444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The California freight and logistics market represents one of the most dynamic and strategically important transportation networks in North America. California’s position as the nation’s largest economy and primary gateway for international trade creates unprecedented opportunities for freight and logistics operations. The state handles approximately 40% of all containerized imports entering the United States, establishing it as a critical hub for global supply chain operations.

Market dynamics in California are driven by the state’s diverse economic landscape, including major metropolitan areas, agricultural regions, and manufacturing centers. The freight and logistics sector encompasses trucking, rail transport, warehousing, distribution centers, and intermodal facilities that collectively support the movement of goods throughout the state and beyond. With projected growth rates of 6.2% CAGR through the next five years, the market demonstrates robust expansion potential.

Geographic advantages position California as a natural logistics hub, with extensive port facilities in Los Angeles and Long Beach serving as primary entry points for Asian imports. The state’s transportation infrastructure includes major interstate highways, rail networks, and distribution centers strategically located to serve both domestic and international markets. Technology adoption rates in California’s logistics sector exceed 75% for digital tracking and automated systems, reflecting the industry’s commitment to operational efficiency.

The California freight and logistics market refers to the comprehensive network of transportation, warehousing, and distribution services that facilitate the movement of goods within, into, and out of California. This market encompasses all modes of freight transportation including trucking, rail, air cargo, and maritime shipping, along with supporting infrastructure such as warehouses, distribution centers, and intermodal facilities.

Freight operations involve the physical transportation of goods, while logistics services encompass the broader planning, coordination, and management of supply chain activities. The California market is characterized by its integration with international trade flows, particularly from Asia-Pacific regions, and its role in distributing goods throughout the western United States. Key components include last-mile delivery services, cross-docking operations, inventory management, and value-added services such as packaging and assembly.

Market participants range from large multinational logistics providers to specialized regional carriers and technology-enabled startups. The sector supports diverse industries including retail, manufacturing, agriculture, automotive, and e-commerce, making it a critical component of California’s economic infrastructure.

California’s freight and logistics market continues to demonstrate exceptional resilience and growth potential, driven by the state’s position as America’s primary trade gateway and largest consumer market. The sector benefits from substantial infrastructure investments, technological innovation, and strategic geographic positioning that creates competitive advantages for businesses operating within the state.

Key market drivers include the ongoing growth of e-commerce, which accounts for 15.8% of total retail sales in California, and the state’s role in facilitating international trade relationships. The market has adapted to evolving consumer expectations for faster delivery times and increased supply chain transparency, leading to significant investments in automation and digital technologies.

Sustainability initiatives represent a major trend shaping the market, with California’s environmental regulations driving adoption of clean transportation technologies and green logistics practices. The state’s commitment to carbon neutrality by 2045 is accelerating investments in electric vehicles, alternative fuels, and energy-efficient warehouse operations. Market consolidation continues as larger players acquire specialized service providers to expand their capabilities and geographic reach.

Future growth prospects remain strong, supported by continued population growth, economic expansion, and evolving trade patterns. The market’s ability to adapt to disruptions, as demonstrated during recent global supply chain challenges, reinforces its strategic importance to both state and national economic interests.

Strategic positioning defines California’s freight and logistics market, with several critical insights shaping industry development and investment decisions:

Market maturity varies across different segments, with traditional trucking and warehousing representing established sectors while emerging technologies and specialized services offer growth opportunities. Competitive dynamics favor companies that can provide comprehensive solutions combining multiple service offerings with advanced technology capabilities.

Economic growth serves as the primary driver for California’s freight and logistics market, with the state’s diverse economy generating consistent demand for transportation and distribution services. Population expansion continues to create new consumer markets, while business growth drives commercial shipping requirements across multiple industry sectors.

International trade relationships significantly impact market dynamics, particularly with Asia-Pacific trading partners. California’s strategic position on the Pacific Rim enables efficient access to growing Asian markets, supporting both import and export activities. Trade volume growth of approximately 4.5% annually creates sustained demand for logistics services and infrastructure capacity.

E-commerce expansion represents a transformative force reshaping logistics requirements and service expectations. Online retail growth drives demand for specialized fulfillment centers, rapid delivery capabilities, and flexible distribution networks. Consumer expectations for same-day and next-day delivery create opportunities for innovative logistics solutions and last-mile optimization.

