444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Brazil rail freight transport market represents a critical component of the nation’s logistics infrastructure, serving as a backbone for industrial and agricultural commodity movement across vast geographical distances. Brazil’s extensive rail network spans over 30,000 kilometers, connecting major production centers with ports, urban areas, and international borders. The market has experienced steady growth driven by increasing demand for efficient, cost-effective transportation solutions for bulk commodities including iron ore, soybeans, sugar, and manufactured goods.

Market dynamics indicate robust expansion potential, with the sector projected to grow at a compound annual growth rate (CAGR) of 4.2% over the forecast period. This growth trajectory reflects Brazil’s position as a major global exporter of agricultural and mineral commodities, requiring reliable rail infrastructure to maintain competitive advantage in international markets. The market encompasses various segments including freight rail operators, infrastructure providers, rolling stock manufacturers, and logistics service providers.

Regional distribution shows concentrated activity in the Southeast and South regions, which account for approximately 65% of total rail freight volume. These areas benefit from established industrial bases, proximity to major ports like Santos and Paranaguá, and well-developed rail connections. The market continues evolving through infrastructure investments, technological modernization, and regulatory reforms aimed at enhancing operational efficiency and service quality.

The Brazil rail freight transport market refers to the comprehensive ecosystem of railway-based cargo transportation services, infrastructure, and related activities within Brazilian territory. This market encompasses the movement of goods via rail networks, including bulk commodities, containerized cargo, and specialized freight across domestic and international routes.

Rail freight transport in Brazil involves multiple stakeholders including railway operators, cargo owners, logistics providers, and infrastructure managers working collaboratively to facilitate efficient goods movement. The market includes various service categories such as long-haul transportation, regional distribution, intermodal connections, and specialized handling for specific commodity types. Key characteristics include high-capacity transportation, cost-effectiveness for bulk goods, environmental sustainability compared to road transport, and strategic importance for export-oriented industries.

Market participants range from large-scale mining companies operating dedicated rail lines to independent freight operators serving diverse industrial sectors. The system integrates with ports, terminals, warehouses, and other transportation modes to create comprehensive logistics solutions supporting Brazil’s economic development and international trade competitiveness.

Brazil’s rail freight transport market demonstrates significant potential for sustained growth, driven by the country’s position as a leading global exporter of agricultural and mineral commodities. The market benefits from ongoing infrastructure investments, regulatory improvements, and increasing recognition of rail transport’s environmental and economic advantages over alternative modes.

Key market drivers include expanding agricultural production, growing mining activities, port capacity increases, and government initiatives promoting rail infrastructure development. The sector shows particular strength in bulk commodity transportation, with iron ore and agricultural products representing approximately 75% of total rail freight volume. Technological advancement through digitalization, automation, and improved rolling stock enhances operational efficiency and service reliability.

Market challenges encompass infrastructure bottlenecks, regulatory complexities, competition from road transport, and the need for substantial capital investments in network expansion and modernization. Despite these obstacles, the market outlook remains positive, supported by Brazil’s economic fundamentals, export growth potential, and increasing focus on sustainable transportation solutions. Strategic opportunities exist in intermodal integration, specialized cargo services, and regional connectivity improvements.

Market analysis reveals several critical insights shaping the Brazil rail freight transport landscape:

These insights highlight the market’s strategic importance for Brazil’s economic development and its potential for continued growth through infrastructure investment, technological advancement, and operational improvements.

Agricultural expansion serves as a primary driver for Brazil’s rail freight transport market, with the country’s position as a leading global producer of soybeans, corn, sugar, and other commodities generating substantial transportation demand. The ongoing development of agricultural frontiers, particularly in the Cerrado region, creates new freight corridors requiring efficient rail connections to export terminals.

