444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Brazil optical transceiver market represents a dynamic and rapidly evolving segment within the country’s telecommunications infrastructure landscape. Optical transceivers serve as critical components in modern data communication networks, enabling high-speed data transmission across fiber optic cables in various applications ranging from data centers to telecommunications networks. Brazil’s strategic position as Latin America’s largest economy has positioned the country as a significant market for advanced optical communication technologies.

Market dynamics in Brazil are driven by the country’s ongoing digital transformation initiatives, increasing demand for high-speed internet connectivity, and substantial investments in telecommunications infrastructure. The market demonstrates robust growth potential, with industry analysts projecting a compound annual growth rate (CAGR) of 12.5% over the forecast period. This growth trajectory reflects Brazil’s commitment to modernizing its digital infrastructure and meeting the evolving connectivity demands of businesses and consumers.

Key market segments include data center applications, telecommunications networks, enterprise networking solutions, and emerging 5G infrastructure deployments. The Brazilian market exhibits strong demand for various transceiver types, including SFP, SFP+, QSFP, and CFP modules, with increasing adoption of higher-speed variants to support bandwidth-intensive applications. Regional distribution shows concentrated activity in major metropolitan areas, with São Paulo, Rio de Janeiro, and Brasília leading market adoption at approximately 45% of total market share.

The Brazil optical transceiver market refers to the comprehensive ecosystem encompassing the development, manufacturing, distribution, and deployment of optical transceiver modules within Brazil’s telecommunications and data communication infrastructure. Optical transceivers are sophisticated electronic devices that convert electrical signals into optical signals for transmission over fiber optic cables and vice versa, enabling high-speed, long-distance data communication with minimal signal degradation.

These devices serve as fundamental building blocks in modern network architectures, facilitating seamless data transmission across various network topologies including metropolitan area networks (MANs), wide area networks (WANs), and local area networks (LANs). The Brazilian market encompasses multiple transceiver form factors, transmission speeds, and wavelength specifications designed to meet diverse application requirements across different industry verticals.

Market scope includes both domestic consumption and regional distribution activities, with Brazil serving as a strategic hub for optical transceiver deployment across South America. The market definition encompasses various stakeholder categories including equipment manufacturers, system integrators, telecommunications service providers, data center operators, and enterprise customers seeking advanced optical communication solutions.

Brazil’s optical transceiver market demonstrates exceptional growth momentum driven by accelerating digital transformation initiatives and expanding telecommunications infrastructure investments. The market benefits from strong government support for broadband expansion programs and increasing private sector investments in data center development and network modernization projects.

Key growth drivers include the rapid expansion of cloud computing services, increasing demand for high-definition video streaming, growing adoption of Internet of Things (IoT) applications, and the ongoing deployment of 5G networks across major Brazilian cities. These factors collectively contribute to sustained demand for high-performance optical transceiver solutions capable of supporting bandwidth-intensive applications.

Market segmentation reveals strong performance across multiple application areas, with data center applications accounting for approximately 38% of market demand, followed by telecommunications infrastructure at 32% market share. Enterprise networking solutions and emerging 5G applications represent rapidly growing segments with significant future potential.

Competitive landscape features a mix of international technology leaders and regional solution providers, creating a dynamic market environment characterized by continuous innovation and competitive pricing strategies. The market outlook remains highly positive, supported by favorable regulatory policies, increasing foreign investment, and Brazil’s strategic importance in the regional telecommunications ecosystem.

Strategic market insights reveal several critical trends shaping Brazil’s optical transceiver landscape. The market demonstrates strong alignment with global technology trends while addressing specific regional requirements and challenges unique to the Brazilian telecommunications environment.

Primary market drivers propelling Brazil’s optical transceiver market growth encompass a diverse range of technological, economic, and regulatory factors that collectively create favorable conditions for market expansion and innovation.

Digital transformation initiatives across Brazilian enterprises and government organizations represent a fundamental driver, with organizations investing heavily in network infrastructure upgrades to support cloud migration, digital services, and remote work capabilities. This transformation requires high-performance optical transceivers capable of handling increased data volumes and ensuring reliable connectivity.

