444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Brazil insulin drugs and delivery devices market represents a critical segment of the nation’s healthcare infrastructure, addressing the growing prevalence of diabetes mellitus across the country. Brazil’s healthcare system has witnessed significant transformation in diabetes management, with innovative insulin formulations and advanced delivery technologies becoming increasingly accessible to patients nationwide. The market encompasses a comprehensive range of therapeutic solutions, including rapid-acting, long-acting, and intermediate-acting insulin preparations, alongside sophisticated delivery mechanisms such as insulin pens, pumps, and continuous glucose monitoring systems.

Market dynamics indicate robust expansion driven by rising diabetes incidence rates, with approximately 16.8 million adults currently diagnosed with diabetes in Brazil, representing one of the highest prevalence rates in Latin America. The Brazilian government’s commitment to universal healthcare through the Sistema Único de Saúde (SUS) has facilitated broader access to insulin therapies, while private healthcare initiatives continue to drive adoption of premium delivery devices and biosimilar insulin products.

Technological advancement remains a cornerstone of market evolution, with smart insulin pens, continuous glucose monitoring integration, and personalized dosing algorithms gaining significant traction among Brazilian patients. The market demonstrates strong growth potential, with projections indicating a compound annual growth rate of 8.2% through the forecast period, supported by increasing healthcare expenditure and enhanced diabetes awareness programs across urban and rural populations.

The Brazil insulin drugs and delivery devices market refers to the comprehensive ecosystem of pharmaceutical products, medical devices, and healthcare solutions designed to manage diabetes mellitus through insulin therapy administration. This market encompasses both traditional insulin formulations derived from human and animal sources, as well as modern biosimilar and analog insulin products that offer improved pharmacokinetic profiles and patient convenience.

Delivery devices within this market include traditional syringes and vials, modern insulin pen systems, sophisticated insulin pump technologies, and emerging smart delivery platforms that integrate with digital health monitoring systems. The market also encompasses ancillary products such as blood glucose monitoring devices, continuous glucose monitors, and insulin storage solutions that support comprehensive diabetes management protocols.

Healthcare integration represents a fundamental aspect of this market, involving coordination between pharmaceutical manufacturers, medical device companies, healthcare providers, and government health agencies to ensure optimal patient outcomes through accessible and affordable diabetes care solutions across Brazil’s diverse geographic and socioeconomic landscape.

Strategic market positioning reveals the Brazil insulin drugs and delivery devices market as a rapidly evolving healthcare segment characterized by increasing demand for innovative therapeutic solutions and patient-centric delivery technologies. The market benefits from strong government support through public health initiatives, while private sector investment continues to drive technological innovation and market accessibility improvements.

Key growth drivers include rising diabetes prevalence rates, with type 2 diabetes accounting for approximately 90% of diagnosed cases, alongside increasing adoption of advanced insulin delivery systems among tech-savvy patient populations. The market demonstrates significant potential for biosimilar insulin penetration, offering cost-effective alternatives to branded products while maintaining therapeutic efficacy and safety profiles.

Competitive landscape features established multinational pharmaceutical companies alongside emerging Brazilian biotechnology firms, creating a dynamic environment for product innovation and market expansion. Strategic partnerships between international manufacturers and local distributors have enhanced market penetration, particularly in underserved regions where traditional healthcare infrastructure remains limited.

Future outlook indicates sustained growth momentum supported by demographic trends, healthcare policy reforms, and technological advancement in diabetes management solutions, positioning Brazil as a key market for insulin therapy innovation in the Latin American region.

Market segmentation analysis reveals distinct patterns in insulin product adoption and delivery device preferences across different patient demographics and geographic regions within Brazil. The following insights highlight critical market characteristics:

Demographic transformation serves as the primary catalyst for market expansion, with Brazil’s aging population and changing lifestyle patterns contributing to increased diabetes incidence rates. The country’s rapid urbanization has led to dietary changes and reduced physical activity levels, creating favorable conditions for type 2 diabetes development across diverse population segments.