Mining sector growth contributes significantly to market expansion, with Brazil’s vast mineral resources including iron ore, bauxite, and other commodities requiring high-capacity transportation solutions. Major mining companies continue investing in dedicated rail infrastructure to support production increases and maintain cost competitiveness in global markets. Export demand from key trading partners, particularly China and other emerging economies, drives consistent freight volumes.

Infrastructure investment initiatives by government and private sector entities support market growth through network expansion, capacity improvements, and technological modernization. The New Legal Framework for Railways and related regulatory reforms enhance investment attractiveness and operational flexibility. Environmental considerations increasingly favor rail transport due to its lower carbon emissions per ton-kilometer compared to road transport, aligning with sustainability objectives and corporate environmental commitments.

Cost advantages of rail transport for long-distance, high-volume shipments make it the preferred mode for many bulk commodities, particularly when considering total logistics costs including handling, storage, and port access. Port capacity expansion projects create additional demand for efficient inland transportation connections, supporting rail freight market growth.

Infrastructure limitations represent significant constraints on Brazil’s rail freight transport market growth, with bottlenecks at key corridors, terminals, and port connections limiting capacity and service reliability. Many rail lines require substantial upgrades to handle increased traffic volumes and heavier freight loads, necessitating considerable capital investments that may strain operator resources.

Regulatory complexities and bureaucratic processes can delay project approvals, infrastructure investments, and operational improvements. The complex web of federal, state, and local regulations creates compliance challenges and increases operational costs for market participants. Competition from road transport remains intense, particularly for shorter distances and time-sensitive cargo, with trucking offering greater flexibility and door-to-door service capabilities.

High capital requirements for rail infrastructure development, rolling stock acquisition, and technology implementation create barriers to entry and limit expansion capabilities for smaller operators. The long payback periods associated with rail investments may discourage some potential investors, particularly in uncertain economic conditions. Maintenance costs for aging infrastructure and equipment strain operational budgets and may compromise service quality.

Geographic constraints including challenging terrain, environmental restrictions, and land acquisition difficulties complicate network expansion efforts. Skills shortages in specialized railway operations, maintenance, and engineering limit the industry’s ability to implement advanced technologies and maintain high service standards. Economic volatility affecting commodity prices and export volumes creates uncertainty for long-term investment planning and capacity utilization.

Infrastructure modernization presents substantial opportunities for market participants, with government initiatives and private investments creating demand for advanced rail technologies, improved rolling stock, and enhanced operational systems. The development of new rail corridors, particularly connecting agricultural regions to ports, offers significant growth potential for freight operators and service providers.

Intermodal transportation integration creates opportunities for comprehensive logistics solutions combining rail, road, and waterway transport modes. This approach can optimize cost efficiency, reduce transit times, and improve service reliability for diverse cargo types. Technology adoption including digitalization, automation, and data analytics enables operational improvements, predictive maintenance, and enhanced customer service capabilities.

Specialized cargo services for high-value goods, temperature-controlled products, and hazardous materials represent growing market segments with premium pricing potential. The expansion of container freight services supports Brazil’s manufacturing sector and import/export trade growth. Regional connectivity improvements can unlock new markets and support economic development in underserved areas.

Public-private partnerships offer mechanisms for infrastructure development, risk sharing, and operational efficiency improvements. Environmental regulations and corporate sustainability commitments increasingly favor rail transport, creating competitive advantages over road-based alternatives. Export market diversification and trade agreement developments may generate new freight flows requiring efficient rail transportation solutions. Value-added services including warehousing, cargo handling, and supply chain management create additional revenue opportunities for rail freight operators.

Supply and demand dynamics in Brazil’s rail freight transport market reflect the interplay between infrastructure capacity, commodity production cycles, and export market conditions. Seasonal variations in agricultural production create fluctuating demand patterns, with peak harvest periods generating high freight volumes that may strain system capacity. Mining operations provide more consistent year-round demand, helping balance overall market dynamics.

