444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

Brazil is a prominent player in the global oil and gas industry, and its midstream market plays a crucial role in the country’s energy sector. The midstream sector encompasses various activities involved in the transportation, storage, and distribution of oil and gas products. It acts as a bridge between the upstream exploration and production activities and the downstream refining and marketing processes. The Brazil oil and gas midstream market is a dynamic and evolving sector, constantly adapting to the changing needs of the industry.

Meaning

The term “midstream” in the context of the oil and gas industry refers to the infrastructure and logistics involved in the transportation, storage, and distribution of petroleum products. It includes pipelines, storage terminals, tankers, and other facilities that facilitate the movement of oil and gas from production sites to refineries, distribution centers, and end consumers. The midstream sector plays a critical role in ensuring the efficient and reliable supply of oil and gas products.

Executive Summary

The Brazil oil and gas midstream market is witnessing steady growth due to the country’s significant oil and gas reserves and its strategic location as a major exporter. The market offers lucrative opportunities for industry participants and stakeholders involved in various midstream activities. However, it also faces challenges such as regulatory constraints, environmental concerns, and infrastructure limitations. Despite these challenges, the Brazil oil and gas midstream market is expected to grow steadily in the coming years, driven by increasing demand for energy and favorable government policies.

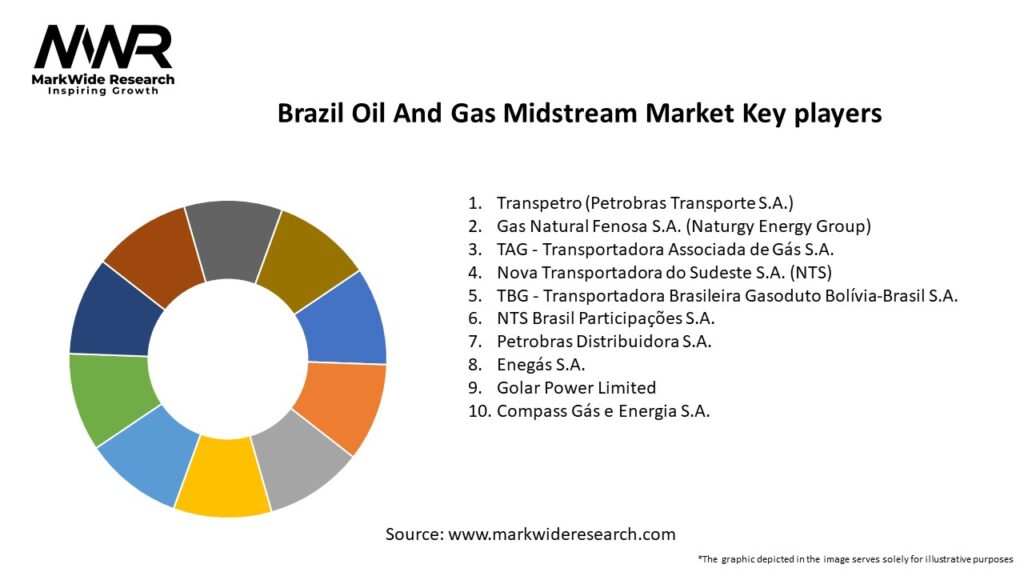

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Several key factors are driving the growth of the Brazil oil and gas midstream market:

Market Restraints

Despite the positive growth prospects, the Brazil oil and gas midstream market faces certain challenges:

Market Opportunities

The Brazil oil and gas midstream market offers several opportunities for industry participants and stakeholders:

Market Dynamics

The Brazil oil and gas midstream market is influenced by various dynamic factors:

Regional Analysis

The Brazil oil and gas midstream market exhibits regional variations due to the country’s diverse geography and resource distribution. The offshore pre-salt fields, located primarily in the southeastern and northeastern regions, require extensive midstream infrastructure to transport the extracted resources. The northern and western regions, with their onshore oil and gas reserves, also contribute to the demand for midstream services. Furthermore, the southern region, including the state of Rio Grande do Sul, is a significant hub for refining and petrochemical industries, driving midstream activities in the area.

Competitive Landscape

Leading Companies in the Brazil Oil and Gas Midstream Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

