444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The bulk containers and packaging market represents a critical segment of the global logistics and supply chain industry, encompassing a diverse range of large-capacity storage and transportation solutions. This dynamic market serves multiple industries including chemicals, pharmaceuticals, food and beverages, agriculture, and manufacturing sectors. Market dynamics indicate robust growth driven by increasing global trade, e-commerce expansion, and the need for efficient bulk material handling solutions.

Industrial demand for bulk containers continues to surge as companies seek cost-effective packaging solutions that can handle large volumes while maintaining product integrity. The market encompasses various container types including intermediate bulk containers (IBCs), flexible intermediate bulk containers (FIBCs), drums, pails, and specialized bulk packaging systems. Growth projections suggest the market is expanding at a 6.2% CAGR through the forecast period, driven by technological advancements and sustainability initiatives.

Regional distribution shows North America and Europe maintaining significant market positions, while Asia-Pacific emerges as the fastest-growing region with 42% market share in bulk container adoption. The increasing focus on supply chain optimization and environmental sustainability continues to shape market development patterns across all major geographical regions.

The bulk containers and packaging market refers to the comprehensive industry segment focused on manufacturing, distributing, and utilizing large-capacity containers designed for storing, transporting, and handling bulk materials across various industrial applications. These specialized packaging solutions are engineered to accommodate substantial quantities of liquids, powders, granules, and other bulk materials while ensuring product safety, regulatory compliance, and operational efficiency throughout the supply chain process.

Container specifications typically range from intermediate-capacity solutions holding hundreds of liters to large-scale systems capable of managing thousands of kilograms of materials. The market encompasses both rigid and flexible container designs, each optimized for specific material types, transportation methods, and storage requirements. Technology integration increasingly includes smart monitoring systems, RFID tracking capabilities, and advanced materials that enhance container performance and supply chain visibility.

Market fundamentals demonstrate strong growth momentum in the bulk containers and packaging sector, driven by expanding industrial production, international trade growth, and increasing emphasis on sustainable packaging solutions. The market benefits from diverse end-user applications spanning chemical processing, food production, pharmaceutical manufacturing, and agricultural operations. Innovation trends focus on developing lightweight yet durable materials, improving container reusability, and integrating digital tracking technologies.

Competitive dynamics reveal a fragmented market structure with numerous regional and global players competing across different container categories and application segments. Leading manufacturers are investing heavily in research and development to create more efficient, sustainable, and cost-effective bulk packaging solutions. Market consolidation activities continue as companies seek to expand their geographical presence and technological capabilities through strategic acquisitions and partnerships.

Regulatory environment significantly influences market development, with stringent safety standards for hazardous materials handling and increasing environmental regulations driving innovation in recyclable and biodegradable container materials. The market shows 78% adoption rate of sustainable packaging practices among major industrial users, reflecting growing environmental consciousness across supply chains.

Market segmentation reveals distinct growth patterns across different container types and end-user industries. The following key insights highlight critical market developments:

Industrial growth across emerging economies serves as a primary catalyst for bulk containers and packaging market expansion. Manufacturing sector development, particularly in chemicals, pharmaceuticals, and food processing industries, creates substantial demand for efficient bulk material handling solutions. Global trade volume increases necessitate more sophisticated packaging systems capable of maintaining product integrity during long-distance transportation.

E-commerce expansion significantly impacts market dynamics as online retailers and logistics providers require scalable packaging solutions for bulk inventory management. The shift toward just-in-time manufacturing and lean supply chain practices drives demand for flexible, efficient bulk container systems. Sustainability initiatives across industries promote adoption of reusable and recyclable packaging options, creating new market opportunities for innovative container manufacturers.

Technological advancement in materials science enables development of lighter, stronger, and more versatile bulk containers. Smart packaging technologies incorporating sensors and tracking capabilities provide enhanced supply chain visibility and inventory management capabilities. Regulatory compliance requirements for hazardous materials handling create specialized market segments with higher value propositions and profit margins.

High initial investment costs associated with implementing comprehensive bulk packaging systems can deter smaller companies from adopting advanced solutions. The complexity of integrating new container systems with existing supply chain infrastructure presents significant operational challenges. Regulatory complexity across different geographical markets creates compliance burdens that increase operational costs and market entry barriers.