5G network deployment constitutes another significant growth catalyst, with Brazilian telecommunications operators investing substantially in next-generation wireless infrastructure. The deployment of 5G networks requires extensive fiber optic backhaul networks equipped with advanced optical transceivers to support the high-speed, low-latency requirements of 5G applications.

Data center expansion across Brazil drives substantial demand for optical transceivers, with hyperscale data centers, colocation facilities, and edge computing deployments requiring high-density, high-speed optical connectivity solutions. The growth of cloud services and digital content delivery networks further amplifies this demand.

Government broadband initiatives including the National Broadband Plan and rural connectivity programs create sustained demand for optical communication infrastructure, directly benefiting the transceiver market through large-scale network deployment projects.

Market restraints affecting Brazil’s optical transceiver market include several challenges that may impact growth momentum and market development across different segments and applications.

Economic volatility and currency fluctuations present ongoing challenges for market participants, particularly affecting import costs for international transceiver manufacturers and creating pricing pressures that may impact adoption rates among cost-sensitive customer segments.

Technical complexity associated with optical transceiver deployment and integration requires specialized expertise that may be limited in certain regions, potentially slowing adoption rates and increasing implementation costs for end-users seeking advanced optical communication solutions.

Regulatory compliance requirements and certification processes can create barriers for new market entrants and may extend time-to-market for innovative transceiver solutions, particularly affecting smaller vendors and specialized technology providers.

Infrastructure limitations in certain regions of Brazil, including limited fiber optic network coverage and power infrastructure constraints, may restrict market expansion opportunities and limit the addressable market for high-performance optical transceivers.

Competition from alternative technologies including wireless solutions and copper-based systems may limit market growth in specific applications where optical transceivers face cost or complexity disadvantages compared to alternative connectivity solutions.

Significant market opportunities exist within Brazil’s optical transceiver landscape, driven by emerging applications, technological advancements, and evolving customer requirements across multiple industry verticals.

Edge computing deployment presents substantial growth opportunities as organizations implement distributed computing architectures requiring high-speed optical connectivity between edge locations and central data centers. This trend creates demand for compact, cost-effective transceiver solutions optimized for edge applications.

Industrial automation and Industry 4.0 initiatives across Brazilian manufacturing sectors create new market opportunities for ruggedized optical transceivers capable of operating in harsh industrial environments while providing reliable, high-speed connectivity for automated systems and IoT applications.

Smart city initiatives in major Brazilian metropolitan areas offer opportunities for optical transceiver deployment in intelligent transportation systems, public safety networks, and municipal broadband infrastructure projects that require robust optical communication solutions.

Healthcare digitization accelerated by recent global events creates opportunities for optical transceivers in telemedicine applications, hospital network infrastructure, and medical device connectivity solutions that demand reliable, high-bandwidth communication capabilities.

Educational technology expansion driven by distance learning requirements and digital classroom initiatives presents opportunities for optical transceiver deployment in educational institution networks and e-learning infrastructure projects across Brazil.

Market dynamics within Brazil’s optical transceiver sector reflect the complex interplay of technological innovation, competitive pressures, regulatory influences, and evolving customer demands that collectively shape market evolution and growth trajectories.

Technology advancement cycles drive continuous market evolution, with manufacturers regularly introducing higher-speed, more efficient transceiver solutions that enable new applications and improve network performance. The transition from 10G to 100G and beyond represents a significant dynamic affecting market demand patterns and competitive positioning.

Supply chain considerations play an increasingly important role in market dynamics, with global component shortages and logistics challenges affecting product availability and pricing strategies. Brazilian market participants are developing more resilient supply chain strategies to mitigate these challenges.

Customer behavior evolution shows increasing sophistication in transceiver selection criteria, with buyers focusing on total cost of ownership, energy efficiency, and long-term compatibility rather than solely on initial purchase price. This shift influences vendor strategies and product development priorities.

Competitive intensity continues to increase as new market entrants challenge established players, leading to innovation acceleration and improved value propositions for end customers. Market share distribution shows approximately 60% concentration among the top five vendors, indicating a moderately consolidated market structure.

Comprehensive research methodology employed for analyzing Brazil’s optical transceiver market incorporates multiple data collection and analysis techniques to ensure accurate, reliable, and actionable market insights for stakeholders across the value chain.

