444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada clinical nutrition market represents a rapidly expanding healthcare segment focused on delivering specialized nutritional solutions for patients with complex medical conditions. This dynamic market encompasses enteral nutrition, parenteral nutrition, and specialized dietary supplements designed to support therapeutic outcomes across various healthcare settings. Healthcare providers increasingly recognize the critical role of clinical nutrition in patient recovery, disease management, and overall treatment efficacy.

Market dynamics indicate substantial growth driven by an aging population, rising prevalence of chronic diseases, and enhanced awareness of nutrition’s therapeutic benefits. The market serves diverse healthcare environments including hospitals, long-term care facilities, home healthcare settings, and specialized nutrition clinics. Clinical nutrition products range from standard formulations to highly specialized therapeutic diets tailored for specific medical conditions such as diabetes, renal disease, and critical care scenarios.

Growth projections suggest the market will experience a robust 8.2% CAGR over the forecast period, reflecting increasing healthcare expenditure and growing emphasis on personalized nutrition therapy. Provincial healthcare systems across Canada are integrating clinical nutrition services more comprehensively, recognizing their cost-effectiveness in reducing hospital readmissions and improving patient outcomes.

The Canada clinical nutrition market refers to the comprehensive ecosystem of specialized nutritional products, services, and therapeutic interventions designed to address the nutritional needs of patients with medical conditions requiring clinical supervision. This market encompasses both enteral and parenteral nutrition solutions, along with specialized dietary supplements that support medical treatment protocols and patient recovery processes.

Clinical nutrition differs from general nutrition by focusing on evidence-based nutritional interventions that directly impact disease management and therapeutic outcomes. Products within this market are formulated to meet specific metabolic requirements, address nutrient deficiencies, and support organ function in patients with compromised health status. Healthcare professionals including registered dietitians, physicians, and specialized nutrition teams collaborate to develop individualized nutrition care plans.

Market participants include pharmaceutical companies, medical device manufacturers, specialized nutrition companies, and healthcare service providers who deliver comprehensive nutrition therapy solutions across Canada’s diverse healthcare landscape.

Canada’s clinical nutrition market demonstrates exceptional growth potential driven by demographic shifts, evolving healthcare practices, and increasing recognition of nutrition’s therapeutic value. The market benefits from a well-established healthcare infrastructure, supportive regulatory environment, and growing investment in preventive healthcare approaches. Key market segments including enteral nutrition, parenteral nutrition, and specialized supplements each contribute significantly to overall market expansion.

Demographic trends particularly favor market growth, with approximately 18% of Canada’s population expected to be over 65 by 2030, creating increased demand for clinical nutrition interventions. Chronic disease prevalence continues rising, with diabetes affecting over 11% of Canadian adults, driving demand for specialized nutritional management solutions.

Innovation leadership characterizes the competitive landscape, with companies investing heavily in research and development to create more effective, patient-friendly nutrition solutions. Digital health integration and personalized nutrition approaches represent emerging growth opportunities that will reshape market dynamics in coming years.

Strategic market insights reveal several critical factors shaping Canada’s clinical nutrition landscape:

Primary market drivers propelling Canada’s clinical nutrition market growth encompass demographic, healthcare, and technological factors that create sustained demand for specialized nutrition solutions. Population aging represents the most significant driver, with seniors requiring more intensive nutritional support due to age-related physiological changes, medication interactions, and increased susceptibility to malnutrition.

Chronic disease prevalence continues expanding across all age groups, creating substantial demand for therapeutic nutrition interventions. Conditions such as diabetes, chronic kidney disease, inflammatory bowel disease, and cancer require specialized nutritional management that standard dietary approaches cannot adequately address. Healthcare providers increasingly recognize clinical nutrition as an essential component of comprehensive treatment protocols.

Healthcare system evolution toward value-based care models emphasizes outcomes and cost-effectiveness, positioning clinical nutrition as a strategic intervention that reduces complications, shortens hospital stays, and improves patient quality of life. Evidence-based medicine continues demonstrating clinical nutrition’s positive impact on treatment outcomes, driving broader adoption across healthcare settings.

Technological advancement in nutrition delivery systems, monitoring devices, and formulation science creates more effective, convenient, and patient-friendly solutions that enhance compliance and therapeutic efficacy.

