444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Brazilian industrial and institutional cleaning chemicals market represents a dynamic and rapidly evolving sector within Latin America’s largest economy. This comprehensive market encompasses a diverse range of specialized cleaning solutions designed for industrial facilities, commercial establishments, healthcare institutions, educational facilities, and government buildings across Brazil. The market has demonstrated remarkable resilience and growth potential, driven by increasing awareness of hygiene standards, stringent regulatory requirements, and the expanding industrial base throughout the country.

Market dynamics indicate sustained growth momentum, with the sector experiencing a compound annual growth rate (CAGR) of 6.2% over recent years. This growth trajectory reflects Brazil’s commitment to maintaining high cleanliness standards across various sectors, particularly in response to evolving health and safety regulations. The market encompasses various product categories including disinfectants, degreasers, floor cleaners, sanitizers, and specialized industrial cleaning formulations.

Regional distribution shows significant concentration in Brazil’s industrial heartlands, with São Paulo and Rio de Janeiro accounting for approximately 45% of total market consumption. The expanding manufacturing sector, coupled with increased focus on workplace safety and environmental compliance, continues to drive demand for advanced cleaning chemical solutions across diverse industrial applications.

The Brazilian industrial and institutional cleaning chemicals market refers to the comprehensive ecosystem of specialized chemical products, solutions, and services designed to maintain cleanliness, hygiene, and safety standards in industrial facilities, commercial buildings, healthcare institutions, educational establishments, and government facilities throughout Brazil. This market encompasses both traditional cleaning agents and advanced formulations that address specific industrial cleaning challenges while meeting environmental and regulatory compliance requirements.

Industrial cleaning chemicals within this context include heavy-duty degreasers, equipment cleaners, floor maintenance products, and specialized solvents designed for manufacturing environments. Institutional cleaning chemicals focus on products suitable for hospitals, schools, offices, hotels, and public facilities, emphasizing safety, efficacy, and user-friendly application methods. The market also includes ancillary products such as dispensing systems, application equipment, and maintenance services that support comprehensive cleaning programs.

Brazil’s industrial and institutional cleaning chemicals market stands as a cornerstone of the country’s commitment to maintaining high standards of cleanliness and hygiene across diverse sectors. The market has evolved significantly, driven by increasing industrialization, urbanization, and heightened awareness of health and safety protocols. Key market drivers include stringent regulatory frameworks, expanding healthcare infrastructure, and growing emphasis on sustainable cleaning solutions.

Product innovation remains at the forefront of market development, with manufacturers focusing on eco-friendly formulations, concentrated products, and multi-purpose cleaning solutions. The market demonstrates strong potential for continued expansion, supported by Brazil’s robust industrial base and increasing adoption of professional cleaning standards across institutional sectors. Market penetration rates indicate that approximately 78% of large industrial facilities have adopted professional cleaning chemical programs, while institutional adoption continues to accelerate.

Competitive dynamics reveal a market characterized by both international players and strong domestic manufacturers, creating a diverse ecosystem that serves various customer segments effectively. The integration of digital technologies, sustainable practices, and customized solutions positions the market for sustained growth and innovation in the coming years.

Market intelligence reveals several critical insights that define the current landscape and future trajectory of Brazil’s industrial and institutional cleaning chemicals sector:

Industrial expansion across Brazil continues to serve as a primary catalyst for market growth, with new manufacturing facilities and industrial complexes requiring comprehensive cleaning chemical solutions. The country’s diverse industrial base, spanning automotive, petrochemical, food processing, and textile sectors, creates sustained demand for specialized cleaning products tailored to specific operational requirements.

Regulatory frameworks play a crucial role in driving market demand, as government agencies implement stricter health and safety standards across industrial and institutional sectors. These regulations mandate the use of approved cleaning chemicals and establish protocols for maintaining workplace cleanliness, directly impacting product adoption rates and market expansion.

Healthcare infrastructure development represents another significant driver, with Brazil’s expanding hospital networks, clinics, and medical facilities requiring advanced disinfection and sanitization solutions. The emphasis on infection control and patient safety creates consistent demand for high-performance cleaning chemicals that meet medical-grade standards.

