444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Brazil life and non-life insurance market represents one of the most dynamic and rapidly evolving insurance landscapes in Latin America. Brazil’s insurance sector has demonstrated remarkable resilience and growth potential, driven by increasing consumer awareness, regulatory improvements, and expanding economic opportunities. The market encompasses a comprehensive range of insurance products including life insurance, health insurance, property and casualty coverage, and specialized commercial lines.

Market dynamics in Brazil’s insurance sector reflect the country’s unique economic and demographic characteristics. With a population exceeding 215 million people and a growing middle class, Brazil presents substantial opportunities for insurance penetration and market expansion. The sector has experienced consistent growth, with annual growth rates averaging approximately 8.5% over the past five years, significantly outpacing many developed markets.

Digital transformation has emerged as a critical driver of market evolution, with insurers increasingly adopting advanced technologies to enhance customer experience and operational efficiency. The integration of artificial intelligence, data analytics, and mobile platforms has revolutionized how insurance products are distributed, underwritten, and serviced across Brazil’s diverse geographic regions.

Regulatory framework improvements have strengthened market stability and consumer confidence. The Brazilian insurance regulator, SUSEP (Superintendência de Seguros Privados), has implemented progressive policies that promote innovation while maintaining prudential oversight. These regulatory enhancements have attracted international investment and facilitated market consolidation among leading insurance providers.

The Brazil life and non-life insurance market refers to the comprehensive ecosystem of insurance products and services offered to individuals, businesses, and institutions throughout Brazil. This market encompasses traditional life insurance policies that provide financial protection for beneficiaries, as well as non-life insurance products covering property, casualty, health, automotive, and specialized commercial risks.

Life insurance components include term life, whole life, universal life, and group life insurance products designed to provide financial security and estate planning solutions. These products serve diverse customer segments ranging from individual consumers seeking basic coverage to high-net-worth individuals requiring sophisticated wealth transfer strategies.

Non-life insurance segments encompass property insurance for residential and commercial properties, automotive insurance mandatory for vehicle owners, health insurance supplementing Brazil’s public healthcare system, and specialized coverage for emerging risks such as cyber security and environmental liability. The market also includes reinsurance services that support primary insurers in managing large-scale risks.

Market participants include domestic insurance companies, international insurers with local operations, mutual insurance organizations, and specialized insurance intermediaries. Distribution channels range from traditional agency networks and bancassurance partnerships to innovative digital platforms and direct-to-consumer models that leverage Brazil’s expanding internet connectivity.

Brazil’s insurance market stands as a cornerstone of the country’s financial services sector, demonstrating robust growth momentum and increasing sophistication. The market has evolved significantly over the past decade, transitioning from a primarily traditional, relationship-based industry to a technology-driven, customer-centric ecosystem that serves diverse demographic and economic segments.

Key performance indicators highlight the market’s strong fundamentals and growth trajectory. Insurance penetration rates have increased steadily, with life insurance penetration reaching approximately 3.2% of GDP and non-life insurance penetration achieving 4.1% of GDP. These figures, while still below developed market averages, represent substantial improvement and indicate significant remaining growth potential.

Digital adoption has accelerated dramatically, particularly following the COVID-19 pandemic, with online insurance sales growing by more than 45% annually over the past three years. This digital transformation has enabled insurers to reach previously underserved populations and reduce distribution costs while improving customer engagement and satisfaction.

Market consolidation continues as leading insurers pursue strategic acquisitions and partnerships to achieve scale economies and expand product portfolios. The competitive landscape features a mix of large domestic insurers, international companies, and emerging insurtech startups that bring innovative approaches to product development and customer service.

Regulatory environment improvements have enhanced market stability and consumer protection while promoting innovation and competition. Recent regulatory initiatives have streamlined product approval processes, enhanced solvency requirements, and encouraged the development of new insurance products tailored to Brazil’s evolving risk landscape.

