444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Cameroon container glass market represents a vital segment of the country’s packaging industry, serving diverse sectors including beverages, food processing, pharmaceuticals, and cosmetics. Container glass manufacturing in Cameroon has experienced steady growth driven by increasing urbanization, rising consumer spending, and expanding industrial activities across the Central African region. The market encompasses various glass container types including bottles, jars, vials, and specialty packaging solutions designed to meet local and regional demand.

Market dynamics indicate robust expansion with the sector benefiting from Cameroon’s strategic position as a regional hub for manufacturing and trade. The industry has witnessed significant investments in modern glass manufacturing technologies, with local producers adopting advanced furnace systems and automated production lines to enhance efficiency and product quality. Growth rates have remained consistently positive, with the market expanding at approximately 6.2% annually over recent years.

Regional significance extends beyond domestic consumption as Cameroon serves neighboring countries in the Central African Economic and Monetary Union (CEMAC). The market’s development aligns with government initiatives promoting industrial diversification and import substitution strategies. Manufacturing capabilities have evolved to include both clear and colored glass containers, with increasing focus on lightweight designs and sustainable production practices.

The Cameroon container glass market refers to the comprehensive ecosystem of glass container manufacturing, distribution, and consumption within Cameroon’s borders, encompassing all stakeholders involved in producing glass packaging solutions for various industries. This market includes primary glass manufacturers, secondary processors, distributors, and end-users across multiple sectors requiring glass packaging solutions.

Container glass specifically denotes hollow glass products designed for packaging applications, manufactured through processes including melting raw materials, forming, annealing, and finishing. The market encompasses various container types ranging from beverage bottles and food jars to pharmaceutical vials and cosmetic containers, each designed to meet specific industry requirements and consumer preferences.

Market scope extends to include both domestic production and imports, with local manufacturing playing an increasingly important role in meeting regional demand. The definition encompasses the entire value chain from raw material sourcing through final product delivery, including quality control, logistics, and customer service components essential for market functionality.

Strategic positioning of Cameroon’s container glass market reflects the country’s growing industrial base and expanding consumer market. The sector has demonstrated resilience and adaptability, successfully navigating economic challenges while maintaining growth momentum. Key performance indicators show consistent improvement in production capacity, product quality, and market penetration across target segments.

Market leaders have invested significantly in technology upgrades and capacity expansion, resulting in improved operational efficiency and product diversification. The industry benefits from favorable government policies supporting manufacturing development and regional trade facilitation. Consumer preferences increasingly favor glass packaging due to environmental consciousness and perceived quality advantages over alternative materials.

Competitive landscape features both established players and emerging manufacturers, creating dynamic market conditions that drive innovation and competitive pricing. The sector’s contribution to Cameroon’s industrial output has grown substantially, with employment generation and skills development representing important socioeconomic benefits. Export potential remains significant, with regional markets offering substantial opportunities for expansion.

Primary insights reveal several critical factors shaping the Cameroon container glass market’s trajectory and competitive dynamics:

Economic growth serves as the primary driver for Cameroon’s container glass market expansion, with increasing disposable income and urbanization creating sustained demand for packaged goods. Industrial development across food and beverage sectors has generated substantial requirements for quality glass packaging solutions, particularly as manufacturers seek to enhance product presentation and shelf life.

Government initiatives promoting import substitution and industrial diversification have created favorable conditions for local glass manufacturing development. Infrastructure improvements including transportation networks and energy supply reliability have reduced operational costs and improved market accessibility. The establishment of industrial zones with preferential policies has attracted both domestic and foreign investment in glass manufacturing facilities.

Consumer preferences increasingly favor glass packaging due to environmental concerns and perceived quality advantages. Health consciousness among consumers has driven demand for glass containers in pharmaceutical and food applications, where product purity and safety are paramount. Regional integration through CEMAC has expanded market opportunities, enabling Cameroonian manufacturers to serve broader geographic areas with reduced trade barriers.

Technological advancement in glass manufacturing has made production more efficient and cost-effective, enabling competitive pricing while maintaining quality standards. Raw material availability within the region, including silica sand and limestone, provides cost advantages for local production compared to imports.

Energy costs represent a significant constraint for container glass manufacturing in Cameroon, with high electricity tariffs and unreliable power supply affecting production efficiency and operational costs. Technical expertise limitations in specialized glass manufacturing processes create dependencies on foreign technical assistance and skilled personnel, increasing operational expenses and limiting rapid capacity expansion.