Environmental awareness increasingly influences purchasing decisions, with organizations seeking cleaning solutions that minimize environmental impact while maintaining effectiveness. This trend drives innovation in biodegradable formulations and sustainable packaging solutions, creating new market opportunities for environmentally conscious manufacturers.

Economic volatility presents ongoing challenges for the Brazilian market, with currency fluctuations and economic uncertainty affecting purchasing power and investment decisions across industrial and institutional sectors. These economic pressures can lead to delayed facility upgrades and reduced spending on premium cleaning solutions.

Raw material costs continue to impact market dynamics, as fluctuating prices for chemical ingredients and packaging materials affect product pricing and profit margins. Manufacturers must balance cost management with product quality and performance requirements, creating ongoing operational challenges.

Regulatory complexity can serve as a market restraint, as navigating Brazil’s complex regulatory environment requires significant resources and expertise. Compliance costs and lengthy approval processes may limit market entry for some manufacturers and slow product innovation cycles.

Skills shortage in specialized cleaning applications affects market growth potential, as many facilities lack trained personnel capable of implementing advanced cleaning programs effectively. This limitation can reduce demand for sophisticated cleaning chemical solutions and limit market expansion opportunities.

Digital transformation presents significant opportunities for market expansion, as IoT-enabled dispensing systems, automated monitoring solutions, and data analytics platforms enhance cleaning program efficiency and effectiveness. These technological advances create new revenue streams and strengthen customer relationships through value-added services.

Sustainable product development offers substantial growth potential, with increasing demand for eco-friendly cleaning solutions that meet performance requirements while minimizing environmental impact. Manufacturers can differentiate their offerings through innovative green formulations and sustainable packaging solutions.

Market consolidation opportunities exist as smaller regional players seek partnerships or acquisition opportunities with larger manufacturers. This consolidation can create synergies, expand distribution networks, and enhance product portfolios across diverse market segments.

Export potential to neighboring Latin American markets represents an attractive opportunity for Brazilian manufacturers, leveraging established production capabilities and regional market knowledge to expand beyond domestic boundaries. The proximity to other South American markets provides logistical advantages and cultural familiarity.

Supply chain optimization continues to evolve as manufacturers implement more efficient distribution networks and inventory management systems. The integration of digital technologies enables better demand forecasting and reduces supply chain costs while improving customer service levels. Efficiency improvements of approximately 25% have been achieved through advanced logistics solutions.

Customer relationship management has become increasingly sophisticated, with manufacturers providing comprehensive support services including training programs, technical assistance, and customized cleaning protocols. This approach strengthens customer loyalty and creates barriers to competitive entry while generating additional revenue opportunities.

Product lifecycle management reflects the dynamic nature of the market, with continuous innovation cycles introducing new formulations, improved packaging, and enhanced application methods. Manufacturers must balance innovation investments with market demands while maintaining competitive pricing structures.

Competitive positioning strategies focus on differentiation through specialized products, superior customer service, and comprehensive solution offerings. Companies that successfully combine product innovation with strong customer relationships achieve sustainable competitive advantages in this dynamic market environment.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Brazil’s industrial and institutional cleaning chemicals market. Primary research involves direct engagement with industry stakeholders, including manufacturers, distributors, end-users, and regulatory authorities, providing firsthand perspectives on market dynamics and trends.

Secondary research encompasses extensive analysis of industry reports, government publications, trade association data, and academic studies to establish market context and validate primary findings. This approach ensures comprehensive coverage of market segments and regional variations across Brazil’s diverse economic landscape.

Data validation processes include cross-referencing multiple sources, conducting expert interviews, and applying statistical analysis techniques to ensure accuracy and reliability of market insights. The methodology incorporates both quantitative and qualitative analysis approaches to provide balanced market perspectives.

Market modeling techniques utilize advanced analytical tools to project future market trends and identify growth opportunities. These models consider various economic, regulatory, and technological factors that influence market development and provide strategic insights for industry participants.

São Paulo region dominates the Brazilian market, accounting for approximately 32% of total consumption, driven by the state’s concentrated industrial base and large urban population. The region’s diverse manufacturing sectors, including automotive, chemical, and food processing industries, create substantial demand for specialized cleaning chemicals across various applications.

