444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Cameroon grains market represents a cornerstone of the nation’s agricultural economy, encompassing the production, processing, and distribution of essential cereal crops including maize, rice, wheat, sorghum, and millet. Agricultural development in Cameroon has experienced significant transformation over recent years, with grain production serving as a critical component of food security and economic stability. The market demonstrates robust growth potential driven by increasing domestic demand, population growth, and government initiatives supporting agricultural modernization.

Market dynamics indicate substantial opportunities for expansion across multiple grain varieties, with maize and rice leading production volumes. The sector benefits from favorable climatic conditions across different agro-ecological zones, enabling year-round cultivation in various regions. Investment flows into agricultural infrastructure, irrigation systems, and processing facilities have contributed to enhanced productivity levels, with grain yields showing consistent improvement of approximately 4.2% annually over the past five years.

Regional distribution patterns reveal concentrated production activities in the Far North, North, and Adamawa regions, which collectively account for 68% of total grain output. The market structure encompasses smallholder farmers, medium-scale producers, and emerging commercial agricultural enterprises, creating a diverse ecosystem that supports both subsistence and commercial grain production activities.

The Cameroon grains market refers to the comprehensive ecosystem encompassing the cultivation, processing, trading, and consumption of cereal crops within Cameroon’s agricultural sector. This market includes primary grains such as maize, rice, wheat, sorghum, millet, and other cereal varieties that form the foundation of the nation’s food security framework and agricultural economy.

Market scope extends beyond basic production to include value-added processing, storage infrastructure, distribution networks, and export activities. The sector integrates traditional farming practices with modern agricultural techniques, creating opportunities for enhanced productivity and market access. Stakeholder participation involves farmers, cooperatives, processing companies, traders, government agencies, and international development organizations working collaboratively to strengthen grain production capabilities.

Economic significance of the grains market extends to rural livelihoods, urban food supply, and national food security objectives. The market serves both domestic consumption needs and regional export opportunities, positioning Cameroon as an important grain supplier within the Central African Economic and Monetary Union (CEMAC) region.

Strategic analysis of the Cameroon grains market reveals a sector poised for substantial growth, driven by demographic trends, agricultural modernization initiatives, and increasing market demand. The market demonstrates resilient performance despite challenges related to climate variability and infrastructure limitations, with production volumes maintaining steady growth trajectories across key grain varieties.

Government support through agricultural development programs has catalyzed improvements in farming techniques, seed quality, and post-harvest management practices. These initiatives have resulted in productivity gains of approximately 15% over the past three years, particularly in maize and rice production systems. Investment priorities focus on irrigation infrastructure, mechanization, and value chain development to enhance overall market competitiveness.

Market opportunities emerge from growing urban populations, changing dietary preferences, and regional trade integration. The sector benefits from strategic geographic positioning, diverse agro-ecological zones, and established trade relationships with neighboring countries. Future prospects indicate continued expansion potential, supported by ongoing agricultural transformation programs and private sector engagement in grain value chains.

Production patterns across the Cameroon grains market reveal several critical insights that shape market dynamics and future development strategies:

Population growth serves as a fundamental driver of the Cameroon grains market, with increasing demographic pressures creating sustained demand for staple food crops. The country’s population expansion generates consistent market demand, particularly in urban areas where grain consumption patterns continue to evolve. Urbanization trends contribute to changing food preferences and increased demand for processed grain products, creating opportunities for value-added production.

Government initiatives play a crucial role in market development through agricultural modernization programs, subsidies for inputs, and infrastructure development projects. Policy support for grain production includes improved seed distribution, fertilizer subsidies, and extension services that enhance farmer productivity. Investment programs in irrigation infrastructure and rural roads facilitate market access and reduce production constraints.

Regional trade integration within the CEMAC region creates expanded market opportunities for Cameroon grain producers. Trade agreements and reduced barriers enable increased exports to neighboring countries, particularly Chad, Central African Republic, and Equatorial Guinea. Climate advantages in certain regions provide competitive advantages for grain production, with diverse agro-ecological zones supporting year-round cultivation activities.

