444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada bioplastics market represents a rapidly evolving sector within the country’s sustainable materials landscape, driven by increasing environmental consciousness and stringent regulatory frameworks. Bioplastics have emerged as a critical component of Canada’s circular economy strategy, offering biodegradable and bio-based alternatives to conventional petroleum-derived plastics. The market encompasses a diverse range of applications spanning packaging, automotive, agriculture, textiles, and consumer goods sectors.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 12.5% over the forecast period. This expansion is primarily attributed to government initiatives promoting sustainable packaging solutions, corporate sustainability commitments, and growing consumer preference for environmentally responsible products. Provincial regulations across Canada, particularly in British Columbia, Ontario, and Quebec, have accelerated the adoption of biodegradable materials in various industries.

Key market segments include biodegradable plastics, bio-based non-biodegradable plastics, and specialty bioplastic compounds. The packaging industry dominates consumption patterns, accounting for approximately 45% of total market demand, followed by agricultural applications and automotive components. Innovation centers in Toronto, Vancouver, and Montreal are driving technological advancements in bioplastic formulations and processing technologies.

The Canada bioplastics market refers to the comprehensive ecosystem of bio-based and biodegradable plastic materials, manufacturing processes, distribution networks, and end-use applications within Canadian territory. Bioplastics encompass materials derived from renewable biological resources such as corn starch, sugarcane, vegetable oils, and cellulose, as well as synthetic polymers designed to biodegrade under specific environmental conditions.

Market classification includes two primary categories: bio-based plastics manufactured from renewable feedstocks and biodegradable plastics engineered to decompose naturally through microbial action. Canadian bioplastics serve diverse applications ranging from single-use packaging and agricultural films to durable goods and automotive components. The market encompasses raw material suppliers, processing equipment manufacturers, converters, brand owners, and waste management service providers.

Regulatory frameworks define bioplastic standards through organizations like the Canadian Standards Association (CSA) and align with international certifications including ASTM and EN standards. Market participants include multinational corporations, domestic manufacturers, research institutions, and government agencies collaborating to advance sustainable material solutions across Canada’s industrial landscape.

Canada’s bioplastics market demonstrates exceptional growth momentum, positioned as a strategic component of the nation’s environmental sustainability agenda. Market expansion is driven by converging factors including regulatory mandates, corporate environmental commitments, technological innovations, and shifting consumer preferences toward sustainable packaging solutions.

Government initiatives play a pivotal role, with federal and provincial policies targeting single-use plastic reduction and promoting circular economy principles. Investment flows into bioplastic manufacturing facilities have increased substantially, with major projects announced in Ontario, Alberta, and Quebec. Research and development activities, supported by institutions like the National Research Council of Canada, focus on improving bioplastic performance characteristics and reducing production costs.

Market segmentation reveals packaging applications leading demand, followed by agricultural films and automotive components. Regional distribution shows Ontario commanding the largest market share at approximately 38%, driven by concentrated manufacturing activities and proximity to major consumer markets. Competitive dynamics feature both established multinational players and emerging Canadian companies developing specialized bioplastic solutions.

Future projections indicate sustained growth potential, with market penetration expected to accelerate as production scales increase and cost competitiveness improves relative to conventional plastics. Strategic partnerships between material suppliers, converters, and end-users are fostering innovation and market development across diverse application segments.

Strategic market analysis reveals several critical insights shaping Canada’s bioplastics landscape:

Market intelligence indicates that consumer awareness and willingness to pay premium prices for sustainable products continue to strengthen, supporting market expansion across multiple sectors. Investment patterns show increasing venture capital and government funding directed toward bioplastic startups and scaling operations.

Environmental regulations constitute the primary driver propelling Canada’s bioplastics market forward. Federal initiatives including the Single-Use Plastics Prohibition Regulations and the Canadian Environmental Protection Act create mandatory requirements for biodegradable alternatives in specific applications. Provincial legislation in British Columbia, Prince Edward Island, and other jurisdictions further accelerates adoption through targeted bans and extended producer responsibility programs.

