444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Brazil offshore energy market has emerged as a significant player in the global energy industry. Offshore energy refers to the exploration and production of oil and gas reserves located in the seabed. Brazil is blessed with extensive offshore resources, particularly in its pre-salt basins, which are considered among the most promising areas for hydrocarbon exploration and production. This market overview will provide insights into the meaning of the offshore energy market, key market insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, and more.

Meaning

The Brazil offshore energy market refers to the exploration, production, and utilization of energy resources located in offshore areas of Brazil, particularly in its coastal waters. These energy resources primarily include oil and gas reserves, as well as renewable sources such as offshore wind and wave energy. Brazil is recognized as one of the world’s most prominent offshore energy markets due to its vast reserves and potential for exploration and production.

Executive Summary

The Brazil offshore energy market is a vital sector that contributes significantly to the country’s energy needs and economic growth. With extensive offshore reserves, Brazil has attracted substantial investments from domestic and international companies looking to tap into its energy potential. This executive summary provides an overview of the key market insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, and category-wise insights of the Brazil offshore energy market.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

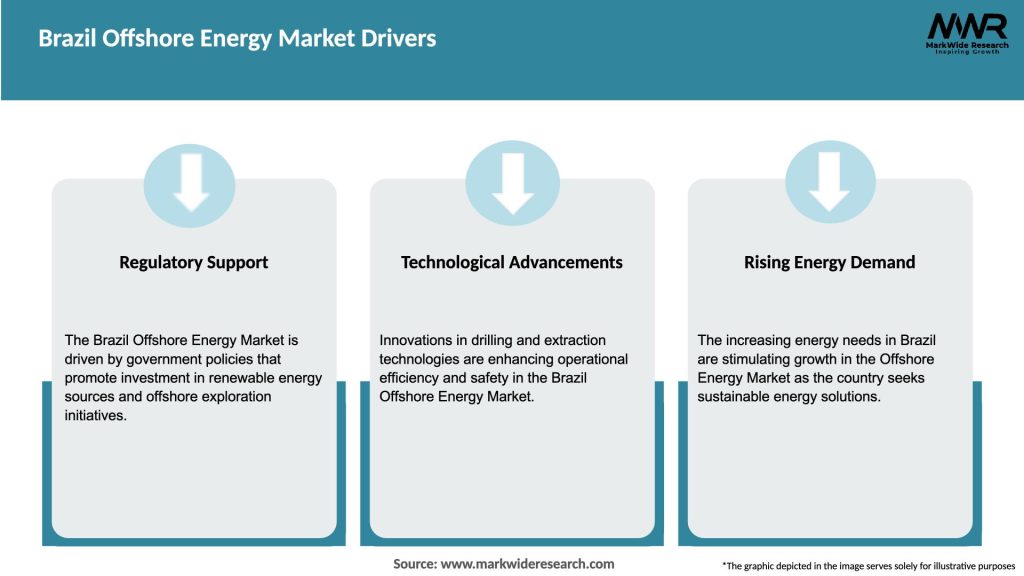

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Brazil offshore energy market is influenced by various dynamics, including government policies, global energy demand and prices, technological advancements, environmental concerns, and geopolitical factors. These dynamics shape the market landscape, impact investment decisions, and drive industry trends and developments.

Regional Analysis

The Brazil offshore energy market encompasses various offshore basins along the country’s extensive coastline. Notable regions for offshore energy exploration and production include the Campos Basin, Santos Basin, and Espirito Santo Basin. Each region has unique geological characteristics and resource potential, attracting investments from different companies and contributing to regional economic development.

Competitive Landscape

Leading Companies in the Brazil Offshore Energy Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Brazil offshore energy market can be segmented based on the type of energy resources, including oil, gas, wind, and wave energy. Each segment has distinct characteristics, investment requirements, and market dynamics. Oil and gas exploration and production dominate the current market, while renewable energy segments are expected to grow in the coming years.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the Brazil offshore energy market, primarily due to the global economic downturn, travel restrictions, and reduced energy demand. The pandemic led to project delays, decreased investments, and operational challenges for offshore energy companies. However, the market has shown resilience, and as the global economy recovers, investments and activities in the Brazil offshore energy sector are expected to rebound.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Brazil offshore energy market is expected to witness significant growth in the coming years. Exploration and production activities in the pre-salt reserves will continue to drive the oil and gas segment. Additionally, offshore wind and wave energy projects are expected to gain momentum as Brazil advances its renewable energy goals. Technological advancements, regulatory reforms, and collaborations will shape the future outlook of the market.

Conclusion

The Brazil offshore energy market offers immense potential for the exploration, production, and utilization of energy resources located in its coastal waters. With abundant offshore reserves, government support, and growing energy demand, the market presents significant opportunities for industry participants and stakeholders. While facing challenges such as complex regulations and high upfront costs, the market is evolving with technological advancements, renewable energy development, and collaborative partnerships. The future outlook remains positive, driven by pre-salt discoveries, the transition to renewable energy, and ongoing industry developments.

What is Offshore Energy?

Offshore energy refers to the production of energy from resources located in ocean or sea environments, including oil, natural gas, and renewable sources like wind and wave energy. This sector plays a crucial role in meeting energy demands and reducing reliance on land-based resources.

What are the key players in the Brazil Offshore Energy Market?

Key players in the Brazil Offshore Energy Market include Petrobras, Equinor, and Shell, which are involved in various aspects of offshore oil and gas exploration and production. These companies are also exploring renewable energy opportunities, such as offshore wind projects, among others.

What are the growth factors driving the Brazil Offshore Energy Market?

The Brazil Offshore Energy Market is driven by increasing energy demand, advancements in extraction technologies, and the country’s vast offshore reserves. Additionally, government policies promoting energy diversification and sustainability are contributing to market growth.

What challenges does the Brazil Offshore Energy Market face?

The Brazil Offshore Energy Market faces challenges such as environmental concerns, regulatory hurdles, and fluctuating oil prices. These factors can impact investment decisions and the overall viability of offshore projects.

What opportunities exist in the Brazil Offshore Energy Market?

Opportunities in the Brazil Offshore Energy Market include the expansion of renewable energy projects, particularly offshore wind and solar energy. Additionally, technological innovations in drilling and production can enhance efficiency and reduce costs.

What trends are shaping the Brazil Offshore Energy Market?

Trends in the Brazil Offshore Energy Market include a shift towards sustainable energy practices, increased investment in renewable technologies, and the integration of digital solutions for operational efficiency. These trends are reshaping how energy is produced and consumed offshore.

Brazil Offshore Energy Market

| Segmentation Details | Description |

|---|---|

| Service Type | Exploration, Production, Decommissioning, Maintenance |

| Technology | Floating Platforms, Subsea Systems, Wind Turbines, Solar Arrays |

| End User | Utilities, Industrial, Government, Private Sector |

| Installation | Onshore, Offshore, Shallow Water, Deep Water |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Brazil Offshore Energy Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at