Market restraints present challenges that may limit growth potential within Canada’s clinical nutrition sector. High product costs represent a significant barrier, particularly for specialized formulations and advanced delivery systems that require substantial research and development investment. Many clinical nutrition products carry premium pricing that may limit accessibility for certain patient populations or healthcare facilities with constrained budgets.

Regulatory complexity can slow product development and market entry, as clinical nutrition products must meet stringent safety and efficacy requirements. Health Canada’s approval processes, while ensuring patient safety, may create delays that impact competitive positioning and market responsiveness to emerging needs.

Healthcare professional education gaps present ongoing challenges, as effective clinical nutrition implementation requires specialized knowledge that may not be uniformly available across all healthcare settings. Training requirements and continuing education needs create implementation barriers, particularly in smaller healthcare facilities or remote regions.

Patient compliance issues affect treatment outcomes, as clinical nutrition interventions often require significant lifestyle modifications and long-term adherence to specialized dietary regimens. Taste preferences, cultural dietary practices, and psychological factors may impact patient acceptance of clinical nutrition products.

Emerging opportunities within Canada’s clinical nutrition market present substantial growth potential for innovative companies and healthcare providers. Home healthcare expansion creates significant opportunities for portable, user-friendly clinical nutrition solutions that enable patients to receive specialized care in comfortable, familiar environments while reducing healthcare system costs.

Digital health integration offers transformative opportunities through smart nutrition delivery systems, mobile health applications, and remote monitoring technologies that enhance patient engagement and treatment adherence. Artificial intelligence and machine learning applications can optimize nutrition formulations and predict patient responses, creating more effective personalized treatment approaches.

Preventive healthcare emphasis creates opportunities for clinical nutrition interventions in pre-disease states and early intervention scenarios. Wellness programs and population health initiatives increasingly incorporate clinical nutrition components, expanding market reach beyond traditional acute care settings.

Indigenous health initiatives present unique opportunities to develop culturally appropriate clinical nutrition solutions that address specific health challenges within Indigenous communities while respecting traditional dietary practices and cultural preferences.

Pediatric specialization represents an underserved market segment with significant growth potential, as childhood obesity, diabetes, and other chronic conditions create demand for age-appropriate clinical nutrition interventions.

Market dynamics within Canada’s clinical nutrition sector reflect complex interactions between healthcare policy, demographic trends, technological innovation, and competitive forces. Supply chain considerations play crucial roles, particularly following recent global disruptions that highlighted the importance of domestic manufacturing capabilities and supply security for essential healthcare products.

Healthcare integration trends demonstrate increasing collaboration between clinical nutrition providers, healthcare institutions, and technology companies to create comprehensive care solutions. Interdisciplinary approaches combining medical, nutritional, and technological expertise produce more effective patient outcomes and drive market innovation.

Competitive intensity continues increasing as established pharmaceutical companies, specialized nutrition firms, and emerging technology startups compete for market share. Innovation cycles are accelerating, with companies investing heavily in research and development to create differentiated products that address unmet clinical needs.

Reimbursement landscapes significantly impact market dynamics, as provincial healthcare coverage policies influence product adoption and market access. Health economics research increasingly demonstrates clinical nutrition’s cost-effectiveness, supporting broader reimbursement coverage and market expansion.

Comprehensive research methodology employed in analyzing Canada’s clinical nutrition market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes extensive interviews with healthcare professionals, clinical nutrition specialists, industry executives, and regulatory experts across Canada’s diverse healthcare landscape.

Secondary research encompasses analysis of government health statistics, provincial healthcare reports, industry publications, and academic research studies focusing on clinical nutrition outcomes and market trends. Data triangulation methods validate findings across multiple sources to ensure research integrity and minimize bias.

Market sizing methodologies utilize bottom-up and top-down approaches, analyzing healthcare expenditure patterns, patient population demographics, and product utilization rates across different healthcare settings. MarkWide Research employs proprietary analytical models that account for regional variations and healthcare system differences across Canadian provinces.

Forecasting models incorporate demographic projections, healthcare policy changes, and technological advancement timelines to project market growth trajectories. Scenario analysis considers various potential market developments and their impacts on growth projections.

Regional market dynamics across Canada reveal significant variations in clinical nutrition adoption, healthcare infrastructure, and growth opportunities. Ontario dominates the market with approximately 38% market share, driven by its large population, advanced healthcare infrastructure, and concentration of major healthcare institutions. The province’s robust research and development ecosystem supports innovation in clinical nutrition solutions.

