions, and environmental compliance measures add costs and complexity to equipment selection and operation. Regulatory compliance requires ongoing investment in newer, cleaner equipment technologies.

Green construction initiatives create substantial opportunities for equipment manufacturers and service providers to develop and deploy environmentally sustainable solutions. The growing emphasis on carbon reduction and sustainable building practices drives demand for electric, hybrid, and fuel-efficient equipment options. Government incentives for clean technology adoption support market development in this segment.

Digital transformation presents significant opportunities for equipment integration with construction management systems, IoT platforms, and data analytics solutions. The development of smart construction sites requires equipment capable of seamless digital integration and real-time performance monitoring. Technology partnerships between equipment manufacturers and software providers create new value propositions.

Infrastructure renewal programs across Canadian provinces offer long-term growth opportunities as aging infrastructure requires replacement and modernization. Bridge rehabilitation, road reconstruction, and utility infrastructure upgrades create sustained demand for specialized equipment and services. Public-private partnerships facilitate large-scale infrastructure projects that drive equipment demand.

Export market potential exists for Canadian equipment manufacturers and service providers to expand into international markets, leveraging expertise gained in challenging Canadian operating conditions. The reputation for durability and reliability in harsh environments positions Canadian companies favorably in global markets.

Supply chain dynamics significantly influence equipment availability and pricing across the Canadian market. Global manufacturing disruptions, component shortages, and logistics challenges impact equipment delivery timelines and costs. Manufacturers are adapting through supply chain diversification and local sourcing strategies to improve reliability and reduce lead times.

Competitive dynamics intensify as established equipment manufacturers face competition from emerging technology providers and alternative business models. The shift toward equipment-as-a-service models and digital platforms creates new competitive landscapes that challenge traditional sales and rental approaches. Market consolidation trends among dealers and rental companies reshape distribution channels and customer relationships.

Customer behavior evolution reflects changing priorities toward operational efficiency, sustainability, and total cost of ownership rather than initial purchase price. Construction companies increasingly evaluate equipment based on lifecycle value, including fuel efficiency, maintenance costs, and resale value. Decision-making processes incorporate data analytics and performance metrics to optimize equipment selection and utilization.

Regulatory dynamics continue evolving with stricter environmental standards, safety requirements, and operational guidelines that influence equipment specifications and market demand. Compliance requirements drive equipment upgrades and create opportunities for manufacturers offering advanced, compliant solutions.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Canadian construction equipment market. Primary research includes extensive interviews with industry stakeholders, equipment manufacturers, dealers, rental companies, and end-users across various construction segments and geographic regions.

Secondary research incorporates analysis of government statistics, industry reports, trade publications, and regulatory filings to establish market baselines and identify trends. Data validation processes ensure consistency and accuracy across multiple information sources and research methodologies.

Market modeling utilizes statistical analysis and forecasting techniques to project market trends and growth patterns. The methodology incorporates economic indicators, construction activity data, and equipment utilization metrics to develop comprehensive market projections. Regional analysis examines provincial and territorial variations in market dynamics and growth drivers.

Industry expert consultation provides qualitative insights and validation of quantitative findings through structured interviews with construction industry leaders, equipment manufacturers, and market analysts. MarkWide Research methodology ensures comprehensive coverage of market segments and geographic regions for complete market understanding.

Ontario market represents the largest regional segment, accounting for approximately 32% of national equipment demand, driven by extensive construction activity in the Greater Toronto Area and ongoing infrastructure projects throughout the province. The region benefits from diverse construction sectors including residential, commercial, and industrial development that sustain consistent equipment demand.

Alberta’s market demonstrates strong performance with significant resource sector activity and infrastructure development supporting robust equipment utilization. The province’s oil and gas industry, combined with mining operations and urban development, creates demand for specialized heavy equipment and construction machinery. Equipment rental penetration rates in Alberta exceed national averages due to project-based construction patterns.

British Columbia shows steady growth driven by infrastructure investments, residential construction, and forestry sector activity. The province’s challenging terrain and environmental considerations create demand for specialized equipment capable of operating in diverse conditions. Sustainability initiatives in BC drive adoption of cleaner equipment technologies.