Material cost volatility affects container manufacturing economics, particularly for plastic and metal-based packaging solutions. Fluctuating raw material prices create uncertainty in pricing strategies and profit margins. Transportation constraints including weight limitations and dimensional restrictions impact container design flexibility and market adoption rates.

Environmental concerns regarding plastic waste and disposal challenges create pressure for alternative materials that may be more expensive or less durable. The need for specialized handling equipment and trained personnel increases total cost of ownership for bulk container systems. Market fragmentation across different industries and regions complicates standardization efforts and economies of scale realization.

Emerging markets present substantial growth opportunities as industrialization accelerates and supply chain infrastructure develops. Countries in Asia-Pacific, Latin America, and Africa show increasing demand for modern bulk packaging solutions. Technology integration opportunities include developing smart containers with IoT capabilities, real-time monitoring systems, and predictive maintenance features.

Sustainability trends create opportunities for manufacturers developing biodegradable, recyclable, and reusable container solutions. The circular economy concept drives demand for container systems designed for multiple use cycles and end-of-life recyclability. Industry specialization opportunities exist in developing containers for specific applications such as pharmaceutical cold chain, food safety, and hazardous materials handling.

Digital transformation initiatives across supply chains create demand for containers with integrated tracking and monitoring capabilities. According to MarkWide Research analysis, companies implementing smart bulk container systems report 35% improvement in inventory accuracy and supply chain visibility. Partnership opportunities with logistics providers and technology companies enable development of comprehensive bulk packaging solutions.

Supply chain evolution significantly influences bulk containers and packaging market dynamics as companies seek more efficient, sustainable, and cost-effective solutions. The integration of advanced materials, smart technologies, and sustainable practices creates a complex ecosystem of opportunities and challenges. Market forces include increasing regulatory requirements, environmental consciousness, and technological advancement driving continuous innovation.

Competitive pressure intensifies as manufacturers strive to differentiate their offerings through superior performance, sustainability features, and value-added services. The market experiences ongoing consolidation as larger players acquire specialized manufacturers to expand their technological capabilities and market reach. Customer expectations continue to evolve toward more sophisticated solutions that provide enhanced supply chain visibility and operational efficiency.

Innovation cycles accelerate as companies invest in research and development to create next-generation bulk packaging solutions. The convergence of materials science, digital technologies, and sustainability requirements drives development of revolutionary container designs and functionalities. Market maturation in developed regions contrasts with rapid growth in emerging markets, creating diverse strategic opportunities for market participants.

Comprehensive analysis of the bulk containers and packaging market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes extensive interviews with industry executives, manufacturers, distributors, and end-users across different geographical regions and market segments. Data collection encompasses quantitative surveys, qualitative interviews, and expert consultations to gather diverse perspectives on market trends and dynamics.

Secondary research involves thorough analysis of industry reports, company financial statements, regulatory filings, and trade publications to validate primary research findings. Market sizing and forecasting utilize statistical modeling techniques incorporating historical data, current market conditions, and future growth projections. Validation processes include cross-referencing multiple data sources and conducting expert reviews to ensure research accuracy and reliability.

Analytical framework incorporates both top-down and bottom-up approaches to market estimation, considering macroeconomic factors, industry-specific drivers, and company-level performance indicators. The research methodology ensures comprehensive coverage of all major market segments, geographical regions, and competitive dynamics affecting the bulk containers and packaging industry.

North America maintains a significant position in the bulk containers and packaging market, driven by advanced manufacturing infrastructure and stringent regulatory standards. The region shows 28% market share with strong demand from chemical, pharmaceutical, and food processing industries. Innovation leadership in smart packaging technologies and sustainable materials positions North American manufacturers at the forefront of market development.

Europe demonstrates robust market performance with emphasis on environmental sustainability and regulatory compliance. The region’s focus on circular economy principles drives demand for reusable and recyclable bulk container solutions. Market maturity in Western Europe contrasts with growth opportunities in Eastern European markets experiencing industrial development and infrastructure modernization.