Capital requirements for establishing modern glass manufacturing facilities are substantial, creating barriers to entry for potential investors and limiting market competition. Raw material quality variations and supply chain disruptions occasionally impact production consistency and product quality, affecting customer satisfaction and market reputation.

Competition from imports remains challenging, particularly from established manufacturers in neighboring countries with more advanced production capabilities and economies of scale. Environmental regulations are becoming increasingly stringent, requiring investments in emission control systems and waste management infrastructure that add to operational costs.

Transportation infrastructure limitations in some regions affect distribution efficiency and increase logistics costs, particularly for serving rural markets and export destinations. Currency fluctuations impact the cost of imported equipment and raw materials, creating uncertainty in investment planning and pricing strategies.

Regional expansion presents substantial opportunities as CEMAC integration deepens and trade barriers continue to reduce. Cameroon’s strategic location positions local manufacturers to serve as regional suppliers for container glass products, particularly given the limited manufacturing capacity in neighboring countries. Export potential extends beyond the immediate region to include markets in West and East Africa where demand for quality glass packaging continues to grow.

Product diversification opportunities exist in specialty glass containers for pharmaceuticals, cosmetics, and premium food products where higher margins and growing demand create attractive market segments. Sustainable packaging trends favor glass containers due to their recyclability and environmental benefits, creating opportunities for manufacturers emphasizing green credentials.

Technology partnerships with international glass manufacturers could accelerate capability development and market expansion while reducing technology transfer costs. Value-added services including custom design, labeling, and packaging solutions offer opportunities for revenue enhancement and customer relationship strengthening.

Government support through industrial development programs and export promotion initiatives creates favorable conditions for market expansion and investment attraction. Growing middle class consumption patterns favor premium packaged products, driving demand for quality glass containers across multiple sectors.

Supply chain dynamics in Cameroon’s container glass market reflect the interplay between local production capabilities and import requirements. Demand patterns show seasonal variations aligned with agricultural cycles and beverage consumption trends, requiring flexible production planning and inventory management strategies. Pricing mechanisms are influenced by raw material costs, energy prices, and competitive pressures from both domestic and imported products.

Innovation cycles within the market are accelerating as manufacturers adopt new technologies and production methods to improve efficiency and product quality. Customer relationships have evolved toward longer-term partnerships with key accounts, particularly in the beverage and pharmaceutical sectors where consistent supply and quality are critical.

Market consolidation trends indicate potential for merger and acquisition activities as smaller players seek scale advantages and larger companies pursue market share expansion. Regulatory environment continues evolving with new standards for product quality, environmental compliance, and worker safety affecting operational requirements and costs.

According to MarkWide Research, market dynamics suggest increasing integration between glass manufacturers and their key customers, with collaborative product development and supply chain optimization becoming more common. Investment patterns show growing interest from international players seeking to establish regional manufacturing presence in Central Africa.

Primary research methodologies employed comprehensive stakeholder interviews including glass manufacturers, distributors, end-users, and industry experts to gather firsthand insights into market conditions and trends. Data collection involved structured questionnaires and in-depth discussions with key market participants to understand operational challenges, growth strategies, and market outlook perspectives.

Secondary research encompassed analysis of government statistics, industry reports, trade data, and company financial statements to establish market size, growth patterns, and competitive positioning. Market validation processes included cross-referencing multiple data sources and conducting follow-up interviews to ensure accuracy and reliability of findings.

Quantitative analysis utilized statistical methods to identify trends, correlations, and growth patterns within the market data. Qualitative assessment focused on understanding market dynamics, competitive strategies, and future development opportunities through expert opinions and industry insights.

Geographic coverage included all major regions within Cameroon, with particular attention to industrial centers and urban markets where container glass demand is concentrated. Temporal analysis covered historical performance over the past five years and forward-looking projections based on identified trends and market drivers.

Littoral Region dominates Cameroon’s container glass market, hosting the majority of manufacturing facilities and serving as the primary distribution hub. Douala’s industrial zone concentrates most glass production capacity, benefiting from port access, transportation infrastructure, and proximity to major consumer markets. The region accounts for approximately 68% of total container glass production and 55% of domestic consumption.

