444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Brazil plastic packaging films market represents a dynamic and rapidly evolving sector within the country’s packaging industry, driven by increasing consumer demand, industrial growth, and technological advancements. Brazil’s position as Latin America’s largest economy has positioned it as a key market for plastic packaging films, with applications spanning food and beverage, pharmaceuticals, consumer goods, and industrial sectors. The market demonstrates robust growth potential with an estimated compound annual growth rate (CAGR) of 6.2% over the forecast period, reflecting the country’s expanding manufacturing base and rising consumer spending.

Market dynamics in Brazil are influenced by several factors including urbanization trends, changing lifestyle patterns, and the growing emphasis on product protection and shelf-life extension. The food packaging segment dominates the market, accounting for approximately 45% of total consumption, driven by Brazil’s significant agricultural production and food processing industry. Flexible packaging solutions have gained particular traction due to their cost-effectiveness, lightweight properties, and superior barrier characteristics compared to traditional packaging materials.

Technological innovations in plastic film manufacturing have enhanced product performance, with developments in multilayer films, biodegradable options, and smart packaging solutions gaining momentum. The market benefits from strong domestic production capabilities and established supply chains, while also facing challenges related to environmental sustainability and regulatory compliance. Regional distribution shows concentration in industrial hubs, with São Paulo and Rio de Janeiro states representing approximately 55% of market demand.

The Brazil plastic packaging films market refers to the comprehensive ecosystem encompassing the production, distribution, and consumption of thin plastic materials used for packaging applications across various industries within Brazil. These films are manufactured from different polymer resins including polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and other specialized materials, designed to provide protection, preservation, and presentation functions for packaged goods.

Plastic packaging films serve multiple critical functions including moisture barrier protection, oxygen resistance, mechanical strength, and visual appeal enhancement. The market encompasses various film types such as stretch films for pallet wrapping, shrink films for product bundling, barrier films for food preservation, and specialty films for specific industrial applications. Manufacturing processes include blown film extrusion, cast film extrusion, and co-extrusion techniques that enable the production of single-layer and multilayer film structures.

Market scope extends beyond basic packaging to include value-added features such as anti-static properties, UV protection, printability, and enhanced sealability. The definition also encompasses the entire value chain from raw material suppliers and film manufacturers to converters, brand owners, and end consumers, creating a complex network of stakeholders within Brazil’s packaging ecosystem.

Brazil’s plastic packaging films market demonstrates exceptional growth momentum, driven by the country’s expanding consumer base, industrial development, and increasing adoption of flexible packaging solutions. The market benefits from strong fundamentals including a large domestic market, established manufacturing infrastructure, and growing export capabilities. Key growth drivers include rising disposable incomes, urbanization trends, and the food industry’s expansion, which collectively contribute to sustained demand growth of approximately 6.2% annually.

Market segmentation reveals diverse applications across food and beverage packaging, pharmaceutical packaging, consumer goods, and industrial applications. The food packaging segment maintains market leadership due to Brazil’s position as a major agricultural producer and food exporter. Technological advancements in film manufacturing have enabled the development of high-performance materials with enhanced barrier properties, sustainability features, and cost optimization benefits.

Competitive dynamics feature a mix of multinational corporations and domestic players, with increasing focus on innovation, sustainability, and customer-specific solutions. Regional concentration in industrial centers provides advantages in terms of supply chain efficiency and market access. Future prospects remain positive, supported by ongoing industrialization, e-commerce growth, and increasing consumer awareness of packaging quality and convenience.

Strategic market insights reveal several critical trends shaping the Brazil plastic packaging films landscape. The market demonstrates strong resilience and adaptability, with manufacturers increasingly focusing on sustainable solutions and circular economy principles. Consumer preferences are shifting toward packaging that offers convenience, product protection, and environmental responsibility, driving innovation in biodegradable and recyclable film technologies.

Primary market drivers propelling the Brazil plastic packaging films market include robust economic fundamentals, demographic trends, and evolving consumer behaviors. Economic growth and rising disposable incomes have increased consumer spending on packaged goods, directly benefiting the packaging films industry. The country’s expanding middle class demonstrates growing preference for convenience foods, processed products, and branded goods that require sophisticated packaging solutions.