Primary research activities include extensive interviews with key market participants including transceiver manufacturers, system integrators, telecommunications service providers, data center operators, and enterprise end-users. These interviews provide firsthand insights into market trends, challenges, and opportunities from multiple stakeholder perspectives.

Secondary research encompasses analysis of industry reports, company financial statements, regulatory filings, trade association publications, and technical specifications to develop comprehensive understanding of market structure, competitive landscape, and technology trends affecting the Brazilian market.

Market sizing methodology utilizes bottom-up and top-down approaches, analyzing demand patterns across different application segments, regional markets, and customer categories to develop accurate market assessments and growth projections.

Data validation processes include cross-referencing multiple information sources, conducting follow-up interviews with key respondents, and applying statistical analysis techniques to ensure data accuracy and reliability throughout the research process.

Regional market analysis reveals significant variations in optical transceiver adoption patterns, growth rates, and market characteristics across different Brazilian states and metropolitan areas, reflecting diverse economic conditions, infrastructure development levels, and industry concentrations.

Southeast Region dominates the Brazilian optical transceiver market, accounting for approximately 52% of total market demand. São Paulo and Rio de Janeiro metropolitan areas lead adoption due to high concentrations of data centers, telecommunications infrastructure, and enterprise customers requiring advanced optical communication solutions.

Southern Region demonstrates strong growth momentum with 18% market share, driven by industrial automation initiatives, technology sector development, and increasing investments in telecommunications infrastructure across Rio Grande do Sul, Santa Catarina, and Paraná states.

Northeast Region shows emerging market potential with 15% market share, supported by government broadband expansion programs, tourism industry digitization, and growing technology sector presence in cities like Recife and Salvador.

Central-West Region including Brasília represents 10% of market demand, primarily driven by government network infrastructure projects and agribusiness sector digitization initiatives that require reliable optical communication solutions.

Northern Region accounts for 5% market share but demonstrates significant growth potential as infrastructure development programs expand fiber optic network coverage and digital services access across the Amazon region.

Competitive landscape in Brazil’s optical transceiver market features a diverse mix of international technology leaders, regional solution providers, and emerging market entrants competing across multiple dimensions including technology innovation, pricing strategies, and customer service capabilities.

Market competition intensifies through continuous technology innovation, strategic partnerships with local system integrators, and customized solutions development addressing specific Brazilian market requirements and regulatory compliance needs.

Market segmentation analysis reveals distinct demand patterns and growth characteristics across various categories, enabling targeted strategies for different customer segments and application areas within Brazil’s optical transceiver market.

By Form Factor:

By Data Rate:

By Application:

Category-wise analysis provides detailed insights into specific market segments, revealing unique characteristics, growth drivers, and competitive dynamics that influence adoption patterns and market development within Brazil’s optical transceiver landscape.

Data Center Category represents the largest and fastest-growing segment, driven by hyperscale cloud providers, colocation facilities, and enterprise data centers upgrading to higher-speed connectivity solutions. This category demonstrates strong demand for 100G and 400G transceivers with emphasis on power efficiency and density optimization.

Telecommunications Category encompasses service provider networks, mobile backhaul infrastructure, and core network applications requiring reliable, high-performance optical transceivers. Growth in this category is driven by 5G deployment, network capacity expansion, and infrastructure modernization initiatives.

Enterprise Networking Category shows increasing sophistication as organizations implement campus networks, wide area networks, and hybrid cloud connectivity solutions requiring advanced optical transceiver capabilities. This segment demonstrates growing demand for cost-effective, easy-to-deploy solutions.

Industrial Applications Category emerges as a high-potential segment with manufacturing facilities, utility companies, and transportation systems implementing optical communication solutions for automation, monitoring, and control applications requiring ruggedized transceiver designs.

Government and Public Sector Category includes federal, state, and municipal network infrastructure projects requiring optical transceivers for broadband expansion, smart city initiatives, and public safety communication systems.

Industry participants and stakeholders across Brazil’s optical transceiver value chain realize significant benefits from market participation, technological advancement, and strategic positioning within this dynamic and growing market segment.