Centre Region represents the second-largest market, driven by Yaoundé’s urban population and government sector demand. Manufacturing presence in this region focuses primarily on pharmaceutical and specialty glass containers, serving the capital’s medical and research institutions. Market share in terms of consumption reaches approximately 22% of national demand.

Western Regions including West and Northwest show growing demand driven by agricultural processing industries and beverage production. Local bottling operations for both alcoholic and non-alcoholic beverages create steady demand for glass containers, though most supply comes from Littoral Region manufacturers.

Northern Regions exhibit lower demand levels but represent growth opportunities as economic development and urbanization progress. Distribution challenges due to transportation infrastructure limitations affect market penetration, but government infrastructure investments are improving accessibility.

Export markets primarily serve Chad, Central African Republic, and Equatorial Guinea, with cross-border trade facilitated by CEMAC agreements and Cameroon’s strategic geographic position.

Market leadership is shared among several key players, each with distinct competitive advantages and market positioning strategies:

Competitive strategies emphasize technology advancement, quality improvement, and customer service excellence. Market differentiation occurs through product specialization, with some manufacturers focusing on specific sectors such as pharmaceuticals or premium beverages. Pricing competition remains intense, particularly in standard container categories where product differentiation is limited.

Innovation initiatives include lightweight container designs, improved recycling capabilities, and custom packaging solutions. Strategic partnerships with international technology providers and regional distributors enhance competitive positioning and market reach.

By Product Type:

By End-User Industry:

By Distribution Channel:

Beverage Container Category demonstrates the strongest growth dynamics, driven by expanding brewery operations and soft drink manufacturing. Beer bottles represent the largest sub-segment, with local breweries increasingly preferring glass packaging for premium product positioning. Innovation trends include lightweight designs reducing transportation costs and environmental impact while maintaining product integrity.

Food Packaging Category shows steady growth aligned with food processing industry expansion and changing consumer preferences toward preserved and packaged foods. Jam and preserve jars benefit from growing local fruit processing operations, while sauce and condiment containers serve expanding restaurant and food service sectors.

Pharmaceutical Container Category exhibits the highest growth rates and profit margins, driven by healthcare sector development and increasing pharmaceutical manufacturing. Quality requirements in this segment are stringent, creating barriers to entry but offering premium pricing for qualified suppliers. Regulatory compliance with international pharmaceutical packaging standards is essential for market participation.

Specialty Applications including cosmetics and industrial containers offer niche opportunities with higher margins but limited volume potential. Customization requirements in these segments favor manufacturers with flexible production capabilities and design expertise.

Manufacturers benefit from growing domestic and regional demand, enabling capacity utilization improvements and economies of scale realization. Technology investments in modern production equipment yield efficiency gains and quality improvements that enhance competitive positioning. Government support through industrial development policies provides favorable operating conditions and investment incentives.

End-users gain access to locally produced glass containers with shorter supply chains, reduced logistics costs, and improved supply security. Quality improvements in local production meet international standards while offering cost advantages over imports. Customization capabilities allow for product differentiation and brand enhancement opportunities.

Distributors benefit from expanding product portfolios and growing market demand, creating opportunities for business growth and geographic expansion. Partnership relationships with manufacturers provide exclusive distribution rights and marketing support in specific territories or market segments.

Government stakeholders realize benefits through industrial development, employment generation, and foreign exchange savings from import substitution. Tax revenues from manufacturing operations and related economic activities contribute to public finance objectives. Regional trade facilitation enhances Cameroon’s position as a manufacturing hub for Central Africa.

MWR analysis indicates that stakeholder benefits extend beyond direct economic impacts to include technology transfer, skills development, and industrial ecosystem strengthening that support broader economic development objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Focus represents the most significant trend shaping the container glass market, with manufacturers and consumers increasingly prioritizing environmental considerations. Recycling initiatives are expanding, with glass recovery rates improving through better collection systems and consumer education programs. Lightweight designs reduce material usage and transportation costs while maintaining product performance and safety standards.

Technology Integration continues advancing with manufacturers adopting automated production systems, quality control technologies, and energy-efficient furnace designs. Digital transformation includes production monitoring systems, predictive maintenance capabilities, and customer relationship management platforms that enhance operational efficiency and service quality.

Product Innovation focuses on specialized container designs for specific applications, including pharmaceutical packaging with enhanced barrier properties and beverage containers with improved aesthetic appeal. Customization capabilities are expanding as manufacturers invest in flexible production systems that accommodate smaller batch sizes and unique customer requirements.