Technology adoption accelerates operational improvements and enables new service offerings. Advanced analytics, artificial intelligence, and automation technologies enhance efficiency while reducing costs. Digital transformation initiatives improve supply chain visibility and enable proactive management of logistics operations.

Infrastructure development supports market expansion through improved transportation networks, expanded port facilities, and modernized warehouse complexes. Public and private investments in infrastructure create capacity for future growth while enhancing operational efficiency for existing operations.

Regulatory complexity presents significant challenges for freight and logistics operators in California, with environmental regulations, labor laws, and safety requirements creating compliance costs and operational constraints. Environmental standards require substantial investments in clean transportation technologies and sustainable practices, impacting profitability for some market participants.

Infrastructure limitations constrain growth in certain regions, particularly regarding highway capacity, rail connectivity, and warehouse availability. Traffic congestion in major metropolitan areas increases transportation costs and delivery times, affecting service quality and operational efficiency. Limited availability of suitable industrial real estate in prime locations creates barriers to expansion for logistics providers.

Labor market challenges include driver shortages, skilled worker availability, and rising wage costs that impact operational expenses. Workforce development requirements for new technologies and specialized equipment create training costs and implementation delays. Competition for qualified personnel intensifies as the market expands and technology requirements evolve.

Economic volatility affects demand patterns and investment decisions, with market participants facing uncertainty regarding future growth trajectories. Supply chain disruptions from global events create operational challenges and require adaptive strategies to maintain service levels.

Technology implementation costs represent significant capital investments that may be challenging for smaller operators to absorb. Integration complexities and system compatibility issues can create implementation delays and additional expenses for companies adopting new technologies.

Sustainability initiatives create substantial opportunities for companies developing clean transportation solutions and environmentally responsible logistics practices. California’s commitment to carbon reduction goals drives demand for electric vehicles, alternative fuels, and energy-efficient operations. Green logistics services command premium pricing while supporting long-term market positioning.

Technology innovation enables new service offerings and operational improvements that create competitive advantages. Automation technologies in warehousing and transportation reduce labor costs while improving accuracy and efficiency. Advanced analytics and artificial intelligence applications optimize routing, inventory management, and predictive maintenance.

Last-mile delivery represents a rapidly expanding market segment driven by e-commerce growth and changing consumer expectations. Urban logistics solutions including micro-fulfillment centers, drone delivery, and autonomous vehicles create opportunities for innovative service providers. Specialized delivery services for time-sensitive and high-value goods offer premium revenue potential.

Cross-border trade expansion with Mexico and other international partners creates opportunities for specialized logistics services and infrastructure development. Nearshoring trends may increase demand for North American logistics networks as companies diversify their supply chains.

Value-added services including packaging, assembly, customization, and returns processing provide opportunities for logistics providers to expand their service offerings and increase revenue per customer. Supply chain consulting and optimization services leverage expertise to help clients improve their logistics operations.

Competitive intensity characterizes California’s freight and logistics market, with established players competing against innovative startups and technology-enabled service providers. Market consolidation continues as larger companies acquire specialized capabilities and expand their geographic reach. Strategic partnerships between traditional logistics providers and technology companies create new competitive dynamics.

Customer expectations drive service innovation and operational improvements, with businesses demanding greater supply chain visibility, faster delivery times, and flexible service options. Service differentiation becomes increasingly important as customers evaluate providers based on technology capabilities, sustainability practices, and value-added services.

Pricing pressures result from competitive bidding processes and customer cost reduction initiatives, requiring logistics providers to improve operational efficiency and find new revenue sources. Technology investments help offset margin pressure by reducing operational costs and enabling premium service offerings.

Regulatory changes create both challenges and opportunities, with environmental regulations driving innovation while potentially increasing compliance costs. Labor regulations affect operational strategies and cost structures, particularly regarding driver classification and working time requirements.

Economic cycles influence demand patterns and investment decisions, with market participants adapting their strategies to maintain profitability during different economic conditions. Supply chain resilience becomes a key competitive factor as customers prioritize reliable service providers who can maintain operations during disruptions.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into California’s freight and logistics market. Primary research includes structured interviews with industry executives, logistics managers, and key stakeholders across different market segments and geographic regions within California.

