444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Brazil soy beverage market represents one of the most dynamic and rapidly evolving segments within the country’s food and beverage industry. As consumer preferences shift toward plant-based alternatives and health-conscious choices, soy beverages have emerged as a cornerstone of Brazil’s alternative protein landscape. The market demonstrates robust growth potential driven by increasing awareness of lactose intolerance, environmental sustainability concerns, and the nutritional benefits of soy-based products.

Market dynamics indicate that Brazil’s position as one of the world’s largest soy producers provides a significant competitive advantage in the soy beverage sector. The country’s extensive agricultural infrastructure and established supply chains create favorable conditions for market expansion. Consumer adoption rates have shown consistent upward trends, with urban populations leading the charge in embracing plant-based alternatives.

Regional distribution across Brazil shows concentrated demand in major metropolitan areas, with São Paulo and Rio de Janeiro accounting for approximately 45% of total consumption. The market benefits from increasing retail penetration and growing availability across various distribution channels, from traditional supermarkets to specialized health food stores.

The Brazil soy beverage market refers to the commercial sector encompassing the production, distribution, and consumption of liquid beverages derived from soybeans within Brazilian territory. These beverages serve as plant-based alternatives to traditional dairy milk, offering similar nutritional profiles while catering to consumers seeking lactose-free, vegan, or environmentally sustainable options.

Soy beverages in the Brazilian context include various product formulations ranging from plain unsweetened varieties to flavored options incorporating chocolate, vanilla, strawberry, and other taste profiles. The market encompasses both ready-to-drink products and concentrated formulations requiring dilution before consumption.

Market participants include multinational food corporations, domestic Brazilian companies, and emerging startups focused on plant-based innovations. The sector operates within Brazil’s broader food and beverage regulatory framework, ensuring product safety and quality standards while promoting nutritional transparency through mandatory labeling requirements.

Brazil’s soy beverage market stands at a pivotal juncture, characterized by accelerating consumer adoption and expanding product innovation. The market benefits from Brazil’s position as a global soy production leader, creating cost advantages and supply chain efficiencies that support competitive pricing strategies.

Key growth drivers include rising health consciousness, increasing lactose intolerance awareness, and growing environmental sustainability concerns among Brazilian consumers. The market demonstrates particular strength in urban areas where disposable income levels and health awareness tend to be higher.

Product diversification has emerged as a critical success factor, with manufacturers introducing fortified varieties containing added vitamins, minerals, and protein enhancements. Flavor innovation continues to drive market expansion, with tropical fruit combinations and traditional Brazilian taste profiles gaining popularity.

Distribution channels have evolved significantly, with e-commerce platforms showing substantial growth rates alongside traditional retail networks. The market benefits from increasing shelf space allocation in mainstream supermarkets and growing presence in convenience stores and foodservice establishments.

Consumer behavior analysis reveals several critical insights driving market development in Brazil’s soy beverage sector:

Health and wellness trends represent the primary catalyst driving Brazil’s soy beverage market expansion. Increasing consumer awareness of the relationship between diet and health outcomes has created substantial demand for nutritious plant-based alternatives. Soy beverages offer complete protein profiles, essential amino acids, and beneficial compounds like isoflavones that appeal to health-conscious consumers.

Lactose intolerance prevalence in Brazil provides a significant market foundation, with studies indicating that approximately 57% of the Brazilian population experiences some degree of lactose malabsorption. This biological factor creates a substantial addressable market for plant-based alternatives that deliver similar nutritional benefits without digestive complications.

Environmental sustainability concerns increasingly influence consumer purchasing decisions, particularly among younger demographics. Soy beverage production typically requires fewer natural resources and generates lower greenhouse gas emissions compared to traditional dairy farming, appealing to environmentally conscious consumers.

Agricultural advantages stemming from Brazil’s position as a leading global soy producer create favorable market conditions. Domestic soy production ensures supply chain stability, cost competitiveness, and quality control throughout the manufacturing process.

Consumer perception challenges continue to limit market penetration in certain demographic segments. Traditional preferences for dairy milk remain strong, particularly in rural areas and among older consumer groups who associate dairy products with nutritional superiority and cultural traditions.

Taste and texture barriers present ongoing challenges for market expansion. Some consumers find soy beverages less palatable than dairy alternatives, citing differences in mouthfeel, aftertaste, or overall sensory experience that limit repeat purchase behavior.