Market segmentation reveals distinct growth patterns across different insurance categories, with health insurance and automotive coverage leading expansion efforts. The following key insights characterize Brazil’s insurance market dynamics:

Consumer behavior patterns indicate increasing insurance awareness and willingness to purchase coverage, particularly among Brazil’s expanding middle class. MarkWide Research analysis suggests that consumer education initiatives and improved product accessibility are driving higher adoption rates across all major insurance categories.

Economic growth serves as a fundamental driver of Brazil’s insurance market expansion. As the country’s economy continues recovering from previous challenges, increased disposable income and business investment create greater demand for both personal and commercial insurance products. The correlation between economic growth and insurance penetration remains strong, with each percentage point of GDP growth typically generating proportional increases in insurance demand.

Demographic trends significantly influence market dynamics, particularly Brazil’s aging population and urbanization patterns. An aging demographic increases demand for life insurance, health coverage, and retirement planning products. Simultaneously, rapid urbanization creates concentrated populations requiring property insurance, automotive coverage, and specialized urban risk protection.

Regulatory improvements continue driving market development through enhanced consumer protection, streamlined product approval processes, and increased market transparency. Recent regulatory initiatives have reduced barriers to entry for new insurers while strengthening solvency requirements and consumer protection measures. These improvements have increased consumer confidence and attracted international investment.

Technology adoption accelerates market growth by improving operational efficiency, reducing costs, and enhancing customer experience. Advanced analytics enable better risk assessment and pricing, while digital platforms expand market reach and reduce distribution expenses. Mobile technology particularly benefits Brazil’s geographically diverse population by providing insurance access in remote areas.

Infrastructure development creates new insurance opportunities as Brazil invests in transportation, energy, and telecommunications infrastructure. These large-scale projects require comprehensive insurance coverage, driving growth in commercial lines and specialized coverage areas. Infrastructure improvements also support economic growth, creating a positive feedback loop for insurance demand.

Economic volatility represents a significant challenge for Brazil’s insurance market, as periods of economic uncertainty can reduce consumer spending on discretionary insurance products. Currency fluctuations, inflation concerns, and political instability can impact both consumer demand and insurer profitability, particularly for companies with significant international exposure.

Regulatory complexity continues to challenge market participants, despite recent improvements. Brazil’s federal structure creates multiple layers of regulation, and compliance requirements can be burdensome for smaller insurers. Complex tax structures and varying state-level requirements add operational complexity and costs that can limit market entry and expansion.

Low insurance awareness in certain population segments limits market penetration, particularly in rural areas and among lower-income demographics. Cultural factors and limited financial literacy contribute to low insurance adoption rates, requiring significant investment in consumer education and awareness programs.

Distribution challenges persist in Brazil’s vast geographic territory, where reaching remote populations remains costly and complex. Traditional distribution models may be inadequate for serving dispersed rural populations, while digital solutions face limitations due to internet connectivity and digital literacy constraints.

Competitive pressure from both domestic and international players can compress margins and limit profitability. Intense competition in certain segments, particularly automotive and health insurance, has led to price competition that can undermine underwriting discipline and long-term market sustainability.

Digital transformation presents unprecedented opportunities for market expansion and operational improvement. Insurers can leverage artificial intelligence, machine learning, and big data analytics to enhance risk assessment, streamline claims processing, and develop personalized products. Digital platforms enable cost-effective distribution to previously underserved markets while improving customer engagement and retention.

Microinsurance development offers substantial growth potential by serving Brazil’s large low-income population. Partnerships with banks, retailers, and government programs can facilitate distribution of affordable insurance products tailored to specific demographic needs. Mobile payment systems and simplified product designs make microinsurance increasingly viable and scalable.

Emerging risk coverage creates new product opportunities as Brazil’s economy becomes more sophisticated and technology-dependent. Cyber insurance, environmental liability coverage, and specialized professional indemnity products address evolving risk landscapes. Climate change adaptation and renewable energy projects also generate new insurance requirements.

Bancassurance expansion leverages Brazil’s extensive banking network to distribute insurance products efficiently. Banks’ existing customer relationships and branch networks provide cost-effective distribution channels, particularly for life insurance and personal lines coverage. Enhanced integration between banking and insurance services creates cross-selling opportunities and improved customer value propositions.

