444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Brazil surveillance IP cameras market represents a rapidly expanding segment within the country’s security technology landscape, driven by increasing urbanization, rising crime rates, and growing awareness of advanced security solutions. Brazil’s surveillance infrastructure has undergone significant transformation as organizations and government entities prioritize comprehensive security measures across residential, commercial, and public sectors.

Market dynamics indicate robust growth potential, with the surveillance IP camera segment experiencing accelerated adoption rates of approximately 12.5% annually. This growth trajectory reflects Brazil’s commitment to modernizing security infrastructure while addressing evolving safety challenges in major metropolitan areas including São Paulo, Rio de Janeiro, and Brasília.

Technological advancement serves as a primary catalyst for market expansion, with high-definition imaging, artificial intelligence integration, and cloud-based storage solutions driving consumer and enterprise adoption. The market encompasses diverse applications ranging from retail loss prevention and residential security to smart city initiatives and critical infrastructure protection.

Regional distribution shows concentrated demand in Brazil’s southeastern and southern regions, accounting for approximately 68% of total market activity. Urban centers demonstrate particularly strong adoption rates, with commercial establishments and government facilities leading implementation efforts across various surveillance IP camera technologies.

The Brazil surveillance IP cameras market refers to the comprehensive ecosystem of internet protocol-enabled security cameras, associated software platforms, and supporting infrastructure deployed across Brazilian territories for monitoring, recording, and security management purposes. IP surveillance technology enables digital video transmission over network connections, providing enhanced image quality, remote accessibility, and advanced analytics capabilities compared to traditional analog systems.

Market scope encompasses various camera types including dome cameras, bullet cameras, PTZ (pan-tilt-zoom) systems, and specialized surveillance equipment designed for indoor and outdoor applications. The technology integrates seamlessly with existing network infrastructure, enabling scalable security solutions for diverse end-user requirements.

Surveillance IP cameras in Brazil serve multiple functions including real-time monitoring, video analytics, motion detection, facial recognition, and automated alert systems. These capabilities support law enforcement activities, business operations, residential security, and public safety initiatives across urban and rural environments.

Brazil’s surveillance IP cameras market demonstrates exceptional growth momentum, supported by increasing security concerns, technological innovation, and government initiatives promoting smart city development. The market benefits from rising disposable income, expanding commercial sectors, and growing awareness of advanced security solutions among Brazilian consumers and enterprises.

Key market drivers include urbanization trends affecting approximately 87% of Brazil’s population, increasing crime rates in major cities, and regulatory requirements for surveillance systems in commercial and public spaces. Technology adoption accelerates as IP camera costs decrease while functionality and reliability improve significantly.

Market segmentation reveals diverse applications across retail, banking, transportation, healthcare, education, and residential sectors. Commercial applications dominate current demand, while residential adoption grows rapidly as consumers prioritize home security and property protection.

Competitive landscape features both international technology leaders and domestic manufacturers, creating dynamic market conditions that benefit end-users through improved product offerings, competitive pricing, and enhanced customer support services.

Market intelligence reveals several critical insights shaping Brazil’s surveillance IP cameras landscape:

Primary market drivers propelling Brazil’s surveillance IP cameras market include escalating security concerns across urban environments, with crime rates in major cities necessitating comprehensive monitoring solutions. Urbanization trends concentrate population density in metropolitan areas, creating increased demand for sophisticated security infrastructure.

Government initiatives supporting smart city development programs allocate significant resources toward public safety infrastructure, including surveillance camera networks. These programs demonstrate commitment to leveraging technology for enhanced citizen security and urban management capabilities.

Commercial sector expansion drives substantial demand as retail establishments, banking institutions, and corporate facilities implement comprehensive security measures. Loss prevention strategies increasingly rely on advanced surveillance technology to protect assets and ensure operational continuity.

Technological advancement makes IP surveillance systems more accessible and cost-effective, enabling broader adoption across diverse market segments. Improved image quality, enhanced analytics capabilities, and simplified installation processes reduce barriers to technology implementation.

Insurance requirements and regulatory compliance mandates create additional demand drivers, as businesses seek to meet security standards and qualify for favorable insurance terms through documented surveillance capabilities.

Market constraints affecting Brazil’s surveillance IP cameras sector include economic volatility and currency fluctuations that impact technology investment decisions. Budget limitations among small businesses and residential consumers restrict adoption of premium surveillance solutions despite growing security awareness.