Industrial expansion across multiple sectors including food processing, pharmaceuticals, and consumer goods manufacturing has created sustained demand for packaging materials. Brazil’s position as a major agricultural producer and food exporter necessitates advanced packaging solutions to maintain product quality during transportation and storage. The food and beverage industry continues to drive significant demand, with fresh produce, meat processing, and dairy sectors requiring specialized barrier films.

Urbanization trends have transformed consumption patterns, with urban consumers increasingly relying on packaged and processed foods. E-commerce growth has created new packaging requirements, particularly for protective films used in shipping and logistics. Technological advancements in film manufacturing have enabled the development of high-performance materials that offer superior protection while reducing material usage, appealing to cost-conscious manufacturers and environmentally aware consumers.

Market restraints affecting the Brazil plastic packaging films industry include environmental concerns, regulatory pressures, and raw material price volatility. Environmental sustainability has become a significant challenge, with increasing consumer awareness and regulatory scrutiny regarding plastic waste and its environmental impact. Government initiatives promoting circular economy principles and waste reduction are creating pressure for industry transformation toward more sustainable packaging solutions.

Raw material costs represent a major constraint, with petroleum-based polymer prices subject to global oil market fluctuations. Currency volatility affects import costs for specialized additives and machinery, impacting overall production economics. Regulatory compliance requirements, particularly for food contact applications, necessitate significant investments in quality control systems and certification processes.

Competition from alternative packaging materials including paper-based solutions, biodegradable materials, and reusable packaging systems poses ongoing challenges. Infrastructure limitations in certain regions affect distribution efficiency and market penetration. Technical challenges in developing cost-effective sustainable alternatives while maintaining performance standards continue to constrain market growth in certain segments.

Significant market opportunities exist within the Brazil plastic packaging films sector, driven by emerging applications, technological innovations, and evolving consumer needs. Sustainable packaging solutions represent the most promising growth avenue, with increasing demand for biodegradable films, recyclable materials, and reduced-plastic alternatives. Bio-based polymers and compostable films offer substantial market potential as environmental consciousness continues to rise.

Smart packaging technologies present innovative opportunities, including films with embedded sensors, freshness indicators, and anti-counterfeiting features. E-commerce expansion creates demand for specialized protective films, tamper-evident packaging, and lightweight solutions that reduce shipping costs. Export market development offers growth potential, with Brazil’s competitive manufacturing costs and strategic location providing advantages in serving Latin American and global markets.

Agricultural packaging represents an underexplored opportunity, with Brazil’s massive agricultural sector requiring advanced films for crop protection, storage, and transportation. Pharmaceutical packaging growth driven by healthcare sector expansion and aging population demographics offers high-value market segments. Industrial applications including construction films, automotive packaging, and electronics protection present diversification opportunities beyond traditional consumer packaging markets.

Market dynamics in the Brazil plastic packaging films sector reflect complex interactions between supply-side factors, demand drivers, and external influences. Supply chain dynamics are characterized by vertical integration trends, with major players investing in upstream petrochemical capabilities and downstream converting operations. Demand patterns show seasonal variations aligned with agricultural cycles, holiday periods, and economic conditions.

Competitive dynamics feature intense price competition in commodity film segments, while specialty and high-performance films command premium pricing. Innovation cycles are accelerating, with companies investing approximately 3-5% of revenues in research and development activities. Market consolidation trends are evident, with larger players acquiring smaller specialized manufacturers to expand product portfolios and market reach.

Regulatory dynamics are evolving rapidly, with new environmental standards and food safety requirements influencing product development priorities. Customer dynamics show increasing sophistication, with brand owners demanding customized solutions, sustainability credentials, and supply chain transparency. Technology dynamics favor companies with advanced manufacturing capabilities and ability to develop next-generation packaging solutions.

Research methodology employed for analyzing the Brazil plastic packaging films market encompasses comprehensive primary and secondary research approaches. Primary research includes structured interviews with industry executives, manufacturers, suppliers, and key stakeholders across the value chain. Secondary research involves analysis of industry reports, government statistics, trade publications, and company financial statements to establish market foundations and validate findings.

Data collection methods include quantitative surveys, qualitative interviews, and observational studies of market trends and consumer behaviors. Market sizing employs multiple approaches including top-down analysis based on industry statistics and bottom-up calculations from company-level data. Forecasting models incorporate economic indicators, demographic trends, and industry-specific factors to project market growth trajectories.