Quebec market benefits from significant infrastructure spending and construction activity in major urban centers. The province’s focus on infrastructure renewal and transportation projects supports consistent equipment demand. Language requirements and local preferences influence equipment selection and service delivery approaches.

Western provinces collectively demonstrate strong equipment demand driven by resource sector activities, agricultural operations, and infrastructure development. Saskatchewan and Manitoba show particular strength in agricultural and mining equipment segments, while the territories require specialized equipment for remote construction projects.

Market leadership is distributed among several major international equipment manufacturers with strong Canadian operations and dealer networks. The competitive environment emphasizes product innovation, service quality, and local market understanding to differentiate offerings and maintain market position.

Competitive strategies focus on technology differentiation, service excellence, and customer relationship management. Manufacturers invest heavily in dealer training, parts availability, and customer support to maintain competitive advantages in the Canadian market.

By Equipment Type:

By Application:

By End User:

Earthmoving equipment dominates the Canadian market with excavators leading in sales volume and rental activity. Hydraulic excavators show particular strength due to versatility and efficiency in diverse construction applications. The segment benefits from continuous technological improvements including fuel efficiency, operator comfort, and automated systems that enhance productivity.

Material handling equipment demonstrates steady growth driven by increased construction activity and logistics requirements. Wheel loaders and telehandlers show strong demand in both construction and industrial applications. The segment increasingly incorporates advanced hydraulic systems and operator assistance technologies.

Road construction equipment benefits from substantial government infrastructure spending and highway maintenance requirements. Asphalt pavers and compaction equipment show consistent demand driven by transportation infrastructure projects. The segment emphasizes fuel efficiency and emission compliance to meet environmental regulations.

Compact equipment represents a rapidly growing category with increasing adoption in urban construction projects and residential applications. Mini excavators and skid steer loaders gain popularity due to maneuverability and versatility in confined spaces. The segment shows strong rental penetration rates among smaller construction companies.

Specialized equipment categories including forestry and mining machinery demonstrate strong performance in resource-dependent regions. Forestry equipment benefits from sustainable logging practices and advanced technology integration. Mining equipment shows resilience despite commodity price fluctuations.

Equipment manufacturers benefit from strong market demand driven by infrastructure spending and construction activity growth. The Canadian market offers opportunities for technology innovation and product differentiation through advanced features and sustainable solutions. Local manufacturing and assembly operations provide cost advantages and improved customer service capabilities.

Dealers and distributors gain from comprehensive product portfolios and strong aftermarket service opportunities. The emphasis on customer relationships and local market knowledge creates competitive advantages and revenue stability. Service revenue streams provide consistent income and customer retention benefits.

Construction companies benefit from advanced equipment technologies that improve productivity, reduce operating costs, and enhance project efficiency. Equipment rental options provide operational flexibility and reduced capital requirements for project-specific needs. Technology integration enables better project management and cost control.

Equipment rental companies experience growing demand as construction companies seek flexible, cost-effective equipment access. The rental model provides opportunities for fleet optimization and utilization improvement. Digital platforms enhance customer experience and operational efficiency.

Financial institutions benefit from equipment financing opportunities and lease arrangements that support market growth. The stable asset values and strong resale markets provide security for lending activities. Equipment financing programs facilitate market expansion and customer acquisition.

Strengths:

Weaknesses:

Opportunities:

Threats:

Electrification trends are transforming the construction equipment landscape as manufacturers develop electric and hybrid alternatives to traditional diesel-powered machinery. Battery technology improvements enable longer operating times and faster charging capabilities, making electric equipment viable for more construction applications. Urban construction projects increasingly favor electric equipment due to noise reduction and emission elimination benefits.

Automation and autonomous operation represent significant technological trends reshaping equipment capabilities and operational efficiency. GPS guidance systems, automated grading, and remote operation capabilities reduce operator requirements while improving precision and productivity. The integration of artificial intelligence and machine learning enhances equipment performance optimization.

Telematics and connectivity enable comprehensive equipment monitoring, predictive maintenance, and fleet management optimization. Real-time data collection and analysis provide insights into equipment utilization, fuel consumption, and maintenance requirements. Digital platforms facilitate remote diagnostics and proactive service delivery.