Healthcare infrastructure development continues to drive market growth through expanded access to specialized diabetes care services and improved insulin distribution networks. Government initiatives to strengthen primary healthcare capabilities have enhanced early diabetes detection and treatment initiation, leading to increased demand for insulin therapies and delivery devices.

Technological innovation represents a significant growth driver, with patients increasingly seeking convenient, accurate, and discreet insulin delivery solutions. The integration of digital health technologies, including smartphone connectivity and automated dosing algorithms, has attracted younger patient demographics and improved treatment adherence rates.

Economic factors including rising disposable income levels and expanded health insurance coverage have facilitated access to premium insulin products and advanced delivery devices. The Brazilian government’s commitment to healthcare spending, representing approximately 9.2% of GDP, supports continued market expansion through public procurement programs and subsidized patient access initiatives.

Economic constraints pose significant challenges to market growth, particularly regarding access to premium insulin products and advanced delivery devices among lower-income patient populations. The high cost of continuous glucose monitoring systems and insulin pump technologies limits adoption rates, despite their clinical benefits for diabetes management.

Regulatory complexities within Brazil’s healthcare system can delay the introduction of innovative insulin products and delivery technologies. The lengthy approval processes for new medical devices and pharmaceutical products create barriers for international manufacturers seeking to enter the Brazilian market with cutting-edge diabetes management solutions.

Healthcare disparities between urban and rural regions limit market penetration for advanced insulin delivery systems. Rural areas often lack specialized diabetes care facilities and trained healthcare professionals, creating challenges for patient education and ongoing support for complex insulin regimens.

Supply chain vulnerabilities occasionally disrupt insulin availability, particularly for specialized formulations and delivery devices that require cold chain storage and distribution. These disruptions can impact patient treatment continuity and create hesitancy among healthcare providers regarding newer insulin products.

Biosimilar expansion presents substantial opportunities for market growth, with patent expirations for major insulin brands creating space for cost-effective alternatives. Brazilian pharmaceutical companies are well-positioned to develop and manufacture biosimilar insulin products, potentially reducing treatment costs while maintaining therapeutic efficacy.

Digital health integration offers significant potential for market transformation through connected insulin delivery devices and comprehensive diabetes management platforms. The growing adoption of telemedicine and remote patient monitoring creates opportunities for innovative insulin delivery solutions that integrate with digital health ecosystems.

Rural market penetration represents an underserved opportunity, with government initiatives to expand healthcare access in remote regions creating demand for portable, user-friendly insulin delivery devices. Mobile health clinics and community health programs provide channels for introducing advanced diabetes management technologies to previously inaccessible patient populations.

Public-private partnerships present opportunities for market expansion through collaborative initiatives that combine government healthcare objectives with private sector innovation. These partnerships can facilitate the development of affordable insulin products and delivery devices tailored to Brazilian patient needs and healthcare system requirements.

Competitive intensity within the Brazil insulin drugs and delivery devices market continues to escalate as established pharmaceutical giants compete with emerging biotechnology companies and local manufacturers. This competition drives innovation in product development, pricing strategies, and patient support programs, ultimately benefiting Brazilian diabetes patients through improved treatment options and accessibility.

Regulatory evolution shapes market dynamics through ongoing reforms in Brazil’s healthcare regulatory framework. The Agência Nacional de Vigilância Sanitária (ANVISA) continues to modernize approval processes for insulin products and medical devices, potentially accelerating the introduction of innovative diabetes management technologies while maintaining safety and efficacy standards.

Healthcare policy changes influence market dynamics through modifications to public healthcare coverage and reimbursement policies. Recent initiatives to expand insulin access through the SUS system have increased market demand while creating pressure for cost-effective treatment solutions that balance clinical outcomes with healthcare budget constraints.