Technology adoption drives productivity improvements through mechanization, improved seed varieties, and modern farming practices. Agricultural research institutions contribute to developing climate-resilient grain varieties that enhance production stability and market reliability.

Infrastructure limitations pose significant challenges to the Cameroon grains market, particularly in rural areas where inadequate transportation networks limit market access and increase transaction costs. Poor road conditions during rainy seasons create barriers to grain movement from production areas to consumption centers. Storage facilities remain insufficient, leading to post-harvest losses that reduce overall market efficiency and farmer incomes.

Climate variability presents ongoing challenges to grain production, with irregular rainfall patterns and extreme weather events affecting crop yields and production planning. Drought conditions in northern regions and flooding in some areas create production uncertainties that impact market stability. Limited irrigation infrastructure constrains production potential, particularly during dry seasons when water availability becomes critical.

Access to finance remains a significant constraint for many grain producers, limiting their ability to invest in improved inputs, equipment, and technology. Traditional banking systems often lack appropriate financial products for agricultural activities, creating barriers to market participation and expansion. Input costs for fertilizers, seeds, and equipment continue to increase, affecting production economics and farmer profitability.

Market information systems remain underdeveloped, limiting farmers’ ability to make informed production and marketing decisions. Price volatility and limited market transparency create uncertainties that affect investment decisions and market participation levels.

Value addition represents substantial opportunities within the Cameroon grains market, with significant potential for developing processing industries that transform raw grains into higher-value products. Food processing capabilities can be expanded to include flour milling, breakfast cereals, snack foods, and other consumer products that capture additional value along the supply chain. Investment in processing infrastructure creates employment opportunities and enhances market competitiveness.

Export market development offers promising opportunities, particularly for surplus grain production that exceeds domestic consumption requirements. Regional demand from neighboring countries provides stable market outlets for Cameroon grain producers. Quality improvement initiatives can position Cameroon grains competitively in international markets, potentially accessing premium price segments.

Technology integration presents opportunities for modernizing grain production systems through precision agriculture, improved varieties, and mechanization. Digital platforms for market information, weather forecasting, and agricultural extension services can enhance farmer decision-making and productivity. Cooperative development enables smallholder farmers to access markets, inputs, and services more effectively through collective action.

Public-private partnerships create opportunities for leveraging resources and expertise to develop grain value chains. Collaboration between government agencies, private companies, and development organizations can accelerate market development and infrastructure improvements.

Supply dynamics in the Cameroon grains market reflect the interaction between production capabilities, seasonal variations, and market demand patterns. Production cycles follow distinct seasonal patterns, with planting activities concentrated during rainy seasons and harvests occurring during dry periods. Regional variations in production timing create opportunities for market arbitrage and storage activities that smooth supply fluctuations throughout the year.

Demand patterns demonstrate steady growth driven by population increases, urbanization, and changing consumption preferences. Urban consumers increasingly demand processed grain products, while rural populations maintain traditional consumption patterns focused on whole grains. Price mechanisms reflect supply and demand interactions, with seasonal price variations providing market signals for production and storage decisions.

Market integration between regions remains limited due to transportation constraints and information gaps, creating price differentials that represent both challenges and opportunities. MarkWide Research analysis indicates that improved market integration could reduce price volatility by 23% and enhance overall market efficiency. Cross-border trade dynamics influence domestic market conditions, particularly in border regions where informal trade activities are significant.

Competitive dynamics involve interactions between smallholder farmers, medium-scale producers, and emerging commercial operations. Market power remains distributed among numerous small producers, limiting individual market influence but creating opportunities for collective action through cooperatives and farmer organizations.

