444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Brazil offshore oil and gas upstream market represents one of the most dynamic and strategically important energy sectors in Latin America. Brazil’s extensive coastline and rich pre-salt reserves have positioned the country as a global leader in deepwater exploration and production technologies. The market encompasses exploration, drilling, production, and field development activities in Brazil’s territorial waters, with particular focus on the prolific pre-salt basins that have revolutionized the country’s energy landscape.

Market dynamics indicate robust growth driven by technological advancements, increased foreign investment, and government initiatives to maximize hydrocarbon recovery. The sector has experienced significant expansion with production levels reaching new heights, supported by advanced drilling techniques and enhanced recovery methods. Current growth projections suggest the market is expanding at a compound annual growth rate of 6.2%, reflecting strong investor confidence and operational efficiency improvements.

Pre-salt discoveries have fundamentally transformed Brazil’s offshore upstream sector, with these ultra-deepwater reserves containing some of the world’s highest-quality crude oil. The Santos Basin, Campos Basin, and Espírito Santo Basin represent the core production areas, collectively accounting for approximately 85% of Brazil’s offshore production capacity. These geological formations continue to attract substantial international investment and technological innovation.

The Brazil offshore oil and gas upstream market refers to the comprehensive ecosystem of exploration, development, and production activities conducted in Brazilian territorial waters for hydrocarbon extraction. This market encompasses all upstream operations including seismic surveys, exploratory drilling, field development, production optimization, and infrastructure deployment in offshore environments.

Upstream activities specifically focus on the initial phases of the oil and gas value chain, from resource identification through production commencement. In Brazil’s context, this includes sophisticated deepwater and ultra-deepwater operations, advanced subsea technologies, and complex reservoir management systems designed to maximize recovery from challenging offshore environments.

Operational scope extends from shallow water developments to ultra-deepwater projects exceeding 2,000 meters depth, requiring specialized vessels, drilling rigs, subsea equipment, and production platforms. The market integrates cutting-edge technologies with environmental stewardship practices, ensuring sustainable resource extraction while maintaining operational excellence and safety standards.

Brazil’s offshore upstream sector continues demonstrating exceptional resilience and growth potential, driven by world-class reserves, technological innovation, and strategic government policies. The market benefits from favorable geological conditions, particularly in pre-salt formations, which offer superior reservoir characteristics and production economics compared to conventional offshore developments globally.

Key performance indicators reveal sustained production growth, with offshore fields contributing approximately 92% of Brazil’s total oil production. Major international oil companies maintain significant presence alongside Brazil’s national oil company, creating a competitive environment that fosters innovation and operational efficiency. The sector’s technological advancement has positioned Brazil as a global reference for deepwater operations.

Investment flows remain robust, supported by attractive fiscal terms, proven reserves, and established infrastructure. Recent regulatory reforms have enhanced market accessibility for international operators while maintaining strategic national interests. The market outlook remains positive, with substantial undeveloped reserves providing long-term growth opportunities and energy security for Brazil.

Strategic insights reveal several critical factors driving market evolution and competitive positioning:

Primary growth drivers propelling the Brazil offshore upstream market encompass geological advantages, technological innovation, and supportive regulatory frameworks. The exceptional quality of pre-salt reserves continues attracting global investment, with these formations offering superior production characteristics and extended field life compared to conventional offshore developments.

Technological advancement serves as a fundamental driver, with Brazil pioneering deepwater exploration and production techniques. Advanced drilling technologies, enhanced subsea systems, and sophisticated reservoir management capabilities enable economic development of previously inaccessible reserves. These innovations have reduced operational costs while improving production efficiency and environmental performance.

Government initiatives support market expansion through favorable fiscal policies, streamlined licensing procedures, and infrastructure development programs. Recent regulatory reforms have enhanced market competitiveness while maintaining strategic national interests. The establishment of clear legal frameworks provides investor confidence and long-term planning certainty for major capital investments.

Energy security considerations drive continued investment in domestic production capabilities, reducing import dependence and strengthening Brazil’s energy independence. Growing global energy demand, particularly from emerging markets, creates favorable export opportunities for Brazilian offshore production, supporting sustained market growth and international competitiveness.