International expansion opportunities exist for Brazilian insurers seeking growth beyond domestic markets. Brazil’s insurance expertise in tropical agriculture, mining, and energy sectors can be exported to other Latin American and emerging markets with similar risk profiles and economic characteristics.

Supply and demand dynamics in Brazil’s insurance market reflect the interplay between growing consumer awareness, expanding economic activity, and evolving risk landscapes. Demand growth consistently outpaces supply expansion in many segments, creating opportunities for new market entrants and product innovation. Market growth rates have averaged 6.8% annually over the past decade, indicating sustained momentum despite periodic economic challenges.

Competitive dynamics continue evolving as traditional insurers face challenges from insurtech startups and digital-native companies. Established insurers leverage their brand recognition, distribution networks, and financial strength, while new entrants compete through innovative products, superior customer experience, and operational efficiency. This competition drives overall market improvement and consumer benefits.

Pricing dynamics vary significantly across different insurance segments, influenced by regulatory requirements, competitive intensity, and underlying risk trends. Health insurance pricing faces pressure from medical cost inflation, while automotive insurance pricing benefits from improved vehicle safety technology and telematics adoption. Life insurance pricing has become more sophisticated through improved mortality data and risk assessment capabilities.

Distribution dynamics are shifting toward digital channels and hybrid models that combine traditional and online approaches. Digital channel adoption has increased by more than 35% annually over recent years, driven by consumer preference for convenience and insurers’ focus on cost reduction. Traditional agents remain important for complex products and relationship-based sales, while digital platforms excel in commodity products and younger demographics.

Innovation dynamics accelerate as insurers invest in technology and product development to maintain competitive advantage. Partnerships between traditional insurers and technology companies create new capabilities and market opportunities. Regulatory sandboxes and innovation initiatives encourage experimentation with new business models and product concepts.

Primary research methodologies employed in analyzing Brazil’s insurance market include comprehensive surveys of industry participants, in-depth interviews with senior executives, and focus groups with consumers across different demographic segments. These primary sources provide current market insights, competitive intelligence, and forward-looking perspectives on industry trends and challenges.

Secondary research incorporates analysis of regulatory filings, industry reports, financial statements, and academic studies related to Brazil’s insurance sector. Government statistics, central bank data, and insurance association publications provide quantitative foundations for market analysis and trend identification.

Data collection processes ensure comprehensive coverage of all major insurance segments, geographic regions, and market participants. Structured questionnaires and standardized interview protocols maintain consistency and comparability across different data sources. Quality control measures verify data accuracy and eliminate potential biases or inconsistencies.

Analytical frameworks combine quantitative statistical analysis with qualitative market assessment to provide comprehensive market understanding. Trend analysis, correlation studies, and predictive modeling identify key market drivers and future growth patterns. Comparative analysis with other Latin American markets provides regional context and benchmarking opportunities.

Validation processes include triangulation of findings across multiple data sources, expert review panels, and market participant feedback sessions. These validation steps ensure research accuracy and reliability while identifying potential gaps or limitations in the analysis.

São Paulo region dominates Brazil’s insurance market, accounting for approximately 45% of total premium volume across all insurance segments. The region’s economic concentration, high population density, and sophisticated financial services infrastructure create ideal conditions for insurance market development. São Paulo serves as headquarters for most major Brazilian insurers and hosts significant international insurance company operations.

Rio de Janeiro represents the second-largest regional market, contributing roughly 18% of national insurance premiums. The region’s diverse economy, including oil and gas, tourism, and financial services, generates substantial commercial insurance demand. Rio’s port facilities and industrial base require specialized coverage for marine, cargo, and industrial risks.

Minas Gerais has emerged as a significant growth market, particularly for agricultural and mining-related insurance products. The state’s diversified economy and growing population create opportunities across multiple insurance segments. Regional growth rates in Minas Gerais have exceeded 12% annually over the past five years, outpacing national averages.