Rio de Janeiro represents the second-largest regional market, with significant consumption in petrochemical, steel, and port-related industries. The region’s focus on heavy industrial applications drives demand for specialized degreasers and industrial-strength cleaning formulations, contributing approximately 18% of national market share.

Southern Brazil, encompassing Rio Grande do Sul, Santa Catarina, and Paraná, demonstrates strong growth potential driven by expanding agribusiness, textile, and manufacturing sectors. This region shows increasing adoption of professional cleaning standards, with market penetration rates growing at 8.5% annually.

Northeastern states present emerging opportunities as industrial development accelerates and institutional infrastructure expands. Government investments in healthcare and education facilities create new demand for institutional cleaning chemicals, while growing manufacturing activities support industrial segment growth.

Market leadership is characterized by a mix of international corporations and strong domestic players, creating a competitive environment that drives innovation and customer service excellence. The competitive landscape reflects diverse strategies ranging from broad product portfolios to specialized niche offerings.

Competitive strategies emphasize differentiation through product innovation, customer service excellence, and comprehensive solution offerings. Companies invest significantly in research and development, technical support capabilities, and market-specific product adaptations to maintain competitive positioning.

By Product Type:

By End-User Industry:

Industrial segment analysis reveals strong demand for specialized cleaning chemicals that address specific manufacturing challenges. Heavy industries such as petrochemical and steel production require robust degreasers and equipment cleaners capable of handling extreme conditions and contamination levels. Adoption rates in industrial segments reach 85% for large facilities, indicating mature market penetration.

Institutional segment dynamics show increasing sophistication in cleaning program requirements, with healthcare facilities leading adoption of advanced disinfection protocols. Educational institutions demonstrate growing awareness of cleaning chemical importance, particularly in response to health and safety concerns. Market penetration in institutional segments continues expanding at 12% annually.

Product category performance indicates strong growth in eco-friendly formulations and concentrated products that reduce packaging waste and transportation costs. Disinfectants and sanitizers show particularly robust demand growth, driven by heightened hygiene awareness across all market segments.

Application-specific solutions gain traction as customers seek cleaning chemicals tailored to their unique operational requirements. This trend supports premium pricing strategies and strengthens customer relationships through customized product development and technical support services.

Manufacturers benefit from Brazil’s large domestic market and growing industrial base, providing substantial opportunities for revenue growth and market expansion. The diverse industrial landscape creates demand for varied product portfolios, enabling companies to leverage economies of scale while serving multiple market segments effectively.

Distributors gain from the fragmented nature of the Brazilian market, which requires extensive distribution networks and local market knowledge. Strong distributor relationships provide competitive advantages through enhanced customer access and improved service delivery capabilities across diverse geographic regions.

End-users receive significant value through improved cleaning efficiency, regulatory compliance support, and cost optimization opportunities. Professional cleaning chemical programs enhance workplace safety, reduce operational risks, and support sustainability objectives while maintaining high cleanliness standards.

Investors find attractive opportunities in a market characterized by steady growth, increasing sophistication, and ongoing consolidation potential. The essential nature of cleaning chemicals provides defensive characteristics while growth drivers offer upside potential for strategic investments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration represents the most significant trend shaping the market, with customers increasingly prioritizing environmentally responsible cleaning solutions. Manufacturers respond by developing biodegradable formulations, reducing packaging waste, and implementing sustainable production practices that appeal to environmentally conscious buyers.

Digital transformation accelerates across the industry, with IoT-enabled dispensing systems, mobile applications for inventory management, and data analytics platforms enhancing cleaning program efficiency. These technological advances create new revenue opportunities while strengthening customer relationships through value-added services.

Customization demand grows as customers seek cleaning solutions tailored to their specific operational requirements and industry challenges. This trend supports premium pricing strategies and creates competitive differentiation opportunities for manufacturers capable of delivering specialized formulations and technical support.

Consolidation activities increase as larger players acquire regional manufacturers to expand market presence and achieve economies of scale. According to MarkWide Research analysis, this consolidation trend is expected to continue, creating a more concentrated competitive landscape while improving operational efficiencies.