Corporate sustainability commitments represent another significant growth driver, with major Canadian companies establishing ambitious plastic reduction and circular economy targets. Retail chains like Loblaws, Metro, and Canadian Tire are implementing comprehensive sustainable packaging strategies that prioritize bioplastic alternatives. Food service operators including Tim Hortons and McDonald’s Canada are transitioning to biodegradable packaging solutions to meet consumer expectations and regulatory requirements.

Consumer behavior shifts demonstrate increasing preference for environmentally responsible products, with surveys indicating 73% of Canadian consumers willing to pay premium prices for sustainable packaging. Millennial and Generation Z demographics particularly drive demand for eco-friendly alternatives, influencing brand purchasing decisions and market positioning strategies.

Technological advancements in bioplastic formulations and processing technologies enhance performance characteristics while reducing production costs. Innovation partnerships between universities, research institutions, and industry players accelerate commercialization of next-generation bioplastic materials with improved functionality and broader application potential.

Cost competitiveness remains a significant restraint limiting widespread bioplastics adoption across price-sensitive market segments. Production costs for many bioplastic materials continue to exceed conventional plastic alternatives by 20-40%, creating barriers for mass market applications where price sensitivity is paramount. Scale limitations in current manufacturing capacity restrict economies of scale benefits that could improve cost structures.

Performance limitations in certain bioplastic formulations affect suitability for demanding applications requiring specific mechanical, thermal, or barrier properties. Shelf life considerations and temperature sensitivity can limit application scope, particularly in food packaging and industrial uses. Processing challenges may require specialized equipment modifications or new manufacturing techniques, increasing conversion costs for processors.

Infrastructure constraints in composting and biodegradation facilities limit the environmental benefits of biodegradable plastics in regions lacking appropriate waste management systems. Consumer confusion regarding proper disposal methods and biodegradation requirements can undermine environmental objectives and market acceptance.

Feedstock availability and price volatility for bio-based raw materials create supply chain uncertainties that affect production planning and cost predictability. Competition with food applications for agricultural feedstocks raises sustainability concerns and potential price pressures during commodity market fluctuations.

Government support programs present substantial opportunities for market expansion through funding initiatives, tax incentives, and procurement preferences favoring sustainable materials. Federal investment in clean technology and circular economy projects provides capital access for bioplastic manufacturing facility development and technology commercialization. Provincial programs supporting innovation and export development create additional growth catalysts.

Agricultural waste utilization offers significant opportunity for developing domestic feedstock supplies from abundant Canadian agricultural residues. Forestry byproducts and agricultural processing waste streams provide renewable raw material sources that support local supply chain development while addressing waste management challenges. Biorefinery integration can optimize resource utilization and improve economic viability.

Export market potential emerges as international demand for sustainable materials accelerates, particularly in the United States and European markets where regulatory frameworks increasingly favor bioplastic alternatives. Trade agreements and sustainability partnerships create market access opportunities for Canadian manufacturers with competitive advantages in clean technology and environmental stewardship.

Application diversification beyond traditional packaging markets presents growth opportunities in automotive, construction, textiles, and electronics sectors. Specialty applications requiring unique biodegradation characteristics or bio-based content offer higher value market segments with reduced price sensitivity and enhanced differentiation potential.

Supply chain evolution characterizes the dynamic nature of Canada’s bioplastics market, with traditional plastic processors adapting operations to accommodate new material requirements and processing parameters. Converter investments in specialized equipment and technical expertise enable broader market participation and application development. Raw material sourcing strategies increasingly emphasize local and sustainable feedstock procurement to support supply chain resilience and environmental objectives.

Competitive positioning reflects a complex landscape featuring established multinational corporations, emerging technology companies, and specialized Canadian manufacturers. Market consolidation trends include strategic acquisitions and partnerships aimed at expanding product portfolios and market reach. Innovation competition focuses on developing superior performance characteristics, cost-effective production processes, and novel application solutions.

Regulatory dynamics continue evolving with ongoing policy development at federal and provincial levels, creating both opportunities and compliance challenges for market participants. Standards development through organizations like the Canadian Standards Association ensures quality and performance consistency while facilitating market acceptance and international trade.