Southern states including Rio Grande do Sul, Santa Catarina, and Paraná collectively represent approximately 22% of the national market. These states’ strong agricultural sectors, manufacturing base, and relatively high income levels support robust insurance penetration across both personal and commercial lines.

Northeastern region presents significant growth opportunities despite currently representing a smaller market share. Government investment in infrastructure, tourism development, and renewable energy projects are driving increased insurance demand. The region’s large population and improving economic conditions suggest substantial long-term growth potential.

Central-West region benefits from Brazil’s agricultural expansion and agribusiness development. Specialized crop insurance, equipment coverage, and rural property protection drive market growth in this region. The area’s rapid economic development and population growth create expanding opportunities for personal lines insurance as well.

Market leadership in Brazil’s insurance sector is characterized by a mix of large domestic insurers, international companies, and specialized providers serving specific market segments. The competitive environment continues evolving through consolidation, strategic partnerships, and new market entrants bringing innovative approaches to insurance delivery.

Competitive strategies focus on digital transformation, customer experience enhancement, and operational efficiency improvement. Leading insurers invest heavily in technology platforms, data analytics capabilities, and mobile applications to maintain competitive advantage and serve evolving customer expectations.

Market consolidation continues as larger insurers acquire smaller competitors to achieve scale economies and expand geographic coverage. Strategic partnerships between insurers and technology companies create new capabilities and market opportunities while sharing development costs and risks.

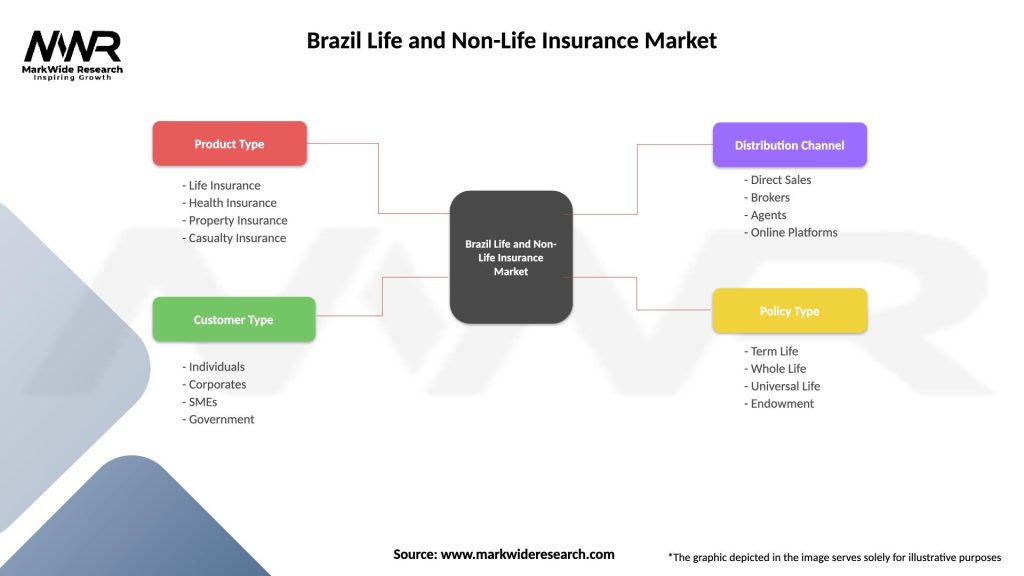

By Product Type: Brazil’s insurance market segmentation reflects diverse consumer and business needs across multiple product categories. Each segment demonstrates distinct growth patterns, competitive dynamics, and regulatory requirements that influence market development strategies.

By Distribution Channel: Insurance distribution in Brazil utilizes multiple channels to reach diverse customer segments effectively, with each channel serving specific market needs and customer preferences.

By Customer Segment: Market segmentation by customer type reflects different risk profiles, coverage needs, and purchasing behaviors that require tailored products and services.