Competitive dynamics involve both direct competition between rail operators and modal competition with road and waterway transport. Pricing strategies must balance cost recovery requirements with competitive positioning against alternative transport modes. The market shows increasing consolidation trends as larger operators acquire smaller companies to achieve economies of scale and expand service coverage.

Technological dynamics drive operational improvements through advanced train control systems, predictive maintenance technologies, and digital logistics platforms. These innovations enhance safety, efficiency, and service reliability while reducing operational costs. Regulatory dynamics continue evolving with government efforts to promote competition, improve service quality, and attract private investment in rail infrastructure.

Economic dynamics including commodity price fluctuations, exchange rate movements, and global trade patterns significantly influence freight volumes and market profitability. Environmental dynamics increasingly favor rail transport due to its lower carbon footprint, supporting modal shift initiatives and sustainable logistics strategies. Investment dynamics reflect the balance between infrastructure needs, available capital, and expected returns in a capital-intensive industry.

Primary research methodologies employed in analyzing Brazil’s rail freight transport market include comprehensive interviews with industry executives, railway operators, logistics providers, and government officials. Survey instruments capture quantitative data on freight volumes, operational metrics, investment plans, and market perceptions from key stakeholders across the value chain.

Secondary research encompasses analysis of government statistics, industry reports, financial statements, and regulatory documents to establish market baselines and identify trends. Data triangulation methods ensure accuracy and reliability by cross-referencing multiple information sources and validating findings through expert consultations.

Market segmentation analysis examines freight volumes by commodity type, geographic region, operator category, and service characteristics. Competitive analysis evaluates market share, service offerings, pricing strategies, and operational capabilities of major market participants. Trend analysis identifies emerging patterns in technology adoption, regulatory changes, and market structure evolution.

Forecasting methodologies incorporate econometric modeling, scenario analysis, and expert judgment to project market growth trajectories under various assumptions. Risk assessment frameworks evaluate potential challenges and opportunities affecting market development. Stakeholder analysis maps the influence and interests of various market participants to understand decision-making dynamics and strategic relationships.

Southeast region dominates Brazil’s rail freight transport market, accounting for approximately 45% of total freight volume, driven by concentrated industrial activity, major mining operations, and proximity to Santos port. The region benefits from well-established rail infrastructure, including connections to key production centers and export terminals. São Paulo state serves as a critical hub for intermodal connections and distribution activities.

South region represents roughly 25% of market activity, with strong agricultural production driving freight demand for soybeans, corn, and other commodities. The region’s rail network connects efficiently to Paranaguá and Rio Grande ports, supporting export flows to international markets. Infrastructure quality in the South region generally exceeds national averages, enabling reliable service delivery.

Central-West region shows rapid growth potential, contributing approximately 20% of current freight volumes with significant expansion opportunities as agricultural frontiers develop. The region requires substantial infrastructure investment to realize its full potential, particularly in connecting remote production areas to main rail corridors. Mato Grosso state represents a key growth market for rail freight services.

Northeast and North regions collectively account for the remaining 10% of market activity, with limited rail infrastructure constraining growth opportunities. However, these regions offer long-term potential through mineral resource development, agricultural expansion, and strategic port connections. Infrastructure development projects in these regions could significantly alter regional market dynamics over the forecast period.