Product innovation continues at an accelerated pace, with manufacturers introducing advanced formulations that combine superior cleaning performance with environmental sustainability. Recent developments include enzyme-based cleaners, concentrated products that reduce packaging requirements, and multi-purpose solutions that simplify inventory management for customers.

Strategic partnerships between manufacturers and technology companies create integrated solutions that combine cleaning chemicals with digital monitoring and dispensing systems. These collaborations enhance product value propositions while creating barriers to competitive entry through comprehensive solution offerings.

Regulatory developments include updated environmental standards and workplace safety requirements that influence product formulations and market demand patterns. Manufacturers invest significantly in compliance capabilities and product reformulation to meet evolving regulatory requirements while maintaining performance standards.

Market expansion initiatives focus on underserved regions and emerging customer segments, with companies establishing new distribution partnerships and local manufacturing capabilities to improve market access and customer service levels across Brazil’s diverse geographic markets.

Investment priorities should focus on sustainable product development and digital technology integration to capture emerging market opportunities. Companies that successfully combine environmental responsibility with technological innovation will achieve competitive advantages in an increasingly sophisticated market environment.

Market expansion strategies should emphasize regional diversification and customer segment development to reduce concentration risks and capture growth opportunities. MWR analysis indicates that companies with balanced geographic and sector exposure demonstrate superior resilience during economic volatility periods.

Partnership development represents a critical success factor, with strategic alliances enabling companies to access new technologies, expand distribution networks, and enhance customer service capabilities. Successful partnerships create synergies that benefit all stakeholders while strengthening competitive positioning.

Operational excellence initiatives should focus on supply chain optimization, cost management, and customer service enhancement to maintain profitability while supporting growth objectives. Companies that achieve operational efficiency while maintaining product quality will succeed in competitive market conditions.

Market trajectory indicates continued growth driven by industrial expansion, regulatory requirements, and increasing sophistication in cleaning program requirements. The market is expected to maintain steady growth momentum, with projected annual growth rates of 6.8% over the next five years, supported by Brazil’s economic recovery and infrastructure development initiatives.

Technology adoption will accelerate as digital solutions become more accessible and demonstrate clear value propositions for customers. IoT-enabled systems, automated dispensing, and data analytics platforms will become standard features in professional cleaning programs, creating new revenue opportunities for innovative manufacturers.

Sustainability requirements will intensify as environmental regulations evolve and customer awareness increases. Companies that proactively develop eco-friendly products and sustainable business practices will capture market share while those that lag behind face competitive disadvantages and regulatory challenges.

Market consolidation will continue as larger players acquire regional manufacturers and smaller companies seek strategic partnerships to remain competitive. This consolidation will create a more efficient industry structure while potentially reducing competition in some market segments. MarkWide Research projects that market concentration will increase moderately while maintaining healthy competitive dynamics.

Brazil’s industrial and institutional cleaning chemicals market presents a compelling combination of steady growth prospects, diverse application opportunities, and evolving customer requirements that create substantial value for industry participants. The market’s resilience during economic challenges, combined with strong fundamentals driven by regulatory support and industrial expansion, positions it as an attractive sector for continued investment and development.

Strategic success in this market requires balancing traditional strengths in product quality and customer service with emerging requirements for sustainability, technology integration, and customized solutions. Companies that successfully navigate these evolving demands while maintaining operational efficiency will capture disproportionate market share and achieve sustainable competitive advantages.

Future market development will be characterized by increased sophistication in customer requirements, accelerated technology adoption, and continued emphasis on environmental responsibility. Industry participants who proactively address these trends through innovation, strategic partnerships, and operational excellence will thrive in Brazil’s dynamic cleaning chemicals market, contributing to the country’s industrial competitiveness and institutional hygiene standards.

What is Brazilian Industrial and Institutional Cleaning Chemicals?

Brazilian Industrial and Institutional Cleaning Chemicals refer to a range of products designed for cleaning and sanitizing in industrial and institutional settings, including facilities like hospitals, schools, and manufacturing plants. These chemicals are formulated to meet specific cleaning needs and regulatory standards.