Secondary research incorporates analysis of industry reports, government statistics, trade association data, and company financial information to establish market trends and competitive dynamics. Data validation processes ensure accuracy and consistency across multiple information sources and research methodologies.

Market segmentation analysis examines different service categories, customer industries, and geographic regions to identify growth opportunities and competitive positioning. Trend analysis evaluates historical performance data and forward-looking indicators to project future market developments.

Stakeholder engagement includes consultations with industry associations, regulatory agencies, and academic institutions to gain comprehensive perspectives on market dynamics and future trends. Technology assessment evaluates emerging innovations and their potential impact on market structure and competitive dynamics.

Economic modeling incorporates macroeconomic factors, demographic trends, and industry-specific variables to develop realistic growth projections and scenario analyses. Competitive intelligence gathering provides insights into market participant strategies, service offerings, and performance metrics.

Southern California dominates the state’s freight and logistics market, accounting for approximately 65% of total activity due to the concentration of major ports, population centers, and distribution facilities. Los Angeles County serves as the primary hub, with extensive warehouse complexes, intermodal facilities, and transportation networks supporting both domestic and international trade flows.

San Francisco Bay Area represents the second-largest regional market, driven by technology industry growth, dense population, and proximity to agricultural production areas. Silicon Valley creates specialized logistics requirements for high-value technology products, while the region’s ports handle significant containerized cargo volumes.

Central Valley serves as a critical agricultural logistics corridor, with specialized transportation and storage facilities supporting the movement of fresh produce and processed foods. Fresno and Stockton function as important distribution hubs connecting agricultural producers with domestic and international markets.

Northern California markets including Sacramento and surrounding areas benefit from strategic positioning between major metropolitan regions and serve as important distribution points for consumer goods and industrial products. The region’s transportation infrastructure supports efficient movement of goods between northern and southern California markets.

Border regions with Mexico create specialized logistics opportunities for cross-border trade, with San Diego and Imperial County serving as important gateways for international commerce. These areas require specialized customs clearance and cross-border transportation capabilities.

Market leadership in California’s freight and logistics sector includes both national carriers and regional specialists who have developed strong competitive positions through service excellence, technology innovation, and strategic geographic positioning.

Regional competitors include specialized carriers and logistics providers who focus on specific geographic areas or industry sectors within California. Technology companies are increasingly entering the market with innovative solutions for routing optimization, warehouse automation, and supply chain visibility.

Service-based segmentation divides the California freight and logistics market into distinct categories based on the types of services provided and customer requirements:

By Transportation Mode:

By Service Type:

By Industry Vertical:

Trucking services maintain the dominant position in California’s freight market, handling approximately 78% of total freight tonnage within the state. Long-haul operations connect California with national markets, while regional and local services support intrastate commerce and last-mile delivery requirements. Technology adoption in trucking includes electronic logging devices, GPS tracking, and route optimization systems that improve efficiency and regulatory compliance.

Warehousing and distribution services experience strong growth driven by e-commerce expansion and supply chain optimization initiatives. Modern facilities incorporate automation technologies, climate control systems, and strategic locations near major transportation hubs. The segment benefits from increasing demand for value-added services including packaging, assembly, and returns processing.

Intermodal transportation leverages California’s extensive rail network and port facilities to provide cost-effective long-distance shipping solutions. Container movements between ports and inland distribution centers represent a significant portion of intermodal activity. The segment supports environmental sustainability goals by reducing highway congestion and fuel consumption.

Last-mile delivery emerges as a high-growth segment driven by e-commerce expansion and changing consumer expectations. Urban delivery challenges create opportunities for innovative solutions including micro-fulfillment centers, electric delivery vehicles, and alternative delivery methods. The segment commands premium pricing due to service complexity and customer service requirements.

Specialized logistics services cater to specific industry requirements including temperature-controlled transportation, hazardous materials handling, and high-security shipments. Healthcare logistics represents a growing specialty segment with stringent regulatory requirements and specialized handling procedures.

