444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada cloud computing market represents one of the most dynamic and rapidly evolving technology sectors in North America, demonstrating exceptional growth momentum across diverse industry verticals. Canadian enterprises are increasingly embracing cloud-based solutions to enhance operational efficiency, reduce infrastructure costs, and accelerate digital transformation initiatives. The market encompasses a comprehensive range of services including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS), each contributing to the robust expansion of cloud adoption nationwide.

Market dynamics indicate that Canadian organizations are experiencing a fundamental shift from traditional on-premises IT infrastructure to flexible, scalable cloud environments. This transformation is driven by the growing demand for remote work capabilities, enhanced data security measures, and the need for agile business operations. Growth projections suggest the market is expanding at a compound annual growth rate (CAGR) of 12.5%, reflecting the accelerating pace of cloud adoption across small and medium enterprises (SMEs) and large corporations alike.

Regional distribution shows that Ontario and British Columbia lead cloud adoption rates, accounting for approximately 65% of total market activity. The financial services, healthcare, and manufacturing sectors are emerging as primary drivers of cloud infrastructure investment, with government initiatives supporting digital modernization efforts across public sector organizations.

The Canada cloud computing market refers to the comprehensive ecosystem of cloud-based services, infrastructure, and solutions delivered to Canadian businesses, government organizations, and individual consumers through internet-connected platforms and data centers located within Canadian borders or serving Canadian customers.

Cloud computing in the Canadian context encompasses the delivery of computing services including servers, storage, databases, networking, software, analytics, and intelligence over the internet to offer faster innovation, flexible resources, and economies of scale. Canadian cloud services are characterized by adherence to strict data sovereignty requirements, compliance with federal and provincial privacy regulations, and integration with local business practices and regulatory frameworks.

Service models within the Canadian market include Infrastructure as a Service (IaaS) providing virtualized computing resources, Platform as a Service (PaaS) offering development and deployment environments, and Software as a Service (SaaS) delivering ready-to-use applications. Deployment models range from public clouds accessible to multiple organizations, private clouds dedicated to single entities, hybrid clouds combining public and private elements, and multi-cloud strategies utilizing services from multiple providers.

Canada’s cloud computing landscape is experiencing unprecedented transformation as organizations across all sectors accelerate their digital modernization efforts. The market demonstrates remarkable resilience and growth potential, driven by increasing demand for scalable computing resources, enhanced cybersecurity solutions, and flexible work arrangements that became essential during recent global disruptions.

Key market indicators reveal that Canadian businesses are prioritizing cloud investments, with 78% of enterprises planning to increase their cloud spending over the next two years. This trend reflects a strategic shift toward cloud-first approaches in IT infrastructure planning and deployment. Small and medium enterprises are particularly active in cloud adoption, recognizing the cost-effectiveness and scalability benefits that cloud solutions provide for growing businesses.

Competitive dynamics show a healthy mix of global cloud providers and Canadian-focused service companies competing for market share. Major international players are establishing stronger Canadian presences through local data centers and partnerships, while domestic providers leverage their understanding of Canadian regulatory requirements and business practices. Innovation trends include artificial intelligence integration, edge computing capabilities, and industry-specific cloud solutions tailored to Canadian market needs.

Strategic insights from comprehensive market analysis reveal several critical trends shaping the Canadian cloud computing landscape:

Digital transformation initiatives across Canadian enterprises represent the primary catalyst driving cloud computing adoption. Organizations are recognizing that cloud infrastructure provides the foundation for modernizing business processes, improving customer experiences, and maintaining competitive advantages in increasingly digital markets. Operational efficiency gains from cloud adoption include reduced IT maintenance overhead, faster application deployment, and improved resource utilization.

Remote work requirements have fundamentally altered how Canadian businesses approach IT infrastructure planning. The need for secure, scalable, and accessible computing resources that support distributed workforces has accelerated cloud migration timelines across industries. Collaboration tools and cloud-based productivity suites have become essential components of modern workplace strategies.

Cost reduction pressures continue to motivate cloud adoption as organizations seek to minimize capital expenditures on IT hardware and reduce ongoing operational expenses. Cloud computing’s pay-as-you-use model allows businesses to align IT costs with actual usage patterns and scale resources according to demand fluctuations. Small and medium enterprises particularly benefit from accessing enterprise-grade computing capabilities without significant upfront investments.

