444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada Buy Now Pay Later market represents a transformative segment within the nation’s financial technology landscape, experiencing unprecedented growth as consumers increasingly embrace flexible payment solutions. This innovative payment method allows customers to purchase goods and services immediately while deferring payment through structured installment plans, fundamentally reshaping how Canadians approach retail transactions and financial planning.

Market dynamics indicate that the Canadian BNPL sector is expanding at a remarkable 28.5% CAGR, driven by changing consumer preferences, technological advancement, and the growing acceptance of alternative payment methods among both merchants and consumers. The integration of BNPL solutions across various retail sectors, from fashion and electronics to home improvement and healthcare, demonstrates the versatility and broad appeal of these payment platforms.

Digital transformation has accelerated adoption rates significantly, with 67% of Canadian millennials reporting regular use of BNPL services for online and in-store purchases. The market encompasses various service models, including traditional installment plans, pay-in-four structures, and extended financing options, catering to diverse consumer needs and spending patterns across different demographic segments.

Regulatory developments continue to shape the market landscape, with Canadian financial authorities implementing frameworks to ensure consumer protection while fostering innovation. This balanced approach has created a conducive environment for both established financial institutions and emerging fintech companies to develop comprehensive BNPL solutions tailored to the Canadian market’s unique characteristics.

The Canada Buy Now Pay Later market refers to the comprehensive ecosystem of financial services and technology platforms that enable consumers to make immediate purchases while spreading payments across predetermined time periods without traditional credit requirements. This market encompasses various stakeholders, including BNPL service providers, retail merchants, financial institutions, and regulatory bodies working together to facilitate seamless payment experiences.

BNPL services typically operate through partnerships between payment providers and merchants, offering consumers the ability to split purchases into multiple installments, often with zero or low interest rates for short-term payment plans. These solutions integrate directly into e-commerce platforms and point-of-sale systems, providing instant approval decisions based on alternative credit assessment methods.

Market participants include global BNPL leaders adapting their services for Canadian consumers, domestic financial institutions developing proprietary solutions, and emerging fintech companies focusing specifically on the Canadian market’s unique regulatory and cultural landscape. The ecosystem also encompasses technology infrastructure providers, data analytics companies, and merchant integration specialists supporting the broader BNPL value chain.

Canada’s BNPL market has emerged as a critical component of the nation’s evolving payment landscape, characterized by rapid adoption across diverse consumer segments and retail categories. The market’s growth trajectory reflects fundamental shifts in consumer financial behavior, technological capabilities, and merchant acceptance of alternative payment methods.

Key growth drivers include increasing consumer demand for financial flexibility, the proliferation of e-commerce platforms, and the integration of sophisticated risk assessment technologies that enable instant credit decisions. The market benefits from strong regulatory support that balances innovation with consumer protection, creating a stable foundation for sustainable growth.

Competitive dynamics feature a mix of international BNPL giants establishing Canadian operations, traditional financial institutions launching proprietary solutions, and innovative domestic startups developing niche offerings. This diversity has resulted in a 42% increase in available BNPL options for Canadian consumers over the past two years, enhancing choice and driving service improvements across the sector.

Market challenges include managing credit risk in an evolving economic environment, ensuring compliance with provincial and federal regulations, and maintaining sustainable business models while offering attractive consumer terms. Despite these challenges, the market continues to demonstrate resilience and adaptability, positioning itself for continued expansion across new retail verticals and consumer segments.

Consumer adoption patterns reveal significant insights into the Canadian BNPL market’s evolution and future potential. Research indicates that 73% of Canadian consumers view BNPL services as a preferable alternative to traditional credit cards for specific purchase categories, particularly for discretionary spending and larger ticket items.

Consumer financial preferences serve as the primary catalyst driving Canada’s BNPL market expansion, with changing attitudes toward debt, credit, and financial planning fundamentally reshaping payment method selection. The desire for greater financial control and transparency has led consumers to favor BNPL solutions over traditional revolving credit products.