Quebec represents the second-largest regional market, accounting for roughly 23% of national demand, with unique linguistic and cultural considerations influencing product development and marketing strategies. The province’s emphasis on preventive healthcare creates opportunities for clinical nutrition interventions in community health settings.

British Columbia demonstrates strong growth potential with approximately 13% market share, driven by an aging population and progressive healthcare policies that support innovative nutrition interventions. The province’s focus on home healthcare and community-based services creates demand for portable clinical nutrition solutions.

Alberta shows robust market development with 12% market share, supported by strong healthcare funding and growing awareness of clinical nutrition benefits. Prairie provinces collectively represent emerging opportunities, particularly in rural healthcare settings where clinical nutrition can address access challenges.

Atlantic provinces present unique opportunities for clinical nutrition solutions addressing rural healthcare needs and aging populations, while Northern territories require specialized approaches considering remote locations and Indigenous health considerations.

Competitive dynamics within Canada’s clinical nutrition market feature a diverse mix of multinational corporations, specialized nutrition companies, and emerging technology-focused startups. Market leadership is distributed among several key players who compete through product innovation, clinical evidence development, and strategic healthcare partnerships.

Competitive strategies increasingly focus on value-based healthcare partnerships, clinical outcomes research, and technology integration to differentiate offerings and demonstrate therapeutic value to healthcare providers and payers.

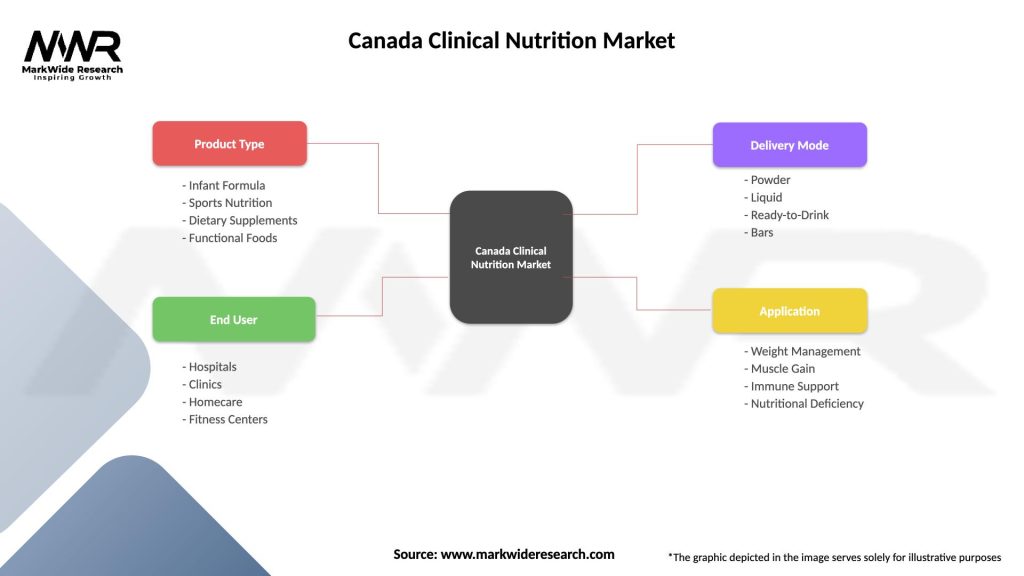

Market segmentation within Canada’s clinical nutrition sector reveals distinct categories based on product type, application, end-user, and delivery method. Product-based segmentation divides the market into enteral nutrition, parenteral nutrition, and specialized supplements, each serving specific clinical needs and patient populations.

By Product Type:

By Application:

By End-User:

Enteral nutrition represents the largest market category, driven by its versatility, cost-effectiveness, and broad clinical applications. This segment benefits from continuous product innovation, including specialized formulations for specific disease states and improved delivery systems that enhance patient comfort and compliance. Growth rates in enteral nutrition reflect increasing recognition of gut health’s importance in overall patient outcomes.

Parenteral nutrition serves critical care and complex medical situations where enteral feeding is contraindicated. This high-value segment requires sophisticated manufacturing capabilities and strict quality controls, creating barriers to entry that benefit established players. Technological advancement in parenteral nutrition focuses on reducing complications and improving nutrient delivery precision.

Specialized supplements represent the fastest-growing category, with growth rates exceeding 12% annually in certain therapeutic areas. This segment benefits from increasing disease-specific research and growing physician awareness of targeted nutritional interventions. Personalization trends drive development of more specific formulations tailored to individual patient needs and genetic profiles.