Health Insurance Category represents the fastest-growing segment in Brazil’s non-life insurance market, driven by limitations in public healthcare capacity and increasing consumer demand for premium medical services. Health insurance penetration has reached approximately 25% of the population, with significant growth potential remaining in underserved segments. Private health insurance provides access to shorter waiting times, specialized treatments, and premium hospital facilities.

Automotive Insurance Category benefits from mandatory insurance requirements and recovering vehicle sales following economic challenges. Enhanced enforcement of insurance requirements and growing awareness of comprehensive coverage benefits drive market expansion. Telematics and usage-based insurance models are gaining traction, particularly among younger drivers seeking personalized pricing.

Life Insurance Category is experiencing transformation as traditional protection products are supplemented by hybrid policies combining insurance and investment features. Growing wealth accumulation needs and retirement planning concerns drive demand for sophisticated life insurance solutions. Life insurance adoption rates remain below 15% of the adult population, indicating substantial growth opportunities.

Property Insurance Category serves both residential and commercial markets with coverage for fire, theft, natural disasters, and other property perils. Climate change concerns and increasing property values drive demand for comprehensive coverage. Specialized products for condominiums and gated communities address Brazil’s unique housing patterns.

Commercial Lines Category encompasses diverse business insurance needs including general liability, professional indemnity, and specialized industry coverage. Growing business sophistication and risk awareness drive demand for comprehensive commercial insurance programs. International businesses operating in Brazil require coverage that meets global standards and local regulatory requirements.

Insurance Companies benefit from Brazil’s expanding market opportunities through revenue growth, geographic diversification, and product innovation possibilities. The large domestic market provides scale economies and reduces dependence on international markets subject to currency and political risks. Regulatory improvements create more predictable operating environments and reduced compliance costs.

Consumers gain access to improved insurance products, competitive pricing, and enhanced service delivery through market competition and innovation. Digital platforms provide greater convenience and transparency in insurance purchasing and claims handling. Expanded product availability serves previously underserved market segments and emerging risk needs.

Distribution Partners including agents, brokers, and bancassurance partners benefit from growing commission opportunities and expanded product portfolios. Technology investments by insurers provide distribution partners with better tools and support systems. Market growth creates opportunities for new distribution models and specialized service providers.

Reinsurers benefit from Brazil’s growing insurance market through increased premium volume and diversification opportunities. Brazil’s unique risk profile in areas such as tropical agriculture and natural catastrophes provides valuable portfolio diversification for international reinsurers. Local market expertise becomes increasingly valuable as the market grows and sophisticates.

Technology Providers find significant opportunities in Brazil’s insurance market through digital transformation initiatives and operational improvement projects. Insurers’ investments in technology platforms, data analytics, and customer experience enhancement create substantial demand for specialized technology solutions and services.

Government and Regulators benefit from a robust insurance sector that supports economic stability, consumer protection, and financial system resilience. Insurance market development contributes to overall financial sector growth and provides important risk transfer mechanisms for economic development projects.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-First Strategies are transforming how Brazilian insurers interact with customers, process applications, and handle claims. Companies are investing heavily in mobile applications, artificial intelligence, and automated underwriting systems to improve efficiency and customer satisfaction. Digital adoption rates among insurance customers have increased by more than 40% over the past three years, accelerated by pandemic-driven behavioral changes.

Personalization and Customization trends reflect growing consumer demand for insurance products tailored to individual needs and risk profiles. Insurers are leveraging big data analytics and machine learning to develop personalized pricing, coverage options, and service delivery. Usage-based insurance models in automotive coverage and lifestyle-based health insurance pricing exemplify this trend.

Sustainability and ESG Integration are becoming increasingly important as Brazilian insurers recognize the importance of environmental, social, and governance factors in long-term business success. Climate risk assessment, sustainable investment practices, and social impact measurement are being integrated into business strategies and product development processes.

Ecosystem Partnerships are expanding as insurers collaborate with technology companies, retailers, and service providers to create comprehensive customer value propositions. These partnerships enable insurers to offer additional services beyond traditional insurance coverage while accessing new customer segments and distribution channels.