E-commerce growth continues to accelerate BNPL adoption, as online retailers seek to reduce cart abandonment rates and increase average order values. The seamless integration of BNPL options into digital checkout processes has proven particularly effective in converting browsers into buyers, especially for higher-value purchases where payment flexibility becomes a decisive factor.

Technological advancement in risk assessment and fraud prevention has enabled BNPL providers to offer instant approval decisions while maintaining acceptable risk profiles. Machine learning algorithms and alternative data sources allow for more accurate credit evaluations, expanding access to consumers who might not qualify for traditional credit products.

Merchant benefits drive continued adoption as retailers recognize the value of BNPL partnerships in increasing sales conversion rates, improving customer acquisition, and enhancing overall shopping experiences. The ability to offer flexible payment options without assuming credit risk makes BNPL particularly attractive to merchants across various retail sectors.

Economic factors including inflation concerns and changing employment patterns have increased consumer interest in payment flexibility and budget management tools. BNPL services provide a structured approach to managing larger purchases without the uncertainty and potential costs associated with traditional credit products.

Regulatory uncertainty presents ongoing challenges for BNPL providers operating in Canada’s complex financial services environment, where provincial and federal jurisdictions may impose different requirements for consumer lending and payment services. Compliance costs and operational complexity can limit market entry and expansion strategies for both domestic and international providers.

Credit risk management remains a significant concern as BNPL providers must balance accessibility with responsible lending practices. The challenge of accurately assessing creditworthiness using alternative data sources while maintaining low default rates requires sophisticated risk management systems and continuous model refinement.

Consumer debt concerns have emerged as regulators and consumer advocacy groups raise awareness about potential over-borrowing and the cumulative impact of multiple BNPL commitments. These concerns may lead to stricter regulatory oversight and could influence consumer adoption rates if not properly addressed through education and responsible lending practices.

Market saturation risks in certain retail categories and demographic segments may limit growth opportunities as competition intensifies among BNPL providers. The challenge of differentiating services and maintaining profitability while offering attractive consumer terms creates pressure on business model sustainability.

Economic volatility can impact both consumer demand for BNPL services and the credit performance of existing portfolios. Economic downturns may reduce discretionary spending while simultaneously increasing default rates, creating dual pressure on BNPL provider revenues and risk profiles.

Underserved demographics represent significant expansion opportunities for BNPL providers willing to develop tailored solutions for specific consumer segments. Older consumers, rural populations, and newcomers to Canada present untapped markets with distinct needs and preferences that current offerings may not fully address.

B2B payment solutions offer substantial growth potential as small and medium-sized businesses seek flexible payment options for equipment purchases, inventory management, and operational expenses. The adaptation of BNPL models for business-to-business transactions could unlock new revenue streams and market segments.

Healthcare financing presents a compelling opportunity as Canadians increasingly seek payment flexibility for elective procedures, dental care, and other healthcare expenses not fully covered by public insurance. Specialized BNPL solutions for healthcare could address a significant market need while generating stable, predictable revenue streams.

Integration with financial wellness platforms and budgeting tools could enhance the value proposition of BNPL services while addressing regulatory concerns about responsible lending. Partnerships with financial education providers and personal finance management platforms could differentiate offerings and improve customer outcomes.

Cross-border commerce opportunities exist as Canadian consumers increasingly shop from international retailers, creating demand for BNPL solutions that work seamlessly across currencies and jurisdictions. Providers that can offer consistent experiences for global e-commerce transactions may capture significant market share.

Competitive intensity continues to reshape the Canadian BNPL landscape as established players defend market share while new entrants seek to differentiate through specialized offerings or superior user experiences. This dynamic environment drives continuous innovation in product features, merchant integration capabilities, and customer service standards.

Partnership strategies have become increasingly important as BNPL providers seek to expand their reach through collaborations with major retailers, financial institutions, and technology platforms. Strategic alliances enable faster market penetration while sharing the costs and risks associated with customer acquisition and technology development.