Sustainability focus drives development of fuel-efficient equipment, alternative fuel systems, and environmentally responsible manufacturing processes. Circular economy principles influence equipment design for improved recyclability and component reuse. Manufacturers emphasize lifecycle environmental impact reduction and sustainable business practices.

Service digitization transforms aftermarket support through digital platforms, augmented reality maintenance assistance, and predictive service scheduling. Customer portals provide equipment information, service history, and parts ordering capabilities. Digital service delivery improves response times and customer satisfaction.

Technology partnerships between equipment manufacturers and technology companies accelerate innovation in automation, connectivity, and digital solutions. Strategic alliances enable rapid development and deployment of advanced equipment capabilities that meet evolving customer requirements.

Manufacturing investments in Canadian facilities demonstrate manufacturer commitment to local market support and supply chain optimization. Production capacity expansions and technology upgrades enhance manufacturing efficiency and product quality while reducing delivery times.

Dealer network consolidation creates larger, more capable distribution partners with enhanced service capabilities and geographic coverage. Acquisition activity among dealers improves market reach and customer service quality while achieving operational efficiencies.

Rental fleet expansion by major rental companies increases equipment availability and market penetration. Fleet modernization programs introduce advanced equipment technologies to rental markets, accelerating adoption among construction companies.

Training program development addresses skilled operator shortages through partnerships between manufacturers, dealers, and educational institutions. Certification programs ensure operator competency with advanced equipment technologies and safety systems.

Regulatory compliance initiatives drive equipment upgrades and technology adoption to meet evolving environmental and safety standards. Emission standards and noise regulations influence equipment design and market demand patterns.

MarkWide Research recommends that equipment manufacturers prioritize technology integration and sustainability initiatives to maintain competitive positioning in the evolving Canadian market. Investment focus should emphasize electric and hybrid equipment development, advanced telematics systems, and autonomous operation capabilities that address customer priorities and regulatory requirements.

Dealers and distributors should enhance digital service capabilities and customer engagement platforms to improve service delivery and customer retention. Service excellence becomes increasingly important as equipment complexity increases and customers demand comprehensive support throughout equipment lifecycles.

Construction companies should evaluate total cost of ownership when making equipment decisions, considering fuel efficiency, maintenance costs, and productivity benefits rather than focusing solely on initial purchase prices. Equipment utilization optimization through data analytics and fleet management systems can significantly improve operational efficiency.

Rental companies should invest in fleet modernization and digital platforms to enhance customer experience and operational efficiency. Technology adoption in rental operations enables better equipment tracking, maintenance scheduling, and customer service delivery.

Financial institutions should develop specialized equipment financing programs that address the unique requirements of construction equipment investments. Flexible financing options can facilitate market growth and customer acquisition while managing risk through equipment value retention.

Market growth prospects remain positive driven by sustained infrastructure investment, technological advancement, and construction industry evolution. Long-term trends favor equipment solutions that combine productivity enhancement, environmental sustainability, and operational efficiency to meet evolving customer requirements.

Technology integration will accelerate with increasing adoption of electric equipment, autonomous systems, and digital connectivity solutions. Equipment manufacturers that successfully integrate these technologies while maintaining reliability and cost-effectiveness will capture market leadership positions.

Infrastructure investment programs at federal and provincial levels provide sustained demand drivers for construction equipment across multiple sectors. Transportation infrastructure, housing development, and utility modernization projects create long-term equipment demand stability.

Sustainability requirements will increasingly influence equipment selection and operational practices. Environmental regulations and customer preferences favor clean technology adoption, creating opportunities for manufacturers offering sustainable equipment solutions.

Market consolidation trends may continue among dealers and rental companies seeking scale advantages and operational efficiency improvements. Strategic partnerships between manufacturers, dealers, and service providers will enhance customer value delivery and market competitiveness.

Skills development initiatives will become critical for market growth as equipment complexity increases and operator requirements evolve. Training programs and certification systems will ensure adequate skilled workforce availability to support market expansion.

The Canada construction equipment market demonstrates strong fundamentals and positive growth prospects supported by infrastructure investment, technological innovation, and evolving customer requirements. Market dynamics favor equipment solutions that combine advanced technology, environmental sustainability, and operational efficiency to meet the diverse needs of Canadian construction sectors.