Comprehensive analysis of the Cameroon grains market employs multiple research methodologies to ensure accurate and reliable market insights. Primary research activities include field surveys, farmer interviews, and stakeholder consultations across major grain-producing regions. Data collection encompasses production statistics, price information, trade flows, and market participant perspectives gathered through structured questionnaires and focus group discussions.

Secondary research incorporates analysis of government statistics, agricultural reports, trade data, and academic studies related to grain production and marketing in Cameroon. International databases and regional agricultural organizations provide comparative information and regional context for market analysis. Statistical analysis employs quantitative methods to identify trends, correlations, and market relationships that inform strategic insights.

Validation processes include cross-referencing multiple data sources, expert consultations, and field verification of key findings. Market participant feedback ensures that research findings accurately reflect current market conditions and emerging trends. Analytical frameworks incorporate supply chain analysis, value chain mapping, and competitive assessment methodologies to provide comprehensive market understanding.

Quality assurance measures include peer review processes, data verification protocols, and continuous monitoring of market developments to maintain research accuracy and relevance.

Far North Region represents the largest grain-producing area in Cameroon, contributing approximately 35% of national grain output through extensive cultivation of sorghum, millet, and maize. The region benefits from suitable climatic conditions for dryland agriculture and established farming systems adapted to semi-arid conditions. Production systems in this region emphasize drought-resistant varieties and traditional farming practices that have evolved over generations.

North Region contributes significantly to grain production, particularly maize and sorghum, with modern irrigation projects enhancing productivity levels. The region demonstrates strong growth potential through ongoing infrastructure development and agricultural modernization initiatives. Rice production has expanded substantially in irrigated areas, creating new market opportunities and diversifying regional agricultural activities.

Adamawa Region specializes in maize production and serves as a major supplier to southern markets, benefiting from favorable rainfall patterns and fertile soils. The region’s strategic location facilitates market access and trade activities with neighboring regions. Commercial farming operations are emerging alongside traditional smallholder systems, creating diverse production models.

Center and South Regions focus primarily on maize production for local consumption and urban markets, with growing interest in rice cultivation. These regions benefit from proximity to major urban centers and established transportation networks that facilitate market access. Processing activities are concentrated in these regions due to infrastructure availability and market proximity.

Market structure in the Cameroon grains sector is characterized by numerous stakeholders operating at different levels of the value chain, from production through processing and distribution. The competitive environment includes smallholder farmers, medium-scale producers, processing companies, and trading organizations that collectively shape market dynamics.

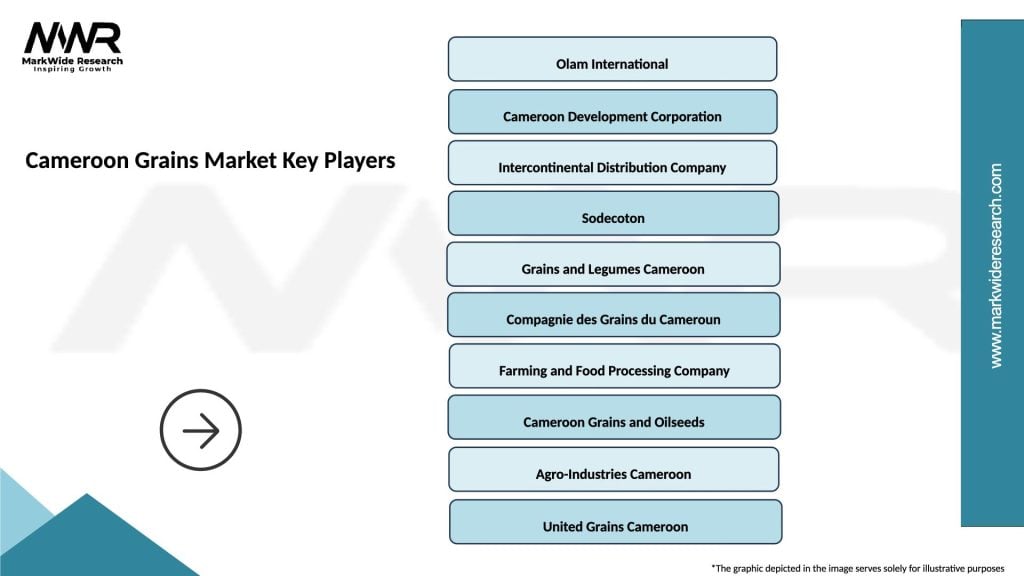

Key market participants include:

Competitive advantages vary among participants, with some focusing on production efficiency, others on processing capabilities, and some on market access and distribution networks. Strategic positioning reflects different approaches to market participation, from vertically integrated operations to specialized service providers.

Market consolidation trends are emerging as larger organizations acquire smaller operations and develop integrated value chains that span production through marketing activities.

By Grain Type:

By Production System:

By Market Channel:

Maize Category demonstrates the strongest market performance with consistent production growth and diverse applications ranging from direct consumption to animal feed and industrial processing. Production efficiency improvements have resulted from adoption of improved varieties and enhanced farming practices. Market demand remains robust across all segments, with processing industries creating additional value-added opportunities.

Rice Category shows exceptional growth potential with government support driving expansion of cultivation areas and processing capabilities. Consumer preference shifts toward rice consumption in urban areas create sustained market demand. Import substitution opportunities exist as domestic production capacity expands to meet growing consumption requirements.

Sorghum and Millet Categories maintain importance for food security and traditional consumption patterns, particularly in northern regions. These drought-resistant crops provide stability during challenging climatic conditions. Export opportunities exist for specialty markets and traditional food applications in neighboring countries.

Processing Categories represent significant value-addition opportunities across all grain types, with flour milling, feed production, and specialty food products creating enhanced market value. Technology adoption in processing activities enables quality improvements and market competitiveness.

Farmers benefit from the expanding grains market through improved income opportunities, access to better inputs and technology, and enhanced market linkages. Productivity improvements resulting from modern farming practices and improved varieties increase profitability and economic sustainability. Cooperative participation provides access to services and markets that individual farmers cannot access independently.

Processing companies gain from reliable raw material supply, growing market demand, and opportunities for value-added product development. Vertical integration strategies enable companies to capture additional value along the supply chain while ensuring quality control and supply security. Export opportunities provide access to regional markets and premium price segments.

Government agencies achieve food security objectives, rural development goals, and economic diversification through a thriving grains sector. Tax revenues from agricultural activities and related businesses contribute to public finances. Employment creation in rural areas supports poverty reduction and social stability objectives.

Consumers benefit from improved food security, stable prices, and access to diverse grain products. Quality improvements in grain production and processing enhance nutritional value and food safety. Local production reduces dependence on imports and supports economic sovereignty.

Development organizations find opportunities to support sustainable agricultural development, poverty reduction, and food security initiatives through targeted interventions in the grains sector.

Strengths:

Weaknesses:

Opportunities:

Threats:

Mechanization adoption represents a significant trend transforming grain production systems across Cameroon, with increasing numbers of farmers accessing tractors, harvesters, and other equipment through rental services and cooperative arrangements. Technology integration extends to precision agriculture techniques, GPS-guided equipment, and data-driven farming practices that optimize resource utilization and enhance productivity.

Value chain integration emerges as companies and cooperatives develop vertically integrated operations spanning production, processing, and marketing activities. This trend enables better quality control, cost management, and market responsiveness. Contract farming arrangements between processors and farmers create stable market relationships and guaranteed income streams.

Sustainable agriculture practices gain prominence as environmental concerns and climate change adaptation become priorities. Organic farming methods and integrated pest management systems attract growing interest from both producers and consumers. Water-efficient irrigation technologies and drought-resistant varieties address climate challenges.

Digital transformation influences grain marketing through mobile platforms, electronic payment systems, and online market information services. MWR research indicates that digital adoption in agricultural marketing has increased by 28% over the past two years, improving market transparency and efficiency.