Equipment Manufacturers benefit from expanding market opportunities, diversified revenue streams, and the ability to leverage Brazil as a regional hub for Latin American market penetration. The growing market provides opportunities for volume scaling, cost optimization, and technology innovation development.

System Integrators gain access to comprehensive solution portfolios, technical expertise development opportunities, and expanded customer relationships across multiple industry verticals. The market growth enables service expansion and specialization in high-value optical communication solutions.

Telecommunications Service Providers achieve network performance improvements, operational cost reductions, and enhanced service delivery capabilities through advanced optical transceiver deployment. These benefits enable competitive differentiation and revenue growth opportunities.

Enterprise Customers realize improved network performance, reduced operational costs, and enhanced business continuity through reliable optical communication infrastructure. The technology enables digital transformation initiatives and competitive advantage development.

Technology Partners benefit from ecosystem collaboration opportunities, joint solution development initiatives, and market access facilitation through strategic partnerships with established market participants.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping Brazil’s optical transceiver landscape reflect global technology evolution, regional market characteristics, and emerging application requirements that influence product development, competitive strategies, and market growth patterns.

Speed Migration Trend shows accelerating adoption of higher-speed transceiver solutions, with organizations upgrading from 10G to 100G and beyond to support bandwidth-intensive applications including cloud services, video streaming, and data analytics platforms.

Miniaturization Trend drives demand for compact, high-density optical transceiver solutions that enable space-efficient network designs while maintaining performance standards. This trend particularly affects data center and enterprise networking applications.

Energy Efficiency Trend reflects growing emphasis on power consumption optimization, with customers prioritizing energy-efficient transceiver designs that reduce operational costs and support sustainability initiatives across various application segments.

Integration Trend shows increasing demand for integrated optical communication solutions that combine transceivers with additional functionality including monitoring, management, and diagnostic capabilities for simplified deployment and operation.

Customization Trend reveals growing customer requirements for application-specific transceiver solutions tailored to unique operating environments, performance requirements, and integration constraints across different industry verticals.

Cost Optimization Trend demonstrates market pressure for cost-effective solutions without performance compromise, driving innovation in manufacturing processes, component integration, and supply chain optimization strategies.

Recent industry developments within Brazil’s optical transceiver market demonstrate the dynamic nature of technological advancement, strategic partnerships, and market expansion initiatives that shape competitive positioning and growth opportunities.

Technology Innovation developments include the introduction of 400G and 800G transceiver solutions by leading manufacturers, enabling next-generation network architectures and supporting emerging applications requiring ultra-high-speed connectivity capabilities.

Strategic Partnerships between international transceiver manufacturers and Brazilian system integrators create enhanced local market presence, improved customer support capabilities, and customized solution development addressing specific regional requirements.

Manufacturing Investments include establishment of local assembly and testing facilities by major vendors, reducing supply chain complexity and improving responsiveness to Brazilian market demands while supporting local economic development.

Standards Development activities involve Brazilian participation in international optical communication standards organizations, ensuring compatibility with global technology trends while addressing specific regional requirements and applications.

Certification Programs launched by industry associations and educational institutions develop local technical expertise in optical transceiver technologies, supporting market growth through improved implementation capabilities and customer support services.

Sustainability Initiatives include development of environmentally responsible transceiver designs, recycling programs, and energy-efficient solutions addressing growing customer emphasis on corporate social responsibility and environmental stewardship.

Strategic recommendations from MarkWide Research analysis provide actionable insights for market participants seeking to optimize their positioning, growth strategies, and competitive advantages within Brazil’s evolving optical transceiver market landscape.

Market Entry Strategy recommendations emphasize the importance of local partnership development, regulatory compliance preparation, and customized solution offerings that address specific Brazilian market requirements and customer preferences.

Technology Investment suggestions focus on higher-speed transceiver development, energy efficiency optimization, and integration capabilities that align with emerging market trends and customer demands across different application segments.

Customer Engagement recommendations include enhanced technical support services, local presence establishment, and educational program development that build customer relationships and support successful technology adoption.

Supply Chain Optimization strategies involve local sourcing development, inventory management improvement, and logistics efficiency enhancement to ensure reliable product availability and competitive pricing in the Brazilian market.