Innovation acceleration through cloud platforms enables Canadian companies to experiment with new technologies, develop applications faster, and bring products to market more quickly. Cloud services provide access to advanced capabilities like artificial intelligence, machine learning, and big data analytics that would be prohibitively expensive to implement independently.

Data sovereignty concerns represent a significant challenge for cloud adoption in Canada, as organizations must navigate complex regulatory requirements regarding data storage, processing, and cross-border transfer. Compliance obligations under federal and provincial privacy legislation create additional complexity in cloud provider selection and implementation strategies.

Security apprehensions continue to influence cloud adoption decisions, particularly among organizations handling sensitive information or operating in highly regulated industries. Concerns about data breaches, unauthorized access, and loss of direct control over security measures can slow cloud migration initiatives. Cybersecurity incidents affecting major cloud providers occasionally reinforce these concerns and impact market confidence.

Skills shortages in cloud computing expertise create implementation and management challenges for Canadian organizations. The rapid evolution of cloud technologies requires specialized knowledge that may not be readily available in local talent markets. Training costs and the time required to develop internal cloud competencies can delay adoption timelines and increase project complexity.

Legacy system integration complexities often present technical and financial barriers to cloud migration. Organizations with significant investments in existing IT infrastructure may face challenges in modernizing applications, migrating data, and maintaining business continuity during transition periods. Integration costs and potential disruptions to ongoing operations can impact cloud adoption decisions.

Government digitization initiatives present substantial opportunities for cloud service providers as federal, provincial, and municipal governments modernize their IT infrastructure and service delivery capabilities. Public sector cloud adoption is accelerating, driven by citizen service improvement goals and operational efficiency mandates.

Industry-specific cloud solutions offer significant growth potential as providers develop specialized offerings for healthcare, financial services, manufacturing, and natural resources sectors. Vertical expertise in regulatory compliance, industry workflows, and specialized security requirements creates competitive advantages and premium pricing opportunities.

Edge computing expansion represents an emerging opportunity as Canadian organizations seek to process data closer to end users and connected devices. The growing Internet of Things (IoT) ecosystem and real-time application requirements are driving demand for distributed cloud architectures. 5G network deployment will further accelerate edge computing adoption and create new service opportunities.

Artificial intelligence integration within cloud platforms offers providers opportunities to differentiate their services and capture higher-value engagements. Machine learning capabilities embedded in cloud infrastructure can help Canadian businesses automate processes, gain insights from data, and develop intelligent applications more efficiently.

Competitive intensity in the Canadian cloud computing market continues to increase as global providers expand their local presence and domestic companies enhance their service offerings. Price competition is driving down basic infrastructure costs while pushing providers to differentiate through specialized services, superior support, and industry expertise.

Technology evolution is reshaping market dynamics as new cloud computing paradigms emerge and mature. Containerization, serverless computing, and microservices architectures are changing how applications are developed and deployed in cloud environments. Innovation cycles are accelerating, requiring providers to continuously invest in platform capabilities and service enhancements.

Customer expectations are evolving toward more sophisticated cloud services that provide business value beyond basic infrastructure provisioning. Organizations increasingly demand integrated solutions that combine infrastructure, platform services, and business applications. Service quality metrics including uptime, performance, and support responsiveness are becoming critical competitive differentiators.

Regulatory influences continue to shape market dynamics as governments develop policies regarding data protection, cybersecurity, and digital sovereignty. Compliance requirements create both challenges and opportunities for cloud providers willing to invest in meeting Canadian regulatory standards and certification requirements.

Comprehensive market analysis was conducted using a multi-faceted research approach combining primary and secondary data sources to ensure accuracy and completeness of market insights. Primary research included structured interviews with cloud service providers, enterprise IT decision-makers, and industry experts across major Canadian metropolitan areas.

Secondary research encompassed analysis of industry reports, government publications, company financial statements, and technology trend analyses from reputable sources. Data validation processes included cross-referencing multiple sources and conducting follow-up interviews to verify key findings and market projections.

Market segmentation analysis utilized both top-down and bottom-up approaches to estimate market sizes and growth rates across different service categories, deployment models, and industry verticals. Statistical modeling techniques were applied to project future market trends and identify growth opportunities.

Competitive landscape assessment involved detailed analysis of major cloud providers’ Canadian operations, service portfolios, pricing strategies, and market positioning. SWOT analysis frameworks were applied to evaluate competitive strengths and market opportunities for different provider categories.