Regional trade integration accelerates through improved cross-border procedures, harmonized standards, and regional trade agreements that facilitate grain exports to neighboring countries.

Infrastructure investments have significantly impacted the Cameroon grains market, with major road rehabilitation projects improving market access for rural farmers. The completion of rural feeder roads in key production areas has reduced transportation costs and enhanced market integration. Storage facility construction projects have expanded post-harvest storage capacity, reducing losses and enabling better price realization for farmers.

Irrigation development projects in the Far North and North regions have expanded rice production capabilities and enabled dry season cultivation of various grain crops. These investments have contributed to production stability and increased yields in participating areas. Processing industry expansion includes new rice mills, maize processing facilities, and flour mills that add value to raw grain production.

Seed system improvements through research institutions and private companies have introduced improved varieties with higher yields, disease resistance, and climate adaptation characteristics. Extension services expansion has enhanced farmer access to technical knowledge and modern farming practices.

Financial services development includes new agricultural credit products, crop insurance schemes, and mobile banking services that improve farmer access to financial resources. Cooperative strengthening programs have enhanced farmer organization capabilities and market participation.

Policy reforms have streamlined agricultural regulations, improved input subsidy programs, and enhanced support for agricultural research and development activities.

Infrastructure development should remain a top priority for stakeholders seeking to enhance market efficiency and competitiveness. Investment focus should emphasize rural road networks, storage facilities, and processing infrastructure that directly impact farmer incomes and market access. Public-private partnerships can leverage resources and expertise to accelerate infrastructure development.

Technology adoption programs should target smallholder farmers with appropriate technologies that enhance productivity without requiring excessive capital investment. Mechanization services through cooperatives and service providers can make equipment accessible to small-scale producers. Extension services should emphasize practical training and demonstration activities.

Value chain development initiatives should focus on strengthening linkages between producers, processors, and markets. Contract farming arrangements can provide stability for both farmers and processors while ensuring quality standards. Processing capacity expansion should align with production growth and market demand patterns.

Financial inclusion efforts should develop agricultural credit products tailored to grain production cycles and farmer needs. Risk management tools including crop insurance and weather-based insurance can protect farmers against production losses. Mobile banking and digital payment systems can improve transaction efficiency.

Market information systems should provide timely and accurate price data, weather forecasts, and market intelligence to support farmer decision-making. MarkWide Research analysis suggests that improved market information could increase farmer incomes by 18% through better timing of sales and production decisions.

Growth prospects for the Cameroon grains market remain positive, supported by demographic trends, government commitment to agricultural development, and increasing regional market integration. Production expansion is expected to continue as more land comes under cultivation and productivity improvements are realized through technology adoption and improved farming practices.

Processing sector development will likely accelerate as demand for value-added products increases and investment in processing infrastructure expands. Export opportunities are expected to grow as regional trade integration progresses and Cameroon establishes itself as a reliable grain supplier to neighboring countries.

Technology integration will transform production systems over the next decade, with precision agriculture, improved varieties, and mechanization becoming more widespread. Climate adaptation strategies will become increasingly important as weather patterns continue to evolve, requiring drought-resistant varieties and water-efficient production systems.

Market consolidation trends may emerge as larger operations develop economies of scale and vertical integration strategies. However, smallholder farmers will continue to play important roles, particularly through cooperative arrangements and contract farming systems.

Sustainability considerations will influence production practices, with growing emphasis on environmentally friendly farming methods and climate-smart agriculture approaches. Digital transformation will continue to reshape marketing systems, financial services, and information access for grain producers and traders.

The Cameroon grains market presents substantial opportunities for growth and development, supported by favorable agricultural conditions, government policy support, and increasing market demand. Strategic investments in infrastructure, technology, and value chain development can unlock significant potential for enhanced productivity and market competitiveness.