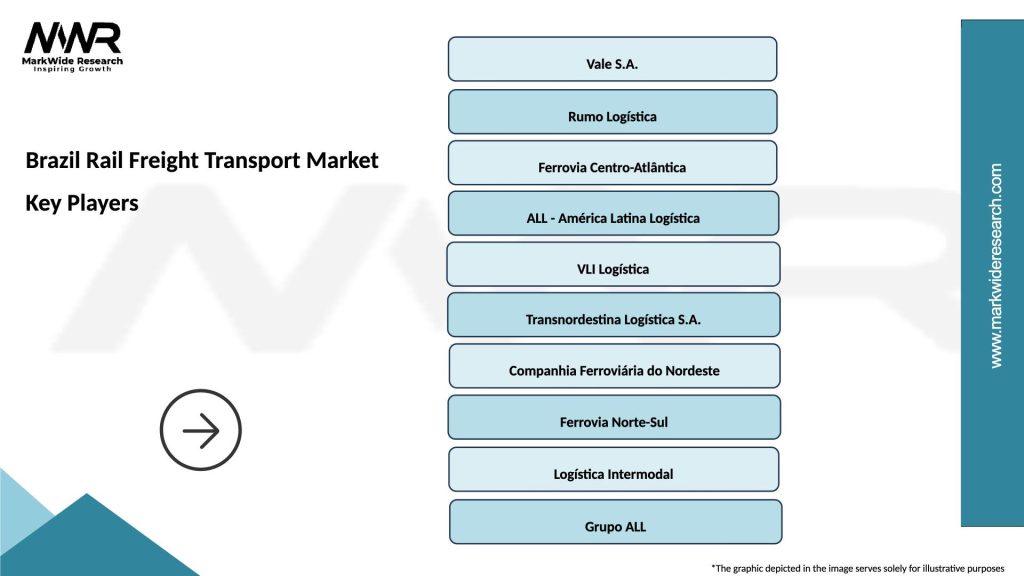

Market leadership in Brazil’s rail freight transport sector is concentrated among several major operators with extensive network coverage and specialized service capabilities:

Competitive strategies focus on operational efficiency improvements, service quality enhancement, and strategic partnerships to expand market reach. Technology investments in automation, digitalization, and advanced logistics systems provide competitive differentiation. Vertical integration strategies enable some operators to control entire supply chains from production to port delivery.

Market consolidation trends reflect economies of scale advantages and the need for substantial capital investments in infrastructure and equipment. Strategic alliances between operators, shippers, and logistics providers create comprehensive service offerings and improve market competitiveness.

By Commodity Type:

By Service Type:

By Distance:

Iron ore transportation represents the most mature and established segment of Brazil’s rail freight market, characterized by high-volume, long-distance movements from mining regions to export ports. This category benefits from dedicated infrastructure, specialized rolling stock, and integrated supply chain management. Operational efficiency in this segment reaches industry-leading levels due to standardized processes and substantial scale economies.

Agricultural freight shows the highest growth potential, driven by expanding production in frontier regions and increasing export demand. This segment requires flexible service offerings to accommodate seasonal variations, diverse crop types, and varying destination requirements. Infrastructure development in agricultural regions creates new opportunities for rail freight operators to capture market share from road transport.

Container freight represents an emerging growth category as Brazil’s manufacturing sector expands and import/export trade diversifies. This segment requires specialized handling equipment, intermodal terminals, and coordination with port operations. Service reliability and schedule adherence are critical success factors for container freight services.

General cargo encompasses diverse freight types requiring varied service capabilities, from bulk materials to finished goods. This segment offers opportunities for value-added services including warehousing, distribution, and supply chain management. Customer relationships and service flexibility are key competitive advantages in this category.

Freight shippers benefit from rail transport’s cost advantages for long-distance, high-volume shipments, with potential savings of 20-30% compared to road transport for suitable cargo types. Service reliability and schedule predictability enable better supply chain planning and inventory management. Environmental benefits support corporate sustainability objectives and regulatory compliance requirements.

Railway operators gain from stable, long-term revenue streams through dedicated service contracts and the ability to optimize asset utilization across diverse freight categories. Operational efficiency improvements through technology adoption and scale economies enhance profitability and competitive positioning. Market expansion opportunities exist through infrastructure development and service diversification.

Government stakeholders benefit from rail freight transport’s contribution to economic development, export competitiveness, and environmental sustainability. Infrastructure investments in rail transport support regional development objectives and reduce road maintenance costs. Tax revenue generation from rail freight activities contributes to public finances.