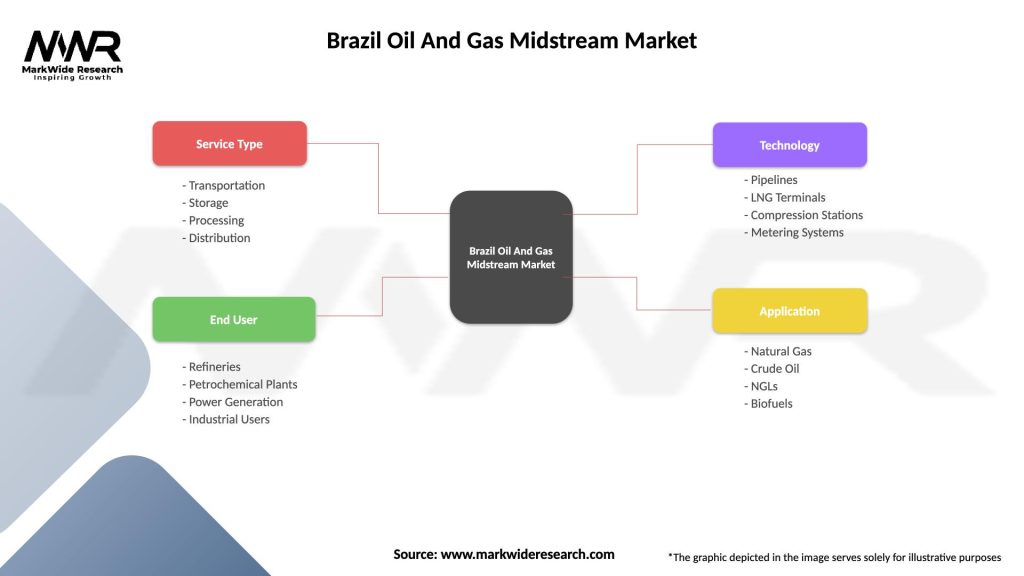

Segmentation

The Brazil oil and gas midstream market can be segmented based on various factors, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The Brazil oil and gas midstream market offers several benefits for industry participants and stakeholders:

SWOT Analysis

A SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis provides insights into the internal and external factors that impact the Brazil oil and gas midstream market:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

The Brazil oil and gas midstream market is influenced by several key trends:

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the Brazil oil and gas midstream market. The crisis led to a sharp decline in oil prices and reduced energy demand due to lockdowns and economic slowdown. This resulted in production cuts and project delays across the industry. However, as the global economy recovers and energy demand rebounds, the midstream market is expected to regain momentum. The pandemic has also highlighted the importance of operational resilience, remote monitoring, and digitalization in the midstream sector.

Key Industry Developments

The Brazil oil and gas midstream market has witnessed several key industry developments:

Analyst Suggestions

Based on the market analysis, analysts suggest the following strategies for industry participants and stakeholders in the Brazil oil and gas midstream market:

Future Outlook

The future outlook for the Brazil oil and gas midstream market is optimistic. The country’s vast oil and gas reserves, growing energy demand, and strategic location position it favorably for midstream infrastructure development. Despite challenges such as regulatory constraints and environmental concerns, investments in pipeline networks, storage terminals, and port facilities are expected to drive the market growth. The integration of renewable energy sources and the adoption of digital technologies will shape the future of the midstream sector, enabling a sustainable and efficient energy infrastructure.

Conclusion

The Brazil oil and gas midstream market is a critical component of the country’s energy sector, facilitating the transportation, storage, and distribution of oil and gas products. The market offers opportunities for infrastructure development, technological advancements, and sustainability practices. While facing challenges such as regulatory constraints and infrastructure limitations, the market is expected to grow steadily due to expanding reserves, favorable government policies, and increasing energy demand. Collaboration, innovation, environmental sustainability, and stakeholder engagement are key strategies for industry participants to thrive in the evolving midstream landscape. With a positive future outlook, the Brazil oil and gas midstream market is poised for continued growth and transformation.

What is Oil And Gas Midstream?

Oil And Gas Midstream refers to the sector involved in the transportation, storage, and processing of oil and gas products. This includes pipelines, terminals, and processing facilities that connect upstream production with downstream distribution.

What are the key players in the Brazil Oil And Gas Midstream Market?

Key players in the Brazil Oil And Gas Midstream Market include Petrobras, Transpetro, and Nova Transportadora do Sudeste. These companies are involved in various aspects of midstream operations, such as pipeline transportation and storage solutions, among others.

What are the growth factors driving the Brazil Oil And Gas Midstream Market?

The Brazil Oil And Gas Midstream Market is driven by increasing energy demand, investments in infrastructure, and the expansion of offshore oil production. Additionally, government policies promoting energy security and sustainability are contributing to market growth.

What challenges does the Brazil Oil And Gas Midstream Market face?

The Brazil Oil And Gas Midstream Market faces challenges such as regulatory hurdles, environmental concerns, and fluctuating oil prices. These factors can impact investment decisions and operational efficiency within the sector.

What opportunities exist in the Brazil Oil And Gas Midstream Market?

Opportunities in the Brazil Oil And Gas Midstream Market include the development of new pipeline projects, advancements in technology for efficient transportation, and the potential for increased foreign investment. The shift towards renewable energy sources also presents avenues for innovation.

What trends are shaping the Brazil Oil And Gas Midstream Market?

Trends in the Brazil Oil And Gas Midstream Market include the adoption of digital technologies for monitoring and management, a focus on sustainability practices, and the integration of renewable energy solutions. These trends are reshaping operational strategies and enhancing efficiency.

Brazil Oil And Gas Midstream Market

| Segmentation Details | Description |

|---|---|

| Service Type | Transportation, Storage, Processing, Distribution |

| End User | Refineries, Petrochemical Plants, Power Generation, Industrial Users |

| Technology | Pipelines, LNG Terminals, Compression Stations, Metering Systems |

| Application | Natural Gas, Crude Oil, NGLs, Biofuels |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Brazil Oil and Gas Midstream Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at