Competitive Differentiation approaches emphasize unique value proposition development, specialized solution offerings, and customer service excellence that create sustainable competitive advantages in an increasingly competitive market environment.

Market Expansion recommendations include regional market penetration strategies, application diversification initiatives, and strategic acquisition opportunities that accelerate growth and market share development.

Future market outlook for Brazil’s optical transceiver sector remains highly positive, supported by continued digital transformation momentum, infrastructure investment growth, and emerging technology adoption across multiple industry verticals and application areas.

Growth trajectory projections indicate sustained market expansion with compound annual growth rates exceeding 12% over the next five years, driven by 5G network deployment, data center expansion, and enterprise network modernization initiatives across Brazil’s major metropolitan areas and emerging regional markets.

Technology evolution will continue toward higher-speed solutions, with 400G and 800G transceivers gaining significant market traction while emerging technologies including coherent optics and silicon photonics create new market opportunities and application possibilities.

Market maturation will bring increased customer sophistication, standardization of deployment practices, and enhanced competitive dynamics that benefit end-users through improved product offerings, competitive pricing, and comprehensive support services.

Regional expansion opportunities will emerge as infrastructure development programs extend fiber optic network coverage to underserved areas, creating new market segments and growth opportunities for optical transceiver deployment across Brazil’s diverse geographic regions.

Application diversification will continue with emerging use cases in industrial automation, smart city infrastructure, healthcare technology, and educational networks creating additional demand drivers and market expansion opportunities beyond traditional telecommunications and data center applications.

Brazil’s optical transceiver market represents a compelling growth opportunity characterized by strong fundamentals, favorable market dynamics, and significant expansion potential across multiple application segments and regional markets. The market benefits from Brazil’s position as Latin America’s largest economy, substantial government support for digital infrastructure development, and accelerating adoption of advanced optical communication technologies.

Key success factors for market participants include strategic local partnerships, technology innovation focus, customer-centric solution development, and comprehensive understanding of Brazilian market requirements and regulatory environment. The market rewards vendors who demonstrate commitment to local market development through investments in technical support, customized solutions, and long-term customer relationships.

Market outlook remains highly positive with sustained growth expected across all major segments, driven by 5G deployment, data center expansion, enterprise digital transformation, and emerging applications in industrial automation and smart city initiatives. The Brazil optical transceiver market is well-positioned to capitalize on these trends while serving as a strategic hub for broader Latin American market development and expansion opportunities.

What is Optical Transceiver?

An optical transceiver is a device that combines a transmitter and a receiver into a single module, enabling the transmission and reception of data over optical fiber. These devices are essential in telecommunications, data centers, and high-speed networking applications.

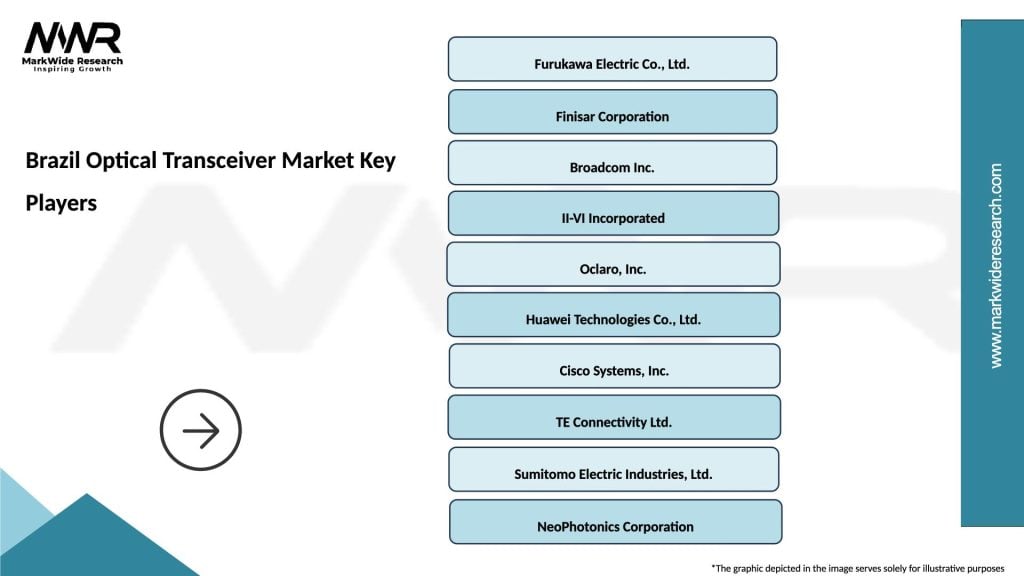

What are the key players in the Brazil Optical Transceiver Market?