Port operators gain from efficient rail connections that enhance cargo throughput capacity and reduce terminal congestion. Intermodal integration improves overall logistics chain efficiency and service quality. Equipment manufacturers benefit from ongoing demand for rolling stock, infrastructure components, and technology systems supporting market growth and modernization initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization and automation represent transformative trends reshaping Brazil’s rail freight transport market, with operators implementing advanced train control systems, predictive maintenance technologies, and digital logistics platforms. These innovations enhance operational efficiency, improve safety performance, and enable real-time cargo tracking capabilities. Data analytics applications optimize route planning, asset utilization, and maintenance scheduling.

Intermodal integration continues gaining momentum as shippers seek comprehensive logistics solutions combining rail, road, and waterway transport modes. This trend drives development of multimodal terminals, standardized container handling systems, and coordinated service offerings. Supply chain optimization through intermodal solutions reduces total logistics costs and improves service reliability.

Sustainability focus increasingly influences transportation decisions, with rail freight benefiting from its environmental advantages over road transport. Carbon footprint reduction initiatives by major shippers favor rail transport for suitable cargo types. Green logistics strategies incorporate rail transport as a key component of sustainable supply chain management.

Infrastructure modernization trends include capacity expansion projects, technology upgrades, and efficiency improvements across the rail network. Public-private partnerships facilitate infrastructure development while sharing investment risks and operational responsibilities. Regional connectivity improvements focus on connecting underserved areas to main rail corridors, supporting economic development objectives.

Regulatory framework evolution through the New Legal Framework for Railways has introduced significant changes to market structure, competition rules, and investment incentives. These reforms aim to attract private investment, improve operational efficiency, and enhance service quality across the rail freight sector. Concession renewals and new bidding processes create opportunities for market entry and expansion.

Infrastructure investment projects including the Norte-Sul Railway extension, Ferrogrão corridor development, and various capacity expansion initiatives represent billions in committed investments. These projects will significantly enhance Brazil’s rail freight capacity and connectivity, particularly for agricultural regions. Technology integration in new infrastructure incorporates advanced signaling, communication, and control systems.

Strategic partnerships between railway operators, mining companies, agricultural producers, and logistics providers create integrated service offerings and shared investment opportunities. Vertical integration strategies enable some companies to control entire supply chains from production to port delivery. International cooperation agreements facilitate cross-border rail connections and trade facilitation.

Rolling stock modernization programs introduce more efficient locomotives, specialized freight cars, and advanced maintenance technologies. Environmental compliance initiatives include emission reduction programs, noise mitigation measures, and biodiversity protection protocols. Safety improvements through enhanced training programs, technology adoption, and operational procedures reduce accident rates and improve service reliability.

MarkWide Research analysis indicates that rail freight operators should prioritize infrastructure capacity expansion and technology adoption to capitalize on growing market opportunities. Investment strategies should focus on bottleneck elimination, intermodal terminal development, and digital transformation initiatives that enhance operational efficiency and customer service capabilities.

Market positioning strategies should emphasize rail transport’s environmental benefits, cost advantages, and reliability for suitable cargo types. Service diversification into specialized freight categories, value-added logistics services, and comprehensive supply chain solutions can create competitive differentiation and revenue growth opportunities.

Partnership development with shippers, port operators, and other logistics providers enables integrated service offerings and market expansion. Technology investments in automation, digitalization, and data analytics provide operational improvements and competitive advantages. Regulatory engagement ensures compliance with evolving requirements and influences policy development favorably.

Risk management strategies should address infrastructure constraints, economic volatility, and competitive pressures through diversified service portfolios, flexible operational capabilities, and strong financial management. Sustainability initiatives align with market trends and customer requirements while supporting long-term competitiveness. Human capital development through training and skill enhancement programs ensures operational excellence and safety performance.

Long-term growth prospects for Brazil’s rail freight transport market remain positive, supported by the country’s role as a major global commodity exporter and ongoing infrastructure development initiatives. Market expansion is expected to continue at a steady pace of 4-5% annually over the next decade, driven by agricultural production growth, mining sector development, and improved rail infrastructure capacity.