Infrastructure challenges in certain regions limit network connectivity and bandwidth availability required for optimal IP camera performance. Rural areas particularly face connectivity constraints that affect surveillance system effectiveness and reliability.

Privacy concerns and regulatory uncertainties surrounding surveillance technology deployment create hesitation among potential users. Data protection regulations require careful compliance consideration, potentially slowing implementation timelines and increasing deployment costs.

Technical complexity associated with advanced surveillance systems may deter less technically sophisticated users from adopting IP camera technology. Installation, configuration, and maintenance requirements can present significant challenges for organizations lacking internal technical expertise.

Cybersecurity vulnerabilities inherent in network-connected devices raise concerns about system security and data protection. These concerns may limit adoption among security-conscious organizations requiring robust protection against potential cyber threats.

Significant opportunities emerge from Brazil’s expanding smart city initiatives, creating demand for integrated surveillance solutions that support comprehensive urban management systems. Government investment in public safety infrastructure presents substantial growth potential for surveillance IP camera providers.

Residential market expansion offers considerable opportunities as middle-class consumers increasingly prioritize home security solutions. Growing awareness of surveillance technology benefits, combined with improving affordability, creates favorable conditions for residential market penetration.

Integration opportunities with emerging technologies including artificial intelligence, machine learning, and Internet of Things (IoT) platforms enable development of advanced surveillance solutions. These technological convergences create new value propositions for end-users seeking comprehensive security ecosystems.

Export potential exists for Brazilian surveillance technology companies to serve regional markets throughout Latin America. Established domestic expertise and understanding of regional requirements position Brazilian companies advantageously for international expansion.

Vertical market specialization presents opportunities for customized surveillance solutions addressing specific industry requirements in healthcare, education, transportation, and critical infrastructure sectors.

Market dynamics in Brazil’s surveillance IP cameras sector reflect complex interactions between technological innovation, economic conditions, and evolving security requirements. Competitive pressures drive continuous product improvement and pricing optimization, benefiting end-users through enhanced value propositions.

Supply chain considerations influence market dynamics as manufacturers balance local production capabilities with imported component requirements. Currency fluctuations affect pricing strategies and profitability margins for both domestic and international suppliers operating in the Brazilian market.

Customer preferences evolve toward integrated solutions combining surveillance cameras with analytics software, cloud storage, and mobile accessibility features. This trend drives market participants to develop comprehensive platforms rather than standalone products.

Regulatory environment continues evolving as government agencies establish standards for surveillance technology deployment in public and commercial spaces. These developments create both opportunities and challenges for market participants navigating compliance requirements.

Technology lifecycle dynamics show accelerating innovation cycles, with new features and capabilities emerging regularly. Market participants must balance investment in current technologies while preparing for next-generation developments.

Comprehensive research methodology employed for analyzing Brazil’s surveillance IP cameras market incorporates multiple data collection approaches ensuring accurate and reliable market intelligence. Primary research includes extensive interviews with industry executives, technology providers, system integrators, and end-users across diverse market segments.

Secondary research encompasses analysis of government publications, industry reports, trade association data, and regulatory documentation relevant to surveillance technology deployment in Brazil. Market surveys capture consumer preferences, purchasing behavior, and technology adoption patterns among residential and commercial users.

Data validation processes ensure information accuracy through cross-referencing multiple sources and expert verification. Quantitative analysis employs statistical modeling techniques to project market trends and growth patterns based on historical data and current market indicators.

Qualitative insights emerge from in-depth discussions with industry stakeholders, providing contextual understanding of market dynamics, competitive positioning, and future development prospects. This methodology combination delivers comprehensive market intelligence supporting strategic decision-making.

Regional market distribution across Brazil demonstrates significant concentration in the southeastern region, particularly São Paulo and Rio de Janeiro metropolitan areas, which account for approximately 45% of total market activity. These urban centers drive demand through dense commercial districts, extensive residential developments, and substantial government infrastructure investments.

Southern region markets, including Porto Alegre and Curitiba, contribute approximately 23% of market share with strong adoption rates among manufacturing facilities, logistics centers, and commercial establishments. The region benefits from higher disposable income levels and advanced technology infrastructure supporting IP surveillance deployment.

Northeastern markets show emerging growth potential, representing about 18% of current market activity with accelerating adoption in major cities like Salvador, Recife, and Fortaleza. Government smart city initiatives and tourism industry security requirements drive increasing surveillance technology implementation.