Ontario dominates the Canadian cloud computing market, accounting for approximately 42% of total market activity, driven by the concentration of financial services companies, technology firms, and government organizations in the Toronto metropolitan area. Major cloud providers have established significant data center presence in the region to serve enterprise customers and comply with data residency requirements.

British Columbia represents the second-largest regional market with approximately 23% market share, supported by a thriving technology sector, growing startup ecosystem, and increasing adoption among natural resources companies. Vancouver’s position as a technology hub and gateway to Asia-Pacific markets contributes to strong cloud service demand.

Quebec’s cloud market demonstrates steady growth with unique characteristics including language requirements and provincial data protection regulations. Montreal’s emergence as an artificial intelligence and technology center is driving demand for specialized cloud services and research computing capabilities.

Alberta and Saskatchewan show increasing cloud adoption rates, particularly among energy and agriculture companies seeking to modernize operations and improve efficiency. Western provinces collectively represent growing opportunities for cloud providers willing to address industry-specific requirements and regulatory considerations.

Atlantic provinces demonstrate accelerating cloud adoption supported by government digitization initiatives and growing technology sectors. Regional development programs are encouraging cloud-based innovation and entrepreneurship across Maritime provinces.

Market leadership in the Canadian cloud computing sector is characterized by intense competition among global technology giants and specialized domestic providers. The competitive environment reflects diverse customer needs ranging from basic infrastructure services to sophisticated industry-specific solutions.

Competitive strategies include aggressive pricing, specialized industry solutions, enhanced security features, and superior customer support. Market differentiation increasingly focuses on data sovereignty compliance, Canadian regulatory expertise, and localized service delivery capabilities.

Service model segmentation reveals distinct growth patterns and customer preferences across different cloud computing categories:

By Service Type:

By Deployment Model:

By Organization Size:

Healthcare cloud services demonstrate exceptional growth potential as Canadian healthcare organizations modernize patient care systems, implement electronic health records, and enhance telemedicine capabilities. Regulatory compliance with provincial health information privacy legislation drives demand for specialized healthcare cloud solutions with enhanced security features.

Financial services cloud adoption is accelerating as banks, credit unions, and insurance companies embrace digital banking platforms, risk management systems, and customer analytics solutions. Regulatory oversight from federal financial regulators influences cloud provider selection and implementation strategies.

Manufacturing cloud solutions are gaining traction as Canadian manufacturers implement Industry 4.0 initiatives, predictive maintenance systems, and supply chain optimization platforms. Internet of Things integration and real-time data processing requirements drive demand for edge computing capabilities.

Government cloud services show strong growth as federal, provincial, and municipal governments modernize citizen services, implement digital identity systems, and enhance cybersecurity capabilities. Data sovereignty requirements create opportunities for Canadian cloud providers and domestic data center operators.

Education cloud adoption has accelerated significantly with universities, colleges, and school boards implementing remote learning platforms, student information systems, and research computing capabilities. Budget constraints make cost-effective cloud solutions particularly attractive to educational institutions.

Cost optimization benefits enable Canadian organizations to reduce IT infrastructure expenses, eliminate hardware maintenance costs, and convert capital expenditures to operational expenses. Scalability advantages allow businesses to adjust computing resources based on demand fluctuations without significant upfront investments.

Innovation acceleration through cloud platforms provides access to cutting-edge technologies including artificial intelligence, machine learning, and advanced analytics capabilities. Time-to-market improvements enable faster application development, testing, and deployment cycles.

Business continuity enhancement through cloud-based backup, disaster recovery, and redundancy capabilities helps organizations maintain operations during disruptions. Geographic distribution of cloud resources provides resilience against localized outages or disasters.

Competitive advantage from cloud adoption includes improved agility, faster decision-making through better data access, and ability to respond quickly to market changes. Customer experience improvements result from more reliable applications, faster performance, and enhanced service availability.

Compliance support through cloud providers’ security certifications and regulatory expertise helps organizations meet Canadian privacy and security requirements more effectively. Risk mitigation benefits include professional security management, regular updates, and access to cybersecurity expertise.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration is becoming a standard feature across cloud platforms as Canadian organizations seek to leverage machine learning capabilities for business insights, process automation, and customer experience enhancement. AI-powered services are driving premium pricing and creating competitive differentiation opportunities for cloud providers.

Edge computing adoption is accelerating as organizations require real-time data processing capabilities for Internet of Things applications, autonomous systems, and low-latency services. Distributed cloud architectures are emerging to support these requirements while maintaining centralized management and security.