Market maturation indicators include increasing production capacity, improving cost competitiveness, and expanding application diversity. Investment flows demonstrate growing confidence in long-term market viability, with both private and public funding supporting capacity expansion and technology development initiatives across Canada’s bioplastics ecosystem.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of market insights and projections. Primary research includes structured interviews with industry executives, technology developers, government officials, and end-user representatives across Canada’s bioplastics value chain. Survey methodologies capture quantitative data on market trends, adoption patterns, and growth projections from diverse stakeholder perspectives.

Secondary research encompasses analysis of government publications, industry reports, academic studies, and corporate disclosures to establish market context and validate primary findings. Database analysis of trade statistics, production data, and regulatory filings provides quantitative foundation for market sizing and trend analysis. Patent research reveals innovation trends and competitive positioning in emerging bioplastic technologies.

Market modeling techniques integrate multiple data sources to develop robust growth projections and scenario analyses. Statistical analysis validates data consistency and identifies key correlation factors influencing market development. Expert validation through industry advisory panels ensures research findings align with market realities and stakeholder experiences.

Data triangulation methods cross-reference findings from multiple sources to enhance accuracy and minimize bias in market assessments. Continuous monitoring of regulatory developments, technology advances, and competitive activities ensures research currency and relevance for strategic decision-making purposes.

Ontario dominates Canada’s bioplastics market with approximately 38% market share, driven by concentrated manufacturing activities, proximity to major consumer markets, and supportive provincial policies. Toronto region serves as a key innovation hub with multiple research institutions and technology companies developing advanced bioplastic solutions. Manufacturing facilities in southern Ontario benefit from established supply chains, skilled workforce availability, and transportation infrastructure supporting both domestic and export markets.

Quebec represents the second-largest regional market, accounting for approximately 28% of national demand, with strong government support for clean technology development and circular economy initiatives. Montreal hosts significant research and development activities, while industrial regions around Quebec City and Sherbrooke provide manufacturing capabilities. Provincial policies promoting sustainable packaging and waste reduction create favorable market conditions for bioplastic adoption.

British Columbia demonstrates rapid growth potential with 18% market share, supported by progressive environmental regulations and strong consumer environmental consciousness. Vancouver serves as a gateway for Asian market access and hosts innovative bioplastic companies. Provincial initiatives targeting single-use plastic reduction and extended producer responsibility programs drive market demand across multiple sectors.

Alberta presents emerging opportunities with 12% market share, leveraging agricultural feedstock availability and petrochemical industry expertise. Prairie provinces collectively offer substantial agricultural waste resources for bioplastic feedstock development. Atlantic Canada shows growing interest in marine-based bioplastic applications and sustainable fisheries packaging solutions, representing 4% of national market activity.