Logistics providers benefit from California’s strategic geographic position and diverse economy, which create consistent demand for transportation and distribution services. Market size and diversity enable specialization opportunities and economies of scale that improve operational efficiency and profitability. Access to major ports and transportation infrastructure provides competitive advantages for serving both domestic and international markets.

Shippers and manufacturers gain access to comprehensive logistics networks that support efficient supply chain operations and market access. Service competition among logistics providers results in innovative solutions, competitive pricing, and improved service quality. California’s logistics infrastructure enables businesses to reach large consumer markets and optimize their distribution strategies.

Technology companies find opportunities to develop and deploy innovative solutions for logistics optimization, warehouse automation, and supply chain visibility. Market demand for technology-enabled services creates revenue opportunities and supports the development of new business models. Collaboration with traditional logistics providers enables technology companies to scale their solutions and expand market reach.

Real estate investors benefit from strong demand for industrial properties including warehouses, distribution centers, and logistics facilities. Strategic locations near ports, airports, and major highways command premium valuations and generate stable rental income. Market growth supports continued development opportunities and asset appreciation.

Economic development benefits include job creation, tax revenue generation, and support for diverse industry sectors that depend on efficient logistics services. Infrastructure investments improve regional competitiveness and support long-term economic growth throughout California.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation accelerates across California’s freight and logistics market, with companies investing in advanced technologies to improve operational efficiency and customer service. Artificial intelligence and machine learning applications optimize routing, inventory management, and predictive maintenance. Real-time tracking and visibility systems provide customers with enhanced supply chain transparency and control.

Sustainability initiatives gain momentum as environmental regulations and corporate responsibility commitments drive adoption of clean transportation technologies. Electric vehicle deployment increases for last-mile delivery operations, while alternative fuels gain traction for long-haul transportation. Green building standards influence warehouse and distribution center development.

Automation expansion transforms warehouse operations through robotic systems, automated storage and retrieval systems, and autonomous material handling equipment. Labor optimization strategies balance automation investments with workforce development to maintain service quality while improving efficiency. According to MarkWide Research analysis, automation adoption rates exceed 60% in major California distribution centers.

Last-mile innovation addresses urban delivery challenges through micro-fulfillment centers, drone delivery pilots, and autonomous vehicle testing. Customer expectations for faster delivery times drive investment in local distribution networks and flexible delivery options. Same-day and next-day delivery capabilities become standard service offerings for many logistics providers.

Supply chain resilience becomes a strategic priority following recent global disruptions, with companies diversifying their logistics networks and building redundancy into their operations. Nearshoring trends may increase demand for North American logistics services as companies reduce dependence on distant suppliers.

Infrastructure investments continue to reshape California’s logistics landscape, with major port expansion projects, highway improvements, and rail network enhancements supporting increased capacity and operational efficiency. Port of Los Angeles and Port of Long Beach implement modernization programs to handle larger vessels and increase container throughput.

Technology partnerships between traditional logistics providers and innovative technology companies create new service capabilities and competitive advantages. Strategic alliances enable rapid deployment of advanced solutions including autonomous vehicles, warehouse robotics, and predictive analytics platforms.

Regulatory developments include new environmental standards for transportation equipment and facility operations, driving investment in clean technologies and sustainable practices. Labor legislation affects operational strategies and cost structures, particularly regarding driver classification and working time requirements.

Market consolidation continues through acquisitions and mergers that create larger, more comprehensive service providers with enhanced geographic reach and service capabilities. Private equity investment in logistics companies supports growth initiatives and technology adoption.

Real estate development focuses on modern, technology-enabled facilities located near major transportation hubs and population centers. Speculative construction increases to meet growing demand for warehouse and distribution space, particularly for e-commerce fulfillment operations.

Strategic positioning recommendations emphasize the importance of technology adoption and service differentiation in California’s competitive logistics market. Investment priorities should focus on automation technologies, sustainability initiatives, and last-mile delivery capabilities that align with market trends and customer expectations.

Geographic expansion strategies should consider emerging markets within California, particularly in the Central Valley and inland regions where growth opportunities exist with lower operating costs. Facility location decisions should balance proximity to customers with real estate costs and transportation access.