Key players in the Brazil Optical Transceiver Market include companies like Finisar Corporation, Lumentum Holdings, and Cisco Systems, which are known for their innovative optical communication solutions and products, among others.

What are the growth factors driving the Brazil Optical Transceiver Market?

The Brazil Optical Transceiver Market is driven by the increasing demand for high-speed internet, the expansion of data centers, and the growth of cloud computing services. Additionally, the rise in mobile data traffic and the need for efficient communication networks contribute to market growth.

What challenges does the Brazil Optical Transceiver Market face?

Challenges in the Brazil Optical Transceiver Market include the high cost of advanced optical components and the rapid technological changes that require continuous innovation. Additionally, competition from alternative technologies can hinder market growth.

What opportunities exist in the Brazil Optical Transceiver Market?

Opportunities in the Brazil Optical Transceiver Market include the increasing adoption of 5G technology, which requires advanced optical transceivers for enhanced connectivity. Furthermore, the growing trend of smart cities and IoT applications presents new avenues for market expansion.

What trends are shaping the Brazil Optical Transceiver Market?

Trends in the Brazil Optical Transceiver Market include the shift towards higher data rates and the development of compact, energy-efficient transceivers. Additionally, the integration of artificial intelligence in network management is becoming increasingly prevalent.

Brazil Optical Transceiver Market

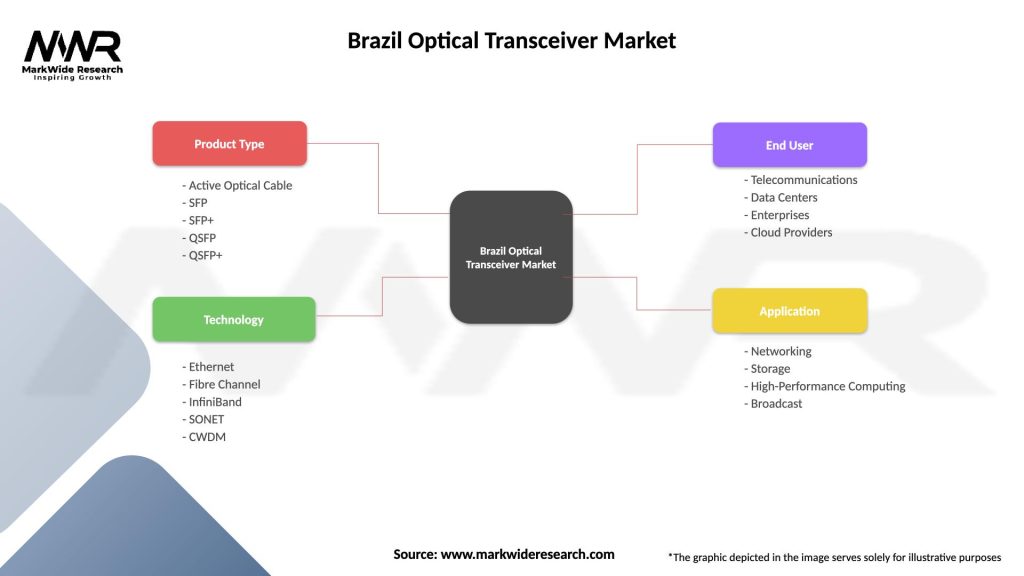

| Segmentation Details | Description |

|---|---|

| Product Type | Active Optical Cable, SFP, SFP+, QSFP, QSFP+ |

| Technology | Ethernet, Fibre Channel, InfiniBand, SONET, CWDM |

| End User | Telecommunications, Data Centers, Enterprises, Cloud Providers |

| Application | Networking, Storage, High-Performance Computing, Broadcast |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Brazil Optical Transceiver Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at