Quality assurance measures include data triangulation, expert validation, and cross-verification of findings across multiple sources. Regional analysis methodology involves state-level data collection and analysis to understand geographic market variations. Competitive analysis employs structured frameworks to evaluate market positioning, strategic capabilities, and performance metrics of key industry participants.

Regional analysis of the Brazil plastic packaging films market reveals significant geographic concentration and varying growth patterns across different states and regions. Southeast region dominates market activity, accounting for approximately 60% of total consumption, driven by industrial concentration in São Paulo and Rio de Janeiro states. Manufacturing hubs in this region benefit from proximity to petrochemical complexes, transportation infrastructure, and major consumer markets.

South region represents the second-largest market, with strong agricultural and food processing industries driving demand for packaging films. Rio Grande do Sul and Santa Catarina states show particular strength in food packaging applications, supported by meat processing, dairy, and agricultural export industries. The region accounts for approximately 20% of market share and demonstrates steady growth aligned with agricultural production cycles.

Northeast region shows emerging growth potential, driven by industrial development initiatives and expanding consumer markets. Bahia and Pernambuco states are developing as regional manufacturing centers, supported by government incentives and infrastructure investments. Center-West region benefits from agricultural expansion, particularly in Mato Grosso state, where agribusiness growth drives demand for agricultural and food packaging films. North region remains a smaller market but shows growth potential linked to natural resource development and infrastructure improvements.

Competitive landscape in the Brazil plastic packaging films market features a diverse mix of multinational corporations, regional players, and specialized manufacturers. Market structure shows moderate concentration, with the top five players accounting for approximately 40% of market share, while numerous smaller companies serve niche segments and regional markets.

Competitive strategies emphasize innovation, sustainability, customer service, and operational efficiency. Market leaders invest heavily in research and development, advanced manufacturing technologies, and strategic partnerships to maintain competitive advantages.

Market segmentation of the Brazil plastic packaging films industry reveals diverse applications and product categories serving different end-user requirements. By material type, the market encompasses polyethylene (PE) films, polypropylene (PP) films, polyethylene terephthalate (PET) films, and specialty polymer films, each offering distinct performance characteristics and cost profiles.

By application:

By technology:

Food packaging category dominates the Brazil plastic packaging films market, representing the largest consumption segment with diverse applications across fresh produce, meat processing, dairy products, and processed foods. Fresh produce packaging benefits from Brazil’s position as a major agricultural exporter, requiring films that extend shelf life and maintain product quality during transportation. Meat packaging applications demand high-barrier films with excellent oxygen and moisture protection properties.

Pharmaceutical packaging category shows strong growth potential, driven by Brazil’s expanding healthcare sector and aging population demographics. Drug packaging requires specialized films with superior barrier properties, tamper-evidence features, and regulatory compliance. Medical device packaging represents a high-value segment with stringent quality requirements and growth opportunities in the domestic and export markets.

Industrial packaging category encompasses diverse applications including construction films, automotive packaging, and electronics protection. Construction films benefit from infrastructure development and building activity growth. Agricultural films represent an emerging category with applications in crop protection, greenhouse covering, and storage solutions, leveraging Brazil’s massive agricultural sector.

Industry participants in the Brazil plastic packaging films market enjoy numerous strategic advantages and growth opportunities. Manufacturers benefit from access to a large domestic market, competitive raw material costs, and established supply chain infrastructure. Cost advantages stem from proximity to petrochemical feedstock sources and relatively low labor costs compared to developed markets.

Market access benefits include serving both domestic demand and export opportunities to neighboring Latin American countries. Diversification opportunities allow companies to serve multiple end-user segments and reduce dependence on any single market vertical. Innovation advantages emerge from collaboration with research institutions and access to emerging technologies in sustainable packaging solutions.

Stakeholder benefits extend throughout the value chain:

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the Brazil plastic packaging films industry reflect evolving consumer preferences, technological advancements, and sustainability imperatives. Sustainability trend represents the most significant development, with increasing adoption of recyclable materials, bio-based polymers, and circular economy principles. Biodegradable films are gaining traction, particularly in food packaging applications where environmental impact concerns are highest.