Partnership development with technology companies, real estate developers, and complementary service providers can accelerate growth and enhance competitive positioning. Strategic alliances enable access to new capabilities and markets without requiring substantial capital investments.

Workforce development initiatives should address skill gaps in technology operation, data analysis, and specialized logistics functions. Training programs and retention strategies become critical for maintaining service quality and operational efficiency as the market evolves.

Sustainability planning should anticipate future regulatory requirements and customer expectations for environmentally responsible logistics operations. Early adoption of clean technologies and green practices can create competitive advantages and support long-term market positioning.

Growth projections for California’s freight and logistics market remain positive, supported by continued economic expansion, population growth, and evolving trade patterns. Market evolution will be shaped by technology adoption, sustainability requirements, and changing customer expectations for service quality and delivery speed.

Technology integration will accelerate, with artificial intelligence, automation, and advanced analytics becoming standard components of logistics operations. Autonomous vehicles and drone delivery systems may begin commercial deployment in specific applications, particularly for last-mile delivery in urban areas. MWR projects that technology-enabled services will account for 85% of market growth over the next five years.

Sustainability initiatives will intensify as California pursues its carbon neutrality goals and businesses respond to environmental regulations and customer expectations. Electric vehicle adoption will expand beyond last-mile delivery to include regional and long-haul transportation applications. Green building standards and renewable energy systems will become standard features of new logistics facilities.

Market consolidation may continue as companies seek to achieve economies of scale and comprehensive service capabilities. Strategic partnerships between logistics providers, technology companies, and real estate developers will create new business models and service offerings.

International trade relationships will influence market dynamics, with potential shifts in trade patterns affecting port volumes and logistics requirements. Nearshoring trends may create opportunities for increased North American trade flows and specialized logistics services.

California’s freight and logistics market represents a dynamic and strategically important sector that continues to evolve in response to technological innovation, regulatory changes, and shifting customer expectations. The market’s fundamental strengths, including strategic geographic positioning, extensive infrastructure, and diverse economic base, provide a solid foundation for continued growth and development.

Future success in this market will depend on companies’ ability to adapt to changing conditions, invest in appropriate technologies, and develop sustainable business practices that align with California’s environmental goals. Market participants who can effectively balance operational efficiency with service quality while maintaining cost competitiveness will be best positioned to capitalize on growth opportunities.

Strategic investments in technology, sustainability, and workforce development will be critical for maintaining competitive advantages and meeting evolving customer requirements. The market’s continued evolution toward more automated, sustainable, and customer-centric operations creates both challenges and opportunities for industry participants at all levels.

What is Freight And Logistics?

Freight and logistics refer to the processes involved in the transportation, storage, and management of goods. This includes various activities such as shipping, warehousing, and inventory management, which are essential for supply chain efficiency.

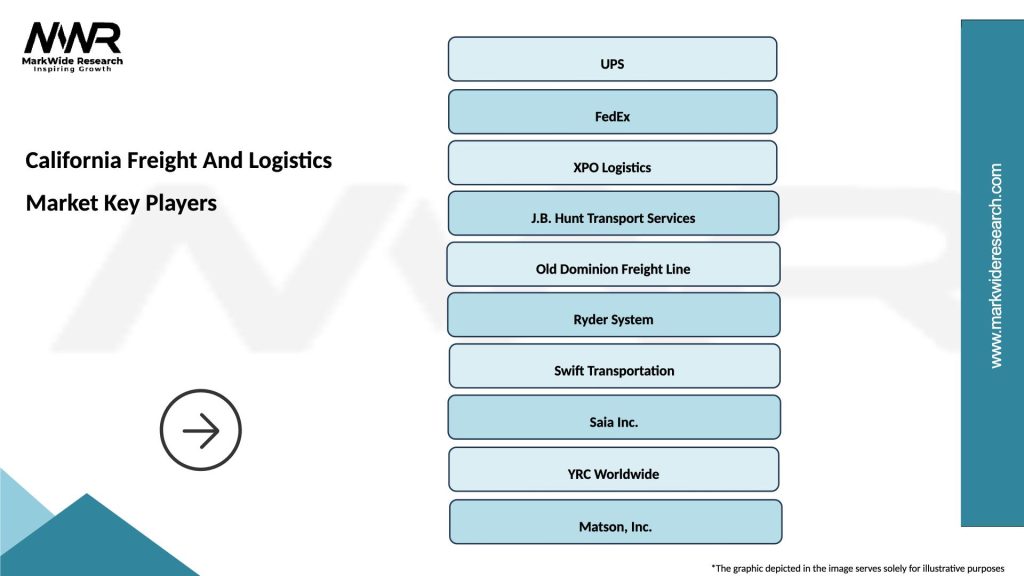

What are the key players in the California Freight And Logistics Market?