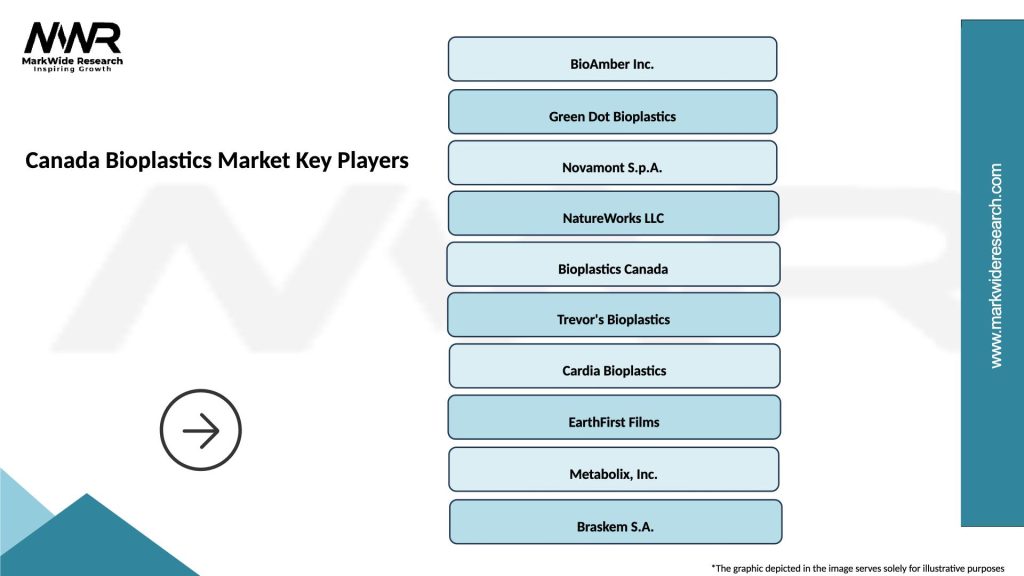

Market leadership features a diverse mix of international corporations and Canadian companies competing across different market segments and application areas:

Competitive strategies emphasize technology differentiation, application-specific solutions, and strategic partnerships with Canadian converters and brand owners. Market positioning varies from cost-competitive commodity grades to high-performance specialty materials commanding premium pricing in niche applications.

By Product Type:

By Application:

By End-Use Industry:

Packaging Applications dominate market consumption with flexible packaging films representing the fastest-growing segment. Food packaging requirements drive innovation in barrier properties, shelf-life extension, and compostability characteristics. E-commerce packaging presents emerging opportunities as online retail growth creates demand for sustainable shipping materials and protective packaging solutions.

Agricultural Applications demonstrate strong growth potential with mulch films offering significant environmental benefits through soil biodegradation and elimination of plastic waste removal requirements. Controlled-release systems for fertilizers and pesticides provide precision agriculture benefits while reducing environmental impact. Plant containers and seedling trays support sustainable horticulture practices.

Automotive Segment shows increasing adoption of bio-based materials in interior applications, driven by lightweighting objectives and sustainability commitments from major automotive manufacturers. Natural fiber reinforcement enhances mechanical properties while maintaining biodegradability in appropriate applications. Under-hood components require specialized formulations addressing temperature and chemical resistance requirements.

Consumer Electronics represent an emerging category with biodegradable housings and components addressing end-of-life disposal challenges. 3D printing filaments based on bioplastic materials support sustainable manufacturing practices and reduced environmental impact in prototyping and production applications.

Manufacturers benefit from accessing growing market segments driven by regulatory requirements and consumer preferences for sustainable products. Product differentiation opportunities enable premium pricing strategies and enhanced brand positioning in environmentally conscious markets. Innovation partnerships with research institutions and technology companies accelerate product development and market entry timelines.

Brand Owners achieve sustainability objectives while meeting regulatory compliance requirements through bioplastic adoption. Consumer appeal strengthens brand loyalty and market positioning among environmentally conscious demographics. Supply chain sustainability improvements support corporate environmental commitments and stakeholder expectations.

Converters and Processors access new revenue streams through specialized bioplastic processing capabilities and value-added services. Technical expertise in bioplastic processing creates competitive advantages and customer relationship opportunities. Equipment investments in bioplastic-compatible processing technology enable market participation and growth.

Government Stakeholders advance environmental policy objectives through market-based solutions that reduce plastic pollution and support circular economy principles. Economic development benefits include job creation, technology innovation, and export opportunities in growing global markets. Regulatory frameworks supporting bioplastic adoption demonstrate leadership in environmental stewardship and sustainable development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Circular Economy Integration represents a dominant trend with bioplastics positioned as key components of comprehensive waste reduction and resource recovery strategies. Compostable packaging systems align with municipal organic waste collection programs, creating synergies between material selection and waste management infrastructure. Design for circularity principles influence product development and application strategies.

Performance Enhancement through advanced formulation technologies addresses historical limitations in mechanical properties, thermal stability, and barrier characteristics. Nanotechnology integration improves material properties while maintaining biodegradability. Multi-layer structures combining different bioplastic materials optimize performance for specific applications.

Supply Chain Localization trends emphasize domestic feedstock sourcing and regional manufacturing capabilities to reduce transportation costs and environmental impact. Agricultural waste valorization creates value-added opportunities for farmers while supporting bioplastic raw material supplies. Biorefinery development integrates bioplastic production with other bio-based products.