Patient behavior evolution reflects changing expectations for diabetes management, with increasing demand for personalized treatment approaches and technology-enabled solutions. This shift drives market dynamics toward patient-centric product development and comprehensive support services that address individual lifestyle and treatment preferences.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into the Brazil insulin drugs and delivery devices market. Primary research involved extensive interviews with healthcare professionals, diabetes specialists, pharmaceutical executives, and patient advocacy groups across major Brazilian metropolitan areas and rural regions.

Secondary research incorporated analysis of government health statistics, pharmaceutical industry reports, academic publications, and regulatory documentation from ANVISA and the Brazilian Ministry of Health. This approach provided historical market data, regulatory trends, and policy developments that influence market dynamics and growth projections.

Data validation processes included cross-referencing multiple sources, expert review panels, and statistical analysis to ensure research accuracy and reliability. Market sizing and growth projections were developed using established econometric models adapted for the Brazilian healthcare market’s unique characteristics and regulatory environment.

Stakeholder engagement throughout the research process involved collaboration with patient organizations, healthcare providers, and industry associations to validate findings and ensure practical relevance for market participants and healthcare decision-makers across Brazil’s diverse healthcare landscape.

Southeast Region dominates the Brazil insulin drugs and delivery devices market, with São Paulo and Rio de Janeiro states accounting for approximately 48% of total market demand. This region benefits from advanced healthcare infrastructure, higher income levels, and greater access to specialized diabetes care services, driving adoption of premium insulin products and sophisticated delivery devices.

Northeast Region represents a rapidly growing market segment, with increasing diabetes awareness and expanding healthcare access contributing to rising insulin demand. Government health initiatives in states like Bahia and Pernambuco have improved diabetes screening and treatment programs, creating opportunities for market expansion in previously underserved populations.

South Region demonstrates strong market penetration for advanced insulin delivery technologies, with states like Rio Grande do Sul and Santa Catarina showing high adoption rates for insulin pump systems and continuous glucose monitoring devices. The region’s relatively affluent population and well-developed healthcare infrastructure support premium product segments.

Central-West Region shows emerging market potential, with Brasília and surrounding areas experiencing rapid healthcare development and increasing diabetes prevalence. The region’s growing urban centers create opportunities for insulin product distribution and patient education programs that support market expansion.

North Region presents unique challenges and opportunities, with vast geographic distances and limited healthcare infrastructure requiring innovative distribution strategies for insulin products and delivery devices. Mobile health initiatives and telemedicine programs offer potential solutions for reaching remote patient populations in states like Amazonas and Pará.

Market leadership in the Brazil insulin drugs and delivery devices market is characterized by intense competition among established multinational pharmaceutical companies and emerging local manufacturers. The competitive environment drives continuous innovation in product development, patient support services, and market access strategies.

Product segmentation within the Brazil insulin drugs and delivery devices market reveals distinct categories based on insulin type, delivery mechanism, and patient application. This segmentation provides insights into market preferences and growth opportunities across different therapeutic approaches.

By Insulin Type:

By Delivery Device:

By Application:

Insulin drugs category demonstrates robust growth across all formulation types, with analog insulin products gaining market share due to improved pharmacokinetic profiles and patient convenience. Biosimilar insulin products have achieved significant market penetration, offering cost-effective alternatives while maintaining therapeutic equivalence to branded formulations.

Delivery devices category shows strong preference for insulin pen systems, which combine convenience, accuracy, and discretion for daily diabetes management. Smart insulin pens with digital connectivity features are experiencing rapid adoption among tech-savvy patients, particularly in urban markets where smartphone penetration exceeds 85%.

Continuous glucose monitoring integration with insulin delivery systems represents an emerging category with substantial growth potential. These integrated solutions offer real-time glucose data and automated insulin dosing adjustments, appealing to patients seeking comprehensive diabetes management technologies.