Smart packaging trends include integration of sensors, freshness indicators, and interactive features that enhance consumer experience and product safety. Lightweighting initiatives focus on reducing material usage while maintaining performance, driven by cost optimization and environmental considerations. Customization trends show increasing demand for tailored solutions that meet specific customer requirements and brand differentiation needs.

Digital transformation trends encompass automation in manufacturing processes, digital printing capabilities, and supply chain digitization. E-commerce packaging trends emphasize protective properties, tamper-evidence, and unboxing experience enhancement. Barrier technology trends focus on developing high-performance films with enhanced oxygen, moisture, and light protection properties for extended shelf life applications.

Recent industry developments in the Brazil plastic packaging films market demonstrate dynamic innovation and strategic evolution. Capacity expansion projects by major manufacturers reflect confidence in market growth prospects and increasing demand. Technology investments focus on advanced extrusion equipment, multilayer film capabilities, and sustainable material development.

Strategic partnerships between film manufacturers and brand owners are increasing, aimed at developing customized packaging solutions and ensuring supply chain security. Acquisition activities show consolidation trends, with larger companies acquiring specialized manufacturers to expand product portfolios and market reach. Research collaborations with universities and research institutions are advancing sustainable packaging technologies and bio-based material development.

Regulatory developments include new environmental standards, food safety requirements, and extended producer responsibility programs that influence industry practices. Export initiatives by Brazilian manufacturers are expanding market reach to neighboring countries and global markets. Sustainability certifications and eco-labeling programs are becoming increasingly important for market differentiation and customer acceptance.

Industry analysts recommend strategic approaches for success in the Brazil plastic packaging films market. MarkWide Research analysis suggests that companies should prioritize sustainability initiatives, investing in biodegradable and recyclable film technologies to address environmental concerns and regulatory requirements. Innovation investment in smart packaging solutions and advanced barrier technologies will provide competitive differentiation and premium pricing opportunities.

Market expansion strategies should focus on underserved segments including pharmaceutical packaging, agricultural applications, and e-commerce packaging solutions. Operational excellence through automation, quality improvement, and supply chain optimization will enhance competitiveness in price-sensitive market segments. Strategic partnerships with key customers and suppliers can provide market stability and growth opportunities.

Export development represents a significant opportunity, with Brazilian manufacturers well-positioned to serve Latin American markets through competitive costs and strategic location advantages. Talent development in technical and sustainability expertise will be crucial for long-term success. Digital transformation initiatives should encompass manufacturing processes, customer engagement, and supply chain management to improve efficiency and responsiveness.

Future outlook for the Brazil plastic packaging films market remains positive, supported by strong fundamentals and emerging growth opportunities. Market growth is projected to continue at a healthy pace, driven by economic development, population growth, and evolving consumer preferences. Sustainability transformation will reshape the industry, with increasing adoption of eco-friendly materials and circular economy practices becoming standard rather than exceptional.

Technology evolution will enable development of next-generation packaging solutions with enhanced performance, reduced environmental impact, and smart functionality. Market diversification into new applications and end-user segments will provide growth opportunities beyond traditional food packaging. Export growth potential remains significant, with Brazilian manufacturers positioned to capture increasing regional and global market share.

Investment opportunities will focus on sustainable technology development, capacity expansion in high-growth segments, and digital transformation initiatives. Regulatory evolution will continue to influence industry practices, creating both challenges and opportunities for companies that proactively adapt to changing requirements. MWR projections indicate sustained market expansion with growth rates of approximately 6-8% annually over the next five years, reflecting the sector’s resilience and adaptation capabilities.

Brazil plastic packaging films market represents a dynamic and evolving industry with significant growth potential and strategic importance within the country’s manufacturing sector. Market fundamentals remain strong, supported by a large domestic market, competitive manufacturing capabilities, and diverse application opportunities across food, pharmaceutical, and industrial segments. The industry demonstrates resilience and adaptability in addressing environmental challenges while maintaining growth momentum and market expansion.

Strategic priorities for industry participants include sustainability transformation, innovation development, and market diversification to capture emerging opportunities. Competitive advantages stem from Brazil’s raw material access, manufacturing infrastructure, and strategic location for serving regional markets. Future success will depend on companies’ ability to balance growth objectives with environmental responsibility, technological advancement, and customer satisfaction.