Technology adoption will accelerate operational improvements, with digitalization, automation, and advanced analytics becoming standard industry practices. Intermodal integration will deepen, creating more comprehensive and efficient logistics solutions for diverse cargo types. Environmental considerations will increasingly favor rail transport as sustainability becomes a more important factor in transportation decisions.

Infrastructure development projects currently under construction or planning will significantly enhance network capacity and connectivity over the forecast period. Regional expansion into underserved areas will create new market opportunities and support economic development objectives. Service quality improvements through technology adoption and operational optimization will enhance rail transport’s competitive position.

Market structure evolution may include further consolidation among operators, increased private sector participation, and enhanced competition through regulatory reforms. International connectivity improvements could expand cross-border freight opportunities and regional integration. MWR projections indicate that Brazil’s rail freight transport market will maintain its strategic importance while adapting to changing economic conditions, technological advances, and evolving customer requirements.

Brazil’s rail freight transport market represents a vital component of the nation’s logistics infrastructure, supporting economic development, export competitiveness, and sustainable transportation objectives. The market demonstrates strong fundamentals through its cost advantages for bulk commodities, environmental benefits, and strategic importance to key industries including mining and agriculture.

Growth opportunities exist through infrastructure investment, technology adoption, service diversification, and market expansion into underserved regions. While challenges including infrastructure constraints, regulatory complexity, and competitive pressures require careful management, the overall market outlook remains positive. Strategic initiatives focusing on operational efficiency, customer service, and sustainability will determine competitive success in this evolving market landscape.

Future success in Brazil’s rail freight transport market will depend on operators’ ability to adapt to changing market conditions, embrace technological innovation, and develop comprehensive service offerings that meet diverse customer requirements. The market’s continued evolution toward greater efficiency, reliability, and environmental sustainability positions it as a critical enabler of Brazil’s economic growth and international competitiveness in global commodity markets.

What is Brazil Rail Freight Transport?

Brazil Rail Freight Transport refers to the system of transporting goods and commodities via rail networks across Brazil. This mode of transport is crucial for moving bulk materials such as agricultural products, minerals, and manufactured goods efficiently over long distances.

What are the key companies in the Brazil Rail Freight Transport Market?

Key companies in the Brazil Rail Freight Transport Market include Rumo Logística, MRS Logística, and Vale S.A., which play significant roles in freight operations and logistics services, among others.

What are the main drivers of the Brazil Rail Freight Transport Market?

The main drivers of the Brazil Rail Freight Transport Market include the increasing demand for efficient logistics solutions, the growth of the agricultural sector, and the need for sustainable transport options to reduce road congestion.

What challenges does the Brazil Rail Freight Transport Market face?

Challenges in the Brazil Rail Freight Transport Market include infrastructure limitations, regulatory hurdles, and competition from road transport, which can affect service reliability and cost-effectiveness.

What opportunities exist in the Brazil Rail Freight Transport Market?

Opportunities in the Brazil Rail Freight Transport Market include investments in infrastructure modernization, the expansion of rail networks to underserved regions, and the potential for increased intermodal transport solutions.

What trends are shaping the Brazil Rail Freight Transport Market?

Trends shaping the Brazil Rail Freight Transport Market include the adoption of digital technologies for logistics management, a focus on sustainability initiatives, and the integration of rail transport with other modes of freight transport.

Brazil Rail Freight Transport Market

| Segmentation Details | Description |

|---|---|

| Type | Bulk Cargo, Containerized Cargo, Intermodal Transport, Refrigerated Goods |

| End User | Agriculture, Mining, Manufacturing, Retail |

| Service Type | Freight Forwarding, Logistics Management, Warehousing, Last-Mile Delivery |

| Technology | GPS Tracking, Automated Systems, IoT Solutions, Data Analytics |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Brazil Rail Freight Transport Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at