Central-west region demonstrates steady growth, accounting for approximately 14% of market share, with Brasília leading adoption due to government facility security requirements and expanding commercial sectors. Agricultural regions within this area show growing interest in surveillance solutions for property protection and operational monitoring.

Northern region represents the smallest market segment but shows promising growth potential as infrastructure development and urbanization trends create new opportunities for surveillance technology deployment across emerging commercial and residential developments.

Competitive environment in Brazil’s surveillance IP cameras market features diverse participants ranging from global technology leaders to specialized regional providers. Market leadership positions are contested through innovation, pricing strategies, and comprehensive solution offerings addressing varied customer requirements.

Key market participants include:

Competitive strategies emphasize product differentiation through advanced features, competitive pricing, local support services, and comprehensive solution portfolios addressing diverse market segments and application requirements.

Market segmentation analysis reveals diverse categories based on technology type, application, end-user, and deployment environment. Technology segmentation includes fixed cameras, PTZ cameras, dome cameras, bullet cameras, and specialized surveillance equipment designed for specific monitoring requirements.

By Technology Type:

By Application:

By End-User:

Commercial segment dominates market activity, driven by retail establishments, banking institutions, and corporate facilities implementing comprehensive security measures. Loss prevention strategies increasingly rely on advanced IP surveillance technology, with adoption rates reaching approximately 78% among large commercial establishments.

Residential category shows accelerating growth as middle-class consumers prioritize home security solutions. Smart home integration capabilities drive purchasing decisions, with consumers seeking surveillance systems compatible with existing home automation platforms and mobile device management.

Government applications create substantial demand through smart city initiatives and public safety infrastructure investments. Municipal projects focus on comprehensive surveillance networks supporting law enforcement activities and emergency response capabilities across urban environments.

Industrial applications emphasize operational monitoring and asset protection, with manufacturing facilities and logistics centers implementing surveillance systems for security and operational efficiency purposes. Integration capabilities with existing industrial control systems influence technology selection decisions.

Transportation sector requirements focus on passenger safety, cargo security, and operational monitoring across airports, ports, and public transit systems. Specialized features including facial recognition and behavioral analytics support enhanced security protocols.

Technology providers benefit from expanding market opportunities driven by increasing security awareness and government infrastructure investments. Revenue growth potential emerges from diverse application segments and evolving customer requirements for advanced surveillance capabilities.

System integrators gain opportunities through complex deployment projects requiring specialized expertise in installation, configuration, and ongoing maintenance services. Service revenue streams provide sustainable business models complementing product sales activities.

End-users realize significant benefits including enhanced security capabilities, operational efficiency improvements, and risk mitigation through comprehensive surveillance coverage. Return on investment manifests through reduced security incidents, insurance cost savings, and improved operational visibility.

Government agencies achieve public safety objectives through modern surveillance infrastructure supporting law enforcement activities and emergency response capabilities. Smart city initiatives benefit from integrated surveillance systems providing comprehensive urban monitoring and management capabilities.

Economic stakeholders benefit from job creation in technology sectors, increased foreign investment in surveillance technology, and development of domestic expertise in advanced security solutions. Export opportunities emerge as Brazilian companies develop competitive capabilities for regional markets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend shaping Brazil’s surveillance IP cameras market, with AI-powered analytics enabling advanced features including facial recognition, behavioral analysis, and automated threat detection. Machine learning capabilities enhance system effectiveness while reducing false alarm rates.

Cloud-based solutions gain momentum as organizations seek scalable storage and management platforms reducing on-premise infrastructure requirements. Software-as-a-Service models provide cost-effective access to advanced surveillance capabilities for small and medium enterprises.

Mobile integration becomes increasingly important as users demand remote access and control capabilities through smartphone and tablet applications. Real-time notifications and mobile viewing capabilities influence purchasing decisions across residential and commercial segments.

Edge computing adoption increases as organizations seek to process video analytics locally, reducing bandwidth requirements and improving response times. Intelligent cameras with built-in processing capabilities enable sophisticated analysis without centralized server requirements.

Cybersecurity enhancement becomes critical as network-connected surveillance systems require robust protection against potential cyber threats. Encryption protocols and secure authentication mechanisms become standard features addressing security concerns.

Energy efficiency considerations drive adoption of Power-over-Ethernet technology and low-power camera designs reducing operational costs and environmental impact. Sustainable technology approaches align with corporate environmental responsibility initiatives.