Long-term prospects remain favorable, with the Brazil plastic packaging films market positioned to benefit from continued economic development, industrial expansion, and evolving consumer needs. The industry’s transformation toward sustainable practices and advanced technologies will create new value propositions and market opportunities, ensuring continued relevance and growth in Brazil’s packaging ecosystem.

What is Plastic Packaging Films?

Plastic packaging films are thin layers of plastic used for wrapping and protecting products. They are commonly used in various applications such as food packaging, medical supplies, and consumer goods.

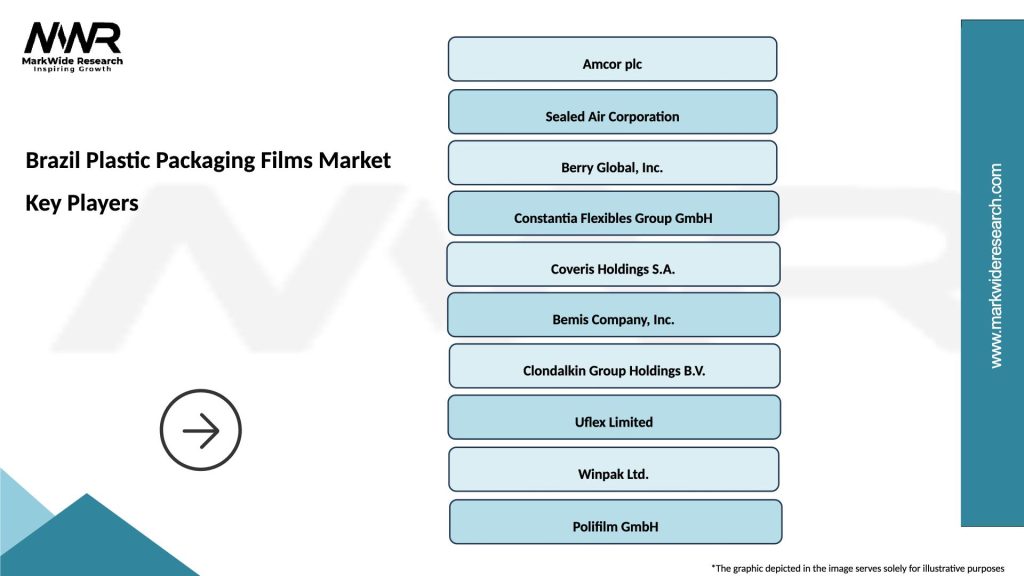

What are the key players in the Brazil Plastic Packaging Films Market?

Key players in the Brazil Plastic Packaging Films Market include Amcor, Sealed Air Corporation, and Berry Global, among others. These companies are known for their innovative packaging solutions and extensive product offerings.

What are the main drivers of the Brazil Plastic Packaging Films Market?

The main drivers of the Brazil Plastic Packaging Films Market include the growing demand for convenient packaging solutions, the rise in e-commerce, and the increasing focus on food safety and preservation.

What challenges does the Brazil Plastic Packaging Films Market face?

The Brazil Plastic Packaging Films Market faces challenges such as environmental concerns regarding plastic waste, regulatory pressures for sustainable packaging, and competition from alternative materials.

What opportunities exist in the Brazil Plastic Packaging Films Market?

Opportunities in the Brazil Plastic Packaging Films Market include the development of biodegradable films, advancements in recycling technologies, and the increasing demand for customized packaging solutions.

What trends are shaping the Brazil Plastic Packaging Films Market?

Trends shaping the Brazil Plastic Packaging Films Market include the shift towards sustainable packaging, the integration of smart packaging technologies, and the growing popularity of flexible packaging formats.

Brazil Plastic Packaging Films Market

| Segmentation Details | Description |

|---|---|

| Product Type | Stretch Films, Shrink Films, Barrier Films, Rigid Films |

| Application | Food Packaging, Medical Packaging, Industrial Packaging, Consumer Goods Packaging |

| Material | Polyethylene, Polypropylene, Polyvinyl Chloride, Biodegradable Plastics |

| End User | Food & Beverage, Pharmaceuticals, Electronics, Personal Care |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Brazil Plastic Packaging Films Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at