Patient support services have evolved into a distinct market category, with manufacturers providing comprehensive education programs, adherence monitoring, and lifestyle counseling to improve treatment outcomes and patient satisfaction across diverse demographic segments.

Healthcare providers benefit from expanded treatment options and improved patient outcomes through access to innovative insulin products and delivery technologies. Advanced insulin formulations and smart delivery devices enable more precise diabetes management, reducing complications and healthcare costs while improving patient quality of life.

Pharmaceutical companies gain opportunities for market expansion through product innovation, strategic partnerships, and biosimilar development initiatives. The growing Brazilian diabetes population provides a substantial market for insulin products, while regulatory support for generic medications creates competitive advantages for cost-effective treatment solutions.

Patients receive significant benefits through improved treatment convenience, better glucose control, and reduced injection-related complications. Modern insulin delivery devices offer enhanced lifestyle flexibility and treatment discretion, while comprehensive patient support programs improve adherence and clinical outcomes.

Healthcare systems achieve cost-effectiveness improvements through biosimilar insulin adoption and reduced diabetes-related complications. Efficient insulin delivery systems and patient education programs contribute to better resource utilization and improved population health outcomes across Brazil’s diverse healthcare landscape.

Technology companies find opportunities for innovation in digital health integration, connected medical devices, and data analytics platforms that support comprehensive diabetes management. The convergence of insulin delivery and digital health technologies creates new revenue streams and market differentiation opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalized medicine emerges as a dominant trend, with insulin therapy increasingly tailored to individual patient characteristics, lifestyle factors, and genetic profiles. Advanced analytics and continuous glucose monitoring data enable healthcare providers to optimize insulin regimens for improved glycemic control and reduced hypoglycemic episodes.

Digital health integration continues to transform diabetes management through connected insulin delivery devices, smartphone applications, and cloud-based data platforms. These technologies enable real-time treatment adjustments, remote patient monitoring, and comprehensive diabetes management support that improves patient outcomes and healthcare efficiency.

Biosimilar adoption accelerates across the Brazilian market as healthcare providers and patients seek cost-effective insulin alternatives without compromising therapeutic efficacy. This trend supports healthcare budget optimization while maintaining access to essential diabetes medications for diverse patient populations.

Patient-centric design influences product development priorities, with manufacturers focusing on user-friendly interfaces, reduced injection pain, and lifestyle integration features. Smart insulin pens with dose memory, injection reminders, and connectivity features address patient preferences for convenient and discreet diabetes management solutions.

Telemedicine expansion facilitates diabetes care access in remote regions through virtual consultations, remote monitoring, and digital patient education programs. This trend supports market penetration in underserved areas while reducing healthcare delivery costs and improving patient convenience.

Regulatory approvals for next-generation insulin products and delivery devices continue to expand treatment options for Brazilian diabetes patients. Recent ANVISA approvals for ultra-rapid-acting insulin formulations and smart insulin pen systems demonstrate the agency’s commitment to facilitating access to innovative diabetes management technologies.

Strategic partnerships between international pharmaceutical companies and Brazilian healthcare organizations enhance market penetration and patient access. These collaborations focus on local manufacturing capabilities, distribution network expansion, and patient education programs tailored to Brazilian cultural and linguistic preferences.

Technology innovations in insulin delivery systems include the development of patch pumps, closed-loop systems, and artificial pancreas technologies that offer automated glucose management with minimal patient intervention. These advances represent the future of diabetes care and create new market opportunities for technology-focused companies.

Manufacturing investments by pharmaceutical companies in Brazilian production facilities support local insulin supply security while reducing costs through domestic manufacturing. These investments demonstrate long-term market commitment and create opportunities for export to other Latin American markets.

Patient advocacy initiatives led by diabetes organizations and healthcare providers improve awareness, education, and access to insulin therapies across diverse Brazilian communities. These programs support market growth through increased diagnosis rates and treatment initiation among previously undiagnosed diabetes patients.