Multi-cloud strategies are becoming mainstream as organizations seek to avoid vendor lock-in, optimize costs, and leverage best-of-breed services from multiple providers. Cloud management platforms are evolving to support complex multi-cloud environments and provide unified visibility and control.

Sustainability focus is influencing cloud provider selection as Canadian organizations prioritize environmental responsibility and carbon footprint reduction. Green cloud initiatives including renewable energy usage and energy-efficient data centers are becoming important competitive factors.

Industry-specific solutions are proliferating as cloud providers develop specialized offerings for healthcare, financial services, manufacturing, and other vertical markets. Regulatory compliance and industry expertise are becoming key differentiators in these specialized segments.

Major cloud providers continue expanding their Canadian presence through new data center investments, strategic partnerships, and local hiring initiatives. Infrastructure investments are focusing on edge computing capabilities, enhanced security features, and improved connectivity to serve growing demand.

Government initiatives including the federal Digital Government Strategy and various provincial digitization programs are accelerating public sector cloud adoption. Policy developments regarding data sovereignty and cybersecurity are shaping market requirements and competitive dynamics.

Merger and acquisition activity is increasing as larger cloud providers acquire specialized Canadian companies to enhance their local capabilities and market presence. Strategic partnerships between international providers and Canadian system integrators are expanding service delivery capabilities.

Technology innovations including quantum computing research, advanced artificial intelligence capabilities, and next-generation networking technologies are being integrated into cloud platforms. Research collaborations between cloud providers and Canadian universities are advancing cloud computing capabilities.

Regulatory developments including updates to privacy legislation and cybersecurity frameworks are influencing cloud service requirements and compliance standards. Industry standards for cloud security and data protection are evolving to address Canadian market needs.

MarkWide Research analysis indicates that Canadian organizations should prioritize cloud strategies that balance innovation opportunities with regulatory compliance requirements. Strategic recommendations include developing comprehensive cloud governance frameworks, investing in staff training, and establishing clear data management policies.

Cloud provider selection should emphasize factors beyond cost including security capabilities, compliance certifications, local support availability, and long-term strategic alignment. Due diligence processes should thoroughly evaluate providers’ Canadian operations, data handling practices, and regulatory compliance track records.

Risk management strategies should address potential challenges including vendor lock-in, data portability, and service availability. Contingency planning should include backup providers, data recovery procedures, and business continuity measures to ensure operational resilience.

Skills development initiatives are essential for organizations to maximize cloud investment returns and maintain competitive advantages. Training programs should focus on cloud architecture, security management, and cost optimization techniques.

Performance monitoring and cost management practices should be implemented from the beginning of cloud adoption to ensure optimal resource utilization and budget control. Regular assessments of cloud usage patterns and cost structures can identify optimization opportunities.

Market projections indicate continued robust growth in the Canadian cloud computing sector, with adoption rates expected to reach 85% among large enterprises within the next three years. Small and medium enterprises are anticipated to drive significant growth as cloud services become more accessible and cost-effective.

Technology evolution will continue reshaping the market landscape as emerging technologies including quantum computing, advanced artificial intelligence, and next-generation networking capabilities become integrated into cloud platforms. Innovation cycles are expected to accelerate, requiring continuous adaptation and investment from both providers and customers.

Regulatory developments will likely increase emphasis on data sovereignty, cybersecurity, and privacy protection, creating both challenges and opportunities for cloud providers operating in Canada. Compliance requirements may become more stringent, favoring providers with strong Canadian operations and regulatory expertise.

Competitive dynamics are expected to intensify as the market matures, with differentiation increasingly based on specialized services, industry expertise, and superior customer experience. Market consolidation may occur as smaller providers are acquired or form strategic partnerships to compete effectively.

Investment opportunities will likely emerge in areas including edge computing infrastructure, artificial intelligence capabilities, and industry-specific cloud solutions. MWR analysis suggests that providers focusing on Canadian regulatory compliance and data sovereignty requirements will be well-positioned for future growth.

Canada’s cloud computing market stands at a pivotal juncture characterized by accelerating adoption, increasing sophistication, and growing strategic importance across all sectors of the economy. The market demonstrates remarkable resilience and growth potential, driven by digital transformation imperatives, operational efficiency requirements, and the need for flexible, scalable computing resources.

Key success factors for market participants include understanding Canadian regulatory requirements, developing specialized industry solutions, and maintaining strong local presence and support capabilities. Organizations that can effectively balance innovation with compliance, cost optimization with security, and global scale with local expertise will be best positioned to capitalize on market opportunities.