Key players in the California Freight And Logistics Market include companies like XPO Logistics, J.B. Hunt Transport Services, and Schneider National. These companies provide a range of services from freight transportation to supply chain management, among others.

What are the main drivers of growth in the California Freight And Logistics Market?

The growth of the California Freight And Logistics Market is driven by factors such as the increasing demand for e-commerce, advancements in technology, and the expansion of infrastructure. Additionally, the rise in consumer expectations for faster delivery times plays a significant role.

What challenges does the California Freight And Logistics Market face?

The California Freight And Logistics Market faces challenges such as regulatory compliance, rising fuel costs, and labor shortages. These factors can impact operational efficiency and increase costs for logistics providers.

What opportunities exist in the California Freight And Logistics Market?

Opportunities in the California Freight And Logistics Market include the adoption of automation and AI technologies, the growth of green logistics practices, and the expansion of last-mile delivery services. These trends can enhance efficiency and sustainability in logistics operations.

What trends are shaping the California Freight And Logistics Market?

Trends shaping the California Freight And Logistics Market include the integration of digital platforms for supply chain visibility, the use of electric vehicles for transportation, and the emphasis on sustainability. These innovations are transforming how logistics companies operate.

California Freight And Logistics Market

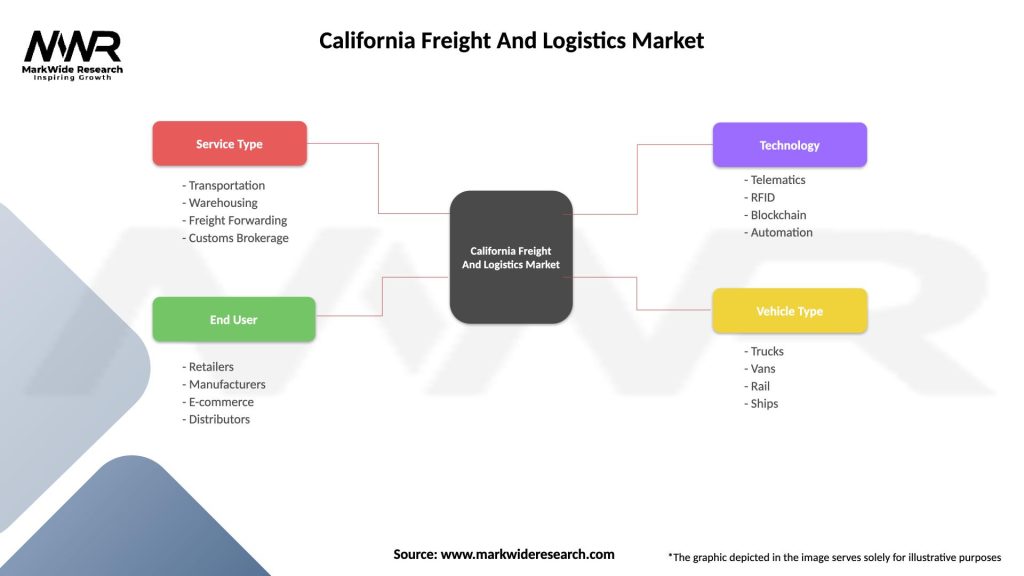

| Segmentation Details | Description |

|---|---|

| Service Type | Transportation, Warehousing, Freight Forwarding, Customs Brokerage |

| End User | Retailers, Manufacturers, E-commerce, Distributors |

| Technology | Telematics, RFID, Blockchain, Automation |

| Vehicle Type | Trucks, Vans, Rail, Ships |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the California Freight And Logistics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at