Digital Integration includes smart packaging applications incorporating biodegradable electronics and sensors for food safety and supply chain tracking. Blockchain technology supports sustainability claims verification and supply chain transparency. Artificial intelligence optimizes bioplastic formulations and processing parameters for improved performance and cost efficiency.

Manufacturing Capacity Expansion includes several major facility announcements across Canada, with Ontario hosting new bioplastic production plants and Quebec attracting international investment in sustainable materials manufacturing. Technology partnerships between Canadian companies and international bioplastic leaders accelerate market development and knowledge transfer.

Research Breakthroughs from Canadian universities and research institutions advance bioplastic science, including University of Toronto developments in cellulose-based materials and McGill University innovations in marine-degradable plastics. Government funding through programs like the Strategic Innovation Fund supports commercialization of promising technologies.

Regulatory Milestones include implementation of federal single-use plastic regulations and provincial extended producer responsibility programs creating market demand for bioplastic alternatives. Standards development through the Canadian Standards Association establishes quality and performance benchmarks for market acceptance.

Corporate Commitments from major Canadian retailers and food service companies include ambitious timelines for sustainable packaging adoption. Supply chain partnerships between bioplastic manufacturers and end-users accelerate market penetration and application development. Investment announcements from venture capital and private equity firms demonstrate growing confidence in market potential.

Strategic positioning recommendations emphasize focusing on high-value applications where performance requirements justify premium pricing while building scale in cost-sensitive segments. MarkWide Research analysis suggests prioritizing partnerships with major brand owners and retailers to secure long-term demand commitments and market access.

Technology investment priorities should address performance gaps in key applications while developing cost-effective production processes that improve competitiveness with conventional plastics. Innovation partnerships with research institutions and technology companies can accelerate development timelines and reduce commercialization risks.

Market entry strategies for new participants should consider regional advantages, feedstock availability, and proximity to target markets. Vertical integration opportunities in feedstock processing and waste management create value chain synergies and competitive advantages.

Policy engagement remains critical for market development, with industry participants encouraged to actively participate in regulatory development processes and standards setting activities. International expansion opportunities should leverage Canada’s clean technology reputation and trade relationships to access growing global markets for sustainable materials.

Market trajectory indicates sustained growth momentum with compound annual growth rates expected to maintain double-digit levels through the forecast period. Regulatory drivers will continue strengthening as additional jurisdictions implement plastic reduction policies and circular economy initiatives. Technology maturation will improve cost competitiveness and expand application possibilities across diverse market segments.

Capacity expansion projects currently under development will significantly increase domestic production capabilities and reduce import dependence. MWR projections suggest Canadian bioplastic production capacity could increase by 85% over the next five years through announced facility expansions and new plant construction. Export opportunities will grow as international markets increasingly prioritize sustainable materials.

Innovation acceleration through continued research and development investment will address remaining performance limitations and cost barriers. Next-generation materials incorporating advanced biodegradation characteristics and enhanced functionality will expand market opportunities. Digital integration will create new value propositions in smart packaging and supply chain applications.

Market consolidation trends may emerge as the industry matures, with strategic acquisitions and partnerships optimizing production scale and market reach. Sustainability integration will become increasingly sophisticated, with life-cycle assessment and circular economy principles driving material selection and application development decisions across all market segments.

Canada’s bioplastics market stands at a pivotal juncture, positioned for substantial growth driven by converging regulatory, technological, and market forces. Government support through environmental policies and innovation funding creates a favorable ecosystem for market development, while consumer preferences increasingly favor sustainable alternatives to conventional plastics.

Market fundamentals demonstrate strong potential with diverse application opportunities, abundant feedstock resources, and established innovation capabilities supporting long-term growth prospects. Competitive dynamics feature both international leaders and emerging Canadian companies developing specialized solutions for domestic and export markets.

Strategic success in this evolving market requires balancing performance enhancement with cost competitiveness while building sustainable supply chains and customer relationships. Industry participants who effectively navigate regulatory requirements, technology challenges, and market dynamics will capture significant value creation opportunities in Canada’s transition toward a more sustainable materials economy.