Regulatory Technology (RegTech) adoption helps insurers manage complex compliance requirements more efficiently while reducing costs and operational risks. Automated reporting systems, compliance monitoring tools, and regulatory change management platforms are becoming standard components of insurer technology infrastructure.

Customer Experience Focus drives investments in omnichannel service delivery, streamlined claims processing, and proactive customer communication. Insurers recognize that superior customer experience is essential for retention and growth in increasingly competitive markets.

Regulatory Modernization initiatives by SUSEP have streamlined product approval processes, enhanced solvency requirements, and promoted innovation through regulatory sandboxes. Recent changes allow for more flexible product designs and faster market entry for new insurance solutions. These regulatory improvements have attracted international investment and encouraged domestic market expansion.

Insurtech Innovation has accelerated with numerous startups entering the Brazilian market with digital-native approaches to insurance delivery. These companies focus on specific market segments or product categories, often partnering with established insurers to access distribution channels and regulatory expertise. MWR analysis indicates that insurtech investment in Brazil has grown substantially over recent years.

Consolidation Activity continues as larger insurers acquire smaller competitors to achieve scale economies and expand market coverage. Recent transactions have focused on specialty lines, regional players, and technology-enabled companies that bring innovative capabilities to traditional insurers.

International Expansion by Brazilian insurers into other Latin American markets reflects growing confidence and expertise in emerging market insurance operations. These expansions leverage Brazil’s experience in serving diverse demographics and managing complex regulatory environments.

Technology Infrastructure investments by major insurers include cloud computing platforms, artificial intelligence systems, and advanced analytics capabilities. These investments support improved underwriting accuracy, operational efficiency, and customer service delivery while enabling new product development and market expansion.

Distribution Innovation includes new partnership models with retailers, digital platforms, and financial technology companies. These partnerships expand market reach and provide customers with more convenient access to insurance products through familiar channels and touchpoints.

Market Entry Strategies for new participants should focus on specific market segments or geographic regions where established players may be underserving customer needs. Digital-native approaches and innovative product designs can provide competitive advantages, particularly among younger demographics and urban populations. Partnership strategies with established distribution channels can accelerate market penetration while reducing initial investment requirements.

Technology Investment should prioritize customer-facing applications and operational efficiency improvements that provide measurable returns on investment. Insurers should focus on technologies that enhance underwriting accuracy, streamline claims processing, and improve customer engagement. Partnerships with technology providers may be more cost-effective than internal development for many applications.

Product Development opportunities exist in underserved market segments and emerging risk categories. Microinsurance products for low-income populations, cyber insurance for businesses, and climate-related coverage represent significant growth opportunities. Product simplification and digital delivery can reduce costs and improve accessibility for price-sensitive customers.

Distribution Strategy should incorporate multiple channels to reach diverse customer segments effectively. While digital channels offer cost advantages and convenience, traditional channels remain important for complex products and relationship-based sales. Hybrid approaches that combine digital efficiency with personal service may provide optimal customer experience.

Risk Management requires enhanced focus on emerging risks including cyber security, climate change, and regulatory changes. Insurers should invest in risk assessment capabilities and maintain adequate capital reserves to handle potential volatility. Reinsurance strategies should provide appropriate protection while maintaining profitability.

Regulatory Compliance systems should be designed for flexibility and scalability to accommodate changing requirements and business growth. Automated compliance monitoring and reporting systems can reduce costs and operational risks while ensuring consistent regulatory adherence across all business operations.

Market Growth Projections indicate continued expansion of Brazil’s insurance sector, driven by economic recovery, demographic trends, and increasing insurance awareness. MarkWide Research forecasts suggest the market will maintain robust growth momentum, with annual growth rates expected to average 7.2% over the next five years. This growth will be supported by expanding middle-class populations, improved regulatory frameworks, and technological innovations.

Digital Transformation will continue reshaping the insurance landscape, with artificial intelligence, machine learning, and blockchain technologies becoming standard components of insurer operations. These technologies will enable more accurate risk assessment, automated claims processing, and personalized customer experiences. Digital channel penetration is projected to exceed 60% of total sales within the next decade.