Future growth prospects remain highly positive as cloud computing becomes increasingly integral to Canadian business operations, government services, and economic competitiveness. The market’s evolution toward more sophisticated, specialized, and integrated cloud solutions presents significant opportunities for providers, customers, and the broader Canadian technology ecosystem to achieve sustained success and competitive advantage in the global digital economy.

What is Cloud Computing?

Cloud computing refers to the delivery of computing services over the internet, including storage, processing power, and applications. It enables businesses and individuals to access and manage data remotely, enhancing flexibility and scalability.

What are the key players in the Canada Cloud Computing Market?

Key players in the Canada Cloud Computing Market include Amazon Web Services, Microsoft Azure, Google Cloud, and IBM Cloud. These companies provide a range of cloud services, from infrastructure to software solutions, catering to various industries and sectors.

What are the main drivers of growth in the Canada Cloud Computing Market?

The main drivers of growth in the Canada Cloud Computing Market include the increasing demand for data storage solutions, the rise of remote work, and the need for scalable IT infrastructure. Additionally, businesses are adopting cloud services to enhance operational efficiency and reduce costs.

What challenges does the Canada Cloud Computing Market face?

The Canada Cloud Computing Market faces challenges such as data security concerns, regulatory compliance issues, and the complexity of cloud migration. Organizations must navigate these challenges to fully leverage cloud technologies while ensuring data protection.

What opportunities exist in the Canada Cloud Computing Market?

Opportunities in the Canada Cloud Computing Market include the growth of artificial intelligence and machine learning applications, the expansion of Internet of Things (IoT) solutions, and the increasing adoption of hybrid cloud models. These trends present avenues for innovation and investment.

What trends are shaping the Canada Cloud Computing Market?

Trends shaping the Canada Cloud Computing Market include the rise of multi-cloud strategies, increased focus on sustainability in cloud operations, and advancements in edge computing. These trends are influencing how businesses deploy and manage their cloud resources.

Canada Cloud Computing Market

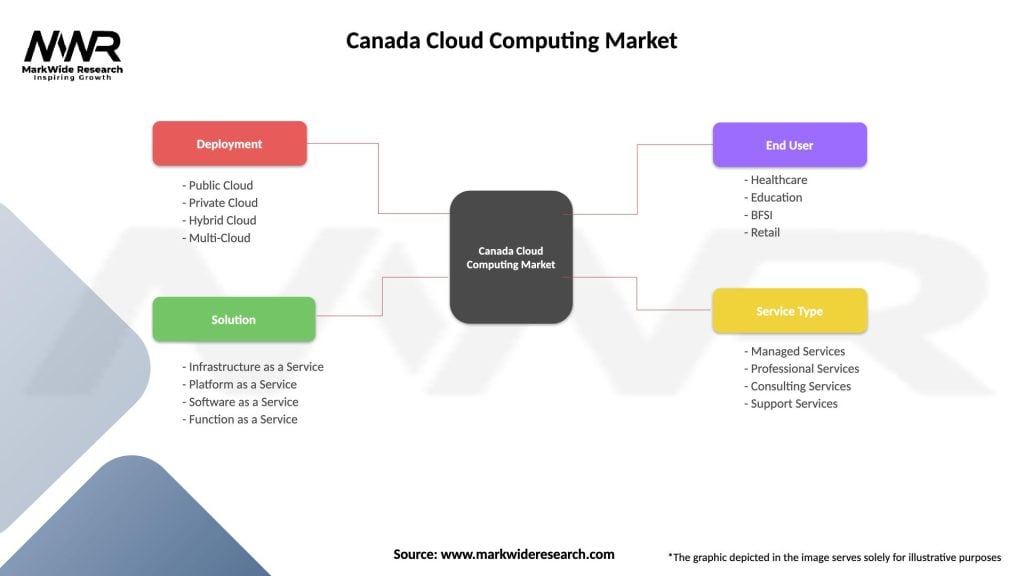

| Segmentation Details | Description |

|---|---|

| Deployment | Public Cloud, Private Cloud, Hybrid Cloud, Multi-Cloud |

| Solution | Infrastructure as a Service, Platform as a Service, Software as a Service, Function as a Service |

| End User | Healthcare, Education, BFSI, Retail |

| Service Type | Managed Services, Professional Services, Consulting Services, Support Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Cloud Computing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at