Price competitiveness remains a constraint in price-sensitive market segments. While production costs have decreased, premium soy beverages often carry higher retail prices than conventional dairy milk, limiting accessibility for budget-conscious consumers.

Regulatory complexities surrounding plant-based beverage labeling and marketing claims create compliance challenges for manufacturers. Restrictions on using dairy-related terminology and requirements for clear plant-based identification can impact marketing effectiveness and consumer understanding.

Supply chain vulnerabilities related to soy crop variations, weather patterns, and agricultural policy changes can affect raw material availability and pricing stability, impacting market predictability and planning.

Product innovation opportunities present significant potential for market expansion through development of enhanced formulations, unique flavor profiles, and functional beverages targeting specific health benefits. Opportunities exist for protein-enriched varieties, probiotic-enhanced products, and specialized formulations for athletes and fitness enthusiasts.

Geographic expansion into underserved regions of Brazil offers substantial growth potential. Rural and interior markets remain largely untapped, presenting opportunities for companies willing to invest in distribution infrastructure and consumer education initiatives.

Foodservice integration represents a growing opportunity as restaurants, cafes, and institutional foodservice providers increasingly incorporate plant-based options into their offerings. Coffee shops and quick-service restaurants show particular interest in soy-based alternatives for beverages and menu applications.

E-commerce growth creates new distribution channels and direct-to-consumer opportunities. Online platforms enable companies to reach consumers in remote areas while building brand relationships through subscription services and personalized product recommendations.

Export potential leverages Brazil’s agricultural advantages to serve international markets, particularly in Latin America and regions with growing plant-based beverage demand.

Competitive intensity in Brazil’s soy beverage market has increased significantly as both domestic and international players recognize the sector’s growth potential. Market dynamics reflect a balance between established food companies leveraging existing distribution networks and innovative startups introducing disruptive products and marketing approaches.

Supply chain integration has become a critical competitive factor, with successful companies developing vertical integration strategies that control quality and costs from soybean sourcing through final product distribution. This integration enables better margin management and quality consistency.

Consumer education initiatives play an increasingly important role in market development. Companies invest in awareness campaigns highlighting nutritional benefits, environmental advantages, and versatility of soy beverages to overcome traditional dairy preferences and misconceptions about plant-based alternatives.

Technological advancement in processing techniques has improved product quality, shelf stability, and sensory characteristics. Modern processing methods enable manufacturers to create soy beverages with improved taste profiles and nutritional retention, addressing historical consumer concerns about plant-based alternatives.

Regulatory evolution continues to shape market dynamics as authorities develop frameworks for plant-based beverage standards, labeling requirements, and health claims validation. These regulatory developments provide clarity for manufacturers while ensuring consumer protection and market transparency.

Comprehensive market analysis for Brazil’s soy beverage sector employs multiple research methodologies to ensure accuracy and reliability of findings. The research approach combines quantitative data collection with qualitative insights to provide a complete market perspective.

Primary research activities include structured interviews with industry executives, retail managers, and consumer focus groups across major Brazilian metropolitan areas. These interviews provide insights into market trends, consumer preferences, and competitive dynamics that quantitative data alone cannot capture.

Secondary research sources encompass industry reports, government statistics, trade association data, and company financial disclosures. This information provides historical context and market sizing data essential for trend analysis and future projections.

Consumer surveys conducted across diverse demographic segments provide insights into purchasing behavior, brand preferences, consumption patterns, and factors influencing product selection. Survey methodologies ensure representative sampling across geographic regions and socioeconomic segments.

Market observation techniques include retail audits, price monitoring, and distribution channel analysis to understand market dynamics from a supply chain perspective. These observations complement survey data with real-world market behavior insights.

Southeast Brazil dominates the soy beverage market, accounting for approximately 52% of national consumption. This region benefits from high urbanization rates, elevated income levels, and strong health consciousness among consumers. São Paulo and Rio de Janeiro serve as primary market centers with extensive retail infrastructure and distribution networks.

Southern Brazil represents the second-largest regional market, contributing roughly 23% of total demand. The region’s agricultural heritage and proximity to soy production areas create favorable market conditions. Consumer acceptance of plant-based alternatives shows steady growth, particularly in urban centers like Porto Alegre and Curitiba.

Northeast Brazil demonstrates emerging market potential with growing adoption rates despite lower current consumption levels. The region’s large population base and increasing urbanization create opportunities for market expansion, though price sensitivity remains a significant consideration.