Operational challenges present significant constraints to market expansion, particularly the technical complexity and high capital requirements associated with deepwater and ultra-deepwater developments. These projects demand specialized equipment, advanced technologies, and extensive expertise, creating barriers for smaller operators and limiting market participation to well-capitalized companies.

Environmental regulations impose increasingly stringent requirements on offshore operations, necessitating substantial investments in environmental protection systems and compliance measures. While these regulations ensure sustainable development, they also increase operational costs and project timelines, potentially affecting investment returns and market competitiveness.

Infrastructure limitations in certain offshore areas constrain development potential, requiring significant investments in subsea infrastructure, processing facilities, and transportation systems. The remote location of many offshore fields necessitates complex logistics and supply chain management, increasing operational complexity and costs.

Market volatility in global oil prices creates uncertainty for long-term investment decisions, particularly for high-capital offshore projects with extended development timelines. Economic fluctuations and geopolitical factors can impact investment flows and project economics, requiring robust risk management strategies and flexible operational approaches.

Exploration potential remains substantial across Brazil’s offshore basins, with numerous undeveloped prospects and emerging play concepts offering significant growth opportunities. Advanced seismic technologies and geological understanding continue revealing new hydrocarbon accumulations, particularly in frontier areas and deeper geological formations.

Technology innovation creates opportunities for enhanced recovery from existing fields and economic development of marginal discoveries. Digital transformation, artificial intelligence, and automation technologies offer potential for operational optimization, cost reduction, and improved safety performance across offshore operations.

International partnerships provide opportunities for technology transfer, capital investment, and market expansion. Collaboration between Brazilian companies and international operators facilitates knowledge sharing, risk mitigation, and access to global markets, supporting sustained industry growth and competitiveness.

Energy transition initiatives create opportunities for offshore renewable energy development, carbon capture and storage projects, and low-carbon hydrocarbon production. The existing offshore infrastructure and expertise can be leveraged for emerging energy technologies, supporting Brazil’s energy transition goals while maintaining economic value from offshore assets.

Competitive dynamics within Brazil’s offshore upstream market reflect a balanced ecosystem of national and international operators, each contributing unique capabilities and resources. The market structure promotes innovation through competition while ensuring strategic national interests are maintained through appropriate regulatory oversight and participation requirements.

Supply chain integration has evolved significantly, with local content requirements driving development of domestic manufacturing capabilities and service provision. This integration has created a robust industrial ecosystem supporting offshore operations while building national technical capabilities and employment opportunities.

Technological evolution continues reshaping market dynamics, with digitalization and automation transforming traditional operational approaches. According to MarkWide Research analysis, these technological advances have contributed to 25% improvement in operational efficiency across major offshore fields, demonstrating the sector’s commitment to continuous improvement.

Investment patterns show increasing focus on high-return, low-risk projects, with operators prioritizing developments in proven basins with established infrastructure. This approach optimizes capital allocation while maintaining production growth, supporting sustainable market expansion and investor returns.

Comprehensive analysis of Brazil’s offshore upstream market employs multiple research methodologies to ensure accuracy and reliability of market insights. Primary research includes extensive interviews with industry executives, government officials, and technical experts across the offshore oil and gas value chain.

Data collection encompasses production statistics, investment flows, regulatory developments, and technological innovations from authoritative sources including government agencies, industry associations, and company reports. This information is validated through cross-referencing and expert consultation to ensure accuracy and completeness.

Market modeling utilizes advanced analytical techniques to project future trends, growth patterns, and competitive dynamics. Statistical analysis of historical data, combined with forward-looking indicators, provides robust foundation for market forecasting and strategic planning.

Industry validation ensures research findings align with market realities through stakeholder feedback and expert review. This validation process enhances the reliability and practical applicability of research conclusions, supporting informed decision-making by market participants and stakeholders.

Santos Basin dominates Brazil’s offshore production landscape, accounting for approximately 60% of total offshore output. This prolific basin contains the majority of pre-salt discoveries and represents the focal point for international investment and technological innovation. Major fields including Lula, Buzios, and Mero demonstrate exceptional productivity and reserve quality.