Key success factors include continued focus on smallholder farmer support, infrastructure development, and market integration initiatives that connect producers with consumers efficiently. Collaborative approaches involving government agencies, private sector participants, and development organizations will be essential for realizing the sector’s full potential.

Future growth will depend on addressing current constraints while capitalizing on emerging opportunities in processing, export markets, and technology adoption. The market’s resilience and adaptability position it well for continued expansion and contribution to Cameroon’s economic development and food security objectives.

What is Grains?

Grains are small, hard seeds that are harvested for food, feed, and other uses. They include cereals like rice, maize, and wheat, which are staple foods in many diets, including in Cameroon.

What are the key players in the Cameroon Grains Market?

Key players in the Cameroon Grains Market include companies like Société Camerounaise de Transformation de Céréales, Coton Development Corporation, and Intercontinental Distribution Company, among others.

What are the growth factors driving the Cameroon Grains Market?

The Cameroon Grains Market is driven by factors such as increasing population demand for staple foods, rising urbanization leading to changes in dietary preferences, and government initiatives to boost local grain production.

What challenges does the Cameroon Grains Market face?

Challenges in the Cameroon Grains Market include issues like climate change affecting crop yields, inadequate infrastructure for storage and distribution, and competition from imported grains.

What opportunities exist in the Cameroon Grains Market?

Opportunities in the Cameroon Grains Market include the potential for organic grain production, investment in modern agricultural technologies, and expanding export markets for local grains.

What trends are shaping the Cameroon Grains Market?

Trends in the Cameroon Grains Market include a growing interest in sustainable farming practices, the adoption of improved seed varieties, and increasing consumer awareness of food quality and safety.

Cameroon Grains Market

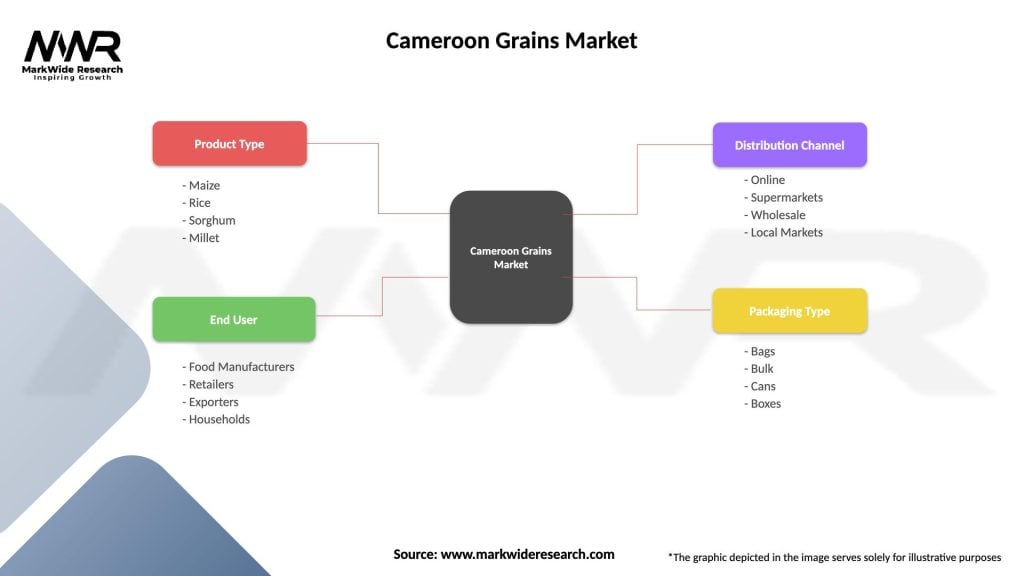

| Segmentation Details | Description |

|---|---|

| Product Type | Maize, Rice, Sorghum, Millet |

| End User | Food Manufacturers, Retailers, Exporters, Households |

| Distribution Channel | Online, Supermarkets, Wholesale, Local Markets |

| Packaging Type | Bags, Bulk, Cans, Boxes |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Cameroon Grains Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at