Central-West Brazil shows unique market characteristics due to its role as a major soy production region. Local availability of raw materials supports competitive pricing, while growing urban populations in cities like Brasília drive demand for health-conscious beverage options.

Northern Brazil represents the smallest regional market but shows potential for future growth as distribution infrastructure improves and consumer awareness increases. The region’s diverse population and growing middle class create opportunities for targeted marketing approaches.

Market leadership in Brazil’s soy beverage sector reflects a combination of multinational corporations and domestic companies, each leveraging distinct competitive advantages to capture market share and drive growth.

Competitive strategies vary significantly across market participants, with established players focusing on distribution expansion and product innovation while newer entrants emphasize differentiation through organic certification, unique flavors, and direct-to-consumer marketing approaches.

Product type segmentation reveals distinct market categories based on formulation and positioning:

Packaging format segmentation addresses different consumption occasions and preferences:

Distribution channel segmentation reflects diverse retail landscapes:

Plain soy beverages represent the foundational market category, appealing primarily to consumers seeking direct dairy milk substitutes. This segment demonstrates steady growth driven by lactose-intolerant consumers and health-conscious individuals prioritizing minimal processing and additive-free products. Market penetration remains highest in urban areas with elevated health awareness.

Flavored varieties show the strongest growth momentum, with chocolate-flavored options leading consumption patterns. Brazilian consumers demonstrate particular affinity for tropical fruit flavors including açaí, coconut, and passion fruit combinations. These products successfully attract consumers who might otherwise avoid plain plant-based alternatives due to taste preferences.

Fortified soy beverages command premium pricing while targeting specific nutritional needs. Products enhanced with calcium, vitamin D, and B-complex vitamins appeal to consumers seeking comprehensive nutritional profiles comparable to or superior to dairy milk. This category shows particular strength among fitness enthusiasts and health-conscious families.

Organic soy beverages represent the fastest-growing category segment, though from a smaller base. Consumer willingness to pay premium prices for organic certification reflects growing environmental consciousness and perceived health benefits. This segment demonstrates strong growth potential as organic awareness increases across Brazilian consumer segments.

Ready-to-drink formats dominate market share due to convenience factors and consumer preferences for immediate consumption. Single-serving packages show particular strength in urban markets where on-the-go consumption patterns align with busy lifestyles and commuting behaviors.

Manufacturers benefit from Brazil’s abundant soy production capacity, which provides cost advantages and supply chain security unavailable in many other markets. Domestic soy availability enables competitive pricing strategies while maintaining quality standards and profit margins.

Retailers gain from expanding product categories that attract health-conscious consumers and drive higher-margin sales. Soy beverages typically command better margins than traditional dairy products while appealing to growing demographic segments seeking plant-based alternatives.

Distributors capitalize on growing market demand and expanding geographic penetration opportunities. The sector’s growth trajectory provides stable business development prospects and opportunities for partnership expansion with both established and emerging brands.

Consumers receive nutritional benefits including complete protein profiles, essential amino acids, and beneficial plant compounds. Soy beverages provide lactose-free alternatives without sacrificing nutritional value, while often delivering additional health benefits through fortification and natural soy compounds.

Agricultural stakeholders benefit from value-added processing opportunities that capture higher margins than commodity soy sales. The domestic soy beverage market creates additional demand channels for Brazilian soy producers while supporting rural economic development.

Environmental stakeholders gain from reduced environmental impact compared to traditional dairy production. Soy beverage production typically requires less water, land, and energy while generating lower greenhouse gas emissions, supporting sustainability objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Premiumization trends are reshaping Brazil’s soy beverage market as consumers increasingly seek high-quality products with enhanced nutritional profiles and superior taste characteristics. This trend drives demand for organic certification, non-GMO ingredients, and artisanal production methods that command premium pricing.

Flavor innovation continues to accelerate with manufacturers introducing uniquely Brazilian taste profiles that resonate with local preferences. Tropical fruit combinations, traditional dessert flavors, and regional specialties create differentiation opportunities while appealing to cultural taste preferences.

Functional beverage development represents a growing trend as consumers seek products delivering specific health benefits beyond basic nutrition. Probiotic-enhanced varieties, protein-boosted formulations, and beverages targeting specific health concerns show increasing market traction.

Sustainable packaging initiatives gain momentum as environmental consciousness influences purchasing decisions. Companies invest in recyclable packaging materials, reduced packaging waste, and sustainable sourcing practices to appeal to environmentally aware consumers.