Campos Basin maintains significant production levels as Brazil’s traditional offshore development area, contributing roughly 25% of national offshore production. Mature fields in this basin benefit from established infrastructure and operational expertise, while new discoveries continue extending the basin’s productive life and economic value.

Espírito Santo Basin represents an emerging growth area with substantial exploration potential and recent commercial discoveries. This basin offers opportunities for both conventional and pre-salt developments, attracting increasing operator interest and investment commitment for future development phases.

Emerging basins including Sergipe-Alagoas, Recôncavo, and Potiguar provide additional growth opportunities through exploration activities and field development programs. These areas offer potential for discovering new hydrocarbon accumulations while leveraging existing infrastructure and operational capabilities.

Market leadership reflects a diverse ecosystem of national and international operators, each contributing specialized capabilities and resources:

Strategic positioning varies among operators, with some focusing on exploration and early development while others emphasize production optimization and field life extension. This diversity creates a dynamic competitive environment promoting innovation and operational excellence.

By Water Depth:

By Basin:

By Activity Type:

Pre-salt developments represent the premium category within Brazil’s offshore upstream market, offering superior reservoir characteristics and production economics. These formations typically yield high-quality crude oil with excellent flow rates and extended productive life, making them highly attractive for international investment and advanced technology deployment.

Conventional offshore fields continue providing stable production and cash flow generation, particularly in mature basins with established infrastructure. These developments benefit from operational experience, proven technologies, and existing processing facilities, offering lower-risk investment opportunities with predictable returns.

Exploration activities focus increasingly on high-potential areas with geological similarities to successful discoveries. Advanced seismic technologies and improved geological understanding enable more targeted exploration programs, reducing risk and improving discovery success rates across various offshore basins.

Infrastructure development encompasses subsea systems, floating production platforms, and transportation networks supporting offshore operations. This category requires substantial capital investment but provides long-term value through supporting multiple field developments and enabling economic production from remote locations.

Operators benefit from access to world-class reserves, favorable geological conditions, and established regulatory frameworks supporting long-term investment planning. Brazil’s offshore environment offers opportunities for applying advanced technologies while achieving competitive production costs and attractive investment returns.

Service companies gain access to a sophisticated market requiring specialized equipment, advanced technologies, and technical expertise. The Brazilian offshore sector provides opportunities for technology development, capacity building, and international expansion through participation in complex deepwater projects.

Government stakeholders benefit from substantial revenue generation through royalties, taxes, and local content requirements. The offshore sector contributes significantly to national economic development, employment creation, and energy security while supporting Brazil’s position as a major oil exporter.

Local communities benefit from employment opportunities, infrastructure development, and economic multiplier effects from offshore operations. The sector supports coastal economies through direct employment, supply chain participation, and community investment programs.

International investors gain exposure to high-quality assets with strong growth potential and competitive returns. Brazil’s offshore market offers portfolio diversification opportunities while providing access to advanced technologies and operational expertise.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation continues reshaping offshore operations through advanced data analytics, artificial intelligence, and automated systems. These technologies enable predictive maintenance, optimized production, and enhanced safety performance while reducing operational costs and environmental impact.

Sustainability integration has become a central focus, with operators implementing carbon reduction strategies, environmental protection measures, and social responsibility programs. MWR data indicates that sustainability initiatives have achieved 22% reduction in environmental impact across major offshore operations.

Operational efficiency improvements through standardization, modularization, and supply chain optimization continue driving cost reductions and performance enhancements. These trends enable economic development of previously marginal discoveries while improving returns on existing investments.

International collaboration has intensified, with technology sharing, joint ventures, and strategic partnerships becoming increasingly common. This collaboration facilitates risk sharing, capability enhancement, and market access for participants across the offshore value chain.

Regulatory evolution reflects changing industry dynamics, environmental priorities, and technological capabilities. Recent regulatory updates have streamlined licensing processes while maintaining environmental protection standards and safety requirements.