Market entry strategies for new participants should focus on biosimilar development and cost-effective delivery device solutions that address the needs of price-sensitive patient segments. MarkWide Research analysis indicates that companies offering comprehensive patient support programs alongside competitive pricing achieve superior market penetration rates in the Brazilian healthcare environment.

Innovation priorities should emphasize digital health integration and user-friendly device design that appeals to Brazil’s growing smartphone-enabled population. Companies investing in connected insulin delivery systems and comprehensive diabetes management platforms are positioned to capture market share among tech-savvy patient demographics.

Distribution strategies must address Brazil’s geographic diversity and healthcare infrastructure variations through multi-channel approaches that combine traditional pharmacy networks with digital health platforms and mobile clinic partnerships. Rural market penetration requires innovative logistics solutions and local healthcare provider collaboration.

Regulatory engagement remains critical for successful market participation, with companies advised to maintain proactive communication with ANVISA and other regulatory bodies to ensure timely product approvals and market access. Understanding local regulatory requirements and cultural preferences enhances product development and commercialization success.

Partnership development with Brazilian healthcare organizations, patient advocacy groups, and government health agencies creates competitive advantages through enhanced market credibility and patient access. These relationships support long-term market success and sustainable business growth in Brazil’s evolving healthcare landscape.

Market expansion projections indicate sustained growth momentum driven by demographic trends, healthcare policy support, and technological innovation in diabetes management solutions. The Brazilian insulin drugs and delivery devices market is expected to maintain robust growth rates, with increasing penetration of advanced delivery technologies and biosimilar insulin products.

Technology evolution will continue to reshape diabetes care through artificial intelligence integration, predictive analytics, and automated insulin delivery systems that minimize patient burden while optimizing glycemic control. These advances position Brazil as a key market for next-generation diabetes management technologies and comprehensive care platforms.

Healthcare accessibility improvements through government initiatives and private sector innovation will expand market reach to previously underserved populations. Mobile health technologies and telemedicine platforms offer solutions for rural healthcare delivery challenges while creating new market opportunities for innovative companies.

Competitive dynamics will intensify as biosimilar products gain market share and technology companies enter the diabetes care space with digital health solutions. This competition will drive innovation, improve patient outcomes, and create more affordable treatment options for Brazilian diabetes patients across diverse socioeconomic segments.

Regulatory environment evolution will continue to support market growth through streamlined approval processes for innovative insulin products and medical devices. MWR projections suggest that regulatory modernization initiatives will accelerate the introduction of cutting-edge diabetes management technologies while maintaining safety and efficacy standards.

The Brazil insulin drugs and delivery devices market represents a dynamic and rapidly evolving healthcare segment with substantial growth potential driven by demographic trends, technological innovation, and supportive healthcare policies. The market’s foundation rests on Brazil’s significant diabetes population and the government’s commitment to universal healthcare access through comprehensive public health programs.

Strategic opportunities abound for market participants willing to invest in innovation, patient education, and comprehensive diabetes management solutions that address the diverse needs of Brazilian patients across urban and rural settings. The convergence of digital health technologies with traditional insulin therapy creates new possibilities for personalized treatment approaches and improved patient outcomes.

Market challenges including economic disparities, regulatory complexities, and healthcare infrastructure variations require thoughtful strategies and collaborative approaches that leverage public-private partnerships and innovative distribution models. Companies that successfully navigate these challenges while delivering value to patients and healthcare providers will achieve sustainable competitive advantages.

Future success in the Brazil insulin drugs and delivery devices market will depend on companies’ ability to balance innovation with affordability, technology advancement with user simplicity, and global expertise with local market understanding. The market’s continued evolution toward patient-centric care and digital health integration positions Brazil as a critical market for diabetes management innovation in the Latin American region and beyond.

What is Insulin Drugs & Delivery Devices?