Recent industry developments demonstrate accelerating innovation and market expansion across Brazil’s surveillance IP cameras sector. Technology partnerships between international providers and local system integrators enhance market penetration and customer support capabilities.

Government procurement programs for smart city initiatives create substantial opportunities for surveillance technology providers. Public-private partnerships enable comprehensive security infrastructure development across major metropolitan areas.

Product launches featuring advanced AI capabilities, improved image quality, and enhanced cybersecurity measures address evolving market requirements. Competitive differentiation increasingly focuses on software capabilities and integrated solution offerings.

Market consolidation activities include strategic acquisitions and partnerships aimed at expanding geographic coverage and technical capabilities. Vertical integration strategies enable comprehensive solution delivery from hardware manufacturing through system maintenance.

Regulatory developments include updated privacy protection requirements and surveillance system standards affecting deployment practices. Compliance frameworks provide clearer guidance for organizations implementing surveillance technology.

Investment activities in research and development focus on next-generation surveillance capabilities including advanced analytics, improved image sensors, and enhanced integration platforms. Innovation initiatives support long-term market competitiveness and technology leadership.

Market participants should prioritize development of integrated solution portfolios combining surveillance cameras with analytics software, cloud storage, and mobile management platforms. Comprehensive offerings provide competitive advantages and higher customer value propositions compared to standalone products.

Investment strategies should emphasize artificial intelligence and machine learning capabilities enabling advanced video analytics and automated threat detection. Technology differentiation through AI-powered features creates opportunities for premium pricing and market leadership positions.

Geographic expansion efforts should focus on emerging markets within Brazil’s northeastern and central-west regions where urbanization trends create new opportunities for surveillance technology deployment. Regional partnerships with local system integrators facilitate market entry and customer relationship development.

Cybersecurity measures require immediate attention as network-connected surveillance systems become attractive targets for cyber attacks. Security-first design approaches and robust encryption protocols become essential for maintaining customer confidence and regulatory compliance.

Service capabilities development including installation, maintenance, and technical support services create sustainable revenue streams and competitive differentiation. Customer relationship management through comprehensive service offerings enhances long-term business sustainability.

According to MarkWide Research analysis, organizations should prepare for accelerating technology adoption rates and evolving customer requirements demanding more sophisticated surveillance capabilities integrated with broader security ecosystems.

Future market prospects for Brazil’s surveillance IP cameras sector appear exceptionally promising, with sustained growth expected across all major market segments. Technology evolution will continue driving market expansion as artificial intelligence, cloud computing, and mobile integration capabilities become standard features rather than premium options.

Growth projections indicate continued market expansion at rates exceeding 11% annually over the next five years, supported by government infrastructure investments, commercial sector growth, and increasing residential adoption. Smart city initiatives will create substantial opportunities for comprehensive surveillance system deployments.

Technology convergence with Internet of Things platforms, artificial intelligence systems, and cloud computing infrastructure will enable development of sophisticated security ecosystems providing comprehensive monitoring and analysis capabilities. Integration opportunities will drive innovation and market differentiation.

Market maturation will shift competitive focus from hardware specifications toward software capabilities, service quality, and integrated solution offerings. Value-added services including analytics, cloud storage, and professional monitoring will become increasingly important revenue sources.

Regulatory environment evolution will provide clearer frameworks for surveillance technology deployment while addressing privacy protection requirements. Compliance standards will drive technology development toward more secure and privacy-conscious surveillance solutions.

Export potential for Brazilian surveillance technology companies will expand as domestic expertise and market understanding position local providers advantageously for regional market expansion throughout Latin America and beyond.

Brazil’s surveillance IP cameras market represents a dynamic and rapidly expanding sector characterized by strong growth fundamentals, technological innovation, and diverse application opportunities. The market benefits from favorable demographic trends, increasing security awareness, and substantial government investment in smart city infrastructure development.

Market drivers including urbanization, rising crime rates, and evolving security requirements create sustained demand for advanced surveillance solutions across commercial, residential, and government sectors. Technology advancement continues reducing barriers to adoption while enhancing system capabilities and user experience.

Competitive landscape features both established international providers and emerging domestic companies, creating dynamic market conditions that benefit end-users through improved products, competitive pricing, and enhanced service offerings. Innovation focus on artificial intelligence, cloud integration, and mobile accessibility drives continuous market evolution.