Asia-Pacific emerges as the fastest-growing regional market with 42% market share and accelerating industrialization across multiple countries. China and India lead regional growth with expanding manufacturing sectors and increasing international trade volumes. Infrastructure development and rising environmental awareness create substantial opportunities for advanced bulk packaging solutions throughout the region.

Latin America and Middle East & Africa represent emerging markets with significant growth potential driven by industrial development and improving supply chain infrastructure. These regions show increasing adoption of modern bulk packaging solutions as companies seek to enhance operational efficiency and meet international quality standards.

Market structure reveals a diverse competitive environment with global manufacturers, regional specialists, and niche players competing across different segments and geographical markets. Leading companies focus on technological innovation, geographical expansion, and strategic partnerships to strengthen their market positions.

Strategic initiatives among leading players include capacity expansion, technology development, and sustainability improvements. Companies increasingly invest in research and development to create innovative container designs that meet evolving customer requirements and regulatory standards.

By Product Type:

By Material Type:

By End-User Industry:

Intermediate Bulk Containers represent the largest and fastest-growing category within the bulk packaging market, driven by their versatility and efficiency in handling various liquid and powder materials. These containers offer superior space utilization and handling convenience compared to traditional packaging methods. Innovation trends focus on developing hybrid designs that combine the benefits of rigid and flexible containers.

Flexible containers gain market traction due to their cost-effectiveness and space-saving characteristics during storage and transportation. The category shows 25% growth rate in adoption among agricultural and food processing industries. Material advancements improve durability and barrier properties while maintaining flexibility and cost advantages.

Smart containers emerge as a premium category incorporating IoT sensors, RFID tracking, and monitoring capabilities. These advanced solutions provide real-time visibility into container location, condition, and contents. MWR data indicates that companies using smart bulk containers achieve 40% reduction in inventory management costs and improved supply chain efficiency.

Sustainable packaging categories experience accelerated growth as companies prioritize environmental responsibility. Recyclable, reusable, and biodegradable container options gain market share across multiple industries. Circular economy principles drive development of container systems designed for multiple use cycles and end-of-life recyclability.

Manufacturers benefit from bulk containers through improved operational efficiency, reduced packaging costs, and enhanced supply chain management capabilities. Large-capacity containers enable economies of scale in production and distribution while reducing labor requirements for material handling. Quality control improvements result from standardized packaging systems that maintain product integrity throughout the supply chain.

Logistics providers gain significant advantages through optimized transportation efficiency and reduced handling complexity. Bulk containers maximize vehicle capacity utilization and minimize loading/unloading time requirements. Cost savings of up to 30% in transportation expenses are achievable through efficient bulk packaging systems compared to traditional smaller container approaches.

End-users experience benefits including reduced packaging waste, improved inventory management, and enhanced product safety. Bulk containers enable just-in-time delivery systems and reduce storage space requirements. Environmental benefits include reduced packaging material consumption and improved recyclability compared to multiple smaller containers.

Supply chain stakeholders benefit from enhanced traceability, improved inventory accuracy, and reduced handling complexity. Smart container technologies provide real-time visibility into product location and condition throughout the supply chain. Risk mitigation improves through better product protection and regulatory compliance capabilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as the dominant trend shaping bulk containers and packaging market development. Companies increasingly prioritize recyclable materials, reusable designs, and circular economy principles in their packaging strategies. Bio-based materials gain traction as alternatives to traditional petroleum-based plastics, driven by environmental regulations and corporate sustainability commitments.

Smart packaging technologies revolutionize bulk container functionality through integration of sensors, RFID tags, and IoT connectivity. These advanced systems provide real-time monitoring of container location, temperature, humidity, and contents integrity. Data analytics capabilities enable predictive maintenance, optimized supply chain management, and enhanced inventory control.

Customization trends reflect increasing demand for application-specific container solutions tailored to unique industry requirements. Pharmaceutical companies require specialized containers for temperature-sensitive products, while chemical manufacturers need containers with enhanced safety features. Modular designs enable flexible configuration options that adapt to changing operational requirements.

Automation compatibility becomes increasingly important as companies implement automated material handling systems. Bulk containers must integrate seamlessly with robotic systems, automated storage and retrieval systems, and conveyor networks. Standardization efforts focus on developing containers that work efficiently across different automated systems and supply chain configurations.