Recent discoveries in pre-salt formations continue expanding Brazil’s offshore resource base, with several significant finds announced across the Santos and Campos basins. These discoveries demonstrate ongoing exploration success and provide foundation for future production growth and investment opportunities.

Technology deployment has accelerated, with advanced subsea processing systems, enhanced recovery techniques, and digital monitoring capabilities being implemented across major offshore fields. These technological advances improve production efficiency while reducing operational costs and environmental impact.

Infrastructure expansion includes new floating production platforms, subsea networks, and transportation systems supporting increased production capacity. Major infrastructure investments enable development of previously inaccessible reserves while improving operational flexibility and efficiency.

Regulatory updates have streamlined environmental licensing, enhanced local content requirements, and improved fiscal terms for certain development categories. These changes support continued investment while ensuring appropriate environmental protection and national economic benefits.

International partnerships have expanded, with new joint ventures and strategic alliances formed between Brazilian and international companies. These partnerships facilitate technology transfer, risk sharing, and capital optimization for major offshore developments.

Investment strategy should prioritize high-return projects in proven basins while maintaining exposure to exploration opportunities in emerging areas. Operators should focus on developments with established infrastructure access and favorable reservoir characteristics to optimize capital efficiency and investment returns.

Technology adoption remains critical for maintaining competitiveness and operational efficiency. Companies should invest in digital technologies, automation systems, and advanced production techniques to reduce costs, improve safety, and enhance environmental performance.

Partnership development offers opportunities for risk mitigation, capability enhancement, and market access. Strategic alliances between international and domestic companies can facilitate technology transfer while optimizing capital allocation and operational expertise.

Regulatory compliance requires proactive engagement with evolving environmental and safety requirements. Companies should invest in compliance systems, environmental protection measures, and stakeholder engagement to ensure sustainable operations and social license maintenance.

Market diversification through geographic expansion and technology application in other markets can reduce concentration risk while leveraging Brazilian offshore expertise. International expansion opportunities exist in other deepwater markets requiring similar technological capabilities.

Production growth is expected to continue driven by pre-salt field developments and enhanced recovery from existing fields. MarkWide Research projects that offshore production will increase by approximately 8.5% annually over the next five years, supported by major field developments and technological improvements.

Technology evolution will further enhance operational efficiency and reduce development costs, making previously marginal discoveries economically viable. Advanced subsea technologies, digital monitoring systems, and automated production capabilities will continue transforming offshore operations.

Investment flows are expected to remain robust, supported by attractive returns, proven reserves, and stable regulatory environment. International operators will likely increase their Brazilian presence through acquisitions, joint ventures, and new exploration commitments.

Environmental integration will become increasingly important, with operators implementing comprehensive sustainability strategies and carbon reduction programs. The sector will continue evolving toward lower-carbon operations while maintaining production growth and economic competitiveness.

Market expansion opportunities include development of marginal fields, exploration in frontier basins, and application of Brazilian offshore expertise in international markets. The sector’s technological leadership positions Brazil as a global reference for deepwater operations and innovation.

Brazil’s offshore oil and gas upstream market represents one of the world’s most dynamic and promising energy sectors, driven by exceptional geological endowments, technological innovation, and supportive regulatory frameworks. The market’s foundation on world-class pre-salt reserves provides sustainable competitive advantages and long-term growth potential that positions Brazil as a global energy leader.

Strategic advantages including advanced deepwater capabilities, established infrastructure, and international operator participation create a robust ecosystem supporting continued expansion and innovation. The sector’s demonstrated ability to reduce costs while improving operational efficiency and environmental performance ensures sustained competitiveness in global energy markets.

Future prospects remain highly favorable, with substantial undeveloped reserves, ongoing technological advancement, and strong investment interest supporting continued growth. The market’s evolution toward greater sustainability and operational efficiency aligns with global energy trends while maintaining Brazil’s position as a preferred destination for offshore investment and technological development.

What is Brazil Offshore Oil & Gas Upstream?

Brazil Offshore Oil & Gas Upstream refers to the exploration and production activities related to oil and natural gas that occur in offshore areas of Brazil. This sector is crucial for the country’s energy supply and economic growth, involving various processes such as drilling, extraction, and transportation of hydrocarbons.