Insulin Drugs & Delivery Devices refer to the medications and tools used to manage diabetes, including various types of insulin and devices like syringes, pens, and pumps that facilitate insulin delivery.

What are the key players in the Brazil Insulin Drugs & Delivery Devices Market?

Key players in the Brazil Insulin Drugs & Delivery Devices Market include Novo Nordisk, Sanofi, and Eli Lilly, among others.

What are the main drivers of the Brazil Insulin Drugs & Delivery Devices Market?

The main drivers of the Brazil Insulin Drugs & Delivery Devices Market include the rising prevalence of diabetes, increasing awareness about diabetes management, and advancements in insulin delivery technologies.

What challenges does the Brazil Insulin Drugs & Delivery Devices Market face?

Challenges in the Brazil Insulin Drugs & Delivery Devices Market include high costs of innovative insulin therapies, regulatory hurdles, and the need for better patient education on diabetes management.

What opportunities exist in the Brazil Insulin Drugs & Delivery Devices Market?

Opportunities in the Brazil Insulin Drugs & Delivery Devices Market include the development of biosimilar insulins, increasing investment in diabetes care technologies, and expanding access to healthcare services.

What trends are shaping the Brazil Insulin Drugs & Delivery Devices Market?

Trends shaping the Brazil Insulin Drugs & Delivery Devices Market include the rise of smart insulin delivery devices, personalized medicine approaches, and a growing focus on telehealth solutions for diabetes management.

Brazil Insulin Drugs & Delivery Devices Market

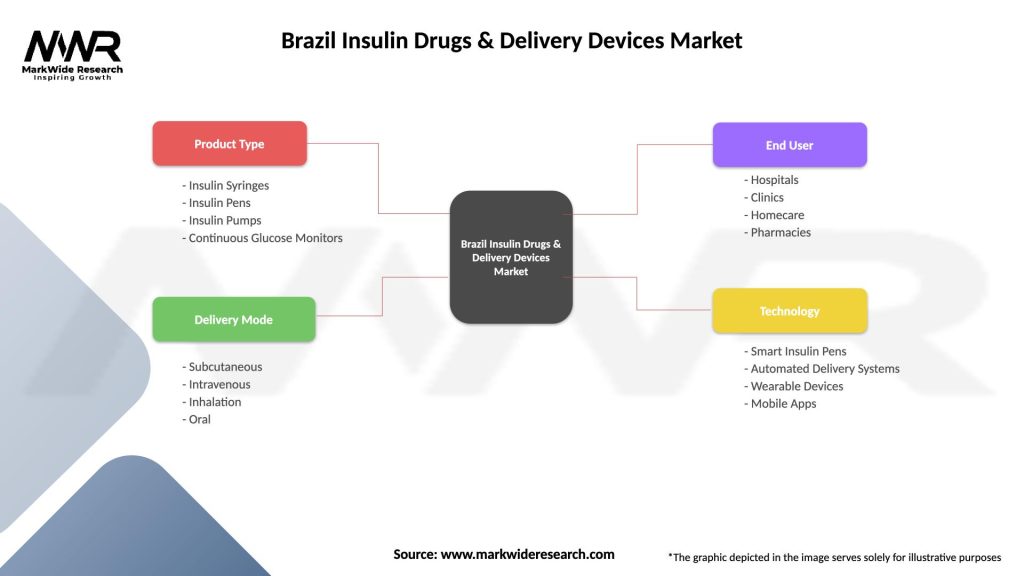

| Segmentation Details | Description |

|---|---|

| Product Type | Insulin Syringes, Insulin Pens, Insulin Pumps, Continuous Glucose Monitors |

| Delivery Mode | Subcutaneous, Intravenous, Inhalation, Oral |

| End User | Hospitals, Clinics, Homecare, Pharmacies |

| Technology | Smart Insulin Pens, Automated Delivery Systems, Wearable Devices, Mobile Apps |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Brazil Insulin Drugs & Delivery Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at