Technology partnerships between container manufacturers and technology companies accelerate development of smart packaging solutions. Recent collaborations focus on integrating advanced sensors, blockchain tracking, and artificial intelligence capabilities into bulk container systems. Innovation investments reach record levels as companies compete to develop next-generation packaging technologies.

Sustainability initiatives drive major manufacturers to invest in renewable materials and circular economy solutions. Leading companies announce commitments to achieve carbon neutrality and zero waste to landfill across their operations. Recycling programs expand as manufacturers take responsibility for end-of-life container management and material recovery.

Regulatory developments across major markets influence container design and material selection. New safety standards for hazardous materials handling and environmental regulations regarding plastic waste create both challenges and opportunities for manufacturers. Compliance investments increase as companies adapt to evolving regulatory requirements.

Market consolidation continues as larger players acquire specialized manufacturers to expand their technological capabilities and geographical presence. Strategic acquisitions focus on companies with innovative technologies, sustainable solutions, or strong positions in emerging markets. Vertical integration trends see manufacturers expanding into related services and supply chain solutions.

Investment priorities should focus on sustainable packaging technologies and smart container systems that provide enhanced supply chain visibility. Companies should prioritize research and development in bio-based materials and recyclable container designs to meet evolving environmental requirements. Strategic partnerships with technology providers can accelerate innovation and market entry for advanced packaging solutions.

Market expansion strategies should target emerging economies with growing industrial sectors and improving supply chain infrastructure. Asia-Pacific markets offer particularly attractive opportunities for companies with scalable manufacturing capabilities and local market expertise. Localization strategies become essential for success in diverse regional markets with varying regulatory requirements and customer preferences.

Technology integration represents a critical success factor for maintaining competitive advantage in the evolving bulk packaging market. Companies should invest in IoT capabilities, data analytics platforms, and automation compatibility to meet customer demands for smart packaging solutions. MarkWide Research analysis suggests that companies implementing comprehensive technology strategies achieve 25% higher customer retention rates compared to traditional packaging providers.

Sustainability leadership becomes increasingly important for long-term market success as customers prioritize environmental responsibility in their supply chain decisions. Companies should develop comprehensive sustainability strategies encompassing materials selection, manufacturing processes, and end-of-life management. Circular economy principles should guide product development and business model innovation.

Market evolution toward smart, sustainable, and highly efficient bulk packaging solutions will accelerate over the next decade. Technology integration will become standard across all container categories, with IoT connectivity and data analytics capabilities driving operational improvements. Growth projections indicate continued market expansion at 6.8% CAGR through 2030, driven by industrial growth and supply chain optimization initiatives.

Innovation trajectories will focus on developing containers that combine multiple advanced features including smart monitoring, sustainable materials, and enhanced safety capabilities. Breakthrough technologies in materials science will enable creation of lighter, stronger, and more environmentally friendly container solutions. Automation integration will become essential as supply chains become increasingly automated and digitized.

Regional dynamics will shift toward emerging markets as industrialization accelerates and supply chain infrastructure develops. Asia-Pacific will likely maintain its position as the fastest-growing regional market, while mature markets in North America and Europe will focus on technology advancement and sustainability improvements. Market consolidation will continue as companies seek scale advantages and technological capabilities.

Sustainability transformation will fundamentally reshape the bulk packaging industry as circular economy principles become mainstream. Companies that successfully transition to sustainable business models will gain competitive advantages and market leadership positions. Regulatory evolution will continue driving innovation in environmentally friendly packaging solutions and waste reduction strategies.

The bulk containers and packaging market stands at a transformative juncture characterized by technological innovation, sustainability imperatives, and evolving customer requirements. Market dynamics indicate robust growth potential driven by industrial expansion, supply chain optimization needs, and increasing environmental consciousness across industries. Strategic opportunities exist for companies that can successfully integrate smart technologies, sustainable materials, and customer-centric solutions.

Competitive success will increasingly depend on companies’ ability to innovate continuously, adapt to regulatory changes, and meet evolving sustainability requirements. The market rewards organizations that invest in research and development, forge strategic partnerships, and maintain focus on customer value creation. Technology integration and sustainability leadership emerge as critical differentiators in an increasingly competitive marketplace.