What are the key players in the Brazil Offshore Oil & Gas Upstream Market?

Key players in the Brazil Offshore Oil & Gas Upstream Market include Petrobras, Equinor, and Shell, which are involved in exploration, production, and technological advancements in offshore oil and gas extraction. These companies play a significant role in shaping the market dynamics and driving innovation, among others.

What are the growth factors for the Brazil Offshore Oil & Gas Upstream Market?

Growth factors for the Brazil Offshore Oil & Gas Upstream Market include the increasing global demand for energy, advancements in drilling technologies, and the discovery of new oil reserves. Additionally, government policies promoting investment in offshore exploration contribute to market expansion.

What challenges does the Brazil Offshore Oil & Gas Upstream Market face?

The Brazil Offshore Oil & Gas Upstream Market faces challenges such as environmental regulations, fluctuating oil prices, and operational risks associated with offshore drilling. These factors can impact investment decisions and project viability in the sector.

What opportunities exist in the Brazil Offshore Oil & Gas Upstream Market?

Opportunities in the Brazil Offshore Oil & Gas Upstream Market include the potential for new discoveries in underexplored areas and the adoption of renewable energy technologies. Additionally, partnerships with international firms can enhance technological capabilities and investment.

What trends are shaping the Brazil Offshore Oil & Gas Upstream Market?

Trends shaping the Brazil Offshore Oil & Gas Upstream Market include the increasing focus on sustainability and reducing carbon emissions, as well as the integration of digital technologies in exploration and production processes. These trends are driving innovation and efficiency in the sector.

Brazil Offshore Oil & Gas Upstream Market

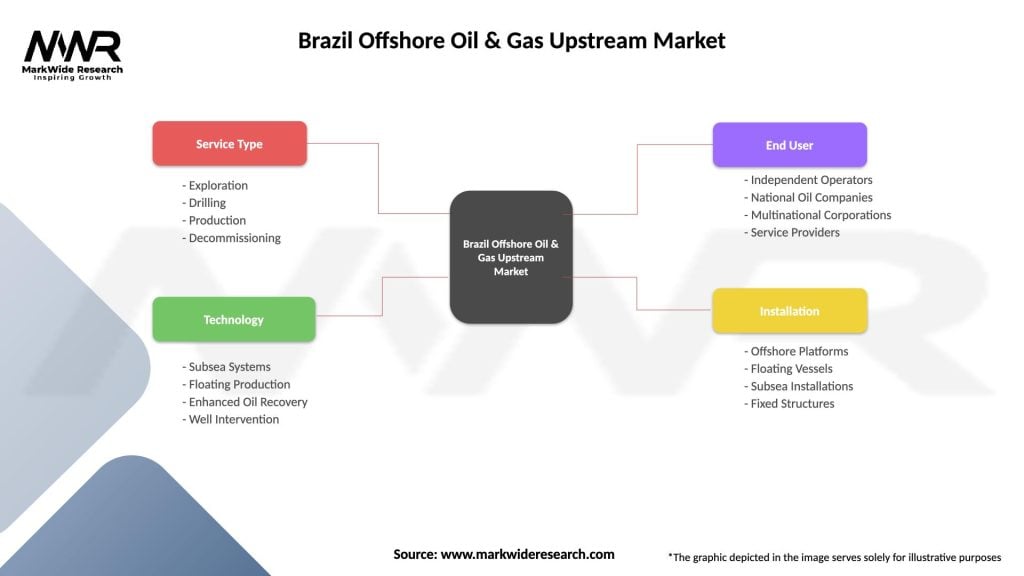

| Segmentation Details | Description |

|---|---|

| Service Type | Exploration, Drilling, Production, Decommissioning |

| Technology | Subsea Systems, Floating Production, Enhanced Oil Recovery, Well Intervention |

| End User | Independent Operators, National Oil Companies, Multinational Corporations, Service Providers |

| Installation | Offshore Platforms, Floating Vessels, Subsea Installations, Fixed Structures |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Brazil Offshore Oil & Gas Upstream Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at