Pediatric clinical nutrition presents unique challenges and opportunities, requiring specialized expertise in child development, taste preferences, and age-appropriate formulations. Regulatory requirements for pediatric products are particularly stringent, creating competitive advantages for companies with specialized capabilities.

Healthcare providers benefit from clinical nutrition solutions through improved patient outcomes, reduced complications, and shorter hospital stays that enhance operational efficiency and financial performance. Evidence-based nutrition interventions support quality metrics and accreditation requirements while demonstrating commitment to comprehensive patient care.

Patients experience enhanced quality of life, faster recovery times, and better management of chronic conditions through appropriate clinical nutrition interventions. Home-based nutrition therapy enables patients to maintain independence while receiving specialized care, improving psychological well-being and treatment adherence.

Healthcare systems achieve cost savings through reduced readmissions, complications, and length of stay when clinical nutrition is properly integrated into care protocols. Population health improvements result from preventive nutrition interventions that address chronic disease risk factors.

Industry participants benefit from growing market demand, opportunities for innovation, and potential for strategic partnerships with healthcare providers. Technology integration creates new revenue streams and competitive differentiation opportunities.

Regulatory bodies benefit from improved patient safety and outcomes data that support evidence-based policy development and resource allocation decisions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalized nutrition emerges as a dominant trend, with companies developing customized formulations based on individual patient genetics, metabolism, and specific medical conditions. Precision medicine approaches integrate clinical nutrition with broader treatment protocols to optimize therapeutic outcomes and minimize adverse effects.

Digital health integration transforms clinical nutrition delivery through smart feeding systems, mobile health applications, and remote monitoring technologies. Artificial intelligence applications optimize nutrition formulations and predict patient responses, enabling more effective treatment protocols.

Sustainability focus drives development of environmentally responsible packaging, sourcing practices, and manufacturing processes. Plant-based formulations gain traction as alternatives to traditional protein sources, addressing both environmental concerns and dietary preferences.

Home healthcare expansion creates demand for user-friendly, portable clinical nutrition solutions that enable patients to receive specialized care outside institutional settings. Caregiver education and support systems become increasingly important for successful home-based nutrition therapy.

Preventive applications expand clinical nutrition beyond treatment to prevention and wellness, with products designed to address pre-disease states and risk factor modification. Population health initiatives increasingly incorporate clinical nutrition components.

Recent industry developments demonstrate accelerating innovation and market evolution within Canada’s clinical nutrition sector. Product launches focus on specialized formulations addressing specific therapeutic needs, with companies investing heavily in research and development to create differentiated offerings.

Strategic partnerships between nutrition companies and healthcare providers create integrated care models that improve patient outcomes while reducing costs. Technology collaborations combine nutrition expertise with digital health capabilities to develop comprehensive patient management solutions.

Regulatory approvals for new therapeutic nutrition products expand treatment options for healthcare providers and patients. Health Canada continues supporting innovation while maintaining rigorous safety standards that protect patient welfare.

Manufacturing investments in Canadian facilities enhance supply chain security and reduce dependence on international suppliers. Capacity expansion projects position companies to meet growing domestic demand while potentially serving export markets.

Clinical research initiatives generate evidence supporting clinical nutrition efficacy and cost-effectiveness, driving broader adoption across healthcare settings. Academic partnerships advance scientific understanding of nutrition’s therapeutic potential.

Market participants should prioritize investment in digital health integration and personalized nutrition capabilities to maintain competitive advantage in evolving healthcare environments. Technology partnerships with digital health companies can accelerate innovation and create comprehensive patient care solutions.

Healthcare providers should develop comprehensive clinical nutrition protocols that integrate with existing care pathways and quality improvement initiatives. Staff education and training programs ensure optimal implementation and patient outcomes.

Policy makers should consider expanding reimbursement coverage for clinical nutrition interventions that demonstrate clear cost-effectiveness and improved patient outcomes. MarkWide Research analysis suggests that broader coverage could reduce overall healthcare costs while improving population health.

Companies entering the market should focus on underserved segments such as pediatric nutrition, Indigenous health, or rural healthcare applications where specialized solutions can create competitive advantages. Regulatory expertise and clinical evidence development capabilities are essential for success.