Future market leaders will be those companies that can effectively balance operational efficiency, environmental responsibility, and technological advancement while maintaining cost competitiveness. The bulk containers and packaging market offers substantial opportunities for growth and innovation, positioning it as an attractive sector for investment and strategic development in the evolving global economy.

What is Bulk Containers and Packaging?

Bulk containers and packaging refer to large-scale storage and transport solutions designed for bulk materials, including liquids, powders, and granules. These solutions are essential in various industries such as food and beverage, chemicals, and pharmaceuticals.

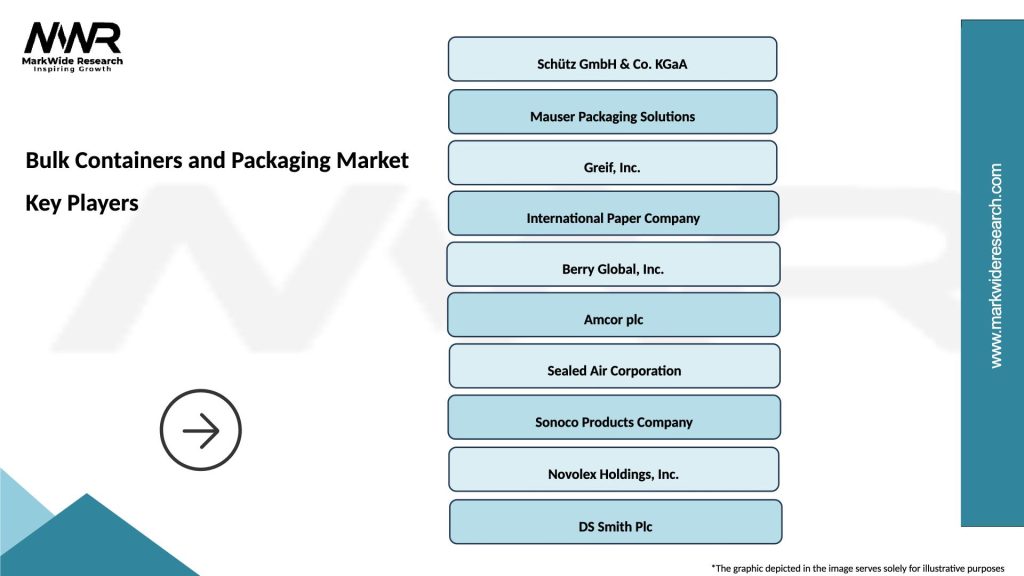

What are the key players in the Bulk Containers and Packaging Market?

Key players in the Bulk Containers and Packaging Market include companies like Mauser Packaging Solutions, Greif, Inc., and Schütz GmbH, which provide a range of bulk packaging solutions for different industries, among others.

What are the main drivers of growth in the Bulk Containers and Packaging Market?

The growth of the Bulk Containers and Packaging Market is driven by the increasing demand for efficient and sustainable packaging solutions, the rise in e-commerce, and the need for cost-effective logistics in industries such as food, chemicals, and construction.

What challenges does the Bulk Containers and Packaging Market face?

Challenges in the Bulk Containers and Packaging Market include regulatory compliance regarding safety and environmental standards, competition from alternative packaging solutions, and fluctuations in raw material prices affecting production costs.

What opportunities exist in the Bulk Containers and Packaging Market?

Opportunities in the Bulk Containers and Packaging Market include the development of eco-friendly packaging materials, innovations in smart packaging technologies, and the expansion of logistics and supply chain solutions tailored for bulk handling.

What trends are shaping the Bulk Containers and Packaging Market?

Trends in the Bulk Containers and Packaging Market include a shift towards sustainable packaging practices, increased automation in packaging processes, and the growing use of reusable bulk containers to reduce waste and improve efficiency.

Bulk Containers and Packaging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Drums, IBCs, Bags, Pallets |

| Material | Plastic, Metal, Glass, Paper |

| End User | Agriculture, Chemicals, Food & Beverage, Pharmaceuticals |

| Packaging Type | Flexible, Rigid, Bulk, Custom |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Bulk Containers and Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at