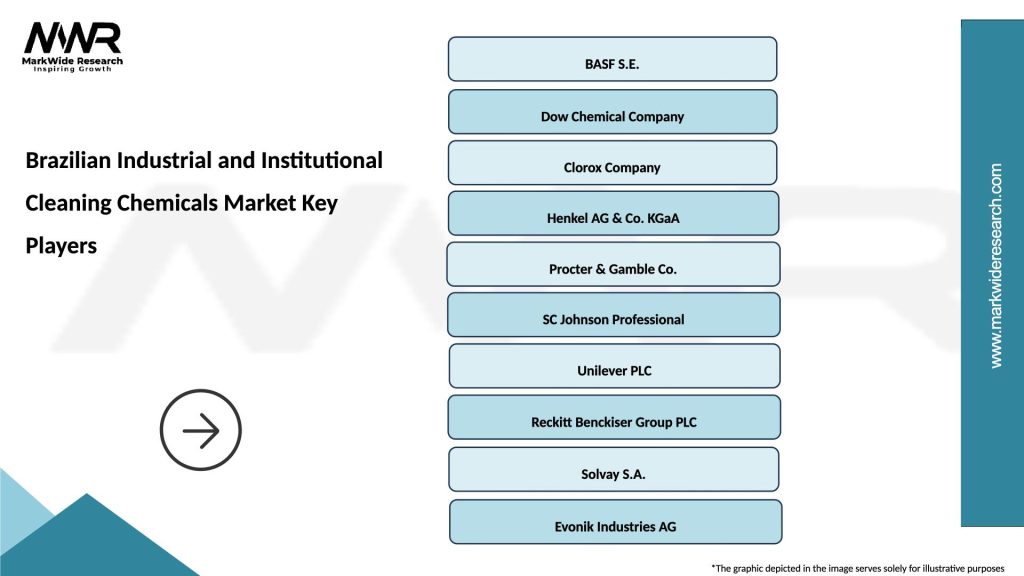

What are the key players in the Brazilian Industrial and Institutional Cleaning Chemicals Market?

Key players in the Brazilian Industrial and Institutional Cleaning Chemicals Market include companies such as Unilever, Procter & Gamble, and Ecolab, which offer a variety of cleaning solutions tailored for different sectors. These companies focus on innovation and sustainability in their product offerings, among others.

What are the growth factors driving the Brazilian Industrial and Institutional Cleaning Chemicals Market?

The growth of the Brazilian Industrial and Institutional Cleaning Chemicals Market is driven by increasing hygiene awareness, stringent regulations on cleanliness in public spaces, and the expansion of the healthcare and hospitality sectors. Additionally, the rise in industrial activities contributes to the demand for effective cleaning solutions.

What challenges does the Brazilian Industrial and Institutional Cleaning Chemicals Market face?

Challenges in the Brazilian Industrial and Institutional Cleaning Chemicals Market include regulatory compliance, the need for eco-friendly products, and competition from local manufacturers. Additionally, fluctuating raw material prices can impact production costs and pricing strategies.

What opportunities exist in the Brazilian Industrial and Institutional Cleaning Chemicals Market?

Opportunities in the Brazilian Industrial and Institutional Cleaning Chemicals Market include the growing demand for green cleaning products and the potential for technological advancements in cleaning formulations. The increasing focus on sustainability also opens avenues for companies to innovate and capture market share.

What trends are shaping the Brazilian Industrial and Institutional Cleaning Chemicals Market?

Trends in the Brazilian Industrial and Institutional Cleaning Chemicals Market include the shift towards biodegradable and non-toxic cleaning agents, the integration of smart cleaning technologies, and the rising popularity of concentrated cleaning products. These trends reflect a broader movement towards sustainability and efficiency in cleaning practices.

Brazilian Industrial and Institutional Cleaning Chemicals Market

| Segmentation Details | Description |

|---|---|

| Product Type | Disinfectants, Degreasers, Surface Cleaners, Floor Cleaners |

| Application | Healthcare Facilities, Food Processing, Hospitality, Education |

| End User | Commercial, Industrial, Government, Residential |

| Packaging Type | Bottles, Drums, Totes, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Brazilian Industrial and Institutional Cleaning Chemicals Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at