Digital marketing expansion reflects changing consumer behavior and media consumption patterns. Social media campaigns, influencer partnerships, and digital content marketing become increasingly important for brand building and consumer engagement, particularly among younger demographics.

Convenience format growth addresses busy lifestyles and on-the-go consumption patterns. Single-serving packages, resealable containers, and portable formats show strong growth as consumers prioritize convenience without compromising nutritional quality.

Manufacturing capacity expansion across major players reflects confidence in long-term market growth prospects. Companies invest in new production facilities and equipment upgrades to meet growing demand while improving operational efficiency and product quality.

Strategic partnerships between soy beverage manufacturers and retail chains create exclusive distribution agreements and co-marketing opportunities. These partnerships enable better shelf positioning and consumer education while providing retailers with differentiated product offerings.

Technology adoption in processing and packaging improves product quality and shelf stability. Advanced processing techniques enhance taste profiles while extending product life, addressing historical challenges associated with plant-based beverage quality and consumer acceptance.

Regulatory framework development provides clearer guidelines for plant-based beverage labeling, health claims, and quality standards. These developments create more predictable operating environments while ensuring consumer protection and market transparency.

Research and development investments focus on improving nutritional profiles, taste characteristics, and functional benefits. Companies collaborate with research institutions to develop innovative formulations that address specific consumer needs and preferences.

Market consolidation activities include acquisitions and mergers as larger companies seek to expand market presence and smaller players look for growth capital and distribution access. These activities reshape competitive dynamics while creating opportunities for market development.

MarkWide Research analysis indicates that companies should prioritize consumer education initiatives to overcome traditional dairy preferences and misconceptions about plant-based alternatives. Educational campaigns highlighting nutritional benefits, environmental advantages, and product versatility can accelerate market adoption across diverse consumer segments.

Product portfolio diversification emerges as a critical success strategy, with companies recommended to develop comprehensive offerings spanning different price points, flavors, and functional benefits. This approach enables market share capture across multiple consumer segments while reducing dependence on single product categories.

Distribution channel expansion should focus on underserved geographic regions and emerging retail formats. Companies investing in rural market penetration and e-commerce capabilities position themselves advantageously for long-term growth as these channels develop.

Strategic partnerships with foodservice providers, coffee chains, and institutional buyers can accelerate market penetration while creating new consumption occasions. These partnerships provide volume opportunities and brand exposure beyond traditional retail channels.

Innovation investment in taste improvement and nutritional enhancement addresses primary consumer barriers to adoption. Companies developing superior taste profiles and enhanced nutritional benefits gain competitive advantages in increasingly crowded markets.

Sustainability positioning becomes increasingly important as environmental consciousness grows among Brazilian consumers. Companies emphasizing sustainable sourcing, eco-friendly packaging, and environmental benefits create differentiation opportunities while appealing to values-driven consumers.

Market growth projections indicate continued expansion driven by demographic trends, health consciousness, and environmental awareness. The sector demonstrates strong fundamentals supporting sustained growth over the medium to long term, with urban markets leading adoption patterns.

Consumer acceptance rates are expected to increase as product quality improvements address historical taste and texture concerns. Younger demographics show particularly strong adoption patterns, suggesting favorable long-term market dynamics as these consumers mature and influence household purchasing decisions.

Geographic expansion into interior and rural markets presents significant growth opportunities as distribution infrastructure develops and consumer awareness increases. These markets offer substantial untapped potential for companies willing to invest in market development and consumer education.

Product innovation will continue driving market evolution with enhanced formulations, unique flavors, and functional benefits creating new consumption occasions and consumer segments. Companies investing in research and development maintain competitive advantages in rapidly evolving markets.

Competitive dynamics suggest increasing market entry from both domestic and international players, creating more choices for consumers while intensifying competition for market share. This competition drives innovation and quality improvements while potentially pressuring margins.

MWR projections indicate that the market will experience sustained growth momentum over the next five years, with particularly strong performance expected in premium segments and flavored varieties. The combination of favorable demographic trends, improving product quality, and expanding distribution creates positive conditions for continued market development.

Brazil’s soy beverage market stands positioned for continued growth and evolution, driven by fundamental shifts in consumer preferences toward health-conscious and environmentally sustainable food choices. The market benefits from Brazil’s unique advantages as a major soy producer, creating cost competitiveness and supply chain security that support long-term market development.

Key success factors for market participants include consumer education, product innovation, and strategic distribution expansion. Companies that effectively address taste preferences, nutritional needs, and convenience requirements while maintaining competitive pricing will capture the greatest market opportunities.