Regulatory evolution influences market dynamics as government agencies develop frameworks specific to BNPL services, potentially creating new compliance requirements while also providing clearer operating guidelines. MarkWide Research analysis suggests that proactive engagement with regulators has become a critical success factor for market participants.

Technology integration drives operational efficiency and customer experience improvements as BNPL providers invest in artificial intelligence, machine learning, and advanced analytics capabilities. These technological investments enable better risk assessment, fraud prevention, and personalized service delivery while reducing operational costs.

Consumer behavior shifts continue to influence market dynamics as users become more sophisticated in their BNPL usage patterns and expectations. The evolution from occasional use to regular integration into financial planning requires providers to adapt their services and communication strategies accordingly.

Primary research methodologies employed in analyzing the Canada BNPL market include comprehensive surveys of consumer usage patterns, merchant adoption experiences, and industry stakeholder perspectives. Direct interviews with BNPL executives, retail partners, and regulatory officials provide qualitative insights into market trends and future developments.

Secondary research encompasses analysis of publicly available financial reports, regulatory filings, industry publications, and academic studies related to alternative payment methods and consumer finance trends. This approach ensures comprehensive coverage of market dynamics from multiple authoritative sources.

Data collection processes involve both quantitative analysis of transaction volumes, user demographics, and market penetration rates, as well as qualitative assessment of service quality, customer satisfaction, and competitive positioning. Statistical sampling methods ensure representative coverage across different consumer segments and geographic regions.

Market modeling techniques incorporate economic indicators, demographic trends, and technology adoption patterns to project future market development scenarios. These models account for various external factors that could influence BNPL market growth, including regulatory changes, economic conditions, and competitive dynamics.

Validation procedures include cross-referencing findings across multiple data sources, conducting expert reviews, and performing sensitivity analyses to ensure accuracy and reliability of market assessments. This rigorous approach maintains high standards for research quality and analytical integrity.

Ontario dominates the Canadian BNPL market, accounting for approximately 38% of total transaction volume, driven by the province’s large population, high e-commerce adoption rates, and concentration of major retailers. Toronto’s position as a financial and technology hub has attracted significant BNPL provider investment and innovation.

British Columbia represents the second-largest regional market, with 22% market share, benefiting from high disposable income levels, tech-savvy consumers, and strong e-commerce infrastructure. Vancouver’s multicultural population has driven demand for diverse BNPL solutions catering to different cultural preferences and shopping behaviors.

Quebec’s unique regulatory environment and cultural characteristics have created distinct BNPL adoption patterns, with 18% of national market volume. French-language service requirements and specific consumer protection regulations have influenced how BNPL providers structure their offerings in this important market.

Alberta and Saskatchewan together account for 15% of market activity, with adoption rates influenced by economic cycles in the energy sector and varying consumer confidence levels. These provinces show particular strength in BNPL usage for home improvement and automotive-related purchases.

Atlantic provinces demonstrate growing BNPL adoption despite representing a smaller portion of overall market volume, with 7% combined market share. Rural and remote communities in these regions have shown particular interest in BNPL solutions for online shopping, where traditional retail options may be limited.

Market leadership in Canada’s BNPL sector features a dynamic mix of international platforms, domestic financial institutions, and specialized fintech companies, each bringing distinct advantages and strategic approaches to capturing market share and customer loyalty.

Competitive strategies focus on merchant acquisition, user experience optimization, and risk management capabilities, with successful providers demonstrating ability to balance growth with sustainable unit economics and regulatory compliance.

By Payment Structure:

By Application Channel:

By Industry Vertical:

Fashion and Apparel continues to dominate BNPL transaction volumes, with consumers particularly drawn to payment flexibility for seasonal purchases, special occasion clothing, and premium brand items. The category benefits from strong emotional purchase drivers and the ability to spread costs across multiple pay periods, making higher-end fashion more accessible to budget-conscious consumers.

Electronics and Technology represents a high-value segment where BNPL solutions provide significant consumer benefit by making expensive items more affordable through structured payment plans. Smartphones, laptops, gaming equipment, and smart home devices show particularly strong BNPL adoption rates, with consumers appreciating the ability to access latest technology without large upfront investments.