Market Consolidation trends indicate potential for merger and acquisition activities as companies seek scale advantages and market share expansion. Strategic partnerships between local manufacturers and international technology providers are becoming more common, facilitating knowledge transfer and capability development.

Regional Integration through CEMAC continues creating opportunities for cross-border trade and investment, with Cameroon positioned as a regional manufacturing hub for container glass products.

Capacity Expansion Projects have been announced by major manufacturers, with new production lines and facility upgrades planned to meet growing demand. Technology Upgrades include installation of modern furnace systems and automated handling equipment that improve efficiency and product quality while reducing environmental impact.

International Partnerships have been established between Cameroonian manufacturers and global glass technology providers, facilitating knowledge transfer and technical capability development. Investment Commitments from both domestic and foreign investors indicate confidence in market growth prospects and long-term viability.

Quality Certifications have been achieved by leading manufacturers, including ISO standards and pharmaceutical packaging certifications that enable access to premium market segments. Environmental Initiatives include waste reduction programs, energy efficiency improvements, and recycling system development that align with sustainability objectives.

Export Market Development activities have expanded, with Cameroonian manufacturers establishing distribution networks in neighboring countries and participating in regional trade exhibitions. Product Diversification initiatives include development of specialty containers for pharmaceutical and cosmetic applications, representing higher-margin market opportunities.

Government Policy Support continues through industrial development programs, tax incentives, and infrastructure investments that benefit the container glass sector and broader manufacturing industry.

Investment Priorities should focus on technology modernization and capacity expansion to meet growing demand while improving operational efficiency. Energy management strategies including renewable energy adoption and efficiency improvements can reduce operational costs and environmental impact. Skills development programs for technical personnel will reduce dependence on foreign expertise and improve operational capabilities.

Market Expansion strategies should prioritize regional export development, leveraging Cameroon’s strategic position and CEMAC trade advantages. Product diversification into specialty segments such as pharmaceuticals and cosmetics offers higher margins and growth potential. Customer relationship strengthening through value-added services and technical support can improve competitive positioning.

Strategic Partnerships with international technology providers and regional distributors can accelerate market development and capability enhancement. Sustainability initiatives including recycling programs and environmental compliance will become increasingly important for market acceptance and regulatory compliance.

Quality Focus remains critical for market success, with international certification and continuous improvement programs essential for competitive advantage. Supply chain optimization including raw material sourcing and distribution efficiency can reduce costs and improve service levels.

MarkWide Research recommends that industry participants focus on long-term strategic planning while maintaining operational flexibility to respond to market changes and opportunities as they emerge.

Growth projections for Cameroon’s container glass market remain positive, with continued expansion expected across all major segments. Market maturation will likely lead to increased competition and consolidation, favoring manufacturers with scale advantages and technological capabilities. Regional integration through CEMAC will continue creating opportunities for market expansion and cross-border investment.

Technology advancement will drive efficiency improvements and product innovation, with manufacturers adopting Industry 4.0 technologies and sustainable production practices. Environmental regulations will become more stringent, requiring investments in clean technologies and waste management systems. Consumer preferences will increasingly favor sustainable packaging solutions, benefiting glass containers over alternative materials.

Investment flows are expected to continue as both domestic and foreign investors recognize market potential and government support for industrial development. Export opportunities will expand as regional markets develop and trade facilitation improves. Product diversification into specialty applications will provide growth opportunities and margin enhancement.

Market challenges including energy costs and technical expertise limitations will require ongoing attention and strategic solutions. Infrastructure development by government will improve operating conditions and market accessibility. Competitive dynamics will intensify as market growth attracts new entrants and existing players expand capabilities.

Long-term prospects remain favorable, with the container glass market positioned to benefit from Cameroon’s economic development and regional leadership in manufacturing. Success factors will include technology adoption, quality focus, and strategic market positioning that leverages competitive advantages while addressing market challenges effectively.

Cameroon’s container glass market presents significant opportunities for growth and development, supported by favorable market dynamics, government policies, and regional integration trends. Market fundamentals remain strong with growing domestic demand, expanding export opportunities, and increasing industrial sophistication driving sector development.