Future prospects remain highly positive as Brazil continues modernizing security infrastructure and embracing advanced surveillance technologies. The market will likely experience sustained growth supported by smart city initiatives, commercial expansion, and increasing residential adoption of sophisticated security solutions. Strategic positioning in this evolving market requires focus on integrated solutions, advanced analytics capabilities, and comprehensive customer support services to capture emerging opportunities and maintain competitive advantages in Brazil’s expanding surveillance IP cameras market.

What is Surveillance IP Cameras?

Surveillance IP Cameras are digital video cameras that transmit data over a network, allowing for remote monitoring and recording. They are widely used in security systems for various applications, including residential, commercial, and public safety.

What are the key players in the Brazil Surveillance IP Cameras Market?

Key players in the Brazil Surveillance IP Cameras Market include Hikvision, Dahua Technology, Axis Communications, and Bosch Security Systems, among others. These companies are known for their innovative products and extensive distribution networks.

What are the main drivers of the Brazil Surveillance IP Cameras Market?

The main drivers of the Brazil Surveillance IP Cameras Market in Brazil include the increasing demand for security solutions, advancements in technology, and the growing trend of smart cities. Additionally, rising crime rates have led to a heightened focus on surveillance.

What challenges does the Brazil Surveillance IP Cameras Market face?

The Brazil Surveillance IP Cameras Market faces challenges such as privacy concerns, regulatory compliance issues, and the high cost of advanced surveillance technologies. These factors can hinder market growth and adoption rates.

What opportunities exist in the Brazil Surveillance IP Cameras Market?

Opportunities in the Brazil Surveillance IP Cameras Market include the integration of artificial intelligence for enhanced analytics, the expansion of cloud-based storage solutions, and the increasing adoption of IoT devices in security systems. These trends are expected to drive innovation and growth.

What trends are shaping the Brazil Surveillance IP Cameras Market?

Trends shaping the Brazil Surveillance IP Cameras Market include the shift towards high-definition video quality, the rise of wireless camera systems, and the growing importance of cybersecurity in surveillance solutions. These trends reflect the evolving needs of consumers and businesses.

Brazil Surveillance IP Cameras Market

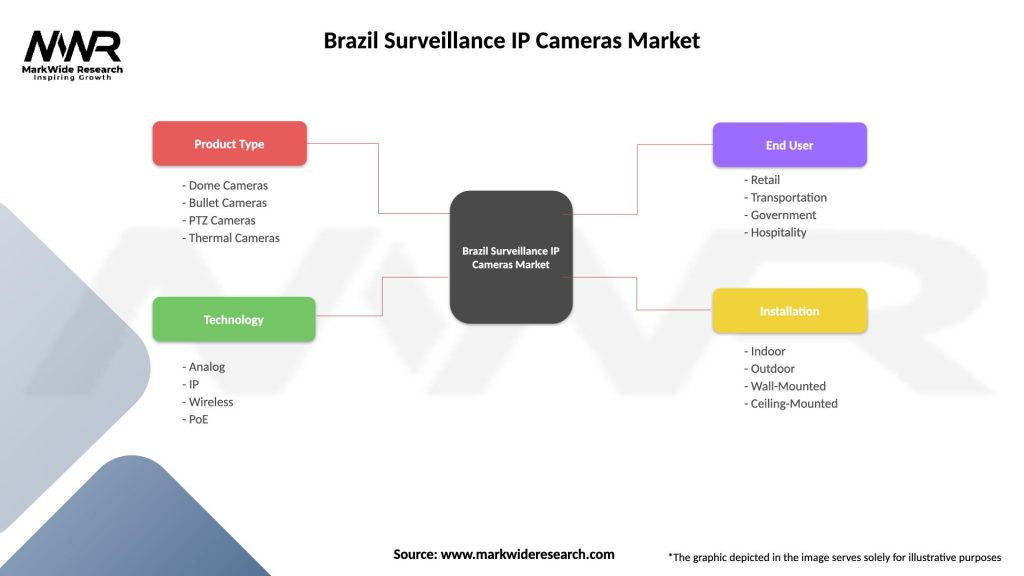

| Segmentation Details | Description |

|---|---|

| Product Type | Dome Cameras, Bullet Cameras, PTZ Cameras, Thermal Cameras |

| Technology | Analog, IP, Wireless, PoE |

| End User | Retail, Transportation, Government, Hospitality |

| Installation | Indoor, Outdoor, Wall-Mounted, Ceiling-Mounted |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Brazil Surveillance IP Cameras Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at