Market challenges related to traditional dairy preferences and price sensitivity require targeted strategies emphasizing value proposition communication and gradual market education. However, favorable demographic trends and increasing health awareness create supportive conditions for overcoming these challenges.

Future prospects remain positive as the market matures and expands beyond early adopter segments into mainstream consumer categories. The combination of improving product quality, expanding distribution networks, and growing consumer acceptance suggests sustained growth potential across multiple market segments and geographic regions throughout Brazil.

What is Soy Beverage?

Soy beverage, often referred to as soy milk, is a plant-based drink made from soybeans. It is commonly used as a dairy milk alternative and is popular among consumers seeking lactose-free or vegan options.

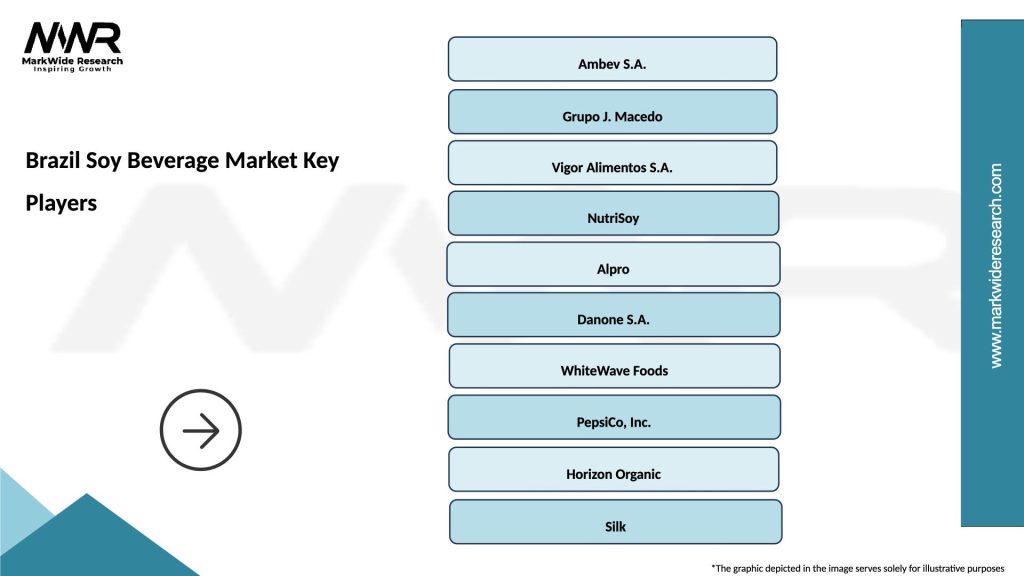

What are the key players in the Brazil Soy Beverage Market?

Key players in the Brazil Soy Beverage Market include companies like Danone, WhiteWave, and Vigor, which offer a variety of soy-based products. These companies are known for their innovative approaches to plant-based beverages, among others.

What are the growth factors driving the Brazil Soy Beverage Market?

The Brazil Soy Beverage Market is driven by increasing health consciousness among consumers, a rise in lactose intolerance, and the growing popularity of vegan diets. Additionally, the demand for sustainable and plant-based protein sources is contributing to market growth.

What challenges does the Brazil Soy Beverage Market face?

Challenges in the Brazil Soy Beverage Market include competition from other plant-based beverages, such as almond and oat milk, and potential supply chain issues related to soybean production. Consumer perception and taste preferences can also pose challenges for market penetration.

What opportunities exist in the Brazil Soy Beverage Market?

Opportunities in the Brazil Soy Beverage Market include expanding product lines to include flavored and fortified options, as well as targeting health-conscious consumers through marketing strategies. The increasing trend of plant-based diets presents a significant opportunity for growth.

What trends are shaping the Brazil Soy Beverage Market?

Trends in the Brazil Soy Beverage Market include the rise of organic and non-GMO soy products, as well as innovations in packaging and sustainability practices. Additionally, there is a growing interest in functional beverages that offer added health benefits.

Brazil Soy Beverage Market

| Segmentation Details | Description |

|---|---|

| Product Type | Unsweetened, Sweetened, Flavored, Organic |

| End User | Households, Restaurants, Cafés, Health Stores |

| Distribution Channel | Supermarkets, Online Retail, Convenience Stores, Specialty Shops |

| Packaging Type | Bottles, Tetra Packs, Cans, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Brazil Soy Beverage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at