Key success factors include technology leadership, service excellence, and customer relationship management as the market becomes increasingly sophisticated and competitive. Equipment manufacturers, dealers, and service providers that adapt to changing market conditions while maintaining focus on customer value delivery will achieve sustainable growth and market leadership.

Future market development will be shaped by continued infrastructure investment, technology advancement, and sustainability initiatives that drive equipment innovation and adoption. The Canadian construction equipment market offers substantial opportunities for stakeholders who understand market dynamics and customer requirements while delivering solutions that enhance construction industry productivity and efficiency.

What is Construction Equipment?

Construction equipment refers to heavy machinery and vehicles used for construction activities, including excavation, lifting, and material handling. Common types include bulldozers, cranes, and excavators, which are essential for various construction projects.

What are the key players in the Canada Construction Equipment Market?

Key players in the Canada Construction Equipment Market include companies like Caterpillar, John Deere, and Komatsu, which provide a range of machinery for construction and earthmoving applications, among others.

What are the growth factors driving the Canada Construction Equipment Market?

The Canada Construction Equipment Market is driven by factors such as increasing infrastructure development, urbanization, and advancements in construction technology. These elements contribute to a rising demand for efficient and innovative construction machinery.

What challenges does the Canada Construction Equipment Market face?

Challenges in the Canada Construction Equipment Market include fluctuating raw material prices, regulatory compliance issues, and the need for skilled operators. These factors can impact production costs and project timelines.

What opportunities exist in the Canada Construction Equipment Market?

Opportunities in the Canada Construction Equipment Market include the growing trend towards automation and the adoption of eco-friendly equipment. Additionally, investments in renewable energy projects are expected to boost demand for specialized construction machinery.

What trends are shaping the Canada Construction Equipment Market?

Trends in the Canada Construction Equipment Market include the integration of smart technology in machinery, such as telematics and IoT capabilities, which enhance operational efficiency. There is also a shift towards electric and hybrid equipment to reduce environmental impact.

Canada Construction Equipment Market

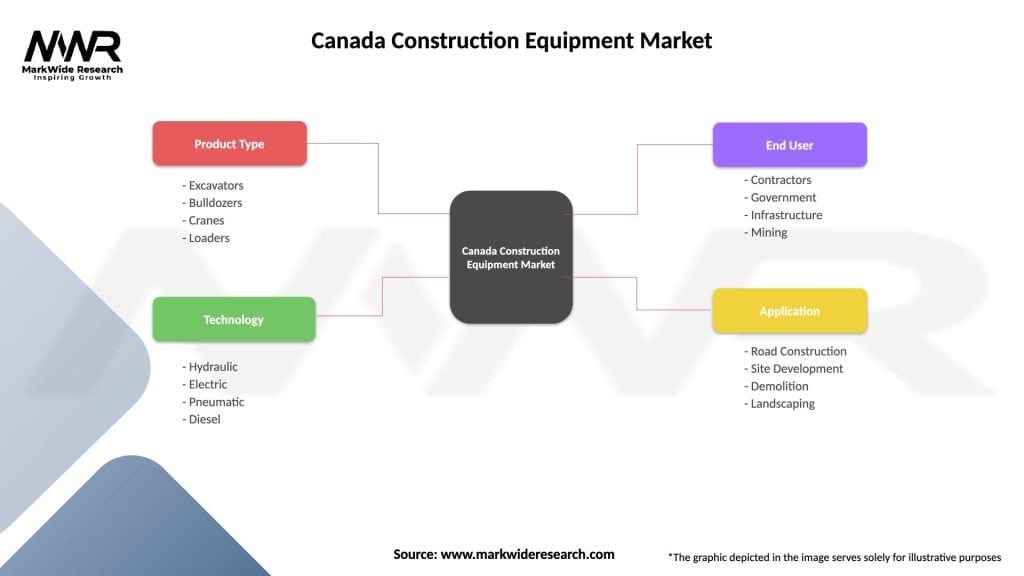

| Segmentation Details | Description |

|---|---|

| Product Type | Excavators, Bulldozers, Cranes, Loaders |

| Technology | Hydraulic, Electric, Pneumatic, Diesel |

| End User | Contractors, Government, Infrastructure, Mining |

| Application | Road Construction, Site Development, Demolition, Landscaping |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Construction Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at