Investment strategies should emphasize companies with strong research and development capabilities, established healthcare relationships, and technology integration potential. Long-term demographic trends support sustained market growth across multiple segments.

Future market prospects for Canada’s clinical nutrition sector remain exceptionally positive, supported by favorable demographic trends, advancing healthcare practices, and increasing recognition of nutrition’s therapeutic value. Growth projections indicate sustained expansion with the market expected to maintain robust growth rates exceeding 8% annually through the forecast period.

Technological advancement will continue reshaping market dynamics, with artificial intelligence, personalized medicine, and digital health integration creating new opportunities for innovation and differentiation. Smart nutrition systems that monitor patient responses and adjust formulations automatically represent the future of clinical nutrition delivery.

Healthcare system evolution toward value-based care models will increasingly favor clinical nutrition interventions that demonstrate clear outcomes and cost-effectiveness. Preventive healthcare emphasis will expand clinical nutrition applications beyond traditional treatment settings into wellness and population health initiatives.

Market consolidation may occur as larger companies acquire specialized firms to expand capabilities and market reach. International expansion opportunities may emerge as Canadian companies leverage domestic success to enter global markets.

Regulatory evolution will likely support innovation while maintaining safety standards, potentially streamlining approval processes for products with strong clinical evidence. MWR projects that regulatory harmonization efforts may facilitate market access and reduce development costs.

Canada’s clinical nutrition market represents a dynamic, rapidly expanding healthcare segment with exceptional growth potential driven by demographic trends, technological innovation, and evolving healthcare practices. The market benefits from strong fundamentals including universal healthcare coverage, aging population demographics, and increasing recognition of nutrition’s therapeutic value in comprehensive patient care.

Key success factors for market participants include investment in research and development, technology integration capabilities, strategic healthcare partnerships, and deep understanding of regulatory requirements. Companies that can demonstrate clear clinical outcomes and cost-effectiveness will be best positioned to capitalize on expanding opportunities across diverse healthcare settings.

Future market evolution will be shaped by personalized medicine trends, digital health integration, and expanding applications in preventive healthcare. The convergence of nutrition science, technology innovation, and value-based healthcare creates unprecedented opportunities for companies that can deliver comprehensive, evidence-based solutions that improve patient outcomes while reducing healthcare costs.

Strategic positioning in this market requires long-term commitment to innovation, clinical evidence development, and collaborative relationships with healthcare providers. As Canada’s healthcare system continues evolving toward more integrated, patient-centered care models, clinical nutrition will play an increasingly central role in achieving optimal therapeutic outcomes and population health objectives.

What is Clinical Nutrition?

Clinical Nutrition refers to the study and practice of nutrition in relation to health and disease management. It involves the use of dietary interventions to prevent or treat medical conditions, focusing on personalized nutrition plans for patients.

What are the key players in the Canada Clinical Nutrition Market?

Key players in the Canada Clinical Nutrition Market include companies like Nestlé Health Science, Abbott Laboratories, and Danone, which provide a range of nutritional products and services tailored to clinical needs, among others.

What are the growth factors driving the Canada Clinical Nutrition Market?

The Canada Clinical Nutrition Market is driven by factors such as the increasing prevalence of chronic diseases, a growing aging population, and rising awareness about the importance of nutrition in health management.

What challenges does the Canada Clinical Nutrition Market face?

Challenges in the Canada Clinical Nutrition Market include regulatory hurdles, the need for extensive clinical research to validate product efficacy, and competition from alternative therapies and dietary supplements.

What opportunities exist in the Canada Clinical Nutrition Market?

Opportunities in the Canada Clinical Nutrition Market include the development of personalized nutrition solutions, advancements in nutritional science, and the potential for growth in telehealth services that integrate nutrition counseling.

What trends are shaping the Canada Clinical Nutrition Market?

Trends in the Canada Clinical Nutrition Market include a shift towards plant-based nutrition products, increased focus on gut health, and the integration of technology in nutrition management, such as mobile health applications.

Canada Clinical Nutrition Market

| Segmentation Details | Description |

|---|---|

| Product Type | Infant Formula, Sports Nutrition, Dietary Supplements, Functional Foods |

| End User | Hospitals, Clinics, Homecare, Fitness Centers |

| Delivery Mode | Powder, Liquid, Ready-to-Drink, Bars |

| Application | Weight Management, Muscle Gain, Immune Support, Nutritional Deficiency |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Clinical Nutrition Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at