Product Innovation will focus on emerging risks and underserved market segments, with particular emphasis on climate-related coverage, cyber insurance, and microinsurance products. Hybrid products combining insurance and investment features will gain popularity as consumers seek comprehensive financial solutions. Parametric insurance products may emerge for specific risks such as weather-related agricultural losses.

Market Consolidation is expected to continue as smaller insurers face pressure from regulatory requirements and competitive challenges. Strategic partnerships and acquisitions will create larger, more diversified insurance groups capable of investing in technology and serving national markets effectively. International insurers may increase their Brazilian presence through acquisitions or joint ventures.

Regulatory Evolution will likely focus on consumer protection, market stability, and innovation promotion. Regulatory sandboxes and innovation initiatives will encourage new product development while maintaining appropriate oversight. Enhanced solvency requirements and risk management standards will strengthen market resilience and consumer confidence.

Sustainability Integration will become increasingly important as insurers incorporate environmental, social, and governance factors into business strategies. Climate risk assessment, sustainable investment practices, and social impact measurement will influence product development, underwriting decisions, and capital allocation strategies.

The Brazil life and non-life insurance market represents one of Latin America’s most dynamic and promising insurance sectors, characterized by substantial growth potential, increasing sophistication, and evolving customer needs. Despite facing challenges related to economic volatility and regulatory complexity, the market demonstrates remarkable resilience and adaptability that position it for continued expansion and development.

Key success factors for market participants include embracing digital transformation, developing innovative products for underserved segments, and building strategic partnerships that enhance distribution reach and operational capabilities. The market’s large domestic population, improving regulatory environment, and expanding middle class create favorable conditions for sustained growth across all major insurance categories.

Future opportunities in Brazil’s insurance market will be driven by technological innovation, demographic trends, and evolving risk landscapes that require new coverage solutions. Companies that successfully combine traditional insurance expertise with digital capabilities and customer-centric approaches will be best positioned to capitalize on these opportunities and achieve long-term success in this dynamic market environment.

What is Life and Non-Life Insurance?

Life and Non-Life Insurance refers to the two main categories of insurance products. Life insurance provides financial protection to beneficiaries upon the policyholder’s death, while non-life insurance covers various risks such as property damage, liability, and health-related expenses.

What are the key players in the Brazil Life and Non-Life Insurance Market?

Key players in the Brazil Life and Non-Life Insurance Market include companies like Bradesco Seguros, Porto Seguro, and Itaú Seguros, which offer a range of insurance products to consumers and businesses, among others.

What are the growth factors driving the Brazil Life and Non-Life Insurance Market?

The growth of the Brazil Life and Non-Life Insurance Market is driven by increasing awareness of insurance benefits, a growing middle class, and the expansion of digital insurance platforms that enhance accessibility for consumers.

What challenges does the Brazil Life and Non-Life Insurance Market face?

Challenges in the Brazil Life and Non-Life Insurance Market include regulatory complexities, competition from insurtech startups, and the need for traditional insurers to adapt to changing consumer preferences and digital transformation.

What opportunities exist in the Brazil Life and Non-Life Insurance Market?

Opportunities in the Brazil Life and Non-Life Insurance Market include the potential for product innovation, the rise of personalized insurance solutions, and the increasing demand for coverage in underserved segments such as small businesses and rural areas.

What trends are shaping the Brazil Life and Non-Life Insurance Market?

Trends in the Brazil Life and Non-Life Insurance Market include the adoption of artificial intelligence for underwriting and claims processing, the growth of telematics in auto insurance, and a focus on sustainability and ESG factors in product offerings.

Brazil Life and Non-Life Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Life Insurance, Health Insurance, Property Insurance, Casualty Insurance |

| Customer Type | Individuals, Corporates, SMEs, Government |

| Distribution Channel | Direct Sales, Brokers, Agents, Online Platforms |

| Policy Type | Term Life, Whole Life, Universal Life, Endowment |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Brazil Life and Non-Life Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at