Strategic positioning as a regional manufacturing hub provides competitive advantages that can be leveraged for market expansion and investment attraction. Technology advancement and quality improvement initiatives position local manufacturers to compete effectively while serving diverse market segments with specialized requirements.

Challenges including energy costs, technical expertise, and infrastructure limitations require ongoing attention but do not fundamentally undermine market prospects. Investment opportunities remain attractive for both domestic and foreign participants seeking exposure to Central African market growth and industrial development.

Future success will depend on continued focus on operational excellence, customer service, and strategic market development that builds on existing strengths while addressing competitive challenges. The Cameroon container glass market is well-positioned to achieve sustained growth and contribute meaningfully to the country’s industrial development objectives and regional economic integration goals.

What is Container Glass?

Container glass refers to glass products designed for packaging and storing various goods, including beverages, food, and pharmaceuticals. It is known for its durability, recyclability, and ability to preserve the quality of its contents.

What are the key players in the Cameroon Container Glass Market?

Key players in the Cameroon Container Glass Market include Societe des Verres du Cameroun, O-I Glass, and Verallia, among others. These companies are involved in the production and distribution of container glass products for various industries.

What are the growth factors driving the Cameroon Container Glass Market?

The growth of the Cameroon Container Glass Market is driven by increasing demand for sustainable packaging solutions, the rise in the beverage industry, and a growing preference for glass over plastic due to health and environmental concerns.

What challenges does the Cameroon Container Glass Market face?

The Cameroon Container Glass Market faces challenges such as high production costs, competition from alternative packaging materials, and logistical issues related to distribution and transportation.

What opportunities exist in the Cameroon Container Glass Market?

Opportunities in the Cameroon Container Glass Market include expanding the recycling infrastructure, increasing consumer awareness of eco-friendly packaging, and the potential for innovation in glass manufacturing technologies.

What trends are shaping the Cameroon Container Glass Market?

Trends in the Cameroon Container Glass Market include a shift towards lightweight glass containers, the adoption of smart packaging technologies, and an increasing focus on sustainable production practices.

Cameroon Container Glass Market

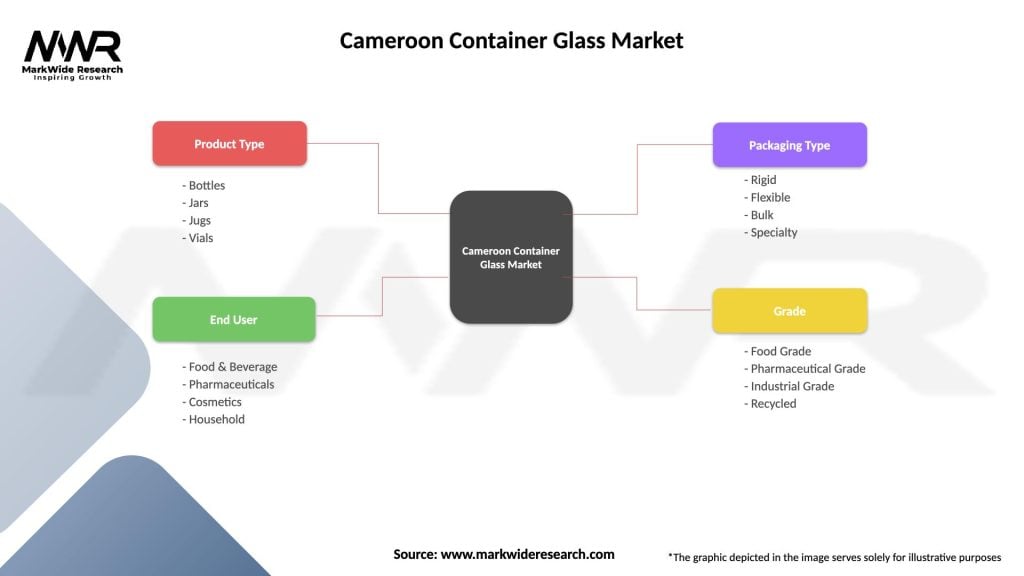

| Segmentation Details | Description |

|---|---|

| Product Type | Bottles, Jars, Jugs, Vials |

| End User | Food & Beverage, Pharmaceuticals, Cosmetics, Household |

| Packaging Type | Rigid, Flexible, Bulk, Specialty |

| Grade | Food Grade, Pharmaceutical Grade, Industrial Grade, Recycled |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Cameroon Container Glass Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at