Home and Garden has emerged as a rapidly growing BNPL category, driven by increased home improvement activities and furniture purchases. The category benefits from higher average transaction values and lower return rates, making it attractive for both consumers seeking payment flexibility and BNPL providers managing risk profiles.

Travel and Experiences represent an expanding opportunity for BNPL providers, with consumers increasingly using installment payments for vacation bookings, event tickets, and experiential purchases. This category requires specialized risk assessment approaches due to the time gap between purchase and service delivery.

Healthcare and Wellness presents significant growth potential as consumers seek payment options for elective procedures, dental care, and wellness services not fully covered by insurance. Specialized BNPL solutions for healthcare could address important consumer needs while generating stable revenue streams for providers.

Consumer advantages include enhanced purchasing power, improved budget management capabilities, and access to interest-free or low-cost credit alternatives. BNPL services provide transparency in payment obligations and help consumers avoid the revolving debt cycles associated with traditional credit cards, promoting healthier financial habits.

Merchant benefits encompass increased conversion rates, higher average order values, and expanded customer acquisition opportunities. Retailers report that BNPL integration reduces cart abandonment rates while enabling them to offer payment flexibility without assuming credit risk or managing complex financing operations.

BNPL provider opportunities include revenue generation through merchant fees, consumer interest charges, and data monetization possibilities. Successful providers can build valuable customer relationships and financial services ecosystems while maintaining relatively asset-light business models compared to traditional lenders.

Financial institution partnerships enable traditional banks and credit unions to participate in the BNPL market without developing proprietary solutions, leveraging existing customer relationships while offering innovative payment options. These partnerships can enhance customer retention and cross-selling opportunities.

Economic benefits for the broader Canadian economy include increased consumer spending, support for retail sector growth, and enhanced financial inclusion for consumers who may not qualify for traditional credit products. BNPL services can stimulate economic activity while promoting responsible spending patterns.

Strengths:

Weaknesses:

Opportunities:

Threats:

Mobile-first experiences continue to drive BNPL innovation as providers prioritize smartphone-optimized interfaces and app-based shopping experiences. The trend toward mobile commerce integration reflects changing consumer preferences and the importance of seamless, instant payment solutions in the digital shopping journey.

AI-powered risk assessment represents a critical technological trend enabling BNPL providers to make more accurate credit decisions while expanding access to underserved consumer segments. Machine learning algorithms analyze alternative data sources to assess creditworthiness beyond traditional credit scores, improving both approval rates and portfolio performance.

Merchant integration depth has evolved beyond simple checkout options to include comprehensive e-commerce solutions, inventory management integration, and customer relationship management tools. This trend reflects BNPL providers’ efforts to become essential partners rather than just payment processors for retail merchants.

Financial wellness integration emerges as providers seek to address regulatory concerns and consumer needs by incorporating budgeting tools, spending analytics, and financial education resources into their platforms. This trend positions BNPL services as comprehensive financial management solutions rather than simple credit alternatives.

Regulatory compliance innovation drives development of new technologies and processes to meet evolving regulatory requirements while maintaining user experience quality. Providers are investing in compliance automation, consumer protection features, and transparent communication tools to address regulatory expectations proactively.

Strategic partnerships between major Canadian retailers and BNPL providers have accelerated market adoption, with exclusive arrangements and co-branded solutions becoming increasingly common. These partnerships often include marketing collaboration, data sharing agreements, and joint product development initiatives that benefit both parties.

Regulatory framework evolution has seen Canadian financial authorities develop specific guidelines for BNPL operations, including consumer disclosure requirements, responsible lending standards, and data protection protocols. MWR analysis indicates that proactive regulatory engagement has become essential for market participants seeking sustainable growth.

Technology infrastructure investments by BNPL providers focus on scalability, security, and integration capabilities to support rapid growth while maintaining service quality. Cloud-based architectures, API-first development approaches, and advanced analytics platforms enable providers to adapt quickly to changing market conditions and customer needs.