What is Bioplastics?

Bioplastics are materials derived from renewable biomass sources, such as plant starches, vegetable fats, and oils, which can be used as alternatives to conventional plastics. They are designed to reduce environmental impact and can be biodegradable or recyclable.

What are the key players in the Canada Bioplastics Market?

Key players in the Canada Bioplastics Market include companies like BASF, Novamont, and NatureWorks, which are known for their innovative bioplastic solutions. These companies focus on developing sustainable materials for various applications, including packaging and consumer goods, among others.

What are the growth factors driving the Canada Bioplastics Market?

The Canada Bioplastics Market is driven by increasing consumer demand for sustainable products, government regulations promoting eco-friendly materials, and advancements in bioplastic technology. Additionally, the rise in environmental awareness among consumers is pushing industries to adopt bioplastics.

What challenges does the Canada Bioplastics Market face?

The Canada Bioplastics Market faces challenges such as high production costs compared to traditional plastics, limited availability of raw materials, and consumer misconceptions about bioplastics. These factors can hinder market growth and adoption in various sectors.

What opportunities exist in the Canada Bioplastics Market?

Opportunities in the Canada Bioplastics Market include the development of new bioplastic materials for specific applications, such as food packaging and agricultural films. Additionally, increasing investments in research and development can lead to innovative solutions that meet consumer needs.

What trends are shaping the Canada Bioplastics Market?

Trends in the Canada Bioplastics Market include a growing focus on circular economy practices, advancements in biopolymer technology, and increased collaboration between companies and research institutions. These trends aim to enhance the performance and sustainability of bioplastics.

Canada Bioplastics Market

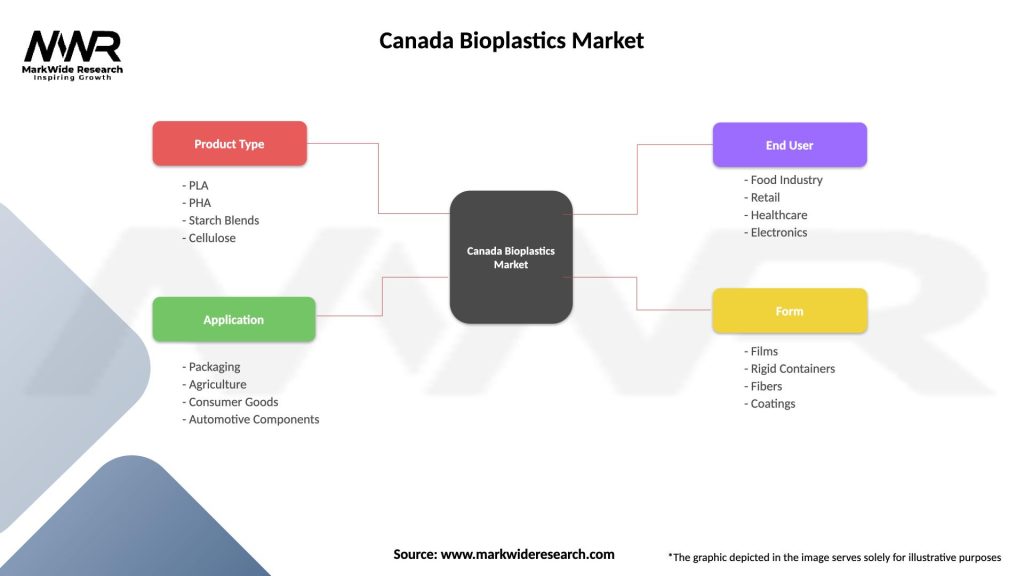

| Segmentation Details | Description |

|---|---|

| Product Type | PLA, PHA, Starch Blends, Cellulose |

| Application | Packaging, Agriculture, Consumer Goods, Automotive Components |

| End User | Food Industry, Retail, Healthcare, Electronics |

| Form | Films, Rigid Containers, Fibers, Coatings |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Bioplastics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at