International expansion by Canadian-founded BNPL companies demonstrates the global potential of solutions developed for the Canadian market, while international providers continue to adapt their offerings for Canadian regulatory and cultural requirements. This cross-border activity drives innovation and competitive intensity.

Financial institution entry into the BNPL market through proprietary solutions and strategic acquisitions reflects the growing importance of alternative payment methods in comprehensive financial services offerings. Traditional banks are leveraging existing customer relationships and regulatory expertise to compete with fintech specialists.

Market participants should prioritize regulatory compliance and consumer protection measures to ensure sustainable growth in an evolving regulatory environment. Proactive engagement with regulators and investment in compliance infrastructure will be critical for long-term success as oversight frameworks continue to develop.

Technology investment in artificial intelligence and machine learning capabilities should focus on improving risk assessment accuracy while expanding access to underserved consumer segments. Advanced analytics can help providers balance growth objectives with responsible lending practices, addressing both business and regulatory requirements.

Partnership strategies should emphasize deep integration with merchant systems and comprehensive value proposition development beyond basic payment processing. Successful providers will become essential partners for retailers by offering inventory management, customer insights, and marketing support capabilities.

Consumer education initiatives should address responsible usage patterns and financial literacy to support sustainable market growth while addressing regulatory concerns about over-borrowing. Educational programs can differentiate providers while promoting healthy consumer financial behaviors.

Market expansion opportunities in underserved demographics and geographic regions require tailored approaches that address specific needs and preferences. Providers should invest in market research and localized solution development to capture growth opportunities beyond core urban markets.

Market evolution over the next five years will likely see continued growth driven by expanding merchant acceptance, technological innovation, and evolving consumer preferences toward flexible payment solutions. The integration of BNPL services into broader financial services ecosystems will create new opportunities for customer engagement and revenue generation.

Regulatory maturation is expected to provide clearer operating frameworks while potentially introducing new compliance requirements that could favor established providers with robust operational capabilities. The balance between innovation promotion and consumer protection will continue to shape market dynamics and competitive positioning.

Technology advancement will enable more sophisticated risk assessment, personalized service delivery, and seamless integration across multiple channels and platforms. Artificial intelligence and machine learning capabilities will become increasingly important for maintaining competitive advantages in credit decisioning and customer experience.

Market consolidation may occur as competition intensifies and regulatory requirements increase operational complexity. Successful providers will likely be those that can demonstrate sustainable unit economics, strong risk management capabilities, and comprehensive value propositions for both consumers and merchants.

MarkWide Research projections suggest that the Canadian BNPL market will continue expanding into new retail categories and demographic segments, with particular growth potential in B2B applications, healthcare financing, and cross-border commerce solutions. The market’s maturation will likely bring increased sophistication in service offerings and competitive differentiation strategies.

Canada’s Buy Now Pay Later market represents a dynamic and rapidly evolving segment of the financial services industry, characterized by strong consumer adoption, technological innovation, and supportive regulatory frameworks. The market’s growth trajectory reflects fundamental changes in consumer payment preferences and the increasing importance of financial flexibility in retail transactions.

Key success factors for market participants include robust risk management capabilities, comprehensive merchant integration, regulatory compliance excellence, and consumer-focused service delivery. The ability to balance growth objectives with responsible lending practices will be critical for sustainable market development and regulatory acceptance.

Future opportunities exist in market expansion to underserved segments, development of specialized solutions for specific industries, and integration with broader financial wellness platforms. The evolution toward comprehensive financial services ecosystems will create new value propositions and competitive advantages for innovative providers.

Market challenges including regulatory complexity, credit risk management, and competitive intensity require strategic responses and operational excellence. Successful navigation of these challenges will determine which providers can achieve sustainable growth and market leadership in Canada’s evolving Buy Now Pay Later market landscape.

What is Buy Now Pay Later?

Buy Now Pay Later (BNPL) is a payment option that allows consumers to purchase goods and services immediately and pay for them over time, often without interest. This model is increasingly popular in e-commerce, retail, and travel sectors, providing flexibility to consumers.

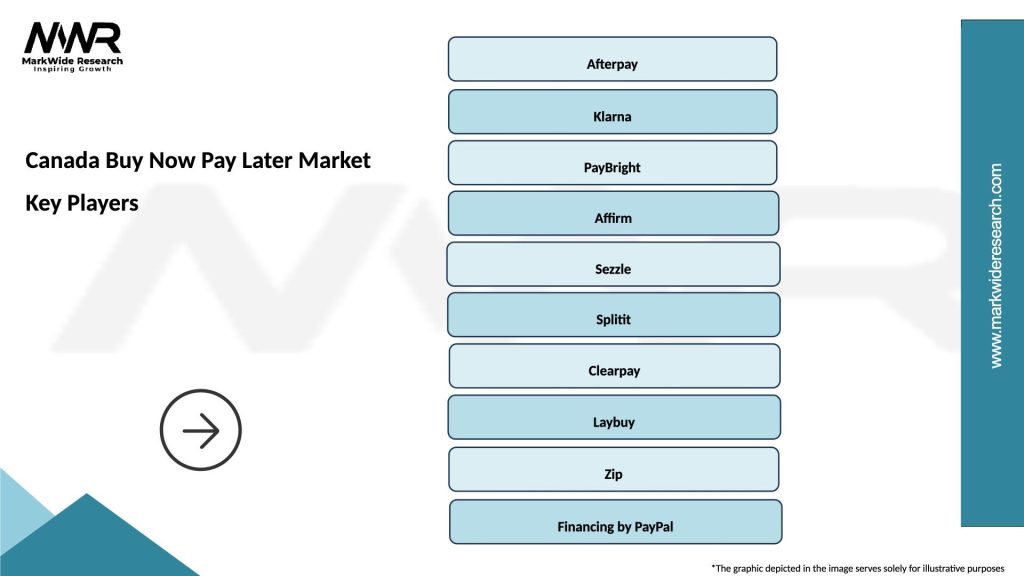

What are the key players in the Canada Buy Now Pay Later Market?

Key players in the Canada Buy Now Pay Later market include Afterpay, Klarna, and PayBright, which offer various BNPL solutions to consumers and merchants. These companies are competing to enhance user experience and expand their market reach, among others.

What are the growth factors driving the Canada Buy Now Pay Later Market?

The growth of the Canada Buy Now Pay Later market is driven by increasing consumer demand for flexible payment options, the rise of e-commerce, and the growing acceptance of BNPL by retailers. Additionally, younger consumers are more inclined to use these services for online shopping.

What challenges does the Canada Buy Now Pay Later Market face?

The Canada Buy Now Pay Later market faces challenges such as regulatory scrutiny, potential consumer debt issues, and competition from traditional credit options. These factors may impact the sustainability and growth of BNPL services in the region.

What opportunities exist in the Canada Buy Now Pay Later Market?

Opportunities in the Canada Buy Now Pay Later market include expanding into underserved demographics, integrating with emerging technologies like mobile wallets, and partnering with more retailers to enhance service offerings. The increasing trend of online shopping also presents significant growth potential.

What trends are shaping the Canada Buy Now Pay Later Market?

Trends shaping the Canada Buy Now Pay Later market include the integration of BNPL options at checkout, the rise of mobile payment solutions, and a focus on responsible lending practices. Additionally, consumer preferences are shifting towards more transparent and flexible payment solutions.

Canada Buy Now Pay Later Market

| Segmentation Details | Description |

|---|---|

| Customer Type | Millennials, Gen Z, Working Professionals, Students |

| Service Type | Retail Financing, E-commerce Solutions, Point of Sale, Subscription Services |

| Distribution Channel | Online Platforms, Mobile Apps, In-store Purchases, Social Media |

| Payment Method | Credit Card, Debit Card, Bank Transfer, Digital Wallets |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Buy Now Pay Later Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at